- Form 13F Holdings Report (13F-HR)

January 24 2011 - 8:39AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 13F

FORM 13F COVER PAGE

Report for the Calendar Year Ended: December 31, 2010

Check here if Amendment [ ]; Amendment Number: ______

This Amendment (Check only one.): [ ] is a restatement.

[ ] adds new holdings entries.

Institutional Investment Manager Filing this Report:

Name: Enterprise Financial Services Corp

Address: 150 North Meramec

Clayton, Missouri 63105

|

Form 13F File Number: 28-13645

The institutional investment manager filing this report and the person by whom

it is signed hereby represent that the person signing the report is authorized

to submit it, that all information contained herein is true, correct and

complete, and that it is understood that all required items, statements,

schedules, lists, and tables, are considered integral parts of this form.

Person Signing this Report on Behalf of Reporting Manager:

Name: Deborah N. Barstow

Title: Senior Vice President and Controller

Phone: 314-810-3624

|

Signature, Place, and Date of Signing:

/s/ Deborah N. Barstow Clayton, Missouri January 21, 2011

______________________

[Signature] [City, State] [Date]

Deborah N. Barstow

|

Report Type (Check only one.):

[ X ] 13F HOLDINGS REPORT. (Check here if all holdings of this reporting

manager are reported in this report.)

[ ] 13F NOTICE. (Check here if no holdings reported are in this report, and

all holdings are reported by other reporting manager(s).)

[ ] 13F COMBINATION REPORT. (Check here if a portion of the holdings for this

reporting manager are reported in this report and a portion are reported

by other reporting manager(s).)

FORM 13F SUMMARY PAGE

Report Summary

Number of Other Included Managers: 1

Form 13F Information Table Entry Total: 533

Form 13F Information Table Value Total: $122,595 (thousands)

|

List of Other Included Managers:

Provide a numbered list of the name(s) and Form 13F file number(s) of all

institutional investment managers with respect to which this report is filed,

other than the manager filing this report.

No. Form 13F File Number Name

1. 028-13646 Enterprise Bank & Trust

ENTERPRISE BANK

CLIENT NO. 414 SCHEDULE 13F WORKSHEET AS OF 12/31/2010 PAGE 1

|

Below is a list of the equity securities that you have flagged on your

Charlotte files as "13 F Securities" with a "13 F Investment Discretion" of

SOLE or SHARED. Securities are listed by Security Type and in CUSIP number

order within each Security Type. Security positions with an Investment

Discretion of NONE, and Security Types 01-06, 12, 15, 16, 18-22, 25-27 and

34-37 are not included in this report.

FORM 13F INFORMATION TABLE

VALUE SHARES/ SH/ PUT/ INVSTMT OTHER VOTING AUTHORITY

NAME OF ISSUER TITLE OF CLASS CUSIP (X$1000) PRN AMT PRN CALL DSCRETN MANAGERS SOLE SHARED NONE

------------------------------ ---------------- --------- -------- -------- --- ---- ------- ------------ -------- -------- -------

BUNGE LIMITED G16962105 1 19 SH SOLE 19 0 0

COVIDIEN PLC G2554F105 12 270 SH SOLE 270 0 0

INGERSOLL RAND LTD G47791101 502 10650 SH SOLE 3415 0 7235

NORDIC AMERICAN TANKER SHIPPING LTD G65773106 5 175 SH SOLE 175 0 0

SEAGATE TECHNOLOGY PLC G7945M107 4 260 SH SOLE 260 0 0

ACE LIMITED H0023R105 12 200 SH SOLE 200 0 0

ALCON INC H01301102 1 8 SH SOLE 8 0 0

WEATHERFORD INTNTL LTD H27013103 19 853 SH SOLE 853 0 0

LOGITECH INTERNATIONAL SA H50430232 1 65 SH SOLE 65 0 0

TYCO ELECTRONICS LTD H8912P106 6 180 SH SOLE 180 0 0

TYCO INTL LTD H89128104 6 140 SH SOLE 140 0 0

QIAGEN N72482107 2 87 SH SOLE 87 0 0

ABB LTD ADR 000375204 16 700 SH SOLE 700 0 0

AT&T INC 00206R102 1604 54598 SH SOLE 48363 2400 3835

AT&T INC 00206R102 26 875 SH DEFINED 0 875 0

ABBOTT LABORATORIES 002824100 325 6780 SH SOLE 1200 2700 2880

ABERDEEN ASIA-PACIFIC INC FD 003009107 7 1000 SH SOLE 1000 0 0

ADOBE SYSTEMS INC 00724F101 25 800 SH SOLE 800 0 0

ADVENT CLAYMORE CONV SECURITIES & INC FD 00764C109 4 200 SH SOLE 200 0 0

AFFILIATED MANAGERS GROUP 008252108 20 200 SH SOLE 200 0 0

AGNICO EAGLE MINES LTD 008474108 422 5500 SH SOLE 5500 0 0

AIRGAS INC 009363102 95 1519 SH SOLE 1519 0 0

ALBEMARLE CORP 012653101 54 960 SH SOLE 0 960 0

ALLERGAN INC 018490102 443 6450 SH SOLE 1550 0 4900

ALLERGAN INC 018490102 34 500 SH DEFINED 0 0 500

ALLIANT ENERGY CORP 018802108 37 1000 SH SOLE 0 1000 0

ALLSTATE CORP 020002101 32 1002 SH SOLE 1002 0 0

ALTRIA GROUP INC 02209S103 20 825 SH SOLE 825 0 0

AMAZON.COM INC 023135106 90 500 SH SOLE 500 0 0

-------- ------- ------- ----- ------

TOTAL FOR PAGE 1 3825 96316 69031 7935 19350

|

ENTERPRISE BANK

CLIENT NO. 414 SCHEDULE 13F WORKSHEET AS OF 12/31/2010 PAGE 2

|

FORM 13F INFORMATION TABLE

VALUE SHARES/ SH/ PUT/ INVSTMT OTHER VOTING AUTHORITY

NAME OF ISSUER TITLE OF CLASS CUSIP (X$1000) PRN AMT PRN CALL DSCRETN MANAGERS SOLE SHARED NONE

------------------------------ ---------------- --------- -------- -------- --- ---- ------- ------------ -------- -------- -------

