As

filed with the Securities and Exchange Commission on May 7, 2019

Registration

No. 333-226823

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

POST-EFFECTIVE

AMENDMENT NO. 1

TO

FORM S-1

ON

FORM S-3

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

FLEXSHOPPER,

INC.

(

Exact

name of registrant as specified in its charter

)

|

Delaware

|

|

26-0579295

|

|

(

State

or other jurisdiction of

|

|

(

I.R.S.

Employer

|

|

incorporation

or organization)

|

|

Identification

No.)

|

FlexShopper,

Inc.

2700

N. Military Trail, Suite 200

Boca

Raton, FL

(855)

353-9289

(

Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices

)

Brad

Bernstein

Chief

Executive Officer

FlexShopper,

Inc.

2700

N. Military Trail, Suite 200

Boca

Raton, FL

(855)

353-9289

(

Name,

address, including zip code, and telephone number, including area code, of agent for service

)

Copy

to:

Mark

R. Busch

K&L

Gates LLP

214

North Tryon Street, 47th Floor

Charlotte,

North Carolina 28202

(704)

331-7440

From

time to time after the effective date of this registration statement.

(

Approximate

date of commencement of proposed sale to the public

)

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please

check the following box. ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933 check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please

check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become

effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register

additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following

box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act (check one):

|

Large

accelerated filer ☐

|

|

Accelerated

filer ☐

|

|

Non-accelerated

filer ☒

|

|

Smaller

reporting company ☒

|

|

|

|

Emerging

growth company ☐

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until

the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall

become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY

NOTE

This

Post-Effective Amendment No. 1 (“Post-Effective Amendment”) to the Registration Statement on Form S-1 (Registration No.

333-226823) (the “Registration Statement”) of FlexShopper, Inc. (the “Company”) is being filed pursuant

to the undertakings in the Registration Statement to update and supplement the information contained in the Registration Statement,

which was previously declared effective by the Securities and Exchange Commission (the “SEC”) on September 25, 2018.

The

Registration Statement registered the offer and sale of 10,000,000 units at a public offering price of $1.00 per unit, each unit

consisting of one share of the Company’s common stock and one-half (1/2) of one warrant, each whole warrant exercisable

for one share of common stock (“Public Warrants”), including warrants to purchase 750,000 additional shares of common

stock sold to the underwriter to cover over-allotments (the “Underwriter’s Warrants” and, together with the

Public Warrants, the “Warrants”). The Registration Statement also registered on a continuous basis the 5,750,000 shares

of common stock underlying the Warrants (the “Warrant Shares”). As of the date of this Post-Effective Amendment, no

Warrants have been exercised and no Warrant Shares have been issued. No additional securities are being registered under this

Post-Effective Amendment. All applicable registration fees were paid at the time the Registration Statement was originally

filed.

This

Post-Effective Amendment is being filed to (i) update the contents of the prospectus contained in the Registration Statement

pursuant to Section 10(a)(3) of the Securities Act of 1933, as amended (the “Securities Act”), in respect of the continuous

offering pursuant to Rule 415 of up to 5,750,000 Warrant Shares previously registered on the Registration Statement and (ii) convert

the Registration Statement on Form S-1 into a registration statement on Form S-3.

THE INFORMATION IN THIS PROSPECTUS

IS NOT COMPLETE AND MAY BE CHANGED. THESE SECURITIES MAY NOT BE SOLD UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES

AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PRELIMINARY PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND WE ARE NOT SOLICITING

AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

Subject to completion, dated

May 7, 2019

FlexShopper,

Inc.

Prospectus

5,750,000

Shares of Common Stock Issuable Upon Exercise of Outstanding Warrants

This

prospectus relates to an aggregate of 5,000,000 shares of our common stock, par value $0.0001 per share, which, as of the date

of this prospectus, are issuable upon exercise of 5,000,000 warrants (“Public Warrants”) originally issued as part

of the units sold in our public offering, which closed on September 28, 2018 (the “Offering”), and upon exercise of

750,000 warrants (“Underwriters’ Warrants and, together with the Public Warrants, the “Warrants”) issued

to the underwriters of the Offering and its designees.

As

of the date of this prospectus, the Warrants have an exercise price of $1.25 per share of common stock and will expire on September

28, 2023. If the Warrants are exercised, we will receive the proceeds from such exercise.

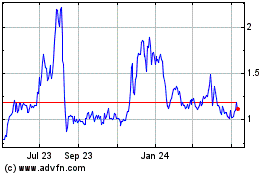

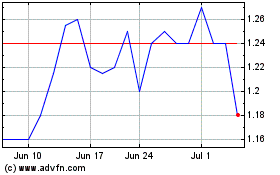

On

May 6, 2019, the last reported sale price for our common stock was $0.87 per share. Our common stock and the Warrants are

traded on the Nasdaq Capital Market under the symbols “FPAY” and “FPAYW,” respectively.

Our

business and an investment in our common stock involve a high degree of risk. Before making any investment in our common

stock, you should read and carefully consider risks described in the “Risk Factors” section on page 8 of this

prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the common stock offered

hereby or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This

prospectus is dated , 2019.

TABLE

OF CONTENTS

Unless

otherwise stated or the context otherwise requires, the terms “FlexShopper,” “we,” “us,” “our”

and the “Company” refer to FlexShopper, Inc., a Delaware corporation, and its consolidated subsidiaries.

You

should rely only on the information contained in this prospectus and any related free writing prospectus that we may provide to

you in connection with this offering. We have not, and the underwriters have not, authorized anyone to provide you

with additional or different information. If anyone provides you with different or inconsistent information, you should

not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the

offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the

date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our securities

in this offering. Our business, financial condition, results of operations and prospects may have changed since that date.

For

investors outside the United States: neither we nor the underwriters have done anything that would permit this offering or possession

or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any

jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves

about and to observe any restrictions relating to this offering and the distribution of this prospectus and any such free writing

prospectus outside of the United States.

MARKET

AND INDUSTRY DATA

Unless

otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate is based

on information from independent industry and research organizations, other third-party sources (including industry publications,

surveys and forecasts), and management estimates. Management estimates are derived from publicly available information released

by independent industry analysts and third-party sources, as well as data from our internal research, and are based on assumptions

made by us upon reviewing such data and our knowledge of such industry and markets, which we believe to be reasonable. Although

we believe the data from these third-party sources is reliable, we have not independently verified any third-party information.

In addition, projections, assumptions and estimates of the future performance of the industry in which we operate and our future

performance are necessarily subject to uncertainty and risk due to a variety of factors, including those described in “Risk

Factors” and “Cautionary Note Regarding Forward-Looking Statements and Other Information Contained In This Prospectus.”

These and other factors could cause results to differ materially from those expressed in the estimates made by the independent

parties and by us.

