Filed Pursuant to Rule 424(b)(5)

Registration

No. 333-233567

PROSPECTUS SUPPLEMENT

(to Prospectus dated September 12,

2019)

EDESA

BIOTECH, INC.

1,355,380

Common Shares

We are

offering 1,355,380 of our common shares, no par value

(“Common Shares”), directly to the investors pursuant

to this prospectus supplement and the accompanying prospectus at a

price of (i) $3.20 for investors other than investors that are

officers, directors, employees or consultants of the company and

(ii) $4.11 for each investor that is an officer, director, employee

or consultant of the company. In a concurrent private placement, we

are also selling to purchasers of Common Shares in this offering

(i) Class A Purchase Warrants to purchase an aggregate of 1,016,553

of our Common Shares (the “Class A Purchase Warrants”)

and (ii) Class B Purchase Warrants to purchase an aggregate of

677,703 of our Common Shares (the “Class B Purchase

Warrants,” and together with the Class A Purchase Warrants,

the “Purchase Warrants”). The Class A Purchase Warrants

will be exercisable at any time on or after the six (6) month

anniversary the date of issuance (the “Class A Purchase

Warrant Initial Exercise Date”), at an exercise price of

$4.80 per share and will expire on the third anniversary of the

Class A Purchase Warrant Initial Exercise Date. The Class B

Purchase Warrants will be exercisable at any time on or after the

six (6) month anniversary the date of issuance (the “Class B

Purchase Warrant Initial Exercise Date”), at an exercise

price of $4.00 per share and will expire on the four month

anniversary of the Class B Purchase Warrant Initial Exercise Date.

The Purchase Warrants and the Common Shares issuable upon the

exercise of the Purchase Warrants (the “Warrant

Shares”), are not being registered under the Securities Act

of 1933, as amended, or the Securities Act, pursuant to the

registration statement of which this prospectus supplement and the

accompanying base prospectus form a part and are not being offered

pursuant to this prospectus supplement and the accompanying

prospectus. The Purchase Warrants and Warrant Shares are being

offered pursuant to an exemption from the registration requirement

of the Securities Act provided in Section 4(a)(2) of the Securities

Act and/or Regulation D Rule 506(b). With respect to non-U.S.

investors, the Common Shares offered pursuant to this prospectus

supplement and the accompanying prospectus as well as the Purchase

Warrants and Warrant Shares will be subject to restrictions on

resale in accordance with applicable foreign laws.

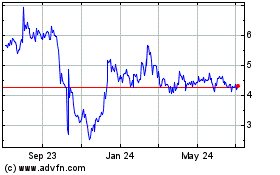

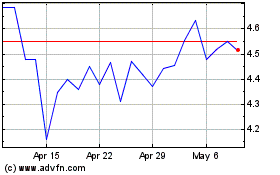

Our

Common Shares trade on The Nasdaq Capital Market under the symbol

“EDSA.” The last reported sale price on January 3, 2020

was $3.99 per Common Share.

The

aggregate market value of our outstanding Common Shares held by

non-affiliates, as computed within sixty (60) days prior to the

date of this prospectus supplement, was approximately $13,989,385

based on 7,504,468 shares of outstanding Common Shares, of which

approximately 2,753,816 shares were held by non-affiliates, and a

reported closing price of $5.08 per Common Share on The Nasdaq

Capital Market on November 20, 2019. Under the registration

statement to which this prospectus supplement forms a part, we may

not sell our securities in a primary offering with a value

exceeding one-third of our public float in any 12-month period

(unless our public float rises to $75.0 million or more). As of the

date of this prospectus supplement, we have not sold any securities

pursuant to General Instruction I.B.6. of Form S-3 during the prior

12 calendar month period that ends on, and includes, the date of

this prospectus supplement and accordingly, we may sell up to

$4,663,128 of Common Shares hereunder.

We have

retained Brookline Capital Markets, a division of Arcadia

Securities, LLC, to act as the placement agent in the United States

in connection with this offering. The placement agent is not

purchasing or selling any of our Common Shares offered pursuant to

this prospectus supplement or the accompanying prospectus. See

“Plan of Distribution” beginning on page S-41 of this

prospectus supplement for more information regarding these

arrangements. Outside of the United States, we are directly

soliciting offers to purchase our Common Shares from non-U.S.

investors.

Investing in our Common Shares involves risks, including those

described in the "Risk Factors" section beginning on page S-4

of this prospectus supplement and the section captioned

"Item 1A—Risk Factors" in our most recently filed Annual

Report on Form 10-K, which is incorporated by reference into

this prospectus supplement and the accompanying

prospectus.

Neither the Securities and Exchange Commission nor any state

securities commission has approved or disapproved of these

securities or determined if this prospectus supplement or the

accompanying prospectus is truthful or complete. Any representation

to the contrary is a criminal offense.

|

|

|

|

|

Public Offering

Price (1)

|

$3.20

|

$4,244,980

|

|

Public Offering

Price (2)

|

$4.11

|

$115,500

|

|

Placement

Agent’s Fees (3)

|

$0.15

|

$207,475

|

|

Proceeds to Us

(Before Expenses)

|

$3.06

|

$4,153,005

|

(1) For

investors other than investors that are officers, directors,

employees or consultants of the company.

(2) For

each investor that is an officer, director, employee or consultant

of the company.

(3) We

have agreed to pay the placement agent an aggregate cash placement

fee equal to 6.5% of the gross proceeds in this offering from sales

arranged by the placement agent (or 3.5% in the case of sales to

U.S. investors introduced by the company). The placement agent will

not receive any cash placement fee with respect to non-U.S.

investors introduced by the Company. We have also agreed to

reimburse the placement agent for certain expenses incurred by the

placement agent up to an amount not to exceed $55,000 and to issue

to the placement agent warrants with a term of five years to

purchase up to 12,364 of our Common Shares at an exercise price of

$3.20 per share. For additional information on the placement

agent’s fees, compensation and expense reimbursement, see

“Plan of Distribution” beginning on page S-41 of this

prospectus supplement.

We

anticipate that delivery of the Common Shares will be made on or

about January 8, 2020.

Placement Agent

Brookline Capital Markets, a division of Arcadia

Securities

The date of this

prospectus supplement is January 6, 2020

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

ABOUT THIS PROSPECTUS

SUPPLEMENT

This prospectus supplement is a supplement to the accompanying

prospectus that is also a part of this document. This prospectus

supplement and the accompanying prospectus are part of a

registration statement on Form S-3 (File No. 333-233567)

that we filed with the Securities and Exchange Commission, or the

SEC, using a “shelf” registration process. Under this

“shelf” registration process, we may from time to time

sell any combination of securities described in the accompanying

prospectus in one or more offerings up to a total of

$50.0 million.

This prospectus supplement and the accompanying prospectus do not

constitute an offer to sell or a solicitation of an offer to buy

the shares offered hereby in any jurisdiction where, or to any

person to whom, it is unlawful to make such offer or solicitation.

