Lower-Income Shoppers Fuel Gains at Dollar Chains

August 29 2019 - 2:18PM

Dow Jones News

By Sarah Nassauer

Dollar-store chains Dollar General Corp. and Dollar Tree Inc.

said Thursday sales rose during the most recent quarter and that

executives are working to manage the cost of new tariffs on Chinese

goods.

Comparable sales at Dollar General, which has over 15,800 stores

mostly outside of big cities, rose 4% during the quarter ended Aug.

2. At Dollar Tree, which owns both the Dollar Tree and Family

Dollar chains, comparable sales rose 2.4% during the quarter ended

Aug. 3.

Executives at both chains said their core low- and middle-income

shoppers continue to spend amid low unemployment and rising

wages.

But Dollar Tree reported lower profits as expenses rose,

flattening its shares as rival Dollar General share's rose over 10%

in morning trading. Some investors also noted Dollar General's

higher sales lift, leading some analysts to say the

more-rural-focused chain is gaining ground on Dollar Tree.

There are signs "that Dollar Tree is treading water rather than

proactively taking market share in the same way as its rival is

doing," said Neil Saunders, managing director of GlobalData

Retail.

Dollar Tree has worked to turn around its Family Dollar chain

after purchasing the then-struggling dollar retailer for nearly $9

billion in cash-and-stock four years ago. It has closed hundreds of

Family Dollars and invested heavily to improve others. Those

efforts are starting to bear fruit, though they have added to

expenses, Dollar Tree executives said on a call with analysts

Thursday.

Executives blamed a global helium shortage for some sales

weakness at the Dollar Tree chain. Lost balloon sales during

Valentine's Day, Mother's Day and Father's Day, along with

gradations reduced comparable sales by 0.4%, said Gary Philbin,

chief executive at Dollar Tree, on a call with analysts.

Dollar Tree reported a profit of $180.3 million, or 76 cents a

share, down from $273.9 million, or $1.15 a share, in the

comparable quarter last year.

Goodlettsville, Tenn.-based Dollar General reported a profit of

$426.6 million, or $1.65 a share, up from $407.2 million, or $1.52

a share, in the comparable quarter last year.

Each chain raised profit estimates for the full year and said

they are working to mitigate Chinese tariff-related cost increases.

Dollar Tree said it expects net income per share to fall between

$4.90 and $5.11 for the full fiscal year, up from a previous

estimate of $4.77 to $5.07. Dollar General said annual earnings per

share will fall in the range of $6.36 to $6.51, up from a previous

estimate of $6.30 to $6.50.

"We've negotiated price concessions, canceled orders, modified

specs, evolved product mix and diversified vendors. We are now

taking actions to mitigate the recently announced tariff increases

and will continue to assess the future impact of these tariffs,"

said Dollar Tree's Mr. Philbin.

Overall, both chains -- which are focused on value and often

sell smaller amounts of products at lower dollar amounts than

big-box competitors -- have fared well as shoppers search out value

and convenience even as more shopping shifts online. In recent

weeks Walmart Inc., Target Corp. and T.J. Maxx parent TJX Cos. have

reported strong sales growth, while Macy's Inc., Nordstrom Inc. and

other middle-market mall-based retailers continue to struggle.

Dollar Tree and Family Dollar were among the three dollar-store

chains that reached a collective $1.2 million settlement on Monday

with the New York attorney general's office after undercover

investigators found expired over-the-counter drugs and obsolete

motor oil on store shelves in the state. The two chains settled for

$100,000.

Write to Sarah Nassauer at sarah.nassauer@wsj.com

(END) Dow Jones Newswires

August 29, 2019 14:03 ET (18:03 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

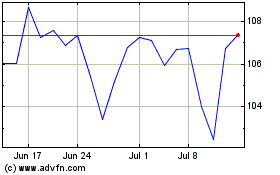

Dollar Tree (NASDAQ:DLTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dollar Tree (NASDAQ:DLTR)

Historical Stock Chart

From Apr 2023 to Apr 2024