PROSPECTUS

SUMMARY

OUR

COMPANY

Since

December 2013, we have developed a business that focuses on improving the quality of life of our customers by providing them the

opportunity to obtain ownership of high-quality durable products, such as consumer electronics, home appliances, computers (including

tablets and wearables), smartphones, tires, jewelry and furniture (including accessories), under affordable payment lease-to-own

(“LTO”) purchase agreements with no long-term obligation, including through an extensive online experience. Our customers

can acquire well-known brands such as Samsung, Frigidaire, Hewlett-Packard, LG, Whirlpool, Simmons, Philips, Ashley, Apple and

more. We believe that the introduction of FlexShopper’s LTO programs support broad untapped expansion opportunities within

the U.S. consumer e-commerce and retail marketplaces. We have successfully developed and are currently processing LTO transactions

using our “LTO Engine,” FlexShopper’s proprietary technology that automates the process of consumers receiving

spending limits and entering into leases for durable goods to within seconds. The LTO Engine is the basis for FlexShopper’s

primary sales channels, which include business to consumer (“B2C”) and business to business (“B2B”) channels,

as described in further detail below. Concurrently, e-tailers and retailers that work with FlexShopper may increase their sales

by utilizing FlexShopper’s online channels to connect with consumers that want to acquire products on an LTO basis. FlexShopper’s

sales channels include (1) selling directly to consumers via the online FlexShopper.com LTO Marketplace featuring thousands of

durable goods, (2) utilizing FlexShopper’s LTO payment method at check out on e-commerce sites and through in-store terminals

and (3) facilitating LTO transactions with retailers that have not yet become part of the FlexShopper.com LTO Marketplace.

INDUSTRY

OVERVIEW

The

LTO industry offers consumers an alternative to traditional methods of obtaining electronics, computers, home furnishings, appliances

and other durable goods. FlexShopper’s customers typically do not have sufficient cash or credit to obtain these goods,

so they find the short-term nature and affordable payments of LTO attractive.

The

Lease-Purchase Transaction

A

lease-purchase transaction is a flexible alternative for consumers to obtain and enjoy brand name merchandise with no long-term

obligation. Key features of our lease-purchase transactions include:

Brand

name merchandise

. FlexShopper offers well-known brands such as LG, Samsung, Sony and Vizio home electronics; Frigidaire,

General Electric, LG, Samsung and Whirlpool appliances; Acer, Apple, Asus, Samsung and Toshiba computers and/or tablets; Samsung

and Apple smartphones; and Ashley, Powell and Standard furniture, among other brands.

Convenient

payment options

.

Our customers make payments on a weekly, bi-weekly or monthly basis. Payments are automatically

deducted from the customer’s authorized checking account or debit card. Additionally, customers may make additional payments

or exercise early payment options, which enable them to save money.

No

long-term commitment

.

A customer may terminate a lease-purchase agreement at any time with no long-term obligation

by paying amounts due under the lease-purchase agreement and returning the leased item to FlexShopper.

Applying

has no impact on credit or FICO score

.

We do not use FICO scores to determine customers’ spending limits

so our underwriting does not impact consumers’ credit with the three main credit bureaus.

Flexible

options to obtain ownership

.

Ownership of the merchandise generally transfers to the customer if the customer

makes all payments during the lease term, which is one year, or exercises early payment options, which typically save the customer

money.

Key

Trends Driving the Industry:

Non-prime

consumers represent the largest segment of the credit market.

Approximately 38% of Americans have low credit scores

according to Experian, and approximately 50 million American households are underbanked, sub-prime or credit invisible, or have

no credit history. This segment of consumers represents a significant and underserved market.

According

to Wall Street and industry research, the addressable market size for non-prime consumers is between $20 and $25 billion, with

consumer electronics constituting 44% of such amount. We believe that underwriting consumer electronics online is one of our competitive

advantages since this is the majority of our business and has not been a focus of our peers.

Additional

industry trends include:

|

|

●

|

Consumers

recognizing that they have more convenient options to acquire the products they want.

|

|

|

●

|

The

difficult retail climate leading retailers to embrace “save the sale” financing

to increase sales with new consumers.

|

|

|

●

|

Technology

advances in online underwriting and LTO digital functionality continuing to drive the

B2B market segment by making it easier for retailers and consumers to transact on an

LTO basis in an efficient and timely manner.

|

GROWTH OPPORTUNITIES AND STRATEGIES

Like many industries, the internet and other technology is transforming

the LTO industry. FlexShopper has positioned itself to take advantage of this transformation by focusing on the expansion of the

LTO industry online and into mainstream retail and e-tail. The brick-and-mortar LTO industry serves approximately 3.4 million consumers

annually, generating approximately $6.1 billion in sales primarily through approximately 6,700 LTO brick and mortar stores. Through

its strategic sales channels, FlexShopper believes it can expand the LTO industry, also known as the rent-to-own or RTO industry.

FlexShopper has successfully developed and is currently processing LTO transactions using its “LTO Engine,” FlexShopper’s

proprietary technology that automates the process of consumers receiving spending limits and entering into leases for durable goods

to within seconds. The LTO Engine is the basis for FlexShopper’s primary sales channels, which include B2C and B2B channels,

illustrated in the diagram below:

We

believe we have created a unique platform whereby our B2B and B2C sales channels beneficially advance each other. For our B2C

channels, we directly market to our consumers LTO opportunities at FlexShopper.com, where they can choose from over 150,000 of

the latest products shipped directly to them by certain of the nation’s largest retailers. This generates sales for our

retail partners, which encourages them to incorporate our B2B solutions into their online and in-store sales channels. The lease

originations by our retail partners using our B2B channels, which have no customer acquisition cost to us, subsidize our B2C customer

acquisition costs. Meanwhile, our B2C marketing promotes FlexShopper.com, which provides incremental sales for our retail partners

as well as benefitting our FlexShopper.com business.

To

achieve our goal of being the preeminent “pure play” virtual LTO leader, we intend to execute the following strategies:

Continue

to grow FlexShopper into a dominant LTO brand.

Given strong consumer demand and organic growth potential for

our LTO solutions, we believe that significant opportunities exist to expand our presence within current markets via existing

marketing channels. As non-prime consumers become increasingly familiar and comfortable with our retail kiosk partnerships, online

marketplace and mobile solutions, we plan to capture the new business generated as they migrate away from less convenient legacy

brick-and-mortar LTO stores.

Expand

the range of customers served

.

We continue to evaluate new product and market opportunities that fit into our

overall strategic objective of delivering next-generation retail, online and mobile LTO terms that span the non-prime/near-prime

credit spectrum. For example, we are evaluating products with lower fees that would be more focused on the needs of more creditworthy

subprime consumers that prefer a less expensive LTO option. In addition, we are continually focused on improving our analytics

to effectively underwrite and serve consumers within those segments of the non-prime credit spectrum that we do not currently

reach, including profitable deeper penetration of the sub-prime spectrum. We believe the current generation of our underwriting

model is performing well and will continue to improve over time as its data set expands.

