- Sales grew 22.3 percent, including 17.5

percent organic growth

- $308.0 million in sales versus $251.9

million in sales in Q3 2017

- Net income of $8.4 million versus $2.9

million compared to Q3 2017

- GAAP diluted EPS of $0.46, compared to

$0.16 in Q3 2017

- $23.2 million in earnings before

interest, taxes, depreciation and amortization (“EBITDA”)

DXP Enterprises, Inc. (NASDAQ: DXPE) today announced

financial results for the third quarter ended September 30,

2018. The following are results for the three months and nine

months ended September 30, 2018, compared to the three months

and nine months ended September 30, 2017. A reconciliation of

the non-GAAP financial measures can be found in the back of this

press release.

Third Quarter 2018 financial highlights:

- Sales increased 22.3 percent to $308.0

million, compared to $251.9 million for the third quarter of

2017.

- Earnings per diluted share for the

third quarter was $0.46 based upon 18.4 million diluted shares,

compared to $0.16 per share in the third quarter of 2017, based on

18.2 million diluted shares.

- Earnings before interest, taxes,

depreciation and amortization (EBITDA) for the third quarter was

$23.2 million compared to $13.5 million for the third quarter of

2017, an increase of 71.9 percent. EBITDA as a percentage of sales

was 7.5 percent and 5.4 percent, respectively, comparing the third

quarter of 2018 versus 2017.

David R. Little, Chairman and CEO commented, “We are pleased

with our performance in the third quarter as the team maintained

momentum and delivered strong results. The oil and gas and

industrial economy remain firm with all key indicators remaining

positive. We achieved 22.3 percent sales growth, solid EBITDA

margins and outstanding diluted earnings per share growth. DXP’s

third quarter 2018 sales were $308.0 million. Organic sales for the

quarter increased 17.5 percent year-over-year and acquisitions

added $12.1 million in sales. EBITDA grew 71.9 percent

year-over-year. In terms of our business segments for the third

quarter of 2018, sales were $187.8 million for Service Centers,

$76.7 million for Innovative Pumping Solutions and $43.6 million

for Supply Chain Services. Business segment operating income

increased 55.6 percent year-over-year. Overall, DXP has been

trending around 20 percent growth year-over-year which is

consistent with our expectations. With the outlook for global

economic growth and oil and industrial demand remaining solid, we

still look to show improvement in organic and acquisition sales

growth and margins. We believe we are well positioned to outgrow

the market and to generate improved operating margins and returns

for the benefit of our shareholders as we begin to move into

2019.”

Kent Yee, CFO, remarked, “Our third quarter year-over-year

financial results continue to reflect the growth we have been

experiencing in fiscal 2018 and reflect our financial goals to grow

20 percent year-over-year, through a combination of organic and

acquisition sales. On a sales per day basis, DXP continues to show

sequential increases and has experienced eight consecutive quarters

of sales per day per quarter increases. Total debt outstanding as

of September 30, 2018 was $249.6 million. DXP’s secured

leverage ratio or net debt to EBITDA ratio was 2.7:1.0. We expect

to finish fiscal 2018 with strong momentum continuing into fiscal

2019.”

We will host a conference call regarding 2018 third quarter

results on the Company’s website (www.dxpe.com) Monday, November 5,

2018 at 10 am CST. Web participants are encouraged to go to the

Company’s website at least 15 minutes prior to the start of the

call to register, download and install any necessary audio

software. The online archived replay will be available immediately

after the conference call at www.dxpe.com.

Non-GAAP Financial Measures

DXP supplements reporting of net income with non-GAAP

measurements, including EBITDA, adjusted EBITDA and free cash flow.

This supplemental information should not be considered in isolation

or as a substitute for the unaudited GAAP

measurements. Additional information regarding EBITDA and free

cash flow referred to in this press release are included below

under "Unaudited Reconciliation of Non-GAAP Financial

Information."

The Company believes EBITDA provides additional information

about: (i) operating performance, because it assists in comparing

the operating performance of the business, as it removes the impact

of non-cash depreciation and amortization expense as well as items

not directly resulting from core operations such as interest

expense and income taxes and (ii) the performance and the

effectiveness of operational strategies. Additionally, EBITDA

performance is a component of a measure of the Company’s financial

covenants under its credit facility. Furthermore, some investors

use EBITDA as a supplemental measure to evaluate the overall

operating performance of companies in the industry. Management

believes that some investors’ understanding of performance is

enhanced by including this non-GAAP financial measure as a

reasonable basis for comparing ongoing results of operations. By

providing this non-GAAP financial measure, together with a

reconciliation from net income, the Company believes it is

enhancing investors’ understanding of the business and results of

operations, as well as assisting investors in evaluating how well

the Company is executing strategic initiatives.

