Equinix Beats on Higher Revenues - Analyst Blog

July 29 2011 - 6:30AM

Zacks

Equinix Inc.

(EQIX) reported second quarter 2011

earnings per share of 64 cents, comprehensively beating the Zacks

Consensus Estimate of 57 cents.

Revenues

Revenues in the reported quarter

were $394.9 million, up 33.0% from the year-ago quarter and 9.0%

from the previous quarter. Quarterly result included $11.7 million

in revenues from the newly acquired ALOG data centers. Recurring

revenues, consisting primarily of colocation, interconnection and

managed services, were $376.5 million in the second quarter, a 9%

increase over the previous quarter and a 33% increase over the

prior-year quarter. Non-recurring revenues were $18.4 million in

the quarter.

Solid market fundamentals such as

the growth of IP, mobile, video, cloud and electronic trading

combined with the company’s global leadership position will likely

drive profitability over the long term.

Operating

Results

Cash gross margin (excluding

depreciation, amortization and including stock-based compensation)

in the quarter was 65.0% versus 66.0% in the sequentially preceding

quarter and remained unchanged from the year-ago quarter. Total

operating expenses increased 11.9% from the year-ago quarter and

7.52% from the previous quarter.

The year-over-year increase in

operating expenses was primarily attributed to higher selling and

marketing expenses (up 28.2%) and general and administrative

expenses (up 21.2%). Adjusted EBITDA, defined as income or loss

from operations before depreciation, amortization and accretion,

stock-based compensation, restructuring charges and acquisition

costs, in the second quarter was $181.3 million, up 8.0% from the

previous quarter and 37.0% from the earlier-year quarter.

Reported net income in the quarter

was $30.7 million or 64 cents per diluted share versus a net loss

of $2.3 million or 5 cents per share in the year-ago quarter.

One-time items in the quarter were negligible.

Balance Sheet & Cash

Flow

The company generated cash from

operating activities of $140.3 million in the second quarter

compared with $117.8 million in the previous quarter. As of June

30, 2011, cash, cash equivalents and investments were $423.1

million versus $456.7 million in the earlier quarter. In July 2011,

the company received net proceeds of approximately $735.6 million

from the 7.00% senior notes offering.

Guidance

For the third quarter of 2011, the

company expects revenues in the range of $412.0 to $417.0 million.

Cash gross margin is expected to be approximately 65.0%. Cash

selling, general and administrative expenses are projected at

approximately $86.0 million. Adjusted EBITDA is expected between

$180.0 and $185.0 million. Capital expenditures are estimated

between $160.0 and $180.0 million, comprising approximately $30.0

million in ongoing capital expenditures and $130.0 to $150.0

million in expansion capital expenditures.

For fiscal 2011, revenues are

expected to be roughly $1,590.0 million. Cash gross margin is

expected to range between 65.0% and 66.0%. Cash selling, general

and administrative expenses are expected to approximate $320.0

million. Adjusted EBITDA is projected at $720.0 million. Capital

expenditures are expected in the range of $645.0 to $665.0 million,

comprising approximately $115.0 million in ongoing capital

expenditures and $530.0 to $550.0 million in expansion capital

expenditures.

Our Take

Equinix is one of the leading

providers of co-location services and is well positioned to drive

significant growth going forward. The company has delivered strong

second quarter results and provided a decent guidance for the

fiscal year. We believe further growth in client base and

strategic acquisitions will enhance the company’s revenue potential

and expand its geographic reach.

Moreover, we are encouraged by

Equinix’ effort to expand the current facilities and maintain its

fiscal discipline. We are also positive about its recurring revenue

model. Despite all the positives, competitive treats from the likes

of AT&T Inc. (T) and Verizon

Inc. (VZ) raise our apprehension. European exposure and

industry consolidation are also causes for concern.

Equinix holds a Zacks #3 Rank,

implying a short-term Hold rating.

EQUINIX INC (EQIX): Free Stock Analysis Report

AT&T INC (T): Free Stock Analysis Report

VERIZON COMM (VZ): Free Stock Analysis Report

Zacks Investment Research

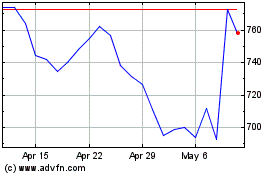

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From Aug 2024 to Sep 2024

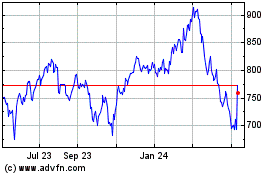

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From Sep 2023 to Sep 2024