AMEREN CORP 023608102 309 10965 SH SOLE 10565 0 400

AMERICA MOVIL S A B DE C V 02364W105 68 1188 SH SOLE 1188 0 0

AMERICAN ELEC PWR INC 025537101 6 156 SH SOLE 156 0 0

AMERICAN EXPRESS CO 025816109 187 4365 SH SOLE 3525 840 0

AMERISOURCEBERGEN CORP 03073E105 14 400 SH SOLE 400 0 0

AMERIPRISE FINL INC 03076C106 44 768 SH SOLE 600 168 0

AMGEN INC 031162100 37 670 SH SOLE 670 0 0

ANADARKO PETE CORP 032511107 7 95 SH SOLE 95 0 0

ANHEUSER BUSCH INBEV ADR 03524A108 57 1000 SH SOLE 0 0 1000

APACHE CORPORATION 037411105 119 1000 SH SOLE 1000 0 0

APACHE CORPORATION 037411105 75 625 SH DEFINED 0 0 625

APPLE INC 037833100 829 2571 SH SOLE 2100 0 471

APPLIED MATERIALS INC 038222105 27 1900 SH SOLE 1900 0 0

ARCH COAL INC 039380100 32 900 SH DEFINED 0 0 900

ARM HOLDINGS ADR 042068106 3 134 SH SOLE 134 0 0

ARTESIAN RES CORP CLASS A 043113208 66 3474 SH SOLE 3474 0 0

ASHLAND INC (NEW 044209104 10 200 SH SOLE 200 0 0

ATMOS ENERGY 049560105 17 550 SH SOLE 550 0 0

AUTODESK INC 052769106 5 120 SH SOLE 120 0 0

AUTOMATIC DATA PROCESSING 053015103 39 850 SH SOLE 850 0 0

AVALONBAY COMMUNITIES INC 053484101 23 206 SH SOLE 206 0 0

BB&T CORPORATION 054937107 25 967 SH SOLE 300 667 0

BP PLC ADR 055622104 257 5827 SH SOLE 5827 0 0

BP PLC ADR 055622104 113 2550 SH DEFINED 0 0 2550

BP PRUDHOE BAY ROYALTY TR 055630107 61 480 SH SOLE 480 0 0

BANK OF AMERICA CORPORATION 060505104 420 31496 SH SOLE 27631 950 2915

BANK OF AMERICA CORPORATION 060505104 83 6200 SH DEFINED 0 0 6200

AIG COMMODITY 06738C778 39 800 SH SOLE 300 0 500

BASSETT FURNITURE INDS 070203104 2 500 SH SOLE 500 0 0

BAXTER INTL INC 071813109 137 2708 SH SOLE 2708 0 0

BECTON DICKINSON & CO 075887109 44 525 SH SOLE 0 0 525

BED BATH & BEYOND INC 075896100 13 266 SH SOLE 266 0 0

BERKSHIRE HATHAWAY CLASS B NEW 084670702 393 4910 SH SOLE 4420 0 490

BERKSHIRE HATHAWAY CLASS B NEW 084670702 280 3500 SH DEFINED 0 3500 0

-------- ------- ------- ----- ------

TOTAL FOR PAGE 2 3841 92866 70165 6125 16576

|

ENTERPRISE BANK

CLIENT NO. 414 SCHEDULE 13F WORKSHEET AS OF 12/31/2010 PAGE 3

|

FORM 13F INFORMATION TABLE

VALUE SHARES/ SH/ PUT/ INVSTMT OTHER VOTING AUTHORITY

NAME OF ISSUER TITLE OF CLASS CUSIP (X$1000) PRN AMT PRN CALL DSCRETN MANAGERS SOLE SHARED NONE

------------------------------ ---------------- --------- -------- -------- --- ---- ------- ------------ -------- -------- -------

BEST BUY CO INC 086516101 346 10100 SH SOLE 3300 0 6800

BEST BUY CO INC 086516101 26 750 SH DEFINED 0 0 750

BIOGEN IDEC INC 09062X103 572 8535 SH SOLE 2310 0 6225

BLACKROCK S&P 09250D109 27 2000 SH SOLE 0 0 2000

BLACKROCK DIV ACHIEVERS TM TR 09250N107 9 850 SH SOLE 850 0 0

BLACKROCK CREDIT ALLOCATION INCOME TRUST IV 092508100 12 1000 SH SOLE 1000 0 0

BLACKROCK ENHANCED DIVID ACHIEVERS TR 09251A104 7 850 SH SOLE 850 0 0

BLACKROCK REAL ASSET EQUITY TRUST 09254B109 34 2300 SH SOLE 0 0 2300

BLACKROCK FLOATING RATE INC STRATEGIES FUND 09255Y108 0 10 SH SOLE 10 0 0

H & R BLOCK INC 093671105 48 4000 SH SOLE 4000 0 0

BOARDWALK PIPELINE PARTNERS LP 096627104 4 120 SH SOLE 120 0 0

BOARDWALK PIPELINE PARTNERS LP 096627104 43 1395 SH DEFINED 0 0 1395

BOEING CO 097023105 85 1297 SH SOLE 1297 0 0

BRISTOL MYERS SQUIBB 110122108 169 6402 SH SOLE 6402 0 0

BRISTOL MYERS SQUIBB 110122108 40 1500 SH DEFINED 0 0 1500

BROADCOM CORP 111320107 26 595 SH SOLE 595 0 0

BUCKEYE PARTNERS LP 118230101 91 1365 SH DEFINED 0 0 1365

CSX CORPORATION 126408103 97 1500 SH SOLE 0 0 1500

CVS CAREMARK CORP 126650100 2870 82532 SH SOLE 17309 65223 0

CABLEVISION NY GROUP CL A 12686C109 6 170 SH SOLE 170 0 0

CAMDEN PROPERTY TRUST 133131102 17 320 SH SOLE 320 0 0

CANON INC ADR 138006309 62 1212 SH SOLE 272 0 940

CAPITAL SOUTHWEST CORP 140501107 42 406 SH SOLE 406 0 0

CARDINAL HEALTH INC 14149Y108 17 439 SH SOLE 439 0 0

CAREFUSION CORP 14170T101 5 189 SH SOLE 189 0 0

CARNIVAL CORP PAIRED 143658300 607 13157 SH SOLE 3457 0 9700

CARNIVAL CORP PAIRED 143658300 46 1000 SH DEFINED 0 0 1000

CATERPILLAR INC 149123101 141 1510 SH SOLE 1510 0 0

CENTERPOINT ENERGY INC 15189T107 4 234 SH SOLE 234 0 0

CENTURYTEL INC 156700106 22 486 SH SOLE 486 0 0

CERNER CORP 156782104 74 780 SH SOLE 780 0 0

CHESAPEAKE ENERGY CORP 165167107 272 10500 SH SOLE 10500 0 0

CHEVRON CORP 166764100 2288 25076 SH SOLE 24676 0 400

CHEVRON CORP 166764100 274 3000 SH DEFINED 0 3000 0

-------- ------- ------- ----- ------

TOTAL FOR PAGE 3 8383 185580 81482 68223 35875

|

ENTERPRISE BANK

CLIENT NO. 414 SCHEDULE 13F WORKSHEET AS OF 12/31/2010 PAGE 4

|

FORM 13F INFORMATION TABLE

VALUE SHARES/ SH/ PUT/ INVSTMT OTHER VOTING AUTHORITY

NAME OF ISSUER TITLE OF CLASS CUSIP (X$1000) PRN AMT PRN CALL DSCRETN MANAGERS SOLE SHARED NONE

------------------------------ ---------------- --------- -------- -------- --- ---- ------- ------------ -------- -------- -------

