5G's Growing Costs Sting Swedish Telecom Giant Ericsson -- Update

January 24 2020 - 7:37AM

Dow Jones News

By Dominic Chopping and Parmy Olson

STOCKHOLM -- Ericsson AB returned to profit in the fourth

quarter but concerns about higher costs associated with new

fifth-generation mobile networks and a slowdown in North America

sent its shares down more than 7%.

The Swedish telecom-equipment maker, emerging from years of

costly restructuring, has bet big on the growing 5G market, where

it is battling Finland's Nokia Corp. and China's Huawei

Technologies Co. That effort, and cost cuts elsewhere, have started

to bear fruit in recent quarters.

However, Ericsson on Friday said momentum stalled in North

America in the last three months of 2019, with sales in the region

falling 4% compared with the previous year.

"Due to the uncertainty related to an announced operator merger,

we saw a slowdown in our North American business," said Chief

Executive Börje Ekholm, adding that the region generated "the

lowest share of total sales for some time."

T-Mobile US Inc. and Sprint Corp. agreed to merge almost two

years ago but the deal hasn't been finalized amid a protracted

antitrust fight.

Ericsson said there was growth among other customers and that

the underlying fundamentals in North America remain strong. It also

said the slowdown in North America was offset by operators in Asia

and the Middle East continuing to spend on 5G networks.

Still, investments associated with the new technology, which

promises to supercharge cellphones and ultimately enable driverless

cars and internet-controlled factories, are increasing costs.

Ericsson said its costs rose in the quarter as it invested in

acquisitions, digitization and security, and warned expenses would

continue to rise this year. While the company said higher costs

won't jeopardize its financial targets, Citi analyst Amit

Harchandani said he expects consensus earnings this year to move

lower.

Despite the challenges, Ericsson reported a net profit of 4.43

billion Swedish kronor ($465 million) for the fourth quarter, up

from a loss of 6.55 billion kronor in the same period last year.

Sales rose 4% to 66.37 billion kronor, driven by its key networks

unit, and the company raised its full-year dividend.

Ericsson said it now has 78 commercial 5G agreements with

operators and 24 live 5G networks on four continents.

Analysts have raised expectations that Ericsson and Nokia might

benefit from a U.S. push to discourage allied governments and their

carriers from buying Huawei gear. The U.S. says Huawei's equipment

could be commandeered by Chinese authorities to disrupt or spy on

communications, an allegation the company denies.

However, while Huawei is shut out of America, its absence has

only given way to fierce competition between the two European

companies. Ericsson also says it is yet to see much benefit

elsewhere in the world.

Mr. Ekholm said in an interview with The Wall Street Journal

earlier this week that adoption of 5G is "actually slowing down, in

many countries" because of geopolitical concerns around the use of

Huawei equipment. "That has created more uncertainty for our

customers," he said, adding, "This whole notion that this was a win

for Ericsson and Nokia so far has not materialized."

Against that backdrop, Ericsson is pushing to make the most of

the U.S.

At a dinner with President Trump and other CEOs at the World

Economic Forum in Davos, Switzerland, this week, Mr. Ekholm

directly asked the president to make more spectrum available to

mobile operators to help boost 5G deployments. He added, according

to a transcript of the event, that permitting processes were "a

real restriction."

Write to Dominic Chopping at dominic.chopping@wsj.com and Parmy

Olson at parmy.olson@wsj.com

(END) Dow Jones Newswires

January 24, 2020 07:22 ET (12:22 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

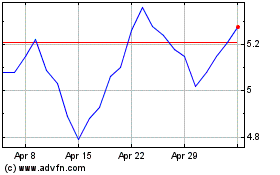

Ericsson (NASDAQ:ERIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

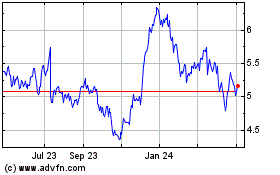

Ericsson (NASDAQ:ERIC)

Historical Stock Chart

From Apr 2023 to Apr 2024