As filed with the Securities and Exchange Commission on

June 21, 2019

Registration No. 333-_________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

DXP Enterprises, Inc.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

Texas

(State or other jurisdiction of

incorporation or organization)

|

76-0509661

(I.R.S. Employer

Identification No.)

|

5301 Hollister

Houston, Texas 77040

(713) 996-4700

(

Address, Including Zip Code, and Telephone Number,

Including Area Code, of Registrant’s Principal Executive Offices)

Kent Yee

Senior Vice President and Chief Financial Officer

5301 Hollister

Houston, Texas 77040

(713) 996-4700

(Name, Address, Including Zip Code, and Telephone Number,

Including Area Code, of Agent for Service)

Copy to:

Norton Rose Fulbright US LLP

1301 McKinney, Suite 5100

Houston, Texas 77010

(713) 651-5151

Attention: Brian P. Fenske

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this registration statement.

If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box.

¨

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box.

þ

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

þ

If this form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

Large accelerated Filer

¨

|

Accelerated filer

þ

|

|

Non-accelerated filer

¨

|

Smaller Reporting Company

¨

|

|

|

Emerging Growth Company

¨

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act.

¨

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

Title of Each Class of

Securities to be Registered

|

Amount to be Registered

|

Proposed Maximum Offering Price Per Unit / Maximum

Aggregate Offering Price

|

Amount of Registration Fee

|

|

Senior Debt Securities

|

(1)

|

(1)

|

(2)

|

|

Subordinated Debt Securities

|

(1)

|

(1)

|

(2)

|

|

Common Stock, par value $.01 per share

|

(1)

|

(1)

|

(2)

|

|

Preferred Stock, par value $1.00 per share

|

(1)

|

(1)

|

(2)

|

|

Warrants

|

(1)

|

(1)

|

(2)

|

|

Total

|

(1)

|

(1)

|

(2)

|

|

|

|

|

(1)

|

There are being registered hereunder such indeterminate number of shares of common stock and preferred stock, such indeterminate number of warrants, such indeterminate principal amount of senior debt securities and such indeterminate principal amount of subordinated debt securities as may be sold from time to time by DXP Enterprises, Inc., each at indeterminate prices. DXP Enterprises, Inc., is also registering hereunder such indeterminate number of shares of common stock and preferred stock and amount of senior debt securities or subordinated debt securities as may be issued upon conversion of or exchange for preferred stock or debt securities that provide for conversion or exchange, upon exercise of warrants or pursuant to the anti-dilution provisions of any such securities.

|

|

|

|

|

(2)

|

DXP Enterprises, Inc. is relying upon Rules 456(b) and 457(r) under the Securities Act of 1933 and, accordingly, is deferring payment of all of the registration fee in connection with this registration statement.

|

PROSPECTUS

DXP Enterprises, Inc.

Senior Debt Securities

Subordinated Debt Securities

Common Stock

Preferred Stock

Warrants

This prospectus will allow us to issue from time to time an indeterminate number of our senior debt securities, subordinated debt securities, common stock, $0.01 par value, preferred stock, $1.00 par value, and warrants from time to time at prices and on terms to be determined at or prior to the time of the offering. We refer to our senior debt securities and our subordinate debt securities collectively as the “debt securities”, and we refer to our debt securities, common stock, preferred stock, and warrants collectively as the “securities.” We may offer and sell these securities to or through one or more underwriters, dealers and agents, or directly to purchasers, on a continuous or delayed basis. This prospectus describes the general terms of these securities. The specific terms of any securities and the specific manner in which we will offer them will be included in a supplement to this prospectus relating to that offering.

We encourage you to carefully read this prospectus and any prospectus supplement before you invest in our securities. We also encourage you to read the documents we have referred you to in the “Where You Can Find More Information” section of this prospectus for information on us and for our financial statements. This prospectus may not be used to consummate sales of our securities unless accompanied by a prospectus supplement.

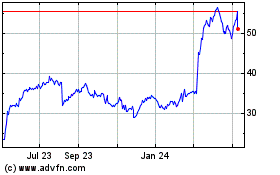

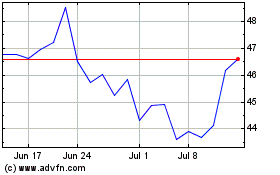

Our common stock is traded on The NASDAQ Global Select Market (“NASDAQ”) under the symbol “DXPE.”

We urge you to carefully review and consider the information under the heading “Risk Factors” on page 2 of this prospectus and in the applicable prospectus supplement before investing in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is

June 21, 2019

.

|

|

|

|

|

|

|

|

|

|

TABLE OF CONTENTS

|

|

|

|

|

|

|

Page

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOTE OF CAUTION REGARDING FORWARD-LOOKING STATEMENTS

|

|

|

|

|

|

|

|

|

|

|

USE OF PROCEEDS

|

|

|

|

|

|

|

|

|

|

PLAN OF DISTRIBUTION

|

|

|

|

|

|

|

|

|

|

|

DESCRIPTION OF DEBT SECURITIES

|

|

|

|

|

|

|

|

|

|

|

DESCRIPTION OF CAPITAL STOCK AND INDEMNIFICATION OF DIRECTORS AND OFFICERS

|

|

|

|

|

|

|

|

|

|

DESCRIPTION OF WARRANTS

|

|

|

|

|

|

|

|

|

|

LEGAL MATTERS

|

|

|

|

|

|

|

|

|

|

EXPERTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

|

|

|

|

|

|

|

|

|

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

|

|

|

|

|

|

|

|

|

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or SEC, using a “shelf” registration process under the Securities Act of 1933, as amended (the “Securities Act”). Under this shelf process, we may sell the securities described in this prospectus in one or more offerings. This prospectus provides you with a general description of the securities we may offer. Each time we sell securities, we will provide a prospectus supplement that will contain specific information about the terms of that offering. The prospectus supplement may also add, update or change information contained in this prospectus. If information varies between this prospectus and the Company’s prospectus supplement, you should rely on the information in the Company’s prospectus supplement. You should read both the prospectus and any prospectus supplement together with the additional information described under the heading “Where You Can Find More Information.”

