UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2021

Commission File Number: 001-38397

Farmmi, Inc.

(Translation of registrant’s name into English)

Fl

1, Building No. 1, 888 Tianning Street, Liandu District

Lishui,

Zhejiang Province

People’s

Republic of China 323000

(Address of principal

executive offices)

Indicate by check mark whether the registrant files

or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

EXPLANATORY NOTE

Letter From CEO

On September 29, 2021, the

Chief Executive Officer, Yefang Zhang, issued a letter to shareholders, detailing an expansion of the Company’s addressable market

through acquisition and strategic plans for the Company’s future development. The full text of the letter from Ms. Zhang is as Exhibit

99.1.

New subsidiaries

In September 2021, Farmmi,

Inc., a Cayman Islands corporation (the “Company”) established four new subsidiaries. Zhejiang Yitang Medical Service Co.,

Ltd. was established on September 7, 2021. Zhejiang Yiting Medical Technology Co., Ltd. and Farmmi (Hangzhou) Health Development Co.,

Ltd. were established on September 17, 2021. Zhejiang Farmmi Healthcare Technology Co., Ltd was established on September 18, 2021. As

the Company intends to expand its operations into the healthcare industry, the Company expects these new subsidiaries to play an important

role in the future.

Shareholder change

of Lishui E-Commerce

On September 10, 2021, the

Board of Directors of Lishui Farmmi E-Commerce Co., Ltd. (“Lishui E-Commerce”), a subsidiary of the Company, approved Lishui

E-Commerce’s capital increase by RMB 16,500,000 to RMB 21,500,000 and approved the increased capital invested by Zhejiang Forest

Food Co., Ltd. (“Zhejiang Forest”) as a new shareholder. After the capital increase, Zhejiang Forest held approximately 77%

of the shares of Lishui E-Commerce. At the time of increase and investment, Zhejiang Forest was a subsidiary of the Company.

On September 18, 2021, Zhejiang

Forest and Zhejiang Farmmi Agricultural Science and Technology Group Co., Ltd. (“Farmmi Agricultural”), another subsidiary

of the Company, entered into a Share Transfer Agreement (the “E-Commerce Agreement”). Under the terms of the E-Commerce Agreement,

Zhejiang Forest transferred its shares in Lishui Farmmi E-Commerce to Farmmi Agricultural, for approximately 77% of the shares of Lishui

E-Commerce for no consideration. After the transfer of the shares, Zhejiang Forest has no equity interest in Lishui E-Commerce, and Farmmi

Agricultural holds approximately 77% of Lishui E-Commerce.

Divestiture

On September 27, 2021, Farmmi

Agricultural and Hangzhou Dawo Software Co., Ltd., the only shareholders of Zhejiang Forest, entered into a Share Transfer Agreement (“Share

Transfer Agreement”) to transfer all of their equity in Zhejiang Forest to Lishui Zhongjun Technology Co., Ltd., an unrelated party,

for a total price of RMB 18,200,000. After this transfer, Zhejiang Forest has been divested from the Company. The Company made this decision

based on the challenges the Company encountered in the agriculture food business.

The Company’s Board

of Directors approved the terms of the Share Transfer Agreement based on its belief that the price for the transaction is fair and it

is in the best interests of the Company and its shareholders.

Acquisition

On September 27, 2021, Zhejiang

Farmmi Agricultural Supply Chain Co., Ltd., a subsidiary of the Company, entered into an Acquisition Agreement (“Jiangxi Xiangbo

Acquisition Agreement”) with Ganzhou Tengguang Agriculture and Forestry Development Co., Ltd., an unrelated third party, to acquire

all the shares of Jiangxi Xiangbo Agriculture and Forestry Development Co., Ltd. (“Jiangxi Xiangbo”) for a total price of

RMB 70 million. The Company made this decision based on its decision to expand it forest related business.

On September 27, 2021,

Zhejiang Farmmi Agricultural Supply Chain Co., Ltd., a subsidiary of the Company, entered into another Share Transfer Agreement (

“Guoning Zhonghao Acquisition Agreement”) with Ningbo Guoning Zhonghao Technology Co., Ltd. and Jianxin Huang to acquire

all the shares of Guoning Zhonghao (Ningbo) Trade Co., Ltd. (“Guoning Zhonghao”) for a total price of RMB 5,000. As of

the date of acquisition, Guoning Zhonghao had nominal operations.

The Company’s Board

of Directors approved the terms of the acquisition agreements based on its belief that the price for each transaction is fair and entry

into the agreements is in the best interests of the Company and its shareholders.

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Farmmi, Inc.

|

|

|

|

|

|

Date: September 29, 2021

|

By:

|

/s/ Yefang Zhang

|

|

|

|

Yefang Zhang

|

|

|

|

Chief Executive Officer

|

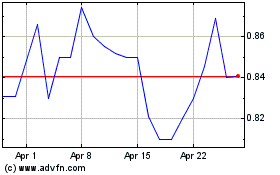

Farmmi (NASDAQ:FAMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

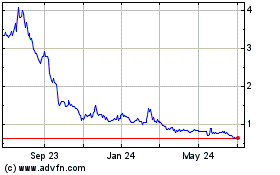

Farmmi (NASDAQ:FAMI)

Historical Stock Chart

From Apr 2023 to Apr 2024