FormFactor, Inc. (Nasdaq:FORM) today announced its financial

results for the third quarter of fiscal 2006, ended September 30,

2006. Quarterly revenues were $96.8 million, up 5% from $92.4

million in the second quarter of fiscal 2006, and up 55% from $62.4

million in the third quarter of fiscal 2005. �FormFactor had

another record quarter as revenue, production and net income

reached historical highs. Demand for advanced probe cards in the

third quarter continued to reflect the ongoing trends in the market

including customers� ramping production for memory and logic, the

transition to advanced nodes, and the ongoing need for higher

parallelism in wafer test,� said Joseph Bronson, President of

FormFactor. �Factory capacity continued to ramp, as production

efficiencies and yields increased in many segments of our

manufacturing operations.� Net income for the third quarter of

fiscal 2006 was $15.8 million or $0.33 per share on a fully diluted

basis, which included $3.9 million or $0.08 per share of

incremental FAS 123R stock option expense, net of tax. This

compares to $15.3 million or $0.32 per share on a fully diluted

basis for the second quarter of fiscal 2006, which included $2.8

million or $0.06 per share of incremental FAS 123R stock option

expense, net of tax. Net income for the third quarter of fiscal

2005 was $9.8 million or $0.23 per share on a fully diluted basis,

which was prior to the adoption of FAS 123R. Bookings for the third

quarter of fiscal 2006 were $90.5 million. Bookings for the second

quarter of fiscal 2006 and third quarter of fiscal 2005 were $96.5

million and $62.9 million, respectively. �We are pleased with our

63% revenue growth year-to-date,� said Igor Khandros, Chief

Executive Officer of FormFactor. �We are encouraged by customers�

interest in our new Harmony� NAND Flash product. We are confident

in business growth opportunities in 2007 and beyond, driven by our

robust product development pipeline, supporting multiple growth

drivers in our customers� businesses.� The company has posted its

revenue breakdown by region and market segment on the Investors

section of its website at www.formfactor.com. FormFactor will

conduct a conference call at 1:30 p.m. PDT, or 4:30 p.m. EDT,

today. The public is invited to listen to a live web cast of

FormFactor�s conference call on the Investors section of the

company�s website at www.formfactor.com. An audio replay of the

conference call will also be made available approximately two hours

after the conclusion of the call. The audio replay will remain

available until October 27, 2006 at 6:30 p.m. PDT and can be

accessed by dialing (888) 286-8010 or (617) 801-6888 and entering

confirmation code 19398524. About FormFactor: Founded in 1993,

FormFactor, Inc. (Nasdaq:FORM) is the leader in advanced wafer

probe cards, which are used by semiconductor manufacturers to

electrically test integrated circuits, or ICs. The company�s wafer

sort, burn-in and device performance testing products move IC

testing upstream from post-packaging to the wafer level, enabling

semiconductor manufacturers to lower their overall production

costs, improve yields, and bring next-generation devices to market.

