Item 5.02.

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(e)

Material Compensatory Plans, Contracts or Arrangements.

(1) German American Bancorp, Inc. 2019 Employee Stock Purchase Plan

. On March 4, 2019, the Board of Directors (the “Board”) of German American Bancorp, Inc. (the “Company”) adopted the German American Bancorp, Inc. 2019 Employee Stock Purchase Plan (the “Purchase Plan”). The Purchase Plan was approved and adopted by the shareholders of the Company at its 2019 annual meeting of shareholders held on May 16, 2019. The Purchase Plan replaces the Company’s 2009 Employee Stock Purchase Plan, which was set to expire on August 16, 2019.

The effective date of the Purchase Plan will be October 1, 2019, with the first offering period thereunder commencing on such date. The purpose of the Purchase Plan is to provide eligible employees of the Company and its subsidiaries with a convenient opportunity to purchase the Company’s common shares financed by payroll deductions.

The following summary of the key features of the Purchase Plan does not purport to be complete and is qualified in its entirety by reference to the full text of the Purchase Plan, which is set forth in Exhibit 10.1 to this Current Report.

Options to Purchase Shares in Offerings

. The Purchase Plan provides a series of 3-month offering periods, commencing on the first day and ending on the last trading day of each calendar quarter, for the purchase of the Company’s common stock by participating employees. A total of 750,000 common shares will be reserved for issuance under the Purchase Plan. The Purchase Plan will continue until September 30, 2029, or, if earlier, until all of the shares of common stock allocated to the Purchase Plan have been purchased. The Compensation/Human Resources Committee of the Board (the “Committee”) has the authority to change the duration and/or frequency of the offering periods. However, in no event shall any option granted under the Purchase Plan be exercisable more than twenty-seven (27) months from its grant date.

Eligibility

. All employees of the Company and its participating subsidiaries who have been employed for at least six months as of the first day of the offering are eligible to participate in the Purchase Plan.

Purchase of Shares

. Prior to each offering period, eligible employees would be entitled to elect to have a specified percentage of their eligible cash compensation deducted from their pay. The Committee will establish the maximum percentage that any one employee may have deducted. No participant may be granted an option under the Purchase Plan if such option would entitle the participant to purchase common shares having a market value in excess of the amount specified by the Committee or if, immediately after an option is granted under the Purchase Plan, the employee owns more than 5% of the total combined voting power or value of all classes of shares of the Company or of any parent or subsidiary of the Company. In no event will a participant be allowed to purchase more than $25,000 in Fair Market Value (as defined below under “Price” and based upon the grant date) of the Company’s common shares under the Purchase Plan, and any other stock purchase plan maintained by the Company or a parent or subsidiary of the Company that is qualified under Internal Revenue Code Section 423, for any one calendar year. Participants may increase, decrease or suspend their payroll deductions one time each offering period and may withdraw the balance of their payroll deduction account at any time during each offering period. At the end of each offering period, the balance of each participant’s payroll deduction account will be applied towards the purchase of common shares. All shares purchased will be credited in book-entry form to a separate share account for each participant.

Price

. The price at which the shares will be deemed to have been purchased under each offering (the “option price”) will be determined by the Committee, and will be an amount in the range from ninety five percent (95%) and one hundred percent (100%) of the Fair Market Value of the Company’s common shares on the last trading day of the offering period. If the Committee for any reason should fail to determine the price for any offering within the percentage range specified by the preceding sentence for any offering, the percentage shall be ninety-five percent (95%). “Fair Market Value” of a common share on a given date means the NASDAQ Official Closing Price (or similar closing price information if The NASDAQ Stock Market LLC (NASDAQ) no longer makes available a figure called the NASDAQ Official Closing Price) on such date (“NOCP”), or if no NOCP is furnished by NASDAQ for the Company’s common shares on such date, the NOCP of a common share on the most recent day on which NASDAQ has furnished an NOCP for the common shares. If the Company’s common shares are not listed on any given date on the NASDAQ Global Select Market or similar market for which an NOCP (or similar closing price) is furnished by NASDAQ, then “Fair Market Value” is defined as the fair market value of a share on such date as determined in good faith by the Committee.

Administration

. The Board has delegated administration of the Purchase Plan to the Committee. The Committee has the authority, subject to the terms of the Purchase Plan, to (i) adopt, alter, and repeal administrative rules and practices governing the Purchase Plan; (ii) interpret the terms and provisions of the Purchase Plan; and (iii) otherwise supervise the administration of the Purchase Plan.

