United States

Securities and Exchange

Commission

Washington, D.C. 20549

Schedule 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities

Exchange

Act of 1934 (Amendment No. )

Filed

by the Registrant

Filed

by the Registrant

|

Filed

by a Party other than the Registrant

Filed

by a Party other than the Registrant

|

|

|

|

|

Check the appropriate

box:

|

|

Preliminary Proxy Statement

|

|

CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14A-6(E)(2))

|

|

Definitive Proxy Statement

|

|

Definitive Additional Materials

|

|

Soliciting Material Pursuant to Section 240.14a-12

|

DMC GLOBAL INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

|

Payment of Filing Fee (check

the appropriate box):

|

|

No fee required.

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

(1) Title of each class of securities to

which transaction applies:

|

|

(2) Aggregate number of securities to which

transaction applies:

|

|

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

(4) Proposed maximum aggregate value of

transaction:

|

|

(5) Total fee

paid:

|

|

Fee

paid previously with preliminary materials.

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

Amount Previously Paid:

(2)

Form, Schedule or Registration Statement No.:

(3)

Filing Party:

(4)

Date Filed:

|

|

MAY 20, 2020

8:30 a.m. Local Time

11800 Ridge Parkway,

Suite 300, Broomfield,

Colorado 80021

|

|

|

NOTICE

of Annual Meeting

of Stockholders

|

|

|

|

|

|

To the Stockholders of DMC Global Inc.:

|

|

|

|

|

|

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of DMC Global Inc., a Delaware corporation, will be held on May 20, 2020, at 8:30 a.m. local time at 11800 Ridge Parkway, Suite 300, Broomfield, Colorado 80021, for the following purposes:

|

|

|

|

|

|

1.

|

To elect the seven director nominees identified in the accompanying proxy statement to hold office until the 2021 Annual Meeting of Stockholders;

|

|

|

2.

|

To approve a non-binding, advisory vote on the compensation of our named executive officers;

|

|

|

3.

|

To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020; and

|

|

|

4.

|

To transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

|

|

|

|

|

|

|

The foregoing items of business are more fully described in the proxy statement accompanying this notice.

|

|

|

|

|

The Board of Directors has fixed the close

of business on March 26, 2020, as the record date for the determination of stockholders entitled to notice of, and to

vote at, this Annual Meeting and at any adjournment or postponement thereof.

We intend to hold our annual meeting in person.

However, we are sensitive to the public health and travel concerns our stockholders may have and recommendations that public health

officials may issue in light of the evolving COVID-19 situation. As a result, we may impose additional procedures or limitations

on meeting attendees or may decide to hold the meeting in a different location or solely by means of remote communication (i.e.,

a virtual-only meeting). Because there are certain costs associated with holding a virtual-only meeting, we currently plan to address

COVID-19 concerns relating to the meeting by having directors and others whose physical presence at the meeting is not essential

attend the meeting via teleconference. In addition, (i) stockholders and others may listen to the meeting in real-time by calling

(844) 407-9500 or (862) 298-0850 (international access) and (ii) stockholders may submit questions they would like to have answered

at the meeting by sending those questions to our Corporate Secretary in advance of the meeting at the address set forth in “Information

Concerning the Annual Meeting and Voting—Contact Information”. We believe that these procedures will reduce risks relating

to COVID-19 and provide many of the benefits of a virtual-only meeting while minimizing associated costs. We will continue to monitor

the COVID-19 situation and if changes to our current plan become advisable, we will disclose the updated plan on our proxy website

(www.investorvote.com/boom). We encourage you to check this website prior to the meeting if you plan to attend.

Important Notice Regarding the Availability

of Proxy Materials for the Annual Meeting of Stockholders to be Held on May 20, 2020.

Similar to last year, we will be using the

“Notice and Access” method that allows companies to provide proxy materials to stockholders via the Internet. On or about

April 8, 2020, we will mail to our stockholders a Notice of Internet Availability of Proxy Materials which contains specific

instructions on how to access Annual Meeting materials via the Internet, as well as instructions on how to request paper copies.

We believe this process should provide a convenient way to access your proxy materials and vote. The Proxy Statement and our annual

report on Form 10-K for the fiscal year ended December 31, 2019 are available at www.investorvote.com/boom.

|

|

By Order of

the Board of Directors,

|

|

|

|

|

|

MICHELLE H. SHEPSTON

|

|

April 8, 2020

|

Chief Legal Officer

and Secretary

|

Table of Contents

|

|

2020 PROXY SUMMARY

|

|

|

|

|

|

THIS SUMMARY HIGHLIGHTS AND SUPPLEMENTS INFORMATION CONTAINED ELSEWHERE IN THIS PROXY STATEMENT. THE SUMMARY DOES NOT CONTAIN ALL OF THE INFORMATION THAT YOU SHOULD CONSIDER AND THE ENTIRE PROXY STATEMENT SHOULD BE READ CAREFULLY BEFORE VOTING.

|

ANNUAL MEETING OF STOCKHOLDERS

|

Time and Date

|

8:30 a.m., May 20, 2020

|

|

Place

|

11800 Ridge Parkway, Suite 300, Broomfield, Colorado 80021

|

|

Record Date

|

March 26, 2020

|

AGENDA

|

|

•

|

The election of the seven director nominees

identified in this proxy statement

|

|

|

•

|

An advisory vote on the compensation of

our named executive officers

|

|

|

•

|

A ratification of the selection of Ernst &

Young LLP as our independent registered public accounting firm for 2020

|

|

|

•

|

Such other business as may properly come

before the meeting

|

VOTING MATTERS

|

|

Board

|

Page

Reference (for

|

|

Proposal

|

Recommendation

|

more

detail)

|

|

1. Election

of directors

|

FOR each Nominee

|

7

|

|

2. Advisory vote on executive compensation

|

FOR

|

18

|

|

3. Ratification of appointment of Ernst & Young LLP as auditor for 2020

|

FOR

|

19

|

EXECUTIVE COMPENSATION

2019 Business Overview

2019 represented the second consecutive year

in which DMC reported record sales, adjusted operating income, adjusted net income, adjusted earnings per share and Adjusted EBITDA*.

The Company’s continued financial growth primarily was due to growth in DynaEnergetics, DMC’s oilfield products business,

and strong operating income margins in NobelClad, DMC’s composite metals business. Growth at DynaEnergetics, which generated

78% of the Company’s consolidated sales during 2019, primarily was due to increased customer adoption of its DynaStage™

DS Factory-Assembled, Performance-Assured™ perforating systems. Despite challenging conditions in North America’s oil

and gas industry, from which DynaEnergetics generates the majority of its sales, DynaEnergetics reported a 31% increase in full-year

2019 sales and a 61% increase in Adjusted EBITDA.

* Adjusted EBITDA is a non-GAAP (generally

accepted accounting principles) financial measure and is defined as follows: EBITDA is defined as net income plus or minus net

interest plus taxes, depreciation and amortization. Adjusted EBITDA excludes from EBITDA stock-based compensation, restructuring

and impairment charges and, when appropriate, other extraordinary items that management does not utilize in assessing DMC’s

or the relevant business unit’s operating performance. Net cash and net debt are non-GAAP financial measures. We define net

debt as total debt less cash and cash equivalents, and we define net cash as cash and cash equivalents less total debt. Adjusted

EBITDA, net cash, and net debt for a relevant fiscal year are the same as reported in the Company’s Form 10-K for that period.

For a reconciliation of Adjusted EBITDA to the most directly comparable generally accepted accounting principle measure, refer

to Item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations from our Annual Report

on Form 10-K for the year ended December 31, 2019.