CHICO'S FAS INC 168615102 6 500 SH SOLE 0 0 500

CHINA MOBILE LTD ADR 16941M109 12 240 SH SOLE 240 0 0

CHUBB CORPORATION 171232101 21 350 SH SOLE 350 0 0

CHURCH & DWIGHT CO INC 171340102 117 1691 SH SOLE 1691 0 0

CIENA CORP 171779309 0 14 SH SOLE 14 0 0

CINEDIGM DIGITAL CINEMA CORP 172407108 0 100 SH SOLE 100 0 0

CISCO SYSTEMS INC 17275R102 722 35705 SH SOLE 15130 0 20575

CITIGROUP INC 172967101 14 3009 SH SOLE 2509 0 500

CITRIX SYS INC 177376100 464 6785 SH SOLE 1740 0 5045

CLAYMORE/MAC GLOBAL SOLAR ENERGY 18383M621 6 775 SH DEFINED 0 0 775

CLOROX CO 189054109 815 12889 SH SOLE 12689 0 200

CNINSURE INC ADR 18976M103 69 4000 SH SOLE 4000 0 0

COCA COLA COMPANY 191216100 287 4359 SH SOLE 4359 0 0

COLGATE PALMOLIVE CO 194162103 495 6160 SH SOLE 5560 0 600

COMCAST CORP CL A 20030N101 4 199 SH SOLE 199 0 0

COMCAST CORP NEW 20030N200 45 2147 SH SOLE 2147 0 0

COMMERCE BANCSHARES INC 200525103 30 757 SH SOLE 757 0 0

CONAGRA INC 205887102 6 250 SH SOLE 250 0 0

CONOCOPHILLIPS 20825C104 373 5480 SH SOLE 3780 0 1700

CONOCOPHILLIPS 20825C104 68 1000 SH DEFINED 0 1000 0

CONSOLIDATED EDISON INC 209115104 113 2290 SH SOLE 1890 0 400

CREE INC 225447101 2 25 SH SOLE 25 0 0

CROWN CASTLE INTL 228227104 11 250 SH SOLE 250 0 0

CROWN HOLDINGS INC 228368106 33 1000 SH SOLE 1000 0 0

CYTRX CORP 232828301 600 600000 SH SOLE 600000 0 0

DCP MIDSTREAM LP 23311P100 6 160 SH SOLE 160 0 0

DNP SELECT INCOME FD 23325P104 89 9691 SH SOLE 5041 4000 650

DPL INC 233293109 100 3910 SH SOLE 435 3375 100

DANAHER CORPORATION 235851102 603 12780 SH SOLE 3530 0 9250

DANAHER CORPORATION 235851102 47 1000 SH DEFINED 0 0 1000

DARDEN RESTAURANTS INC 237194105 58 1250 SH SOLE 1250 0 0

DEERE & CO 244199105 35 425 SH SOLE 425 0 0

DELL INC 24702R101 8 596 SH SOLE 596 0 0

-------- -------- -------- ------- -------

TOTAL FOR PAGE 4 5259 719787 670117 8375 41295

|

ENTERPRISE BANK

CLIENT NO. 414 SCHEDULE 13F WORKSHEET AS OF 12/31/2010 PAGE 5

|

FORM 13F INFORMATION TABLE

VALUE SHARES/ SH/ PUT/ INVSTMT OTHER VOTING AUTHORITY

NAME OF ISSUER TITLE OF CLASS CUSIP (X$1000) PRN AMT PRN CALL DSCRETN MANAGERS SOLE SHARED NONE

------------------------------ ---------------- --------- -------- -------- --- ---- ------- ------------ -------- -------- -------

DIAGEO PLC ADR 25243Q205 37 500 SH SOLE 500 0 0

DIAGEO PLC ADR 25243Q205 223 3000 SH DEFINED 0 3000 0

DIAMOND OFFSHORE DRILLING 25271C102 11 162 SH SOLE 162 0 0

DISNEY WALT HOLDING CO 254687106 107 2850 SH SOLE 1500 0 1350

DISCOVERY COMMUNICATIONS CLASS A 25470F104 18 425 SH DEFINED 0 0 425

DISCOVERY COMMUNICATIONS CLASS C 25470F302 16 425 SH DEFINED 0 0 425

DIRECTV CLASS A 25490A101 4 94 SH SOLE 94 0 0

DOLBY LABORATORIES INC 25659T107 3 50 SH SOLE 50 0 0

DOMINION RES INC VA NEW 25746U109 32 758 SH SOLE 32 726 0

DRESSER-RAND GROUP INC 261608103 34 800 SH SOLE 800 0 0

DU PONT E I DENEMOURS & CO 263534109 5 91 SH SOLE 91 0 0

DUKE ENERGY HOLDING CO 26441C105 140 7889 SH SOLE 6089 1000 800

DUKE REALTY CORP 264411505 19 1500 SH SOLE 500 0 1000

DUN & BRADSTREET 26483E100 5 62 SH SOLE 62 0 0

DYNEX CAP INC 26817Q506 2 150 SH SOLE 150 0 0

E M C CORP MASS 268648102 457 19980 SH SOLE 4730 0 15250

EOG RESOURCES INC 26875P101 46 500 SH SOLE 500 0 0

EATON VANCE TAX-MANAGED GLOBAL 27829F108 9 880 SH SOLE 880 0 0

EBAY INC 278642103 44 1575 SH SOLE 0 0 1575

EDWARDS LIFESCIENCES CORP 28176E108 40 500 SH SOLE 500 0 0

EL PASO CORPORATION 28336L109 1 58 SH SOLE 58 0 0

EL PASO ELECTRIC 283677854 1 34 SH SOLE 34 0 0

EL PASO PIPELINE PARTNERS LP 283702108 94 2810 SH DEFINED 0 0 2810

EMERSON ELEC CO 291011104 1541 26953 SH SOLE 26953 0 0

EMERSON ELEC CO 291011104 21 370 SH DEFINED 0 0 370

EMPIRE DISTRICT ELECTRIC CO 291641108 20 900 SH SOLE 900 0 0

ENBRIDGE ENERGY PARTNERS LP 29250R106 75 1200 SH SOLE 1200 0 0

ENBRIDGE ENERGY PARTNERS LP 29250R106 155 2485 SH DEFINED 0 0 2485

ENCANA CORP 292505104 1 36 SH SOLE 36 0 0

ENERGIZER HLDGS INC 29266R108 744 10212 SH SOLE 2355 1762 6095

ENERGY TRANSFER PARTNERS LP 29273R109 106 2045 SH SOLE 1000 0 1045

ENERGY TRANSFER EQUITY LP 29273V100 43 1090 SH DEFINED 0 0 1090

ENTERGY CORP NEW 29364G103 25 350 SH SOLE 350 0 0

-------- ------- ------- -------- -------

TOTAL FOR PAGE 5 4079 90734 49526 6488 34720

|

ENTERPRISE BANK

CLIENT NO. 414 SCHEDULE 13F WORKSHEET AS OF 12/31/2010 PAGE 6

|

FORM 13F INFORMATION TABLE

VALUE SHARES/ SH/ PUT/ INVSTMT OTHER VOTING AUTHORITY

NAME OF ISSUER TITLE OF CLASS CUSIP (X$1000) PRN AMT PRN CALL DSCRETN MANAGERS SOLE SHARED NONE

------------------------------ ---------------- --------- -------- -------- --- ---- ------- ------------ -------- -------- -------

ENTERPRISE FINANCIAL SERVICES CORP 293712105 17245 1648637 SH SOLE 1574466 0 74171

ENTERPRISE FINANCIAL SERVICES CORP 293712105 323 30885 SH DEFINED 30885 0 0

ENTERPRISE PRODUCTS PARTNERS 293792107 245 5894 SH SOLE 4536 1358 0

ENTERPRISE PRODUCTS PARTNERS 293792107 131 3145 SH DEFINED 0 0 3145

ENTERTAINMENT PROPERTIES TRUST REITS 29380T105 14 300 SH SOLE 300 0 0

EQUITY ONE INC 294752100 8 450 SH SOLE 450 0 0

EURONET WORLDWIDE INC 298736109 17 1000 SH SOLE 1000 0 0

EXELON CORP 30161N101 69 1646 SH SOLE 1646 0 0

EXPEDIA INC 30212P105 11 445 SH SOLE 445 0 0

EXPRESS SCRIPTS INC 302182100 149 2760 SH SOLE 2760 0 0

EXPRESS SCRIPTS INC 302182100 49 915 SH DEFINED 0 0 915

EXXON MOBIL CORP 30231G102 3305 45193 SH SOLE 38298 2357 4538

EXXON MOBIL CORP 30231G102 333 4550 SH DEFINED 0 3000 1550

FACTSET RESEARCH SYSTEMS INC 303075105 508 5420 SH SOLE 1400 0 4020

FACTSET RESEARCH SYSTEMS INC 303075105 38 400 SH DEFINED 0 0 400

FAMILY DOLLAR STORES 307000109 268 5400 SH SOLE 5400 0 0

FEDERAL REALTY INVESTMENT TR 313747206 109 1400 SH SOLE 1200 0 200

FEDERATED INCS INC PA 314211103 25 950 SH SOLE 0 0 950

FEDEX CORPORATION 31428X106 50 540 SH DEFINED 0 0 540

FIDELITY NATIONAL INFORMATION SERVICES 31620M106 82 2995 SH SOLE 2995 0 0

FIDUCIARY CLAYMORE MLP 31647Q106 17 796 SH SOLE 796 0 0

FIFTH THIRD BANCORP 316773100 29 1972 SH SOLE 1972 0 0

FIRST SOLAR, INC 336433107 13 100 SH DEFINED 0 0 100

FISERV INC 337738108 19 319 SH SOLE 319 0 0

FIRSTENERGY CORP 337932107 44 1200 SH SOLE 1200 0 0

FLUOR CORP 343412102 21 310 SH SOLE 310 0 0

FORD MOTOR CO (NEW) 345370860 142 8442 SH SOLE 8442 0 0

FOREST LABS INC 345838106 9 290 SH SOLE 290 0 0

FREEPORT-MCMORAN COPPER&GOLD CL B 35671D857 17 145 SH SOLE 145 0 0

FRESENIUS MED CARE AG & CO KGAA ADR 358029106 2 34 SH SOLE 34 0 0

FRONTIER COMMUNICATIONS CORP 35906A108 17 1755 SH SOLE 1296 459 0

GABELLI EQUITY TRUST 362397101 26 4500 SH SOLE 4500 0 0

GABELLI HLTHCARE & WELLNESS 36246K103 0 25 SH SOLE 25 0 0

-------- ------- ------- -------- -------

TOTAL FOR PAGE 6 23335 1782813 1685110 7174 90529

|

ENTERPRISE BANK

CLIENT NO. 414 SCHEDULE 13F WORKSHEET AS OF 12/31/2010 PAGE 7

|

FORM 13F INFORMATION TABLE

VALUE SHARES/ SH/ PUT/ INVSTMT OTHER VOTING AUTHORITY

NAME OF ISSUER TITLE OF CLASS CUSIP (X$1000) PRN AMT PRN CALL DSCRETN MANAGERS SOLE SHARED NONE

------------------------------ ---------------- --------- -------- -------- --- ---- ------- ------------ -------- -------- -------