(2)

German American Bancorp, Inc. 2019 Long-Term Equity Incentive Plan

. On March 4, 2019, the Board adopted the German American Bancorp, Inc. 2019 Long-Term Equity Incentive Plan (the “Incentive Plan”). The Incentive Plan, which was subject to approval by the shareholders of the Company, became effective on May 16, 2019 when approved and adopted at the Company’s 2019 annual meeting of shareholders held on such date.

The Incentive Plan, which replaces the Company’s 2009 Long Term Equity Incentive Plan, is designed to promote the interests of the Company and its shareholders by providing a means by which the Board can award stock-based incentives to employees and directors of the Company or any subsidiary. The Incentive Plan permits the Board to grant incentive stock options, non-qualified stock options, restricted stock, and stock appreciation rights.

The purpose of the Incentive Plan is to further the growth, development, and financial success of the Company by providing for stock-based incentives to participants that align their interests more closely with those of the Company’s shareholders. The Company also believes that the Incentive Plan will assist it in its efforts to attract and retain quality employees and directors, providing discretion and flexibility in designing incentives to attract, reward and retain employees (including executive officers) and directors and to ensure the continued close alignment of their interests with the interests of shareholders generally.

The following summary of the material features of the Incentive Plan does not purport to be complete and is qualified in its entirety by reference to the full text of the Incentive Plan, which is set forth in Exhibit 10.2 to this Current Report.

Administration

. In accordance with the terms of the Incentive Plan, the Board has delegated administration of the Incentive Plan to the Committee (i.e., the Compensation/Human Resources Committee of the Board). The Committee may delegate ministerial non-discretionary functions to one or more officers or employees of the Company. Subject to any limitations in the Incentive Plan, the Committee has the power to determine the terms of the awards, including the employees and directors who will receive awards, the exercise price of options, the fair market value of the shares subject to each award, the number of shares subject to each award, the vesting schedule and exercisability of awards and the form of consideration payable upon exercise or purchase, as applicable.

2

Eligibility

. The Committee may designate those persons eligible to receive awards under the Incentive Plan from among the employees and directors of the Company or any subsidiary.

Shares Available under the Plan

. The aggregate number of the Company’s common shares with respect to which awards may be granted under the Incentive Plan may not exceed 1,000,000.

Share Counting; Limitations on Recycling

. Subject to the application of the “Adjustments” paragraph below, shares that: (a) are subject to issuance upon exercise of an option but cease to be subject to the option for any reason other than the option being exercised; (b) are subject to an award granted under the Incentive Plan but are forfeited or are repurchased by the Company at the original issue price; or (c) are subject to an award that otherwise terminates without shares being issued will again be available for grant and issuance in connection with future awards under the Incentive Plan. However, the following shares may not again be made available for future grant and issuance as awards under the Incentive Plan: (x) shares that are withheld to pay the exercise price of an award or to satisfy any tax withholding obligations in connection with an award; (y) shares not issued or delivered as a result of the net settlement of an outstanding option or stock appreciation right; or (z) shares of the Company’s common stock repurchased on the open market with the proceeds of an exercised option. In the case of stock appreciation rights, only shares delivered in connection with the settlement of the right will be deducted from the aggregate share limit set forth above.

Adjustments

. If the Company’s outstanding common shares are changed into, or exchanged for, a different number or kind of shares or securities of the Company through any capital reorganization or reclassification, or if the number of outstanding common shares is changed through a stock split or stock dividend, an appropriate adjustment will be made by the Committee in the number, kind, and/or exercise price with respect to common shares as to which awards may be granted under the Incentive Plan. A corresponding adjustment will also be made in the number, kind, and/or exercise price for the Company’s common shares with respect to which there are unexercised outstanding awards. Any such adjustment in an outstanding award, however, shall be made without change in the total price applicable to the unexercised portion of the award but with a corresponding adjustment in the price for each common share covered by the award.

Types of Awards

. The Incentive Plan provides for the grant of incentive stock options, non-statutory stock options, stock appreciation rights, and restricted stock. The Company’s employees and directors, and any subsidiary corporation’s employees and directors, are eligible to receive awards under the Incentive Plan. However, incentive stock options may only be granted to the Company’s employees or any subsidiary corporation’s employees.

With respect to all stock options granted under the Incentive Plan, the exercise price must at least be equal to the fair market value of the Company’s common shares on the date of grant. For this purpose (and for so long as the Company’s common shares are traded on a national securities exchange or are readily tradeable on an established securities market), fair market value means, on any date, the closing price of the Company’s common shares on such date, or if there was no trading in the shares on such date, then on the next preceding date on which there was trading in the shares. The term of an incentive stock option may not exceed 10 years, except that with respect to any participant who owns 10% or more of the voting power of all classes of the Company’s outstanding shares as of the grant date, the term of an incentive stock option must not exceed five years and the exercise price must equal at least 110% of the fair market value on the grant date. The Committee determines the terms of all other options.