DMC GLOBAL INC. • 2020 PROXY STATEMENT 1

2019 Financial/Strategic Achievements

DMC’s consolidated revenues increased

to a record $398 million in 2019 from $326 million in 2018, a 22% increase. This followed the 69% growth in revenue between

2018 and 2017. The primary driver of the sustained record revenue growth was the continuing sales growth at DynaEnergetics. DynaEnergetics

sales in 2019 were a record $310.4 million, while NobelClad reported sales of $87.1 million.

Consolidated adjusted EBITDA increased from

$59.6 million in 2018 to a record $93.7 million in 2019; a 57% year-over-year increase.

We continued to strengthen our financial

position in 2019. Our leverage ratio improved to 0.2 at the end of 2019 from 0.7 at the end of 2018. Net cash* was $6.1 million

at the end of 2019 versus net debt* of $28.0 million at December 31, 2018.

At DynaEnergetics, our significant investments

in research and development have resulted in several products that are generating strong customer demand and enabling safer, more

efficient and more cost-effective perforating operations. These products, which include the IS2™ intrinsically safe initiating

system and the DynaStage™ (DS) family of Factory-assembled, Performance-assured™ perforating systems, collectively

generate the majority of DynaEnergetics’ total sales. In 2019, DynaEnergetics expanded its DS product family with the addition

of DS Trinity™ 3.5 and DS NLine™, both of which are providing exploration and production companies with new solutions

for addressing increasingly complex well designs.

Our NobelClad business continued to invest

in new applications and made significant progress establishing a broader base of commercial uses for its explosion-welded plate.

NobelClad continued work on a large, first-time order from the international gold-processing industry, and also is pursuing new

applications in the aerospace, alternative energy, defense and transportation sectors.

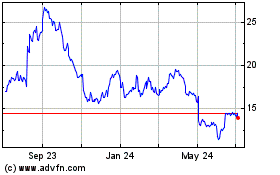

Our total stockholder return (“TSR”)

relative to the compensation peer group identified below was at the 76th percentile over one year, at the 100th

percentile over three years and at the 99th percentile over five years:

TOTAL SHAREHOLDER RETURN RELATIVE TO COMPENSATION PEER GROUP

2019 Compensation Decisions at A Glance

The following pay decisions were made in 2019:

DMC GLOBAL INC. • 2020 PROXY STATEMENT 2

|

|

COMPENSATION

ELEMENT

|

2019

DESIGN

|

|

• Increase

in salary for Mr. Grieves of 23.4% to reflect DynaEnergetics performance

and Mr. Grieves’ individual performance and increasing responsibilities

• Compensation

Committee approved salary increases to other NEOs between 3.6%

and 9.3%

|

• Changes

to base salary consider level of responsibility and complexity of position,

peer compensation levels, individual performance, market alignment and

other factors.

|

|

• Increase

in target award opportunity for Mr. Grieves to 60%

• No

change in target opportunities for any of the other NEOs

|

• Annual

cash incentives

• Targeted

award amounts set as a percentage of salary for each NEO

• Weightings

and metrics: • 70% — Company Performance

• 30%

— Individual Performance

• No

funding on a metric if performance is below threshold; payout capped at

180% of target

|

|

• Compensation

Committee approved increases to NEOs between 29% and 86%

to better align with the market

|

• Consists

of time-based restricted stock or restricted stock units (RSUs) (2/3 of target

LTI value) and performance-based LTI (PSUs) (1/3 of target LTI value)

• Time-based

restricted stock or RSUs vest ratably over 3-year period based on

continued service

• PSUs

vests at end of 3-year period based on metrics set at time of grant

• Actual

payouts can range from 0% to 200% of target award amounts.

• Metrics:

• Relative TSR

• Adjusted EBITDA

|

Good Compensation Governance Practices

The Compensation Committee continually evaluates

the Company’s compensation policies and practices to ensure that they are consistent with good governance principles. Below

are highlights of our governance practices:

|

WHAT

WE DO

|

|

WHAT

WE DON’T DO

|

|

Provide

the majority of compensation in performance-based pay

|

|

|

No “single-trigger” change of control severance benefits

|

|

Maintain robust stock ownership requirements

|

|

|

No hedging transactions or pledging of our common stock by executive officers

|

|

Maintain a clawback policy

|

|

|

No evergreen provision in the equity incentive plan

|

|

Use an independent compensation consultant engaged by the Compensation Committee

|

|

|

No liberal share recycling

|

|

Conduct annual compensation program risk assessment

|

|

|

No liberal definition of change of control

|

|

Limit perquisites

|

|

|

No defined benefit plans for executive officers

|

2019 Say On Pay Results & Shareholder

Engagement

The Board of Directors gives significant

weight to the outcome of the advisory vote on executive compensation (say on pay) vote, as well as feedback from our stockholders,

and responds accordingly. At the 2019 Annual Meeting of Stockholders, approximately 98% of stockholders supported our executive

compensation program. Following the vote and throughout 2019, the Board and senior management team continued their regular cadence

of communications with stockholders, engaging in over 200 meetings with investors in the U.S. and Europe during 2019, and no significant

compensation matters were raised as a concern by investors. However, the Compensation Committee recognizes the ever-evolving compensation

and governance landscape and will continue to review its practices and solicit stakeholder feedback on these issues.

DMC GLOBAL INC. • 2020 PROXY STATEMENT 3

|

|

INFORMATION CONCERNING THE ANNUAL MEETING AND VOTING

|

GENERAL

The Board of Directors (the “Board”)

of DMC Global Inc., a Delaware corporation, is soliciting proxies for use at the Annual Meeting of Stockholders to be

held on May 20, 2020, at 8:30 a.m., local time (the “Annual Meeting”), or at any adjournment or postponement

thereof, for the purposes described in this proxy statement and in the accompanying Notice of Annual Meeting. The Annual Meeting

will be held at 11800 Ridge Parkway, Suite 300, Broomfield, Colorado 80021. On or about April 8, 2020, we will mail to

all stockholders entitled to vote at the meeting, a Notice of Internet Availability of Proxy Materials that contains specific instructions

on how to access Annual Meeting materials via the Internet, as well as instructions on how to request paper copies. Unless the

context otherwise requires, references to “the Company,” “DMC,” “we,” “us” or “our”

refer to DMC Global Inc.

SOLICITATION

We will bear the entire cost of solicitation

of proxies, including preparation, assembly, printing and mailing of the Notice of Internet Availability of Proxy Materials and

any additional information furnished to stockholders. Copies of solicitation materials will be furnished to banks, brokerage houses,

fiduciaries, and custodians holding in their names shares of our common stock beneficially owned by others to forward to such beneficial

owners. We may reimburse persons representing beneficial owners of common stock for their costs of forwarding solicitation materials

to such beneficial owners. Original solicitation of proxies via the Internet may be supplemented by mail, telephone, or personal

solicitation by our directors, officers, or other regular employees. No additional compensation will be paid to directors, officers,

or other regular employees for such services.

OUTSTANDING SHARES AND QUORUM

Only holders of record of common stock at

the close of business on March 26, 2020, will be entitled to notice of and to vote at the Annual Meeting. At the close of

business on March 26, 2020, we had 14,751,696 shares of common stock outstanding and entitled to vote. Each holder of

record of common stock on such date will be entitled to one vote for each share held on all matters to be voted upon at the Annual

Meeting.

