Amended Statement of Beneficial Ownership (sc 13d/a)

September 18 2020 - 8:01AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C.

20549

____________________________

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No.

3)*

____________________________

EDESA BIOTECH, INC.

(Name

of Issuer)

Common Shares, no

par value per share

(Title

of Class of Securities)

27966L108

(CUSIP

Number)

Dr. Pardeep Nijhawan

c/o

Edesa Biotech, Inc.

100 Spy Court

Markham, Ontario, L3R 5H6, Canada

(289)

800-9600

(Name,

Address and Telephone Number of Person Authorized to Receive

Notices and Communications)

September 17, 2020

(Date

of Event which Requires Filing of this Statement)

____________________________

If the

filing person has previously filed a statement on Schedule 13G to

report the acquisition which is the subject of this Schedule 13D,

and is filing this schedule because of §§

240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the

following box. ☐

Note: Schedules filed in paper format shall include a signed

original and five copies of the schedule, including all exhibits.

See Rule 13d-7 for other parties to whom copies are to be

sent.

* The

remainder of this cover page shall be filled out for a reporting

person’s initial filing on this form with respect to the

subject class of securities, and for any subsequent amendment

containing information which would alter disclosures provided in a

prior cover page.

The

information required on the remainder of this cover page shall not

be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 or otherwise subject to the

liabilities of that section of the Act but shall be subject to all

other provisions of the Act (however, see the Notes).

|

CUSIP No. 27966L108

|

|

Page 2

of 9

Pages

|

|

|

|

1

|

NAME OF

REPORTING PERSON

Pardeep Nijhawan Medicine Professional Corporation

|

|

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)(a)

☐

(b)

☐

|

|

3

|

SEC USE

ONLY

|

|

4

|

SOURCE

OF FUNDS (see instructions)

WC

|

|

5

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS

REQUIRED ☐

PURSUANT TO ITEMS

2(d) or 2(e)

|

|

6

|

CITIZENSHIP OR

PLACE OF ORGANIZATION

Ontario,

Canada

|

|

NUMBER OFSHARESBENEFICIALLYOWNED BYEACHREPORTINGPERSON

WITH

|

7

|

SOLE

VOTING POWER

0

|

|

8

|

SHARED

VOTING POWER

2,135,594

|

|

9

|

SOLE

DISPOSITIVE POWER

0

|

|

10

|

SHARED

DISPOSITIVE POWER

2,135,594

|

|

11

|

AGGREGATE AMOUNT

BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,135,594

|

|

12

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(see instructions) ☐

|

|

13

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW 11

22.3%

(1)

|

|

14

|

TYPE OF

REPORTING PERSON (see instructions)

CO

|

(1)

Based on a total of

9,577,619 Common Shares of the Company outstanding as of September

17, 2020 and an additional

11,570 Common Shares underlying vested Class A and Class B warrants

that are deemed outstanding with respect to this Reporting

Person.

|

CUSIP No. 27966L108

|

|

Page 3

of 9

Pages

|

|

|

|

1

|

NAME OF

REPORTING PERSON

The Digestive Health Clinic Inc.

|

|

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)(a)

☐

(b)

☐

|

|

3

|

SEC USE

ONLY

|

|

4

|

SOURCE

OF FUNDS (see instructions)

AF

|

|

5

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS

REQUIRED ☐

PURSUANT TO ITEMS

2(d) or 2(e)

|

|

6

|

CITIZENSHIP OR

PLACE OF ORGANIZATION

Ontario,

Canada

|

|

NUMBER OFSHARESBENEFICIALLYOWNED BYEACHREPORTINGPERSON

WITH

|

7

|

SOLE

VOTING POWER

0

|

|

8

|

SHARED

VOTING POWER

224,094

|

|

9

|

SOLE

DISPOSITIVE POWER

0

|

|

10

|

SHARED

DISPOSITIVE POWER

224,094

|

|

11

|

AGGREGATE AMOUNT

BENEFICIALLY OWNED BY EACH REPORTING PERSON

224,094

|

|

12

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(see instructions) ☐

|

|

13

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW 11

2.3%

(1)

|

|

14

|

TYPE OF

REPORTING PERSON (see instructions)

CO

|

(1)

Based on a total of

9,577,619 Common Shares of the Company outstanding as of September

17, 2020.

|

CUSIP No. 27966L108

|

|

Page 4

of 9

Pages

|

|

|

|

1

|

NAME OF

REPORTING PERSON

1968160

Ontario Inc.

|

|

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)(a)

☐

(b)

☐

|

|

3

|

SEC USE

ONLY

|

|

4

|

SOURCE

OF FUNDS (see instructions)

