First National Corporation (the “Company” or “First National”)

(NASDAQ: FXNC) reported unaudited consolidated net income of $1.7

million, or $0.34 per diluted share, for the first quarter of 2020,

which resulted in a return on average assets of 0.85% and a return

on average equity of 8.72%. This was a $556 thousand, or 25%,

decrease compared to net income for the first quarter of 2019,

which totaled $2.3 million or $0.46 per diluted share, and a return

on average assets of 1.21% and a return on average equity of

13.47%.

Highlights for the first quarter of 2020:

- Provision for loan losses totaled $900 thousand, compared to no

provision in Q1 2019

- Cash and unencumbered securities totaled $133.4 million, or 16%

of assets

- Nonperforming assets decreased to 0.19% of assets

- Loans increased $30.8 million, or 6%

- Deposits increased $36.4 million, or 5%

- Shareholders’ equity increased 13%, or $8.8 million

- Wealth management revenue increased 20%, or $88 thousand

- The Company’s banking subsidiary, First Bank (the “Bank”)

exceeded all regulatory well-capitalized metrics

“Over the last month, our team of associates has demonstrated an

incredible commitment to their customers, their communities, and

one another,” said Scott Harvard, president and chief executive

officer of First National. Harvard continued, “As the world was

being turned upside down by the health crisis, our teammates

overcame their own anxieties to support our neighbors and small

businesses across our footprint. It has been so heartening to

witness their dedication as financial first responders, working

overtime to deliver payroll protection funds to small businesses,

providing access to deposit accounts via changing delivery channels

and reassuring customers, all while supporting their families and

each other. We talk often about First Bank being a people business

that depends on each employee’s powerful actions to enhance the

customer experience. Those actions are occurring daily at First

Bank, making all of us proud of how we serve our customers and

communities.

“We were pleased with the financial performance of the Company

in the first quarter. Expenses were under control while net

interest income and noninterest income both improved over the first

quarter of 2019. During this crisis, we have earned additional new

business through our actions on behalf of small businesses. Looking

forward, our team is focused on efficiently and effectively

managing programs designed to relieve financial pressure on

customers while mitigating what we expect to be increasing credit

risk within the loan portfolio. We expect significant pressure on

several sectors, including the hospitality and health care

industries, which have been constrained by the Virginia governor’s

stay at home order and the public’s adoption of social distancing.

We are fortunate the Bank’s deposits are built on relationships,

on-balance sheet and off-balance sheet liquidity is substantial,

and capital levels exceed all regulatory thresholds to be

considered well-capitalized.”

COVID-19 PANDEMIC UPDATE

In March 2020, the Bank activated its Pandemic Plan and began

taking actions to protect the health of its employees and

customers, while continuing to deliver essential banking services

to small businesses and individuals. This has been accomplished by

limiting access to banking offices and delivering a majority of its

services through branch drive throughs, ATMs and mobile banking

platforms. Approximately 40% of our employees have been working

remotely, while social-distancing and split-shifts have been

created for those employees working in the Bank’s facilities.

Virtually all meetings are held using audio and/or video conference

capabilities. The Company scheduled its annual meeting of

shareholders in a virtual meeting online format.

The Company suspended future stock repurchases under its $5.0

million stock repurchase program due to the economic uncertainty

caused by the pandemic. The stock repurchase program was previously

announced in December 2019. During the first quarter of 2020, the

Company repurchased and retired 129,035 shares at an average price

paid per share of $16.05, for a total of $2.1 million. The Company

will continue to update its enterprise risk assessment and capital

plan as the operating environment develops. The Bank was considered

well capitalized at March 31, 2020.

In response to the unknown impact of the pandemic on the economy

and customers, the Bank implemented a loan payment deferral program

for individual and business customers. Customers with favorable

risk ratings and payment histories have been given the opportunity

to defer monthly payments for 90 days. Approximately 27% of the

Bank’s loan balances have participated in the program. There are no

program fees and no late payment fees charged during the deferral

period for participating loan customers. Interest income continues

to accrue to the Bank during the deferral period.

In an effort to support local small businesses and non-profit

organizations, the Bank is participating as a lender in the U.S.

Small Business Administration’s (“SBA”) Paycheck Protection Program

(“PPP”) and began accepting loan applications in April. In the

first round of funding, the Bank obtained approval of 91% of the

330 loan applications it received prior to the end of funding on

April 16, 2020, which totaled $52.1 million. The Bank continues to

accept applications for processing in the second round of funding

which was approved and signed into law on April 24, 2020. The Bank

did not recognize any revenue related to the program during the

first quarter of 2020.