Pursue

additional strategic retail partnerships.

We intend to continue targeting regional and national retailers to expand

our B2B sales channels. As illustrated in the diagram above, we believe we have the best omnichannel solution for retailers to

“save the sale” with LTO options. In retail, the phrase “save the sale” means offering consumers other

finance options when they don’t qualify for traditional credit. We expect these partnerships to provide us with access to

a broad range of potential new customers, with low customer acquisition costs.

Expand

our relationships with existing customers and retail partners.

Customer acquisition costs represent one of the most

significant expenses for us due to our high percentage of online customers. In comparison, no acquisition cost is incurred for

customers acquired through our retail partnerships. We will seek to expand our strong relationships with existing customers by

providing qualified customers with increased spending limits or offering other products and services to them, as well as seek

to grow our retail partnerships to reduce our overall acquisition cost.

Continue

to optimize marketing across all channels.

Since we began marketing our services to consumers in 2014, we have made

significant progress in targeting our customers and lowering our customer acquisition costs. This is across different media including

direct response television and digital channels such as social media, email, and search engines.

OUR

COMPETITIVE STRENGTHS

The

LTO industry is highly competitive. Our operation competes with other national, regional and local LTO businesses, as well as

with rental stores that do not offer their customers a purchase option. Some of these companies have, or may develop, systems

that enable consumers to obtain through online facilities spending limits and payment terms and to enter into leases nearly instantaneously,

in a manner similar to that provided by FlexShopper’s proprietary technology. We believe the following competitive strengths

differentiate us:

Underwriting

and Risk Management

Specialized

technology and proprietary risk analytics optimized for the non-prime credit

market

.

We have made substantial

investments in our underwriting technology and analytics platforms to support rapid scaling, innovation and regulatory compliance.

Our team of data scientists and risk analysts uses our risk infrastructure to build and test strategies across the entire underwriting

process, using alternative credit data, device authentication, identity verification, and many more data elements. We believe

our real-time proprietary technology and risk analytics platform is better than our competitors’ in underwriting online

consumers and consumer electronics; most of our peers focus on in-store consumers that acquire furniture and appliances, which

we believe are easier to underwrite based on our own experiences. In addition, all our applications are processed instantly with

approvals and spending limits provided within seconds of submission.

LTO

Products for Consumers and Retailers

Expansive

online LTO marketplace.

We have made substantial investments in our custom e-commerce platform to provide consumers

the greatest selection of popular brands delivered by certain of the nation’s largest retailers, including Best Buy, Amazon,

Walmart, Overstock, Serta and many more. Our platform is custom-built for online LTO transactions, which include underwriting

our consumers, serving them LTO leases, syncing and communicating with our retail partners to fulfill orders and all front- and

back-end customer relationship management functions, including collections and billing. The result is a comprehensive technology

platform that manages all facets of our business and enables us to scale with hundreds of thousands of visitors and products.

Omnichannel

“save the sale” product for retailers.

In retail, the phrase “save the sale” means offering

consumers other finance options when they do not qualify for traditional credit. We believe that we have the best omnichannel

solution for retailers to “save the sale” with LTO options. To our knowledge, no competitor has an LTO marketplace

that provides retailers incremental sales with no acquisition cost. In addition, compared to our peers, our product for consumers

requires no money down and typically fewer application fields. We believe this leads to more in-store and online sales. We also

believe that we have the best LTO payment technology at checkout for e-tailers, whereby consumers can seamlessly checkout out

on a third party’s e-commerce site with our LTO payment plugin. In addition, our “integrationless” in-store

technology was a strong selling point for our recent 726-store rollout since it required no equipment or technology investment

from either party.

Providing

LTO consumers an “endless aisle” of products for lease-to-own

.

As illustrated by our B2C channels in

the above diagram, we offer consumers three ways to acquire products on an LTO basis. At FlexShopper.com our customers can choose

from over 150,000 of the latest products shipped by certain of the nation’s largest retailers. If customers want products

that are not available on our marketplace, they may use our “personal shopper” service and simply complete a form

with a link to the webpage of the desired durable good. We will then facilitate their purchase by providing an LTO arrangement.

We also offer consumers the ability to acquire durable goods with our FlexShopper Wallet smartphone application available on Apple

and Android devices. With FlexShopper Wallet, consumers may apply for a spending limit and take a picture of a qualifying item

in any major retail store and we will fill the order for them. With our B2C channels we believe we are providing LTO consumers

with a superior LTO experience and fulfilling our mission to help improve their quality of life by shopping for what they want

where they want.

A

Lean and Scalable Model

Compared

to the brick-and-mortar LTO industry, which is suffering from the same headwinds as traditional retail stores and declining sales,

we have been successful in addressing the LTO consumer through online channels as illustrated in the above diagram illustrating

our B2C and B2B sales channels.

We

believe our model is efficient and scalable for the following reasons:

We

have no inventory risk and are completely drop-ship.

We do not have any of the costs associated with buying, storing

and shipping inventory. Instead, our suppliers ship goods directly to consumers.

We

serve LTO consumers across the United States without brick-and-mortar stores.

We do not have any of the costs associated

with physical stores and the personnel needed to operate them.

As

our sales grow we achieve more operating leverage.

Our model is primarily driven by a technology platform that does

not require significant increases in operating overhead to support sales growth.

SALES

AND MARKETING

B2C

Channels

We

use a multi-channel, analytics-powered approach to marketing our products and services, with both broad-reach and highly-targeted

channels, including television, digital, telemarketing and marketing affiliates. The goal of our marketing is to promote our brand

and primarily to directly acquire new customers at a targeted acquisition cost. Our marketing strategies include the following:

Direct

response television advertising

. We use television advertising supported by our internal analytics and media buys

from a key agency to drive and optimize website traffic and lease originations.

Digital

acquisition

. Our online marketing efforts include pay-per-click, keyword advertising, search engine optimization,

marketing affiliate partnerships, social media programs and mobile advertising integrated with our operating systems and technology

from vendors that allow us to optimize customer acquisition tactics within the daily operations cycle.

User

experience and conversion.

We measure and monitor website visitor usage metrics and regularly test website design

strategies to improve customer experience and conversion rates.

B2B

Channels

We

use internal business development personnel and outside consultants that focus on engaging retailers and e-tailers to use our

services. This includes promoting FlexShopper at key trade shows and conferences.