Persons outside the United States who come into possession of this

prospectus supplement must inform themselves about, and observe any

restrictions relating to, the offering of the Common Shares and the

distribution of this prospectus supplement outside the United

States.

This document is in two parts. The first part is this prospectus

supplement, which describes the terms of the offering of common

shares and also adds to and updates information contained in the

accompanying prospectus and the documents incorporated by reference

into the accompanying prospectus. The second part is the

accompanying prospectus, which provides more general information,

some of which may not apply to the Common Shares. To the extent

there is a conflict between the information contained in this

prospectus supplement, on the one hand, and the information

contained in the accompanying prospectus or any document

incorporated by reference therein, on the other hand, you should

rely on the information in this prospectus supplement.

You should rely only on the information contained in or

incorporated by reference into this prospectus supplement and the

accompanying prospectus or any free writing prospectus. We have

not, and the placement agent has not, authorized any other person

to provide you with different information. If anyone provides you

with different or inconsistent information, you should not rely on

it. The information contained in or incorporated by reference into

this prospectus supplement and the accompanying prospectus is

current as of the date such information is presented, regardless of

the time of delivery of this prospectus supplement or of any sale

of the shares. Our business, financial condition, results of

operations and prospects may have changed since those dates. It is

important for you to read and consider all information contained in

this prospectus supplement and the accompanying prospectus,

including the documents incorporated by reference herein and

therein, in making your investment decision. You should also read

and consider the information in the documents we have referred you

to in the sections entitled “Where You Can Find More

Information” and “Incorporation of Certain Information

By Reference” below.

This prospectus supplement, the accompanying prospectus and the

information incorporated herein and therein by reference include

trademarks, services marks and trade names owned by us or other

companies. All trademarks, service marks and trade names included

or incorporated by reference into this prospectus supplement, the

accompanying prospectus or any related free writing prospectuses

are the property of their respective owners.

Unless the context otherwise requires, the terms “we,”

“our,” “us,” the “company,” and

“Edesa” refer to Edesa Biotech, Inc. and its

subsidiaries.

|

|

|

|

|

|

PROSPECTUS

SUPPLEMENT SUMMARY

This summary highlights selected information contained elsewhere or

incorporated by reference in this prospectus supplement or the

accompanying prospectus. Because it is a summary, it does not

contain all of the information that you should consider before

investing in the shares. You should read this entire prospectus

supplement and the accompanying prospectus carefully, including the

“Risk Factors,” and the financial statements and other

information incorporated by reference in this prospectus supplement

and the accompanying prospectus.

Edesa Biotech, Inc.

Overview

We are a biopharmaceutical company focused on acquiring, developing

and commercializing clinical-stage drugs for dermatological and

gastrointestinal indications with clear unmet medical needs. Our

lead product candidate, EB01, is an sPLA2

inhibitor for the topical treatment of

chronic allergic contact dermatitis (ACD), a common, potentially

debilitating condition and occupational illness. EB01 employs a

novel, non-steroidal mechanism of action and in two clinical

studies has demonstrated statistically significant improvement of

multiple symptoms in ACD patients. Our investigational new

drug (IND) application for EB01 was accepted by the U.S. Food and

Drug Administration (FDA) in November 2018 and we initiated patient

enrollment for a Phase 2B clinical study evaluating EB01 in October

2019.

We also intend to expand the utility of our sPLA2

inhibitor technology, which forms the

basis for EB01, across multiple indications. For example, in

September 2019, we received approval from Health Canada to begin a

proof-of-concept clinical study of EB02, an sPLA2

inhibitor, as a potential treatment

for patients with hemorrhoids disease (HD). In addition to EB01 and

EB02, we plan to expand our portfolio with drug candidates to treat

other skin and gastrointestinal conditions.

Competitive Strengths

We believe that we possess a number of competitive strengths that

position us to become a leading biopharmaceutical company focused

on dermatological and gastrointestinal diseases,

including:

●

Novel pipeline addressing

large underserved markets. Our

product candidates are novel clinical-stage compounds that have

significant scientific rationale for effectiveness. By initially

targeting large markets that have significant unmet medical needs,

we believe that we can drive adoption of new products and improve

our competitive position. For example, we believe that the novel,

non-steroidal mode of action of our lead product candidates will be

an appealing alternative for managing the symptoms of ACD and HD.

These diseases impact millions of people in the United States and

Canada, and can have significant effects on patients’ quality

of life and, in the case of many chronic ACD patients and their

employers, significant workplace-related costs and

limitations.

●

Intellectual property

protection and market exclusivity. We have opportunities to develop our competitive

position through patents, trade secrets, technical know-how and

continuing technological innovation. We have exclusive license

rights in our target indications to multiple patents and pending

patent applications in the United States and in various foreign

jurisdictions. In addition to patent protection, we intend to

utilize trade secrets and market exclusivity afforded to a New

Chemical Entity, where applicable, to enhance or maintain our

competitive position.

●

Experienced management and

drug development capabilities. Our leadership team possesses core capabilities in

dermatology, gastrointestinal medicine, drug development and

commercialization, chemistry, manufacturing and controls, public

company management and finance. Our founder, Chief Executive

Officer, Pardeep Nijhawan, MD, FRCPC, AGAF, is a board-certified

gastroenterologist and hepatologist with a successful track record

of building life science businesses, including Medical Futures,

Inc., which was sold to Tribute Pharmaceuticals in 2015. In

addition to our internal capabilities, we have also established a

network of key opinion leaders, contract research organizations,

contract manufacturing organizations and consultants. As a result,

we believe we are well positioned to efficiently develop novel

dermatological and gastrointestinal treatments.

|

|

|

|

|

|

|

|

|

|

|

|

Our

business strategy is to develop and commercialize innovative drug

products that address unmet medical needs for large, underserved

markets where there is limited competition. Key elements of our

strategy include:

●

Establish EB01 as the leading

treatment for chronic ACD. Our

primary goal is to obtain regulatory approval for EB01 and

commercialize EB01 for use in the treatment of ACD. Based on

promising clinical trial results in which patients treated with

EB01 experienced statistically significant improvements of their

symptoms with minimal side effects, we initiated a Phase 2B

clinical study evaluating EB01 in the United

States.

●

Selectively targeting

additional indications within the areas of dermatology and

gastroenterology. In addition

to our ACD program, we plan to efficiently generate

proof-of-concept data for other programs where the inhibition of

sPLA2

activity may have a therapeutic

benefit. For example, given sufficient funding, we are planning a

clinical study to evaluate EB02 for internal

hemorrhoids.

●

In-license promising product

candidates. We are applying our

cost-effective development approach to advance and expand our

pipeline. Our current product candidates are in-licensed from

academic institutions or other pharmaceutical companies, and we

plan to continue to identify, evaluate and potentially obtain

rights to and develop additional assets. Our objective is to

maintain a well-balanced portfolio with product candidates across

various stages of development. In general, we seek to identify

product candidates and technology that represent a novel

therapeutic approach to dermatological and gastrointestinal

diseases, are supported by compelling science, target an unmet

medical need, and provide a meaningful commercial opportunity. We

do not currently intend to invest significant capital in basic

research, which can be expensive and

time-consuming.