In light of the significant increase in unemployment claims and

the stress on businesses from stay at home orders, the Bank has

been monitoring liquidity on a daily basis. The Bank believes it

has sufficient liquidity to meet demand from its customers with

on-balance sheet liquidity with cash and unencumbered securities of

$133.4 million, or 16% of assets at March 31, 2020, as well as

$176.9 million, or 22% of assets, of off-balance sheet liquidity

that was available overnight through secured funding sources. All

loans originated by the Bank under the PPP are expected to be

pledged to the Federal Reserve’s new Paycheck Protection Program

Liquidity Facility (“PPPLF”). The Bank plans to borrow funds from

the PPPLF to fund PPP loans as needed at an interest rate of

0.35%.

The Bank anticipates the pandemic will have an unfavorable

impact on the financial condition of its customers, and as a

result, has begun the process of identifying the related credit

risk within its loan portfolio with the goal of mitigating the risk

and minimizing potential loan charge-offs. We expect significant

pressure on several sectors of the loan portfolio, including

hospitality, retail shopping and health care. Those sectors

comprise approximately 8%, 5% and 4% of the loan portfolio,

respectively. The magnitude of the potential decline in the Bank’s

loan quality will likely depend on the length and extent that the

Bank’s customers experience business interruptions from the

pandemic.

The Bank considered the impact of the pandemic on the loan

portfolio while determining an appropriate allowance for loan

losses, and as a result, recorded a provision for loan losses of

$900 thousand for the first quarter of 2020, compared to no

provision for loan losses in the first quarter of the prior year.

The higher provision for loan losses was primarily attributable to

an increase in the general reserve component of the allowance for

loan losses. The general reserve was increased through the

adjustment of qualitative factors based on recent unfavorable

changes in economic indicators, which contributed to the majority

of the increase in the provision for loan losses.

BALANCE SHEET

Total assets of First National increased $41.3 million, or 5%,

to $816.4 million at March 31, 2020, compared to $775.1 million at

March 31, 2019. Total securities increased $5.2 million, or 4%, and

loans, net of the allowance for loan losses, increased $30.8

million, or 6%. The Bank increased its cash balances near the end

of the first quarter in anticipation of increased demand for cash

from its customers expecting to receive stimulus checks as a result

of the CARES Act, which was recently signed into law. As a result,

cash and due from banks increased $19.7 million, while

interest-bearing deposits in banks decreased $14.3 million.

Total deposits increased $36.4 million, or 5%, to $720.6 million

at March 31, 2020, compared to $684.2 million at March 31, 2019.

Noninterest-bearing demand deposits increased $8.4 million, or 4%,

and savings and interest-bearing demand deposits increased $29.9

million, or 8%, while time deposits decreased $1.9 million, or

2%.

Shareholders’ equity increased $8.8 million, or 13%, to $78.5

million at March 31, 2020, compared to one year ago, primarily from

a $7.1 million increase in retained earnings and a $3.4 million

increase in accumulated other comprehensive income (loss). These

increases were partially offset by $1.8 million decrease in common

stock and surplus, which resulted from stock repurchases in the

first quarter of 2020 under the Company’s stock repurchase

plan.

ANALYSIS OF THE THREE-MONTH PERIOD

Net interest income increased $127 thousand, or 2%, to $7.0

million for the first quarter of 2020, compared to the same period

of 2019. The increase resulted from a 6% increase in average

earning assets, which was partially offset by a 20 basis point

decrease in the net interest margin. Growth in average earning

assets was led by a $30.2 million increase in average loans, net of

the allowance for loan losses, followed by a $16.2 million increase

in average interest-bearing deposits in banks. The decrease in the

net interest margin resulted from a 23 basis point decrease in the

yield on average earning assets, which was partially offset by a 3

basis point decrease in interest expense as a percent of average

earning assets.

The lower yield on average earning assets was attributable to a

17 basis point decrease in the yield on loans, a 21 basis point

decrease on securities, and an 87 basis point decrease on

interest-bearing deposits in banks, which were all impacted by

lower market rates. The decrease in interest expense as a

percentage of average earning assets was attributable to lower

interest rates paid on deposits and junior subordinated debt, which

were also impacted by lower market rates. The decrease in cost of

interest-bearing checking accounts, money market accounts and

junior subordinated debt totaled 26 basis points, 10 basis points

and 94 basis points, respectively.

Noninterest income increased $114 thousand, or 6%, to $2.1

million, compared to the same period of 2019. The increase was

primarily attributable to an $88 thousand, or 20%, increase in

wealth management fees, and a $32 thousand, or 18% increase in fees

for other customer services. The increase in wealth management fees

resulted primarily from higher balances of assets under management

during the first quarter of 2020 compared to the same period one

year ago. Assets under management increased as a result of new

business relationships and from growth in the market values of

existing accounts. Fees for other customer services increased due

to revenue earned on letter of credit fees.

