Facebook's Libra Could Aid Law Enforcement

July 30 2019 - 5:59AM

Dow Jones News

By Paul Vigna

Lawmakers were up in arms this month about whether Libra,

Facebook Inc.'s proposed new cryptocurrency, would be a haven for

money launderers and other criminal activities.

Facebook, though, says Libra could be a valuable tool for law

enforcement, partly because of the vast amounts of information that

will be generated about its users. That was the message Facebook

executive David Marcus took to Congress during hearings this

month.

The conversation represents how some portions of the crypto

world are trying to move beyond the industry's Wild West heyday and

become a viable payments option.

The ability to use crypto to help catch criminals is ingrained

in its structure. Cash is valuable to criminals because there is no

transaction or ownership record. Bitcoins carry an unalterable

transaction record with them, but not always an ownership record.

With Libra, both the transactions made and who made them will be

recorded.

"You're going to see an expansion of exchanges and wallet

services that have stronger (anti-money-laundering) protocols and

restrictions," said Yaya Fanusie, a former CIA analyst and security

consultant. "That would be good for law enforcement."

Mr. Marcus implied in his testimony on June 17 that law

enforcement could have access to that information when needed.

Facebook and the nonprofit group that will govern Libra, the

Libra Association, will impose rules on the companies that use the

network. Companies like exchanges and wallet providers that want to

use the Libra network will have to comply with regulations around

money laundering. That is something that can't be forced on the

bitcoin network, where there is no one party or group controlling

access.

"I believe that we can improve on the current system," Mr.

Marcus told Congress in his recent testimony. "I think this system

might be potentially better."

Facebook declined to comment beyond the testimony given by Mr.

Marcus. The Libra Association also declined to comment.

Law enforcement has previously used bitcoin to its advantage.

Federal officers used the bitcoin transaction history of Ross

Ulbricht to help convict him in 2015 of running the online drug

site Silk Road.

The crypto sector has been moving in this direction for several

years. Many prominent businesses adhere to standard banking rules,

and several nations, notably Japan and Switzerland, have crafted

laws specifically for digital currencies.

In the U.S., Attorney General William Barr discussed in a speech

last Tuesday how encryption was "enabling dangerous criminals to

cloak their communications and activities," reviving a debate over

whether technology companies should be required to provide law

enforcement a way to unlock some communications.

The software than runs blockchain-based digital currencies,

including bitcoin, maintains a public ledger that records every

transaction. That ledger is maintained by groups whose work is

publicly reviewable. That means any attempt at altering the record

should be visible for everyone to see, making voiding or

counterfeiting difficult.

For bitcoin, so-called "miners" process the transactions, and

"nodes" broadcast them publicly. Anybody can download the software

to run either process. That means there is no central authority to

force compliance with the law. Bitcoin service providers that

submit to regulations do so voluntarily.

On Libra, the members of the Libra Association would determine

who gets to perform those tasks. That would give the association

significant control over the network, and could allow it to force

companies on the network to maintain data on the identities of all

its users and make it available to regulators.

Mr. Fanusie said the eventual outcome will be two worlds of

cryptocurrencies: one regulated and one unregulated.

Mr. Fanusie said law enforcement's job will be easier because

officials will know where to look for crime: at the point where the

unregulated space mixes with the regulated space. Eventually, even

drug smugglers need to cash out.

"The unregulated space will be there," he said, "but it will be

smaller."

Write to Paul Vigna at paul.vigna@wsj.com

(END) Dow Jones Newswires

July 30, 2019 05:44 ET (09:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

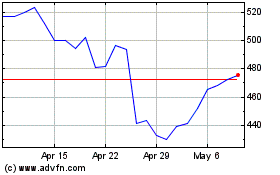

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Mar 2024 to Apr 2024

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Apr 2023 to Apr 2024