Minimum Vesting Requirements

. Vesting periods under the Incentive Plan will be established by the Committee. However, except in connection with awards that may be settled only in cash, the minimum vesting period of each award must be one (1) year (subject to the accelerated vesting described below or as

3

otherwise permitted by the Committee). With respect to up to five percent (5%) of the maximum number of shares available under the Incentive Plan, the Company may grant awards or otherwise accelerate vesting without regard to the one-year minimum vesting period.

Minimum Holding Periods for Named Executive Officers

. Options and stock appreciation rights granted to any named executive officer of the Company must provide that any common shares received in connection with the exercise or vesting of the option or right will be subject to an additional one-year holding period before any sale or transfer of the shares may take place, other than with respect to any shares withheld by the Company to satisfy a participant’s withholding tax obligation in connection with an award.

Rights as a Shareholder

. Unless otherwise provided by the Board or the Committee, a participant will have rights as a shareholder with respect to the Company’s common shares covered by an award, including voting rights or rights to dividends, only upon the date of issuance of a certificate to him/her and, if payment is required, only after payment in full has been made for such common shares.

Limitations on Exercise and Transfer

. Unless otherwise provided by law or the applicable award agreement, the Incentive Plan generally does not allow for the sale or transfer of awards under the Incentive Plan or exercise of awards by any person other than the participant. However, the Incentive Plan permits transfers to the Company, designation of beneficiaries and transfers or exercises by beneficiaries in the event of the participant’s death, transfers by will or the laws of descent and distribution or transfers or exercises by an authorized legal representative on behalf of a participant who has suffered a disability.

Amendments to the Incentive Plan and Awards

. The Committee has the authority to amend the Incentive Plan if the amendment does not materially adversely affect any award without the written consent of the affected participant. Shareholder approval is required only to the extent required under applicable law or if the board of directors determines that it is necessary or advisable. Subject to the prohibition of repricing discussed below, the Committee may unilaterally amend the terms of any award agreement evidencing an award previously granted, except that no such amendment may materially impair the rights of any participant under the applicable award without the participant’s consent, unless such amendment is necessary to comply with applicable law or stock exchange rules or the “clawback” policy described below.

Prohibition on Repricing

. Except in connection with equity restructurings and other situations in which share adjustments are specifically authorized, the Incentive Plan prohibits the Committee from repricing any outstanding option or stock appreciation right (“SAR”) awards without the prior approval of the Company’s shareholders. For these purposes, a “repricing” includes amending the terms of an option or SAR award to lower the exercise price, canceling an option or SAR award in conjunction with granting a replacement option or SAR award with a lower exercise price, canceling an option or SAR award in exchange for cash, other property or grant of a restricted stock award at a time when the per share exercise price of the option or SAR award is greater than the fair market value of a share of the Company’s common stock, or otherwise making an option or SAR award subject to any action that would be treated under accounting rules as a “repricing.”

Clawback of Awards

. Awards granted to an executive officer of the Company under the Incentive Plan will be subject to recovery or clawback if the Committee later determines either (i) that financial results used to determine the amount of that award must be materially restated and that the executive officer engaged in fraud or intentional misconduct related thereto, or (ii) that recovery or repayment of the award is required by the Sarbanes-Oxley Act or other applicable law. In addition, the Compensation Committee may provide that any award, including any shares subject to or issued under an award, is subject to any other recovery, recoupment, clawback and/or other forfeiture policy maintained by the Company from time to time.

4

Separation from Service

. The Committee has the authority to establish the effect of a separation from service on the rights and benefits under any award, however, a director’s separation from service will not accelerate or otherwise increase the number of shares subject to an award unless the committee expressly determines that it will. Participants may exercise awards after a separation from service only in accordance with the terms of the award agreement and, unless otherwise expressly provided by the committee, only with respect to the number of shares as to which the award could have been exercised on the date of the separation from service.

Termination

. The Incentive Plan provides that, upon the occurrence of any of the events described below, the Incentive Plan and each outstanding award will terminate, subject to any provision made by the Committee for the continuation of awards. If awards are to terminate, each participant will have the right, by giving notice at least ten days before the effective date of the event in question, to exercise all or any part of an unexpired award to the extent then exercisable. Events triggering termination of the Incentive Plan and each award granted under the plan include the following:

·

dissolution, liquidation or sale of all or substantially all of the business, properties and assets of the Company,

·

any reorganization, merger, consolidation, sale or exchange of securities in which the Company does not survive,

·

any sale, reorganization, merger, consolidation or exchange of securities in which the Company survives and any of the Company’s shareholders have the opportunity to receive cash, securities of another entity or other property in exchange for their shares of the Company’s common shares, or

·

any acquisition by any person or group of beneficial ownership of more than 50% of the Company’s outstanding shares.

