Current Report Filing (8-k)

July 19 2021 - 4:16PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

FORM 8-K

__________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported):

July 15, 2021

Elys Game Technology, Corp.

(Exact name of Registrant as specified in its charter)

(Former name or former address, if changed since last

report)

|

Delaware

|

001-39170

|

33-0823179

|

|

(State or other jurisdiction of Incorporation or organization)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

130 Adelaide Street West, Suite 701

Toronto, Ontario M5H 2K4, Canada

(Address of Principal Executive Offices)

1-628-258-5148

(Registrant’s Telephone Number, Including Area

Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

☐

Written communications pursuant to Rule 425 under the Securities Act

(17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock

|

ELYS

|

The Nasdaq Capital Market

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

☐

Emerging growth company

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

|

|

Item 2.01

|

Completion of Acquisition or Disposition of Assets

|

On July 15, 2021, pursuant to a Membership Purchase

Agreement (the “Purchase Agreement”), dated July 5, 2021, by and between Elys Game Technology, Corp. (“Elys” or

the “Company”), Bookmakers Company US LLC (“USB”) and the members of Bookmakers Company US LLC, the Company acquired

100% of USB, from its members (the “Sellers”) and USB became a wholly owned subsidiary of the Company.

Founded in 2016, USB is a provider of sports wagering

services such as design and consulting, turn-key sports wagering solutions, and risk management. USB’s management team includes

legendary sports book operator Victor Salerno, President, with over 40 years of experience in the Nevada sports book business managing

risk for over 100 properties and who was inducted into the American Gaming Association's Gaming Hall of Fame in 2015 and SBC's Hall of

Fame in 2020; Bob Kocienski, CEO, with over 40 years of experience in the gaming industry including oversight on the sports books at several

high profile casinos; Robert Walker, Director of Bookmaking, with over 30 years of experience in managing sports books at several casinos

including the Stardust, Mirage, and the MGM; and John Salerno, Director of Operations and Compliance with over 20 years of experience

in the sports wagering industry under the tutelage of his father, Victor Salerno.

Pursuant to the terms of the Purchase Agreement, the

consideration paid for all of the equity of USB was $6 million in cash plus the issuance of 1,265,823 shares of the Company’s common

stock at a price of $4.74 per share based on the volume weighted average closing price of the stock for the 90 trading days preceding

the closing date (the “Stock Consideration”).

The Sellers will have an opportunity to receive up

to an additional $38 million plus a potential premium of 10% (or $3.8 million) based upon achievement of stated adjusted cumulative EBITDA

milestones during the next four years, payable 50% in cash and 50% in Elys stock at a price equal to volume weighted average price of

Elys common stock for the 90 consecutive trading days preceding January 1 of each subsequent fiscal year for the duration of the earnout

period ending December 31, 2025, subject to obtaining shareholder approval, and with a cap of 5,065,000 on the aggregate number of shares

to be issued. Any excess not approved by shareholders or exceeding the cap will be paid in cash. The annual earnout payments are based

on the achievement of the following adjusted cumulative EBITDA milestones:

|

Fiscal Year Ended

|

Adjusted Cumulative EBITDA

|

Maximum Potential Earnout

|

|

2021

|

($213,850)

|

-

|

|

2022

|

$643,950

|

$ 7,600,000

|

|

2023

|

$4,365,127

|

$ 9,500,000

|

|

2024

|

$10,620,825

|

$ 11,400,000

|

|

2025

|

$19,441,483

|

$ 9,500,000

|

The Purchase Agreement contains customary representations,

warranties and covenants of Elys and the Sellers. Subject to certain customary limitations, the Sellers have agreed to indemnify Elys

and its officers and directors against certain losses related to, among other things, breaches of the Sellers’ representations and

warranties, certain specified liabilities and the failure to perform covenants or obligations under the Purchase Agreement.

The foregoing summary of the Purchase Agreement does

not purport to be complete and is qualified in its entirety by reference to the full text of the Purchase Agreement that is filed herewith

as Exhibit 10.1.