A majority of the outstanding shares of common

stock entitled to vote represented in person or by proxy will constitute a quorum at the Annual Meeting. However, if a quorum is

not represented at the Annual Meeting, the stockholders entitled to vote at the meeting, present in person or represented by proxy,

have the power to adjourn the Annual Meeting from time to time, without notice other than by announcement at the Annual Meeting,

until a quorum is present or represented. At any such adjourned meeting at which a quorum is present or represented, any business

may be transacted that might have been transacted at the originally scheduled meeting.

VOTING RIGHTS AND PROCEDURES

Votes cast by proxy or in person will be

counted by one or more persons appointed by us to act as inspectors (the “Election Inspectors”) for the Annual Meeting.

The Election Inspectors will treat shares represented by proxies that reflect abstentions as shares that are present and entitled

to vote for the purpose of determining the presence of a quorum. Abstentions will not have any effect on any of the proposals to

be considered at the Annual Meeting.

DMC GLOBAL INC. • 2020 PROXY STATEMENT 4

Broker non-votes occur when a broker holding

stock on behalf of a beneficial owner (in which case the stock is commonly referred to as being held “in street name”)

lacks authority to vote the shares on some matters. Brokers are permitted to vote on “routine” proposals when they

have not received voting instruction from the beneficial owner of the stock but are not permitted to vote on non-routine matters

in the absence of such an instruction. Proposal 3 relating to the ratification of the appointment of Ernst & Young LLP

as our independent registered accounting firm for the fiscal year ending December 31, 2020 is considered “routine,”

and there will therefore be no broker non-votes for such proposal. However, brokers will not be allowed to vote without instruction

on proposals 1 or 2. The Election Inspectors will treat broker non-votes as shares that are present and entitled to vote for the

purpose of determining the presence of a quorum. Broker non-votes will have no effect on proposals 1 or 2.

We urge you to give voting instructions to

your broker on all proposals.

Directors are elected by a plurality of the

votes cast by the holders of shares entitled to vote in the election at a meeting at which a quorum is present; however, pursuant

to our Majority Voting Policy, any director who fails to receive a majority of the votes cast (in person or by proxy) “FOR”

such candidate is required to submit a letter of resignation to the Board. See “Majority Voting Policy” below. Proxies

may not be voted for a greater number of persons than there are nominees.

The non-binding advisory vote on the compensation

of our named executive officers is subject to the approval of the affirmative vote of a majority of votes cast with respect to

Proposal 2.

The ratification of our selection of Ernst &

Young LLP as our independent registered public accounting firm will be subject to the approval of an affirmative vote of a majority

of votes cast with respect to Proposal 3.

If no direction is indicated

on a proxy card, the shares will be voted FOR each of the proposals set forth in this proxy statement. The persons named in the

proxies will have discretionary authority to vote all proxies with respect to additional matters that are properly presented for

action at the Annual Meeting.

APPRAISAL RIGHTS

No action is proposed at the Annual Meeting

for which the laws of the state of Delaware or our Bylaws provide a right of our stockholders to dissent and obtain appraisal of

or payment for such stockholder’s common stock.

REVOCABILITY OF PROXIES

Any person giving a proxy pursuant to this

solicitation has the power to revoke it at any time prior to the Annual Meeting. It may be revoked by filing with our Corporate

Secretary a written notice of revocation or a duly executed proxy bearing a later date, or it may be revoked by attending the meeting

and voting in person. Attendance at the meeting will not, by itself, revoke a proxy.

VOTING YOUR SHARES

Stockholder of Record: If you are a stockholder

of record, there are several ways for you to vote your shares, as follows:

|

|

•

|

Via the Internet:

If you received a Notice of Internet Availability of Proxy Materials,

you can access our proxy materials and vote online. Instructions to vote online are provided in the Notice.

|

|

|

•

|

By Telephone: You

may vote your shares by calling the telephone number specified on your proxy card. You will need to follow the instructions on

your proxy card and the voice prompts.

|

|

|

•

|

By Written Proxy:

If you have received or requested a paper copy of the proxy materials,

please date and sign the proxy card and return it promptly in the accompanying envelope.

|

|

|

•

|

In Person: All

stockholders of record may vote in person at the Annual Meeting. For those planning to attend in person, we also recommend submitting

a proxy card or voting by telephone or via the Internet to ensure that your vote will be counted if you later decide not to attend

the meeting.

|

Beneficial

Owner: If you are a beneficial owner, you should have received voting instructions from your broker, bank or other

nominee. Beneficial owners must follow the voting instructions provided by their nominee in order to direct such broker, bank or

other nominee as to how to vote their shares. The availability of telephone and Internet voting depends on the voting process of

such broker, bank or nominee. Beneficial owners must obtain a legal proxy from their broker, bank or nominee prior to the Annual

Meeting in order to vote in person.

DMC GLOBAL INC. • 2020 PROXY STATEMENT 5

STOCKHOLDER PROPOSALS

Proposals of stockholders that are intended

to be presented at our 2021 Annual Meeting of Stockholders and to be included in our proxy materials for the meeting must be received

by us not later than December 9, 2020, in order to be included in the proxy statement and proxy relating to that annual meeting.

Notice of any stockholder proposal to be

considered at our 2021 Annual Meeting but not included in our proxy materials, must be submitted in writing and received by us

in the manner set forth in our Bylaws. In general, the Bylaws provide that such a notice must be delivered not later than 60 days

and not earlier than 90 days prior to the first anniversary of this year’s annual meeting date.

CONTACT INFORMATION

If you have questions or need more information

about the Annual Meeting, or if you wish to submit a question or question to be asked at the Annual Meeting, you may write to or

call:

Corporate Secretary

DMC Global Inc.

11800 Ridge Parkway, Suite 300

Broomfield, CO 80021

(303) 665-5700

corpsecretary@dmcglobal.com

You are also invited to visit the Company

website at www.dmcglobal.com. The Company’s website materials are not incorporated by reference into this Proxy Statement.

DMC GLOBAL INC. • 2020 PROXY STATEMENT 6

|

|

PROPOSAL 1

ELECTION OF DIRECTORS

|

There are seven nominees for election to

the Board. Each director elected will hold office until the 2021 Annual Meeting, or until his or her successor is elected and

qualified, or until such director’s earlier death, resignation, or removal.

Shares represented by executed proxies will

be voted, if authority to do so is not withheld, for the election of the seven nominees named below. Each of the nominees has

consented to be named as a nominee and to serve as a director, if elected. In the event that any nominee should be unavailable

for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominee as

the Corporate Governance and Nominating Committee of the Board may propose.