Noninterest expense increased $46 thousand, or 1%, to $6.1

million, compared to the same period one year ago. The increase was

primarily attributable to a $146 thousand, or 4%, increase in

salaries and employee benefits, which was partially offset by a $39

thousand, or 57%, decrease in FDIC assessment, and a $50 thousand,

or 8%, decrease in other operating expense. FDIC assessment expense

was lower compared to the same period one year ago due to credits

that were fully utilized during the first quarter of 2020. Other

operating expense decreased from lower education and training

costs, debit card losses, and loan servicing fees on purchased

loans.

ASSET QUALITY/LOAN LOSS PROVISION

Provision for loan losses totaled $900 thousand for the first

quarter of 2020, compared to no provision for loan losses for the

same period of 2019. The increase in provision for loan losses was

primarily attributable to an increase in the general reserve

component of the allowance for loan losses. The general reserve

component of the allowance for loan losses was increased through

the adjustment of qualitative factors based on recent changes in

economic indicators and contributed approximately $700 thousand of

the higher provision for loan losses. Net charge offs totaled $250

thousand for the first quarter of 2020, compared to $63 thousand

for the first quarter of 2019. Net charge-offs also

contributed to the increased provision for loan losses.

Nonperforming assets totaled $1.5 million, or 0.19% of total

assets at March 31, 2020, compared to $1.9 million, or 0.25% of

total assets, one year ago. The allowance for loan losses totaled

$5.6 million, or 0.96% of total loans, and $4.9 million, or 0.90%

of total loans, at March 31, 2020 and 2019, respectively.

FORWARD-LOOKING STATEMENTS

Certain information contained in this discussion may include

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. These forward-looking

statements relate to the Company’s future operations and are

generally identified by phrases such as “the Company expects,” “the

Company believes” or words of similar import. Although the Company

believes that its expectations with respect to the forward-looking

statements are based upon reliable assumptions within the bounds of

its knowledge of its business and operations, there can be no

assurance that actual results, performance or achievements of the

Company will not differ materially from any future results,

performance or achievements expressed or implied by such

forward-looking statements. Forward-looking statements involve a

number of risks and uncertainties, including the rapidly changing

uncertainties related to the COVID-19 pandemic and its potential

adverse effect on the economy, our employees and customers, and our

financial performance. For details on other factors that could

affect expectations, see the risk factors and other cautionary

language included in the Company’s Annual Report on Form 10-K for

the year ended December 31, 2019, and other filings with the

Securities and Exchange Commission.

ABOUT FIRST NATIONAL CORPORATION

First National Corporation (NASDAQ: FXNC) is the parent company

and bank holding company of First Bank, a community bank that first

opened for business in 1907 in Strasburg, Virginia. The Bank offers

loan and deposit products and services through its website,

www.fbvirginia.com, its mobile banking platform, a network of ATMs

located throughout its market area, one loan production office, a

customer service center in a retirement community, and 14 bank

branch office locations located throughout the Shenandoah Valley,

the central regions of Virginia and in the city of Richmond. In

addition to providing traditional banking services, the Bank

operates a wealth management division under the name First Bank

Wealth Management. First Bank also owns First Bank Financial

Services, Inc., which invests in entities that provide investment

services and title insurance.

CONTACTS

| Scott C. Harvard |

|

M. Shane Bell |

| President and CEO |

|

Executive Vice President and

CFO |

| (540) 465-9121 |

|

(540) 465-9121 |

| shavard@fbvirginia.com |

|

sbell@fbvirginia.com |

| |

|

|

FIRST NATIONAL CORPORATIONQuarterly

Performance Summary(in thousands)

| |

|

(unaudited) |

| |

|

For the Quarter Ended |

| |

|

March

31, |

|

December

31, |

|

September

30, |

|

June

30, |

|

March

31, |

| |

|

2020 |

|

2019 |

|

2019 |

|

2019 |

|

2019 |

| Income Statement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and fees on loans |

|

$ |

7,203 |

|

|

$ |

7,333 |

|

|

$ |

7,429 |

|

|

$ |

7,200 |

|

|

$ |

6,996 |

|

|

Interest on deposits in banks |

|

|

118 |

|

|

|

163 |

|

|

|

97 |

|

|

|

133 |

|

|

|

110 |

|

|

Interest on securities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable interest |

|

|

670 |

|

|

|

627 |

|

|

|

645 |

|

|

|

696 |

|

|

|

737 |

|

|

Tax-exempt interest |

|

|

151 |

|

|

|

156 |

|

|

|

157 |

|

|

|

159 |

|

|

|

156 |

|

|

Dividends |

|

|

26 |

|

|

|

27 |

|

|

|

26 |

|

|

|

26 |

|

|

|

24 |

|

| Total interest income |

|

$ |

8,168 |

|

|

$ |

8,306 |

|

|

$ |

8,354 |

|

|

$ |

8,214 |

|

|

$ |

8,023 |

|

| Interest expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest on deposits |