MANAGEMENT

INFORMATION SYSTEMS

FlexShopper

uses computer-based management information systems to facilitate its entire business model, including underwriting, processing

transactions through its sales channels, managing collections and monitoring leased inventory. Through the use of our proprietary

software developed in-house, each of our retail partners uses our online merchant portal that automates the process of consumers

receiving spending limits and entering into leases for durable goods generally to within seconds. The management information system

generates reports which enable us to meet our financial reporting requirements.

GOVERNMENT

REGULATIONS

The

LTO industry is regulated by and subject to the requirements of various federal, state and local laws and regulations, many of

which are in place for consumer protection. In general, such laws regulate, among other items, applications for leases, late fees,

finance rates, disclosure statements, the substance and sequence of required disclosures, the content of advertising materials

and certain collection procedures. Violations of certain provisions of these laws and regulations may result in penalties ranging

from nominal amounts up to and including forfeiture of fees and other amounts due on leases. We are unable to predict the nature

or effect on our operations or earnings of unknown future legislation, regulations and judicial decisions or future interpretations

of existing and future legislation or regulations relating to our operations, and there can be no assurance that future laws,

decisions or interpretations will not have a material adverse effect on our operations and earnings. In 2016, the Company enhanced

its compliance department by hiring a Chief Compliance Counsel.

INTELLECTUAL

PROPERTY

FlexShopper

was granted U.S. Patent Number 10,089,682 by the U.S. Patent and Trademark Office (the “USPTO”), on October

2, 2018 for its system that enables e-commerce servers to complete LTO transactions through their e-commerce websites.

Moreover, FlexShopper has received an issue notification from the USPTO for U.S. Patent Number 10,282,778 for additional

systems that enable retailer devices to complete LTO transactions through their retailer web pages, as well as systems that

further enable consumer devices to modify received retailer web pages to indicate LTO payments in association with

transaction-eligible products as part of LTO transactions through the retailer web pages. FlexShopper may file additional

patent applications in the future. We can provide no assurances that FlexShopper will be granted any additional patents by

the USPTO. We believe certain proprietary information, including but not limited to our underwriting model, and our patented

and patent-pending systems are central to our business model and we believe they give us a key competitive advantage. We also

rely on trademark and copyright law, trade secret protection, and confidentiality, license and work product agreements with

our employees, customers, and others to protect our proprietary rights. See the section captioned “Risk

Factors” below for more information on and risk associated with respect to our intellectual property.

OPERATIONS

AND EMPLOYEES OF FLEXSHOPPER

Brad

Bernstein, our Chief Executive Officer and President, manages our day-to-day operations and internal growth and oversees our growth

strategy. FlexShopper’s management also includes a Chief Financial Officer and a Chief Risk Officer. In addition, FlexShopper

has a customer service and collections call center. As of March 31, 2019, FlexShopper had 143 employees, all of whom were full

time.

THE

OFFERING

|

Common stock outstanding

|

17,666,193 shares. (1)

|

|

|

|

|

Common stock offered by the Company

|

5,750,000 shares issuable upon the exercise of outstanding Warrants.

|

|

|

|

|

Description of Warrants

|

The Warrants have an exercise price of $1.25 per share and expire at 5:00 P.M., New York

City time, on September 28, 2023.

|

|

|

|

|

Use of proceeds

|

The gross proceeds if all the Warrant holders, as of the date of this prospectus, exercise

their Warrants will be approximately $7.2 million; however, we are unable to predict the timing or amount of potential Warrant

exercises. Accordingly, all such proceeds will be used for working capital and other general corporate purposes. It is possible

that some, or all, of the Warrants may expire and never be exercised.

|

|

|

|

|

Nasdaq symbols

|

Our common stock and the Warrants are listed on the Nasdaq Capital Market under the symbols

“FPAY” and “FPAYW,” respectively.

|

|

|

|

|

Risk factors

|

You should carefully consider the information set forth in this prospectus and, in particular,

the specific factors set forth in the “Risk Factors” section in the Form 10-K and subsequently filed Quarterly

Reports on Form 10-Q incorporated herein by reference before deciding whether or not to invest in common stock.

|

|

|

(1)

|

As

of March 31, 2019. This number excludes the 5,750,000 shares of common stock issuable

upon exercise of the Warrants, as well as:

|

|

|

●

|

1,472,489

shares of common stock issuable upon the exercise of warrants (other than the Warrants),

at a weighted average exercise price of $2.95;

|

|

|

●

|

605,400

shares of our common stock issuable upon the exercise of outstanding stock options issued

pursuant to our 2007 Omnibus Equity Compensation Plan, 2015 Omnibus Equity Compensation

Plan, or our 2018 Omnibus Equity Compensation Plan, or our Incentive Plans, at a weighted

average exercise price of $3.59 per share;

|

|

|

●

|

659,500

shares of our common stock that are reserved for future issuance under our 2018 Omnibus

Equity Compensation Plan;

|

|

|

●

|

216,637

shares of our common stock issuable upon conversion of outstanding shares of Series 1

Convertible Preferred Stock;

|

|

|

●

|

5,639,745

shares of our common stock issuable upon conversion of outstanding shares of Series 2

Convertible Preferred Stock; and

|

|

|

●

|

112,785

shares of our common stock issuable upon conversion of 439 shares of Series 2 Convertible

Preferred Stock issuable upon exercise of outstanding warrants.

|

RISK

FACTORS

An

investment in our common stock involves a high degree of risk. You should carefully consider the risks set forth under the section

captioned “Risk Factors” contained in our Annual Report on Form 10-K for the year ended December 31, 2018, which is

incorporated by reference into this prospectus, and in the other reports that we file with the SEC and incorporate by reference

into this prospectus, before deciding to invest in our common stock. The risks and uncertainties we have described are not the

only ones we face.

If

any of the events described in these risk factors actually occurs, or if additional risks and uncertainties that are not presently

known to us or that we currently deem immaterial later materialize, then our business, prospects, results of operations and financial

condition could be materially adversely affected. In that event, the trading price of our securities could decline,

and you may lose all or part of your investment in our securities. The risks discussed include forward-looking statements,

and our actual results may differ substantially from those discussed in these forward-looking statements. See “Cautionary

Note Regarding Forward-Looking Statements.”

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain

information set forth in this prospectus may contain forward-looking statements within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are intended to be covered by

the “safe harbor” created by those sections. Forward-looking statements, which are based on certain assumptions and

describe our future plans, strategies and expectations, can generally be identified by the use of forward-looking terms such as

“believe,” “expect,” “may,” “will,” “should,” “could,”

“would,” “seek,” “intend,” “plan,” “goal,” “project,”

“estimate,” “anticipate” “strategy,” “future,” “likely” or other comparable

terms and references to future periods. All statements other than statements of historical facts included in this prospectus regarding

our strategies, prospects, financial condition, operations, costs, plans and objectives are forward-looking statements. Examples

of forward-looking statements include, among others, statements we make regarding: the expansion of our lease-to-own program;

expectation concerning our partnerships with retail partners; investments in, and the success of, our underwriting technology

and risk analytics platform; our ability to collect payments due from customers; expected future operating results and; expectations

concerning our business strategy.