The representations, warranties and covenants contained

in the Purchase Agreement were made only for purposes of such agreement and as of specific dates, were solely for the benefit of the parties

to the Purchase Agreement and may be subject to limitations agreed upon by the contracting parties. Accordingly, the Purchase Agreement

is incorporated herein by reference only to provide investors with information regarding the terms of the Purchase Agreement, and not

to provide investors with any other factual information regarding Elys, USB or either of their businesses, and should be read in conjunction

with the disclosures in the Company’s periodic reports and other filings with the Securities and Exchange Commission.

|

|

Item 2.03.

|

Creation of a Direct Financial obligation or an Obligation under an Off-Balance Sheet Arrangement of

a Registrant.

|

The disclosure set forth in Item 2.01 of this Current

Report on Form 8-K is incorporated into this Item 2.03 by reference.

|

|

Item 3.02.

|

Unregistered Sales of Equity Securities.

|

The information regarding the securities of the Company

set forth under Item 1.01 of this Current Report on Form 8-K is incorporated by reference in this Item 3.02 in its entirety. The Stock

Consideration was offered and sold to the Sellers in a transaction exempt from registration under the Securities Act of 1933, as amended

(the “Securities Act”), in reliance on Section 4(a)(2) thereof and Rule 506 of Regulation D thereunder. Each of the Sellers

represented that he, she or it was an “accredited investor,” as defined in Regulation D, and was acquiring the Stock Consideration

for investment only and not with a view towards, or for resale in connection with, the public sale or distribution thereof. Accordingly,

the Stock Consideration has not been registered under the Securities Act and the Stock Consideration may not be offered or sold in the

United States absent registration or an exemption from registration under the Securities Act and any applicable state securities laws.

|

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers.

|

On July 15, 2021, Michele Ciavarella, Executive Chairman

of the Company, was appointed as the interim Chief Executive Officer and President of the Company, effective July 15, 2021. The effective

date of Mr. Ciavarella's appointment coincides with the resignation of Matteo Monteverdi as the Company’s CEO and President to become

the Company’s Head of Special Projects, as previously announced by the Company on July 16, 2021. Mr. Ciavarella will serve as the

Company's Executive Chairman and interim Chief Executive Officer at the pleasure of the Company's board of directors until his earlier

resignation or removal from office.

Mr. Ciavarella (age 59) served as the Company’s

Chief Executive Officer since June 2011, serves as a member of the Company’s Board since June 2011 and has served as the Company’s

Executive Chairman since January 2021 and Chairman of the Board since June 26, 2019. In addition, Mr. Ciavarella has served the Company

in various roles and executive capacities since 2004 including President, Chief Executive Officer and Director of Operations. From 2004

to 2011, Mr. Ciavarella was engaged in senior executive and director roles for a variety of private and publicly listed companies including

Kerr Mines Ltd. (formerly known as Armistice Resources Corp.), Firestar Capital Management Corporation, Mitron Sports Enterprises, Process

Grind Rubber and Dagmar Insurance Services. He also served as the Business Development Officer for Forte Fixtures and Millwork, Inc.,

a family owned business in the commercial retail fixture manufacturing industry from January 2007 until October 2013. From 1990 until

2004, Mr. Ciavarella served as a senior executive, financial planner, life insurance underwriter and financial advisor for Manulife Financial

and Sun Life Financial. Mr. Ciavarella received his Bachelor of Science degree from Laurentian University in Sudbury, Ontario.

On July 19, 2021, Elys issued a press release announcing

the closing of the transactions contemplated by the Purchase Agreement. A copy of the press release is attached hereto as Exhibit 99.1

and is incorporated herein by reference.

|

|

Item 9.01

|

Financial Statements and Exhibits

|

(a) Financial Statements

of Business Acquired.

As permitted by Item 9.01(a)(3)

of Form 8-K, the financial statements required by Item 9.01(a) of Form 8-K will be filed by the Company by an amendment to this Current

Report on Form 8-K not later than 71 days after the date upon which this Current Report on Form 8-K was required to be filed.

(b) Pro Forma Financial Information.

As permitted by Item 9.01(b)(2)

of Form 8-K, the pro forma financial information required by Item 9.01(b) of Form 8-K will be filed by the Company by an amendment to

this Current Report on Form 8-K not later than 71 days after the date upon which this Current Report on Form 8-K was required to be filed.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: July 19, 2021

|

ELYS GAME TECHNOLOGY, CORP.

|

|

|

|

|

|

By: /s/ Michele Ciavarella

|

|

|

Name: Michele Ciavarella

|

|

|

Title: Executive Chairman

|

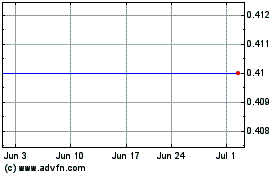

Elys Game Technology (NASDAQ:ELYS)

Historical Stock Chart

From Mar 2024 to Apr 2024

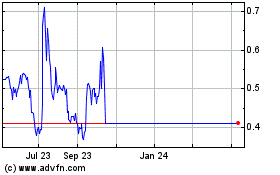

Elys Game Technology (NASDAQ:ELYS)

Historical Stock Chart

From Apr 2023 to Apr 2024