|

$ |

962 |

|

|

$ |

1,042 |

|

|

$ |

1,089 |

|

|

$ |

1,051 |

|

|

$ |

922 |

|

|

Interest on federal funds purchased |

|

|

— |

|

|

|

— |

|

|

|

1 |

|

|

|

— |

|

|

|

— |

|

|

Interest on subordinated debt |

|

|

90 |

|

|

|

91 |

|

|

|

90 |

|

|

|

90 |

|

|

|

89 |

|

|

Interest on junior subordinated debt |

|

|

90 |

|

|

|

98 |

|

|

|

103 |

|

|

|

108 |

|

|

|

111 |

|

|

Interest on other borrowings |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2 |

|

| Total interest expense |

|

$ |

1,142 |

|

|

$ |

1,231 |

|

|

$ |

1,283 |

|

|

$ |

1,249 |

|

|

$ |

1,124 |

|

| Net interest income |

|

$ |

7,026 |

|

|

$ |

7,075 |

|

|

$ |

7,071 |

|

|

$ |

6,965 |

|

|

$ |

6,899 |

|

| Provision for loan losses |

|

|

900 |

|

|

|

250 |

|

|

|

— |

|

|

|

200 |

|

|

|

— |

|

| Net interest income after provision for loan losses |

|

$ |

6,126 |

|

|

$ |

6,825 |

|

|

$ |

7,071 |

|

|

$ |

6,765 |

|

|

$ |

6,899 |

|

| Noninterest income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Service charges on deposit accounts |

|

$ |

681 |

|

|

$ |

753 |

|

|

$ |

757 |

|

|

$ |

715 |

|

|

$ |

701 |

|

|

ATM and check card fees |

|

|

519 |

|

|

|

654 |

|

|

|

586 |

|

|

|

573 |

|

|

|

517 |

|

|

Wealth management fees |

|

|

525 |

|

|

|

496 |

|

|

|

477 |

|

|

|

458 |

|

|

|

437 |

|

|

Fees for other customer services |

|

|

207 |

|

|

|

181 |

|

|

|

177 |

|

|

|

153 |

|

|

|

175 |

|

|

Income from bank owned life insurance |

|

|

115 |

|

|

|

123 |

|

|

|

131 |

|

|

|

99 |

|

|

|

103 |

|

|

Net gains on securities |

|

|

— |

|

|

|

1 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Net gains on sale of loans |

|

|

31 |

|

|

|

89 |

|

|

|

34 |

|

|

|

25 |

|

|

|

22 |

|

|

Other operating income |

|

|

21 |

|

|

|

44 |

|

|

|

29 |

|

|

|

12 |

|

|

|

30 |

|

| Total noninterest income |

|

$ |

2,099 |

|

|

$ |

2,341 |

|

|

$ |

2,191 |

|

|

$ |

2,035 |

|

|

$ |

1,985 |

|

| Noninterest expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

$ |

3,589 |

|

|

$ |

3,193 |

|

|

$ |

3,556 |

|

|

$ |

3,375 |

|

|

$ |

3,443 |

|

|

Occupancy |

|

|

402 |

|

|

|

415 |

|

|

|

398 |

|

|

|

401 |

|

|

|

438 |

|

|

Equipment |

|

|

410 |

|

|

|

406 |

|

|

|

410 |

|

|

|

409 |

|

|

|

420 |

|

|

Marketing |

|

|

106 |

|

|

|

128 |

|

|

|

143 |

|

|

|

239 |

|

|

|

141 |

|

|

Supplies |

|

|

89 |

|

|

|

88 |

|

|

|

86 |

|

|

|

91 |

|

|

|

73 |

|

|

Legal and professional fees |

|

|

279 |

|

|

|

311 |

|

|

|

231 |

|

|

|

303 |

|

|

|

241 |

|

|

ATM and check card expense |

|

|

245 |

|

|

|

231 |

|

|

|

225 |

|

|

|

225 |

|

|

|

216 |

|

|

FDIC assessment |

|

|

30 |

|

|

|

(53 |

) |

|

|

(6 |

) |

|

|

35 |

|

|

|

69 |

|

|

Bank franchise tax |

|

|

153 |

|

|

|

136 |

|

|

|

136 |

|

|

|

136 |

|

|

|

130 |

|

|

Data processing expense |

|

|

184 |

|

|

|

179 |

|

|

|

174 |

|

|

|

179 |

|

|

|

173 |

|

|

Amortization expense |

|

|

52 |

|

|

|

61 |

|

|

|

71 |

|

|

|

80 |

|

|

|

90 |

|

|

Other real estate owned expense, net |

|

|

— |

|

|

|

1 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Net losses (gains) on disposal of premises and equipment |

