FormFactor Announces Pricing of Common Stock Offering

March 10 2006 - 12:15AM

Business Wire

FormFactor, Inc. (NASDAQ:FORM) today announced the pricing of its

public offering of 5,000,000 shares of its common stock at a public

offering price of $38.00 per share. The estimated net proceeds of

the public offering will be approximately $182.0 million. The

underwriters of this offering have an over-allotment option to

purchase up to 750,000 additional shares of common stock. The

underwriting syndicate was led by Goldman, Sachs & Co., sole

bookrunner, and Morgan Stanley as the joint lead managers for the

offering. Citigroup and Thomas Weisel Partners LLC acted as

co-managers. The public offering of FormFactor's common stock will

be made only by means of a prospectus. Copies of the final

prospectus relating to the offering may be obtained by contacting

Goldman, Sachs & Co. at 85 Broad Street, New York, NY 10004,

Attention: Prospectus Department, telephone (212) 902-1000. This

communication shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction. About FormFactor FormFactor, Inc. (Nasdaq:FORM) is an

industry leader in the design, development, manufacture, sale and

support of precision, high performance advanced semiconductor wafer

probe cards. The company's products are based on its proprietary

technologies, including its MicroSpring(R) interconnect technology

and design processes, which enable FormFactor to produce wafer

probe cards for test applications that require reliability, speed,

precision and signal integrity. FormFactor is headquartered in

Livermore, California. For more information, visit the company's

web site at www.formfactor.com. FormFactor and MicroSpring are

registered trademarks of FormFactor, Inc. Forward-Looking

Statements Statements in this press release that are not strictly

historical in nature are forward-looking statements within the

meaning of the federal securities laws, including statements

regarding the proposed public offering of FormFactor's common stock

and other statements relating to goals, plans, objectives and

future events. These forward-looking statements are based on

current information and expectations that are inherently subject to

change and involve a number of risks and uncertainties. Actual

events or results might differ materially from those in any

forward-looking statement due to various factors, including, but

not limited to, market risks. Additional information concerning

factors that could cause actual events or results to differ

materially from those in any forward-looking statement is contained

in the company's Form 10-K for the fiscal year ended December 31,

2005 filed March 1, 2006, the company's registration statement on

Form S-3 filed March 3, 2006, and the company's prospectus

supplement dated March 9, 2006 to be filed, with the Securities and

Exchange Commission ("SEC"), as well as in other SEC filings.

Copies of the company's SEC filings are available at

http://investors.formfactor.com/edgar.cfm. Except as required by

law, the company assumes no obligation to update the information in

this press release, to revise any forward-looking statements or to

update the reasons actual results could differ materially from

those anticipated in forward-looking statements.

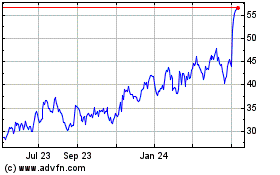

FormFactor (NASDAQ:FORM)

Historical Stock Chart

From Aug 2024 to Sep 2024

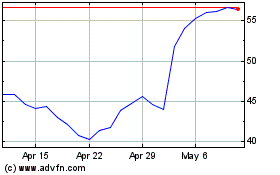

FormFactor (NASDAQ:FORM)

Historical Stock Chart

From Sep 2023 to Sep 2024