German American Bancorp, Inc. (NASDAQ: GABC) reported record

quarterly earnings of $15.1 million, or $0.60 per share, for the

quarter ending on March 31, 2019. This level of quarterly

earnings performance was an increase of 36%, on a per share basis,

compared with fourth quarter 2018 net income of $11.0 million, or

$0.44 per share, and an increase of 18%, on a per share basis,

compared with the first quarter 2018 net income of $11.8 million,

or $0.51 per share.

These quarterly comparisons are inclusive of the

Company’s 2018 five-branch acquisition in the greater Columbus,

Indiana market area on May 18, 2018 and its acquisition of First

Security, Inc. on October 15, 2018. First Security was based

in Owensboro, Kentucky, and operated 11 retail banking offices in

the Owensboro, Bowling Green, Franklin and Lexington, Kentucky

market areas and in Evansville and Newburgh, Indiana market

area.

The record first quarter 2019 earnings, as

compared with the fourth quarter of 2018, were partially

attributable to an increased level of net interest income during

the current quarter, resulting from both increased average earning

assets and an improved tax-equivalent net interest margin.

The increased level of average earning assets during the first

quarter of 2019, compared to the fourth quarter of 2018, was

largely attributable to the effect of the acquisition of First

Security on October 15, 2018.

Other factors contributing to the record first

quarter earnings included the recording of $1.4 million in

contingency insurance revenue during the quarter and a $3.1 million

decline in the level of operating expenses, as compared to the

fourth quarter of 2018. The decline in operating expenses was

materially due to a reduced level of acquisition-related expenses

in the first quarter. The first quarter of 2019 results of

operations included acquisition-related expenses of approximately

$544,000 ($407,000 or $0.02 per share, on an after-tax basis),

compared to $3.1 million (or $2.3 million, or $0.09 per share, on

an after-tax basis) in the fourth quarter of 2018.

End of period loans and deposits as of March 31,

2019, relative to December 31, 2018 year-end balances, were

relatively flat to slightly lower, as March 31, 2019 total loans

declined by 3% on annualized basis, while total deposits decreased

by 1% on an annualized basis. The slight decrease in loans

and deposits during the quarter was largely attributable to

seasonality as the first quarter is historically a slower growth

period for the Company, specifically related to seasonal pay-downs

within the agricultural loan portfolio. Additionally, the

Company repositioned a portion of the acquired loan portfolio

during the quarter, resulting in an elevated level of loan payoffs,

including within the residential mortgage loan portfolio.

Commenting on the Company’s record first quarter

performance, Mark A. Schroeder, German American’s Chairman &

CEO, stated, "We’re extremely pleased with the strong start we

experienced during the first quarter of this year, both in terms of

earnings growth and the continued integration of First

Security. Additionally, we announced the pending acquisition

of Citizens First Corporation of Bowling Green, Kentucky on

February 21, 2019. The combination of First Security and

Citizens First in the vibrant Bowling Green market will position

German American as one of market share leaders in this dynamic

market.”

Schroeder continued, “While balance sheet growth

was limited during the quarter due to seasonal factors, we remain

very encouraged about our ability to experience strong growth

throughout the balance of this year. Our loan pipelines

continue to be exceptionally strong, as evidenced by the 9% growth,

on an annualized basis, that we saw within our Commercial &

Industrial Loans during the first quarter. We also were very

pleased with the approximately 5% annualized growth in end of

period balances in Non-interest-bearing Demand Deposits. Even

though the current economic recovery is approaching historic

length, we’re continuing to see indications that economic growth

will remain strong throughout 2019."

The Company also announced its Board of

Directors declared a regular quarterly cash dividend of $0.17 per

share, which will be payable on May 20, 2019 to shareholders of

record as of May 10, 2019.

Balance Sheet Highlights

The Company completed a five-branch acquisition

of locations of First Financial Bancorp (formerly branch locations

of Mainsource Financial Group, Inc. prior to its merger with First

Financial Bancorp) on May 18, 2018. Four of the branches are

located in Columbus, Indiana, and one in Greensburg, Indiana.

In addition, on October 15, 2018, the Company completed its

acquisition of First Security, Inc. ("First Security") and its

subsidiary bank, First Security Bank, Inc. First Security was

based in Owensboro, Kentucky, and operated 11 retail banking

offices in Owensboro, Bowling Green, Franklin and Lexington,

Kentucky and in Evansville and Newburgh, Indiana.

Total assets for the Company totaled $3.896

billion at March 31, 2019, representing a decline of $33.6 million,

or 3% on an annualized basis, compared with December 31, 2018 and

an increase of $770.5 million, or 25%, compared with March 31,

2018. The increase in total assets as of March 31, 2019

compared to a year ago was driven largely by the acquisition of

First Security and the five-branch network in the Columbus and

Greensburg, Indiana markets, as well as organic loan growth.

March 31, 2019 total loans declined $19.3

million, or 3% on an annualized basis, compared with December 31,

2018 and increased $558.6 million, or 26%, compared with March 31,

2018.