|

|

(9 |

) |

|

|

14 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Other operating expense |

|

|

614 |

|

|

|

694 |

|

|

|

762 |

|

|

|

757 |

|

|

|

664 |

|

| Total noninterest expense |

|

$ |

6,144 |

|

|

$ |

5,804 |

|

|

$ |

6,186 |

|

|

$ |

6,230 |

|

|

$ |

6,098 |

|

| Income before income taxes |

|

$ |

2,081 |

|

|

$ |

3,362 |

|

|

$ |

3,076 |

|

|

$ |

2,570 |

|

|

$ |

2,786 |

|

| Income tax expense |

|

|

376 |

|

|

|

646 |

|

|

|

583 |

|

|

|

484 |

|

|

|

525 |

|

| Net income |

|

$ |

1,705 |

|

|

$ |

2,716 |

|

|

$ |

2,493 |

|

|

$ |

2,086 |

|

|

$ |

2,261 |

|

FIRST NATIONAL CORPORATIONQuarterly

Performance Summary(in thousands, except share and per

share data)

| |

|

(unaudited) |

| |

|

For the Quarter Ended |

| |

|

March

31, |

|

December

31, |

|

September

30, |

|

June

30, |

|

March

31, |

| |

|

2020 |

|

2019 |

|

2019 |

|

2019 |

|

2019 |

| Common Share and Per Common Share Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income, basic |

|

$ |

0.34 |

|

|

$ |

0.55 |

|

|

$ |

0.50 |

|

|

$ |

0.42 |

|

|

$ |

0.46 |

|

| Weighted average shares, basic |

|

|

4,950,887 |

|

|

|

4,968,574 |

|

|

|

4,966,641 |

|

|

|

4,963,737 |

|

|

|

4,960,264 |

|

| Net income, diluted |

|

$ |

0.34 |

|

|

$ |

0.55 |

|

|

$ |

0.50 |

|

|

$ |

0.42 |

|

|

$ |

0.46 |

|

| Weighted average shares, diluted |

|

|

4,955,970 |

|

|

|

4,972,535 |

|

|

|

4,969,126 |

|

|

|

4,965,822 |

|

|

|

4,964,134 |

|

| Shares outstanding at period end |

|

|

4,849,692 |

|

|

|

4,969,716 |

|

|

|

4,968,277 |

|

|

|

4,964,824 |

|

|

|

4,963,487 |

|

| Tangible book value at period end |

|

$ |

16.17 |

|

|

$ |

15.50 |

|

|

$ |

15.11 |

|

|

$ |

14.60 |

|

|

$ |

13.97 |

|

| Cash dividends |

|

$ |

0.11 |

|

|

$ |

0.09 |

|

|

$ |

0.09 |

|

|

$ |

0.09 |

|

|

$ |

0.09 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Key Performance Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average assets |

|

|

0.85 |

% |

|

|

1.36 |

% |

|

|

1.27 |

% |

|

|

1.08 |

% |

|

|

1.21 |

% |

| Return on average equity |

|

|

8.72 |

% |

|

|

14.10 |

% |

|

|

13.31 |

% |

|

|

11.76 |

% |

|

|

13.47 |

% |

| Net interest margin |

|

|

3.77 |

% |

|

|

3.79 |

% |

|

|

3.87 |

% |

|

|

3.88 |

% |

|

|

3.97 |

% |

| Efficiency ratio (1) |

|

|

66.50 |

% |

|

|

60.50 |

% |

|

|

65.65 |

% |

|

|

67.94 |

% |

|

|

67.23 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average Balances |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average assets |

|

$ |

806,609 |

|

|

$ |

795,391 |

|

|

$ |

780,376 |

|

|

$ |

773,574 |

|

|

$ |

757,910 |

|

| Average earning assets |

|

|

755,173 |

|

|

|

745,721 |

|

|

|

730,865 |

|

|

|

724,909 |

|

|

|

709,690 |

|

| Average shareholders’ equity |

|

|

78,659 |

|

|

|

76,424 |

|

|

|

74,291 |

|

|

|

71,124 |

|

|

|

68,089 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Asset Quality |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loan charge-offs |

|

$ |

328 |

|

|

$ |

281 |

|

|

$ |

156 |

|

|

$ |

219 |

|

|

$ |

228 |

|

| Loan recoveries |

|

|

78 |

|

|

|

53 |

|

|

|

73 |

|

|

|

68 |

|

|

|

165 |

|

| Net charge-offs |

|

|

250 |

|

|

|

228 |

|

|

|

83 |

|

|

|

151 |

|

|

|

63 |

|

| Non-accrual loans |

|

|

1,522 |

|

|

|

1,459 |

|

|

|

1,566 |

|

|

|

1,775 |

|

|

|

1,915 |

|

| Other real estate owned, net |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Nonperforming assets |

|

|

1,522 |

|

|

|

1,459 |

|

|

|

1,566 |

|

|

|

1,775 |

|

|

|

1,915 |

|

| Loans 30 to 89 days past due, accruing |

|

|

2,901 |

|

|

|

2,372 |

|

|

|

902 |

|

|

|

792 |

|

|

|

1,002 |

|

| Loans over 90 days past due, accruing |

|

|

86 |

|

|

|

97 |

|

|

|

113 |

|

|

|

19 |

|

|

|

133 |

|

| Troubled debt restructurings, accruing |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