FormFactor is headquartered in Livermore, California with

operations in Europe, Asia and North America. For more information,

visit the company�s website at www.formfactor.com. FormFactor and

MicroSpring are registered trademarks of FormFactor, Inc. All other

product, trademark, company or service names mentioned herein are

the property of their respective owners. Statements in this press

release that are not strictly historical in nature are

forward-looking statements within the meaning of the federal

securities laws, including statements regarding business momentum,

operations, demand for our products and future growth. These

forward-looking statements are based on current information and

expectations that are inherently subject to change and involve a

number of risks and uncertainties. Actual events or results might

differ materially from those in any forward-looking statement due

to various factors, including, but not limited to: the demand for

certain semiconductor devices; the rate at which semiconductor

manufacturers implement manufacturing capability changes, make the

transition to smaller nanometer technology nodes and implement

tooling cycles; the company�s ability to continue to ramp its

factory capacity and increase production efficiencies and yields in

its manufacturing operations and to expand globally, including to

execute on its global manufacturing roadmap; the company�s ability

to develop and deliver innovative technologies, including its

Harmony� NAND Flash product, and to enforce its intellectual

property rights; and the company�s ability to drive its product

development pipeline and support multiple growth drivers in its

customers� businesses. Additional information concerning factors

that could cause actual events or results to differ materially from

those in any forward-looking statement is contained in the

company's Form 10-K for the fiscal period ended December 31, 2005

and the company�s Form 10-Q for the quarterly period ended July 1,

2006, filed with the Securities and Exchange Commission ("SEC"),

and subsequent SEC filings. Copies of the company�s SEC filings are

available at http://investors.formfactor.com/edgar.cfm. The company

assumes no obligation to update the information in this press

release, to revise any forward-looking statements or to update the

reasons actual results could differ materially from those

anticipated in forward-looking statements. FORMFACTOR, INC.

CONSOLIDATED STATEMENTS OF INCOME (In thousands, except per share

data) (Unaudited) � Three Months Ended Nine Months Ended September

30, 2006 September 24, 2005 September 30, 2006 September 24, 2005 �

Revenues $96,757� $62,374� $270,520� $165,676� Cost of revenues

46,492� 34,088� 130,699� 93,484� Gross margin 50,265� 28,286�

139,821� 72,192� � Operating expenses: Research and development

11,994� 7,881� 33,397� 19,461� Selling, general and administrative

19,321� 11,871� 53,034� 31,283� Total operating expenses 31,315�

19,752� 86,431� 50,744� Operating income 18,950� 8,534� 53,390�

21,448� � Interest income 4,485� 1,116� 10,196� 2,912� Other income

(expense), net 59� (630) 45� (655) 4,544� 486� 10,241� 2,257� �

Income before income taxes 23,494� 9,020� 63,631� 23,705� Benefit

from (provision for) income taxes (7,675) 758� (21,763) (4,004) �

Net income $15,819� $9,778� $41,868� $19,701� � Net income per

share: Basic $0.34� $0.25� $0.94� $0.50� � Diluted $0.33� $0.23�

$0.90� $0.47� � Weighted-average number of shares used in per share

calculations: � Basic 46,417� 39,733� 44,625� 39,343� � Diluted

48,494� 41,762� 46,690� 41,492� FORMFACTOR, INC. CONSOLIDATED

BALANCE SHEETS (In thousands, except share and per share data)

(Unaudited) September 30, 2006 December 31, 2005 ASSETS Current

assets: Cash and cash equivalents $276,365� $31,217� Marketable

securities 181,128� 180,391� Accounts receivable, net of allowance

for doubtful accounts of $74 as of September 30, 2006 and December

31, 2005 54,097� 43,967� Inventories 26,317� 18,404� � Deferred tax

assets 11,233� 11,396� Prepaid expenses and other current assets

12,674� 7,169� Total current assets 561,814� 292,544� � Restricted

cash 2,250� 2,250� � Property and equipment, net 87,398� 81,588� �

Deferred tax assets 6,270� 4,518� Other assets 994� 461� � � Total

assets $658,726� $381,361� � LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities: Accounts payable $27,346� $26,369� Accrued