The decline during the first quarter of 2019 was

driven by a seasonal decline in agricultural loans of approximately

$17.2 million, or 19% on an annualized basis, and a decline in

retail loans of $17.8 million, or 12% on an annualized basis,

partially mitigated by an increase of $12.2 million, or 9% on an

annualized basis, of commercial and industrial loans, and an

increase of $3.4 million, or 1% on an annualized basis, of

commercial real estate loans.

| |

|

|

|

|

|

| End of Period

Loan Balances |

3/31/2019 |

|

12/31/2018 |

|

3/31/2018 |

| (dollars in

thousands) |

|

|

|

|

|

| |

|

|

|

|

|

| Commercial &

Industrial Loans |

$ |

555,967 |

|

|

$ |

543,761 |

|

|

$ |

482,219 |

|

| Commercial Real Estate

Loans |

1,212,090 |

|

|

1,208,646 |

|

|

947,948 |

|

| Agricultural Loans |

347,999 |

|

|

365,208 |

|

|

329,138 |

|

| Consumer Loans |

281,724 |

|

|

285,534 |

|

|

216,435 |

|

| Residential Mortgage

Loans |

314,634 |

|

|

328,592 |

|

|

178,108 |

|

| |

$ |

2,712,414 |

|

|

$ |

2,731,741 |

|

|

$ |

2,153,848 |

|

| |

|

|

|

|

|

Non-performing assets totaled $13.1 million at

March 31, 2019 compared to $13.5 million at December 31, 2018 and

$10.7 million at March 31, 2018. Non-performing assets

represented 0.34% of total assets at each of March 31, 2019,

December 31, 2018 and March 31, 2018. Non-performing loans

totaled $12.4 million at March 31, 2019 compared to $13.2 million

at December 31, 2018 and $10.6 million at March 31, 2018.

Non-performing loans represented 0.46% of total loans at March 31,

2019 compared to 0.48% at December 31, 2018 and 0.49% at March 31,

2018.

| |

|

|

|

|

|

| Non-performing

Assets |

|

|

|

|

|

| (dollars in

thousands) |

|

|

|

|

|

| |

3/31/2019 |

|

12/31/2018 |

|

3/31/2018 |

| Non-Accrual Loans |

$ |

12,036 |

|

|

$ |

12,579 |

|

|

$ |

9,479 |

|

| Past Due Loans (90 days

or more) |

393 |

|

|

633 |

|

|

1,105 |

|

| Total

Non-Performing Loans |

12,429 |

|

|

13,212 |

|

|

10,584 |

|

| Other Real Estate |

685 |

|

|

286 |

|

|

68 |

|

| Total

Non-Performing Assets |

$ |

13,114 |

|

|

$ |

13,498 |

|

|

$ |

10,652 |

|

| |

|

|

|

|

|

| Restructured Loans |

$ |

119 |

|

|

$ |

121 |

|

|

$ |

124 |

|

| |

|

|

|

|

|

The Company’s allowance for loan losses totaled

$16.2 million at March 31, 2019 compared to $15.8 million at

December 31, 2018 and $14.5 million at March 31, 2018. The

allowance for loan losses represented 0.60% of period-end loans at

March 31, 2019 compared with 0.58% of period-end loans at December

31, 2018 and 0.67% of period-end loans at March 31, 2018.

From time to time, the Company has acquired loans through bank and

branch acquisitions with the most recent being the First Security

acquisition during the fourth quarter of 2018 and a five-branch

acquisition in the second quarter of 2018. Under acquisition

accounting treatment, loans acquired are recorded at fair value

which includes a credit risk component, and therefore the allowance

on loans acquired is not carried over from the seller. The

Company held a net discount on acquired loans of $18.2 million at

March 31, 2019, $19.5 million at December 31, 2018 and $7.3 million

at March 31, 2018.

March 31, 2019 total deposits declined $7.5

million, or 1% on an annualized basis, compared with December 31,

2018 and increased $598.0 million compared with March 31, 2018.

| |

|

|

|

|

|

| End of Period

Deposit Balances |

3/31/2019 |

|

12/31/2018 |

|

3/31/2018 |

| (dollars in

thousands) |

|

|

|

|

|

| |

|

|

|

|

|

| Non-interest-bearing

Demand Deposits |

$ |

723,995 |

|

|

$ |

715,972 |

|

|

$ |

599,374 |

|

| IB Demand, Savings, and

MMDA Accounts |

1,706,913 |

|

|

1,768,177 |

|

|

1,465,150 |

|

| Time Deposits <

$100,000 |

248,686 |

|

|

249,309 |

|

|

193,864 |

|

| Time Deposits >

$100,000 |

385,576 |

|

|

339,174 |

|

|

208,733 |

|

| |

$ |

3,065,170 |

|

|

$ |

3,072,632 |

|

|

$ |

2,467,121 |

|

| |

|

|

|

|

|

Results of Operations Highlights – Quarter ended March

31, 2019

Net income for the quarter ended March 31, 2019

totaled $15,067,000, or $0.60 per share, an increase of 36% on a

per share basis compared with fourth quarter 2018 net income of

$10,980,000, or $0.44 per share, and an increase of 18% on a

per share basis compared with the first quarter 2018 net income of

$11,813,000, or $0.51 per share.