Forward-looking

statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs,

expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events

and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject

to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our

control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements.

Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results

and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the

following:

|

|

●

|

our

limited operating history, limited cash and history of losses;

|

|

|

●

|

our

ability to obtain adequate financing to fund our business operations in the future;

|

|

|

●

|

the

failure to successfully manage and grow our FlexShopper.com e-commerce platform;

|

|

|

●

|

our

ability to maintain compliance with financial covenants under our Credit Agreement;

|

|

|

●

|

our

dependence on the success of our third-party retail partners and our continued relationships

with them;

|

|

|

●

|

our

compliance with various federal, state and local laws and regulations, including those

related to consumer protection;

|

|

|

●

|

the

failure to protect the integrity and security of customer and employee information; and

|

|

|

●

|

the

other risks and uncertainties described in the Risk Factors and in Management’s

Discussion and Analysis of Financial Condition and Results of Operations sections in

our Annual Report on Form 10-K for the fiscal year ended December 31, 2018 and subsequently filed Quarterly Reports on Form 10-Q.

|

Any

forward-looking statement made by us in this prospectus is based only on information currently available to us and speaks only

as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written

or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise, except

as may be required under applicable law. We anticipate that subsequent events and developments will cause our views to change.

You should read this prospectus and the documents filed as exhibits to the registration statement, of which this prospectus is

a part, completely and with the understanding that our actual future results may be materially different from what we expect.

Our forward-looking statements do not reflect the potential impact of any future acquisitions, merger, dispositions, joint ventures

or investments we may undertake. We qualify all of our forward-looking statements by these cautionary statements.

USE

OF PROCEEDS

The

gross proceeds if all the Warrant holders, as of the date of this prospectus, exercise their Warrants will be approximately $7.2

million; however, we are unable to predict the timing or amount of potential Warrant exercises. Accordingly, all such proceeds

will be used for working capital and general corporate purposes. It is possible that some, or all, of the Warrants may expire

and never be exercised.

DILUTION

If

you purchase shares of our common stock in this offering, you will experience dilution to the extent of the difference between

the Warrants’ exercise price per share and our pro forma net tangible book value per share immediately after this offering.

Net

tangible book value per share represents total tangible assets less total liabilities, divided by the number of shares of common

stock outstanding. Our historical net tangible book value as of March 31, 2019 was $9,032,676, or $0.51 per share of common stock.

After giving effect to the sale of 5,750,000 shares of common stock upon exercise of all of the Warrants covered by this prospectus

at an exercise price of $1.25 per share, our net tangible book value as of March 31, 2019 would have been $16,220,176, or $0.69

per share of common stock. This represents an immediate increase in net tangible book value of $0.18 per share to existing stockholders

and an immediate dilution in net tangible book value of $0.56 per share to investors in this offering. The following table illustrates

this dilution on a per share basis:

|

Public offering price per share

|

|

|

|

|

|

$

|

1.25

|

|

|

Historical net tangible book value per share as of March 31, 2019

|

|

$

|

0.51

|

|

|

|

|

|

|

Increase in net tangible book value per share attributable to this offering

|

|

$

|

0.18

|

|

|

|

|

|

|

As adjusted tangible book value per share, after giving effect to this

offering

|

|

|

|

|

|

$

|

0.69

|

|

|

Dilution per share to investors in this offering

|

|

|

|

|

|

$

|

0.56

|

|

The

above discussion and table are based on 17,666,193 shares of our common stock outstanding as of March 31, 2019 and exclude the

following:

|

|

●

|

1,472,489

shares of common stock issuable upon the exercise of warrants (other than the Warrants),

at a weighted average exercise price of $2.95;

|

|

|

●

|

605,400

shares of our common stock issuable upon the exercise of outstanding stock options issued

pursuant to our Incentive Plans at a weighted average exercise price of $3.59 per share;

|

|

|

●

|

659,500

shares of our common stock that are reserved for future issuance under our 2018 Omnibus

Equity Compensation Plan;

|

|

|

●

|

216,637

shares of our common stock issuable upon conversion of outstanding shares of Series 1

Convertible Preferred Stock;

|

|

|

●

|

5,639,745

shares of our common stock issuable upon conversion of outstanding shares of Series 2

Convertible Preferred Stock; and

|

|

|

●

|

112,785

shares of our common stock issuable upon conversion of 439 shares of Series 2 Convertible

Preferred Stock issuable upon exercise of outstanding warrants.

|

To

the extent that any of these warrants or options are exercised, new options are issued under our 2018 Omnibus Equity Compensation

Plan or we issue additional shares of common stock or other equity securities in the future, there may be further dilution to

investors participating in this offering.

PLAN

OF DISTRIBUTION

We

will issue shares of common stock offered hereby upon exercise of the Warrants. As of the date of this prospectus, the Warrants

are exercisable for a total of up to 5,750,000 shares of our common stock, which can be adjusted pursuant to the terms of the

Warrants. We will not issue fractional shares upon exercise of the Warrants. Each of the Warrants contains instructions for exercise.

In order to exercise any of the Warrants, the holder must deliver to Continental Stock Transfer, Inc., as Warrant Agent, the information

required in the Warrants, along with payment for the exercise price of the shares to be purchased. The Warrant Agent will then

deliver shares of common stock in the manner described in the applicable form of Warrant, each of which is filed as an exhibit

to the registration statement of which this prospectus is a part.

DESCRIPTION

OF CAPITAL STOCK

The

following is a brief description of our capital stock. This summary does not purport to be complete in all respects. This description

is subject to and qualified entirely by the terms of our Restated Certificate of Incorporation, as amended (the “Certificate

of Incorporation”), and our Amended and Restated Bylaws, copies of which have been filed with the SEC and are also available

upon request from us.

Authorized

Capitalization

We

have 40,500,000

shares of capital stock authorized under our Certificate of Incorporation, consisting of 40,000,000

shares of common stock, $0.0001 par value per share, and 500,000 shares of preferred stock, $0.001 par value per share, of which

250,000 shares of preferred stock have been designated as Series 1 Convertible Preferred Stock and 25,000 shares of preferred

stock have been designated as Series 2 Convertible Preferred Stock. As of March 31, 2019, we had 17,666,193 shares of common stock

outstanding held of record by 132 stockholders and 171,191 shares of Series 1 Convertible Preferred Stock and 21,952 shares of

Series 2 Convertible Preferred Stock outstanding. Our authorized but unissued shares of common and preferred stock are available

for issuance without further action by our stockholders, unless such action is required by applicable law or the rules of any

stock exchange or automated quotation system on which our securities may be listed or traded.