NOMINEES

The names of the nominees and certain information about them

are set forth below. In addition, we have included information about each nominee’s specific experience, qualifications,

attributes and skills that led our Board of Directors to conclude that the nominee should serve as a director of the Company,

in light of our business and corporate strategy.

|

Name

|

Position

|

Age

|

|

Kevin T. Longe

|

Director, President and Chief Executive Officer

|

61

|

|

David C. Aldous

|

Director

|

63

|

|

Andrea E. Bertone

|

Director

|

58

|

|

Yvon Pierre Cariou

|

Director

|

74

|

|

Robert A. Cohen

|

Director

|

71

|

|

Richard P. Graff

|

Director

|

73

|

|

Clifton Peter Rose

|

Director

|

69

|

|

Age 61

Director

since: 2012

Committees:

• Risk

|

|

KEVIN T. LONGE

|

|

|

Skills and Qualifications

• Extensive

global operating experience in both standalone businesses and divisions of larger multinational companies

• Strong

background in strategic planning and implementation in diverse industries and business environments

• Strong

financial analysis and management skills

• Deep

experience in technology, product management, marketing and sales, manufacturing, supply chain management, and people

and organizational development

Mr. Longe became our President and

Chief Executive Officer in March 2013. He has served as a director since joining the Company in July 2012 as our Chief

Operating Officer. From March 2011 until agreeing to join the Company, Mr. Longe served as an executive of Sonoco, Inc.,

first as President of Sonoco’s Thermo Safe business from March 2011 to March 2012 and then from March 2012

to July 2012 as a Vice President and General Manager with Sonoco’s Protective Packaging Division. From April 2010

until joining Sonoco, Mr. Longe was self-employed performing consulting and investment work. From 2004 through April 2010,

Mr. Longe served in various positions at Lydall, Inc., most recently (2007-2010) serving as president of its subsidiary,

Lydall Performance Materials, Inc. Mr. Longe holds a B.B.A, with distinction, from The University of Michigan and an M.B.A,

with distinction, from the J.L. Kellogg Graduate School of Management at Northwestern University. We believe it is

important to have our Chief Executive Officer also serve as a director to properly align management’s execution

of our business objectives with the oversight and direction of the Board.

|

DMC GLOBAL INC. • 2020 PROXY STATEMENT 7

|

Age 63

Director

since: 2013

Independent

Committees:

• Audit

• Compensation

|

|

DAVID C. ALDOUS

|

|

|

Skills and Qualifications

• Current

and practical experience in leadership of global operations, financial analysis, project management, risk management,

and health, environment, safety and security matters

• Over

30 years of corporate leadership experience in the energy, alternative energy, chemical and petrochemical industries

• Extensive

skills in strategic planning and corporate development in the industries in which the Company and its customers operate

Mr. Aldous was appointed by the

Board as a director in July 2013 and has served as non-executive Chairman of the Board since May 2018. Since March 2012,

he has served as the Chief Executive Officer and Director of Rive Technology Inc., a privately-held provider of solutions

for diffusion-limited reactions to the energy, chemicals, biofuel and water industries. Prior to joining Rive Technology

Inc., Mr. Aldous served as Chief Executive Officer and Director of Range Fuels Inc., a clean energy and biofuels company

from January 2009 to February 2012. Mr. Aldous also was employed for more than 20 years by Royal Dutch Shell, most recently

as Executive Vice President, Strategy and Portfolio and served as President of Shell Canada Products, where he led an

$11 billion integrated oil business. He also served as President, CEO and Director at CRI/Criterion Inc., a $11 billion

global catalyst company. Mr. Aldous has served on the Board of Directors of a number of companies and joint ventures inside

and outside Royal Dutch Shell. Mr. Aldous holds a B.S. in Fuels Engineering from the University of Utah and an M.B.A.,

with distinction, from the J.L. Kellogg Graduate School of Management at Northwestern University.

|

|

Age 58

Director

since: 2019

Independent

Committees:

• Audit

• Corporate Governance and Nominating

|

|

ANDREA E. BERTONE

|

|

|

Skills and Qualifications

• Current

and practical experience in leadership of global operations, financial analysis, project management, risk management,

and health, environment, safety and security matters

• In

depth experience with multinational companies operating in global markets and significant expertise with respect to mergers

and acquisitions

• Significant

strategic and operational expertise acquired while operating large infrastructure assets throughout Latin America

Public Company Directorships:

• Yamana

Gold Inc.

• Peabody

Energy Corp.

• Amcor

plc

Ms. Bertone was appointed by the

Board as a director in February 2019. She has nearly 20 years of senior management experience in the energy industry in

the Americas and most recently held the position of President of Duke Energy International LLC (“Duke Energy”).

During her seven years in this role, she was responsible for operations across South and Central America. Prior to her

role as President of Duke Energy, Ms. Bertone spent nearly 10 years in increasingly senior management roles with Duke

Energy and its subsidiary companies. Ms. Bertone serves on the board of directors of Yamana Gold Inc., where she serves

on the audit committee and risk and opportunities committees, and on the board of directors for Peabody Energy Corp.,

where she serves on the audit and HSSE committees, and on the board of Amcor plc, where she serves on the compensation

committee. Ms. Bertone completed her JD at the University of São Paulo, Brazil and received her LLM from Chicago-Kent

College of Law in 1995. She also completed a finance program for senior executives at Harvard Business School in 2010.

She is a member of the Brazilian Bar Association. In 2013, she received the Alumni of Distinction Award from Chicago-Kent

College of Law, and in 2016, she was recognized by the National Safety Council through their annual “CEOs Who Get

It” program, as a leader who demonstrates personal commitment to worker safety and health.

|

DMC GLOBAL INC. • 2020 PROXY STATEMENT 8

|

Age 74

Director

since: 2006

Independent

Committees:

• Risk

(Chair)

|

|

YVON PIERRE CARIOU

|

|

|

Skills and Qualifications

• Served

as President and Chief Executive Officer of DMC Global Inc. for over 13 years

• Detailed

knowledge of our operations and corporate strategy, including first-hand experience in growing NobelClad’s worldwide

explosion cladding business and diversifying DynaEnergetics’ oilfields products business

• Decades

of leadership experience with global manufacturing companies

Mr. Cariou was appointed director

in 2006 and served as President and Chief Executive Officer of the Company from 2000 to 2013. From November 1998 to March

2000, he was President and Chief Executive Officer of Astrocosmos Metallurgical Inc., a division of Mersen Group, which

designs and fabricates process equipment for the chemical and pharmaceutical industries. From 1986 to 1998, Mr. Cariou

was the lead executive with five different industrial, material science and manufacturing companies. Earlier in his career,

he spent 15 years with Mersen Group, a global industrial components manufacturer, where he held various executive positions

in France and the United States, including President of Carbone USA Corp. Mr. Cariou is a graduate engineer from Ecole

Nationale Superieure des Arts et Metiers, Paris and he obtained an M.B.A. from Fairleigh Dickinson University, Rutherford,

New Jersey.

|

|

Age 71

Director

since: 2011

Independent

Committees:

• Compensation

(Chair)

• Corporate

Governance and Nominating

|

|

ROBERT A. COHEN

|

|

|

Skills and Qualifications

• Extensive

financial background and management experience with multinational companies, bringing depth to the Board in the areas

of strategic planning, finance and risk management

• Served

as Chief Executive Officer of one of the largest banks in Korea while living in Korea and working with many Korean and

Asian companies

• Substantial

expertise in the Korean and Asian markets, which are key growth markets for NobelClad and DynaEnergetics

Mr. Cohen has served as a director

since February 2011. He is the managing partner of Joranel LLC, a private investment and consulting firm serving institutional

clients. Prior to joining Joranel in 2005, Mr. Cohen spent four years as president and Chief Executive Officer of Korea

First Bank. Previously, Mr. Cohen worked for 25 years with Credit Lyonnais, including eight years as Chief Executive Officer

of Credit Lyonnais USA. He taught economics and finance for 16 years at the Paris Institut Technique de Banque et Finance

and the French School of Management (ESSEC). He is a graduate of Ecole Polytechnique in Paris and earned a doctorate in

finance from the University Paris Dauphine.

|

|

Age 73

Director

since: 2007

Independent

Committees:

• Audit

(Chair)

• Risk

|

|

RICHARD P. GRAFF

|

|

|

Skills and Qualifications

• Over

35 years of experience in public company accounting and consulting on public company accounting policy and practice in

the mining industry

• Substantial

insight and experience with regard to accounting and financial reporting matters for companies operating internationally

• Public

company director experience since 2005, with current service on the boards of two other multinational public companies

Public Company Directorships:

• Yamana

Gold Inc.