Net income for each quarter presented was

impacted by merger and acquisition activity during 2018 and

2019. The first quarter of 2019 results of operations

included acquisition-related expenses of approximately $544,000

($407,000 or $0.02 per share, on an after tax basis), while the the

fourth quarter of 2018 results of operations included

acquisition-related expenses of approximately $3,107,000

($2,343,000 or $0.09 per share, on an after tax basis) and the

first quarter of 2018 included approximately $186,000 ($139,000 or

less than $0.01 per share on an after tax basis).

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Summary Average

Balance Sheet |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Tax-equivalent basis /

dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter Ended |

|

Quarter Ended |

|

Quarter Ended |

| |

|

March 31, 2019 |

|

December 31, 2018 |

|

March 31, 2018 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Principal Balance |

|

Income/ Expense |

|

Yield/ Rate |

|

Principal Balance |

|

Income/ Expense |

|

Yield/ Rate |

|

Principal Balance |

|

Income/ Expense |

|

Yield/ Rate |

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Federal Funds Sold and

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Short-term Investments |

|

$ |

24,538 |

|

|

$ |

141 |

|

|

2.32 |

% |

|

$ |

20,925 |

|

|

$ |

97 |

|

|

1.83 |

% |

|

$ |

8,556 |

|

|

$ |

56 |

|

|

2.65 |

% |

| Securities |

|

825,625 |

|

|

6,549 |

|

|

3.17 |

% |

|

812,191 |

|

|

6,447 |

|

|

3.18 |

% |

|

753,589 |

|

|

5,708 |

|

|

3.03 |

% |

| Loans and Leases |

|

2,718,808 |

|

|

35,207 |

|

|

5.24 |

% |

|

2,662,502 |

|

|

33,771 |

|

|

5.04 |

% |

|

2,139,704 |

|

|

24,032 |

|

|

4.55 |

% |

| Total Interest

Earning Assets |

|

$ |

3,568,971 |

|

|

$ |

41,897 |

|

|

4.74 |

% |

|

$ |

3,495,618 |

|

|

$ |

40,315 |

|

|

4.58 |

% |

|

$ |

2,901,849 |

|

|

$ |

29,796 |

|

|

4.15 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Demand Deposit

Accounts |

|

$ |

691,107 |

|

|

|

|

|

|

|

$ |

714,504 |

|

|

|

|

|

|

|

$ |

585,432 |

|

|

|

|

|

|

| IB Demand, Savings,

and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| MMDA

Accounts |

|

$ |

1,731,118 |

|

|

$ |

2,695 |

|

|

0.63 |

% |

|

$ |

1,794,891 |

|

|

$ |

2,808 |

|

|

0.62 |

% |

|

$ |

1,489,363 |

|

|

$ |

1,275 |

|

|

0.35 |

% |

| Time Deposits |

|

646,726 |

|

|

2,721 |

|

|

1.71 |

% |

|

593,615 |

|

|

2,151 |

|

|

1.44 |

% |

|

398,397 |

|

|

1,008 |

|

|

1.03 |

% |

| FHLB Advances and Other

Borrowings |

|

330,463 |

|

|

2,182 |

|

|

2.68 |

% |

|

271,834 |

|

|

1,654 |

|

|

2.42 |

% |

|

262,784 |

|

|

1,252 |

|

|

1.93 |

% |

| Total

Interest-Bearing Liabilities |

|

$ |

2,708,307 |

|

|

$ |

7,598 |

|

|

1.14 |

% |

|

$ |

2,660,340 |

|

|

$ |

6,613 |

|

|

0.99 |

% |

|

$ |

2,150,544 |

|

|

$ |

3,535 |

|

|

0.67 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of Funds |

|

|

|

|

|

0.86 |

% |

|

|

|

|

|

0.75 |

% |

|

|

|

|

|

0.49 |

% |

| Net Interest

Income |

|

|

|

$ |

34,299 |

|

|

|

|

|

|

|

$ |

33,702 |

|

|

|

|

|

|

|

$ |

26,261 |

|

|

|

|

| Net Interest

Margin |

|

|

|

|

|

3.88 |

% |

|

|

|

|

|

3.83 |

% |

|

|

|

|

|

3.66 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

During the quarter ended March 31, 2019, net

interest income totaled $33,591,000, which represented an increase

of $608,000, or 2%, from the quarter ended December 31, 2018 net

interest income of $32,983,000 and an increase of $7,981,000, or

31%, compared with the quarter ended March 31, 2018 net interest

income of $25,610,000. The increased level of net interest income

during the first quarter of 2019 compared with both the fourth

quarter of 2018 and the first quarter of 2018 was driven primarily

by a higher level of average earning assets and an improved tax

equivalent net interest margin. The increased level of

average earning assets during the first quarter of 2019 compared

with the fourth quarter of 2018, was driven primarily by the

completed acquisition of First Security on October 15, 2018.

The tax equivalent net interest margin for the

quarter ended March 31, 2019 was 3.88% compared with 3.83% in the

fourth quarter of 2018 and 3.66% in the first quarter of

2018. Accretion of loan discounts on acquired loans

contributed approximately 16 basis points to the net interest

margin on an annualized basis in the first quarter of 2019, 13

basis points in the fourth quarter of 2018, and 4 basis points in

the first quarter of 2018.