●

Capture the full commercial

potential of our product candidates. If our product candidates are successfully

developed and approved, we may build commercial infrastructure

capable of directly marketing the products in North America and

potentially other major geographies of strategic interest. We also

plan to evaluate strategic licensing arrangements with

pharmaceutical companies for the commercialization of our drugs,

where applicable, such as in territories where a partner may

contribute additional resources, infrastructure and

expertise.

Corporate Information

We were incorporated in British Columbia, Canada in 2007 and we

operate through our wholly-owned subsidiaries, Edesa Biotech

Research, Inc., an Ontario corporation incorporated in 2015,

formerly known as Edesa Biotech, Inc., which we acquired on June 7,

2019, and Stellar Biotechnologies, Inc., a California corporation

organized September 9, 1999 and acquired on April 12, 2010. Our

Common Shares are traded on The Nasdaq Capital Market under the

symbol “EDSA”. Our principal executive offices are

located at 100 Spy Court, Markham, Ontario L3R 5H6 Canada and our

telephone number at this location is (289) 800-9600. Our website

address is www.edesabiotech.com. The information contained on, or

that can be accessed through, our website is not a part of this

prospectus supplement or the accompanying base prospectus. Our

trademarks and trade names include, but may not be limited to,

“Edesa Biotech” and the Edesa logo.

|

|

|

|

|

|

|

|

|

|

|

|

|

The Offering

The following summary contains basic information about this

offering. The summary is not intended to be complete. You should

read the full text and more specific details contained elsewhere in

this prospectus supplement.

|

|

|

|

|

|

|

|

|

Issuer

|

Edesa

Biotech, Inc.

|

|

|

|

|

|

|

|

|

Common

Shares offered by us in this offering

|

1,355,380

shares

|

|

|

|

|

|

|

|

|

Public

offering price per Common Share

|

(i) $3.20 for

investors other than investors that are officers, directors,

employees or consultants of the company and (ii) $4.11 for each

investor that is an officer, director, employee or consultant of

the company.

|

|

|

|

|

|

|

|

|

Common

Shares outstanding prior to this offering

|

7,504,468

shares

|

|

|

|

|

|

|

|

|

Common

Shares to be outstanding after

this offering

|

8,859,848

shares

|

|

|

|

|

|

|

|

|

Use

of proceeds

|

We currently anticipate that the net proceeds from

the sale of our Common Shares will be used for general

corporate purposes, which may include working capital, capital

expenditures and research and development expenses. See “Use of Proceeds” on

page S-28.

|

|

|

|

|

|

|

|

|

Risk

factors

|

See “Risk Factors” beginning on page S-4 for a

discussion of factors you should carefully consider before deciding

to invest in our securities.

|

|

|

|

|

|

|

|

|

NASDAQ

Capital Market symbol

|

EDSA

|

|

|

|

|

|

|

|

|

Concurrent

private placement

|

In a concurrent private placement, we are

selling to the purchasers of Common Shares in this offering (i)

Class A Purchase Warrants to purchase an aggregate of 1,016,553 of

our Common Shares, or 0.75 of a Common Share for each share

purchased in the offering, and (ii) Class B Purchase Warrants to

purchase an aggregate of 677,703 of our Common Shares, or 0.50 of a

Common Share for each share purchased in the offering. The Class A

Purchase Warrants will be exercisable at any time on or after the

six (6) month anniversary the date of issuance (the “Class A

Purchase Warrant Initial Exercise Date”), at an exercise

price of $4.80 per share and will expire on the third anniversary

of the Class A Purchase Warrant Initial Exercise Date. The Class B

Purchase Warrants will be exercisable at any time on or after the

six (6) month anniversary the date of issuance (the “Class B

Purchase Warrant Initial Exercise Date”), at an exercise

price of $4.00 per share and will expire on the four month

anniversary of the Class B Purchase Warrant Initial Exercise Date.

The Purchase Warrants and the Warrant Shares are not being

registered under the Securities Act of 1933, as amended, or the

Securities Act, pursuant to the registration statement of which

this prospectus supplement and the accompanying base prospectus

form a part and are not being offered pursuant to this prospectus

supplement and the accompanying prospectus. The Purchase Warrants

and Warrant Shares are being offered pursuant to an exemption from

the registration requirement of the Securities Act provided in

Section 4(a)(2) of the Securities Act and/or Regulation D Rule

506(b). With respect to non-U.S. investors, the Common Shares

offered pursuant to this prospectus supplement and the accompanying

prospectus as well as the Purchase Warrants and Warrant Shares will

be subject to restrictions on resale in accordance with applicable

foreigh laws. See “Private Placement Transaction and

Warrants” on page S-31 of this prospectus

supplement.

|

|

|

|

|

|

|

|

|

The number of our Common Shares to be outstanding after the

offering is based on 7,504,468 of our Common Shares outstanding as

of January 6, 2020 and

excludes:

●

319,526

of our Common Shares issuable upon exercise of outstanding options

granted under our equity incentive plans at a weighted average

exercise price of $3.36 per share;

●

833,621 of our Common Shares available

for issuance or future grant pursuant to our equity incentive

plan;

●

48,914

of our Common Shares issuable upon exercise of outstanding warrants

at a weighted average exercise price of $11.19 per

share;

●

the

1,694,256 Common Shares issuable upon exercise of the Purchase

Warrants being offered by us in the concurrent private placement;

and

●

the

12,364 Common Shares issuable upon exercise of warrants being

issued by us to the placement agent in connection with the

offering.

|

|

|

|

|

|

|

Investors should carefully consider the risks described below and

in the filings incorporated by reference including our Annual

Report on Form 10-K for the transition period from January 1, 2019

to September 30, 2019 before deciding whether to invest in our

securities. We expect to update the risk factors from time to time

in the periodic and current reports that we file with the SEC after

the date of this prospectus supplement. These updated risk factors

will be incorporated by reference in this prospectus supplement and

the accompanying prospectus. The risks described below and those

described in our filings incorporated by reference are not the only

ones we face. If any of the following risks actually occurs, our

business, financial condition or results of operations could be

adversely affected. In such case, the trading price of our Common

Shares could decline and you could lose all or part of your

investment. Our actual results could differ materially from those

anticipated in the forward-looking statements made throughout this

prospectus supplement and in the documents incorporated by

reference as a result of different factors, including the risks we

face described below and those described in the filings

incorporated by reference.

Risks Relating to Our Business

We have incurred significant losses since our inception and expect

to continue to incur losses and may never generate profits from

operations or maintain profitability.

Since

inception, we have incurred significant operating losses. As of

September 30, 2019, we have an accumulated deficit of $6.73

million. We have historically financed operations primarily through

issuances of preferred shares that were converted into common

shares, loans that were converted into common shares and government

grants. We have devoted substantially all of our efforts to

research and development, including clinical trials, and have not

completed the development of any of our drug

candidates.