About DXP Enterprises, Inc.

DXP Enterprises, Inc. is a leading products and service

distributor that adds value and total cost savings solutions to

industrial customers throughout the United States, Canada, Mexico

and Dubai. DXP provides innovative pumping solutions, supply chain

services and maintenance, repair, operating and production ("MROP")

services that emphasize and utilize DXP’s vast product knowledge

and technical expertise in rotating equipment, bearings, power

transmission, metal working, industrial supplies and safety

products and services. DXP's breadth of MROP products and service

solutions allows DXP to be flexible and customer-driven, creating

competitive advantages for our customers. DXP’s business segments

include Service Centers, Innovative Pumping Solutions and Supply

Chain Services. For more information, go to www.dxpe.com.

The Private Securities Litigation Reform Act of 1995 provides a

“safe-harbor” for forward-looking statements. Certain information

included in this press release (as well as information included in

oral statements or other written statements made by or to be made

by the Company) contains statements that are forward-looking. Such

forward-looking information involves important risks and

uncertainties that could significantly affect anticipated results

in the future; and accordingly, such results may differ from those

expressed in any forward-looking statement made by or on behalf of

the Company. These risks and uncertainties include, but are not

limited to; ability to obtain needed capital, dependence on

existing management, leverage and debt service, domestic or global

economic conditions, and changes in customer preferences and

attitudes. In some cases, you can identify forward-looking

statements by terminology such as, but not limited to, “may,”

“will,” “should,” “intend,” “expect,” “plan,” “anticipate,”

“believe,” “estimate,” “predict,” “potential,” “goal,” or

“continue” or the negative of such terms or other comparable

terminology. For more information, review the Company’s filings

with the Securities and Exchange Commission.

DXP ENTERPRISES, INC. AND SUBSIDIARIES UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS ($

thousands, except per share amounts)

Three Months EndedSeptember 30, Nine Months

EndedSeptember 30, 2018 2017

2018 2017 Sales $ 308,028 $ 251,930 $

905,191 $ 741,155 Cost of sales 223,958 184,967

659,560 540,741 Gross profit 84,070 66,963 245,631

200,414 Selling, general and administrative expenses 67,257

60,453 197,609 175,411 Operating income 16,813

6,510 48,022 25,003 Other (income) expense, net 120 (153 ) (1,318 )

(324 ) Interest expense 4,781 4,928 15,959

12,573 Income before income taxes 11,912 1,735 33,381 12,754

Provision for (benefit from) income taxes 3,550 (1,176 )

8,962 2,880 Net income 8,362 2,911 24,419 9,874 Net

loss attributable to NCI* (35 ) (55 ) (91 ) (360 ) Net income

attributable to DXP Enterprises, Inc. 8,397 2,966 24,510 10,234

Preferred stock dividend 23 23 68 68

Net income attributable to common shareholders $ 8,374 $

2,943 $ 24,442 $ 10,166 Diluted

earnings per share attributable to DXP Enterprises, Inc. $ 0.46

$ 0.16 $ 1.33 $ 0.56 Weighted

average common shares and common equivalent shares outstanding

18,404 18,234 18,387 18,242 *NCI

represents non-controlling interest

Business segment financial highlights:

- Service

Centers’ revenue for the third quarter was $187.8 million,

an increase of 16.7 percent year-over-year with an 11.0 percent

operating income margin. Organic sales increased 9.2 percent

year-over-year.

- Innovative

Pumping Solutions’ revenue for the third quarter was $76.7

million, an increase of 50.2 percent year-over-year with a 11.4

percent operating income margin.

- Supply Chain

Services’ revenue for the third quarter was $43.6 million,

an increase of 8.9 percent year-over-year with a 8.9 percent

operating income margin.

SEGMENT DATA

($ thousands, unaudited)

Three Months EndedSeptember 30, Nine Months

EndedSeptember 30, Sales 2018

2017 2018 2017 Service Centers $

187,763 $ 160,863 $ 556,700 $ 474,324 Innovative Pumping Solutions

76,662 51,027 218,561 144,555 Supply Chain Services 43,603

40,040 129,930 122,276

Total DXP Sales

$ 308,028 $ 251,930

$ 905,191 $ 741,155

Three Months EndedSeptember 30, Nine Months

EndedSeptember 30, Operating Income 2018

2017 2018 2017 Service Centers $ 20,590 $

15,550 $ 58,353 $ 47,308 Innovative Pumping Solutions 8,773 1,838

24,109 7,103 Supply Chain Services 3,886 3,982 12,196

11,758

Total segments operating income $

33,249 $ 21,370 $

94,658 $ 66,169

Reconciliation of Operating Income for

Reportable Segments

($ thousands, unaudited)