In making your investment decision, you should rely only on the information contained in this prospectus, any prospectus supplement and the documents we have incorporated by reference in this prospectus as provided under “Incorporation of Certain Information by Reference.” We have not authorized anyone else to give you different information. We are not offering these securities in any jurisdiction where the offer is not permitted. You should not assume that the information in this prospectus or any prospectus supplement is accurate as of any date other than the dates of those documents. You should not assume that the information contained in the documents incorporated by reference in this prospectus or in any prospectus supplement is accurate as of any date other than the respective dates of those documents.

As used in this prospectus, the terms “DXP,” “Company,” “we,” “our,” “ours” and “us” refer to DXP Enterprises, Inc. and its subsidiaries, except where the context otherwise requires or as otherwise indicated.

DXP ENTERPRISES, INC.

DXP was incorporated in Texas in 1996 to be the successor to SEPCO Industries, Inc., founded in 1908. Since our predecessor company was founded, we have primarily been engaged in the business of distributing maintenance, repair and operating (“MRO”) products, equipment and service to industrial customers. The Company is organized into three segments: Service Centers, Innovative Pumping Solutions and Supply Chain Services.

The Service Centers are engaged in providing MRO products, equipment and integrated services, including technical expertise and logistics capabilities, to industrial customers with the ability to provide same day delivery. We offer our customers a single source of supply on an efficient and competitive basis by being a first-tier distributor that can purchase products directly from manufacturers. As a first-tier distributor, we are able to reduce our customers’ costs and improve efficiencies in the supply chain. We offer a wide range of industrial MRO products, equipment and integrated services through a continuum of customized and efficient MRO solutions. We also provide services such as field safety supervision, in-house and field repair and predictive maintenance. DXP Service Centers provide a wide range of MRO products in the rotating equipment, bearing, power transmission, hose, fluid power, metal working, industrial supply and safety product and service categories.

DXP’s Supply Chain Services (SCS) segment manages all or part of its customers’ supply chains, including procurement and inventory management. The SCS segment provides fully outsourced MRO solutions for sourcing MRO products including, but not limited to, the following: inventory optimization and management; store room management; transaction consolidation and control; vendor oversight and procurement cost optimization; productivity improvement services; and customized reporting. Our mission is to help our customers become more competitive by reducing their indirect material costs and order cycle time by increasing productivity and by creating enterprise-wide inventory and procurement visibility and control.

DXP’s Innovative Pumping Solutions® (IPS) segment provides integrated, custom pump skid packages, pump remanufacturing and manufactures branded private label pumps to meet the capital equipment needs of our global customer base. Our IPS segment provides a single-source for engineering, systems design and fabrication for unique customer specifications. DXP leverages its MRO product inventories and breadth of authorized products to lower the total cost and maintain the quality of our pump packages.

Our principal executive office is located at 5301 Hollister, Texas 77040, and our telephone number is (713) 996-4700. Our website address on the Internet is www.dxpe.com. Information contained on our website is not incorporated by reference in this prospectus, and you should not consider information contained on our website as part of this prospectus.

RISK FACTORS

An investment in our securities involves risks. We urge you to carefully consider all of the information contained in or incorporated by reference in this prospectus and other information which may be incorporated by reference in this prospectus or any prospectus supplement as provided under “Incorporation of Certain Information by Reference,” including our Annual Reports on Form 10-K for the fiscal year ended December 31, 2018, and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2019, as updated by annual, quarterly and other reports and documents we file with the SEC on or after the date of this prospectus and that are incorporated by reference herein. This prospectus also contains forward-looking statements that involve risks and uncertainties. Please read “Forward-Looking Statements.” Our actual results could differ materially from those anticipated in the forward-looking statements as a result of certain factors, including the risks described elsewhere in this prospectus or any prospectus supplement and in the documents incorporated by reference into this prospectus or any prospectus supplement. If any of these risks occur, our business, financial condition or results of operation could be adversely affected.

NOTE OF CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein and therein contain or incorporate by reference, and our officers and representatives may from time to time make, statements that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act, Section 21E of the Exchange Act of 1934, as amended (the “Exchange Act”), and the U.S. Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “intend,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “goal,” or “continue” or the negative of such terms or other comparable terminology. You are cautioned that any such forward-looking statements involve significant known and unknown risks, uncertainties and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by those forward-looking statements. These factors include, but are not limited to, the following:

|

|

|

|

•

|

decreased capital expenditures in the energy industry, which adversely impacts our customers’ demand for our products and services;

|

|

|

|

|

•

|

direct sales from manufacturers of products to end users;

|

|

|

|

|

•

|

changes in our customer and product mix, or adverse changes to the cost of goods we sell;

|

|

|

|

|

•

|

a deterioration of the oil and gas sector;

|

|

|

|

|

•

|

increased shipping and third-party transportation costs;

|

|

|

|

|

•

|

adverse weather events or natural disasters;

|

|

|

|

|

•

|

loss of or failure to attract and retain key personnel;

|

|

|

|

|

•

|

failing to successfully remediate internal controls weaknesses;

|

|

|

|

|

•

|

new or modified statutory or regulatory requirements;

|

|

|

|

|

•

|

general economic and business conditions, and volatility in commodity and energy prices;

|

|

|

|

|

•

|

risks associated with operating in foreign countries;

|

|

|

|

|

•

|

ability to implement internal growth strategy;

|

|

|

|

|

•

|

ability to refinance existing debt or comply with covenants of credit facilities;

|

|

|

|

|

•

|

risks associated with future acquisitions and acquisition strategy;

|

|

|

|

|

•

|

personal injury and product liability claims;

|

|

|

|

|

•

|

changing prices and market conditions; and

|

|

|

|

|

•

|

such other factors as discussed throughout the “Risk Factors” sections of this prospectus, throughout the Management’s Discussion and Analysis of Financial Condition and Results of Operations and Risk Factors Sections of our Annual Report on Form 10-K for the most recent fiscal year, and in other reports that we file with the SEC from time to time.

|

While our forward-looking statements reflect our best judgment about future events and trends based on the information currently available to us, our results of operations can be affected by the assumptions we make or by risks and uncertainties known or unknown to us, including those described under “Risk Factors” in this prospectus, in our Annual Report on Form 10-K for the most recent fiscal year and other reports that we file with the SEC from time to time. Because such forward-looking statements are subject to risks and uncertainties and our actual results could differ materially from those in such forward-looking statements, the factors set forth under the

heading “Risk Factors” in this prospectus and in our most recent Annual Report on Form 10-K and other reports that we file with the SEC from time to time, among others, in some cases have affected, and in the future could affect, our actual results and could cause our actual results to differ materially from those expressed in any forward-looking statement made by us. Therefore, we cannot guarantee and you should not rely on the accuracy of the forward-looking statements.