We

expect to continue to incur significant expenses and operating

losses for the foreseeable future as we continue the development

of, and seek marketing approvals for our product candidates,

prepare for and begin the commercialization of any approved

products, and add infrastructure and personnel to support our

product development efforts and operations as a public company in

the United States and Canada. The net losses we incur may fluctuate

significantly from quarter to quarter and year to

year.

Our

ability to generate profits from operations and thereafter to

remain profitable depends heavily on, among other

things:

●

the scope, number,

progress, duration, cost, results and timing of clinical trials and

nonclinical studies of our current or future product

candidates;

●

our ability to

raise sufficient funds to support the development and potential

commercialization of our product candidates;

●

the outcomes and

timing of regulatory reviews, approvals or other

actions;

●

our ability to

obtain marketing approval for our product candidates;

●

our ability to

establish and maintain licensing, collaboration or similar

arrangements on favorable terms and whether and to what extent we

retain development or commercialization responsibilities under any

new licensing, collaboration or similar arrangement;

●

the success of any

other business, product or technology that we acquire or in which

we invest;

●

our ability to

maintain, expand and defend the scope of our intellectual property

portfolio;

●

our ability to

manufacture any approved products on commercially reasonable

terms;

●

our ability to

establish a sales and marketing organization or suitable

third-party alternatives for any approved product; and

●

the number and

characteristics of product candidates and programs that we

pursue.

Based

on our current plans, we do not expect to generate significant

revenue unless and until we or a current or potential future

licensee obtains marketing approval for, and commercializes, one or

more of our product candidates, which may require several years.

Neither we nor a licensee may ever succeed in obtaining marketing

approval for, or commercializing our product candidates and, even

if marketing approval is obtained, we may never generate revenues

that are significant enough to generate profits from operations.

Even if we do generate profits from operations, we may not be able

to sustain or increase profitability on a quarterly or annual

basis. Our failure to generate profits from operations and remain

profitable would decrease the value of the company and could impair

our ability to raise capital, expand our business, maintain our

research and development efforts, diversify our product offerings

or continue our operations. A decline in the value of the company

could also cause you to lose all or part of your

investment.

We will need substantial additional funding to finance our

operations through regulatory approval of one or more of our

product candidates. If we are unable to raise capital when needed,

we could be forced to delay, reduce or eliminate our product

development programs or commercialization efforts.

We

expect our research and development expenses to increase

substantially in the future, particularly if we advance any drug

candidates beyond Phase 2 clinical development or expand the number

of drug candidates in clinical studies. In addition, if we obtain

marketing approval for any of our product candidates that are not

then subject to licensing, collaboration or similar arrangements

with third parties, we expect to incur significant

commercialization expenses related to product sales, marketing,

distribution and manufacturing. If we are unable to raise capital

when needed, or on attractive terms, we could be forced to delay,

reduce or eliminate research and development programs or future

commercialization efforts.

We depend heavily on the success of our lead product candidate,

EB01, which we are developing for the treatment of chronic ACD. If

we are unable to obtain regulatory approval or commercialize EB01,

or experience significant delays in doing so, our business will be

materially harmed.

EB01 is

in Phase 2B clinical development. Our ability to generate product

revenues, which may not occur for multiple years, if at all, will

depend heavily on the successful development and commercialization

of EB01 as a treatment for chronic ACD. The success of our product

candidates, including EB01, will depend on a number of factors,

including the following:

●

our ability to

obtain additional capital from potential future licensing,

collaboration or similar arrangements or from any future offering

of our debt or equity securities;

●

our ability to

identify and enter into potential future licenses or other

collaboration arrangements with third parties and the terms of the

arrangements;

●

successful

completion of clinical development;

●

the ability to

provide acceptable evidence demonstrating a product

candidates’ safety and efficacy;

●

receipt of

marketing approvals from applicable regulatory authorities and

similar foreign regulatory authorities;

●

the availability of

raw materials to produce our product candidates;

●

obtaining and

maintaining commercial manufacturing arrangements with third-party

manufacturers or establishing commercial-scale manufacturing

capabilities;

●

obtaining and

maintaining patent and trade secret protection and regulatory

exclusivity;

●

establishing sales,

marketing and distribution capabilities;

●

generating

commercial sales of the product candidate, if and when approved,

whether alone or in collaboration with others;

●

acceptance of the

product candidate, if and when approved, by patients, the medical

community and third-party payors;

●

effectively

competing with other therapies; and

●

maintaining an

acceptable safety profile of the product candidate following

approval.

If we

do not achieve one or more of these factors in a timely manner or

at all, we could experience significant delays or an inability to

successfully commercialize EB01 or any of our other product

candidates, which would materially harm our business. Many of these

factors are beyond our control. Accordingly, we may never be able

to generate revenues through the license or sale of any of our

product candidates.

Our limited operating history may

make it difficult for you to evaluate the success of our business

to date and to assess our future viability.

Our

primarily operating entity, Edesa Biotech Research, Inc. was formed

in July 2015. To date, our operations have been limited to

organization and staffing, developing and securing our technology,

entering into licensing arrangements, raising capital and

undertaking preclinical studies and clinical trials of our product

candidates. We have not yet demonstrated our ability to

successfully complete development of any product candidate, obtain

marketing approval, manufacture a commercial scale product, or

arrange for a third-party to do so on our behalf, or conduct sales

and marketing activities necessary for successful product

commercialization. Assuming we obtain marketing approval for any of

our product candidates, we will need to transition from a company

with a research and development focus to a company capable of

supporting commercial activities. We may encounter unforeseen

expenses, difficulties, complications and delays and may not be

successful in such a transition. Any predictions made about our

future success or viability may not be as accurate as they could be

if we had a longer operating history.

We may not be successful in our efforts to identify and acquire or

in-license additional product candidates.

Part of

our strategy involves diversifying our product development risk by

identifying and acquiring or in-licensing novel product candidates.

We may fail to identify and acquire or in-license promising product

candidates. The competition to acquire or in-license promising

product candidates is fierce, especially from large multinational

companies that have greater resources and experience than we have.

If we are unable to identify and acquire or in-license suitable

product candidates, we will be unable to diversify our product

risk. We believe that any such failure could have a significant

negative impact on our prospects because the risk of failure of any

particular development program in the pharmaceutical field is

high.

We may expend our limited resources to pursue a particular product

candidate and fail to capitalize on product candidates that may be

more profitable or for which there is a greater likelihood of

success.

Because

we have limited financial and managerial resources, we focus on

specific product candidates. As a result, we may forego or delay

pursuit of opportunities with other product candidates that later

could prove to have greater commercial potential. Our resource

allocation decisions may cause us to fail to capitalize on viable

commercial products or profitable market opportunities. If we do

not accurately evaluate the commercial potential or target market

for a particular product candidate, our business may be negatively

impacted.