liabilities 21,850� 20,467� Income tax payable 7,653� 9,697�

Deferred rent 353� 313� Deferred revenue and customer advances

6,556� 3,588� Total current liabilities 63,758� 60,434� � Deferred

rent and other long term liabilities 4,559� 3,138� Total

liabilities 68,317� 63,572� � Stockholders' equity: Common stock,

$0.001 par value 47� 40� Additional paid in capital 496,296�

268,291� Deferred stock-based compensation -� (2,495) Accumulated

other comprehensive loss (114) (359) Retained earnings 94,180�

52,312� Total stockholders' equity 590,409� 317,789� Total

liabilities and stockholders' equity $658,726� $381,361�

FormFactor, Inc. (Nasdaq:FORM) today announced its financial

results for the third quarter of fiscal 2006, ended September 30,

2006. Quarterly revenues were $96.8 million, up 5% from $92.4

million in the second quarter of fiscal 2006, and up 55% from $62.4

million in the third quarter of fiscal 2005. "FormFactor had

another record quarter as revenue, production and net income

reached historical highs. Demand for advanced probe cards in the

third quarter continued to reflect the ongoing trends in the market

including customers' ramping production for memory and logic, the

transition to advanced nodes, and the ongoing need for higher

parallelism in wafer test," said Joseph Bronson, President of

FormFactor. "Factory capacity continued to ramp, as production

efficiencies and yields increased in many segments of our

manufacturing operations." Net income for the third quarter of

fiscal 2006 was $15.8 million or $0.33 per share on a fully diluted

basis, which included $3.9 million or $0.08 per share of

incremental FAS 123R stock option expense, net of tax. This

compares to $15.3 million or $0.32 per share on a fully diluted

basis for the second quarter of fiscal 2006, which included $2.8

million or $0.06 per share of incremental FAS 123R stock option

expense, net of tax. Net income for the third quarter of fiscal

2005 was $9.8 million or $0.23 per share on a fully diluted basis,

which was prior to the adoption of FAS 123R. Bookings for the third

quarter of fiscal 2006 were $90.5 million. Bookings for the second

quarter of fiscal 2006 and third quarter of fiscal 2005 were $96.5

million and $62.9 million, respectively. "We are pleased with our

63% revenue growth year-to-date," said Igor Khandros, Chief

Executive Officer of FormFactor. "We are encouraged by customers'

interest in our new Harmony(TM) NAND Flash product. We are

confident in business growth opportunities in 2007 and beyond,

driven by our robust product development pipeline, supporting

multiple growth drivers in our customers' businesses." The company

has posted its revenue breakdown by region and market segment on

the Investors section of its website at www.formfactor.com.

FormFactor will conduct a conference call at 1:30 p.m. PDT, or 4:30

p.m. EDT, today. The public is invited to listen to a live web cast

of FormFactor's conference call on the Investors section of the

company's website at www.formfactor.com. An audio replay of the

conference call will also be made available approximately two hours

after the conclusion of the call. The audio replay will remain

available until October 27, 2006 at 6:30 p.m. PDT and can be

accessed by dialing (888) 286-8010 or (617) 801-6888 and entering

confirmation code 19398524. About FormFactor: Founded in 1993,

FormFactor, Inc. (Nasdaq:FORM) is the leader in advanced wafer

probe cards, which are used by semiconductor manufacturers to

electrically test integrated circuits, or ICs. The company's wafer

sort, burn-in and device performance testing products move IC

testing upstream from post-packaging to the wafer level, enabling

semiconductor manufacturers to lower their overall production

costs, improve yields, and bring next-generation devices to market.

FormFactor is headquartered in Livermore, California with

operations in Europe, Asia and North America. For more information,

visit the company's website at www.formfactor.com. FormFactor and

MicroSpring are registered trademarks of FormFactor, Inc. All other

product, trademark, company or service names mentioned herein are

the property of their respective owners. Statements in this press

release that are not strictly historical in nature are

forward-looking statements within the meaning of the federal

securities laws, including statements regarding business momentum,

operations, demand for our products and future growth. These

forward-looking statements are based on current information and

expectations that are inherently subject to change and involve a

number of risks and uncertainties. Actual events or results might

differ materially from those in any forward-looking statement due

to various factors, including, but not limited to: the demand for

certain semiconductor devices; the rate at which semiconductor

manufacturers implement manufacturing capability changes, make the

transition to smaller nanometer technology nodes and implement

tooling cycles; the company's ability to continue to ramp its

factory capacity and increase production efficiencies and yields in

its manufacturing operations and to expand globally, including to

execute on its global manufacturing roadmap; the company's ability

to develop and deliver innovative technologies, including its

Harmony(TM) NAND Flash product, and to enforce its intellectual

property rights; and the company's ability to drive its product

development pipeline and support multiple growth drivers in its

customers' businesses. Additional information concerning factors

that could cause actual events or results to differ materially from

those in any forward-looking statement is contained in the

company's Form 10-K for the fiscal period ended December 31, 2005

and the company's Form 10-Q for the quarterly period ended July 1,

2006, filed with the Securities and Exchange Commission ("SEC"),

and subsequent SEC filings. Copies of the company's SEC filings are

available at http://investors.formfactor.com/edgar.cfm. The company

assumes no obligation to update the information in this press

release, to revise any forward-looking statements or to update the

reasons actual results could differ materially from those

anticipated in forward-looking statements. -0- *T FORMFACTOR, INC.

