Nokia, Ericsson Shares Rise After U.S. Floats Idea of Buying Stakes -- Update

February 07 2020 - 7:14AM

Dow Jones News

By Dominic Chopping

STOCKHOLM -- Shares in Ericsson AB and Nokia Corp. rose Friday

after the Trump administration floated the idea that the U.S. could

buy a stake in either of the telecom-equipment manufacturers -- a

sign that investors at least are taking the gambit seriously.

U.S. Attorney General William Barr told an audience in

Washington on Thursday the U.S. and its allies should consider

taking a controlling financial interest in the two Nordic

companies, as a way of countering the dominance of China's Huawei

Technologies Co. in the market for 5G.

The suggestion from Mr. Barr, a former general counsel at

cellphone carrier Verizon Communications Inc. -- a big customer of

Ericsson and Nokia -- left many industry watchers wondering how

serious the administration was about the idea.

Representatives for Ericsson and Nokia didn't comment, and

neither did spokespeople for the governments of Sweden and Finland,

where the two companies are based and are national champions. Some

investors, though, appeared to embrace the idea, with shares in

both companies rising more than 4%.

Cevian Capital, one of Ericsson's largest shareholders, said a

deal would make perfect sense for the U.S. if it wanted to be a

leader in 5G technology. Cevian said it has an 8.4% stake in

Ericsson.

However, any deal would have to involve a hefty premium to

Ericsson's share price, said Christer Gardell, Cevian's managing

partner.

"The current share price greatly undervalues the company's

long-term fundamentals," he said.

The share prices of both Ericsson and Nokia have fallen over the

past year as the companies battle for control of the burgeoning

market for 5G equipment with Huawei.

Mr. Gardell suggested a U.S. investment in Ericsson could pose

fewer hurdles than a deal with Nokia because the Swedish company

doesn't have state ownership. Finland holds a 3.8% stake in Nokia

through its Solidium holding company, which holds stakes in

nationally important listed companies. Solidium declined to

comment.

"It is clearly better for Sweden, the company, the employees and

the shareholders that an American deal is done with Ericsson and

not with Nokia," Mr. Gardell said. "The board and management need

to drive and handle this question with the highest priority."

The suggestion from Mr. Barr represents one of the Trump

administration's most aggressive proposals yet for pushing back

against Shenzhen-based Huawei.

U.S. officials have pushed governments to ban Huawei's gear from

their networks, saying the Chinese company could be legally obliged

to allow Beijing to use its staff and equipment to spy on foreign

networks. Huawei has denied that it would ever do this.

"We have to make a decision on the 'horse' we are going to ride

in this race," Mr. Barr said during a speech at the Center for

Strategic and International Studies in Washington, where

law-enforcement officials described the challenges of combating

China's threats to U.S. economic and national security.

Mr. Barr warned that allowing China to dominate 5G networks

poses a "monumental danger" not just for security but for the

future of the U.S. economy.

The technology promises to supercharge cellphones and ultimately

enable driverless cars and internet-controlled factories.

"Some propose that these concerns could be met by the United

States aligning itself with Nokia and/or Ericsson through American

ownership of a controlling stake, either directly or through a

consortium of private American and allied companies," Mr. Barr

said. "Putting our large market and financial muscle behind one or

both of these firms would make it a more formidable competitor and

eliminate concerns over its staying power."

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

February 07, 2020 06:59 ET (11:59 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

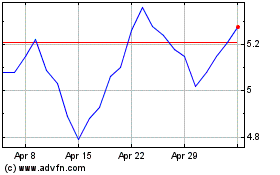

Ericsson (NASDAQ:ERIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

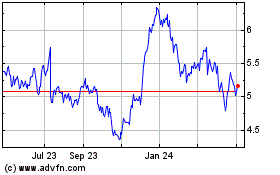

Ericsson (NASDAQ:ERIC)

Historical Stock Chart

From Apr 2023 to Apr 2024