Three Months EndedSeptember 30, Nine Months

EndedSeptember 30, 2018 2017

2018 2017 Operating income for reportable

segments $ 33,249 $ 21,370 $ 94,658 $ 66,169 Adjustment for:

Amortization of intangibles 4,098 4,336 12,575 12,943 Corporate

expenses 12,338 10,524 34,061 28,223

Total operating income 16,813 6,510 48,022 25,003 Interest expense

4,781 4,928 15,959 12,573 Other expense (income), net 120

(153 ) (1,318 ) (324 )

Income before income taxes

11,912 1,735 33,381

12,754

Unaudited Reconciliation of Non-GAAP

Financial Information

($ thousands, unaudited)

The following table is a reconciliation of

EBITDA and adjusted EBITDA, a non-GAAP financial measure, to income

before income taxes, calculated and reported in accordance with

U.S. GAAP.

Three Months EndedSeptember 30, Nine

Months EndedSeptember 30, 2018 2017

2018 2017 Income before income taxes 11,912

1,735 33,381 12,754 Plus: interest expense 4,781 4,928 15,959

12,573 Plus: depreciation and amortization 6,506 6,836 19,710

20,598

EBITDA 23,199

13,499 69,050 45,925

Plus: NCI loss before tax 64 85 120 578 Plus: Stock

compensation expense 526 382 2,023 1,392

Adjusted EBITDA 23,789 13,966

71,193 47,895

DXP ENTERPRISES, INC. AND

SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED

BALANCE SHEETS

($ thousands, except per share

amounts)

September 30, 2018 December 31, 2017

ASSETS Current assets: Cash $ 15,994 $ 22,047

Restricted Cash 396 3,532 Accounts receivable, net of allowances

for doubtful accounts 183,454 167,272 Inventories 116,545 91,413

Costs and estimated profits in excess of billings 38,432 26,915

Prepaid expenses and other current assets 5,640 5,296 Federal

income taxes receivable 1,323 1,440

Total current

assets 361,784 317,915 Property and equipment,

net 52,617 53,337 Goodwill 194,052 187,591 Other intangible assets,

net of accumulated amortization 71,783 78,525 Other long-term

assets 1,596 1,715

Total assets $

681,832 $ 639,083 LIABILITIES

AND EQUITY Current liabilities: Current maturities of

long-term debt $ 3,394 $ 3,381 Trade accounts payable 91,117 80,303

Accrued wages and benefits 16,733 18,483 Customer advances 2,876

2,189 Billings in excess of costs and estimated profits 5,554 4,249

Other current liabilities 16,703 16,220

Total current

liabilities 136,377 124,825 Long-term debt, less

unamortized debt issuance costs 237,434 238,643 Other long-term

liabilities 2,611 — Deferred income taxes 8,048 7,069

Total long-term liabilities 248,093

245,712 Total Liabilities 384,470

370,537 Equity: Total DXP Enterprises, Inc.

equity 296,885 267,979 Non-controlling interest

477 567

Total Equity 297,362

268,546 Total liabilities and equity $

681,832 $ 639,083

Unaudited Reconciliation of Non-GAAP

Financial Information

($ thousands, unaudited)

The following table is a reconciliation of

free cash flow, a non-GAAP financial measure, to cash flow from

operating activities, calculated and reported in accordance with

U.S. GAAP.

Three Months EndedSeptember 30, Nine Months

EndedSeptember 30, 2018 2017

2018 2017 Net cash provided by

operating activities $ 16,825 $ 673 $ 9,842 $ 8,527 Less: purchase

of equipment 2,189 1,039 7,705 2,157

Free cash flow 14,636 (366 )

2,137 6,370

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181105005222/en/

DXP Enterprises, Inc.Kent YeeSenior Vice President,

CFOwww.dxpe.com

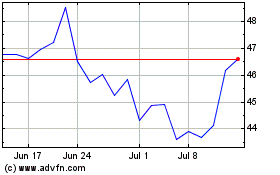

DXP Enterprises (NASDAQ:DXPE)

Historical Stock Chart

From Mar 2024 to Apr 2024

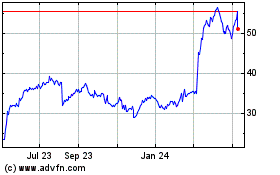

DXP Enterprises (NASDAQ:DXPE)

Historical Stock Chart

From Apr 2023 to Apr 2024