• Alacer

Gold Corporation

Mr. Graff has served as a director

since June 2007. He is a retired partner of PricewaterhouseCoopers LLP where he served as the audit leader in the United

States for the mining industry, until his retirement in 2001. Mr. Graff began his career with PricewaterhouseCoopers LLP

in 1973. Since his retirement, Mr. Graff has been a consultant to the mining industry and was a member of a Financial

Accounting Standards Board task force for establishing accounting and financial reporting guidance in the mining industry.

He represents a consortium of international mining companies and has provided recommendations to the International Accounting

Standards Board on mining industry issues and to regulators on industry disclosure requirements. Mr. Graff serves on the

board of directors of Yamana Gold Inc. (lead independent director) and Alacer Gold Corporation. He received his undergraduate

degree in Economics from Boston College and his post-graduate degree in Accounting from Northeastern University.

|

DMC GLOBAL INC. • 2020 PROXY STATEMENT 9

|

Age 69

Director

since: 2016

Independent

Committees:

• Compensation

• Corporate Governance and Nominating (Chair)

|

|

CLIFTON PETER ROSE

|

|

|

Skills and Qualifications

• Extensive

work with world-leading financial, investment banking and strategic communications firms, which brings depth to the Board

in the areas of strategic planning, leadership, risk management, public relations and corporate governance

• Substantial

experience reviewing and analyzing acquisitions and investments provides unique and valuable perspectives to the Board

as it analyzes growth strategies and opportunities

Mr. Rose has served as a director

since November 2016. He is a senior advisor to Blackstone, the world’s largest alternative asset manager. From 2007

to 2016, he was a senior managing director with Blackstone, and served as its global head of public affairs. Mr. Rose

also spent 20 years with Goldman Sachs, where he was a managing director and held a variety of senior positions in government

relations and media relations in Washington DC, New York and Hong Kong. Mr. Rose currently is vice chairman of Sard Verbinnen,

one of the leading strategic communications firms in the United States. From 1983 to 1987 he was chief of staff to Congressman

Mike Synar (D-Okla) and a partner with the law firm of Williams and Jensen in Washington DC. Mr. Rose is a graduate of

the George Washington University and the Yale Law School. He serves on the national board of the NAACP, where he also

was on the search committee for its former CEO.

|

REQUISITE VOTE

Directors are elected by a plurality of

the votes cast by the shares entitled to vote in the election at a meeting at which a quorum is present; however, pursuant to

our Majority Voting Policy, any director who fails to receive a majority of the votes cast (in person or by proxy) “FOR”

such candidate is required to submit a letter of resignation to the Board. Abstentions and broker non-votes will not be counted

as votes cast for purposes of this proposal and will have no legal effect on this proposal.

|

THE BOARD RECOMMENDS VOTE “FOR” EACH NAMED NOMINEE

|

DMC GLOBAL INC. • 2020 PROXY STATEMENT 10

The following individuals serve as our executive

officers. Each executive officer is appointed by the Board and serves at the pleasure of the Board, subject to the terms of applicable

employment agreements or arrangements as described under “Employment Agreements.”

|

Name

|

Position

|

Age

|

|

Kevin T. Longe

|

President and Chief Executive Officer

|

61

|

|

Michael Kuta

|

Chief Financial Officer

|

45

|

|

Michelle Shepston

|

Vice President, Chief Legal Officer and Secretary

|

45

|

|

Ian Grieves

|

President and Managing Director, DynaEnergetics

|

51

|

|

John Scheatzle

|

President, NobelClad

|

55

|

Kevin T. Longe. Information

regarding Mr. Longe, our President and Chief Executive Officer, is provided under Proposal 1 of this proxy statement

under the caption, “Nominees.”

Michael Kuta. Mr. Kuta joined

the Company on March 31, 2014 as our Chief Financial Officer. From 2007 until joining the Company, Mr. Kuta served in

various executive positions with The Lubrizol Corporation, most recently from September 2011 until March 2014 as its

corporate controller. From September 2009 until assuming that position, he was the finance manager of Lubrizol’s TempRite

Engineered Polymers Business Unit, and before that served Lubrizol as a manager, treasury and capital markets and manager, external

financial reporting. Before joining Lubrizol, Mr. Kuta also served in various financial and accounting positions with Lincoln

Electric Company and Eaton Corporation. Mr. Kuta received a B.B.A. in Accounting from Kent State University and an M.B.A.

from Case Western Reserve University.

Michelle Shepston. Ms. Shepston

joined the Company on August 30, 2016 as our Vice President, Chief Legal Officer and Secretary. For the previous 16 years,

Ms. Shepston was with Denver-based Davis Graham & Stubbs LLP, a leading regional law firm where she was a partner and

practiced with the Corporate Finance and Acquisitions Group. Ms. Shepston brings to the Company expertise in securities law, mergers

and acquisitions, cross-border equity and debt transactions, and contract negotiation and execution. She has advised public and

private company boards on issues of fiduciary duty, risk management and oversight. She also has served a broad spectrum of corporate

clients, including several in the energy and natural resource industries. She earned a J.D. from the University of Denver College

of Law and a B.S. from the University of Illinois.

Ian Grieves. Mr. Grieves

serves as President and Managing Director of DynaEnergetics, having previously served as Senior Vice President and General Manager

of DynaEnergetics from his appointment in January 2013. From 2006 until joining the Company, Mr. Grieves was employed by

Lydall Inc. as senior vice president of the company’s performance materials division (2010-2013), and as vice president

and general manager Europe of the company’s filtration division (2006-2010). From 1995 to 2005, he was employed in various

financial and general management positions with AAF International Inc., with his last position being that of vice president and

general manager of AAF Europe (2003-2005). Mr. Grieves studied economics and graduated from the University of Sunderland, United

Kingdom.

John Scheatzle. Mr. Scheatzle

joined the Company on November 15, 2016 as president of the Company’s NobelClad business. Prior to joining the Company,

he spent the previous 19 years with Materion, an integrated manufacturer of advanced materials for the industrial and consumer

products sectors. In his most recent role, he was vice president and general manager of Materion’s Performance Alloys division.

He was responsible for North American production facilities and the company’s international sales and distribution centers.

He also had oversight of the business’ sales and marketing, research and development, manufacturing; quality, and environmental,

health and safety functions. Before his tenure with Performance Alloys, Mr. Scheatzle was general manager of Materion’s

Ceramic Products division. He also spent seven years with the consulting firm Accenture, where he was a senior manager and worked

with clients in the consumer products, chemicals manufacturing, and metals industries. Mr. Scheatzle holds an M.B.A. with a concentration

in marketing and manufacturing from Case Western Reserve University. He earned a B.S. in business administration from the University

of Akron.

DMC GLOBAL INC. • 2020 PROXY STATEMENT 11

MEETING ATTENDANCE

Directors are encouraged to attend our Annual

Meeting of Stockholders. All of our directors then in office attended the 2019 Annual Meeting of Stockholders.

During the fiscal year ended December 31, 2019,

the Board held 12 meetings. During the fiscal year ended December 31, 2019, each of our directors attended more than

75% of the aggregate of (i) the number of meetings of the Board held during the period in which he was a director and (ii) the

number of meetings of the committees on which he served.

DIRECTOR INDEPENDENCE

The Board has determined that six of the

seven current directors, Messrs. Aldous, Cariou, Cohen, Graff and Rose and Ms. Bertone, are “independent” directors

under the rules promulgated by the Securities and Exchange Commission (“SEC”) and the applicable rules of the Nasdaq.

