Table of Contents

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities

Exchange Act of 1934 (Amendment No.)

Filed by Registrant

☑

Filed by Party other than Registrant

☐

|

Check the appropriate box:

|

|

|

|

|

|

|

☐

|

Preliminary Proxy Statement

|

☐

|

Confidential, for Use of the Commission

|

|

|

|

|

Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

|

|

☑

|

Definitive Proxy Statement

|

☐

|

Definitive Additional Materials

|

|

|

|

|

|

|

☐

|

Soliciting Materials Pursuant to §240.14a-12

|

|

|

FORWARD INDUSTRIES, INC.

(Name of

Registrant as Specified In Its Charter)

____________________________________________

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check the appropriate

box):

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which

the filing fee is calculated and state how it was determined): $_____ per share as determined under Rule 0-11 under the Exchange

Act.

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

☐

Fee paid previously with preliminary materials.

☐

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of

its filing.

|

|

(1)

|

Amount previously paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

Forward

Industries, Inc.

477 Rosemary Avenue

Suite 219

West Palm Beach, Florida 33401

(561) 465-0030

To The Shareholders of Forward Industries,

Inc.:

We are pleased to

invite you to attend the 2020 Annual Meeting of the shareholders of Forward Industries, Inc., which will be held at 10:00 a.m.

on February 11, 2020 at the offices of CohnReznick, 1301 Avenue of the Americas, Seventh Floor, in New York, New York, for the

following purposes:

|

|

1.

|

To elect 4 members to our Board of Directors.

|

|

|

|

|

|

|

2.

|

To ratify the appointment of our independent registered public accounting firm for fiscal year 2020.

|

|

|

|

|

|

|

3.

|

To approve, on an advisory basis, the Company’s executive compensation (“say on pay” vote).

|

|

|

|

|

|

|

4.

|

To approve, on an advisory basis, the frequency of future “say on pay” votes.

|

|

|

|

|

|

|

5.

|

For the transaction of such other matters as may properly come before the Annual Meeting or any adjournment or postponement thereof.

|

Forward’s Board

of Directors has fixed the close of business on December 12, 2019 as the record date for a determination of shareholders entitled

to notice of, and to vote at, this Annual Meeting or any adjournment thereof.

Important Notice Regarding the Availability

of Proxy Materials for the Annual Meeting of Shareholders to Be Held on February 11, 2020: This Proxy Statement and Form 10-K are

available at: https://www.proxyvote.com

If You Plan to Attend

Please note that space

limitations make it necessary to limit attendance to shareholders. Registration and seating will begin at 9:00 a.m. Shares can

be voted at the meeting only if the holder is present in person or by valid proxy.

For admission to the

meeting, each shareholder may be asked to present valid picture identification, such as a driver’s license or passport, and

proof of stock ownership as of the record date, such as the enclosed proxy card or a brokerage statement reflecting stock ownership.

Cameras, recording devices and other electronic devices will not be permitted at the meeting.

If you do not plan

on attending the meeting, please vote your shares via the Internet, by phone or by signing and dating the enclosed proxy and return

it in the business envelope provided. Your vote is very important.

|

By the Order of the Board of Directors

|

|

|

|

/s/ Terence Wise

|

|

Terence Wise

|

|

Chief Executive Officer

|

Dated: December 27, 2019

Whether or not you expect to attend

in person, we urge you to vote your shares at your earliest convenience. This will ensure the presence of a quorum at the meeting.

Promptly voting your shares via the Internet, by phone or by signing, dating, and returning the enclosed proxy card will save us

the expenses and extra work of additional solicitation. An addressed envelope for which no postage is required if mailed in the

United States is enclosed if you wish to vote by mail. Submitting your proxy now will not prevent you from voting your shares at

the meeting if you desire to do so, as your proxy is revocable at your option. Your vote is important, so please act today!

TABLE OF CONTENTS

Forward Industries,

Inc.

477 Rosemary Avenue

Suite 219

West Palm Beach, Florida 33401

(561) 465-0030

2020 ANNUAL MEETING OF SHAREHOLDERS

PROXY STATEMENT

Why am I receiving these materials?

These proxy materials

are being sent to the holders of shares of the voting stock of Forward Industries, Inc., which we refer to as “Forward”

or the “Company,” in connection with the solicitation of proxies by our Board of Directors, which we refer to as the

“Board,” for use at the 2020 Annual Meeting of Shareholders to be held at 10:00 a.m. on February 11, 2020 at 1301 Avenue

of the Americas, Seventh Floor, in New York. The proxy materials relating to the Annual Meeting are first being mailed to shareholders

entitled to vote at the meeting on or about December 27, 2019. A copy of our Form 10-K for the year ended September 30, 2019 is

being mailed concurrently with this Proxy Statement.

Who is Entitled to Vote?

Our Board has fixed

the close of business on December 12, 2019 as the record date for a determination of shareholders entitled to notice of, and to

vote at, this Annual Meeting or any adjournment thereof. On the record date, there were 9,533,851 shares of common stock outstanding.

Each share of Forward common stock represents one vote that may be voted on each matter that may come before the Annual Meeting.

As of the record date, Forward has no outstanding preferred stock.

What is the difference between holding

shares as a record holder and as a beneficial owner?

If your shares are

registered in your name with our transfer agent, American Stock Transfer, you are the “record holder” of those shares.

If you are a record holder, these proxy materials have been provided directly to you by Forward.

If your shares are

held in a stock brokerage account, a bank or other holder of record, you are considered the “beneficial owner” of those

shares held in “street name.” If your shares are held in street name, these proxy materials have been forwarded to

you by that organization. As the beneficial owner, you have the right to instruct this organization on how to vote your shares.

Who May Attend the Meeting?

Record holders and

beneficial owners may attend the Annual Meeting. If your shares are held in street name, you will need to bring a copy of a brokerage

statement or other documentation reflecting your stock ownership as of the record date. Please see below for instructions on how

to vote at the Annual Meeting if your shares are held in street name.

How Do I Vote?

Record

Holder

1.

Vote by Internet. The website address for Internet voting is on your proxy card.

2.

Vote by phone. Call 1 (800) 690-6903 and follow the instructions on your proxy card.

3.

Vote by mail. Mark, date, sign and mail promptly the enclosed proxy card (a postage-paid envelope is provided for

mailing in the United States).

4.

Vote in person. Attend and vote at the Annual Meeting.

If you

vote by Internet or phone, please DO NOT mail your proxy card.

Beneficial

Owner (Holding Shares in Street Name)

1.

Vote by Internet. The website address for Internet voting is on your vote instruction form.

2.

Vote by mail. Mark, date, sign and mail promptly the enclosed vote instruction form (a postage-paid envelope is provided

for mailing in the United States).

3.

Vote in person. Obtain a valid legal proxy from the organization that holds your shares and attend and vote at the Annual

Meeting.

What Constitutes a Quorum?

To carry on the business

of the Annual Meeting, we must have a quorum. A quorum is present when a majority of the shares entitled to vote, as of the record

date, are present in person or represented by proxy. Shares owned by Forward are not considered outstanding or considered to be

present at the Annual Meeting. Broker non-votes (because there are routine matters presented at the Annual Meeting) and abstentions

are counted as present for the purpose of determining the existence of a quorum.

