Ericsson Swings to Forecast-Beating Profit Amid 5G Push

April 17 2019 - 9:13AM

Dow Jones News

By Dominic Chopping

STOCKHOLM -- Ericsson AB returned to profit in the first quarter

as telecom operators in North America continued to splash out on

new fifth-generation networks.

The Swedish telecom-equipment maker is emerging from years of

costly restructuring and has bet big on the growing 5G market,

where it is battling Finland's Nokia Corp. and China's Huawei

Technologies Co.

Its efforts to invest in 5G research, while cutting costs

elsewhere, appear to be paying off. Ericsson said Wednesday that it

swung to a first-quarter net profit of 2.32 billion Swedish kronor

($250.3 million), compared with a net loss of 837 million kronor

for the same period last year. Sales rose 13% to 48.91 billion

kronor.

Those figures, which beat analysts' expectations, prompted

shares to rise 3.5% to trade at a four-year high.

"Our strategy, to work with lead customers in lead markets, is

generating both 5G business and hands-on experience in 5G rollout

and commercialization," Chief Executive Borje Ekholm said.

So far, Ericsson has announced commercial 5G deals with 18 named

operators, including with T-Mobile US, Verizon and AT&T. 5G

technology promises to supercharge cellphones and ultimately enable

driverless cars and internet-controlled factories.

North American operators are eager to lead the transition to 5G

and have been ahead of the pack with their investments in the new

technology, driving Ericsson's networks sales for several quarters.

The company said that trend continued in the first quarter of 2019,

with overall sales in North America up 43%.

Ericsson, and rival Nokia, benefit from less competition in the

U.S. market, given the government has all but barred Huawei sales

over fears its equipment could be commandeered by Chinese

authorities to disrupt or spy on communications.

Most parts of Europe are lagging in the transition to the new

technology, though, primarily because of a lack of spectrum, poor

investment climate and uncertainty about whether some governments

will follow the U.S. in barring Huawei.

Nevertheless, Ericsson said Wednesday that it now expects the

Radio Access Network (RAN) equipment market to increase by 3% this

year, up from a previous forecast for 2% growth.

However, the company did caution that some of its new contracts,

while giving it a foothold with key customers, came with lower

profit margins. It said those contracts, combined with 5G field

trials and large-scale deployments of 5G in parts of Asia this

year, would hurt margins in the second quarter. In the first

quarter, gross margin was 38.4%, up from 34.2% in the same period

last year.

Ericsson also said it had begun settlement discussions with the

U.S. Securities and Exchange Commission and Justice Department

regarding their yearslong investigations into the company's

compliance with the U.S. Foreign Corrupt Practices Act.

It said these talks would likely result in material financial

and other measures, although it couldn't estimate the magnitude and

impact at this time.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

April 17, 2019 08:58 ET (12:58 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

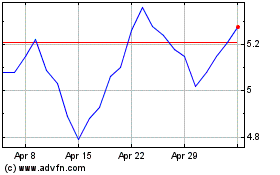

Ericsson (NASDAQ:ERIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

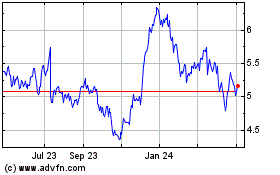

Ericsson (NASDAQ:ERIC)

Historical Stock Chart

From Apr 2023 to Apr 2024