Our future success depends on our ability to retain key executives

and to attract, retain and motivate qualified

personnel.

We are

highly dependent on Dr. Pardeep Nijhawan, our Chief Executive

Officer and Secretary; and Michael Brooks, our President; as well

as other principal members of our management and scientific teams.

Although we have employment agreements with each of our executive

officers, these agreements do not prevent our executives from

terminating their employment with the company at any time. The

unplanned loss of the services of any of these persons could

materially impact the achievement of our research, development,

financial and commercialization objectives. Recruiting and

retaining qualified personnel, including in the United States and

Canada, will also be critical to our success. We may not be able to

attract and retain these personnel on acceptable terms given the

competition among numerous biotechnology and pharmaceutical

companies for similar personnel. In addition, we rely on

consultants and advisors, including scientific and clinical

advisors, to assist us in formulating our research and development

and commercialization strategy. Our consultants and advisors may

have commitments with other entities that may limit their

availability to us.

We expect to expand our capabilities, and as a result, we may

encounter difficulties in managing our growth, which could disrupt

our operations.

We

expect to experience growth in the number of our employees and the

scope of our operations, particularly in the areas of drug

development, regulatory affairs, finance and administration and,

potentially, sales and marketing. To manage our anticipated future

growth, we must continue to implement and improve our managerial,

operational and financial systems, expand our facilities and

continue to recruit and train additional qualified personnel. We

may not be able to effectively manage the expansion of our

operations or recruit and train additional qualified personnel. The

physical expansion of our operations may lead to significant costs

and may divert our management and business development resources.

Any inability to manage growth could delay the execution of our

business plans or disrupt our operations.

We are exposed to risks related to currency exchange

rates.

We

conduct a significant portion of our operations outside of the

United States. Because our financial statements are presented in

U.S. dollars, changes in currency exchange rates have had and could

have in the future a significant effect on our operating results

when our operating results are translated into U.S.

dollars.

We are subject to anti-corruption laws, as well as export control

laws, customs laws, sanctions laws and other laws governing our

operations. If we fail to comply with these laws, it could be

subject to civil or criminal penalties, other remedial measures and

legal expenses, which could adversely affect our business, results

of operations and financial condition.

Our

operations are subject to anti-corruption laws, including the U.S.

Foreign Corrupt Practices Act, or the FCPA, and other

anti-corruption laws that apply in countries where we do business

and may do business in the future. The FCPA and these other laws

generally prohibit us, our officers, and our employees and

intermediaries from bribing, being bribed or making other

prohibited payments to government officials or other persons to

obtain or retain business or gain some other business advantage. We

may in the future operate in jurisdictions that pose a high risk of

potential FCPA violations, and we may participate in collaborations

and relationships with third parties whose actions could

potentially subject us to liability under the FCPA or local

anti-corruption laws. We are also subject to other laws and

regulations governing our international operations, including

regulations administered by the government of the United States and

authorities in the European Union, including applicable export

control regulations, economic sanctions on countries and persons,

customs requirements and currency exchange regulations,

collectively referred to as the Trade Control laws. There is no

assurance that we will be completely effective in ensuring our

compliance with all applicable anti-corruption laws, including the

FCPA or other legal requirements, including Trade Control laws. If

we are not in compliance with the FCPA and other anti-corruption

laws or Trade Control laws, it may be subject to criminal and civil

penalties, disgorgement and other sanctions and remedial measures,

and legal expenses, which could have an adverse impact on our

business, financial condition, results of operations and liquidity.

Likewise, any investigation of any potential violations of the

FCPA, other anti-corruption laws or Trade Control laws by U.S. or

other authorities could also have an adverse impact on our

reputation, our business, results of operations and financial

condition.

Our employees, principal investigators, consultants and commercial

partners may engage in misconduct or other improper activities,

including noncompliance with regulatory standards and requirements

and insider trading, which could cause significant liability for us

and harm our reputation.

We are

exposed to the risk of fraud or other misconduct by our employees,

principal investigators, consultants and collaborators, including

intentional failures to comply with FDA or Office of Inspector

General regulations or similar regulations of comparable non-U.S.

regulatory authorities, provide accurate information to the FDA or

comparable non-U.S. regulatory authorities, comply with

manufacturing standards we have established, comply with federal

and state healthcare fraud and abuse laws and regulations and

similar laws and regulations established and enforced by comparable

non-U.S. regulatory authorities, report financial information or

data accurately or disclose unauthorized activities to us.

Misconduct by these parties could also involve the improper use of

information obtained in the course of clinical trials, which could

result in regulatory sanctions and serious harm to our reputation.

It is not always possible to identify and deter employee

misconduct, and the precautions we take to detect and prevent this

activity may not be effective in controlling unknown or unmanaged

risks or losses or in protecting us from governmental

investigations or other actions or lawsuits stemming from a failure

to be in compliance with such laws, standards or regulations. If

any such actions are instituted against us, and we are not

successful in defending ourselves or asserting our rights, those

actions could have a significant impact on our business and results

of operations, including the imposition of significant fines or

other sanctions.

We rely significantly on information technology and any failure,

inadequacy, interruption or security lapse of that technology,

including any cyber security incidents, could harm our ability to

operate our business effectively.

Despite

the implementation of security measures, our internal computer

systems and those of third parties with which we contract are

vulnerable to damage from cyber-attacks, computer viruses,

unauthorized access, natural disasters, terrorism, war and

telecommunication and electrical failures. System failures,

accidents or security breaches could cause interruptions in our

operations, and could result in a material disruption of ours

clinical and commercialization activities and business operations,

in addition to possibly requiring substantial expenditures of

resources to remedy. The loss of clinical trial data could result

in delays in our regulatory approval efforts and significantly

increase our costs to recover or reproduce the data. To the extent

that any disruption or security breach were to result in a loss of,

or damage to, our data or applications, or inappropriate disclosure

of confidential or proprietary information, we could incur

liability and our product research, development and

commercialization efforts could be delayed.

The wind down or spinoff of our Stellar subsidiary’s legacy

business may not deliver the expected results.

Following

the business combination with Edesa Biotech Research, Inc.,

formerly known as Edesa Biotech Inc., we refocused our primary

business on the development of innovative therapeutics for

dermatological and gastrointestinal indications with clear unmet

medical needs. Over the course of the next 12 months, we intend to

sell or wind down the principal assets and operations of our

Stellar subsidiary’s legacy business, which includes leased

aquaculture facilities, equipment and office space located in Port

Hueneme, California. The sale or wind down of the legacy business

operations may require additional time, may interfere with our

ability to achieve our business objectives and may be difficult to

manage. In addition, we cannot be sure that the sale and wind down

will be as successful in providing meaningful cash proceeds, if at

all; reducing or eliminating costs related to the legacy business;

or result in any unplanned expenditures or unknown, contingent or

other liabilities, including litigation arising in connection with

the wind down or sale of the legacy business assets and operations.