In making its determinations of independence, the Board considered factors for each director such as other directorships, employment

or consulting arrangements, and any relationships with our customers or suppliers. The Board also considered a review of transactions

that occurred since the beginning of 2017 with entities associated with our directors or members of their immediate family.

The Board determined that there were no

related-party transactions or other relationships that needed to be considered in evaluating whether these directors are independent.

Mr. Longe, our President and Chief Executive Officer is the only Board member nominated for re-election who is not independent

based on these criteria.

All current members of the Audit Committee,

the Compensation Committee, and the Corporate Governance and Nominating Committee are independent directors. Our independent directors

hold regularly scheduled meetings in executive session, at which only independent directors are present.

BOARD LEADERSHIP STRUCTURE

The Board does not have a prescribed policy

on whether the Chairman and Chief Executive Officer positions should be separate or combined. The Company currently separates

the positions of Chairman and Chief Executive Officer. Our Chief Executive Officer is responsible for setting the strategic direction

for the Company and the day to day leadership and performance of the Company, while our Chairman of the Board oversees the Board,

approves Board agendas and schedules, facilitates communication between the Chief Executive Officer and the rest of the Board

and provides guidance to the Chief Executive Officer. We believe our Chief Executive Officer and Chairman have an excellent working

relationship that allows the Chief Executive Officer to focus the requisite time and energy on the Company’s businesses,

people and growth opportunities.

Our Board currently has six independent

members and only one non-independent member, the Chief Executive Officer. A number of our independent Board members are currently

serving or have served as senior management of other public companies and are currently serving or have served as directors of

other public companies. We believe that the number of independent, experienced directors, along with the independent oversight

of the Board by our non-executive Chairman, benefits the Company and our stockholders.

The Board assesses our Board leadership

structure from time to time and makes changes when appropriate. We recognize that different board leadership structures are appropriate

for companies in different situations. We believe our current leadership structure is the optimal structure for the Company at

this time.

DMC GLOBAL INC. • 2020 PROXY STATEMENT 12

BOARD COMMITTEES

The Board currently has an Audit Committee,

a Compensation Committee, a Corporate Governance and Nominating Committee and a Risk Committee (formerly, the Health, Safety,

Security and Environment Committee). Each committee operates under a written charter, which sets forth the functions and responsibilities

of the committee. A copy of the charter of each committee can be viewed on our website, www.dmcglobal.com.

MEMBERS OF THE COMMITTEES OF THE BOARD OF

DIRECTORS

|

|

Audit

Committee

|

Compensation

Committee

|

Corporate Governance

and Nominating

Committee

|

Risk

Committee

|

|

INDEPENDENT DIRECTORS

|

|

|

|

|

|

David C. Aldous*

|

|

|

|

|

|

Andrea E. Bertone

|

|

|

|

|

|

Yvon Pierre Cariou

|

|

|

|

|

|

Robert A. Cohen

|

|

|

|

|

|

Richard P. Graff

|

|

|

|

|

|

Clifton Peter Rose

|

|

|

|

|

|

NON-INDEPENDENT DIRECTORS

|

|

|

|

|

|

Kevin T. Longe

|

|

|

|

|

|

Member

|

|

Chair

* Non-Executive Chairman

|

The Audit Committee

The Audit Committee meets with our independent

registered public accounting firm at least four times a year to review quarterly financial results and the annual audit, discuss

financial statements and related disclosures, and receive and consider the accountants’ comments as to internal control

over financial reporting, adequacy of staff and management performance and procedures in connection with the annual audit and

internal control over financial reporting. The Audit Committee also appoints the independent registered public accounting firm.

The Audit Committee currently consists of three directors, each of whom is a non-employee director that the Board has determined

to be “independent” as that concept is defined in Section 10A of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), the rules promulgated by the SEC thereunder, and the applicable rules of the Nasdaq. The Audit

Committee has determined that Mr. Graff qualifies as an “audit committee financial expert” under the rules of the

SEC.

The Charter of the Audit Committee requires

the Audit Committee be comprised of three or more independent directors, at least one of whom qualifies as an “audit committee

financial expert” as defined in Item 407(d)(5) of SEC Regulation S-K. The Charter of the Audit Committee charges the Audit

Committee with the primary responsibility of reviewing the Company’s compliance with the Code of Ethics and Business Conduct

(“Code of Ethics”) as it relates to financial statement and reporting issues and related party transactions that would

be required to be disclosed pursuant to Item 404 of SEC Regulation S-K.

During 2019 the Audit Committee met six

times.

The Compensation Committee

The Compensation Committee makes recommendations

concerning salaries, incentive compensation and equity-based awards to employees and non-employee directors under our stock incentive

plan and otherwise determines compensation levels and performs such other functions regarding compensation as the Board may delegate.

The Compensation Committee is also responsible for reviewing and approving the Compensation Discussion and Analysis included in

the Company’s proxy statement.

The Compensation Committee has authority

to retain such compensation consultants, outside counsel and other advisors as the Compensation Committee in its sole discretion

deems appropriate. The Compensation Committee is currently composed of three directors, each of whom is a non-employee director

that the Board has determined to be “independent” under SEC and Nasdaq rules.

During 2019 the Compensation Committee met four

times.

DMC GLOBAL INC. • 2020 PROXY STATEMENT 13

The Corporate Governance and Nominating Committee

The Corporate Governance and Nominating

Committee recommends director nominees and sets corporate governance policies for the Board and Company. The Corporate Governance

and Nominating Committee currently has four directors, each of whom is a non-employee director that the Board has determined to

be “independent” under the SEC and Nasdaq rules. The main purposes of this Committee are (i) to identify and

recommend individuals to the Board for nomination as members of the Board and its committees; (ii) to develop and recommend

to the Board corporate governance principles applicable to the Company; (iii) to oversee the Board’s annual evaluation

of its performance; (iv) in coordination with the Audit Committee, review compliance with the Company’s Code of Ethics,

and; (v) to undertake such other duties as the Board may from time to time delegate to the Committee.

During 2019, the Corporate Governance

and Nominating Committee met four times.

The Risk Committee (formerly, the Health,

Safety, Security and Environment Committee)

The Health, Safety, Security and Environment

Committee (“HSSE Committee”) was responsible for reviewing the Company’s performance in meeting its health,

safety, security and environmental objectives and facilitating the Board’s oversight of these critical operational issues.

In November 2019, the Board created a new Risk Committee to more broadly address risk, with the primary purpose of assisting the

Board with its oversight of the Company’s level of risk, risk assessment and risk management in areas not otherwise addressed

by other committees of the Board.

The Risk Committee is currently comprised

of two non-employee directors whom the Board has determined are “independent” under SEC and Nasdaq rules, and our

CEO.

The HSSE Committee met four times

during 2019.

DMC GLOBAL INC. • 2020 PROXY STATEMENT 14

COMPENSATION COMMITTEE INTERLOCKS AND

INSIDER PARTICIPATION

We do not have any interlocking relationships

between any director who currently serves or served during 2019 as a member of our Compensation Committee and any of our executive

officers that would require disclosure under the applicable rules promulgated under the U.S. federal securities laws.

CORPORATE GOVERNANCE GUIDELINES

DMC is committed to sound principles of

corporate governance. Our Board has adopted Corporate Governance Guidelines prepared by the Corporate Governance and Nominating

Committee. Among other things, the guidelines provide that directors should serve no longer than a total of 15 years as a non-employee

director or after the director’s 75th birthday.