All forward-looking statements included in this prospectus are made as of the date hereof, based on information available to us as of the date hereof, and we assume no obligation to update any such forward-looking statement or statements. All forward-looking statements incorporated by reference into this prospectus are made as of the date they were originally made based on information available to us on the date such statements were originally made, and we assume no obligation to update any such forward-looking statement or statements.

USE OF PROCEEDS

Unless we inform you otherwise in the prospectus supplement, we will use the net proceeds from the sale of the offered securities for general corporate purposes, which may include capital expenditures, working capital, acquisitions, repayment or refinancing of indebtedness, investments in our subsidiaries or repurchasing or redeeming our securities. Pending any specific application, we may initially invest funds in short-term marketable securities or apply them to the reduction of short-term indebtedness.

PLAN OF DISTRIBUTION

We may use this prospectus and any accompanying prospectus supplement to sell our securities from time to time as follows:

|

|

|

|

•

|

directly to purchasers;

|

|

|

|

|

•

|

through any other method permitted by applicable law.

|

We, or agents designated by us, may directly solicit, from time to time, offers to purchase our securities. Any such agent may be deemed to be an underwriter as that term is defined in the Securities Act. We will name the agents involved in the offer or sale of our securities and describe any commissions payable by us to these agents in the prospectus supplement. Unless otherwise indicated in the prospectus supplement, these agents will be acting on a best efforts basis for the period of their appointment. The agents may be entitled under agreements (which may be entered into with us) to indemnification by us against specific liabilities, including liabilities under the Securities Act. The agents may also be our customers or may engage in transactions with or perform services for us in the ordinary course of business.

If we utilize any underwriters in the sale of our securities in respect of which this prospectus is delivered, we will enter into an underwriting agreement with those underwriters at the time of sale to them. We will set forth the names of these underwriters and the terms of the transaction in the prospectus supplement, which will be used by the underwriters to make resales of our securities in respect of which this prospectus is delivered to the public. We may indemnify the underwriters under the relevant underwriting agreement against specific liabilities, including liabilities under the Securities Act. The underwriters may also be our customers or may engage in transactions with or perform services for us in the ordinary course of business.

If we utilize a dealer in the sale of our securities in respect of which this prospectus is delivered, we will sell those securities to the dealer, as principal. The dealer may then resell those securities to the public at varying prices to be determined by the dealer at the time of resale. We may indemnify the dealers against specific liabilities, including liabilities under the Securities Act. The dealers may also be our customers or may engage in transactions with, or perform services for us in the ordinary course of business.

To the extent that we make sales through one or more underwriters or agents in at-the-market offerings, we will do so pursuant to the terms of a sales agency financing agreement or other at-the-market offering arrangement between us and the underwriters or agents. If we engage in at-the-market sales pursuant to any such agreement, we will issue and sell securities through one or more underwriters or agents, which may act on an agency basis or on a principal basis. During the term of any such agreement, we may sell securities on a

daily basis in exchange transactions or otherwise as we agree with the underwriters or agents. The agreement will provide that any securities sold will be sold at prices related to the then-prevailing market prices for our securities. Therefore, exact figures regarding proceeds that will be raised or commissions to be paid cannot be determined at this time. Pursuant to the terms of any agreement, we also may agree to sell, and the relevant underwriters or agents may agree to solicit offers to purchase, blocks of our common stock or other securities. The terms of any such agreement will be set forth in more detail in a prospectus supplement to this prospectus. In the event that any underwriter or agent acts as principal or broker-dealer acts as underwriter, it may engage in certain transactions that stabilize, maintain or otherwise affect the price of our securities. We will describe any such activities in the prospectus supplement relating to the transaction.

The place and time of delivery for the securities in respect of which this prospectus is delivered will be set forth in the prospectus supplement.

DESCRIPTION OF DEBT SECURITIES

The following description sets forth the material terms and provisions of the debt securities to which any prospectus supplement may relate. Other terms, and the particular terms of a specific series of debt securities (which differ from the terms described below), will be described in the prospectus supplement relating to that series. The debt securities will be senior debt securities or subordinated debt securities. The senior debt securities will be issued under an indenture (the “Senior Indenture”) to be entered into among us and a trustee named in the applicable prospectus supplement, as trustee (the “Senior Trustee”), and the subordinated debt securities will be issued under a separate indenture (the “Subordinated Indenture”) to be entered into among us and a trustee to be named in the applicable prospectus supplement, as trustee (the “Subordinated Trustee”). The term “Trustee” used in this prospectus shall refer to the Senior Trustee or the Subordinated Trustee, as appropriate. The Senior Indenture and the Subordinated Indenture are sometimes collectively referred to herein as the “Indentures” and individually as “Indenture.” The Indentures are subject to and governed by the Trust Indenture Act of 1939, as amended (the “TIA”), and may be supplemented from time to time following execution. Capitalized terms used in this section and not otherwise defined in this section will have the respective meanings assigned to them in the Indentures.