If our plans do not achieve the expected results, our business and

results of operations will be adversely impacted.

Risks Related to Clinical Development, Regulatory Approval and

Commercialization

If clinical trials of our product candidates fail to demonstrate

safety and efficacy to the satisfaction of the FDA, Health Canada

(HC) or the European Medicines Agency (EMA), or do not otherwise

produce favorable results, we may incur additional costs or

experience delays in completing, or ultimately be unable to

complete, the development and commercialization our product

candidates.

In

connection with obtaining marketing approval from regulatory

authorities for the sale of any product candidate, we must complete

preclinical development and then conduct extensive clinical trials

to demonstrate the safety and efficacy of our product candidates in

humans. Clinical trials are expensive, difficult to design and

implement, can take many years to complete and are uncertain as to

outcome. A failure of one or more clinical trials can occur at any

stage of testing. The outcome of preclinical testing and early

clinical trials may not be predictive of the success of later

clinical trials. In particular, the small number of subjects and

patients in early clinical trials of our product candidates may

make the results of these clinical trials less predictive of the

outcome of later clinical trials. The design of a clinical trial

can determine whether our results will support approval of a

product, and flaws in the design of a clinical trial may not become

apparent until the clinical trial is well advanced or completed.

There is no assurance that we will be able to design and execute a

clinical trial to support marketing approval. Moreover, preclinical

and clinical data are often susceptible to varying interpretations

and analyses, and many companies that have believed their product

candidates performed satisfactorily in preclinical studies and

clinical trials have nonetheless failed to obtain marketing

approval of their products.

Positive

results in pre-clinical studies of a product candidate may not be

predictive of similar results in humans during clinical trials, and

promising results from early clinical trials of a product candidate

may not be replicated in later clinical trials. A number of

companies in the pharmaceutical and biotechnology industries have

suffered significant setbacks in late-stage clinical trials even

after achieving promising results in early-stage development.

Accordingly, the results from completed pre-clinical studies and

clinical trials for our product candidates may not be predictive of

the results we may obtain in later stage trials or studies.

Pre-clinical studies or clinical trials may produce negative or

inconclusive results, and we may decide, or regulators may require

us, to conduct additional pre-clinical studies or clinical trials,

or to discontinue clinical trials altogether. Ultimately, we may be

unable to complete the development and commercialization of any of

our product candidates.

Interim results, top-line, initial data may not accurately reflect

the complete results of a particular study or trial.

We may

publicly disclose interim, top-line or initial data from time to

time that is based on a preliminary analysis of then-available

efficacy and safety data, and the results and related findings and

conclusions are subject to change following a more comprehensive

review of the data related to the particular study or trial. We

also make assumptions, estimates, calculations and conclusions as

part of our analyses of data, and we may not have received or had

the opportunity to fully evaluate all data. Interim, top-line and

initial data should be viewed with caution until the final data are

available. In addition, the information we may publicly disclose

regarding a particular preclinical or clinical study is based on

what is typically extensive information, and you or others may not

agree with what we determine is the material or otherwise

appropriate information to include in our disclosure, and any

information we determine not to disclose may ultimately be deemed

significant with respect to future decisions, conclusions, views,

activities or otherwise regarding a particular drug, drug candidate

or our business. If the interim, top-line or initial data that we

report differ from actual results, or if others, including

regulatory authorities, disagree with the conclusions reached, our

ability to obtain approval for, and commercialize, our product

candidates may be harmed or delayed, which could harm our business,

financial condition, operating results or prospects.

If clinical trials for our product candidates are prolonged or

delayed, we may be unable to commercialize our product candidates

on a timely basis, which would require us to incur additional costs

and delay our receipt of any revenue from potential product

sales.

We

cannot predict whether we will encounter problems with any of our

ongoing or planned clinical trials that will cause us or any

regulatory authority to delay or suspend those clinical trials. A

number of events, including any of the following, could delay the

completion of our ongoing and planned clinical trials and

negatively impact our ability to obtain regulatory approval for,

and to market and sell, a particular product

candidate:

●

conditions imposed

by the FDA or any foreign regulatory authority regarding the scope

or design of our clinical trials;

●

delays in

obtaining, or the inability to obtain, required approvals from

institutional review boards, or IRBs, or other reviewing entities

at clinical sites selected for participation in our clinical

trials;

●

insufficient supply

or deficient quality of product candidates supply or materials to

produce our product candidates or other materials necessary to

conduct our clinical trials;

●

delays in obtaining

regulatory agreement for the conduct of the clinical

trials;

●

lower than

anticipated enrollment and retention rate of subjects in clinical

trials for a variety of reasons, including size of patient

population, nature of trial protocol, the availability of approved

effective treatments for the relevant disease and competition from

other clinical trial programs for similar indications;

●

serious and

unexpected drug-related side effects experienced by patients in

clinical trials;

●

failure of

third-party contractors to meet their contractual obligations in a

timely manner;

●

pre-clinical or

clinical trials may produce negative or inconclusive results, which

may require us or any potential future collaborators to conduct

additional pre-clinical or clinical testing or to abandon projects

that we expect to be promising;

●

even if

pre-clinical or clinical trial results are positive, the FDA or

foreign regulatory authorities could nonetheless require

unanticipated additional clinical trials;

●

regulators or

institutional review boards may suspend or terminate clinical

research for various reasons, including noncompliance with

regulatory requirements;

●

product candidates

may not have the desired effects; and

●

the lack of

adequate funding to continue clinical trials.

Additionally,

changes in standard of care or regulatory requirements and guidance

may occur and we may need to amend clinical trial protocols to

reflect these changes. Such amendments may require us to resubmit

our clinical trial protocols to IRBs for re-examination, which may

impact the cost, timing or successful completion of a clinical

trial. Such changes may also require us to reassess the viability

of the program in question.

We do

not know whether our clinical trials will begin as planned, will

need to be restructured or will be completed on schedule, if at

all. Delays in clinical trials will result in increased development

costs for our product candidates. In addition, if we experience

delays in completion of, or if we terminate, any of our clinical

trials, the commercial prospects for our product candidates may be

affected and our ability to generate product revenues will be

delayed. Furthermore, many of the factors that cause, or lead to, a

delay in the commencement or completion of clinical trials may also

ultimately lead to the denial of regulatory approval of a product

candidate.

The clinical trial designs, endpoints and outcomes that will be

required to obtain marketing approval of a drug to treat chronic

ACD or any other indication are uncertain. We may never receive

marketing approval for EB01 as a treatment for chronic

ACD.