Acceleration

. The Committee has the authority to accelerate the vesting and exercisability of all or any portion of any award at any time in its sole discretion, regardless of any provision in the relevant award agreement. The committee may determine the terms and conditions of any acceleration so long as the terms and conditions do not materially adversely affect the rights of any participant without the consent of the participant. The committee may rescind the effect of any acceleration if it was done in anticipation of an event and the committee or the board of directors later determines that the event will not occur.

5

Item 5.07. Submission of Matters to a Vote of Security Holders.

(a)

The Company held its annual meeting of shareholders on May 16, 2019.

(b)

At the close of business on March 11, 2019, the record date for the annual meeting, 24,967,458 of the Company’s common shares were issued and outstanding. Matters voted upon at the annual meeting were as follows:

1.

Election of four (4) directors to serve until the 2022 annual meeting of shareholders;

2.

Approval and adoption of the German American Bancorp, Inc. 2019 Employee Stock Purchase Plan;

3.

Approval and adoption of the German American Bancorp, Inc. 2019 Long-Term Equity Incentive Plan; and

4.

Approval, on an advisory basis, of the appointment of Crowe LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2019.

The final results of the votes taken at the annual meeting were as follows:

Proposal 1 — Election of four (4) directors to serve until the 2022 annual meeting of shareholders:

|

Director’s Name

|

|

Votes For

|

|

Votes

Withheld

|

|

Broker

Non-Votes

|

|

Uncast

Votes

|

|

Zachary W. Bawel

|

|

15,790,924

|

|

230,391

|

|

5,063,675

|

|

1,174

|

|

J. David Lett

|

|

12,546,765

|

|

3,470,146

|

|

5,063,675

|

|

5,578

|

|

Lee A. Mitchell

|

|

15,935,848

|

|

86,094

|

|

5,063,675

|

|

547

|

|

Thomas W. Seger

|

|

13,165,670

|

|

2,856,192

|

|

5,063,675

|

|

627

|

Each director nominee was elected to the Company’s Board of Directors by a plurality of the votes cast among all nominees.

Proposal 2 — Approval and adoption of the German American Bancorp, Inc. 2019 Employee Stock Purchase Plan:

|

Votes For

|

|

Votes Against

|

|

Votes Abstained

|

|

Broker Non-

Votes

|

|

15,648,914

|

|

125,248

|

|

248,326

|

|

5,063,675

|

The approval and adoption of the German American Bancorp, Inc. 2019 Employee Stock Purchase Plan was approved by a majority of the votes cast.

6

Proposal 3 — Approval and adoption of the German American Bancorp, Inc. 2019 Long-Term Equity Incentive Plan:

|

Votes For

|

|

Votes Against

|

|

Votes Abstained

|

|

Broker Non-

Votes

|

|

15,382,054

|

|

393,201

|

|

246,688

|

|

5,063,675

|

The approval and adoption of the German American Bancorp, Inc. 2019 Long-Term Equity Incentive Plan was approved by a majority of the votes cast.

Proposal 4 — Approval, on an advisory basis, of the appointment of Crowe LLP as the Company’s independent registered public accounting firm for 2019:

|

Votes For

|

|

Votes Against

|

|

Votes Abstained

|

|

Broker Non-

Votes

|

|

20,860,840

|

|

147,381

|

|

77,943

|

|

—

|

The appointment of Crowe LLP as the Company’s independent registered public accounting firm for 2019 was approved by a majority of the votes cast.

(c)

Not applicable.

(d)

Not applicable.

Item 9.01. Financial Statements and Exhibits.

(d)

Exhibits

* * * * * *

7

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

GERMAN AMERICAN BANCORP, INC.

|

|

|

|

|

|

Date: May 21, 2019

|

By:

|

/s/ Mark A. Schroeder

|

|

|

|

Mark A. Schroeder, Chairman and Chief Executive Officer

|

8

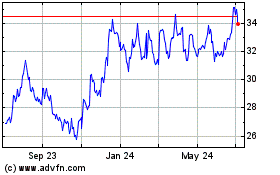

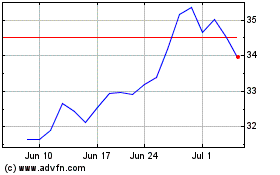

German American Bancorp (NASDAQ:GABC)

Historical Stock Chart

From Mar 2024 to Apr 2024

German American Bancorp (NASDAQ:GABC)

Historical Stock Chart

From Apr 2023 to Apr 2024