What happens if Forward is unable to

obtain a Quorum?

If a quorum is not

present to transact business at the Annual Meeting or if we do not receive sufficient votes in favor of the proposals by the date

of the Annual Meeting, the persons named as proxies may propose one or more adjournments of the Annual Meeting to permit solicitation

of proxies.

What happens if I do not give specific

voting instructions?

Record Holder.

If you are a shareholder of record and you indicate when voting on the Internet or by telephone that you wish to vote as recommended

by the Board, or you sign, date and return a proxy card without giving specific voting instructions, then your shares will be voted

in accordance with the Board’s recommendations.

Beneficial Owners.

If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with

specific voting instructions, the organization that holds your shares may generally vote at its discretion on routine matters but

cannot vote on non-routine matters. If the organization that holds your shares does not receive instructions from you on how to

vote your shares on a non-routine matter, the organization will not have the authority to vote your shares on that proposal. This

is generally referred to as a “broker non-vote.” In tabulating the voting results for any particular proposal, shares

that constitute broker non-votes are not considered entitled to vote on that proposal. Thus, broker non-votes will not affect the

outcome of any matter being voted on at the meeting.

Important Rule Affecting Beneficial

Owners Holding Shares In Street Name

Brokers may no longer

use discretionary authority to vote shares on the election of directors. Please submit your vote instruction form so your vote

is counted.

Which Proposals are Considered “Routine”

or “Non-Routine”?

Only Proposal 2 is

considered routine. A broker or other nominee cannot vote without instructions on non-routine matters, and, therefore, there may

be broker non-votes on Proposals 1, 3, and 4.

How are abstentions treated?

Abstentions have the

same effect as a vote “Against” for Proposals 2-4. Abstentions have no effect on Proposal 1.

How Many Votes are Needed for Each Proposal

to Pass and what is the effect of a Broker Non-Vote and Abstention?

|

Proposals

|

Vote

Required

|

Effect of Broker

Non-Votes

|

Effect of

Abstentions (1)

|

|

|

|

|

|

|

Election of Directors

|

Plurality,

which means that the four nominees receiving the highest number of affirmative votes will be elected.

|

None

|

None

|

|

Ratification of Independent Registered Public Accounting Firm

|

Majority of the shares present in person or represented by proxy at the meeting and entitled to vote

|

No. Broker Non-Votes (Routine Matter)

|

Same as “Against”

|

|

Advisory Vote to Approve Executive Compensation (“Say on Pay” Vote)

|

Majority of the shares present in person or represented by proxy at the meeting and entitled to vote

|

None

|

Same as “Against”

|

|

Advisory Vote to Set the Frequency of Future “Say on Pay” Votes

|

Majority of the shares present in person or represented by proxy at the meeting and entitled to vote

|

None

|

Same as “Against”

|

(1) “Withheld” for Proposal

1.

What Are the Voting Procedures?

In voting by proxy

with regard to the election of directors, you may vote in favor of all nominees, withhold your votes as to all nominees, or withhold

your votes as to specific nominees. With regard to the remaining proposals, you may vote in favor of each proposal or against each

proposal, or in favor of some proposals and against others, or you may abstain from voting on any of these proposals. You should

specify your respective choices on the accompanying proxy card or your vote instruction form.

Is My Proxy Revocable?

You may revoke your

proxy and reclaim your right to vote up to and including the day of the Annual Meeting by giving written notice to the Corporate

Secretary of Forward, by delivering a proxy card dated after the date of the proxy or by voting in person at the Annual Meeting.

All written notices of revocation and other communications with respect to revocations of proxies should be addressed to: Forward

Industries, Inc., 477 S. Rosemary Avenue, Suite 219, West Palm Beach, Florida 33401, Attention: Corporate Secretary.

Who is Paying for the Expenses Involved

in Preparing and Mailing this Proxy Statement?

All of the expenses

involved in preparing, assembling and mailing these proxy materials and all costs of soliciting proxies will be paid by Forward.

In addition to the solicitation by mail, proxies may be solicited by our officers and regular employees by telephone or in person.

Such persons will receive no compensation for their services other than their regular salaries. Arrangements will also be made

with brokerage houses and other custodians, nominees and fiduciaries to forward solicitation materials to the beneficial owners

of the shares held of record by such persons, and we may reimburse such persons for reasonable out of pocket expenses incurred

by them in so doing. We may hire an independent proxy solicitation firm.

What Happens if Additional Matters are

Presented at the Annual Meeting?

Other than the items

of business described in this Proxy Statement, we are not aware of any other business to be acted upon at the Annual Meeting. If

you submit a signed proxy card, the persons named as proxy holders, Messrs. Terence Wise and Michael Matte, will have the discretion

to vote your shares on any additional matters properly presented for a vote at the Annual Meeting. If for any reason any of our

nominees is not available as a candidate for director, the persons named as proxy holders will vote your proxy for such other candidate

or candidates as may be nominated by the Board.

What is “householding” and

how does it affect me?

Record holders who

have the same address and last name will receive only one copy of their proxy materials, unless we are notified that one or more

of these record holders wishes to continue receiving individual copies. This procedure will reduce our printing costs and postage

fees. Shareholders who participate in householding will continue to receive separate proxy cards.

If you are eligible

for householding, but you and other record holders with whom you share an address, receive multiple copies of these proxy materials,

or if you hold Forward stock in more than one account, and in either case you wish to receive only a single copy of each of these

documents for your household, please contact our Corporate Secretary at: Forward Industries, Inc., 477 Rosemary Avenue, Suite 219,

West Palm Beach, Florida 33401, (561) 565-0030.

If you participate

in householding and wish to receive a separate copy of these proxy materials, or if you do not wish to continue to participate

in householding and prefer to receive separate copies of these documents in the future, please contact our Corporate Secretary

as indicated above. Beneficial owners can request information about householding from their brokers, banks or other holders of

record.

Do I Have Dissenters’ (Appraisal)

Rights?

Appraisal rights are

not available to Forward shareholders with any of the proposals brought before the Annual Meeting.

Can a Shareholder Present a Proposal

To Be Considered At the Next Annual Meeting?

If you wish to submit a proposal to be

considered at the 2021 Annual Meeting (“2021 Meeting”), the following is required:

|

|

•

|

For

a shareholder proposal to be considered for inclusion in Forward’s Proxy Statement and proxy card for the 2021 Meeting pursuant

to Rule 14a-8 under the Securities Exchange Act of 1934, which we refer to as the “Exchange Act,” our Corporate Secretary

must receive the written proposal no later than August 29, 2020, which is 120 calendar days prior to the anniversary date Forward’s

Proxy Statement was mailed to shareholders in connection with this Annual Meeting. Such proposals also must comply with SEC regulations

under Rule 14a-8 regarding the inclusion of shareholder proposals in company sponsored materials.

|

|

|

|

|

|

|

•

|

Our

Bylaws include advance notice provisions that require shareholders desiring to recommend or nominate individuals to the Board

or who wish to present a proposal at the 2021 Meeting must do so in accordance with the terms of the advance notice provisions.