AF

|

|

5

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS

REQUIRED ☐

PURSUANT TO ITEMS

2(d) or 2(e)

|

|

6

|

CITIZENSHIP OR

PLACE OF ORGANIZATION

Ontario,

Canada

|

|

NUMBER OFSHARESBENEFICIALLYOWNED BYEACHREPORTINGPERSON

WITH

|

7

|

SOLE

VOTING POWER

0

|

|

8

|

SHARED

VOTING POWER

371,727

|

|

9

|

SOLE

DISPOSITIVE POWER

0

|

|

10

|

SHARED

DISPOSITIVE POWER

371,727

|

|

11

|

AGGREGATE AMOUNT

BENEFICIALLY OWNED BY EACH REPORTING PERSON

371,727

|

|

12

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(see instructions) ☐

|

|

13

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW 11

3.9%

(1)

|

|

14

|

TYPE OF

REPORTING PERSON (see instructions)

CO

|

|

(1) Based

on a total of 9,577,619 Common Shares of the Company outstanding as

of September 17, 2020.

|

|

CUSIP

No. 27966L108

|

|

Page 5

of 9

Pages

|

|

|

|

1

|

NAME OF

REPORTING PERSON

Pardeep Nijhawan

|

|

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)(a)

☐

(b)

☐

|

|

3

|

SEC USE

ONLY

|

|

4

|

SOURCE

OF FUNDS (see instructions)

AF

|

|

5

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS

REQUIRED ☐

PURSUANT TO ITEMS

2(d) or 2(e)

|

|

6

|

CITIZENSHIP OR

PLACE OF ORGANIZATION

Canadian

|

|

NUMBER OFSHARESBENEFICIALLYOWNED BYEACHREPORTINGPERSON

WITH

|

7

|

SOLE

VOTING POWER

585,792

|

|

8

|

SHARED

VOTING POWER

2,731,415

|

|

9

|

SOLE

DISPOSITIVE POWER

585,792

|

|

10

|

SHARED

DISPOSITIVE POWER

2,731,415

|

|

11

|

AGGREGATE AMOUNT

BENEFICIALLY OWNED BY EACH REPORTING PERSON

3,317,207

|

|

12

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(see instructions) ☐

|

|

13

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW 11

34.4%

(1)

|

|

14

|

TYPE OF

REPORTING PERSON (see instructions)

IN

|

(1)

Based on a total of

9,577,619 Common Shares of the Company outstanding as of September

17, 2020, and an additional

48,480 Common Shares underlying vested share options and an

additional 11,570 Common Shares underlying vested Class A and Class

B warrants that are deemed outstanding with respect to this

Reporting Person.

This

Amendment No. 3 (“Amendment No. 3”) amends

and supplements the statement on Schedule 13D jointly filed by

(i) Pardeep

Nijhawan Medicine Professional Corporation, formed in Ontario,

Canada, (ii) The Digestive Health Clinic Inc., formed in Ontario,

Canada and (iii) Dr. Pardeep Nijhawan, an individual on June

17, 2019, as amended by Amendment No. 1 filed on August 19, 2019,

as further amended by Amendment No. 2 filed on January 16, 2020 (as

so amended and supplemented, the “Schedule 13D”), with

respect to the common shares, no par value per share (the

“Common Shares”) of Edesa Biotech, Inc., a British

Columbia corporation, formerly known as

“Stellar Biotechnologies, Inc.” (the

“Company” or the “Issuer”). Except as

expressly amended by this Amendment No. 3, the Schedule 13D

remains in full force and effect.

The purpose of this Amendment No. 3 is to

(i) report the transfer of all of the capital stock of 1968160

Ontario Inc., an Ontario corporation (1968160

Ontario Inc.,

collectively with Pardeep Nijhawan Medicine Professional

Corporation, Dr. Pardeep Nijhawan, and The Digestive Health Clinic

Inc., the “Reporting Persons”), to Dr. Pardeep Nijhawan pursuant to the foreign

equivalent of a domestic relations order and

(ii) to report the acquisition of Common Shares by Pardeep

Nijhawan Medicine Professional Corporation, each as described in this Amendment

No. 3.

Item 1. Security and Issuer.

This

Schedule 13D relates to the Common Shares of the Company, which has

its principal executive offices at 100 Spy Court, Markham, Ontario,

Canada L3R 5H6.

Item 2. Identity and Background.

This Schedule 13D is

jointly filed by the Reporting Persons. Dr. Pardeep Nijhawan

is the sole executive

officer and sole director of each of Pardeep Nijhawan

Medicine Professional Corporation, The Digestive Health Clinic Inc

and 1968160 Ontario Inc. Dr. Pardeep Nijhawan

is also the Chief Executive

Officer of the Issuer. The principal address of the Reporting

Persons is 100 Spy

Court, Markham, Ontario, Canada L3R 5H6.