GENERAL DYNAMICS CORP 369550108 115 1614 SH SOLE 1614 0 0

GENERAL ELECTRIC CO 369604103 1425 77936 SH SOLE 66660 2000 9276

GENERAL ELECTRIC CO 369604103 187 10215 SH DEFINED 0 0 10215

GENERAL MILLS 370334104 472 13270 SH SOLE 10174 3096 0

GENZYME CORPORATION 372917104 7 100 SH SOLE 100 0 0

GETTY REALTY CORP REITS 374297109 6 200 SH SOLE 200 0 0

GILEAD SCIENCES 375558103 61 1695 SH SOLE 250 0 1445

GLAXO SMITHKLINE PLC SPONSORED ADR 37733W105 86 2200 SH SOLE 0 0 2200

GOLDCORP INC 380956409 184 4000 SH SOLE 4000 0 0

GOLDMAN SACHS GROUP INC 38141G104 45 270 SH DEFINED 0 0 270

GOOGLE INC-CL A 38259P508 662 1115 SH SOLE 285 0 830

GOOGLE INC-CL A 38259P508 50 85 SH DEFINED 0 0 85

GRAINGER W W INC 384802104 28 200 SH SOLE 200 0 0

GRAINGER W W INC 384802104 276 2000 SH DEFINED 0 2000 0

HSBC HLDGS PLC ADR NEW 404280406 1 29 SH SOLE 29 0 0

JOHN HANCOCK PREMIUM DIVIDEND FUND 41013T105 12 1005 SH SOLE 394 0 611

JOHN HANCOCK INVESTORS TR 410142103 58 2900 SH SOLE 0 2900 0

HANESBRANDS INC 410345102 2 75 SH SOLE 75 0 0

HARLEY DAVIDSON INC 412822108 23 660 SH SOLE 660 0 0

HAWAIIAN ELEC INDS 419870100 18 800 SH SOLE 0 0 800

HEINZ H J COMPANY 423074103 59 1200 SH SOLE 1200 0 0

HELIOS MULTI-SECTOR HIGH INC 42327Y202 1 200 SH SOLE 200 0 0

HENRY JACK & ASSOC INC 426281101 6 200 SH SOLE 200 0 0

HENRY JACK & ASSOC INC 426281101 117 4000 SH DEFINED 0 4000 0

HERSHEY COMPANY 427866108 14 300 SH SOLE 300 0 0

HEWLETT PACKARD CO 428236103 159 3776 SH SOLE 3276 500 0

HOME DEPOT INC 437076102 47 1330 SH SOLE 430 0 900

HOME DEPOT INC 437076102 105 3000 SH DEFINED 0 3000 0

HONEYWELL INTL INC 438516106 81 1528 SH SOLE 1528 0 0

HUNTINGTON BANCSHARES 446150104 1 206 SH SOLE 206 0 0

ITT INDUSTRIES INC (INDIANA) 450911102 16 300 SH SOLE 300 0 0

ICICI BK LTD 45104G104 3 68 SH SOLE 68 0 0

IKANOS COMMUNICATIONS 45173E105 1 570 SH SOLE 570 0 0

-------- ------- -------- ------- ------

TOTAL FOR PAGE 7 4328 137047 92919 17496 26632

|

ENTERPRISE BANK

CLIENT NO. 414 SCHEDULE 13F WORKSHEET AS OF 12/31/2010 PAGE 8

|

FORM 13F INFORMATION TABLE

VALUE SHARES/ SH/ PUT/ INVSTMT OTHER VOTING AUTHORITY

NAME OF ISSUER TITLE OF CLASS CUSIP (X$1000) PRN AMT PRN CALL DSCRETN MANAGERS SOLE SHARED NONE

------------------------------ ---------------- --------- -------- -------- --- ---- ------- ------------ -------- -------- -------

ILLINOIS TOOL WKS INC 452308109 199 3726 SH SOLE 3506 0 220

ILLINOIS TOOL WKS INC 452308109 213 3980 SH DEFINED 0 3980 0

IMPAC MORTGAGE HOLDINGS 45254P508 1 200 SH SOLE 200 0 0

IMPERIAL OIL LTD 453038408 2 46 SH SOLE 46 0 0

INERGY LP 456615103 8 215 SH DEFINED 0 0 215

INSITUFORM TECHNOLOGIES INC CL A 457667103 8 305 SH SOLE 305 0 0

INTEL CORP 458140100 774 36831 SH SOLE 19906 0 16925

INTEL CORP 458140100 126 6000 SH DEFINED 0 6000 0

INTERNATIONAL BUSINESS MACHS 459200101 494 3368 SH SOLE 3368 0 0

INTERNATIONAL BUSINESS MACHS 459200101 220 1500 SH DEFINED 0 1500 0

ISHS S&P COMMIDITY INDEX TR 46428R107 148 4350 SH SOLE 4350 0 0

I SHS MSCI AUSTRALIA 464286103 28 1100 SH SOLE 1100 0 0

I SHS MSCI BRAZIL 464286400 142 1839 SH SOLE 1839 0 0

I SHS MSCI CANADA 464286509 6 200 SH SOLE 200 0 0

I SHS MSCI TAIWAIN INDEX FD MSCI TAIWAN WEBS 464286731 152 9737 SH SOLE 9737 0 0

ISHS BARCLAYS TIPS BOND FUND 464287176 134 1249 SH SOLE 1249 0 0

I SHARES FTSE CHINA 25 INDEX 464287184 91 2101 SH SOLE 2101 0 0

I SHARES S&P 500 464287200 694 5498 SH SOLE 5370 128 0

ISHS BARCLAYS AGG BOND FUND 464287226 98 927 SH SOLE 927 0 0

ISHARES MSCI EMERGING MKTS 464287234 941 19742 SH SOLE 18318 0 1424

ISHS IBOXX&INVESTMENTGRADE 464287242 145 1335 SH SOLE 1335 0 0

I SHS S&P 500 GROWTH INDEX 464287309 8498 129442 SH SOLE 124008 3147 2287

I SHS S&P 500 GROWTH INDEX 464287309 173 2632 SH DEFINED 2013 619 0

I SHARES S&P 500 VALUE INDEX FUND 464287408 7680 128877 SH SOLE 123656 2922 2299

I SHARES S&P 500 VALUE INDEX FUND 464287408 155 2596 SH DEFINED 1952 644 0

EAFE INDEX TR MSCI I SHS 464287465 2037 34993 SH SOLE 32007 485 2501

EAFE INDEX TR MSCI I SHS 464287465 167 2875 SH DEFINED 0 0 2875

RUSSELL MID CAP VALUE I SHS 464287473 159 3542 SH SOLE 2952 0 590

RUSSELL MID CAP GROWTH I SHS 464287481 218 3843 SH SOLE 3383 0 460

ISHS RUSSELL MIDCAP INDEX FD 464287499 245 2412 SH SOLE 2235 0 177

I SHARES TR S&P 464287507 3 38 SH SOLE 38 0 0

I SHS COHEN & STEERS 464287564 4469 67997 SH SOLE 64471 658 2868

I SHS COHEN & STEERS 464287564 52 787 SH DEFINED 460 327 0

-------- ------- -------- ------- ------

TOTAL FOR PAGE 8 28480 484283 431032 20410 32841

|

ENTERPRISE BANK

CLIENT NO. 414 SCHEDULE 13F WORKSHEET AS OF 12/31/2010 PAGE 9

|

FORM 13F INFORMATION TABLE

VALUE SHARES/ SH/ PUT/ INVSTMT OTHER VOTING AUTHORITY

NAME OF ISSUER TITLE OF CLASS CUSIP (X$1000) PRN AMT PRN CALL DSCRETN MANAGERS SOLE SHARED NONE

------------------------------ ---------------- --------- -------- -------- --- ---- ------- ------------ -------- -------- -------

