UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): April 17,

2020

Edesa Biotech, Inc.

(Exact Name of Registrant as Specified in its Charter)

|

British

Columbia, Canada

|

001-37619

|

N/A

|

|

(State or Other

Jurisdiction of

Incorporation)

|

(Commission

File

Number)

|

(IRS

Employer Identification

No.)

|

|

|

|

|

100 Spy Court

Markham, Ontario, Canada L3R 5H6

|

|

(Address

of Principal Executive Offices)

|

(289) 800-9600

Registrant’s

telephone number, including area code

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2.

below):

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425)

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of exchange on which registered

|

|

Common

Shares

|

|

EDSA

|

|

The

Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging

growth company ☒

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange

Act. ☒

Item 1.01

Entry into a Material Definitive Agreement.

On April 17, 2020, Edesa Biotech, Inc.

(“Edesa”), through its wholly-owned subsidiary Edesa

Biotech Research, Inc., entered into an exclusive license agreement

with NovImmune SA,

which operates under the brand Light Chain Bioscience (“Light

Chain”). Pursuant to the license agreement, Edesa

obtained exclusive rights throughout

the world to certain know-how, patents and data relating to

the monoclonal antibodies targeting TLR4 and CXCL10 (the

“Constructs”). Edesa will

use the exclusive rights to develop products containing the

Constructs (the “Licensed Products”) for therapeutic,

prophylactic and diagnostic applications in humans and

animals.

Unless earlier terminated, the term of the license

agreement will remain in effect for twenty-five years from the date

of first commercial sale of Licensed Products. Subsequently,

the license agreement will automatically renew for five (5) year

periods unless either party terminates the agreement in accordance

with its terms.

Pursuant

to the license agreement, Edesa is exclusively responsible, at its

expense, for the research, development manufacture, marketing,

distribution and commercialization of the Constructs and Licensed

Products and to obtain all necessary licenses and rights. Edesa is

required to use commercially reasonable efforts to develop and

commercialize the Constructs in accordance with the terms of a

development plan established by the parties. Subject to certain

conditions, Edesa is permitted to engage third parties to perform

its activities or obligations under the agreement.

In

exchange for the exclusive rights to develop and commercialize the

Constructs, Edesa issued to Light Chain $2.5 million of its newly

designated Series A-1 Convertible Preferred Shares (the

“Series A-1 Shares”) pursuant to the terms of a

securities purchase agreement entered into between the parties

concurrently with the license agreement. In addition, Edesa is

committed to payments of various amounts to Light Chain upon

meeting certain development, approval and commercialization

milestones as outlined in the license agreement up to an aggregate

amount of $363.5 million. Edesa also has a commitment to pay Light

Chain a royalty based on net sales of Licensed Products in

countries where Edesa directly commercializes Licensed Products and

a percentage of sublicensing revenue received by Edesa in the

countries where Edesa does not directly commercialize Licensed

Products.

The license agreement provides that Light Chain

will remain the exclusive owner of existing intellectual property

in the Constructs and that Edesa will be the exclusive owner of all

intellectual property resulting from the exploitation of the

Constructs pursuant to the license. Subject to certain limitations,

Edesa is responsible for prosecuting, maintaining and enforcing all

intellectual property relating to the Constructs. During the

term of the agreement, Edesa also has the option to purchase the

licensed patents and know-how at a price to be negotiated by the

parties.

If

Edesa defaults or fails to perform any of the terms, covenants,

provisions or its obligations under the license agreement, Light

Chain has the option to terminate the license agreement, subject to

providing Edesa an opportunity to cure such default. The license

agreement is also terminable by Light Chain upon the occurrence of

certain bankruptcy related events pertaining to Edesa.

In

connection with the license agreement and pursuant to a purchase

agreement entered into by the parties on April 17, 2020, Edesa will

purchase from Light Chain its inventory of the TLR4 antibody for an

aggregate purchase price of $5.0 million, payable in two

installments.

The foregoing summaries of the license agreement, securities

purchase agreement and purchase agreement do not purport to be

complete and are qualified in their entirety by reference to the

definitive transaction documents, copies of which are filed as

exhibits to this Current Report. Each of the license

agreement, securities purchase agreement and purchase agreement

contain representations and warranties that the respective parties

made to, and solely for the benefit of, the other party thereto in

the context of all of the terms and conditions of that agreement

and in the context of the specific relationship between the

parties. The provisions of the license agreement, securities

purchase agreement and purchase agreement, including the

representations and warranties contained therein, are not for the

benefit of any party other than the parties to such agreements or

as stated therein and are not intended as documents for investors

and the public to obtain factual information about the current

state of affairs of the parties to those documents and agreements.

Rather, investors and the public should look to other disclosures

contained in the company’s filings with the SEC.

Item

2.01

Completion

of Acquisition or Disposition of Assets.

The

information set forth in Item 1.01 with respect to the

acquisition of the TLR4

antibody inventory is incorporated by reference into this

Item 2.01.

Item 3.02

Unregistered Sales of Equity

Securities.

Pursuant to the license

agreement and securities purchase agreement, Edesa issued 250 of

its Series A-1 Shares to Light Chain. Information regarding the

Series A-1 Shares is contained in Item 5.03 of this Current Report

on Form 8-K, and is incorporated by reference into this Item

3.02.