During the quarter ended March 31, 2019, the

Company recorded a provision for loan loss of $675,000 compared

with no provision for loan loss in the fourth quarter of 2018 and

$350,000 in the first quarter of 2018. The provision during

all periods was done in accordance with the Company's standard

methodology for determining the adequacy of its allowance for loan

loss.

During the quarter ended March 31, 2019,

non-interest income totaled $11,658,000, an increase of $1,925,000,

or 20%, compared with the quarter ended December 31, 2018, and an

increase of $2,166,000, or 23%, compared with the first quarter of

2018.

| |

|

|

|

|

|

| |

Quarter Ended |

|

Quarter Ended |

|

Quarter Ended |

| Non-interest

Income |

3/31/2019 |

|

12/31/2018 |

|

3/31/2018 |

| (dollars in

thousands) |

|

|

|

|

|

| |

|

|

|

|

|

| Trust and Investment

Product Fees |

$ |

1,567 |

|

|

$ |

1,645 |

|

|

$ |

1,773 |

|

| Service Charges on

Deposit Accounts |

1,900 |

|

|

2,072 |

|

|

1,471 |

|

| Insurance Revenues |

3,205 |

|

|

1,877 |

|

|

2,930 |

|

| Company Owned Life

Insurance |

884 |

|

|

420 |

|

|

312 |

|

| Interchange Fee

Income |

2,095 |

|

|

2,235 |

|

|

1,482 |

|

| Other Operating

Income |

871 |

|

|

629 |

|

|

604 |

|

|

Subtotal |

10,522 |

|

|

8,878 |

|

|

8,572 |

|

| Net Gains on Loans |

981 |

|

|

583 |

|

|

650 |

|

| Net Gains on

Securities |

155 |

|

|

272 |

|

|

270 |

|

| Total

Non-interest Income |

$ |

11,658 |

|

|

$ |

9,733 |

|

|

$ |

9,492 |

|

| |

|

|

|

|

|

Service charges on deposit accounts declined

$172,000, or 8%, during the first quarter of 2019 compared with the

fourth quarter of 2018 and increased $429,000, or 29%, compared

with the first quarter of 2018. The decline during the first

quarter of 2019 compared with the fourth quarter of 2018 was

largely related to seasonal declines in deposit fees, while the

increase during the first quarter of 2019 compared with first

quarter of 2018 was largely attributable to the acquisitions

completed during 2018.

Insurance revenues increased $1,328,000, or 71%,

during the quarter ended March 31, 2019, compared with the fourth

quarter of 2018 and increased $275,000, or 9%, compared with the

first quarter of 2018. The increase during the first quarter

of 2019 compared with each of the fourth quarter of 2018 and the

first quarter of 2018 was primarily due to increased contingency

revenue. Contingency revenue during the first quarter of 2019

totaled $1,375,000 compared with no contingency revenue during the

fourth quarter of 2018 and $1,218,000 during the first quarter of

2018. The fluctuation in contingency revenue is a normal

course of business variance and is reflective of claims and loss

experience with insurance carriers that the Company represents

through its property and casualty insurance agency.

Typically, the majority of contingency revenue is recognized during

the first quarter of the year.

Company owned life insurance revenue increased

$464,000, or 110%, during the quarter ended March 31, 2019,

compared with the fourth quarter of 2018 and increased $572,000, or

183%, compared with the first quarter of 2018. The increases were

largely related to death benefits of $554,000 received from life

insurance policies during the first quarter of 2019.

Interchange fees declined $140,000, or 6%,

during the first quarter of 2019 compared with the fourth quarter

of 2018 and increased $613,000, or 41%, compared with the first

quarter of 2018. The increase during the first quarter of

2019 compared with the first quarter of 2018 was largely

attributable to increased card utilization by customers and the

acquisitions completed during 2018.

Other operating income increased $242,000, or

38%, during the quarter ended March 31, 2019 compared with the

fourth quarter of 2018 and increased $267,000, or 44%, compared

with the first quarter of 2018. The increase during the first

quarter quarter of 2019 compared with both comparative periods was

largely attributable to the gain realized on the sale of a former

branch facility of $262,000.

Net gains on sales of loans increased $398,000,

or 68%, during the first quarter of 2019 compared with the fourth

quarter of 2018 and increased $331,000, or 51%, compared with the

first quarter of 2018. The increase during the first quarter

of 2019 in the net gain on sale compared with both comparative

periods was largely attributable to higher pricing levels on loans

sold. Loan sales totaled $28.9 million during the first

quarter of 2019, compared with $35.7 million during the fourth

quarter of 2018 and $29.9 million during the first quarter of

2018.