For a shareholder proposal or a nomination that is not intended to be included in Forward’s Proxy Statement and proxy card

under Rule 14a-8, our Corporate Secretary must receive the written proposal no later than 120 calendar days nor more than 150

calendar days prior to the first anniversary of this years Annual Meeting; Provided, however, that in the event that the 2021

Meeting is changed more than 30 days before or after such anniversary date, the proposal must be received no earlier than the

close of business on the 120th day prior to the 2021 Meeting and not later than the 90th date prior to the 2020 Meeting or the

10th day following the day on which public announcement of the date of such meeting is first made by the Company. If a shareholder

fails to meet these deadlines and fails to satisfy the requirements of Rule 14a-8 under the Exchange Act, we may exercise discretionary

voting authority under proxies we solicit to vote on any such proposal as we determine appropriate. Your notice must contain the

specific information set forth in our Bylaws.

|

|

|

|

|

|

|

•

|

Additionally,

you must be a record holder at the time you deliver your notice to the Corporate Secretary and are entitled to vote at the 2021

Meeting and meet the ownership requirements contained in Section 208 of our Bylaws.

|

A nomination or other

proposal will be disregarded if it does not comply with the above procedures. All proposals and nominations should be sent to Forward

Industries, Inc., 477 S. Rosemary Avenue, Suite 219, West Palm Beach, Florida 33401, Attention: Corporate Secretary.

We reserve the right

to amend our Bylaws and any change will apply to the 2021 Meeting unless otherwise specified in the amendment.

Interest of Officers and Directors in

Matters to Be Acted Upon

Except in the election

to our board of nominees set forth herein, none of the officers or directors have any interest in any of the matters to be acted

upon at the Annual Meeting.

The Board unanimously recommends that

stockholders vote “For” the election to the Board of each of the nominees in Proposal 1, “For” Proposal

2, “For” Proposal 3 and “EVERY THREE YEARS” FOR Proposal 4.

PROPOSAL 1. ELECTION OF DIRECTORS

We currently have

four members of our Board, all of whose terms will expire at this Annual Meeting. The Board proposes the election of the following

nominees as directors:

Howard Morgan

Sangita Shah

Terence Wise

James Ziglar

All of the nominees

listed above are currently directors of Forward, have been nominated for election at the 2020 Annual Meeting, and have agreed to

serve if elected. The four persons who receive the most votes cast will be elected and will serve as directors until the next Annual

Meeting. If a nominee becomes unavailable for election before this Annual Meeting, the Board can name a substitute nominee and

proxies will be voted for such substitute nominee unless an instruction to the contrary is written on the proxy card. Furthermore,

we may appoint an additional person to our Board before the Annual Meeting. The principal occupation and certain other information

about the nominees and our executive officers are set forth on the following pages.

The Board recommends a vote “For”

the election of the nominated slate of directors.

DIRECTORS AND EXECUTIVE OFFICERS

The following table represents our Board as of the record date

(all of which are Board nominees)

|

Name

|

Age

|

Appointed

|

|

|

|

|

|

Howard Morgan

|

59

|

February 2012

|

|

Sangita Shah

|

53

|

February 2015

|

|

Terence Wise

|

72

|

February 2012

|

|

James Ziglar

|

74

|

October 2018

|

Nominee Biographies

Howard Morgan. Mr. Morgan has been

the Managing Director of The Justwise Group Limited (“Justwise”), a company that specializes in the procurement of

consumer durable products from Asia and is an established supplier to a list of major U.K. multi-channel retailers, since 1997.

Since 2013, Mr. Morgan has served as the Chief Executive Officer and a board member of EuroFresh Ltd., a wholesale distributor

of fresh produce in the United Kingdom and Europe. Mr. Morgan was selected as a director as a result of his significant business

management and operational skills as well as his knowledge of foreign sourcing and developing products for large multiple organizations.

Sangita Shah. Ms. Shah currently

serves as director and owner of Odyssean Enterprises Limited, a private advisory and investment company, in addition to serving

as non-executive chairman of Bilby PLC and non-executive chairman of RA International PLC. Ms. Shah is also a board advisor to

Global Reach Technology, a Fast Track WiFi company. Ms. Shah previously worked in seed/mezzanine financing and strategic investments

within the environmental and technology sectors following a number of senior roles held at KPMG and Ernst & Young. Ms. Shah

was selected as a director for her board and accounting experience, and she also serves as our Lead Director.

Terence Wise. Mr. Wise serves as

principal and Chairman of Justwise which he founded in 1977. Mr. Wise also serves as a principal and owner of Forward Industries

Asia-Pacific Corporation (f/k/a Seaton Global Corporation) (“Forward China”), a buying and supplier agent in the Asia-Pacific

region and has significant shareholdings in two furniture manufacturing plants in China. See the section titled “Related

Person Transactions” below. Mr. Wise was selected as a director for his extensive experience in the Asian markets.

James Ziglar. Mr. Ziglar has over

50 years of experience in law, finance, management, and public policy. Since 2009, Mr. Ziglar has served as Senior Counsel to the

law firm of Van Ness Feldman LLP, advising clients on a broad range of business and public policy issues. From 2005 until 2008,

Mr. Ziglar was the President and Chief Executive Officer of Cross Match Technologies, Inc., a leading provider of biometric technologies.

Mr. Ziglar has 18 years of experience in investment banking and before joining Cross Match Technologies in 2005, Mr. Ziglar was

a Managing Director and Chief Business Strategist at UBS Financial Services, Inc. in New York. Mr. Ziglar serves on the Board of

Integrated Biometrics, Inc., and has had extensive experience in the U.S. government, having served as a Law Clerk to Supreme Court

Justice Harry Blackmun, as Assistant Secretary of the Interior, as Commissioner of the Immigration and Naturalization Service, and

as Sergeant at Arms of the U.S. Senate. Mr. Ziglar was chosen as a director for his experience and expertise in management, business,

legal, and policy and regulatory related issues.

Executive Officers

|

Name

|

Age

|

Position

|

Appointed

|

|

Terence Wise

|

72

|

Chief Executive Officer

|

July 2015

|

|

Michael Matte

|

60

|

Chief Financial Officer

|

June 2015

|

See above for Mr. Terence Wise’s

biography.

Michael Matte. Mr. Matte has served

as Chief Financial Officer of Forward since June 2015. From May 2013 until March 2014, Mr. Matte served as the Chief Financial

Officer and Chief Accounting Officer of Aspen Group, Inc., an education technology company. Mr. Matte also served as an Executive

Vice President of Finance and Chief Financial Officer of MeetMe, Inc., a social discovery website, from October 2007 to March 2013.

Executive Officers of IPS

|

Name

|

Age

|

Position

|

Appointed

|

|

Mitchell Maiman

|

67

|

President of IPS

|

2008

|

|

Paul Severino

|

60

|

Chief Operating Officer of

|

2008

|

|

|

|

IPS

|

|

Mitchell Maiman. Mr. Maiman has

served as the President of Intelligent Product Solutions, Inc. (“IPS”), the Company’s wholly-owned subsidiary,

since co-founding it in 2008.

Paul Severino. Mr. Severino has

served as the Chief Operating Officer of IPS, since co-founding it in 2008.

There are no family relationships between

any of the executive officers and directors. Our Bylaws require that each director is elected at our annual meeting of shareholders

and holds office until the next annual meeting of shareholders, or until his or her successor is elected. See the section titled

“Related Person Transactions”.