The

Series A-1 Shares issued to Light Chain were issued in a

transaction exempt from registration under Regulation S promulgated

under the Securities Act of 1933, as amended (the

“Act”), because the offer and sale of such securities

was made to a non-U.S. person (as that term is defined in

Regulation S under the Act) in an offshore

transaction.

Item

3.03

Material

Modification to Rights of Security Holders.

The

information set forth in Item 5.03 with respect to the rights,

preferences, restrictions and other matters pertaining to the

Series A-1 Shares is incorporated by reference into this

Item 3.03.

Item

5.03

Amendments

to Articles of Incorporation or Bylaws; Change in Fiscal

Year.

In

connection with the execution of the license agreement, Edesa filed

Amended and Restated Articles to establish the rights, preferences,

restrictions and other matters pertaining to the Series A-1 Shares.

The Series A-1 Shares have no par value and a stated value of

$10,000 per share and rank, with respect to redemption payments,

rights upon liquidation, dissolution or winding-up of Edesa, or

otherwise, senior in preference and priority to Edesa’s

common shares. A holder of Series A-1 Shares shall not be entitled

to receive dividends unless declared by Edesa’s Board of

Directors. Subject to certain exceptions and adjustments for share

splits, each Series A-1 Share is convertible six months after its

date of issuance into a number of Edesa’s common shares

calculated by dividing (i) the sum of the stated value of such

Series A-1 Share plus a return equal to 3% of the stated value of

such Series A-1 Share per annum (collectively, the “Preferred

Amount”) by (ii) a fixed conversion price of $2.26.

A holder of

Series A-1 Shares will not have the right to convert any portion of

its Series A-1 Shares if the holder, together with its affiliates,

would beneficially own in excess of 4.99% of the number of common

shares outstanding immediately after giving effect to such

conversion (the “Beneficial Ownership Limitation”);

provided, however, that upon notice to Edesa, the holder may

increase the Beneficial Ownership Limitation to a maximum of

9.99%. The Series A-1 Shares do not have the right to vote

on any matters except as required by law and do not contain any

variable pricing features, or any price-based anti-dilutive

features.

In the

event of any liquidation, dissolution or winding-up of Edesa, a

holder of Series A-1 Shares shall be entitled to receive, before

any distribution or payment may be made with respect to

Edesa’s common shares, an amount in cash equal to the

Preferred Amount per share, plus all unpaid accrued dividends on

all such shares.

At any

time, Edesa may redeem some or all outstanding Series A-1 Shares

for a cash payment per share equal to the Preferred Amount. Subject

to certain restrictions, a holder of Series A-1 Shares may require

Edesa to redeem the Series A-1 Shares for cash beginning 18 months

after issuance. In the event of a required redemption, at the

election of Edesa, the redemption amount (which is equal to the

Preferred Amount) may be paid in full or in up to twelve equal

monthly payments with any unpaid redemption amounts accruing

interest at a rate of 3% annually, compounded monthly. On the third

anniversary of the date of issuance of the Series A-1 Shares, Edesa

has the right to convert any outstanding Series A-1 Shares into

common shares.

The

foregoing summary of the rights, preferences, restrictions and

other matters pertaining to the Series A-1 Shares does not purport

to be complete and is qualified in its entirety by reference to

Part 27 of the Amended and Restated Articles of Edesa –

Special Rights and Restriction Attaching to the Series A-1

Convertible Preferred Shares, a copy of which is attached

hereto as Exhibit 3.1 and incorporated herein by

reference.

On

April 20, 2020, Edesa issued a press release regarding the

transactions described in Item 1.01, a copy of which is attached

hereto as Exhibit 99.1 and incorporated herein by

reference.

Item

9.01

Financial

Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

ExhibitNo.

|

|

Description of Exhibit

|

|

|

|

|

|

|

Amended

and Restated Articles of Edesa Biotech, Inc.

|

|

|

|

|

|

|

|

License

Agreement by and between Edesa Biotech Research, Inc. and NovImmune

SA dated April 17, 2020.

|

|

|

|

|

|

|

|

Purchase

Agreement by and between Edesa Biotech Research, Inc. and NovImmune

SA dated April 17, 2020.

|

|

|

|

|

|

|

|

Securities

Purchase Agreement by and between Edesa Biotech, Inc. and NovImmune

SA dated April 17, 2020

|

|

|

|

|

|

|

|

Press

Release issued by Edesa Biotech, Inc. dated April 20,

2020.

|

+ Portions

of this exhibit have been omitted pursuant to Rule 601(b)(10)(iv)

of Regulation S-K.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

Edesa

Biotech, Inc.

|

|

|

|

|

|

Date:

April 23, 2020

|

By:

|

/s/

Michael Brooks

|

|

|

Name:

|

Michael

Brooks, PhD

|

|

|

Title:

|

President

|

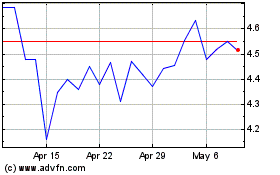

Edesa Biotech (NASDAQ:EDSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

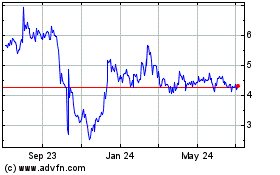

Edesa Biotech (NASDAQ:EDSA)

Historical Stock Chart

From Apr 2023 to Apr 2024