ISHARES RUSSELL 1000 VALUE 464287598 287 4422 SH SOLE 4422 0 0

ISHARES RUSSELL 1000 VALUE 464287598 85 1309 SH DEFINED 0 0 1309

I SHARES S&P MIDCAP 400 GROWTH INDEX 464287606 93 919 SH SOLE 606 0 313

ISHARES RUSSELL 1000 GROWTH 464287614 251 4379 SH SOLE 4379 0 0

ISHARES RUSSELL 1000 GROWTH 464287614 169 2948 SH DEFINED 0 0 2948

I SHS RUSSELL 2000 VALUE 464287630 171 2405 SH SOLE 1565 0 840

I SHS RUSSELL 2000 GROWTH 464287648 225 2573 SH SOLE 1958 0 615

I SHS RUSSELL 2000 464287655 344 4403 SH SOLE 899 200 3304

I SHARES S&P MIDCAP 400 VALUE INDEX 464287705 170 2145 SH SOLE 1871 0 274

ISHARES DJ US REAL ESTATE 464287739 8 150 SH SOLE 0 0 150

ISHARES S&P SMALLCAP 600 464287804 102 1484 SH SOLE 1484 0 0

ISHARES S&P SMALL CAP 600 VALUE INDEX 464287879 46 645 SH SOLE 373 0 272

I SHARES S&P SMALL CAP 600 GROWTH INDEX 464287887 42 578 SH SOLE 250 0 328

I SHS JPM EMERGING MARKET BOND 464288281 64 600 SH SOLE 600 0 0

ISHS IBOXX HI-YIELD CORP BD 464288513 61 680 SH SOLE 680 0 0

I SHS S&P GLOBAL UTILITIES SECURITIES FUND 464288711 23 500 SH SOLE 500 0 0

I SHS DOW JONES REGIONAL BKS 464288778 81 3271 SH SOLE 3271 0 0

ITAU UNIBANCO HOLDONGS SA 465562106 2 79 SH SOLE 79 0 0

JDS UNIPHASE CORP 46612J507 0 12 SH SOLE 12 0 0

JPMORGAN CHASE & CO 46625H100 676 15950 SH SOLE 12520 0 3430

JACOBS ENGR GROUP 469814107 14 300 SH SOLE 300 0 0

JOHNSON & JOHNSON 478160104 911 14736 SH SOLE 13286 0 1450

JOHNSON & JOHNSON 478160104 464 7500 SH DEFINED 0 3000 4500

JOHNSON CONTROLS INC 478366107 20 528 SH SOLE 528 0 0

JOY GLOBAL INC 481165108 39 450 SH DEFINED 0 0 450

KAYNE ANDERSON MLP 486606106 985 31326 SH SOLE 26546 0 4780

KELLOGG COMPANY 487836108 27 519 SH SOLE 519 0 0

KEYCORP NEW COM 493267108 1 102 SH SOLE 102 0 0

KIMBERLY CLARK CORP 494368103 252 4005 SH SOLE 2800 0 1205

KINDER MORGAN MGMT LLC 49455U100 57 854 SH SOLE 0 0 854

KINDER MORGAN ENERGY PARTNER UT LTD PARTNER 494550106 121 1720 SH SOLE 700 0 1020

KINDER MORGAN ENERGY PARTNER UT LTD PARTNER 494550106 225 3200 SH DEFINED 0 0 3200

KRAFT FOODS INC 50075N104 55 1731 SH SOLE 1731 0 0

-------- ------- -------- ------- ------

TOTAL FOR PAGE 9 6071 116423 81981 3200 31242

|

ENTERPRISE BANK

CLIENT NO. 414 SCHEDULE 13F WORKSHEET AS OF 12/31/2010 PAGE 10

|

FORM 13F INFORMATION TABLE

VALUE SHARES/ SH/ PUT/ INVSTMT OTHER VOTING AUTHORITY

NAME OF ISSUER TITLE OF CLASS CUSIP (X$1000) PRN AMT PRN CALL DSCRETN MANAGERS SOLE SHARED NONE

------------------------------ ---------------- --------- -------- -------- --- ---- ------- ------------ -------- -------- -------

KRISPY KREME DOUGHNUTS INC 501014104 3 500 SH SOLE 500 0 0

LSI CORPORATION 502161102 0 44 SH SOLE 44 0 0

L3 COMMUNICATIONS HOLDINGS 502424104 4 50 SH SOLE 50 0 0

LACLEDE GROUP INC 505597104 108 2954 SH SOLE 2954 0 0

LEGG MASON INC 524901105 491 13550 SH SOLE 3450 0 10100

LEGG MASON INC 524901105 38 1050 SH DEFINED 0 0 1050

LENNOX INTL 526107107 38 800 SH SOLE 800 0 0

LIBERTY INTERACTIVE GROUP A 53071M104 3 180 SH SOLE 180 0 0

LIBERTY CAPITAL GROUP A 53071M302 6 90 SH SOLE 90 0 0

LIBERTY STARZ 53071M708 1 9 SH SOLE 9 0 0

LILLY ELI & CO 532457108 18 510 SH SOLE 510 0 0

LINCOLN NATIONAL CORP 534187109 10 359 SH SOLE 0 0 359

LINN ENERGY LLC 536020100 97 2600 SH SOLE 2600 0 0

LIVE NATION INC 538034109 1 114 SH SOLE 114 0 0

LOCKHEED MARTIN CORP 539830109 641 9170 SH SOLE 9170 0 0

LOEWS CORP 540424108 428 11000 SH SOLE 11000 0 0

LOWES COS INC 548661107 239 9530 SH SOLE 9530 0 0

LOWES COS INC 548661107 43 1715 SH DEFINED 0 0 1715

MADISON SQUARE GARDEN INC 55826P100 1 42 SH SOLE 42 0 0

MAGELLAN MIDSTREAM PARTNERS LP 559080106 39 683 SH SOLE 683 0 0

MAGELLAN MIDSTREAM PARTNERS LP 559080106 110 1952 SH DEFINED 0 0 1952

MANAGED HIGH YIELD PLUS FD 561911108 0 4 SH SOLE 4 0 0

MARATHON OIL CORP 565849106 76 2057 SH SOLE 2057 0 0

MARKWEST ENERGY PARTNERS LP 570759100 14 320 SH SOLE 320 0 0

M&I NEW 571837103 47 6861 SH SOLE 6861 0 0

MASTERCARD INC 57636Q104 494 2205 SH SOLE 690 0 1515

MASTERCARD INC 57636Q104 36 160 SH DEFINED 0 0 160

MATTEL INC 577081102 43 1700 SH SOLE 0 0 1700

MAXIM INTEGRATED PRODS INC 57772K101 505 21405 SH SOLE 6030 0 15375

MAXIM INTEGRATED PRODS INC 57772K101 38 1600 SH DEFINED 0 0 1600

MCDONALDS CORP 580135101 836 10887 SH SOLE 10887 0 0

MCDONALDS CORP 580135101 115 1500 SH DEFINED 0 1500 0

MCGRAW HILL COS INC 580645109 53 1460 SH SOLE 480 0 980

-------- ------- -------- ------- ------

TOTAL FOR PAGE 10 4576 107061 69055 1500 36506

|

ENTERPRISE BANK

CLIENT NO. 414 SCHEDULE 13F WORKSHEET AS OF 12/31/2010 PAGE 11

|

FORM 13F INFORMATION TABLE

VALUE SHARES/ SH/ PUT/ INVSTMT OTHER VOTING AUTHORITY

NAME OF ISSUER TITLE OF CLASS CUSIP (X$1000) PRN AMT PRN CALL DSCRETN MANAGERS SOLE SHARED NONE

------------------------------ ---------------- --------- -------- -------- --- ---- ------- ------------ -------- -------- -------