To our

knowledge, there are currently no FDA-approved treatment options

specifically indicated for chronic ACD. Accordingly, there is not a

well-established development path that, with positive outcomes in

clinical trials, would be reasonably assured of receiving marketing

approval for chronic ACD. In particular, if our Phase 2B clinical

trial of EB01 in individuals with chronic ACD is successful, we

plan to use the trial to support pivotal clinical trials designed

to establish the efficacy of EB01 to support, together with

additional long-term safety data, an application for regulatory

approval as a treatment for chronic ACD. The FDA or any regulatory

authority outside of the United States may determine that the

designs or endpoints of any potentially pivotal trial that we

conduct, or that the outcome shown on any particular endpoint in

any potentially pivotal trial that we conduct, are not sufficient

to establish a clinically meaningful benefit for EB01 in the

treatment of chronic ACD or otherwise to support approval, even if

the primary endpoint or endpoints of the trial is or are met with

statistical significance. If this occurs, our business could be

materially harmed. Moreover, if the FDA requires us to conduct

additional clinical trials beyond the ones that we currently

contemplate in order to support regulatory approval in the United

States of EB01 for the treatment of chronic ACD, our finances and

results from operations will be adversely impacted.

Likewise,

if we conduct any future clinical trials designed to support

marketing approval of EB02 as a treatment for HD or clinical trials

designed to support marketing approval of any other of our product

candidates, the FDA or any regulatory authority outside of the

United States may determine that the designs or endpoints of the

trial, or that the outcomes shown on any particular endpoint in the

trial, are not sufficient to establish a clinically meaningful

benefit or otherwise to support approval, even if the primary

endpoint of the trial is met with statistical

significance.

Our Phase 2B clinical trial of EB01 in individuals with chronic ACD

will not be sufficient to be considered a pivotal trial to support

an application for marketing approval of EB01. Even if our Phase 2B

study meets our primary endpoints, it is not certain that

additional pivotal Phase 3 studies, together with additional

long-term safety data will have positive outcomes and or will be

sufficient to enable EB01 to gain regulatory approval as a

treatment for chronic ACD.

If our

Phase 2B clinical trial of EB01 in individuals with chronic ACD

meets our primary endpoints, we plan to request an end of Phase 2

meeting with the FDA and regulatory authorities outside the United

States to seek guidance on the requirements for a new drug

application. We cannot predict the requirements for each of these

regulatory agencies and the requirements set forth by the agencies

could delay and/or negatively impact our ability to obtain

regulatory approval for, and to market and sell a particular

product candidate. We expect to be required by the FDA to conduct

two Phase 3 pivotal clinical trials in patients with chronic ACD to

establish the efficacy of EB01 to support, together with additional

long-term safety data, an application for regulatory approval of

EB01 as a treatment for chronic ACD. The likelihood that the FDA or

any regulatory authority outside the United States will concur with

our plan is uncertain. The FDA or any other regulatory authority

may instead determine that additional clinical and/or non-clinical

trials are required to establish the efficacy of EB01 as a

treatment for chronic ACD, even if the outcome of our Phase 2B

study in individuals is favorable. The risk that the FDA or any

other regulatory authority will determine that additional clinical

and/or non-clinical trials are required to establish the efficacy

of EB01 as a treatment for chronic ACD may be even higher if we

select a primary endpoint for our planned pivotal Phase 3 trials in

chronic ACD for which there is only limited data generated in our

Phase 2 studies. In addition, we intend to enroll in our study

individuals with chronic ACD caused by any of a number of different

conditions (allergens). This may also increase the risk of the FDA

or another regulatory authority determining that additional

clinical and/or non-clinical trials are required to establish the

efficacy of EB01 as a treatment for chronic ACD. If the FDA or a

regulatory authority outside of the United States makes the

determination that additional clinical and/or non-clinical trials

are required, it would result in a more expensive and potentially

longer development program for EB01 than we currently contemplate,

which could delay our ability to generate product revenues with

EB01, interfere with our ability to enter into any potential

licensing or collaboration arrangements with respect to this

program, cause the value of the company to decline, and limit our

ability to obtain additional financing.

If we experience new or additional delays or difficulties in the

enrollment of patients in our clinical trial of EB01 or any other

product candidate, our application and or receipt of marketing

approvals could be delayed or prevented.

Recruiting

patients with moderate to severe chronic ACD may be challenging as

there have not been recent clinical studies conducted with this

patient population. If we are unable to locate and enroll a

sufficient number of eligible patients to participate in clinical

trials of our product candidates including, in particular, our

ongoing trial of EB01 and our planned pivotal trials of EB01 as a

treatment for ACD, we may not be able to initiate or complete the

clinical trials.

Enrollment

delays in our ongoing or planned clinical trials may result in

increased development costs for our product candidates, which would

cause the value of the company to decline and limit our ability to

obtain additional financing. Our inability to enroll a sufficient

number of patients in our ongoing or planned clinical trials of

EB01, or any other Edesa product candidate, would result in

significant delays or may require us to abandon one or more

clinical trials altogether.

If the commercial opportunity in chronic ACD is smaller than we

anticipate, or if we elect to develop EB01 to treat only a specific

subpopulation of patients with chronic ACD, our future revenue from

EB01 will be adversely affected and our business will

suffer.

It is

critical to our ability to grow and become profitable that we

successfully identify patients with chronic ACD. Our projections of

the number of people who have chronic ACD as well as the subset who

have the potential to benefit from treatment with EB01, are based

on a variety of sources, including third-party estimates and

analyses in the scientific literature, and may prove to be

incorrect. Further, new information may emerge that changes our

estimate of the prevalence of these diseases or the number of

patient candidates for EB01. The effort to identify patients with

chronic ACD or our other potential target indications is at an

early stage, and we cannot accurately predict the number of

patients for whom treatment might be possible. Additionally, the

potentially addressable patient population for EB01 may be limited

or may not be amenable to treatment with EB01, and new patients may

become increasingly difficult to identify or access. If the

commercial opportunity in chronic ACD is smaller than we

anticipate, or if we elect to develop EB01 to treat only a specific

subpopulation of patients with chronic ACD, our future financial

performance may be adversely impacted.

While we have chosen to test our product candidates in specific

clinical indications based in part on our understanding of their

mechanisms of action, our understanding may be incorrect or

incomplete and, therefore, our product candidates may not be

effective against the diseases tested in our clinical

trials.

Our

rationale for selecting the particular therapeutic indications for

each of our product candidates is based in part on our

understanding of the mechanism of action of these product

candidates. However, our understanding of the product

candidates’ mechanism of action may be incomplete or

incorrect, or the mechanism may not be clinically relevant to the

diseases treated. In such cases, our product candidates may prove

to be ineffective in the clinical trials for treating those

diseases, and adverse clinical trial results would likely

negatively impact our business and results from

operations.

A successful sPLA2

drug has not been developed to date and we can provide no

assurances that we will be successful or that there will be no

adverse side effects.

Our

unique lead product candidates are first-in-class, novel,

non-steroidal, synthetic anti-inflammatory products that address

the need to target sPLA2

in a broad-ranged manner while avoiding any interference with the

homeostatic cPLA2 family. To date

no drug companies have successfully commercialized an sPLA2

inhibitor and as a result the efficacy and long-term side effects

are not known. There is no guarantee that we will successfully

develop and/or commercialize an sPLA2

inhibitor and/or that our product candidates will have no adverse

side effects.

