Dollar-Store Chains Post Stronger Sales, But Tariffs Cloud Outlook

May 30 2019 - 11:46AM

Dow Jones News

By Aisha Al-Muslim and Sarah Nassauer

Sales at Dollar General Corp. and Dollar Tree Inc. rose in the

latest quarter, but both discount retailers said the prospect of

tariffs being imposed on more products imported from China cast

uncertainty on their businesses.

Dollar Tree on Thursday cut its earnings forecast for the year

as it works to trim its store count and deals with

higher-than-expected import-freight costs. Dollar General

maintained its financial guidance and store-growth outlook.

Both companies said their outlooks include current tariffs on

certain Chinese imports, which the chains have been trying to

mitigate. However, neither company adjusted its forecasts for a

potential next round of tariffs on nearly all remaining goods from

China, which could include many consumer goods such as additional

apparel categories and toys.

If a further round of tariffs are implemented, "we expect that

it will be impactful to both our business, and especially to

consumers in general," said Gary Philbin, chief executive of Dollar

Tree, which also owns the Family Dollar chain. However, thus far,

company merchants have mitigated the cost of most tariffs to date,

he said on a call with analysts. In January the company moved about

$100 million of seasonal purchases out of China, he said.

Dollar Tree, of Chesapeake, Va., now expects earnings per share

for the fiscal year to be $4.77 to $5.07, down from its previous

range of $4.85 to $5.25.

Shares of Dollar General rose 6.1% to $125.82 in morning trading

Thursday, while Dollar Tree's stock was up 4.6% to $99.76.

Many other retailers are formulating plans to manage the impact

of higher tariffs on merchandise imported from China due to the

continuing U.S.-China trade war.

Earlier this month, the Trump administration imposed a 25%

tariff on $200 billion of Chinese goods, up from a 10% duty put in

place in October.

In the first quarter ended May 3, Dollar General said its sales

growth was helped by opening new stores and sales rising at

existing locations. Net sales rose 8.3% to $6.62 billion and

same-store sales grew 3.8%, both above analysts' expectations.

Profit for Dollar General, of Goodlettsville, Tenn., rose to

$385 million, from $364.9 million a year earlier.

Dollar General has been expanding its store footprint and

working to become a bigger seller of food and home goods to grab

more shoppers. During the quarter, Dollar General opened 240 new

stores, remodeled 330 stores and relocated 27 stores.

Dollar Tree said its sales increased in the first quarter ended

May 4 as the performance at its Family Dollar stores began to turn

around.

Net sales rose 4.6% to $5.81 billion and same-store sales grew

2.2%, both above analysts' expectations. Same-store sales rose 2.5%

at Dollar Tree, while sales at stores open at least a year under

the Family Dollar banner rose 1.9%. Although the average amount

spent rose at Family Dollar, boosting sales, the number of shoppers

fell in the quarter.

Dollar Tree has worked to turn around Family Dollar after

purchasing the struggling budget retailer in 2015. However, the

Family Dollar chain has lagged behind competitors, which led

activist investor Starboard Value LP to take a stake in the parent

company, advocate for a sale of Family Dollar, and nominate a slate

of new board directors.

Dollar Tree said earlier this year that it would close hundreds

of Family Dollar stores and marked down the value of the chain

while testing higher price points at Dollar Tree. Starboard

withdrew its director nominations in April, saying the company

showed improvement.

In the quarter, the company closed 16 Family Dollar stores and

opened 45 Dollar Tree stores that had previously been Family Dollar

locations.

"Our Family Dollar turnaround is gaining traction," Mr. Philbin

said. Dollar Tree started testing a new line of products that cost

more than $1 earlier this month [May], he said, and would add the

test to 100 stores initially.

Dollar Tree reported profit of $267.9 million, up from $160.5

million a year earlier.

Write to Aisha Al-Muslim at aisha.al-muslim@wsj.com and Sarah

Nassauer at sarah.nassauer@wsj.com

(END) Dow Jones Newswires

May 30, 2019 11:31 ET (15:31 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

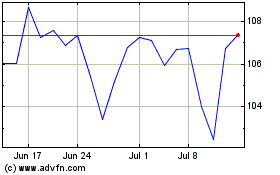

Dollar Tree (NASDAQ:DLTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dollar Tree (NASDAQ:DLTR)

Historical Stock Chart

From Apr 2023 to Apr 2024