Corporate Governance

Board Responsibilities

The Board oversees,

counsels, and directs management in the long-term interest of Forward and its shareholders. The Board’s responsibilities

include establishing broad corporate policies and reviewing the overall performance of Forward. The Board is not, however, involved

in the operating details on a day-to-day basis.

Board Committees and Charters

The Board delegates

various responsibilities and authority to different Board committees (“Board Committees”). The Board and the Board’s

committees (“Committees”) meet throughout the year and act by written consent from time-to-time as appropriate. Committees

regularly report on their activities and actions to the Board.

The Board currently

has and appoints the members of: the Audit Committee, the Compensation Committee, the Nominating and Corporate Governance Committee.

Each of these Committees has a written charter which may be accessed through Forward’s website at: http://www.forwardindustries.com/corporate-governance.html.

The following table identifies the independent

and non-independent Board nominees and Committee members:

|

Name

|

Independent

|

Audit

|

Compensation

|

Nominating

and Corporate

Governance

|

|

Howard Morgan

|

x

|

x

|

|

Chair

|

|

Sangita Shah

|

x

|

Chair

|

x

|

x

|

|

Terence Wise

|

|

|

|

|

|

James Ziglar

|

x

|

x

|

Chair

|

x

|

There were four Board

meetings held in fiscal 2019. All of the directors attended over 75% of the applicable Board and Committee meetings held in fiscal

2019. The Company does not have a policy regarding Board members attending annual meetings.

Director Independence

Our Board has determined

that Howard Morgan, Sangita Shah and James Ziglar are independent in accordance with standards under the Nasdaq Listing Rules.

Our Board determined that as a result of being employed as an executive officer, Mr. Wise was not independent under the Nasdaq Listing

Rules.

Our Board has also

determined that Howard Morgan, Sangita Shah and James Ziglar are independent under the Nasdaq Listing Rules independence standards

for Audit Committee members and Compensation Committee members.

Committees of the Board of Directors

Audit Committee

The Audit Committee

reviews our financial reporting process on behalf of the Board and administers our engagement of the independent registered public

accounting firm. The Audit Committee meets with the independent registered public accounting firm, with and without management

present, to discuss the results of its examinations, the evaluations of our internal controls, and the overall quality of our financial

reporting. Management has the primary responsibility for the financial statements and the reporting process, including the system

of internal controls.

Audit Committee

Financial Expert

Our Board has determined

that Ms. Shah is qualified as an Audit Committee Financial Expert, as that term is defined by the rules of the SEC and in compliance

with the Sarbanes-Oxley Act of 2002.

Compensation Committee

The function of the

Compensation Committee is to make recommendations to the Board concerning Board and committee compensation. The Compensation Committee

is also responsible for oversight of our overall compensation plans and benefit programs, as well as the approval of all employment,

severance and change of control agreements and plans applicable to our executive officers. The Compensation Committee is also responsible

for determining the compensation of and compensation structure for all of the Company’s executive officers. The Compensation

Committee reviews and approves equity-based compensation grants to our officers, directors, employees and consultants.

Nominating and Corporate Governance

Committee

The responsibilities

of the Nominating Committee include the identification of individuals qualified to become Board members, establishing the procedures

for the nomination process and the selection of nominees to stand for election as directors, the oversight of the selection and

composition of committees of the Board, oversight of possible conflicts of interests involving the Board and its members, developing

policies and procedures for related party transactions, developing corporate governance principles, and the oversight of the evaluations

of the Board and management specifically with respect to Corporate Governance The Nominating Committee has not established a policy

with regard to the consideration of any candidates recommended by shareholders. If we receive any shareholder recommended nominations,

the Nominating Committee will carefully review the recommendation(s) and consider such recommendation(s) in good faith.

Board Diversity

While we do not have

a formal policy on diversity, our Board considers diversity to include the skill set, background, reputation, type and length of

business experience of our board members, as well as a particular nominee’s contribution to that mix Although there are many

other factors, the board seeks individuals with experience in the sourcing industry and Asian markets, sales and marketing, legal

and accounting skills and board experience.

Board Leadership Structure

Our Board has determined

that its current structure, with combined Chairman and Chief Executive Officer roles and an independent Lead Director (Sangita

Shah), is in the best interests of Forward and its shareholders at this time. A number of factors support the leadership structure

chosen by the Board, including, among others:

|

|

•

|

The

Chief Executive Officer is intimately involved in the day-to-day operations of Forward and is best positioned to elevate the most

critical business issues for consideration by the Board.

|

|

|

|

|

|

|

•

|

The

Board believes that having the Chief Executive Officer serve in both capacities allows him to more effectively execute Forward’s

strategic initiatives and business plans and confront its challenges. A combined Chairman and Chief Executive Officer structure

provides us with decisive and effective leadership with clearer accountability to our shareholders. The combined role is both

counterbalanced and enhanced by the effective oversight and independence of our Board and the independent leadership provided

by our Lead Director. The Board believes that the appointment of a strong independent Lead Director and the use of regular executive

sessions of the non-management directors, along with the Boards strong committee system, allow it to maintain effective oversight

of management.

|

Role of Board in Risk Oversight

Our risk management

function is overseen by our Board. Our management keeps the Board apprised of material risks and provides directors access to all

information necessary for them to understand and evaluate how these risks interrelate, how they affect us, and how management addresses

those risks. Terence Wise, as our Chief Executive Officer and Chairman of the Board, and Michael Matte, our Chief Financial Officer,

work closely together with the Board and our Lead Director, on how to best address identified risks. If the identified risk poses

an actual or potential conflict with management, our independent directors may conduct the assessment. Presently, the primary risks

affecting us are: (i) our ability to grow our business, (ii) increase our customer base, (iii) diversify our sales outside of the

medical industry and (iv) obtaining the benefits that we anticipate from the acquisition of IPS.

Code of Business Conduct and Ethics

Our Board has adopted

a Code of Business Conduct and Ethics (“Code of Ethics”) that applies to all of our employees, including our Chief

Executive Officer and Chief Financial Officer. Although not required, the Code of Ethics also applies to our Board. The Code of

Ethics provides written standards that we believe are reasonably designed to deter wrongdoing and promote honest and ethical conduct,

including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships, full,

fair, accurate, timely and understandable disclosure, and compliance with laws, rules and regulations, including insider trading,

corporate opportunities and whistle-blowing or the prompt reporting of illegal or unethical behavior. A copy of our Code of Ethics

may be accessed at http://forwardindustries.com/corporate-governance.html

Communication with our Board of Directors

Although we do not

have a formal policy regarding communications with the Board, shareholders may communicate with the Board by writing to us at Forward

Industries, Inc., 477 S. Rosemary Avenue, Suite 219, West Palm Beach, Florida 33401, Attention: Corporate Secretary, or by facsimile

(561) 465-0074. Shareholders who would like their submission directed to a member of the Board may so specify, and the communication

will be forwarded, as appropriate.

Related Person Transactions

On March 12, 2012,

the Company entered into a Buying Agency and Supply Agreement (the “First Sourcing Agreement”) with Forward China.

Terence Wise, the Company’s Chairman, Chief Executive Officer and largest shareholder, is the owner of Forward China. In

addition, Jenny P. Yu, a Managing Director of Forward China, owns more than 5% of the Company’s common stock. On March 13,

2014, the Company entered into Amendment No. 1 to the First Sourcing Agreement with Forward China, dated as of March 11, 2014.