Common

Stock

Based

on the 17,666,193 shares of common stock outstanding as of March 31, 2019, and assuming the issuance by us of 5,750,000 shares

of common stock in this offering, there will be 23,416,193 shares of common stock outstanding upon the closing of this offering.

Holders

of our common stock are entitled to such dividends as may be declared by our board of directors out of funds legally available

for such purpose. The shares of common stock are neither redeemable nor convertible. Holders of common stock have no preemptive

or subscription rights to purchase any of our securities.

Each

holder of our common stock is entitled to one vote for each such share outstanding in the holder’s name. No holder

of common stock is entitled to cumulate votes in voting for directors.

In

the event of our liquidation, dissolution or winding up, the holders of our common stock are entitled to receive pro rata our

assets, which are legally available for distribution, after payments of all debts and other liabilities. All of the

outstanding shares of our common stock are fully paid and non-assessable. The shares of common stock offered by this prospectus

will also be fully paid and non-assessable.

Our

shares of common stock are listed on the Nasdaq Capital Market under the symbol “FPAY.”

Warrants

The

following summary of certain terms and provisions of the Warrants exercisable for the common stock offered hereby is not complete

and is subject to, and qualified in its entirety by, the provisions of the form of Warrant, which is filed as an exhibit to the

registration statement of which this prospectus is a part.

Exercisability

.

The Warrants are exercisable at any time after their original issuance and at any time up to the date that is five years after

their original issuance, or September 28, 2023. The Warrants are exercisable, at the option of each holder, in whole or in part

by delivering to the Warrant Agent a duly executed exercise notice and payment in full in immediately available funds for the

number of shares of common stock purchased upon such exercise. If a registration statement registering the issuance of the shares

of common stock underlying the Warrants under the Securities Act is not effective or available, the holder may elect to exercise

the Warrant through a cashless exercise, in which case the holder would receive upon such exercise the net number of shares of

common stock determined according to the formula set forth in the Warrant. No fractional shares of common stock will be issued

in connection with the exercise of a Warrant. In lieu of fractional shares, we will pay the holder an amount in cash equal to

the fractional amount multiplied by the exercise price.

Exercise

Limitation

. A holder will not have the right to exercise any portion of the Warrant if the holder (together with its affiliates)

would beneficially own in excess of 4.99% of the number of shares of our common stock outstanding immediately after giving effect

to the exercise, as such percentage ownership is determined in accordance with the terms of the Warrants. However, any holder

may increase or decrease such percentage to any other percentage not in excess of 9.99%, provided that any increase in such percentage

shall not be effective until 61 days following notice from the holder to us.

Exercise

Price

. The exercise price per share of common stock purchasable upon exercise of the Warrants is $1.25 per share, as of the

date of this prospectus. The exercise price is subject to appropriate adjustment in the event of certain stock dividends and distributions,

stock splits, stock combinations, reclassifications or similar events affecting our common stock and also upon any distributions

of assets, including cash, stock or other property to our stockholders.

Transferability

.

Subject to applicable laws, the Warrants may be offered for sale, sold, transferred or assigned without our consent.

Exchange

Listing

. The Warrants are listed on the Nasdaq Capital Market under the symbol “FPAYW”.

Warrant

Agent

. The Warrants were issued in registered form under a warrant agency agreement between Continental Stock Transfer &

Trust, as warrant agent, and us. The Warrants are represented by one or more global warrants deposited with a custodian for The

Depository Trust Company (“DTC”) and registered in the name of Cede & Co., a nominee of DTC, or as otherwise directed

by DTC.

Fundamental

Transactions

. In the event of a fundamental transaction, as described in the Warrants and generally including any reorganization,

recapitalization or reclassification of our common stock, the sale, transfer or other disposition of all or substantially all

of our properties or assets, our consolidation or merger with or into another person, the acquisition of more than 50% of our

outstanding common stock, or any person or group becoming the beneficial owner of 50% of the voting power represented by our outstanding

common stock, the holders of the Warrants will be entitled to receive upon exercise of the Warrants the kind and amount of securities,

cash or other property that the holders would have received had they exercised the Warrants immediately prior to such fundamental

transaction.

Rights

as a Stockholder

. Except as otherwise provided in the Warrants or by virtue of such holder’s ownership of shares of

our common stock, the holder of a Warrant does not have the rights or privileges of a holder of our common stock, including any

voting rights, until the holder exercises the Warrant.

Governing

Law

. The Warrants and the warrant agency agreement are governed by New York law.

Stock

Options and Outstanding Warrants

As

of March 31, 2019, we had reserved the following shares of common stock for issuance pursuant to stock options, warrants, conversion

of preferred stock and equity plans:

|

|

●

|

1,472,489

shares of common stock issuable upon the exercise of outstanding warrants, at a weighted

average exercise price of $2.95 per share;

|

|

|

●

|

605,400

shares of our common stock issuable upon the exercise of outstanding stock options issued

pursuant to our Incentive Plans at a weighted average exercise price of $3.59 per share;

|

|

|

●

|

659,500

shares of our common stock that are reserved for future issuance under our 2018 Omnibus

Equity Compensation Plan;

|

|

|

●

|

216,637

shares of our common stock issuable upon conversion of outstanding shares of Series 1

Convertible Preferred Stock;

|

|

|

●

|

5,639,745

shares of our common stock issuable upon conversion of outstanding shares of Series 2

Convertible Preferred Stock; and

|

|

|

●

|

112,785

shares of our common stock issuable upon conversion of 439 shares of Series 2 Convertible

Preferred Stock issuable upon exercise of warrants.

|

Preferred

Stock

Our

board of directors has the authority, without further action by the stockholders, to issue up to 500,000 shares of preferred stock

from time to time in one or more series, including the Series 1 Convertible Preferred Stock and Series 2 Convertible Preferred

Stock described below. The board of directors also has the authority to fix the designations, voting powers, preferences, privileges

and relative rights and the limitations of any series of preferred stock, including dividend rights, conversion rights, voting

rights, terms of redemption and liquidation preferences, any or all of which may be greater than the rights of the common stock.

The board of directors, without stockholder approval, can issue preferred stock with voting, conversion or other rights that could

adversely affect the voting power and other rights of the holders of common stock. Preferred stock could thus be issued quickly

with terms that could delay or prevent a change of control of us or make removal of management more difficult. Additionally, the

issuance of preferred stock may decrease the market price of the common stock and may adversely affect the voting, economic and

other rights of the holders of common stock.

Series

1 Convertible Preferred Stock

On

January 31, 2007, the Company filed a Certificate of Designations with the Secretary of State of Delaware. 250,000 shares of preferred

stock are designated as Series 1 Convertible Preferred Stock, which ranks senior to common stock.