Pardeep Nijhawan

Medicine Professional Corporation is a professional medical

corporation through which Dr. Pardeep Nijhawan operates his medical

practice. The Digestive Health

Clinic Inc. owns and operates specialist medical clinics with

services in gastroenterology, hepatology and internal

medicine. 1968160 Ontario Inc. is a holding company that

holds 371,727 Common Shares of the Company, among other

assets.

During

the last five years, none of the Reporting Persons have been

convicted in a criminal proceeding (excluding traffic violations

and similar misdemeanors) or been a party to a civil proceeding of

a judicial or administrative body of competent jurisdiction and as

a result of such proceeding, was or is subject to a judgment,

decree or final order enjoining future violations of, or

prohibiting or mandating activities subject to, federal or state

securities laws or finding any violation with respect to such

laws.

Dr.

Pardeep Nijhawan is a Canadian citizen.

Item 3. Source and Amount of Funds or Other

Consideration.

Item 3 is hereby supplemented as follows:

Pardeep Nijhawan Medicine Professional Corporation acquired 5,000

Common Shares of the Company on March 17, 2020 at an average

purchase price per share of $1.87 and an additional 3,000 Common

Shares of the Company on May 26, 2020 at an average purchase price

of $2.9797 per share, each in open market purchases.

On September 17, 2020, Dr. Pardeep Nijhawan,

pursuant to the foreign equivalent of a domestic relations order,

was transferred ownership of 1968160 Ontario Inc., which owns

371,727 Common Shares of the Company (the

“Transaction”). The Transaction resulted in Dr. Pardeep

Nijhawan becoming the sole owner of 1968160 Ontario Inc., thereby

resulting in Dr. Pardeep Nijhawan indirectly and beneficially

owning an additional 371,727 Common Shares of the

Company.

Item 4. Purpose of Transaction.

Reference is made

to the disclosure set forth under Item 3 of this Schedule 13D,

which disclosure is incorporated herein by reference.

The Reporting Persons acquired their securities in the Issuer for

investment purposes.

Except as otherwise described in this Schedule, none of the

Reporting Persons currently has any plans or proposals that relate

to or would result in: (a) the acquisition by any person of

additional securities of the Issuer, or the disposition of

securities of the Issuer; (b) an extraordinary corporate

transaction, such as a merger, reorganization or liquidation,

involving the Issuer or any of its subsidiaries; (c) a sale or

transfer of a material amount of assets of the Issuer or any of its

subsidiaries; (d) any change in the present board of directors

or management of the Issuer, including any plans or proposals to

change the number or term of directors or to fill any existing

vacancies on the board; (e) any material change in the present

capitalization or dividend policy of the Issuer; (f) any other

material change in the Issuer’s business or corporate

structure; (g) any changes in the Issuer’s charter or

bylaws or other actions which may impede the acquisition of control

of the Issuer by any person; (h) causing a class of securities

of the Issuer to be delisted from a national securities exchange or

to cease to be authorized to be quoted in an interdealer quotation

system of a registered national securities association;

(i) causing a class of equity securities of the Issuer to

become eligible for termination of registration pursuant to

Section 12(g)(4) of the Securities Exchange Act of 1934, as

amended; or (j) any action similar to any of those enumerated

above.

Item 5. Interest in Securities of the Issuer.

(a)-(b)

Number of Common Shares beneficially owned:

|

Pardeep Nijhawan Medicine Professional Corporation (1)

|

|

2,135,594

shares

|

|

The Digestive Health Clinic Inc.

|

|

224,094 shares

|

|

Pardeep Nijhawan (2)

|

|

3,317,207

shares

|

|

1968160

Ontario Inc.

|

|

371,727

shares

|

(1)

Includes 11,570 Common Shares

underlying vested Class A and Class B warrants that are deemed

outstanding with respect to this Reporting

Person.

(2)

Includes 48,480 Common Shares underlying vested share options and

an additional 11,570 Common Shares underlying vested Class A and

Class B warrants that are deemed outstanding with respect to this

Reporting Person.

Percent of class:

|

Pardeep Nijhawan Medicine Professional Corporation (1)

|

22.3%

|

|

The Digestive Health Clinic Inc. (2)

|

2.3%

|

|

Pardeep Nijhawan (3)

|

34.4%

|

|

1968160 Ontario

Inc. (2)

|

3.9%

|

(1)

Based on a total of

9,577,619 Common Shares of the Company outstanding as of September

17, 2020 and an additional

11,570 Common Shares underlying vested Class A and Class B warrants

that are deemed outstanding with respect to this Reporting

Person.