During the quarter ended March 31, 2019,

non-interest expense totaled $26,759,000, a decline of $3,055,000,

or 10%, compared with the quarter ended December 31, 2018, and an

increase of $6,304,000, or 31%, compared with the first quarter of

2018. The first quarter of 2019 included acquisition-related

expenses of $544,000 while the fourth quarter of 2018 included

acquisition-related expenses of approximately $3,107,000 and the

first quarter of 2018 included acquisition-related expenses of

approximately $186,000.

| |

|

|

|

|

|

| |

Quarter Ended |

|

Quarter Ended |

|

Quarter Ended |

| Non-interest

Expense |

3/31/2019 |

|

12/31/2018 |

|

3/31/2018 |

| (dollars in

thousands) |

|

|

|

|

|

| |

|

|

|

|

|

| Salaries and Employee

Benefits |

$ |

15,044 |

|

|

$ |

15,027 |

|

|

$ |

12,126 |

|

| Occupancy, Furniture

and Equipment Expense |

3,219 |

|

|

3,203 |

|

|

2,409 |

|

| FDIC Premiums |

288 |

|

|

234 |

|

|

237 |

|

| Data Processing

Fees |

1,583 |

|

|

3,108 |

|

|

1,127 |

|

| Professional Fees |

1,327 |

|

|

2,337 |

|

|

871 |

|

| Advertising and

Promotion |

870 |

|

|

1,083 |

|

|

701 |

|

| Intangible

Amortization |

843 |

|

|

810 |

|

|

206 |

|

| Other Operating

Expenses |

3,585 |

|

|

4,012 |

|

|

2,778 |

|

| Total

Non-interest Expense |

$ |

26,759 |

|

|

$ |

29,814 |

|

|

$ |

20,455 |

|

| |

|

|

|

|

|

Salaries and benefits increased $17,000, or less

than 1%, during the quarter ended March 31, 2019 compared with the

fourth quarter of 2018 and increased $2,918,000, or 24%, compared

with the first quarter of 2018. The increase in salaries and

benefits during the first quarter of 2019 compared with both the

fourth quarter of 2018 and the first quarter of 2018 was primarily

attributable to an increased number of full-time equivalent

employees due in part to the acquisition transactions completed

during 2018. The fourth quarter of 2018 also included

approximately $474,000 of acquisition-related salary and benefit

costs.

Occupancy, furniture and equipment expense

increased $16,000, or less than 1%, during the first quarter of

2019 compared with the fourth quarter of 2018 and increased

$810,000, or 34%, compared to the first quarter of 2018. The

increase during the first quarter of 2019 compared with the first

quarter of 2018 was primarily due to operating costs related to the

acquisitions completed during 2018 as well as other facilities the

Company has placed into service over the past several quarters.

Data processing fees declined $1,525,000, or

49%, during the first quarter of 2019 compared with the fourth

quarter of 2018 and increased $456,000, or 40%, compared to the

first quarter of 2018. The decline during the first quarter

of 2019 compared with the fourth quarter of 2018 was driven by

acquisition and conversion-related costs which totaled

approximately $1,668,000 during the fourth quarter of 2018.

The increase in data processing fees during the first quarter of

2019 compared with the first quarter of 2018 was also related to

the on-going operating costs associated with the acquisitions

completed during 2018.

Professional fees declined $1,010,000, or 43%,

during the first quarter of 2019 compared with the fourth quarter

of 2018 and increased $456,000, or 52%, compared to the first

quarter of 2018. The decline during the first quarter of 2019

compared to the fourth quarter of 2018 was due in part to

professional fees related to merger and acquisition activity during

2018 and to fees related to certain contract negotiations.

The increase in professional fees during the first quarter of 2019

compared with 2018 was largely related to acquisition related

professional fees. Merger and acquisition related

professional fees totaled approximately $508,000 during the first

quarter of 2019 compared with $730,000 in the fourth quarter of

2018 and $177,000 during the first quarter of 2018.

Professional fees during the fourth quarter of 2018 also included

approximately $930,000 in fees related to certain contract

negotiations.

Intangible amortization increased $33,000, or

4%, during the quarter ended March 31, 2019 compared with the

fourth quarter of 2018 and increased $637,000, or 309%, compared

with the first quarter of 2018. The increase in intangible

amortization was attributable to the previously discussed

acquisitions completed during 2018.

Other operating expenses declined $427,000, or

11%, during the first quarter of 2019 compared with the fourth

quarter of 2018 and increased $807,000, or 29%, compared with the

first quarter of 2018. The decline in the first quarter of

2019 compared with the fourth quarter of 2018 was partially

attributable to acquisition-related expenses that totaled

approximately $176,000 during the fourth quarter of

2018. The increase during the first quarter of 2019

compared with the first quarter of 2018 was largely attributable to

the operating costs related to the acquisitions completed in

2018.

About German American

German American Bancorp, Inc. is a NASDAQ-traded

(symbol: GABC) bank holding company based in Jasper, Indiana.

German American, through its banking subsidiary German American

Bank, operates 65 banking offices in 20 contiguous southern Indiana

counties and four counties in Kentucky. The Company also owns

an investment brokerage subsidiary (German American Investment

Services, Inc.) and a full line property and casualty insurance

agency (German American Insurance, Inc.).