The First Sourcing Agreement, as amended, provided that Forward China would act as the Company’s exclusive buying agent and

supplier of products in the Asia Pacific region. The Company will purchase products at Forward China’s cost and pay Forward

China a monthly fee for services it provides under the First Sourcing Agreement.

On September 9, 2015,

the Company entered into a Buying Agency and Supply Agreement (the “Second Sourcing Agreement”) with Forward China

on substantially the same terms as the First Sourcing Agreement, which was due to expire on September 11, 2015. The Second Sourcing

Agreement provides that Forward China will act as the Company’s exclusive buying agent of carry and protective solutions

in the APAC Region. Forward China also arranges for sourcing, manufacture and exportation of such products. The Company purchases

products at cost and pays a service fee to Forward China. The service fee is calculated at $100,000 monthly plus 4% of “Adjusted

Gross Profit.” “Adjusted Gross Profit” is defined as the selling price less the cost from Forward China. The

Company recognized approximately $1,398,000 and $1,426,000 during the fiscal years ended September 30, 2019 and 2018, respectively,

in service fees paid to Forward China. Effective October 22, 2019, the Company extended the term of the supply agreement to October

22, 2020 under the same terms, substantially.

The sister of Paul

Severino, the Chief Operating Officer of IPS, is employed by IPS as its Chief Marketing Officer and receives an annual salary of

$156,000 per year.

In order to fund the

acquisition of IPS, the Company issued a $1.6 million promissory note to Forward China in consideration for a one-year loan. The

note was originally due January 18, 2019 but has been subsequently extended several times and is now due on January 17, 2020. The

note bears an interest rate of 8% and pays monthly interest. The Company made approximately $128,000 and $85,000 in interest payments

associated with the note in Fiscal 2019 and Fiscal 2018, respectively.

During Fiscal 2019,

the Company’s design division provided services to Duality Advisers. The Chief Operating and Financial Officer and an equity

owner of Duality Advisers is Jeff Ziglar, the son of James Ziglar, a director. Duality Advisers paid the Company approximately

$150,000 for design services in Fiscal 2019.

Compensation of Directors

In fiscal 2019, the Company paid annual cash compensation

of $60,000 to its non-employee directors as well as stock options for service on the Board. The Company does not pay compensation

for service on the Board to any directors who are employees of the Company.

In fiscal 2019, non-employee

directors were compensated for as follows:

|

|

|

|

|

|

Change in

|

|

|

|

|

|

|

|

|

Pension

|

|

|

|

|

|

|

|

|

Value and

|

|

|

|

|

|

|

|

Non-Equity

|

Nonqualified

|

|

|

|

|

Fees Earned or

|

|

|

Incentive

|

Deferred

|

All

|

|

|

|

Paid in

|

Stock

|

Option

|

Plan

|

Compensation

|

Other

|

|

|

Name

|

Cash

|

Awards

|

Awards

|

Compensation

|

Earnings

|

Compensation

|

Total

|

|

(a)

|

($)(b)

|

($)(c)(1)

|

($)(d)(1)

|

($)(e)

|

($)(f)

|

($)(g)

|

($)(j)

|

|

|

|

|

|

|

|

|

|

|

Howard Morgan

|

70,000

|

0

|

93,900

|

0

|

0

|

0

|

163,900

|

|

|

|

|

|

|

|

|

|

|

Sangita Shah

|

70,000

|

0

|

93,900

|

0

|

0

|

0

|

163,900

|

|

|

|

|

|

|

|

|

|

|

James Ziglar

|

58,492

|

0

|

40,000

|

0

|

0

|

0

|

98,492

|

(1)

Amounts reported represent the aggregate grant date fair value of awards granted without regards to forfeitures, computed in accordance

with ASC 718. This amount does not reflect the actual economic value realized by the director.

This Director Compensation table does

not include Mr. Terence Wise because he is employed as the Company’s Chief Executive Officer and therefore he does not receive

compensation for his service on the Board.

Executive Compensation

The following information

is related to the compensation paid, distributed or accrued by us for fiscal 2019 and 2018 to all Chief Executive Officers (principal

executive officers) serving during the last fiscal year and the two other most highly compensated executive officers serving at

the end of the last fiscal year whose compensation exceeded $100,000. We refer to these individuals as our “Named Executive

Officers.”

Summary Compensation Table

Name and

Principal Position

|

Year

|

Salary

|

Bonus

|

Stock

Awards

|

Option

Awards

|

All Other

Compensation

|

Total

|

|

(a)

|

(b)

|

($)(c)

|

($)(d)

|

($)(e)

|

($)(f)

|

($)(i)(1)

|

($)(j)

|

|

|

|

|

|

|

|

|

|

|

Terence Wise

|

2019

|

300,000

|

0

|

0

|

0

|

0

|

300,000

|

|

Chief Executive Officer

|

2018

|

300,000

|

0

|

0

|

0

|

0

|

300,000

|

|

|

|

|

|

|

|

|

|

|

Michael Matte

|

2019

|

225,000

|

0

|

0

|

0

|

17,890

|

242,890

|

|

Chief Financial Officer

|

2018

|

200,000

|

0

|

0

|

0

|

16,699

|

216,699

|

|

|

|

|

|

|

|

|

|

|

Mitch Maiman

|

2019

|

256,000

|

0

|

0

|

0

|

18,000

|

274,000

|

|

Executive Officer of IPS

|

2018

|

190,482

|

8,820

|

0

|

0

|

0

|

199,302

|

|

|

|

|

|

|

|

|

|

|

Paul Severino

|

2019

|

256,000

|

0

|

0

|

0

|

18,000

|

274,000

|

|

Executive Officer of IPS

|

2018

|

190,482

|

8,820

|

0

|

0

|

0

|

199,302

|

(1) Represents

insurance reimbursements.

Named Executive Officer Employment Compensation

Arrangements/Agreements

Terence Wise.

Effective May 16, 2018, the Company and Terence Wise entered into a three year Employment Agreement. Pursuant to his Employment

Agreement, Mr. Wise shall receive an annual base salary of $300,000.

Michael Matte.

Effective May 16, 2018, the Company and Michael Matte entered into a three year Employment Agreement. Pursuant to his Employment

Agreement, Mr. Matte shall receive an annual base salary of $225,000.

Maiman and Severino.

In connection with the acquisition of IPS, the Company entered into three year employment agreements with Mitch Maiman and Paul

Severino. Under the Employment Agreements, each of Messrs. Maiman and Severino receive an annual base salary of $256,000 and $900

per month for auto and cell phone allowance.

Bonus

Under his Employment

Agreement, Mr. Wise is eligible to receive for each full fiscal year a bonus in the amount of up to 25% of his base salary to be

paid in restricted stock or other equity, the combination and vesting of which shall be determined by the Compensation Committee

in its sole discretion.

Under his Employment

Agreement, Mr. Matte is eligible to receive for each full fiscal year a bonus in the amount of up to 25% of his base salary to

be paid in cash and/or restricted stock or other equity, the combination and vesting of which shall be determined by the Compensation

Committee in its sole discretion.