259 |

|

| Special mention loans |

|

|

6,058 |

|

|

|

6,069 |

|

|

|

1,458 |

|

|

|

2,610 |

|

|

|

1,910 |

|

| Substandard loans, accruing |

|

|

4,368 |

|

|

|

3,410 |

|

|

|

3,758 |

|

|

|

2,825 |

|

|

|

3,132 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Capital Ratios (2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total capital |

|

$ |

86,849 |

|

|

$ |

85,439 |

|

|

$ |

83,591 |

|

|

$ |

82,078 |

|

|

$ |

80,780 |

|

| Tier 1 capital |

|

|

81,265 |

|

|

|

80,505 |

|

|

|

78,679 |

|

|

|

77,083 |

|

|

|

75,834 |

|

| Common equity tier 1 capital |

|

|

81,265 |

|

|

|

80,505 |

|

|

|

78,679 |

|

|

|

77,083 |

|

|

|

75,834 |

|

| Total capital to risk-weighted assets |

|

|

14.98 |

% |

|

|

14.84 |

% |

|

|

14.57 |

% |

|

|

14.24 |

% |

|

|

14.49 |

% |

| Tier 1 capital to risk-weighted assets |

|

|

14.02 |

% |

|

|

13.99 |

% |

|

|

13.71 |

% |

|

|

13.37 |

% |

|

|

13.60 |

% |

| Common equity tier 1 capital to risk-weighted assets |

|

|

14.02 |

% |

|

|

13.99 |

% |

|

|

13.71 |

% |

|

|

13.37 |

% |

|

|

13.60 |

% |

| Leverage ratio |

|

|

10.08 |

% |

|

|

10.13 |

% |

|

|

10.09 |

% |

|

|

9.96 |

% |

|

|

10.01 |

% |

FIRST NATIONAL CORPORATIONQuarterly

Performance Summary(in thousands)

| |

|

(unaudited) |

| |

|

For the Quarter Ended |

| |

|

March

31, |

|

December

31, |

|

September

30, |

|

June

30, |

|

March

31, |

| |

|

2020 |

|

2019 |

|

2019 |

|

2019 |

|

2019 |

| Balance Sheet |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and due from banks |

|

$ |

30,551 |

|

|

$ |

9,675 |

|

|

$ |

11,885 |

|

|

$ |

12,354 |

|

|

$ |

10,862 |

|

| Interest-bearing deposits in banks |

|

|

17,539 |

|

|

|

36,110 |

|

|

|

18,488 |

|

|

|

10,716 |

|

|

|

31,833 |

|

| Securities available for sale, at fair value |

|

|

128,660 |

|

|

|

120,983 |

|

|

|

114,568 |

|

|

|

119,510 |

|

|

|

121,202 |

|

| Securities held to maturity, at amortized cost |

|

|

17,086 |

|

|

|

17,627 |

|

|

|

18,222 |

|

|

|

18,828 |

|

|

|

19,489 |

|

| Restricted securities, at cost |

|

|

1,848 |

|

|

|

1,806 |

|

|

|

1,806 |

|

|

|

1,701 |

|

|

|

1,701 |

|

| Loans held for sale |

|

|

621 |

|

|

|

167 |

|

|

|

1,098 |

|

|

|

675 |

|

|

|

200 |

|

| Loans, net of allowance for loan losses |

|

|

576,283 |

|

|

|

569,412 |

|

|

|

566,341 |

|

|

|

569,959 |

|

|

|

545,529 |

|

| Premises and equipment, net |

|

|

19,619 |

|

|

|

19,747 |

|

|

|

19,946 |

|

|

|

20,182 |

|

|

|

20,282 |

|

| Accrued interest receivable |

|

|

2,124 |

|

|

|

2,065 |

|

|

|

2,053 |

|

|

|

2,163 |

|

|

|

2,143 |

|

| Bank owned life insurance |

|

|

17,562 |

|

|

|

17,447 |

|

|

|

17,324 |

|

|

|

17,193 |

|

|

|

17,094 |

|

| Core deposit intangibles, net |

|

|

118 |

|

|

|

170 |

|

|

|

231 |

|

|

|

302 |

|

|

|

382 |

|

| Other assets |

|

|

4,401 |

|

|

|

4,839 |

|

|

|

5,231 |

|

|

|

4,801 |

|

|

|

4,361 |

|

| Total assets |

|

$ |

816,412 |

|

|

$ |

800,048 |

|

|

$ |

777,193 |

|

|

$ |

778,384 |

|

|

$ |

775,078 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest-bearing demand deposits |