Cautionary Note Regarding Forward-Looking Statements

Certain statements in this press release may be

deemed “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. Readers are

cautioned that, by their nature, forward-looking statements are

based on assumptions and are subject to risks, uncertainties, and

other factors. Actual results and experience could differ

materially from the anticipated results or other expectations

expressed or implied by these forward-looking statements as a

result of a number of factors, including but not limited to, those

discussed in this press release. Factors that could cause actual

experience to differ from the expectations expressed or implied in

this press release include the unknown future direction of interest

rates and the timing and magnitude of any changes in interest

rates; changes in competitive conditions; the introduction,

withdrawal, success and timing of asset/liability management

strategies or of mergers and acquisitions and other business

initiatives and strategies; changes in customer borrowing,

repayment, investment and deposit practices; changes in fiscal,

monetary and tax policies; changes in financial and capital

markets; potential deterioration in general economic conditions,

either nationally or locally, resulting in, among other things,

credit quality deterioration; capital management activities,

including possible future sales of new securities, or possible

repurchases or redemptions by the Company of outstanding debt or

equity securities; risks of expansion through acquisitions and

mergers, such as unexpected credit quality problems of the acquired

loans or other assets, unexpected attrition of the customer base of

the acquired institution or branches, and difficulties in

integration of the acquired operations; factors driving impairment

charges on investments; the impact, extent and timing of

technological changes; potential cyber-attacks, information

security breaches and other criminal activities; litigation

liabilities, including related costs, expenses, settlements and

judgments, or the outcome of matters before regulatory agencies,

whether pending or commencing in the future; actions of the Federal

Reserve Board; changes in accounting principles and

interpretations; potential increases of federal deposit insurance

premium expense, and possible future special assessments of FDIC

premiums, either industry wide or specific to the Company’s banking

subsidiary; actions of the regulatory authorities under the

Dodd-Frank Wall Street Reform and Consumer Protection Act (the

"Dodd-Frank Act") and the Federal Deposit Insurance Act and other

possible legislative and regulatory actions and reforms; impacts

resulting from possible amendments or revisions to the Dodd-Frank

Act and the regulations promulgated thereunder, or to Consumer

Financial Protection Bureau rules and regulations; the continued

availability of earnings and excess capital sufficient for the

lawful and prudent declaration and payment of cash dividends; and

other risk factors expressly identified in the Company’s filings

with the United States Securities and Exchange Commission. Such

statements reflect our views with respect to future events and are

subject to these and other risks, uncertainties and assumptions

relating to the operations, results of operations, growth strategy

and liquidity of the Company. Readers are cautioned not to place

undue reliance on these forward-looking statements. It is intended

that these forward-looking statements speak only as of the date

they are made. We do not undertake any obligation to release

publicly any revisions to these forward-looking statements to

reflect future events or circumstances or to reflect the occurrence

of unanticipated events.

| GERMAN AMERICAN BANCORP, INC. |

| (unaudited, dollars in thousands except per

share data) |

| |

|

|

|

|

|

| Consolidated Balance Sheets |

|

|

|

|

|

|

|

| |

March 31, 2019 |

|

December 31, 2018 |

|

March 31, 2018 |

|

ASSETS |

|

|

|

|

|

| Cash and Due from

Banks |

$ |

45,038 |

|

|

$ |

64,549 |

|

|

$ |

32,023 |

|

|

Short-term Investments |

14,740 |

|

|

32,251 |

|

|

8,187 |

|

|

Investment Securities |

824,950 |

|

|

812,964 |

|

|

737,957 |

|

|

|

|

|

|

|

|

| Loans

Held-for-Sale |

8,586 |

|

|

4,263 |

|

|

6,628 |

|

|

|

|

|

|

|

|

| Loans,

Net of Unearned Income |

2,708,832 |

|

|

2,728,059 |

|

|

2,150,546 |

|

| Allowance

for Loan Losses |

(16,243 |

) |

|

(15,823 |

) |

|

(14,460 |

) |

| Net

Loans |

2,692,589 |

|

|

2,712,236 |

|

|

2,136,086 |

|

|

|

|

|

|

|

|

| Stock in

FHLB and Other Restricted Stock |

13,048 |

|

|

13,048 |

|

|

13,048 |

|

| Premises

and Equipment |

89,600 |

|

|

80,627 |

|

|

58,024 |

|

| Goodwill

and Other Intangible Assets |

112,920 |

|

|

113,645 |

|

|

55,954 |

|

| Other

Assets |

94,053 |

|

|

95,507 |

|

|

77,111 |

|

|

TOTAL ASSETS |

$ |

3,895,524 |

|

|

$ |

3,929,090 |

|

|

$ |

3,125,018 |

|

| |

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

Non-interest-bearing Demand Deposits |

$ |

723,995 |

|

|

$ |

715,972 |

|

|

$ |

599,374 |

|

|

Interest-bearing Demand, Savings, and Money Market Accounts |

1,706,913 |

|

|

1,768,177 |

|

|

1,465,150 |

|

| Time

Deposits |

634,262 |

|

|

588,483 |

|

|

402,597 |

|

| Total

Deposits |

3,065,170 |

|

|

3,072,632 |

|

|

2,467,121 |

|

| |

|

|

|

|

|

|

Borrowings |

317,480 |

|

|

376,409 |

|

|

274,473 |

|

| Other

Liabilities |

33,687 |

|

|

21,409 |

|

|

19,419 |

|

|

TOTAL LIABILITIES |

3,416,337 |

|

|

3,470,450 |

|

|

2,761,013 |

|

| |

|

|

|

|

|

| SHAREHOLDERS'