Each of the Named

Executive Officers is entitled to receive discretionary bonuses under their Employment Agreements at the discretion of the Compensation

Committee.

Termination Provisions

Pursuant to Messrs.

Wise’s and Matte’s Employment Agreements, in the event they terminate their employment for Good Reason, or the Company

terminates their employment without Cause, they shall be entitled, subject to execution and effectiveness of a general release,

to receive a lump-sum payment in the amount equal to six month of their then base salary.

Pursuant to Mr. Wise’s

Employment Agreement, Good Reason is defined as (i) the assignment to the executive without his consent of duties materially inconsistent

with his position as contemplated by the Employment Agreement, (ii) a decrease in annual base salary, other than an across the

board decrease in salary applicable to all senior executives of the Company of not more than 10%, (iii) any failure by the Company

to perform any material obligation under, or its breach of a material provision of, the Employment Agreement, and (iv) failure

of any Company successor to expressly assume and agree to perform the Employment Agreement in the same manner and to the same extent

as the Company would have had there been no successor. Good Reason in Mr. Matte’s Employment Agreement also includes the

relocation of his principal place of business more than 30 miles from West Palm Beach, Florida. Cause is defined as willful misconduct

in connection with the performance of, or willful failure, neglect or refusal to perform, any duties or services under the Employment

Agreement, or commission of, conviction of, or nolo contendere or guilty plea in connection with, a felony or a crime of moral

turpitude.

In the event Messrs.

Maiman’s and Severino’s employment is terminated without Cause, they are entitled to receive, in a lump sum payment,

one year’s base salary. Additionally, they shall receive one year of benefits. Cause is generally defined as (i) gross misconduct,

(ii) committing a felony, (iii) death or disability, (iv) failure to perform his duties and (v) material breach of the Employment

Agreement.

Retirement Plans

The Company has a

Section 401(k) plan and provides an employer matching contribution, for all of its employees, including Named Executive Officers.

The Company does not offer any nonqualified pension plans, supplemental executive retirement plans, or other plans that provide

for the payment of retirement benefits.

Outstanding Awards at Fiscal Year End

Listed below is information

with respect to unexercised options, stock that has not vested, and equity incentive plan awards for each Named Executive Officer

outstanding as of September 30, 2019:

Outstanding Equity Awards At Fiscal Year-End

2019

|

Name

|

Number of

Securities

Underlying

Unexercised

Options (#)

Exercisable

|

Number of

Securities

Underlying

Unexercised

Options

(#)

Unexercisable

|

Equity

Incentive

Plan

Awards:

Number of

Securities

Underlying

Unexercised

Unearned

Options

(#)

|

Option

Exercise

Price

|

Option

Expiration

Date

|

Number of

Shares or

Units of

Stock That

Have Not

Vested (#)

|

Market

Value of

Shares or

Units of

Stock That

Have Not

Vested

|

Equity

Incentive

Plan

Awards:

Number of

Unearned

Shares,

Units or

Other

Rights That

Have Not

Vested (#)

|

Equity

Incentive

Plan

Awards:

Market or

Payout

Value of

Unearned

Shares,

Units or

Other

Rights

That

Have Not

Vested (#)

|

|

(a)

|

(b)

|

(c)

|

(d)

|

($)(e)

|

(f)

|

(g)

|

($)(h)

|

(i)

|

(j)

|

|

|

|

|

|

|

|

|

|

|

|

|

Terence Wise

|

10,000

|

-

|

-

|

1.23

|

10/15/22

|

-

|

-

|

-

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Michael Matte

|

50,000

|

-

|

-

|

0.64

|

6/25/25

|

-

|

-

|

-

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Mitch Maiman

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Paul Severino

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

Risk Assessment Regarding

Compensation Policies and Practices as they Relate to Risk Management

Our compensation program

for employees does not create incentives for excessive risk taking by our employees or involve risks that are reasonably likely

to have a material adverse effect on us. Our compensation has the following risk-limiting characteristics:

|

|

•

|

Our

base pay programs consisting of competitive salary rates provide a reliable level of income on a regular basis, which decreases

incentive on the part of our executives to take unnecessary or imprudent risks;

|

|

|

|

|

|

|

•

|

Awards

are not tied to formulas that could focus executives on specific short-term outcomes;

|

|

|

|

|

|

|

•

|

Equity

awards may be recovered by us should a restatement of earnings occur upon which incentive compensation awards were based, or in

the event of other wrongdoing by the recipient; and

|

|

|

|

|

|

|

•

|

Equity

awards, generally, have multi-year vesting which aligns the long-term interests of our executives with those of our shareholders

and, again, discourages the taking of short- term risk at the expense of long-term performance.

|

PROPOSAL 2. RATIFICATION

OF THE APPOINTMENT OF OUR INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM FOR FISCAL YEAR 2020

Our Board has appointed

CohnReznick LLP to serve as our independent registered public accounting firm for the fiscal year ending September 30, 2020. CohnReznick

LLP has been Forward’s independent registered public accounting firm since 2010. Selection of Forward’s independent

registered public accounting firm is not required to be submitted to a vote of the shareholders of Forward for ratification. However,

Forward is submitting this matter to the shareholders as a matter of good corporate governance. Even if the appointment is ratified,

the Board may, in its discretion, appoint a different independent registered public accounting firm at any time during the year

if they determine that such a change would be in the best interests of Forward and its shareholders. If the appointment is not

ratified, the Board will consider its options.

A representative of

CohnReznick LLP is expected to be present at the Annual Meeting.

The Board recommends a vote “For”

this Proposal No. 2

The Audit Committee,

which currently consists of Sangita Shah, James Ziglar, and Howard Morgan, reviews Forward’s financial reporting process

on behalf of the Board and administers our engagement of the independent registered public accounting firm. The Audit Committee

meets with the independent registered public accounting firm, with and without management present, to discuss the results of its

examinations, the evaluations of our internal controls, and the overall quality of our financial reporting. Management has the

primary responsibility for the financial statements and the reporting process, including the system of internal controls.

The Audit Committee

has met and held discussions with management and CohnReznick LLP. Management represented to the Audit Committee that our financial

statements were prepared in accordance with generally accepted accounting principles and the Audit Committee has reviewed and discussed

the financial statements with management and CohnReznick LLP. The Audit Committee reviewed with CohnReznick LLP its judgments as

to the quality, not just the acceptability, of our accounting principles and such other matters as are required to be discussed

with the Audit Committee in accordance with the standards of the Public Company Accounting Oversight Board, which we refer to as

the "PCAOB."

Audit Committee Report

The Audit Committee

has:

|

|

•

|

reviewed

and discussed the audited financial statements with management;

|

|

|

|

|

|

|

•

|

met

privately with the independent registered public accounting firm and discussed matters required by the PCAOB;

|

|

|

|

|

|

|

•

|

received

the written disclosures and the letter from the independent registered public accounting firm, as required by the applicable requirements

of the PCAOB regarding the independent registered public accounting firm’s communications with the Audit Committee concerning

independence, and has discussed with the independent registered public accounting firm its independence from us; and

|

|

|

|

|

|

|

•

|

in

reliance on the review and discussions referred to above, the Audit Committee recommended to the Board that the audited financial

statements be included in the Annual Report on Form 10-K for the fiscal year ended September 30, 2019 filed with the SEC.

|

This report is submitted

by the Audit Committee:

Sangita Shah

Howard Morgan

James Ziglar

The above Audit Committee

Report is not deemed to be “soliciting material,” is not “filed” with the SEC and is not to be incorporated

by reference in any filings that Forward files with the SEC.