General

The debt securities will be our direct obligations. The prospectus supplement relating to a particular issue of debt securities will describe the terms of those debt securities and the related Indenture, which may include (without limitation) the following:

|

|

|

|

•

|

the title and series of the debt securities;

|

|

|

|

|

•

|

any limit on the aggregate principal amount of the debt securities;

|

|

|

|

|

•

|

the price or prices at which the debt securities will be issued;

|

|

|

|

|

•

|

the maturity date or dates, or the method of determining the maturity date or dates, of the debt securities;

|

|

|

|

|

•

|

the interest rate or rates (which may be fixed, variable or a combination thereof) per annum of the debt securities or the method of determining the interest rate or rates of the debt securities;

|

|

|

|

|

•

|

if applicable, the date or dates from which interest on the debt securities will accrue or the method or methods by which the date or dates are to be determined, the interest payment dates, the date or dates on which payment of interest will commence and the regular record dates for any interest payable on such interest payment dates;

|

|

|

|

|

•

|

if applicable, the date after which and the price or prices at which the debt securities may, pursuant to any optional redemption provisions, be redeemed at our option or at the option of the holders of the debt securities and the other detailed terms and provisions of such optional redemption;

|

|

|

|

|

•

|

the extent to which any of the debt securities will be issuable in temporary or permanent global form and, if so, the identity of the depositary for the global debt security and any additional information related to the global debt securities;

|

|

|

|

|

•

|

the denomination or denominations of debt securities;

|

|

|

|

|

•

|

whether the debt securities will be issued in registered or bearer form or both and, if in bearer form, the related terms and conditions and any limitations on issuance of such bearer debt securities (including exchange for registered debt securities of the same series);

|

|

|

|

|

•

|

information with respect to book-entry procedures;

|

|

|

|

|

•

|

whether any of the debt securities will be issued as original issue discount securities;

|

|

|

|

|

•

|

each office or agency where, subject to the terms of the Indenture, the debt securities may be presented for registration of transfer or exchange;

|

|

|

|

|

•

|

if other than the U.S. dollar, the currencies or currency units in which the debt securities are issued and in which the principal of, premium and interest, if any, on, and additional amounts, if any, in respect of the debt securities will be payable;

|

|

|

|

|

•

|

if other than the Trustee, the identity of each security registrar, paying agent and authenticating agent; and

|

|

|

|

|

•

|

any other terms of the debt securities.

|

Covenants

Under the Indentures, we have agreed to:

|

|

|

|

•

|

pay the principal of, interest and any premium on, the debt securities when due;

|

|

|

|

|

•

|

maintain a place of payment;

|

|

|

|

|

•

|

deposit sufficient funds with any paying agent on or before the due date for any principal, interest or premium;

|

|

|

|

|

•

|

deliver a certificate to the trustee at the end of each fiscal year reviewing our obligations under the Indentures; and

|

|

|

|

|

•

|

preserve and keep in full force and effect our existence, rights and franchises.

|

Events of Default

Unless otherwise specified in the applicable prospectus supplement, each of the following events will be an Event of Default under an Indenture with respect to any series of debt securities issued under that Indenture:

|

|

|

|

•

|

failure to pay principal of (or premium, if any, on) any debt security of the series when due;

|

|

|

|

|

•

|

failure to deposit a sinking fund payment or any other such analogous required payment, if any, when due by the terms of a debt security of the series;

|

|

|

|

|

•

|

failure to pay any interest on any debt security of the series when due, continued for 30 days;

|

|

|

|

|

•

|

failure to perform or comply with any covenant in the applicable Indenture or related supplemental indenture, continued for 90 days after written notice as provided in the Indenture;

|

|

|

|

|

•

|

certain events in bankruptcy, insolvency or reorganization affecting us; and

|

|

|

|

|

•

|

any other Event of Default set forth in the applicable Indenture or supplemental indenture relating to the debt securities of that series.

|

An Event of Default for a particular series of debt securities does not necessarily constitute an Event of Default for any other series of debt securities issued under an Indenture. The applicable Trustee may withhold notice to the holders of a series of debt securities of any default, except payment defaults on those debt securities, if it considers such withholding to be in the interest of the holders.

If an Event of Default occurs and is continuing, then the applicable Trustee or the holders of a specified percentage in aggregate principal amount of the debt securities of that series may declare the entire principal amount of the debt securities of that series to be due and payable immediately; provided, however, that the holders of a majority of the aggregate principal amount of the debt securities of that series may, under certain circumstances, void the declaration.

Subject to provisions in each Indenture relating to its duties in case an Event of Default shall have occurred and be continuing, no Trustee will be under an obligation to exercise any of its rights or powers under that Indenture at the request or direction of any holders of debt securities then outstanding under that Indenture, unless such holders shall have offered to the applicable Trustee reasonable indemnity. In general, such reasonable indemnity is provided, the holders of a majority in aggregate principal amount of the outstanding debt securities of any series will have the right to direct the time, method and place of conducting any proceeding for any remedy available to the applicable Trustee or exercising any power conferred on the applicable Trustee for any series of debt securities.

Defeasance

When we use the term “defeasance,” we mean a discharge from some or all of our obligations under the applicable Indenture. We may choose to either discharge our obligations on the debt securities of any series in a legal defeasance or to be released from covenant restrictions on the debt securities of any series in a covenant defeasance. We may do so at any time after we deposit with the applicable trustee sufficient cash or government securities to pay the principal, any interest or premium and any other sums due on the stated maturity date or a redemption date of the debt securities of the series. If we choose the legal defeasance option, the holders of the debt securities

of the series will not be entitled to the benefits of the applicable Indenture, except for certain obligations, including obligations to register the transfer or exchange of debt securities, to replace lost, stolen or mutilated debt securities, to pay principal and any premium or interest on the originally-stated due dates and certain other obligations set forth in the Indenture.

We may discharge our obligations under the Indentures or be released from covenant restrictions only if we meet certain requirements. Among other things, we must deliver to the trustee an opinion of our legal counsel to the effect that holders of the series of debt securities will not recognize income, gain or loss for U.S. federal income tax purposes as a result of such defeasance and will be subject to U.S. federal income tax on the same amount and in the same manner and at the same times as would have been the case if such deposit and defeasance had not occurred. In the case of legal defeasance only, this opinion must be based on either a ruling received from or published by the Internal Revenue Service or a change in U.S. federal income tax law since the date of the Indenture. No Event of Default with respect to the debt securities discharged shall have occurred or be continuing on the date of the deposit in furtherance of defeasance.