As

of the date of this prospectus, each share of Series 1 Convertible Preferred Stock is convertible into 1.26547 shares of the Company’s

common stock, subject to certain anti-dilution rights. The holders of Series 1 Convertible Preferred Stock have the option to

convert the shares to common stock at any time. Upon conversion, all accumulated and unpaid dividends, if any, will be paid as

additional shares of common stock. The holders of Series 1 Convertible Preferred Stock have the same dividend rights as holders

of common stock, as if the Series 1 Convertible Preferred Stock had been converted to common stock. Additionally, the holders

of Series 1 Convertible Preferred Stock vote with holders of common stock, together as a single class, with each share of Series

1 Convertible Preferred Stock entitled to 5.7877 votes.

During

the three months ended March 31, 2019, 68,214 shares of Series 1 Convertible Preferred Stock were converted into 86,323 shares

of common stock. As of March 31, 2019, there were 171,191 shares of Series 1 Convertible Preferred Stock outstanding convertible

into 216,637 shares of common stock.

Series

2 Convertible Preferred Stock

On

June 10, 2016, the Company entered into a Subscription Agreement with B2 FIE V LLC, providing for the issuance and sale of 20,000

shares of Series 2 Convertible Preferred Stock for gross proceeds of $20.0 million. The Company sold an additional 1,952 shares

of Series 2 Convertible Preferred Stock to a different investor for gross proceeds of $1.95 million at a subsequent closing.

Pursuant

to the authority expressly granted to the Company’s board of directors by the provisions of the Certificate of Incorporation,

the board of directors created and designated 25,000 shares of Series 2 Convertible Preferred Stock, par value $0.001 per share

(“Series 2 Preferred Shares”), by filing a Certificate of Designations with the Delaware Secretary of State (the “Series

2 Certificate of Designations”). The Series 2 Preferred Shares were sold for $1,000 per share (the “Stated Value”)

and accrue dividends on the Stated Value at an annual rate of 10% compounded annually.

As

of March 31, 2019, each share of Series 2 Convertible Preferred Stock was convertible into approximately 257 shares of common

stock; provided the conversion rate is subject to further increase pursuant to a weighted average anti-dilution provision.

The

holders of the Series 2 Preferred Shares have the option to convert such shares into shares of common stock and have the right

to vote with holders of common stock on an as-converted basis. If the average closing price during any 45 day consecutive trading

day period or Change of Control Transaction (as defined in the Series 2 Certificate of Designations) values the common stock at

a price equal to or greater than $23.00 per share, then conversion shall be automatic. Upon a Liquidation Event or Deemed Liquidation

Event (each as defined in the Series 2 Certificate of Designations), holders of Series 2 Preferred Shares shall be entitled to

receive out of the assets of the Company prior to and in preference to the common stock and Series 1 Convertible Preferred Stock

an amount equal to the greater of (1) the Stated Value, plus any accrued and unpaid dividends thereon, and (2) the amount per

share as would have been payable had all Series 2 Preferred Shares been converted to common stock immediately before the Liquidation

Event or Deemed Liquidation Event.

During

the three months ended March 31, 2019, no shares of Series 2 Convertible Preferred Stock were converted into common stock. As

of March 31, 2019, there were 21,952 shares of Series 2 Convertible Preferred Stock outstanding convertible into 5,639,745 shares

of common stock.

LEGAL

MATTERS

The

validity of the common stock offered hereby has been passed upon for us by K&L Gates LLP, Charlotte, North Carolina.

EXPERTS

The

consolidated balance sheets of FlexShopper, Inc. and Subsidiaries as of December 31, 2018 and 2017, and the related consolidated

statements of operations, stockholders’ equity, and cash flows for each of the years then ended, have been audited by EisnerAmper

LLP, independent registered public accounting firm, as stated in their report which is incorporated herein. Such financial statements

have been incorporated herein in reliance on the report of such firm given upon their authority as experts in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

We

have filed with the SEC a Registration Statement on Form S-3 under the Securities Act to register the common stock offered by

this prospectus. The term “registration statement” means the original registration statement and any and all amendments

thereto, including the schedules and exhibits to the original registration statement or any amendment. This prospectus is part

of that registration statement. This prospectus does not contain all of the information set forth in the registration statement

or the exhibits to the registration statement. For further information with respect to us and the common stock being offered pursuant

to this prospectus, you should refer to the registration statement and its exhibits. Statements contained in this prospectus as

to the contents of any contract, agreement or other document referred to are not necessarily complete, and you should refer to

the copy of that contract or other documents filed as an exhibit to the registration statement.

We

file annual reports, quarterly reports, current reports, proxy statements and other information with the SEC under the Exchange

Act. You can read our SEC filings, including the registration statement, at the SEC’s website at www.sec.gov.

You

may read and copy this information at the SEC’s Public Reference Room at 100 F Street, N.E., Washington D.C. 20549, at prescribed

rates. You may obtain information regarding the operation of the public reference room by calling the SEC at 1-800-SEC-0330.

The

SEC also maintains a website (http://www.sec.gov) that contains reports, proxy and information statements and other information

regarding issuers that file electronically with the SEC.

Our

website can be accessed at http://www.flexshopper.com. The information contained on, or that may be obtained from, our website

is not, and shall not be deemed to be, a part of this prospectus.

The

representations, warranties and covenants made by us in any agreement that is filed as an exhibit to the registration statement

of which this prospectus is a part were made solely for the benefit of the parties to such agreement, including, in some cases,

for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty

or covenant to you. Moreover, such representations, warranties or covenants were made as of an earlier date. Accordingly, such

representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

This

prospectus includes statistical and other industry and market data that we obtained from industry publications and research, surveys

and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate

that they have gathered their information from sources they believe to be reliable, although they do not guarantee the accuracy

or completeness of such information. While we believe that these industry publications and third-party research, surveys and studies

are reliable, we have not independently verified such data.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

SEC allows us to “incorporate by reference” information from other documents that we file with it, which means that

we can disclose important information to you by referring you to those documents. The information incorporated by reference is

considered to be part of this prospectus. Information in this prospectus supersedes information incorporated by reference that

we filed with the SEC prior to the date of this prospectus.