MCKESSON CORP 58155Q103 19 275 SH SOLE 275 0 0

MCMORAN EXPLORATION 582411104 428 25000 SH SOLE 25000 0 0

MEADWESTVAC0 CORP 583334107 18 700 SH SOLE 700 0 0

MEDCO HEALTH SOLUTIONS INC 58405U102 9 154 SH SOLE 154 0 0

MEDTRONIC INC 585055106 20 530 SH SOLE 130 0 400

MERCK & CO INC NEW 58933Y105 437 12125 SH SOLE 11831 0 294

MERCK & CO INC NEW 58933Y105 230 6381 SH DEFINED 0 6381 0

METLIFE INC 59156R108 45 1015 SH SOLE 1015 0 0

MICROSOFT CORPORATION 594918104 716 25653 SH SOLE 23717 0 1936

MICROSOFT CORPORATION 594918104 219 7845 SH DEFINED 0 5000 2845

MISSION WEST PROPERTIES INC 605203108 13 2000 SH SOLE 0 2000 0

MONSANTO CO NEW 61166W101 680 9766 SH SOLE 9266 0 500

MOTOROLA INC 620076109 3 300 SH SOLE 300 0 0

MURPHY OIL CORP 626717102 472 6330 SH SOLE 1330 0 5000

MYLAN INC 628530107 19 900 SH SOLE 900 0 0

NTS REALTY HOLDINGS LP 629422106 6 1648 SH SOLE 0 1648 0

NATIONAL OILWELL VARCO INC 637071101 3 45 SH SOLE 45 0 0

NEW FRONTIER MEDIA 644398109 2 1000 SH SOLE 1000 0 0

NEWELL RUBBERMAID 651229106 31 1700 SH SOLE 950 0 750

NEWMONT MINING CORP 651639106 198 3230 SH SOLE 3230 0 0

NEXTERA ENERGY INC 65339F101 216 4147 SH SOLE 2947 1200 0

NICE SYS LTD SPONS ADR 653656108 3 90 SH SOLE 90 0 0

NIKE INC CL B 654106103 196 2300 SH SOLE 2300 0 0

NOKIA CORP ADR 654902204 74 7150 SH SOLE 4000 0 3150

NOVARTIS AG SPNSRD ADR 66987V109 103 1744 SH SOLE 1744 0 0

NOVO NORDISK A/S ADR 670100205 2 22 SH SOLE 22 0 0

NUCOR CORP 670346105 18 415 SH SOLE 415 0 0

NUSTAR ENERGY LP 67058H102 102 1466 SH SOLE 711 755 0

NUVEEN INVT QUALITY MUN FD INC 67062E103 13 1000 SOLE 1000 0 0

NUVEEN MULTI-STRATEGY INCOMEGROWTH FUND 2 67073D102 10 1100 SH SOLE 1100 0 0

NUVEEN MUN VALUE FD INC 670928100 14 1500 SOLE 1500 0 0

NUVEEN QUALITY INCOME MUNICIPAL FUND INC 670977107 14 1000 SOLE 1000 0 0

OMNICOM GROUP INC 681919106 5 114 SH SOLE 114 0 0

------- ------- -------- -------- -------

TOTAL FOR PAGE 11 4338 128645 96786 16984 14875

|

ENTERPRISE BANK

CLIENT NO. 414 SCHEDULE 13F WORKSHEET AS OF 12/31/2010 PAGE 12

|

FORM 13F INFORMATION TABLE

VALUE SHARES/ SH/ PUT/ INVSTMT OTHER VOTING AUTHORITY

NAME OF ISSUER TITLE OF CLASS CUSIP (X$1000) PRN AMT PRN CALL DSCRETN MANAGERS SOLE SHARED NONE

------------------------------ ---------------- --------- -------- -------- --- ---- ------- ------------ -------- -------- -------

ONEOK PARTNERS LP 68268N103 39 490 SH DEFINED 0 0 490

ORACLE CORP 68389X105 557 17795 SH SOLE 5020 0 12775

ORACLE CORP 68389X105 86 2745 SH DEFINED 0 0 2745

PDL BIOPHARMA INC 69329Y104 1 200 SH SOLE 200 0 0

PNC FINANCIAL SERVICES GRP 693475105 71 1163 SH SOLE 1124 0 39

PPL CORPORATION 69351T106 13 500 SH SOLE 500 0 0

PALL CORP 696429307 4 90 SH SOLE 90 0 0

PATRIOT COAL CORP 70336T104 18 930 SH DEFINED 0 0 930

PATTERSON COS INC 703395103 17 550 SH SOLE 550 0 0

PAYCHEX INC 704326107 14 450 SH SOLE 450 0 0

PEABODY ENERGY CORP 704549104 46 725 SH DEFINED 0 0 725

PEPCO HLDGS INC 713291102 8 447 SH SOLE 447 0 0

PEPSICO INC 713448108 1642 25132 SH SOLE 24432 0 700

PEPSICO INC 713448108 2417 37000 SH DEFINED 0 37000 0

PETROL BRASILEIRO-PETROBRAS ADR PREF 71654V101 1 41 SH SOLE 41 0 0

PFIZER INC 717081103 868 49614 SH SOLE 31418 13164 5032

PFIZER INC 717081103 304 17360 SH DEFINED 0 0 17360

PHILIP MORRIS INTL INC 718172109 243 4152 SH SOLE 3212 0 940

PHILIPPINE LONG DISTANCE TELSPONS ADR 718252604 147 2517 SH SOLE 2517 0 0

PHOENIX CO INC 71902E109 5 2096 SH SOLE 2096 0 0

PIMCO MUN INCOME FD 72200R107 13 1000 SOLE 1000 0 0

PIMCO MUN INCOME FD II 72200W106 6 600 SOLE 600 0 0

PIONEER NAT RES CO 723787107 36 415 SH SOLE 415 0 0

PIPER JAFFRAY CO 724078100 2 57 SH SOLE 57 0 0

PIPER JAFFRAY CO 724078100 0 4 SH DEFINED 4 0 0

PLAINS ALL AMERICA LTD 726503105 71 1130 SH SOLE 280 0 850

PLAINS ALL AMERICA LTD 726503105 61 970 SH DEFINED 0 0 970

PLAYBOY ENTERPRISES 728117300 5 1000 SH SOLE 1000 0 0

POWERSHARES 73935X799 37 1550 SH SOLE 0 0 1550

POWERSHARES DB AGRIC FUND 73936B408 57 1750 SH SOLE 1750 0 0

POWERSHARES GLOBAL EXCHANGE 73936T433 50 2000 SH SOLE 2000 0 0

PRINCIPAL FINL GROUP ONC 74251V102 319 9800 SH SOLE 2400 0 7400

PRINCIPAL FINL GROUP ONC 74251V102 24 750 SH DEFINED 0 0 750

------- ------- -------- -------- -------

TOTAL FOR PAGE 12 7182 185023 81603 50164 53256

|

ENTERPRISE BANK

CLIENT NO. 414 SCHEDULE 13F WORKSHEET AS OF 12/31/2010 PAGE 13

|

FORM 13F INFORMATION TABLE

VALUE SHARES/ SH/ PUT/ INVSTMT OTHER VOTING AUTHORITY

NAME OF ISSUER TITLE OF CLASS CUSIP (X$1000) PRN AMT PRN CALL DSCRETN MANAGERS SOLE SHARED NONE

------------------------------ ---------------- --------- -------- -------- --- ---- ------- ------------ -------- -------- -------