Subordination

Debt securities of a series may be subordinated to our “Senior Indebtedness,” which we define generally as money borrowed, including guarantees, by us or, if applicable to any series of outstanding debt securities, by our subsidiaries and guaranteed by us that is not expressly subordinate or junior in right of payment to any of our or, if applicable, any of our subsidiary’s other indebtedness. Subordinated debt securities will be subordinate in right of payment, to the extent and in the manner set forth in the Indenture, the related supplemental indenture and the prospectus supplement relating to such series, to the prior payment of all of our indebtedness and, if applicable, that of any of our subsidiaries that is designated as “Senior Indebtedness” with respect to the series. Under any Subordinated Indenture, payment of the principal, interest and premium, if any, on the subordinated debt securities will generally be subordinated and junior in right of payment to the prior payment in full of all Senior Indebtedness. The Subordinated Indenture will provide that no payment of principal, interest and any premium on the subordinated debt securities may be made in the event:

|

|

|

|

•

|

of any insolvency, bankruptcy or similar proceeding involving us or our property until payment in full of the Senior Indebtedness; or

|

|

|

|

|

•

|

we fail to pay the principal, interest, premium, if any, or any other amounts on any Senior Indebtedness when due or during the continuance of certain defaults on any Senior Indebtedness unless such payments are approved by the representatives of all forms of the Senior Indebtedness.

|

|

|

|

|

•

|

Any Subordinated Indenture will not limit the amount of Senior Indebtedness that we may incur.

|

No Personal Liability of Officers, Directors, Employees or Stockholders

No director, officer, employee or stockholder, as such, of ours or any of our affiliates shall have any personal liability in respect of our obligations under any Indenture or the debt securities by reason of his, her or its status as such.

DESCRIPTION OF CAPITAL STOCK

The following is a description of our capital stock and a summary of the rights of our stockholders and provisions pertaining to indemnification of our directors and officers. You should also refer to our Restated Articles of Incorporation (the Company’s certificate of formation), as amended, and our Bylaws, which are incorporated by reference in this prospectus, and to Texas law.

General

The Company has an authorized capitalization of 110,000,000 shares of capital stock, consisting of 100,000,000 shares of common stock, $0.01 par value, and 10,000,000 shares of preferred stock, $1.00 par value, of which 1,000,000 shares have been designated Series A Preferred Stock and 1,000,000 shares have been designated Series B Convertible Preferred Stock. We have reserved a total of (i) 1,000,000 shares of our common stock for grants of options and restricted stock awards under our stock plans and (ii) 840,000 shares of our common stock for conversion of Series B Convertible Preferred Stock. As of May 31, 2019, there were

17,600,518

shares of common stock,

1,122

shares of Series A Preferred Stock and

15,000

shares of Series B Convertible Preferred Stock outstanding. As of May 31, 2019, there were

370

holders of record of common stock, four holders of Series A Preferred Stock and three holders of Series B Convertible Preferred Stock.

Common Stock

Dividends

. The holders of shares of Series B Convertible Preferred Stock are entitled to dividends before the payment of any dividends to holders of shares of common stock. The holders of shares of common stock have no right or preference to the holders of shares of any other class of capital stock of the Company in respect of the declaration or payment of any dividends or distributions by the Company. Subject to the preferential rights of any holders of any outstanding series of preferred stock, the holders of shares of common stock shall be entitled to equally receive any dividends or distributions if and when declared by the Board of Directors out of any funds legally available for that purpose.

Liquidation, Dissolution or Winding Up

. Subject to the required cash payments to the Series A Preferred Stock and the Series B Convertible Preferred Stock and the prior rights of any other series of preferred stock then outstanding, after payment of liabilities the remainder of the assets of the Company, if any, shall be divided and distributed ratably among the holders of the Series B Convertible Preferred Stock and the common stock.

Redemption

. No shares of common stock are callable or redeemable by the Company.

Conversion

. No holder of common stock has the right to convert or exchange any such shares with or into any other shares of capital stock of the Company.

Voting

. Each share of common stock entitles the holder thereof to one vote, in person or by proxy, at any and all meetings of the shareholders of the Company on all propositions presented to the shareholders generally. Except as specifically provided in the TBOC or in the Company’s Restated Articles of Incorporation, as amended, the affirmative vote required for stockholder action shall be that of holders of a majority of the shares entitled to vote and represented at a meeting at which a quorum is present. Voting is non-cumulative.

Preemptive Rights.

No holder of any security of the Company is entitled to preemptive rights.

Preferred Stock Issuances.

The Company’s Restated Articles of Incorporation, as amended, allow the Board of Directors to issue shares of preferred stock without shareholder approval on such terms as the Board of Directors may determine. The rights of all the holders of our common stock will be subject to, and may be adversely affected by, the rights of the holders of any preferred stock that may be issued in the future. See “Certain Anti-Takeover Effects of Certain Provisions of the Company’s Restated Articles of Incorporation, Bylaws and the Texas Business Organizations Code” below.

Preferred Stock

The following description of the terms of the preferred stock sets forth the material terms and provisions of the preferred stock to which any prospectus supplement may relate. Other terms of any series of the preferred stock offered by any prospectus supplement will be described in that prospectus supplement. The description of the provisions of the preferred stock set forth below and in any prospectus supplement is subject to and qualified in its entirety by reference to our Restated Articles of Incorporation, as amended, relating to each series of the preferred stock.

Our Series A Preferred Stock has a liquidation cash payment right of $100 prior to any distribution of assets available for distribution to any other shareholder. It has no dividend preference, conversion right or mandatory redemption features. Holders of our Series A Preferred Stock are entitled to 1/10 of a vote for each share on all matters submitted to a stockholder vote.

Our Series B Preferred Stock has, subject to the Series A Preferred Stock liquidation cash payment right, a liquidation cash payment right of $100 prior to any distribution of assets available for distribution to any other shareholder and thereafter has the right to share ratably in all assets remaining after payment of liabilities and the satisfaction of the liquidation preferences of any other outstanding shares of preferred stock. Our Series B Preferred Stock also has the right to receive dividends out of any funds available for that purpose at the rate of 6% per annum of the stated value of such Series B Preferred Stock. The Company, at its option, may redeem the Series B Preferred Stock, in whole or in part, five years from its date of issuance. However, no shares of Series B Preferred Stock may be redeemed unless all accrued dividends on all outstanding shares of Series B Preferred Stock shares have been paid for all past dividend periods and full dividends for the current period, except those to be redeemed, have been paid or declared and set apart for payment. Each share of Series B Preferred Stock is convertible at any time prior to redemption, at the holder’s option, into 56 shares of common stock, as a result

of the split of the Company’s common stock on a two-for-one basis declared by the Board of Directors on September 8, 2008. Holders of our Series B Preferred Stock are entitled to 1/10 of a vote for each share on all matters submitted to a stockholder vote.