Our Board periodically, and at least

annually, reviews and revises the Corporate Governance Guidelines, as appropriate, to ensure that they reflect our Board’s

corporate governance objectives and commitments. Our Corporate Governance Guidelines are available on the Company’s website

at www.dmcglobal.com.

STOCK OWNERSHIP GUIDELINES

We have stock ownership guidelines applicable

to our directors and named executive officers. For a descriptions of these guidelines, please see “Compensation Discussion

and Analysis- Stock Ownership Guidelines.”

PLEDGING AND HEDGING POLICIES

Our directors, officers and employees are

prohibited from using any strategies or products (such as derivative securities or short-selling techniques) to hedge against

potential changes in the value of DMC common stock. In addition, our directors, officers and employees are prohibited from holding

DMC securities in a margin account or pledging DMC securities as collateral for a loan.

CODE OF ETHICS AND BUSINESS CONDUCT

We have adopted a Code of Ethics that applies

to all members of our Board and all of our employees, including our principal executive officer, principal financial officer,

principal accounting officer and all other senior members of our finance and accounting departments. We require all employees

to adhere to our Code of Ethics in addressing legal and ethical issues encountered in conducting their work. Our Board periodically,

and at least annually, reviews and revises our Code of Ethics, as appropriate. A copy of our Code of Ethics is available on our

website, www.dmcglobal.com.

DMC GLOBAL INC. • 2020 PROXY STATEMENT 15

RISK OVERSIGHT

Our senior management manages the risks

facing the Company under the oversight and supervision of the Board. The Company has a global Enterprise Risk Management (“ERM”)

team, which is comprised of senior management in key business areas and Mr. Yvon Cariou in his capacity as an independent director

and Chair of the Risk Committee. The ERM team employs a proactive approach to reviewing and analyzing current and potential risks

facing the Company, and reports to the Board regarding the ERM process and risk findings on a quarterly basis. While the full

Board is ultimately responsible for risk oversight at our Company, our Board committees assist the Board in fulfilling its oversight

function in certain areas of risk. The Audit Committee assists the Board in fulfilling its oversight responsibilities with respect

to risk in the areas of financial reporting processes and internal controls around those processes, the Company’s compliance

with legal and regulatory requirements and the financial risks of the Company. The Corporate Governance and Nominating Committee

oversees governance matters, including primary oversight of the Code of Ethics and Business Conduct. The Compensation Committee

oversees the Company’s executive compensation strategy and programs, incentive compensation arrangements and the evaluation

of risks related thereto. The Risk Committee assists the Board in fulfilling its oversight responsibilities with respect to the

management of the Company’s level of risk, risk assessment and risk management in areas not otherwise addressed by other

committees of the Board. Other general business risks such as economic and regulatory risks are monitored by the full Board.

COMPENSATION RISK ASSESSMENT

Our Compensation Committee, with the assistance

of management, reviews on an annual basis our compensation programs and considers whether they encourage excessive risk-taking

by employees at the expense of long-term Company value. The Compensation Committee believes that the design of our compensation

program, which includes a mix of annual and long-term incentives (a substantial portion of which are performance based) and cash

and equity awards, along with our stock ownership guidelines and clawback policy, provide an appropriate balance between risk

and reward and do not motivate imprudent risk-taking. As a result, we do not believe that our compensation policies are reasonably

likely to have a material adverse effect on the Company.

DIRECTOR NOMINATIONS

The Company does not have a formal policy

regarding the consideration of director candidates recommended by stockholders; however, the Corporate Governance and Nominating

Committee reviews recommendations and evaluates nominations received from stockholders in the same manner that potential nominees

recommended by Board members, management or other parties are evaluated. Stockholders may nominate persons for election to the

Board in accordance with our Bylaws. Any stockholder nominations proposed for Board consideration should include the nominee’s

name and qualifications for Board membership and should be mailed to DMC Global Inc., c/o Corporate Secretary, 11800

Ridge Parkway, Suite 300, Broomfield, Colorado 80021.

Qualifications for consideration as a director

nominee may vary according to the particular area of expertise being sought as a complement to the existing Board composition.

However, in making its nominations, the Corporate Governance and Nominating Committee considers, among other things, an individual’s

skills, attributes and functional, business and industry experience, financial background, breadth of knowledge about issues affecting

our business, integrity, independence, diversity of experience, leadership, ability to exercise sound and ethical business judgement

and time available for meetings and consultation.

Diversity along multiple dimensions is an

important element of the Corporate Governance and Nominating Committee’s consideration of nominees. While diversity is evaluated

in a broad sense based on experience, background and viewpoint, the Corporate Governance and Nominating Committee recognizes that

DMC serves diverse communities and customers and believes that the composition of our Board should appropriately reflect this

diversity. Accordingly, the Corporate Governance and Nominating Committee also considers other aspects of diversity, including

gender, race and ethnicity. The Corporate Governance and Nominating Committee is committed to seeking highly qualified women and

individuals from minority groups to include in the pool of nominees and instructs any third-party search firm to consider these

elements accordingly.

For new nominees, the Corporate Governance

and Nominating Committee may also consider the results of the nominee’s interviews with directors and/or other members of

senior management as the Corporate Governance and Nominating Committee deems appropriate.

DMC GLOBAL INC. • 2020 PROXY STATEMENT 16

MAJORITY VOTING POLICY

The Board has adopted a majority voting

policy (“the Majority Voting Policy”) as part its Corporate Governance Guidelines. The policy stipulates that, at

any stockholder meeting at which directors are subject to an uncontested election, if the number of shares “withheld”

for any nominee exceeds the number of shares voted “FOR” such nominee, then, notwithstanding that such director was

duly elected as a matter of corporate law, he or she shall submit to the Board a letter of resignation for consideration by the

Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee will consider such offer of resignation

and will make a recommendation to the Board concerning the acceptance or rejection of the offer of resignation. In the event that

all members of the Corporate Governance and Nominating Committee are among the nominees for director who are offering to resign,

the Board shall appoint a special committee of one or more other independent directors to act on behalf of the Corporate Governance

and Nominating Committee with respect to this policy. The Board shall act promptly with respect to each such letter of resignation

and shall promptly notify the director concerned of its decision.

COMMUNICATIONS WITH THE BOARD

The Board believes that it is important

for stockholders to have a process to send communications to the Board. Accordingly, stockholders desiring to send a communication

to the Board, or to a specific director, may do so by delivering a letter to our Secretary at DMC Global Inc., c/o Corporate

Secretary, 11800 Ridge Parkway, Suite 300, Broomfield, Colorado 80021. The mailing envelope must contain a clear notation indicating

that the enclosed letter is a “Stockholder-Board Communication” or “Stockholder-Director Communication.”

All such letters must identify the author as a stockholder and clearly state whether the intended recipients of the letter are

all members of the Board or specified individual directors. The Secretary will open such communications and make copies and then

circulate them to the appropriate director or directors.

ANNUAL BOARD ASSESSMENTS

In order to monitor and improve its effectiveness,

and to solicit and act upon feedback received, the Board engages in a formal self-evaluation process. The Board believes that

in addition to serving as a tool to evaluate and improve performance, evaluations can serve several other purposes, including

the promotion of good governance, integrity of financial reporting, reduction of risk, strengthening of the Board-management partnership,

and helping set and oversee Board expectations of management. The Board takes a multi-year perspective to identify and evaluate

trends and assure itself that areas identified for improvement are appropriately and timely addressed. As part of the Board’s

evaluation process, directors consider various topics related to Board composition, structure, effectiveness and responsibilities

and the overall mix of director skills, attributes, experience and backgrounds. While the Board conducts a formal evaluation annually,

the Board considers its performance and that of its committees continuously throughout the year and shares feedback with management.