PROCTER & GAMBLE CO 742718109 1937 30108 SH SOLE 29384 0 724

PROGRESS ENERGY INC 743263105 67 1542 SH SOLE 1542 0 0

ETF PRO SHS DOW 500 74347R867 21 1000 SH SOLE 1000 0 0

PROSHARES ULTRA PR 74347X856 39 2000 SH SOLE 2000 0 0

PRUDENTIAL FINANCIAL INC 744320102 6 100 SH SOLE 100 0 0

PUTNAM MANAGED MUNI INCOME TR 746823103 7 959 SOLE 959 0 0

PUTNAM PREMIER INCOME TR 746853100 58 9200 SH SOLE 0 9200 0

QLT INC 746927102 0 20 SH SOLE 20 0 0

QUALCOMM INC 747525103 79 1590 SH SOLE 1590 0 0

QWEST COMMUNICATIONS INTL 749121109 29 3760 SH SOLE 3760 0 0

RF MICRO DEVICES INC 749941100 5 711 SH SOLE 711 0 0

RALCORP HLDGS INC NEW 751028101 390 5994 SH SOLE 1142 577 4275

REGENCY ENERGY LP 75885Y107 16 600 SH SOLE 600 0 0

REGIONS FINANCIAL CORP NEW 7591EP100 298 42584 SH SOLE 42584 0 0

REGIONS FINANCIAL CORP NEW 7591EP100 53 7625 SH DEFINED 0 7625 0

REHABCARE GROUP INC 759148109 6 250 SH SOLE 250 0 0

REINSURANCE GROUP AMER INC NEW 759351604 12 225 SH SOLE 225 0 0

REYNOLDS AMERN INC 761713106 37 1124 SH SOLE 1124 0 0

RITE AID CORP 767754104 2 2000 SH SOLE 2000 0 0

ROPER INDUSTRIES INC 776696106 76 1000 SH SOLE 1000 0 0

ROYAL DUTCH SHELL PLC A SHARES 780259206 29 437 SH SOLE 128 0 309

SBA COMMUNICATIONS CORP 78388J106 7 160 SH SOLE 160 0 0

SPDR TR UNIT SER 1 78462F103 182 1450 SH SOLE 1100 0 350

SPDR GOLD TRUST 78463V107 530 3820 SH SOLE 3820 0 0

SPDR DJ INTL RE 78463X863 155 3977 SH SOLE 3977 0 0

SPDR S&P OIL & GAS 78464A730 53 1000 SH SOLE 1000 0 0

SPDR SERIES TRUST 78464A748 37 1000 SH SOLE 1000 0 0

ST JUDE MED INC 790849103 9 200 SH SOLE 200 0 0

SAN DISK CORP 80004C101 4 90 SH SOLE 90 0 0

SAP AKTIENGESELLSCHAFT ADR 803054204 3 60 SH SOLE 60 0 0

SARA LEE CORP 803111103 54 3100 SH SOLE 1100 0 2000

SASOL LTD ADR 803866300 1 26 SH SOLE 26 0 0

SCANA CORP NEW 80589M102 18 450 SH SOLE 450 0 0

------- ------- -------- -------- -------

TOTAL FOR PAGE 13 4220 128162 103102 17402 7658

|

ENTERPRISE BANK

CLIENT NO. 414 SCHEDULE 13F WORKSHEET AS OF 12/31/2010 PAGE 14

|

FORM 13F INFORMATION TABLE

VALUE SHARES/ SH/ PUT/ INVSTMT OTHER VOTING AUTHORITY

NAME OF ISSUER TITLE OF CLASS CUSIP (X$1000) PRN AMT PRN CALL DSCRETN MANAGERS SOLE SHARED NONE

------------------------------ ---------------- --------- -------- -------- --- ---- ------- ------------ -------- -------- -------

SCHLUMBERGER LTD 806857108 190 2279 SH SOLE 2279 0 0

SCOTTS MIRACLE-GRO CO 810186106 15 300 SH SOLE 300 0 0

SEALED AIR CORP NEW 81211K100 9 350 SH SOLE 350 0 0

SPDR TR FUND HEALTH CARE 81369Y209 33 1060 SH SOLE 1060 0 0

AMEX CONSUMER DISCR SPDR 81369Y407 63 1685 SH SOLE 1685 0 0

SECTOR SPDR FINCL SELECT 81369Y605 79 4950 SH SOLE 4950 0 0

SPDR TECHNOLOGY SELECT SCTOR 81369Y803 163 6485 SH SOLE 6485 0 0

UTILITIES SELECT SECTOR SPDR 81369Y886 11 350 SH SOLE 350 0 0

SEMPRA ENERGY 816851109 10 185 SH SOLE 185 0 0

SHAW GROUP INC 820280105 31 900 SH SOLE 900 0 0

SHERWIN WILLIAMS CO 824348106 25 294 SH SOLE 0 0 294

SIEMENS AG (NEW) 826197501 1 5 SH SOLE 5 0 0

SIGMA ALDRICH CORP 826552101 17 260 SH SOLE 260 0 0

SIGMA ALDRICH CORP 826552101 266 4000 SH DEFINED 0 4000 0

SIRIUS XM RADIO 82967N108 7 4348 SH SOLE 4348 0 0

SMURFIT-STONE CONTAINER CORP 83272A104 1 21 SH SOLE 21 0 0

SNAP ON INC 833034101 7 120 SH SOLE 120 0 0

SOUTHERN CO 842587107 277 7260 SH SOLE 6485 775 0

SOUTHERN CO 842587107 191 5000 SH DEFINED 0 5000 0

SPECTRA ENERGY CORP 847560109 89 3544 SH SOLE 3044 500 0

STANDARD REGISTER CO 853887107 0 73 SH SOLE 73 0 0

STARWOOD HOTEL & RESORTS 85590A401 611 10054 SH SOLE 2600 0 7454

STARWOOD HOTEL & RESORTS 85590A401 49 800 SH DEFINED 0 0 800

STATE STREET CORP 857477103 44 955 SH SOLE 0 0 955

STATE STREET CORP 857477103 93 2000 SH DEFINED 0 2000 0

STRYKER CORP 863667101 30 550 SH SOLE 0 0 550

SUNCOR ENERGY INC NEW 867224107 115 3000 SH SOLE 3000 0 0

SUNOCO LOGISTICS LP 86764L108 71 850 SH SOLE 850 0 0

SUNOCO INC 86764P109 12 300 SH SOLE 300 0 0

SYSCO CORP 871829107 25 842 SH SOLE 842 0 0

TC PIPELINES, LP 87233Q108 123 2370 SH DEFINED 0 0 2370

TECO ENERGY INC 872375100 19 1050 SH SOLE 1050 0 0

TJX COMPANIES INC 872540109 63 1420 SH DEFINED 0 0 1420

-------- ------- -------- -------- -------

TOTAL FOR PAGE 14 2740 67660 41542 12275 13843

|

ENTERPRISE BANK

CLIENT NO. 414 SCHEDULE 13F WORKSHEET AS OF 12/31/2010 PAGE 15

|

FORM 13F INFORMATION TABLE

VALUE SHARES/ SH/ PUT/ INVSTMT OTHER VOTING AUTHORITY

NAME OF ISSUER TITLE OF CLASS CUSIP (X$1000) PRN AMT PRN CALL DSCRETN MANAGERS SOLE SHARED NONE

------------------------------ ---------------- --------- -------- -------- --- ---- ------- ------------ -------- -------- -------