The preferred stock may be issued from time to time by our Board of Directors as shares of one or more series. Subject to the provisions of our Restated Articles of Incorporation, as amended, and limitations prescribed by law, our Board of Directors is expressly authorized to adopt resolutions to issue the shares, fix the number of shares, change the number of shares constituting any series and provide for or change the voting powers, designations, preferences and relative, participating, optional or other special rights, qualifications, limitations or restrictions thereof, including dividend rights (including whether dividends are cumulative), dividend rates, terms of redemption (including sinking fund provisions), redemption prices, conversion rights and liquidation preferences of the shares constituting any class or series of the preferred stock, in each case without any action or vote by the holders of common stock.

The preferred stock shall have the dividend, liquidation, redemption and voting rights set forth in a prospectus supplement relating to a particular series of the preferred stock. Reference is made to the prospectus supplement relating to the particular series of the preferred stock offered by the prospectus supplement for specific terms, including:

|

|

|

|

•

|

the designation and stated value per share of such preferred stock and the number of shares offered;

|

|

|

|

|

•

|

the amount of liquidation preference per share;

|

|

|

|

|

•

|

the initial public offering price at which the preferred stock will be issued;

|

|

|

|

|

•

|

the dividend rate or method of calculation, the dates on which dividends shall be payable, the form of dividend payment and the dates from which dividends shall begin to accumulate, if any;

|

|

|

|

|

•

|

any redemption or sinking fund provisions;

|

|

|

|

|

•

|

any conversion or exchange rights; and

|

|

|

|

|

•

|

any additional voting, dividend, liquidation, redemption, sinking fund and other rights, preferences, privileges, limitations and restrictions.

|

The preferred stock will, when issued, be fully paid and non-assessable and will have no preemptive rights. The rights of the holders of each series of the preferred stock will be subordinate to the rights of our general creditors.

Certain Anti-Takeover Effects of Certain Provisions of the Company’s Restated Articles of Incorporation, Bylaws and the Texas Business Organizations Code

The Company’s Restated Articles of Incorporation, as amended, and Bylaws contain certain provisions that could make the acquisition of the Company by means of a tender or exchange offer, a proxy contest or otherwise more difficult. The description of such provisions, set forth below, is intended only as a summary and is qualified in its entirety by reference to the Restated Articles of Incorporation, as amended, and Bylaws, each of which is filed as an exhibit to the registration statement of which this prospectus forms a part.

Preferred Stock

. The Restated Articles of Incorporation, as amended, authorize the Board of Directors to establish one or more series of preferred stock and to determine, with respect to any series of preferred stock, the terms and rights of such series. The Company believes that the ability of the Board of Directors to issue one or more series of preferred stock will provide the Company with flexibility in structuring possible future financings and acquisitions and in meeting other corporate needs that may arise. The authorized shares of preferred stock, as well as shares of common stock, will be available for issuance without further action by the Company’s shareholders, unless such action is required by the Restated Articles of Incorporation, as amended, applicable laws or the rules of any stock exchange or automated quotation system on which the Company’s securities may be listed or traded.

Although the Board of Directors has no intention at the present time of doing so, it could issue a series of preferred stock that could, depending on the terms of such series, impede the completion of a merger, tender offer or other takeover attempt. The Board of Directors will make any determination to issue such shares based on its judgment as to the best interests of the Company and its shareholders. The Board of Directors, in so acting, could issue preferred stock having terms that could discourage an acquisition attempt through which an acquiror otherwise would be able to change the composition of the Board of Directors, including a tender or exchange offer or other transaction that some or a majority of the Company’s shareholders might believe to be in their best interests or in which shareholders might receive a premium for their stock over the then current market price of such stock.

Special Meeting of Shareholders

. The Bylaws provide that special meetings of shareholders may be called by the President or the Chairman of the Board of Directors and shall be called by the President or the Secretary at the request in writing of a majority of the

Board of Directors or at the request in writing of shareholders owning 30% of the capital stock of the Company issued and outstanding and entitled to vote. Such provisions, together with the other anti-takeover provisions described herein, could also have the effect of discouraging a third party from initiating a proxy contest, making a tender or exchange offer or otherwise attempting to obtain control of the Company.

Texas Anti-Takeover Law

. Section 21.606 of the TBOC imposes a special voting requirement for the approval of certain business combinations and related party transactions between public corporations and affiliated shareholders. In particular, Section 21.606 prohibits certain mergers, sales of assets, reclassifications and other transactions (defined as business combinations) between a shareholder beneficially owning 20% or more of the outstanding stock of a Texas public corporation (such shareholder being defined as an affiliated shareholder) for a period of three years following the date the shareholder acquired the shares representing 20% or more of the corporation’s voting power unless two-thirds of the unaffiliated shareholders approve the transaction at a meeting held for that purpose no earlier than six months after the shareholder acquires that ownership. The provisions requiring such a vote of shareholders do not apply to a transaction with an affiliated shareholder if such transaction or the purchase of shares by the affiliated shareholder is approved by the board of directors before the affiliated shareholder acquires beneficial ownership of 20% of the shares. Section 21.607 contains a provision that allows a corporation to elect out of the statute by an amendment to its certificate of formation or bylaws. Neither our Restated Articles of Incorporation nor our Bylaws exempts us from the restrictions imposed under Section 21.606. Section 21.606 could have the effect of delaying, deferring or preventing a change in control of the Company.

Transfer Agent and Registrar

The transfer agent and registrar for the common stock is American Stock Transfer & Trust Company, New York, New York.

DESCRIPTION OF WARRANTS

We may issue warrants to purchase our senior debt securities, subordinated debt securities, common stock or preferred stock. Warrants may be issued independently or together with any other securities and may be attached to, or separate from, such securities. Each series of warrants will be issued under a separate warrant agreement to be entered into between us and a warrant agent. That warrant agreement, together with the terms of the warrant certificate and warrants, will be filed with the SEC in connection with the offering of the specific warrants.