DMC GLOBAL INC. • 2020 PROXY STATEMENT 17

|

|

PROPOSAL 2

NON-BINDING ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION

|

The Company’s record performance in

2019 was the result of our continuing efforts to strengthen and grow DMC. We believe our executive compensation program has played

a critical role in retaining the key members of our management team and motivating them to focus on the creation of long-term

stockholder value.

Pursuant to Section 14A of the Exchange

Act and SEC Rule 14a-2(a), we are providing our stockholders the opportunity to vote on a non-binding advisory resolution to approve

the compensation of our named executive officers (“Say on Pay”) which is described in this Proxy Statement. Currently,

we are providing these advisory votes on an annual basis. In considering your vote on this proposal, we encourage you to review

all of the relevant information in this proxy statement, including the Compensation Discussion and Analysis, the compensation

tables, and the rest of the narrative disclosures regarding our compensation arrangements.

Following the 2020 Annual Meeting, the next

advisory Say-on-Pay vote is anticipated to be held at our 2021 Annual Meeting of Stockholders.

Our Board strongly endorses the Company’s

executive compensation program and recommends that stockholders vote in favor of the following advisory resolution:

“RESOLVED,

that the compensation paid to the Company’s named executive officers, as disclosed pursuant to the compensation disclosure

rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, compensation tables and narrative

discussion in the Company’s proxy statement is hereby APPROVED.”

REQUISITE VOTE

The advisory vote on the compensation of

our named executive officers will be approved by the majority of votes cast on this proposal. Abstentions and broker non-votes

will not be counted as votes cast on the proposal. Our Board and our Compensation Committee value the opinions of our stockholders

and will consider the outcome of the vote when considering future decisions on the compensation of our named executive officers.

However, this say-on-pay vote is advisory, and therefore not binding on the Company, the Compensation Committee or our Board.

|

THE

BOARD RECOMMENDS VOTE “FOR” APPROVAL OF PROPOSAL 2.

|

DMC GLOBAL INC. • 2020

PROXY STATEMENT 18

|

|

PROPOSAL 3

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

The Audit Committee of the Board has selected

Ernst & Young LLP (“EY”) as our independent registered public accounting firm for the fiscal year ending December

31, 2020. EY has been so engaged since 2002.

The Audit Committee is responsible for the

appointment, compensation, retention and oversight of the Company’s independent registered public accounting firm retained

to audit the Company’s consolidated financial statements. In accordance with its commitment to sound corporate governance

practices, the Audit Committee reviews whether it is in the Company’s best interests to rotate the Company’s independent

registered public accounting firm. In fulfilling its oversight responsibility, the Audit Committee carefully reviews the policies

and procedures for the engagement of the independent registered public accounting firm, including the scope of the audit, audit

fees, auditor independence matters, performance of the independent auditors and the extent to which the independent registered

public accounting firm may be retained to perform non-audit services. The Audit Committee and its Chair are also directly involved

with the selection, review and evaluation of the lead engagement partner and the negotiation of audit fees. The Audit Committee

reviews the performance of the independent registered public accounting firm annually. In conducting its review, the Audit Committee

considered, among other things:

|

•

|

EY’s historical and recent performance on the Company’s audit, including

the extent and quality of EY’s communications with the Audit Committee;

|

|

•

|

The appropriateness of EY’s fees;

|

|

•

|

EY’s tenure as our independent auditor and its depth of understanding of our global

operations and business, operations and systems, accounting policies and practices, including the potential effect on the

financial statements of the major risks and exposures facing the Company, and internal control over financial reporting;

|

|

•

|

EY’s demonstrated professional integrity and objectivity, including through rotation

of the lead audit partner and other key engagement partners;

|

|

•

|

EY’s capabilities and expertise in handling the breadth and complexity of our global

operations, and

|

|

•

|

The advisability and potential impact of selecting a different independent accounting firm.

|

Ratification of the selection of EY by stockholders

is not required by law. However, as a matter of internal policy and good corporate governance, such selection is being submitted

to the stockholders for ratification at the Annual Meeting, and it is the present intention of the Board to continue this policy.

If the stockholders do not ratify this appointment, the Audit Committee will reconsider whether to retain EY. If the selection

of EY is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent registered public

accounting firm at any time it decides that such a change would be in the best interest of the Company and its stockholders.

We expect that a representative of EY will

be present at the Annual Meeting and will be available to respond to appropriate questions.

The Company paid the following fees to EY

for the audit of the consolidated financial statements and for other services provided in the years ended December 31, 2019 and

2018.

AUDITOR FEES

|

|

|

2019

|

|

|

2018

|

|

|

Audit Fees

|

|

$

|

1,044,323

|

|

|

$

|

1,011,140

|

|

|

Audit Related Fees(1)

|

|

$

|

162,113

|

|

|

$

|

-

|

|

|

Tax Fees(2)

|

|

$

|

593,218

|

|

|

$

|

709,469

|

|

|

TOTAL FEES

|

|

$

|

1,799,654

|

|

|

$

|

1,720,609

|

|

|

(1)

|

The Company includes fees related to the following in Audit Related Fees: employee

benefit plan audits, due diligence related to mergers and acquisitions, accounting consultations and audits in connection

with acquisitions, internal control reviews, attest services related to financial reporting that are not required by statute

or regulation, and consultation concerning financial accounting and reporting standards.

|

|

(2)

|

The Company includes fees related to the following in Tax Fees: federal and state tax compliance,

tax advice, and tax planning.

|

DMC GLOBAL INC. • 2020

PROXY STATEMENT 19

AUDIT COMMITTEE PRE-APPROVAL POLICIES AND

PROCEDURES

In accordance with the SEC’s rules

requiring the Audit Committee to pre-approve all audit and non-audit services provided by our independent auditor, the Audit Committee

has adopted a formal policy on auditor independence requiring the approval by the Audit Committee of all professional services

rendered by our independent auditor prior to the commencement of the specified services. The Audit Committee approved all services

performed by EY in 2019 in accordance with our formal policy on auditor independence.

REQUISITE VOTE

The selection of our auditors will be ratified

if the number of votes cast in favor of the proposal exceeds the votes cast opposing the proposal. Abstentions and broker non-votes

will not be counted as votes cast on the proposal.

|

THE BOARD RECOMMENDS VOTE “FOR” APPROVAL OF PROPOSAL 3.

|

|

Notwithstanding

anything to the contrary set forth in any of our filings under the Securities Act of 1933, as amended (the “Securities

Act”), or the Exchange Act, that might incorporate future filings, including this proxy statement, in whole or in part,

the following Audit Committee Report and the Compensation Committee Report shall not be deemed to be “Soliciting Material,”

and are not deemed “filed” with the SEC and shall not be incorporated by reference into any filings under the

Securities Act or Exchange Act whether made before or after the date of this proxy statement and irrespective of any general

incorporation language in such filings.

|

DMC GLOBAL INC. • 2020

PROXY STATEMENT 20

|

|

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

|

As of December 31, 2019, the Audit Committee of DMC Global Inc.

(the “Company”) was comprised of Messrs. Richard P. Graff (Chairman) and David C. Aldous and Ms. Andrea E. Bertone

each of whom the Board of Directors of the Company has determined to be independent as that concept is defined in Section 10A

of the Exchange Act, the rules promulgated by the SEC thereunder; and the applicable rules of the Nasdaq. The Audit Committee