TAIWAN SEMICONDUCTOR MFG LTD 874039100 3 214 SH SOLE 214 0 0

TARGET CORP 87612E106 133 2217 SH SOLE 2217 0 0

TELEFONOS DE MEXICO S A SPON ADR ORD L 879403780 12 760 SH SOLE 760 0 0

TEMPLETON GLOBAL INCOME FD 880198106 13 1180 SH SOLE 1180 0 0

TENNECO AUTOMOTIVE INC 880349105 3 65 SH SOLE 65 0 0

TEVA PHARMACEUTICAL ADR R/B/R 881624209 86 1646 SH SOLE 1646 0 0

TEXAS INSTRUMENTS INC 882508104 20 610 SH SOLE 610 0 0

THERMO FISHER SCIENTIFIC 883556102 39 700 SH SOLE 700 0 0

THERMO FISHER SCIENTIFIC 883556102 221 4000 SH DEFINED 0 4000 0

3M COMPANY 88579Y101 206 2382 SH SOLE 2209 0 173

TIDEWATER INC 886423102 16 300 SH SOLE 300 0 0

TIMKEN CO 887389104 10 200 SH SOLE 200 0 0

TORTOISE ENERGY 89147L100 351 9178 SH SOLE 9178 0 0

TORTOISE CAP RES CORP 89147N304 5 700 SH SOLE 700 0 0

TORTOISE ENERGY CAP CORP 89147U100 6 200 SH SOLE 200 0 0

TOYOTA MOTOR ADR 892331307 42 537 SH SOLE 537 0 0

TRANSACT TECHNOLOGIES INC 892918103 5 500 SH SOLE 500 0 0

TRAVELERS COS INC 89417E109 33 585 SH SOLE 585 0 0

TYSON FOODS CLASS A 902494103 8 490 SH SOLE 490 0 0

U S BANCORP (NEW) 902973304 3463 128441 SH SOLE 128441 0 0

U S BANCORP (NEW) 902973304 126 4662 SH DEFINED 662 4000 0

UNILEVER PLC AMER SHS ADR 904767704 1 38 SH SOLE 38 0 0

UNION PACIFIC CORP 907818108 229 2476 SH SOLE 2476 0 0

UNION PACIFIC CORP 907818108 73 785 SH DEFINED 0 0 785

UNITED PARCEL SVC INC CL B 911312106 22 300 SH SOLE 300 0 0

ETF UNITED STATES NATURAL GAS FUND 912318102 210 35000 SH SOLE 35000 0 0

UNITED TECHNOLOGIES CORP 913017109 386 4900 SH SOLE 4900 0 0

UNITED TECHNOLOGIES CORP 913017109 197 2500 SH DEFINED 0 2500 0

UNITED HEALTH GROUP INC 91324P102 432 11955 SH SOLE 3620 0 8335

UNITED HEALTH GROUP INC 91324P102 34 950 SH DEFINED 0 0 950

V F CORP 918204108 421 4890 SH SOLE 1100 0 3790

V F CORP 918204108 34 400 SH DEFINED 0 0 400

VALENCE TECH INC 918914102 1 450 SH SOLE 450 0 0

------- ------- -------- -------- -------

TOTAL FOR PAGE 15 6841 224211 199278 10500 14433

|

ENTERPRISE BANK

CLIENT NO. 414 SCHEDULE 13F WORKSHEET AS OF 12/31/2010 PAGE 16

|

FORM 13F INFORMATION TABLE

VALUE SHARES/ SH/ PUT/ INVSTMT OTHER VOTING AUTHORITY

NAME OF ISSUER TITLE OF CLASS CUSIP (X$1000) PRN AMT PRN CALL DSCRETN MANAGERS SOLE SHARED NONE

------------------------------ ---------------- --------- -------- -------- --- ---- ------- ------------ -------- -------- -------

VALSPAR CORP 920355104 5 145 SH SOLE 145 0 0

ETF VANGUARD MID CAP VALUE 922908512 53 991 SH SOLE 991 0 0

ETF VANGUARD MID CAP GROWTH 922908538 55 885 SH SOLE 885 0 0

VANGUARD SMALL CAP GROWTH ETF 922908595 223 2859 SH SOLE 2859 0 0

VANGUARD SMALL CAP VALUE ETF 922908611 201 3003 SH SOLE 1964 476 563

I SHS VANGUARD MID CAP 922908629 24 322 SH SOLE 322 0 0

I SHS VANGUARD LARGE CAP ETF 922908637 431 7484 SH SOLE 7484 0 0

VANGUARD GROWTH ETF 922908736 297 4836 SH SOLE 3302 0 1534

VANGUARD VALUE ETF 922908744 188 3519 SH SOLE 1077 0 2442

VANGUARD SMALL-CAP VIPERS 922908751 154 2121 SH SOLE 2121 0 0

ETF VANGUARD TOTAL STOCK MARKET 922908769 77 1188 SH SOLE 1188 0 0

VERIZON COMMUNICATIONS 92343V104 694 19400 SH SOLE 17485 1915 0

VERTEX PHARMACEUTICALS INC 92532F100 2 55 SH SOLE 55 0 0

VIACOM INC CL B NEW 92553P201 2 57 SH SOLE 57 0 0

VISA INC 92826C839 14 200 SH SOLE 200 0 0

VIRTUS INVESTMENT PARTNERS 92828Q109 0 10 SH SOLE 10 0 0

VODAFONE GROUP PLC NEW 92857W209 3 109 SH SOLE 109 0 0

VOLTERRA SEMICONDUCTOR 928708106 8 349 SH SOLE 349 0 0

WPP PLC ADR 92933H101 4 66 SH SOLE 66 0 0

WAL MART STORES INC 931142103 814 15085 SH SOLE 9347 0 5738

WAL MART STORES INC 931142103 169 3130 SH DEFINED 0 2000 1130

WALGREEN CO 931422109 715 18353 SH SOLE 12628 0 5725

WALGREEN CO 931422109 23 600 SH DEFINED 0 0 600

WATERS CORP 941848103 9 115 SH SOLE 115 0 0

WATERS CORP 941848103 233 3000 SH DEFINED 0 3000 0

WATSON PHARMACEUTICALS 942683103 28 550 SH SOLE 550 0 0

WELLPOINT INC 94973V107 14 240 SH SOLE 240 0 0

WELLS FARGO & CO 949746101 178 5757 SH SOLE 5315 0 442

WESTAR ENERGY INC 95709T100 4 169 SH SOLE 169 0 0

WESTERN ASSET EMERGING MARKETS INC 95766E103 13 1000 SH SOLE 1000 0 0

WESTERN ASSET GLOBAL PARTNER INCOME FUND 95766G108 12 1000 SH SOLE 1000 0 0

WESTERN ASSET INC 95766T100 57 4450 SH SOLE 0 4450 0

WESTERN UNION CO 959802109 55 2955 SH SOLE 2955 0 0

------- ------- ------- ------- -------

TOTAL FOR PAGE 16 4759 104003 73988 11841 18174

|

ENTERPRISE BANK

CLIENT NO. 414 SCHEDULE 13F WORKSHEET AS OF 12/31/2010 PAGE 17

|

FORM 13F INFORMATION TABLE

VALUE SHARES/ SH/ PUT/ INVSTMT OTHER VOTING AUTHORITY

NAME OF ISSUER TITLE OF CLASS CUSIP (X$1000) PRN AMT PRN CALL DSCRETN MANAGERS SOLE SHARED NONE

------------------------------ ---------------- --------- -------- -------- --- ---- ------- ------------ -------- -------- -------

WEYERHAEUSER CO 962166104 15 810 SH SOLE 810 0 0

WHOLE FOODS MKT INC 966837106 12 235 SH SOLE 0 235 0

WINDSTREAM CORP 97381W104 9 615 SH SOLE 615 0 0

WISCONSIN ENERGY CORP 976657106 63 1064 SH SOLE 1064 0 0

XCEL ENERGY INC 98389B100 17 724 SH SOLE 724 0 0

YUM BRANDS INC 988498101 192 3908 SH SOLE 3908 0 0

ZIMMER HOLDINGS INC 98956P102 30 560 SH SOLE 560 0 0

------- ------- ------- ------- -------

TOTAL FOR PAGE 17 338 7916 7681 235 0

GRAND TOTALS 122595 4658530 3904398 266327 487805

|

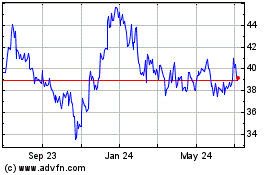

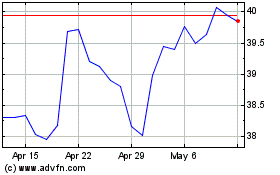

Enterprise Financial Ser... (NASDAQ:EFSC)

Historical Stock Chart

From Aug 2024 to Sep 2024

Enterprise Financial Ser... (NASDAQ:EFSC)

Historical Stock Chart

From Sep 2023 to Sep 2024