Current Report Filing (8-k)

December 30 2019 - 8:46AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 30, 2019

FlexShopper, Inc.

(Exact Name of Registrant as Specified in

Charter)

|

Delaware

|

|

001-37945

|

|

20-5456087

|

|

(State or other jurisdiction

|

|

(Commission File Number)

|

|

(IRS Employer

|

|

of incorporation)

|

|

Identification No.)

|

|

|

|

901 Yamato Road, Suite 260

|

|

|

|

Boca Raton, Florida

|

|

33431

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code: (855) 353-9289

N/A

(Former Name or Former

Address, if Changed Since Last Report)

Securities registered pursuant to Section

12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which

registered

|

|

Common Stock, par value $0.0001 per share

|

|

FPAY

|

|

The Nasdaq Stock Market LLC

|

|

Warrants, each to purchase one share of Common Stock

|

|

FPAYW

|

|

The Nasdaq Stock Market LLC

|

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4

(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

CURRENT REPORT

FlexShopper, Inc.

December 30, 2019

|

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On December 30, 2019, FlexShopper, Inc.

(the “Company”) and holders (each, a “Holder”) of at least 50.1% of the Company’s outstanding publicly

traded warrants (the “Public Warrants”) entered into a Warrant Amendment and Exchange Agreement (the “Exchange

Agreement”). The Public Warrants were previously issued pursuant to the Company’s public offering registered under

the Securities Act of 1933, as amended (the “Securities Act”), pursuant to a prospectus dated September 25, 2018, as

amended by post-effective amendment No. 1 filed with the Securities Exchange Commission (the “SEC”) on May 7, 2019.

Pursuant to the Exchange Agreement, the Holders agreed to exchange their Public Warrants for 0.62 shares of the Company’s

common stock (the “Shares”) for each of their outstanding Public Warrants, agreed with the Company to make a public

offer (the “Offer”) to all other holders of the Public Warrants to exchange their Public Warrants for Shares at the

same rate as the Holders, and amended the terms of the Warrant Agent Agreement for the Public Warrants to permit the Company to

require that all outstanding Public Warrants not exchanged pursuant to the Offer be converted into Shares at a rate of 0.56 Shares

per Public Warrant, which is 10% less than the exchange rate that will apply to the Offer (the “Warrant Amendment”).

The exchange rate of Shares for Public

Warrants under the Exchange Agreement and the Offer was determined through negotiations led by certain institutional

investors which held Public Warrants and are not related parties of the Company. The Holders party to the Exchange Agreement

included four of the Company’s directors (or their affiliated entities), who agreed to exchange a total of 3.8% of the

Public Warrants outstanding pursuant to the Exchange Agreement. These transactions are exempt from registration under Section

3(a)(9) of the Securities Act, as no commission or other remuneration will be paid or given directly or indirectly for

soliciting such transactions.

The Company currently expects to

commence the Offer on Monday, January 6, 2020.

Public Warrants not exchanged for Shares

pursuant to the Offer will remain outstanding subject to their amended terms pursuant to the Warrant Amendment. Following the

consummation of the Offer, in accordance with the terms of the Warrant Amendment, the Company intends to require the conversion

of all outstanding Public Warrants to Shares at a rate of 0.56 Shares per Public Warrant as provided in the Warrant Amendment

(the “Conversion”). The Public Warrants are currently traded on The Nasdaq Capital Market under the symbol “FPAYW”;

however, following the completion of the Offer and Conversion, the Public Warrants will be delisted.

Copies of the Warrant Amendment and the

Exchange Agreement are filed with this report as Exhibits 4.1 and 10.1, respectively, and are hereby incorporated by reference

herein. The foregoing descriptions of the Warrant Amendment and the Exchange Agreement do not purport to be complete and are qualified

in their entirety by reference to the full text of such documents.

|

|

Item 3.02.

|

Unregistered Sales of Equity Securities.

|

The information required herein is incorporated

by reference to Item 1.01 above.

|

|

Item 3.03.

|

Material Modification to Rights of Security Holders.

|

The information required herein is incorporated

by reference to Item 1.01 above.

|

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(a) Exhibits.

The exhibit listed in the following Exhibit Index is filed as part of this current report.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

FLEXSHOPPER, INC.

|

|

|

|

|

Date: December 30, 2019

|

By:

|

/s/ H. Russell Heiser Jr.

|

|

|

|

H. Russell Heiser Jr.

|

|

|

|

Chief Financial Officer

|

3

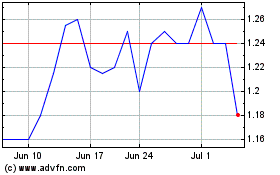

FlexShopper (NASDAQ:FPAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

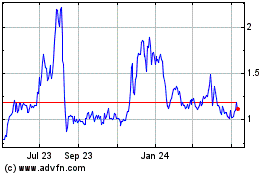

FlexShopper (NASDAQ:FPAY)

Historical Stock Chart

From Apr 2023 to Apr 2024