CONSOLIDATED STATEMENTS OF INCOME (In thousands, except per share

data) (Unaudited) Three Months Ended Nine Months Ended September

September September September 30, 2006 24, 2005 30, 2006 24, 2005

--------- ---------- --------- --------- Revenues $96,757 $62,374

$270,520 $165,676 Cost of revenues 46,492 34,088 130,699 93,484

--------- ---------- --------- --------- Gross margin 50,265 28,286

139,821 72,192 --------- ---------- --------- --------- Operating

expenses: Research and development 11,994 7,881 33,397 19,461

Selling, general and administrative 19,321 11,871 53,034 31,283

--------- ---------- --------- --------- Total operating expenses

31,315 19,752 86,431 50,744 --------- ---------- ---------

--------- Operating income 18,950 8,534 53,390 21,448 Interest

income 4,485 1,116 10,196 2,912 Other income (expense), net 59

(630) 45 (655) --------- ---------- --------- --------- 4,544 486

10,241 2,257 Income before income taxes 23,494 9,020 63,631 23,705

Benefit from (provision for) income taxes (7,675) 758 (21,763)

(4,004) --------- ---------- --------- --------- Net income $15,819

$9,778 $41,868 $19,701 ========= ========== ========= ========= Net

income per share: Basic $0.34 $0.25 $0.94 $0.50 =========

========== ========= ========= Diluted $0.33 $0.23 $0.90 $0.47

========= ========== ========= ========= Weighted-average number of

shares used in per share calculations: Basic 46,417 39,733 44,625

39,343 ========= ========== ========= ========= Diluted 48,494

41,762 46,690 41,492 ========= ========== ========= ========= *T

-0- *T FORMFACTOR, INC. CONSOLIDATED BALANCE SHEETS (In thousands,

except share and per share data) (Unaudited) September December 30,

2006 31, 2005 --------- --------- ASSETS Current assets: Cash and

cash equivalents $276,365 $31,217 Marketable securities 181,128

180,391 Accounts receivable, net of allowance for doubtful accounts

of $74 as of September 30, 2006 and December 31, 2005 54,097 43,967

Inventories 26,317 18,404 Deferred tax assets 11,233 11,396 Prepaid

expenses and other current assets 12,674 7,169 --------- ---------

Total current assets 561,814 292,544 Restricted cash 2,250 2,250

Property and equipment, net 87,398 81,588 Deferred tax assets 6,270

4,518 Other assets 994 461 --------- --------- Total assets

$658,726 $381,361 ========= ========= LIABILITIES AND STOCKHOLDERS'

EQUITY Current liabilities: Accounts payable $27,346 $26,369

Accrued liabilities 21,850 20,467 Income tax payable 7,653 9,697

Deferred rent 353 313 Deferred revenue and customer advances 6,556

3,588 --------- --------- Total current liabilities 63,758 60,434

Deferred rent and other long term liabilities 4,559 3,138 ---------

--------- Total liabilities 68,317 63,572 Stockholders' equity:

Common stock, $0.001 par value 47 40 Additional paid in capital

496,296 268,291 Deferred stock-based compensation - (2,495)

Accumulated other comprehensive loss (114) (359) Retained earnings

94,180 52,312 --------- --------- Total stockholders' equity

590,409 317,789 --------- --------- Total liabilities and

stockholders' equity $658,726 $381,361 ========= ========= *T

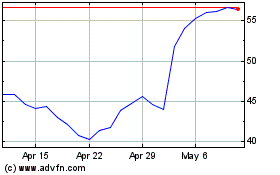

FormFactor (NASDAQ:FORM)

Historical Stock Chart

From Aug 2024 to Sep 2024

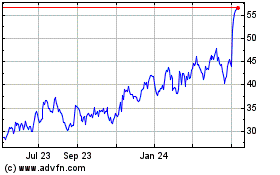

FormFactor (NASDAQ:FORM)

Historical Stock Chart

From Sep 2023 to Sep 2024