(2)

Based on a total of 9,577,619 Common Shares of

the Company outstanding as of September 17, 2020.

(3)

Based on a total of

9,577,619 Common Shares of the Company outstanding as of September

17, 2020, and an additional

48,480 Common Shares underlying vested share options and an

additional 11,570 Common Shares underlying vested Class A and Class

B warrants that are deemed outstanding with respect to this

Reporting Person.

Number of shares as to which such person has:

(i)

Sole

power to vote or to direct the vote:

|

Pardeep Nijhawan Medicine Professional Corporation

|

|

0 shares

|

|

The Digestive Health Clinic Inc.

|

|

0 shares

|

|

Pardeep Nijhawan

|

|

585,792

shares

|

|

1968160

Ontario Inc.

|

|

0

shares

|

(ii)

Shared

power to vote or to direct the vote:

|

Pardeep Nijhawan Medicine Professional Corporation

|

|

2,135,594

shares

|

|

The Digestive Health Clinic Inc.

|

|

224,094 shares

|

|

Pardeep Nijhawan

|

|

2,731,415

shares

|

|

1968160

Ontario Inc.

|

|

371,727

shares

|

(iii)

Sole

power to dispose or to direct the disposition of:

|

Pardeep Nijhawan Medicine Professional Corporation

|

|

0 shares

|

|

The Digestive Health Clinic Inc.

|

|

0 shares

|

|

Pardeep Nijhawan

|

|

585,792

shares

|

|

1968160

Ontario Inc.

|

|

0

shares

|

|

|

|

|

(iv)

Shared

power to dispose or to direct the disposition of:

|

Pardeep Nijhawan Medicine Professional Corporation

|

|

2,135,594

shares

|

|

The Digestive Health Clinic Inc.

|

|

224,094 shares

|

|

Pardeep Nijhawan

|

|

2,731,415

shares

|

|

1968160

Ontario Inc.

|

|

371,727

shares

|

(c)

Except as set forth in this Schedule 13D, the Reporting Persons

have not effected any transactions with respect to the Common

Shares of the Issuer during the past 60 days.

(d)-(e)

Not applicable.

Item

6.

Contracts,

Arrangements, Understandings or Relationships with Respect to

Securities of the Issuer.

This

Amendment No. 3 does not amend the information previously provided

in response to this Item 6.

Item 7. Material to be Filed as Exhibits.

Joint Filing Agreement,

dated as of September 18, 2020 by and among (i) Pardeep Nijhawan

Medicine Professional Corporation, formed in Ontario, Canada, (ii)

The Digestive Health Clinic Inc., formed in Ontario, Canada,

(iii) 1968160 Ontario Inc., formed in Ontario, Canada,

and (iv)

Dr. Pardeep Nijhawan, an individual.

SIGNATURE

After

reasonable inquiry and to the best of my knowledge and belief, I

certify that the information set forth in this statement is true,

complete and correct.

|

|

|

|

|

PARDEEP NIJHAWAN MEDICINE PROFESSIONAL CORPORATION

|

|

|

|

|

|

|

|

|

|

|

Date: September 18, 2020

|

|

By:

|

|

/s/

Pardeep Nijhawan

|

|

|

|

|

|

Name:

|

|

Pardeep

Nijhawan

|

|

|

|

|

|

Title:

|

|

Chief

Executive Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

THE DIGESTIVE HEALTH CLINIC INC.

|

|

|

|

|

|

|

|

|

Date: September 18, 2020

|

|

By:

|

|

/s/

Pardeep Nijhawan

|

|

|

|

|

|

Name:

|

|

Pardeep

Nijhawan

|

|

|

|

|

|

Title:

|

|

Chief

Executive Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: September 18, 2020

|

|

By:

|

|

/s/

Pardeep Nijhawan

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: September 18, 2020

|

|

By:

|

|

/s/

Pardeep Nijhawan

|

|

|

|

|

|

Name:

|

|

Pardeep

Nijhawan

|

|

|

|

|

|

Title:

|

|

Chief

Executive Officer

|

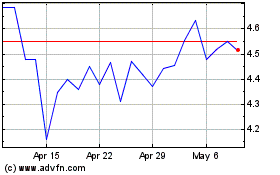

Edesa Biotech (NASDAQ:EDSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

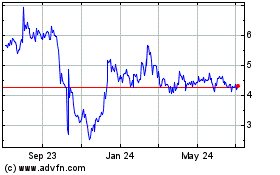

Edesa Biotech (NASDAQ:EDSA)

Historical Stock Chart

From Apr 2023 to Apr 2024