EZCORP Raises Earnings Guidance for Fiscal Third Quarter and Year

June 30 2006 - 5:21PM

PR Newswire (US)

AUSTIN, Texas, June 30 /PRNewswire-FirstCall/ -- EZCORP, Inc.

(NASDAQ:EZPW) announced today that it expects earnings for its

quarter ended June 30, 2006 to be in the range of $0.35 to $0.37

per share, significantly higher than its previously announced

guidance of $0.20 to $0.23. During the quarter, the Company

realized stronger than expected sales gross profit, primarily due

to higher gold values, and a lower than expected earnings drag from

new store openings. The Company opened 25 stores during the

quarter, with most of these opening late in the quarter. The

Company still plans to open more than 100 stores this fiscal year,

pushing much of the anticipated new store earnings drag into the

fiscal fourth quarter. The Company also raised its earnings

guidance for its fiscal year ending September 30, 2006 to a range

of $1.80 to $1.85 per share compared to $1.09 per share for the

twelve month period ended September 30, 2005. The Company will

release earnings for its third fiscal quarter on Tuesday, July 25,

2006 following the close of market. Management will discuss the

third quarter results and outlook for the year in a conference call

scheduled for 3:30 pm Central Time on the 25th. EZCORP is a lender

and provider of credit services to individuals who do not have cash

resources or access to credit to meet their short-term cash needs.

In 280 EZPAWN locations open on June 30, 2006, the Company offers

non- recourse loans collateralized by tangible personal property,

commonly known as pawn loans. At these locations, the Company also

sells merchandise, primarily collateral forfeited from its pawn

lending operations, to consumers looking for good value. In 288

EZMONEY locations and 82 EZPAWN locations open on June 30, 2006,

the Company offers short-term non-collateralized loans, often

referred to as payday loans, or fee based credit services to

customers seeking loans. This announcement contains certain

forward-looking statements regarding the Company's expected

performance for future periods including, but not limited to,

expected future earnings and new store expansion. Actual results

for these periods may materially differ from these statements. Such

forward- looking statements involve risks and uncertainties such as

changing market conditions in the overall economy and the industry,

consumer demand for the Company's services and merchandise, changes

in regulatory environment, and other factors periodically discussed

in the Company's annual, quarterly and other reports filed with the

Securities and Exchange Commission. For additional information,

contact Dan Tonissen at (512) 314-2289. DATASOURCE: EZCORP, Inc.

CONTACT: Dan Tonissen of EZCORP, Inc., +1-512-314-2289 Web site:

http://www.ezcorp.com/

Copyright

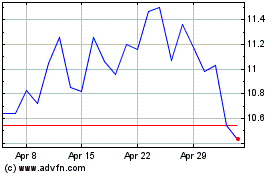

EZCORP (NASDAQ:EZPW)

Historical Stock Chart

From Aug 2024 to Sep 2024

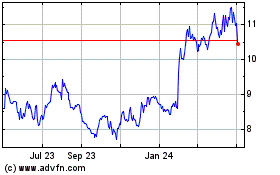

EZCORP (NASDAQ:EZPW)

Historical Stock Chart

From Sep 2023 to Sep 2024