We

incorporate by reference into this prospectus and the registration statement of which this prospectus is a part the information

or documents listed below that we have filed with the SEC:

|

|

●

|

our

Annual Report on Form 10-K for the fiscal year ended December 31, 2018 filed with the

SEC on March 11, 2019;

|

|

|

●

|

our Quarterly Report on Form 10-Q filed with the SEC on May 7, 2019;

|

|

|

●

|

our

Current Reports on Form 8-K filed with the SEC on January 3, 2019, January 25, 2019,

February 1, 2019, February 22, 2019, April 5, 2019 and May 6, 2019;

|

|

|

●

|

our

definitive proxy statement on Schedule 14A related to our 2019 Annual Meeting of Stockholders,

filed with the SEC on March 25, 2019, with respect to those portions incorporated by reference into our Annual Report on Form 10-K for the year ended December

31, 2018 (other than the information furnished rather than filed); and

|

|

|

●

|

the

description of our common stock contained in our Registration Statement on Form 8-A filed

with the SEC on November 14, 2016, including any amendment or report filed for the purpose

of updating such description.

|

We

also incorporate by reference any future filings (other than current reports furnished under Item 2.02 or Item 7.01 of Form

8-K and exhibits filed on such form that are related to such items unless such Form 8-K expressly provides to the contrary) made

with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, including those made on or after the date of

the initial filing of the registration statement of which this prospectus is a part and prior to effectiveness of such registration

statement, until we file a post-effective amendment that indicates the termination of the offering of the Securities made by this

prospectus and will become a part of this prospectus from the date that such documents are filed with the SEC. Information in

such future filings updates and supplements the information provided in this prospectus. Any statements in any such future filings

will automatically be deemed to modify and supersede any information in any document we previously filed with the SEC that is

incorporated or deemed to be incorporated herein by reference to the extent that statements in the later filed document modify

or replace such earlier statements.

We

will furnish without charge to you, on written or oral request, a copy of any or all of the documents incorporated by reference,

including exhibits to these documents. You should direct any requests for documents to FlexShopper, Inc., 2700 North Military

Trail, Suite 200, Boca Raton, FL 33432; Attention: Investor Relations; Telephone: (855) 353-9289. Copies of the above reports

may also be accessed from our website at

www.flexshopper.com

. We have authorized no one to provide you with any information

that differs from that contained in this prospectus. Accordingly, you should not rely on any information that is not contained

in this prospectus. You should not assume that the information in this prospectus is accurate as of any date other than the date

of the front cover of this prospectus.

Any

statement contained in a document incorporated or deemed to be incorporated by reference in this prospectus will be deemed modified,

superseded or replaced for purposes of this prospectus to the extent that a statement contained in this prospectus modifies, supersedes

or replaces such statement.

FlexShopper,

Inc.

Prospectus

5,750,000

Shares of Common Stock Issuable Upon Exercise of Outstanding Warrants

,

2019

PART

II

INFORMATION

NOT REQUIRED IN PROSPECTUS

Item

14. Other Expenses of Issuance and Distribution.

Set

forth below is an estimate (except for registration fees, which are actual) of the approximate amount of the fees and expenses

payable by us in connection with the issuance and distribution of the shares of our common stock described in this Post-Effective

Amendment No. 1.

|

SEC registration fee

|

|

$

|

1,119

|

*

|

|

Accounting fees and expenses

|

|

$

|

20,000

|

|

|

Legal fees and expenses

|

|

$

|

10,000

|

|

|

Miscellaneous

|

|

$

|

4,881

|

|

|

Total

|

|

$

|

36,000

|

|

*

Previously paid.

Item

15. Indemnification of Directors and Officers.

The

following summary is qualified in its entirety by reference to the complete text of any statutes referred to below and the Restated

Certificate of Incorporation of FlexShopper, Inc., a Delaware corporation.

Section

145 of the General Corporation Law of the State of Delaware (the “DGCL”) permits a Delaware corporation to indemnify

any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding,

whether civil, criminal, administrative or investigative (other than an action by or in the right of the corporation) by reason

of the fact that the person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request

of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other

enterprise, against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably

incurred by the person in connection with such action, suit or proceeding if the person acted in good faith and in a manner the

person reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal

action or proceeding, had no reasonable cause to believe the person’s conduct was unlawful.

In

the case of an action by or in the right of the corporation, Section 145 of the DGCL permits a Delaware corporation to indemnify

any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by

reason of the fact that the person is or was a director, officer, employee or agent of the corporation, or is or was serving at

the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust

or other enterprise, against expenses (including attorneys’ fees) actually and reasonably incurred by the person in connection

with such action, suit or proceeding if the person acted in good faith and in a manner the person reasonably believed to be in

or not opposed to the best interests of the corporation and except that no indemnification shall be made in respect of any claim,

issue or matter as to which such person shall have been adjudged to be liable to the corporation unless and only to the extent

that the Court of Chancery or the court in which such action or suit was brought shall determine upon application that, despite

the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled

to indemnity for such expenses that the Court of Chancery or such other court shall deem proper.

Section

145 of the DGCL also permits a Delaware corporation to purchase and maintain insurance on behalf of any person who is or was a

director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director,

officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against any liability

asserted against such person and incurred by such person in any such capacity, or arising out of such person’s status as

such, whether or not the corporation would have the power to indemnify such person against such liability under Section 145 of

the DGCL.

Article

TENTH of our Restated Certificate of Incorporation states that our directors shall not be personally liable to us or to our stockholders

for monetary damages for any breach of fiduciary duty as a director, notwithstanding any provision of law imposing such liability.

Under Section 102(b)(7) of the DGCL, the personal liability of a director to the corporation or its stockholders for monetary

damages for breach of fiduciary duty can be limited or eliminated except (i) for any breach of the director’s duty of loyalty

to the corporation or its stockholders; (ii) for acts or omissions not in good faith or which involve intentional misconduct or

a knowing violation of law; (iii) under Section 174 of the DGCL (relating to unlawful payment of dividend or unlawful stock purchase

or redemption); or (iv) for any transaction from which the director derived an improper personal benefit.

Article

EIGHTH of our Fourth Amended and Restated Certificate of Incorporation provides that we shall indemnify our officers and directors

to the full extent permitted by the DGCL.

We

have obtained directors’ and officers’ liability insurance insuring our directors and officers against liability for

acts or omissions in their capacities as directors or officers, subject to certain exclusions.

In

addition, we have entered into employment agreements to indemnify certain of our officers in addition to the indemnification provided

for in the certificate of incorporation and bylaws. These agreements, among other things, indemnify our directors and some of

our officers for certain expenses (including attorney’s fees), judgments, fines and settlement amounts incurred by such

person in any action or proceeding, including any action by or in our right, on account of services by that person as a director

or officer of FlexShopper, Inc. or as a director or officer of any of our subsidiaries, or as a director or officer of any other

company or enterprise that the person provides services to at our request.

Item

16. Exhibits and Financial Statement Schedules.

Item

17. Undertakings.

Insofar

as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling

persons of the registrant pursuant to the provisions described under Item 15 or otherwise, the registrant has been advised that

in the opinion of the SEC such indemnification by it is against public policy as expressed in the Securities Act of 1933 and is,

therefore, unenforceable. In the event that a claim for indemnification against such liabilities, other than the payment by the