EQUITY |

|

|

|

|

|

| Common

Stock and Surplus |

254,625 |

|

|

254,314 |

|

|

188,501 |

|

| Retained

Earnings |

222,246 |

|

|

211,424 |

|

|

187,342 |

|

|

Accumulated Other Comprehensive Income (Loss) |

2,316 |

|

|

(7,098 |

) |

|

(11,838 |

) |

| SHAREHOLDERS'

EQUITY |

479,187 |

|

|

458,640 |

|

|

364,005 |

|

| |

|

|

|

|

|

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY |

$ |

3,895,524 |

|

|

$ |

3,929,090 |

|

|

$ |

3,125,018 |

|

| |

|

|

|

|

|

| END OF PERIOD

SHARES OUTSTANDING |

24,992,238 |

|

|

24,967,458 |

|

|

22,968,813 |

|

| |

|

|

|

|

|

| TANGIBLE BOOK

VALUE PER SHARE (1) |

$ |

14.66 |

|

|

$ |

13.81 |

|

|

$ |

13.41 |

|

| |

|

|

|

|

|

|

|

| (1)

Tangible Book Value per Share is defined as Total Shareholders'

Equity less Goodwill and Other Intangible Assets divided by End of

Period Shares Outstanding. |

| GERMAN AMERICAN BANCORP, INC. |

| (unaudited, dollars in thousands except per

share data) |

| |

|

|

|

|

|

| Consolidated Statements of

Income |

|

|

|

|

|

|

|

| |

Three Months Ended |

| |

March 31, 2019 |

|

December 31, 2018 |

|

March 31, 2018 |

| INTEREST

INCOME |

|

|

|

|

|

| Interest and Fees on

Loans |

$ |

35,119 |

|

|

$ |

33,678 |

|

|

$ |

23,950 |

|

| Interest

on Short-term Investments |

141 |

|

|

97 |

|

|

56 |

|

| Interest

and Dividends on Investment Securities |

5,929 |

|

|

5,821 |

|

|

5,139 |

|

|

TOTAL INTEREST INCOME |

41,189 |

|

|

39,596 |

|

|

29,145 |

|

| |

|

|

|

|

|

| INTEREST

EXPENSE |

|

|

|

|

|

| Interest

on Deposits |

5,416 |

|

|

4,959 |

|

|

2,283 |

|

| Interest

on Borrowings |

2,182 |

|

|

1,654 |

|

|

1,252 |

|

|

TOTAL INTEREST EXPENSE |

7,598 |

|

|

6,613 |

|

|

3,535 |

|

|

|

|

|

|

|

|

|

NET INTEREST INCOME |

33,591 |

|

|

32,983 |

|

|

25,610 |

|

| Provision

for Loan Losses |

675 |

|

|

— |

|

|

350 |

|

|

NET INTEREST INCOME AFTER PROVISION FOR LOAN

LOSSES |

32,916 |

|

|

32,983 |

|

|

25,260 |

|

| |

|

|

|

|

|

| NON-INTEREST

INCOME |

|

|

|

|

|

| Net Gain

on Sales of Loans |

981 |

|

|

583 |

|

|

650 |

|

| Net Gain

on Securities |

155 |

|

|

272 |

|

|

270 |

|

| Other

Non-interest Income |

10,522 |

|

|

8,878 |

|

|

8,572 |

|

|

TOTAL NON-INTEREST INCOME |

11,658 |

|

|

9,733 |

|

|

9,492 |

|

| |

|

|

|

|

|

| NON-INTEREST

EXPENSE |

|

|

|

|

|

| Salaries

and Benefits |

15,044 |

|

|

15,027 |

|

|

12,126 |

|

| Other

Non-interest Expenses |

11,715 |

|

|

14,787 |

|

|

8,329 |

|

|

TOTAL NON-INTEREST EXPENSE |

26,759 |

|

|

29,814 |

|

|

20,455 |

|

|

|

|

|

|

|

|

| Income

before Income Taxes |

17,815 |

|

|

12,902 |

|

|

14,297 |

|

| Income

Tax Expense |

2,748 |

|

|

1,922 |

|

|

2,484 |

|

| |

|

|

|

|

|

| NET

INCOME |

$ |

15,067 |

|

|

$ |

10,980 |

|

|

$ |

11,813 |

|

| |

|

|

|

|

|

| BASIC EARNINGS

PER SHARE |

$ |

0.60 |

|

|

$ |

0.44 |

|

|

$ |

0.51 |

|

| DILUTED

EARNINGS PER SHARE |

$ |

0.60 |

|

|

$ |

0.44 |

|

|

$ |

0.51 |

|

| |

|

|

|

|

|

| WEIGHTED

AVERAGE SHARES OUTSTANDING |

24,971,863 |

|

|

24,962,878 |

|

|

22,940,402 |

|

| DILUTED

WEIGHTED AVERAGE SHARES OUTSTANDING |

24,971,863 |

|

|

24,962,878 |

|

|

22,940,402 |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| GERMAN AMERICAN BANCORP, INC. |