|

$ |

197,662 |

|

|

$ |

189,623 |

|

|

$ |

189,797 |

|

|

$ |

186,553 |

|

|

$ |

189,261 |

|

| Savings and interest-bearing demand deposits |

|

|

407,555 |

|

|

|

399,255 |

|

|

|

376,047 |

|

|

|

385,399 |

|

|

|

377,673 |

|

| Time deposits |

|

|

115,410 |

|

|

|

117,564 |

|

|

|

119,777 |

|

|

|

117,863 |

|

|

|

117,290 |

|

| Total deposits |

|

$ |

720,627 |

|

|

$ |

706,442 |

|

|

$ |

685,621 |

|

|

$ |

689,815 |

|

|

$ |

684,224 |

|

| Other borrowings |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

5,000 |

|

| Subordinated debt |

|

|

4,987 |

|

|

|

4,983 |

|

|

|

4,978 |

|

|

|

4,974 |

|

|

|

4,969 |

|

| Junior subordinated debt |

|

|

9,279 |

|

|

|

9,279 |

|

|

|

9,279 |

|

|

|

9,279 |

|

|

|

9,279 |

|

| Accrued interest payable and other liabilities |

|

|

3,001 |

|

|

|

2,125 |

|

|

|

1,999 |

|

|

|

1,507 |

|

|

|

1,878 |

|

| Total liabilities |

|

$ |

737,894 |

|

|

$ |

722,829 |

|

|

$ |

701,877 |

|

|

$ |

705,575 |

|

|

$ |

705,350 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Preferred stock |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

| Common stock |

|

|

6,062 |

|

|

|

6,212 |

|

|

|

6,210 |

|

|

|

6,206 |

|

|

|

6,204 |

|

| Surplus |

|

|

5,899 |

|

|

|

7,700 |

|

|

|

7,648 |

|

|

|

7,566 |

|

|

|

7,515 |

|

| Retained earnings |

|

|

63,741 |

|

|

|

62,583 |

|

|

|

60,314 |

|

|

|

58,268 |

|

|

|

56,629 |

|

| Accumulated other comprehensive income (loss), net |

|

|

2,816 |

|

|

|

724 |

|

|

|

1,144 |

|

|

|

769 |

|

|

|

(620 |

) |

| Total shareholders’ equity |

|

$ |

78,518 |

|

|

$ |

77,219 |

|

|

$ |

75,316 |

|

|

$ |

72,809 |

|

|

$ |

69,728 |

|

| Total liabilities and shareholders’ equity |

|

$ |

816,412 |

|

|

$ |

800,048 |

|

|

$ |

777,193 |

|

|

$ |

778,384 |

|

|

$ |

775,078 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loan Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mortgage loans on real estate: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Construction and land development |

|

$ |

40,279 |

|

|

$ |

43,164 |

|

|

$ |

45,193 |

|

|

$ |

46,281 |

|

|

$ |

48,948 |

|

|

Secured by farmland |

|

|

888 |

|

|

|

900 |

|

|

|

916 |

|

|

|

855 |

|

|

|

883 |

|

|

Secured by 1-4 family residential |

|

|

230,980 |

|

|

|

229,438 |

|

|

|

226,828 |

|

|

|

225,820 |

|

|

|

217,527 |

|

|

Other real estate loans |

|

|

240,486 |

|

|

|

235,655 |

|

|

|

232,151 |

|

|

|

236,515 |

|

|

|

220,513 |

|

| Loans to farmers (except those secured by real estate) |

|

|

1,221 |

|

|

|

1,423 |

|

|

|

1,461 |

|

|

|

1,006 |

|

|

|

806 |

|

| Commercial and industrial loans (except those secured by real

estate) |

|

|

54,287 |

|

|

|

48,730 |

|

|

|

49,096 |

|

|

|

48,347 |

|

|

|

45,239 |

|

| Consumer installment loans |

|

|

9,505 |

|

|

|

10,400 |

|

|

|

11,040 |

|

|

|

11,572 |

|

|

|

11,890 |

|

| Deposit overdrafts |

|

|

238 |

|

|

|

374 |

|

|

|

263 |

|

|

|

208 |

|

|

|

204 |

|

| All other loans |

|

|

3,983 |

|

|

|

4,262 |

|

|

|

4,305 |

|

|

|

4,350 |

|

|

|

4,465 |

|

| Total loans |

|

$ |

581,867 |

|

|

$ |

574,346 |

|

|

$ |

571,253 |

|

|

$ |

574,954 |

|

|

$ |

550,475 |

|

| Allowance for loan losses |

|

|

(5,584 |

) |

|

|

(4,934 |

) |

|

|

(4,912 |

) |

|

|

(4,995 |

) |

|

|

(4,946 |

) |

| Loans, net |

|

$ |

576,283 |

|

|

$ |

569,412 |

|

|

$ |

566,341 |

|

|

$ |

569,959 |

|

|

$ |

545,529 |

|

FIRST NATIONAL CORPORATIONQuarterly

Performance Summary(in thousands)