The applicable prospectus supplement will describe the terms of any series of warrants in respect of which this prospectus is being delivered, including, where applicable, the following:

|

|

|

|

•

|

the title of such warrants;

|

|

|

|

|

•

|

the aggregate number of such warrants;

|

|

|

|

|

•

|

the price or prices at which such warrants will be issued;

|

|

|

|

|

•

|

the currency or currencies, in which the price of such warrants will be payable;

|

|

|

|

|

•

|

the securities or other rights, including rights to receive payment in cash or securities based on the value, rate or price of one or more specified commodities, currencies, securities or indices or any combination of the foregoing, purchasable upon exercise of such warrants;

|

|

|

|

|

•

|

the price at which and the currency or currencies in which the securities or other rights purchasable upon exercise of such warrants may be purchased;

|

|

|

|

|

•

|

the date on which the right to exercise such warrants shall commence and the date on which such right shall expire;

|

|

|

|

|

•

|

if applicable, the minimum or maximum amount of such warrants which may be exercised at any one time;

|

|

|

|

|

•

|

if applicable, the anti-dilution provisions of such warrants;

|

|

|

|

|

•

|

if applicable, the redemption or call provisions of such warrants;

|

|

|

|

|

•

|

if applicable, the designation and terms of the securities with which such warrants are issued and the number of such warrants issued with each such security;

|

|

|

|

|

•

|

if applicable, the date on and after which such warrants and the related securities will be separately transferable;

|

|

|

|

|

•

|

information with respect to book-entry procedures, if any;

|

|

|

|

|

•

|

if applicable, a discussion of any material U.S. federal income tax considerations; and

|

|

|

|

|

•

|

any other terms of such warrants, including terms, procedures and limitations relating to the exchange and exercise of such warrants.

|

Until they exercise their warrants, holders of warrants will not have any of the rights of holders of the securities purchasable upon exercise, and will not be entitled to:

|

|

|

|

•

|

receive payments of principal of (or premium, if any, on) or interest, if any, on any debt securities purchasable upon exercise;

|

|

|

|

|

•

|

receive dividend payments, if any, with respect to any underlying securities; or

|

|

|

|

|

•

|

exercise the voting rights of any common stock or preferred stock purchasable upon exercise.

|

LEGAL MATTERS

In connection with particular offerings of our securities in the future, and if stated in the applicable prospectus supplement, the validity of those securities may be passed upon for us by Norton Rose Fulbright US LLP and for any underwriters or agents by counsel named in the applicable prospectus supplement.

EXPERTS

The consolidated financial statements of DXP Enterprises, Inc. and subsidiaries as of December 31, 2018 and 2017, and for the years then ended appearing in our Annual Report on Form 10-K for the year ended December 31, 2018, and the effectiveness of DXP Enterprises, Inc.’s internal control over financial reporting as of December 31, 2018, have been audited by Moss Adams LLP, an independent registered public accounting firm, as stated in their reports, which are incorporated herein by reference. Such consolidated financial statements have been so incorporated in reliance upon the reports of such firm (which report expresses an unqualified opinion and includes an explanatory paragraph regarding the adoption of Accounting Standards Codification Topic No. 606) given upon their authority as experts in accounting and auditing.

The report of Moss Adams LLP on the effectiveness of internal control over financial reporting as of December 31, 2018, expressed an opinion that DXP Enterprises, Inc. and subsidiaries had not maintained effective internal control over financial reporting as of December 31, 2018, based on criteria established in

Internal Control - Integrated Framework (2013)

issued by the Committee of Sponsoring Organizations of the Treadway Commission.

The consolidated financial statements of DXP Enterprises, Inc. and subsidiaries as of December 31, 2016 and for the year ended December 31, 2016, incorporated by reference in this prospectus and elsewhere in the registration from the DXP Enterprises, Inc. Annual Report on Form 10-K for the year ended December 31, 2018 have been audited by Hein & Associates LLP, an independent registered public accounting firm, as stated in their report thereon, incorporated herein by reference in this prospectus and registration statement in reliance upon such report and upon the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form S-3 under the Securities Act with respect to the securities being offered under this prospectus. This prospectus, which is included in the registration statement, does not contain all of the information in the registration statement. We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are also available to the public on the SEC’s Internet website at http://www.sec.gov. Our Internet website address is http://www.dxpe.com. Information on our website or any other website is not incorporated by reference into this prospectus and does not constitute a part of this prospectus unless specifically so designated and filed with the SEC.

We furnish holders of our common stock with annual reports containing financial statements audited by our independent auditors in accordance with generally accepted accounting principles following the end of each fiscal year. We file reports and other information with the SEC pursuant to the reporting requirements of the Exchange Act.

Descriptions in this prospectus of documents are intended to be summaries of the material, relevant portions of those documents, but may not be complete descriptions of those documents. For complete copies of those documents, please refer to the exhibits to the registration statement and other documents filed by us with the SEC.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” the information we have filed with the SEC, which means that we can disclose important information to you without actually including the specific information in this prospectus by referring you to those documents. The information incorporated by reference is an important part of this prospectus and later information that we file with the SEC will automatically update and supersede this information. Therefore, before you decide to invest in a particular offering under this shelf registration, you should always check for reports we may have filed with the SEC after the date of this prospectus. We incorporate by reference into this prospectus the documents listed below and any future filings we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act until the applicable offering under this prospectus and any prospectus supplement is terminated, other than information furnished to the SEC under Item 2.02 or 7.01 of Form 8-K and which is not deemed filed under the Exchange Act and is not incorporated in this prospectus:

We will provide, without charge, to each person, including any beneficial owner, to whom a copy of this prospectus has been delivered, upon written or oral request of such person, a copy of any or all of the documents incorporated by reference herein (other than certain exhibits to such documents not specifically incorporated by reference in such documents). Requests for such copies should be directed to:

DXP Enterprises, Inc.

5301 Hollister

Houston, Texas 77040

(713) 996-4700

Attention: Corporate Secretary

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14.

Other Expenses of Issuance and Distribution

.

The following table sets forth the estimated expenses (other than underwriting discounts and commissions) to be incurred by the Company in connection with the issuance and distribution of the securities registered under this registration statement.

|

|

|

|

|

|

SEC registration fee

|

$ *

|

|

Printing and engraving expenses

|

$ **

|

|

Legal fees and expenses

|

$ **

|

|

Accounting fees and expenses

|

$ **

|

|

Miscellaneous expenses

|

$ **

|

|

Total

|

$ **

|

* In accordance with Rules 456(b) and 457(r) of the Securities Act of 1933, as amended, the registrant is deferring payment of all of the registration fee.