| (unaudited, dollars in thousands except per

share data) |

| |

|

|

|

|

|

|

| |

|

Three Months Ended |

| |

|

March 31, |

|

December 31, |

|

March 31, |

| |

|

2019 |

|

2018 |

|

2018 |

|

EARNINGS PERFORMANCE RATIOS |

|

|

|

|

|

| |

Annualized Return on

Average Assets |

1.55 |

% |

|

1.15 |

% |

|

1.51 |

% |

| |

Annualized Return on

Average Equity |

12.98 |

% |

|

10.05 |

% |

|

13.00 |

% |

| |

Net Interest

Margin |

3.88 |

% |

|

3.83 |

% |

|

3.66 |

% |

| |

Efficiency Ratio

(1) |

58.23 |

% |

|

68.64 |

% |

|

57.21 |

% |

| |

Net Overhead Expense to

Average Earning Assets (2) |

1.69 |

% |

|

2.30 |

% |

|

1.51 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSET QUALITY RATIOS |

|

|

|

|

|

|

|

|

|

|

|

| |

Annualized Net

Charge-offs to Average Loans |

0.04 |

% |

|

0.03 |

% |

|

0.30 |

% |

| |

Allowance for Loan

Losses to Period End Loans |

0.60 |

% |

|

0.58 |

% |

|

0.67 |

% |

| |

Non-performing Assets

to Period End Assets |

0.34 |

% |

|

0.34 |

% |

|

0.34 |

% |

| |

Non-performing Loans to

Period End Loans |

0.46 |

% |

|

0.48 |

% |

|

0.49 |

% |

| |

Loans 30-89 Days Past

Due to Period End Loans |

0.45 |

% |

|

0.54 |

% |

|

0.33 |

% |

| |

|

|

|

|

|

|

|

SELECTED BALANCE SHEET & OTHER FINANCIAL

DATA |

|

|

|

|

|

| |

Average Assets |

$ |

3,886,723 |

|

|

$ |

3,834,251 |

|

|

$ |

3,120,971 |

|

| |

Average Earning

Assets |

$ |

3,568,971 |

|

|

$ |

3,495,618 |

|

|

$ |

2,901,849 |

|

| |

Average Total

Loans |

$ |

2,718,808 |

|

|

$ |

2,662,502 |

|

|

$ |

2,139,704 |

|

| |

Average Demand

Deposits |

$ |

691,107 |

|

|

$ |

714,504 |

|

|

$ |

585,432 |

|

| |

Average Interest

Bearing Liabilities |

$ |

2,708,307 |

|

|

$ |

2,660,340 |

|

|

$ |

2,150,544 |

|

| |

Average Equity |

$ |

464,234 |

|

|

$ |

437,177 |

|

|

$ |

363,579 |

|

| |

|

|

|

|

|

|

| |

Period End

Non-performing Assets (3) |

$ |

13,114 |

|

|

$ |

13,498 |

|

|

$ |

10,652 |

|

| |

Period End

Non-performing Loans (4) |

$ |

12,429 |

|

|

$ |

13,212 |

|

|

$ |

10,584 |

|

| |

Period End Loans 30-89

Days Past Due (5) |

$ |

12,197 |

|

|

$ |

14,815 |

|

|

$ |

7,013 |

|

| |

|

|

|

|

|

|

| |

Tax Equivalent Net

Interest Income |

$ |

34,299 |

|

|

$ |

33,702 |

|

|

$ |

26,261 |

|

| |

Net Charge-offs during

Period |

$ |

255 |

|

|

$ |

228 |

|

|

$ |

1,584 |

|

| |

|

|

|

|

|

|

|

(1) |

Efficiency

Ratio is defined as Non-interest Expense divided by the sum of Net

Interest Income, on a tax equivalent basis, and Non-interest

Income. |

|

(2) |

Net

Overhead Expense is defined as Total Non-interest Expense less

Total Non-interest Income. |

|

(3) |

Non-performing assets are defined as Non-accrual Loans, Loans Past

Due 90 days or more, Restructured Loans, and Other Real Estate

Owned. |

|

(4) |

Non-performing loans are defined as Non-accrual Loans, Loans Past

Due 90 days or more, and Restructured Loans. |

|

(5) |

Loans 30-89 days past

due and still accruing. |

|

|

|

|

|

For additional information, contact:Mark

A Schroeder, Chairman & Chief Executive Officer of

German American Bancorp, Inc.Bradley M Rust,

Executive Vice President/CFO of German American Bancorp, Inc.(812)

482-1314

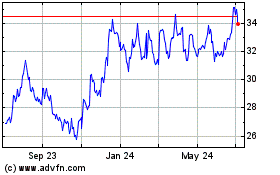

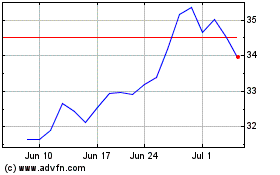

German American Bancorp (NASDAQ:GABC)

Historical Stock Chart

From Mar 2024 to Apr 2024

German American Bancorp (NASDAQ:GABC)

Historical Stock Chart

From Apr 2023 to Apr 2024