It is not the duty

of the Audit Committee to determine that Forward’s financial statements and disclosures are complete and accurate and in

accordance with generally accepted accounting principles or to plan or conduct audits. Those are the responsibilities of management

and Forward’s independent registered public accounting firm. In giving its recommendation to the Board, the Audit Committee

has relied on: (1) management’s representations that such financial statements have been prepared with integrity and objectivity

and in conformity with GAAP; and (2) the report of Forward independent registered public accounting firm with respect to such financial

statements.

Audit Committee’s Pre-Approval Policy

The Audit Committee

pre-approves all audit and permissible non-audit services on a case-by-case basis. In its review of non-audit services, the Audit

Committee considers whether the engagement could compromise the independence of our independent registered public accounting firm,

and whether the reasons of efficiency or convenience is in our best interest to engage our independent registered public accounting

firm to perform the services.

Fees incurred by Forward for the Services

Provided by CohnReznick LLP

The following table

sets forth the aggregate fees paid for or accrued by Forward for audit and other services provided by CohnReznick LLP for the fiscal

years ended 2019 and 2018:

|

|

2019

|

|

2018

|

|

|

($)

|

|

($)

|

|

Audit Fees (1)

|

197,460

|

|

193,130

|

|

Audit Related Fees (2)

|

–

|

|

125,160

|

|

Tax Fees

|

–

|

|

–

|

|

All Other Fees

|

–

|

|

–

|

|

Total

|

197,460

|

|

318,290

|

|

|

|

|

|

|

———————

|

|

|

|

(1) Audit fees – these fees relate to the annual audits

and quarterly reviews of our financial statements and registration statements as well as services that are normally provided by

the independent registered public accounting firm in connection with statutory and regulatory filings or engagements.

(2) Audit Related Fees – these relate to the audit fees

incurred in connection with the acquisition of IPS.

PROPOSAL 3. ADVISORY VOTE TO APPROVE

EXECUTIVE COMPENSATION

Pursuant to Section

14A of the Exchange Act and recent legislation, we are asking our shareholders to vote to approve, on a non-binding, advisory basis,

the compensation of our Named Executive Officers, commonly referred to as the “say-on-pay” vote. In accordance with

the Exchange Act requirements, we are providing our shareholders with an opportunity to express their views on our Named Executive

Officers’ compensation.

Advisory Vote and Board Recommendation;

Vote Required

We encourage shareholders

to read the “Executive Compensation” section in this proxy statement, including the compensation tables and the related

narrative disclosure, which describes the structure and amounts of the compensation of our Named Executive Officers in fiscal year

2019. The compensation of our Named Executive Officers is designed to enable us to attract and retain talented and experienced

executives to lead us successfully in a competitive environment. The Compensation Committee and our Board believe that our executive

compensation strikes the appropriate balance between utilizing responsible, measured pay practices and effectively incentivizing

our Named Executive Officers to dedicate themselves fully to value creation for our shareholders.

This vote is not intended

to address any specific element of compensation but rather the overall compensation of our Named Executive Officers and the compensation

philosophy, policies, practices and disclosures described in this proxy statement.

Accordingly, we ask our shareholders

to vote “FOR” the following resolution at the Annual Meeting:

“RESOLVED, that

the compensation paid to Forward’s Named Executive Officers, as disclosed pursuant to Item 402 of Regulation S-K, including

the compensation tables and narrative discussion is hereby APPROVED.”

Although this advisory

vote is nonbinding, our Board and the Compensation Committee will review and consider the voting results when making future decisions

regarding our Named Executive Officer compensation and related executive compensation programs.

The Board recommends a vote “For”

this Proposal No. 3

PROPOSAL 4. ADVISORY VOTE ON THE FREQUENCY

OF FUTURE “SAY ON PAY” VOTES

As described in our

“say-on-pay” Proposal 3 above, our shareholders are being asked to vote on the compensation of our Named Executive

Officers, as disclosed in this proxy statement. In addition, we are asking our shareholder to cast an advisory vote on how often

we should include a say-on-pay vote in our proxy materials for future shareholders meetings. Shareholders may vote to request the

say-on-pay vote every year, every two years or every three years, or may abstain from voting.

Advisory Vote and Board Recommendation

After careful consideration

of the frequency alternatives, the Board has determined that holding an advisory vote to approve the compensation of our Named

Executive Officers every three years is the most appropriate policy at this time, and recommends that future advisory votes to

approve the compensation of our Named Executive Officers occur every third year. Our executive compensation program is designed

to create long-term value for our shareholders, and a triennial vote will allow shareholders to better judge our executive compensation

program in relation to our long-term performance. We also believe that a vote every three years is an appropriate frequency to

provide sufficient time to thoughtfully consider shareholders’ input and to implement any appropriate changes to our executive

compensation program, in light of the timing that would be required to implement any decisions related to such changes.

You may cast your

vote on your preferred voting frequency by choosing one year, two years, three years or abstain from voting when you vote in response

to the resolution set forth below.

“RESOLVED, that

the option of once every one year, two years or three years that receives the affirmative vote of the greatest number of the votes

cast in person or by proxy at this meeting will be determined to be the preferred frequency of the shareholder with which Forward

is to hold a shareholder vote to approve, on an advisory basis, the compensation of its Named Executive Officers, as disclosed

pursuant to the Securities and Exchange Commission's compensation disclosure rules.”

The option of one

year, two years or three years that receives the affirmative vote of the greatest number of the votes cast in person or by proxy

at this meeting will be the frequency for the advisory vote on executive compensation that has been recommended by shareholders.

Abstentions and broker non-votes will have no effect on the outcome of this Proposal. However, because this vote is advisory and

not binding on the Board or Forward in any way, the Board may decide that it is in the best interests of our shareholders and Forward

to hold an advisory vote on executive compensation more or less frequently than the option approved by our shareholders.

The Board recommends that the shareholders

vote to conduct future advisory votes to approve the compensation of our Named Executive Officers every three years.