| |

|

(unaudited) |

| |

|

For the Quarter Ended |

| |

|

March

31, |

|

December

31, |

|

September

30, |

|

June

30, |

|

March

31, |

| |

|

2020 |

|

2019 |

|

2019 |

|

2019 |

|

2019 |

| Reconciliation of Tax-Equivalent Net

Interest Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP measures: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income – loans |

|

$ |

7,203 |

|

|

$ |

7,333 |

|

|

$ |

7,429 |

|

|

$ |

7,200 |

|

|

$ |

6,996 |

|

|

Interest income – investments and other |

|

|

965 |

|

|

|

973 |

|

|

|

925 |

|

|

|

1,014 |

|

|

|

1,027 |

|

|

Interest expense – deposits |

|

|

(962 |

) |

|

|

(1,042 |

) |

|

|

(1,089 |

) |

|

|

(1,051 |

) |

|

|

(922 |

) |

|

Interest expense – federal funds purchased |

|

|

— |

|

|

|

— |

|

|

|

(1 |

) |

|

|

— |

|

|

|

— |

|

|

Interest expense – subordinated debt |

|

|

(90 |

) |

|

|

(91 |

) |

|

|

(90 |

) |

|

|

(90 |

) |

|

|

(89 |

) |

|

Interest expense – junior subordinated debt |

|

|

(90 |

) |

|

|

(98 |

) |

|

|

(103 |

) |

|

|

(108 |

) |

|

|

(111 |

) |

|

Interest expense – other borrowings |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2 |

) |

| Total net interest income |

|

$ |

7,026 |

|

|

$ |

7,075 |

|

|

$ |

7,071 |

|

|

$ |

6,965 |

|

|

$ |

6,899 |

|

| Non-GAAP measures: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax benefit realized on non-taxable interest income – loans |

|

$ |

10 |

|

|

$ |

10 |

|

|

$ |

9 |

|

|

$ |

10 |

|

|

$ |

11 |

|

|

Tax benefit realized on non-taxable interest income – municipal

securities |

|

|

40 |

|

|

|

41 |

|

|

|

43 |

|

|

|

42 |

|

|

|

41 |

|

| Total tax benefit realized on non-taxable interest income |

|

$ |

50 |

|

|

$ |

51 |

|

|

$ |

52 |

|

|

$ |

52 |

|

|

$ |

52 |

|

| Total tax-equivalent net interest income |

|

$ |

7,076 |

|

|

$ |

7,126 |

|

|

$ |

7,123 |

|

|

$ |

7,017 |

|

|

$ |

6,951 |

|

(1) The efficiency ratio is computed by dividing noninterest

expense excluding other real estate owned income/expense,

amortization of intangibles, and gains and losses on disposal of

premises and equipment by the sum of net interest income on a

tax-equivalent basis and noninterest income, excluding gains and

losses on sales of securities. Tax-equivalent net interest

income is calculated by adding the tax benefit realized from

interest income that is nontaxable to total interest income then

subtracting total interest expense. The tax rate utilized in

calculating the tax benefit is 21%. See the tables above for

tax-equivalent net interest income and reconciliations of net

interest income to tax-equivalent net interest income. The

efficiency ratio is a non-GAAP financial measure that management

believes provides investors with important information regarding

operational efficiency. Such information is not prepared in

accordance with U.S. generally accepted accounting principles

(GAAP) and should not be construed as such. Management

believes; however, such financial information is meaningful to the

reader in understanding operational performance, but cautions that

such information not be viewed as a substitute for GAAP.

(2) All capital ratios reported are for First Bank.

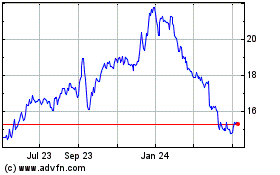

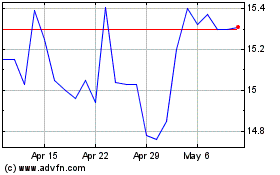

First National (NASDAQ:FXNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

First National (NASDAQ:FXNC)

Historical Stock Chart

From Apr 2023 to Apr 2024