Even if one of our product candidates receives marketing approval,

it may fail to achieve the degree of market acceptance by

physicians, patients, third-party payors and others in the medical

community necessary for commercial success.

If any

product candidate receives marketing approval, the approved product

may nonetheless fail to gain sufficient market acceptance by

physicians, patients, third-party payors and others in the medical

community. If an approved product does not achieve an adequate

level of acceptance, we may not generate significant product

revenues or any profits from operations. Our ability to negotiate,

secure and maintain third-party coverage and reimbursement for our

product candidates may be affected by political, economic and

regulatory developments in the United States, Canada, the European

Union and other jurisdictions. Governments continue to impose cost

containment measures, and third-party payors are increasingly

challenging prices charged for medicines and examining their cost

effectiveness, in addition to their safety and efficacy. These and

other similar developments could significantly limit the degree of

market acceptance of any of our future product candidates that

receive marketing approval.

If we are unable to establish

sales and marketing capabilities or enter into agreements with

third parties to market and any of our other current or future

product candidates, we may not be successful in commercializing the

applicable product candidate if it receives marketing

approval.

We do

not have a sales or marketing infrastructure and have no experience

as a company in the sale or marketing of pharmaceutical products.

To achieve commercial success for any approved product, we must

either develop a sales and marketing organization or outsource

these functions to third parties. There are risks involved with

establishing our own sales and marketing capabilities and entering

into arrangements with third parties to perform these services. For

example, recruiting and training a sales force is expensive and

time consuming and could delay any product launch. If the

commercial launch of a product candidate for which we recruit a

sales force and establish marketing capabilities is delayed or does

not occur for any reason, we would have prematurely or

unnecessarily incurred these commercialization expenses. This may

be costly, and our investment would be lost if we cannot retain or

reposition our sales and marketing personnel. If we enter into

arrangements with third parties to perform sales and marketing

services, our product revenues or the profitability of these

product revenues to us could be lower than if we were to market and

sell any products that we develop ourselves. In addition, we may

not be successful in entering into arrangements with third parties

to sell and market our product candidates or may be unable to do so

on terms that are acceptable to us. We likely will have little

control over such third parties, and any of them may fail to devote

the necessary resources and attention to sell and market our

products effectively. If we do not establish sales and marketing

capabilities successfully, either on our own or in collaboration

with third parties, we will not be successful in commercializing

our product candidates.

We face substantial competition, which may result in others

discovering, developing or commercializing products to treat our

target indications or markets before or more successfully than we

do.

The

development and commercialization of new drug products is highly

competitive. We face competition with respect to our current

product candidates and any products we may seek to develop or

commercialize in the future from major pharmaceutical companies,

specialty pharmaceutical companies and biotechnology companies

worldwide.

Competitors

may also include academic institutions, government agencies and

other public and private research organizations that conduct

research, seek patent protection and establish collaborative

arrangements for research, development, manufacturing and

commercialization. Many of our competitors have significantly

greater financial resources and expertise in research and

development, manufacturing, preclinical testing, conducting

clinical trials, obtaining approvals from regulatory authorities

and marketing approved products than we do. Mergers and

acquisitions in the pharmaceutical and biotechnology industries may

result in even more resources being concentrated among a smaller

number of our competitors. Smaller and other early-stage companies

may also prove to be significant competitors, particularly through

collaborative arrangements with large and established companies.

These third parties compete with us in recruiting and retaining

qualified scientific and management personnel, establishing

clinical trial sites and patient registration for clinical trials,

as well as in acquiring technologies that may be complementary to

or necessary for our programs. Our commercial opportunities could

be reduced or eliminated if our competitors develop and

commercialize products that are more effective, safer, have fewer

or less severe side effects, are approved for broader indications

or patient populations, or are more convenient or less expensive

than any products that we develop and commercializes. Our

competitors may also obtain marketing approval for their products

more rapidly than we may obtain approval for our products, which

could result in our competitors establishing a strong market

position before we are able to enter the market. If approved, our

product candidates will compete for a share of the existing market

with numerous other products being used to treat ACD.

Even if we are able to commercialize one of our product candidates

, the product may become subject to unfavorable pricing

regulations, third-party reimbursement practices or healthcare

reform initiatives, which would harm our business.

The

regulations that govern marketing approvals, pricing, coverage and

reimbursement for new drug products vary widely from country to

country. Current and future legislation may significantly change

the approval requirements in ways that could involve additional

costs and cause delays in obtaining approvals. Some countries

require approval of the sale price of a drug before it can be

marketed. In many countries, the pricing review period begins after

marketing or product licensing approval is granted and, in some

markets, prescription pharmaceutical pricing remains subject to

continuing governmental control even after initial approval is

granted. As a result, we might obtain marketing approval for a

product in a particular country, but then be subject to price

regulations that delay our commercial launch of the product,

possibly for lengthy time periods, and negatively impact the

revenues we are able to generate from the sale of the product in

that country. Adverse pricing limitations may hinder our ability to

recoup our investment in one or more product candidates, even if

our product candidates obtain marketing approval.

Our

ability to commercialize EB01 or any other product candidate

successfully also will depend in part on the extent to which

coverage and adequate reimbursement for these products and related

treatments will be available from government health administration

authorities, private health insurers and other organizations.

Government authorities and other third-party payors, such as

private health insurers and health maintenance organizations,

decide which medications they will pay for and establish

reimbursement levels. Our inability to promptly obtain coverage and

adequate reimbursement rates from both government-funded and

private payors for any approved products that we develop could have

a material adverse effect on our operating results, our ability to

raise capital needed to commercialize products and our overall

financial condition.

Product liability lawsuits against us could cause us to incur

substantial liabilities and to limit commercialization of any

products that we may develop.

We face

an inherent risk of product liability exposure related to the

testing of our product candidates in human clinical trials and will

face an even greater risk if we commercially sell any products that

we may develop. If we cannot successfully defend ourselves against

claims that our product candidates or products caused injuries, we

will incur substantial liabilities.

We have

separate liability insurance policies that cover each of our

ongoing clinical trials, which provide coverage in varying amounts.

The amount of insurance that we currently hold may not be adequate

to cover all liabilities that we may incur. We will need to

increase our insurance coverage when and if we begin conducting

more expansive clinical development of our product candidates.

Insurance coverage is increasingly expensive. We may not be able to

maintain insurance coverage at a reasonable cost or in an amount

adequate to satisfy any liability that may arise.

We will be dependent on third parties for the synthesis,

formulation, and manufacturing, including optimization, technology

transfers and scaling up of clinical scale quantities of all of our

product candidates.

We have

no direct experience in synthesizing, formulating and manufacturing

any of our product candidates, and currently lack the resources or

capability to synthesize, formulate and manufacture any of our

product candidates on a clinical or commercial scale. As a result,

we will be dependent on third parties for the synthesis,

formulation, and manufacturing, including optimization, technology

transfers and scaling up of clinical scale quantities of all our