OWNERSHIP OF OUR STOCK

Voting Securities and Principal Holders Thereof

The following table

sets forth the number of shares of our common stock beneficially owned as of the record date by (i) those persons known by us to

be owners of more than 5% of our common stock, (ii) each director, (iii) our Named Executive Officers, and (iv) all of our executive

officers and directors as a group. Unless otherwise specified in the notes to this table, the address for each person is: c/o Forward

Industries, Inc., 477 Rosemary Avenue, Suite 219, West Palm Beach, Florida 33401.

|

Title of Class

|

Beneficial

Owner

|

Amount of

Beneficial

Ownership (1)

|

Percent

Beneficially

Owned (1)

|

|

|

Directors and Named Executive

|

|

|

|

|

|

Officers:

|

|

|

|

|

|

Common Stock

|

Terence Wise (2)

|

1,618,541

|

17.0

|

%

|

|

|

|

|

|

|

|

Common Stock

|

Michael Matte (3)

|

100,000

|

1.0

|

%

|

|

|

|

|

|

|

|

Common Stock

|

Mitch Maiman (4)

|

200,918

|

2.1

|

%

|

|

|

|

|

|

|

|

Common Stock

|

Paul Severino (5)

|

200,918

|

2.1

|

%

|

|

|

|

|

|

|

|

Common Stock

|

Howard Morgan (6)

|

250,237

|

2.6

|

%

|

|

|

|

|

|

|

|

Common Stock

|

Sangita Shah (7)

|

439,237

|

4.5

|

%

|

|

|

|

|

|

|

|

Common Stock

|

James Ziglar (8)

|

60,007

|

*

|

|

|

|

|

|

|

|

|

Common Stock

|

All directors and executive officers as a group

|

|

|

|

|

(7 persons)

|

2,869,858

|

28.4

|

%

|

|

|

|

|

|

|

|

5% Shareholders:

|

|

|

|

|

|

Common Stock

|

Terence Wise (2)

|

1,618,541

|

17.0

|

%

|

|

|

|

|

|

|

|

Common Stock

|

Jenny Yu (9)

|

1,113,564

|

11.7

|

%

|

|

|

|

|

|

|

|

Common Stock

|

Renaissance Technologies, LLC (10)

|

718,980

|

7.5

|

%

|

|

———————

|

|

|

|

* Less than 1%.

|

|

(1)

|

|

Applicable percentages are based on 9,533,851 shares outstanding as of the record date, adjusted as required by rules of the SEC. Beneficial ownership is determined under the rules of the SEC and generally includes voting or investment power with respect to securities. Shares of common stock underlying options and warrants and convertible notes currently exercisable or convertible, or exercisable or convertible within 60 days are deemed outstanding for computing the percentage of the person holding such securities but are not deemed outstanding for computing the percentage of any other person. Unless otherwise indicated in the footnotes to this table, Forward believes that each of the shareholders named in the table has sole voting and investment power with respect to the shares of common stock indicated as beneficially owned by them. The table includes only vested options, and warrants or options and warrants that have or will vest and become exercisable within 60 days.

|

|

(2)

|

|

Wise. Mr. Wise is a director and executive officer. Includes 10,000 vested stock options.

|

|

(3)

|

|

Matte. Mr. Matte is an executive officer. Includes 50,000 vested stock options.

|

|

(4)

|

|

Maiman. Mr. Maiman is an executive officer of the Company’s wholly-owned subsidiary.

|

|

(5)

|

|

Severino. Mr. Severino is an executive officer of the Company’s wholly-owned subsidiary.

|

|

(6)

|

|

Morgan. Mr. Morgan is a director. Includes 130,237 vested stock options.

|

|

(7)

|

|

Shah. Ms. Shah is a director. Includes 334,237 vested stock options.

|

|

(8)

|

|

Ziglar. Mr. Ziglar is a director. Includes 50,007 vested stock options.

|

|

(9)

|

|

Yu. Address is 9255 Doheny Rd., Apartment 2905, West Hollywood, California, 90069.

|

|

(10)

|

|

Renaissance. Based on Schedule 13G/A filed on February 13, 2019.Address is 800 Third Avenue, New York, New York 10022.

|

OTHER MATTERS

The Company has no

knowledge of any other matters that may come before the Annual Meeting and does not intend to present any other matters. However,

if any other matters shall properly come before the Meeting or any adjournment, the persons soliciting proxies will have the discretion

to vote as they see fit unless directed otherwise.

If you do not plan

to attend the Annual Meeting, in order that your shares may be represented and in order to assure the required quorum, please sign,

date and return your proxy promptly. In the event you are able to attend the Annual Meeting, at your request, the Company will

cancel your previously submitted proxy.

FORWARD INDUSTRIES, INC.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

ANNUAL MEETING OF SHAREHOLDERS – FEBRUARY 11, 2020 AT 10:00 AM

VOTING INSTRUCTIONS

If you vote by phone or internet, please DO NOT mail your proxy card.

MAIL: Please mark, sign, date, and

return this Proxy Card promptly using the enclosed envelope.

PHONE: Call 1 (800) 690-6903

INTERNET: https://www.proxyvote.com

Control ID:

Proxy ID:

Password:

___________________________________________________________

MARK “X” HERE IF YOU PLAN TO ATTEND THE MEETING: ☐

MARK HERE FOR ADDRESS CHANGE ☐

New Address (if applicable):

____________________________

____________________________

____________________________

IMPORTANT: Please sign

exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor,

administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full

corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name

by authorized person.

Dated: ________________________, 20_____

___________________________________________________________

(Print Name of Shareholder and/or Joint Tenant)

___________________________________________________________

(Signature of Shareholder)

___________________________________________________________

(Second Signature if held jointly)

The shareholder(s) hereby appoints

Terence Wise and Michael Matte, or either of them, as proxies, each with the power to appoint his substitute, and hereby

authorizes them to represent and to vote, as designated on the reverse side of this ballot, all of the shares of voting stock

of FORWARD INDUSTRIES, INC. that the shareholder(s) is/are entitled to vote at the Annual Meeting of Shareholder(s) to be

held at 10:00 a.m., New York time on February 11, 2020, at 1301 Avenue of the Americas, Seventh Floor, in New York, New

York, and any adjournment or postponement thereof.

This proxy, when properly executed,

will be voted in the manner directed herein. If no such direction is made, this proxy will be voted “FOR” all of the

nominees in Proposal 1 and “FOR” Proposals 2 and 3 and EVERY THREE YEARS for frequency for Proposal 4. If any other

business is presented at the meeting, this proxy will be voted by the above-named proxies at the direction of the Board of Directors.

At the present time, the Board of Directors knows of no other business to be presented at the meeting.

Proposal:

1. To elect members to Forward’s Board of Directors.

|

Terence Wise

|

FOR ☐

|

WITHHELD ☐

|

Sangita Shah

|

FOR ☐

|

WITHHELD ☐

|

|

|

|

|

|

|

|

|

Howard Morgan

|

FOR ☐

|

WITHHELD ☐

|

James Ziglar

|

FOR ☐

|

WITHHELD ☐

|

|

|

|

|

|

|

|

|

|

|

2. Ratification of the appointment of Forward’s independent registered public accounting firm for fiscal 2020.

|

FOR ☐ AGAINST ☐ ABSTAIN ☐

|

|

|

|

|

3. Advisory vote to approve Forward’s executive compensation

|

FOR ☐ AGAINST ☐ ABSTAIN ☐

|

|

|

|

|

4. Advisory vote on the frequency of shareholder votes on executive compensation

|

1 YEAR ☐ 2

YEARS ☐ 3 YEARS ☐

|

|

ABSTAIN ☐

|

|

Control ID:

Proxy ID:

Password:

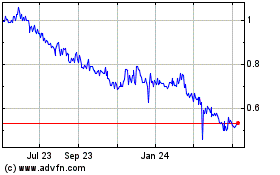

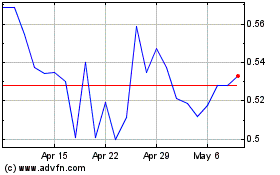

Forward Industries (NASDAQ:FORD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Forward Industries (NASDAQ:FORD)

Historical Stock Chart

From Apr 2023 to Apr 2024