**These fees are calculated based on the number of issuances and amount of securities offered and accordingly cannot be estimated at this time.

Item 15.

Indemnification of Directors and Officers

.

Section 8.101 of the TBOC provides that a corporation may indemnify any director or officer who was, is or is threatened to be named as a defendant or respondent in a proceeding because he or she is or was a director or officer, provided that the director or officer (i) conducted himself or herself in good faith, (ii) reasonably believed (a) in the case of conduct in his or her official capacity, that his or her conduct was in the corporation’s best interests or (b) in all other cases, that his or her conduct was at least not opposed to the corporation’s best interests and (iii) in the case of any criminal proceeding, had no reasonable cause to believe his or her conduct was unlawful. Subject to certain exceptions, a director or officer may not be indemnified if such person is found liable to the corporation or if such person is found liable on the basis that he or she improperly received a personal benefit. Under Texas law, reasonable expenses incurred by a director or officer may be paid or reimbursed by the corporation in advance of a final disposition of the proceeding after the corporation receives a written affirmation by the director or officer of his or her good faith belief that he or she has met the standard of conduct necessary for indemnification and a written undertaking by or on behalf of the director or officer to repay the amount if it is ultimately determined that the director or officer is not entitled to indemnification by the corporation. Texas law requires a corporation to indemnify an officer or director against reasonable expenses incurred in connection with a proceeding in which he or she is named a defendant or respondent because he or she is or was a director or officer if he or she is wholly successful in the defense of the proceeding.

Texas law also permits a corporation to purchase and maintain insurance or another arrangement on behalf of any person who is or was a director or officer against any liability asserted against such person and incurred by such person in such a capacity or arising out of such person’s status as such a person, whether or not the corporation would have the power to indemnify such person against that liability under Section 8.101 of the TBOC.

The Company’s Restated Articles of Incorporation, as amended, and Bylaws provide for indemnification of its officers and directors and the advancement to them of expenses in connection with proceedings and claims, to the fullest extent permitted under the TBOC. Such indemnification may be made even though directors and officers would not otherwise be entitled to indemnification under other provisions of the Company’s Bylaws.

The above discussion of the TBOC, the Company’s Restated Articles of Incorporation, as amended, and Bylaws is not intended to be exhaustive and is qualified in its entirety by such statute, the Restated Articles of Incorporation, as amended, and Bylaws, respectively.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling the Company pursuant to the foregoing provisions, the Company has been informed that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and therefore is unenforceable.

Item 16

. Exhibits

.

The exhibits listed in the Exhibit Index are filed as part of this registration statement.

|

|

|

|

|

|

Exhibit

Number

|

Description

|

|

*1.1

|

Form of Underwriting Agreement of DXP Enterprises, Inc.

|

|

*1.2

|

Form of Distribution Agreement of DXP Enterprises, Inc.

|

|

3.1

|

|

|

3.2

|

|

|

4.1

|

|

|

4.2

|

|

|

4.3

|

|

|

*4.4

|

Form of Senior Note of DXP Enterprises, Inc.

|

|

*4.5

|

Form of Subordinated Note of DXP Enterprises, Inc.

|

|

*4.6

|

Form of Warrant Agreement of DXP Enterprises, Inc.

|

|

*4.7

|

Form of Warrant Certificate of DXP Enterprises, Inc.

|

|

**5.1

|

Opinion of Norton Rose Fulbright US LLP.

|

|

**23.1

|

Consent of Moss Adams LLP.

|

|

**23.2

|

Consent of Hein & Associates LLP.

|

|

**23.3

|

Consent of Norton Rose Fulbright US LLP (incorporated by reference to Exhibit 5.1).

|

|

24.1

|

|

|

***25.1

|

The Statement of Eligibility on Form T-1 under the Trust Indenture Act of 1939 of the Trustee under the Senior Indenture will be incorporated herein by reference from a subsequent filing in accordance with Section 305(b)(2) of the Trust Indenture Act of 1939.

|

|

***25.2

|

The Statement of Eligibility on Form T-1 under the Trust Indenture Act of 1939 of the Trustee under the Subordinated Indenture will be incorporated herein by reference from a subsequent filing in accordance with Section 305(b)(2) of the Trust Indenture Act of 1939.

|

* To be filed, if necessary, by amendment or pursuant to a Current Report on Form 8-K.

** Filed herewith.

*** To be filed with a Form 305B2 or other appropriate form in connection with an applicable offering.

Item 17.

Undertakings.

The undersigned Registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement: (i) to include any prospectus required by Section 10(a)(3) of the Securities Act of 1933; (ii) to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective

registration statement; and (iii) to include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement.

Provided, however

, that paragraphs (1)(i), (1)(ii) and 1(iii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the Registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial

bona fide

offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(i) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which the prospectus related, and the offering of such securities at that time shall be deemed to be the initial

bona fide

offering thereof.

Provided

,

however

, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

For the purpose of determining liability of the Registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities, the undersigned Registrant undertakes that in a primary offering of securities of the undersigned Registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned Registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

|

|

|

|

(i)

|

Any preliminary prospectus or prospectus of the undersigned Registrant relating to the offering required to be filed pursuant to Rule 424;

|

|

|

|

|

(ii)

|

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned Registrant or used or referred to by the undersigned Registrant;

|

|

|

|

|

(iii)

|

The portion of any other free writing prospectus relating to the offering containing material information about the undersigned Registrant or its securities provided by or on behalf of the undersigned Registrant; and

|

|

|

|

|

(iv)

|

Any other communication that is an offer in the offering made by the undersigned Registrant to the purchaser.

|

The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the Registrant’s annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that

is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue.

The undersigned registrant hereby undertakes to file an application for the purpose of determining the eligibility of the trustee to act under subsection (a) of Section 310 of the Trust Indenture Act in accordance with the rules and regulations prescribed by the SEC under Section 305(b)(2) of the Trust Indenture Act.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Houston, State of Texas, on

June 21, 2019

.

|

|

|

|

|

|

|

DXP Enterprises, Inc.

By

/s/ David R. Little

David R. Little

President and Chief Executive Officer

|