DLH Holdings Corp. (NASDAQ: DLHC) (“DLH” or the

“Company”), a leading provider of innovative healthcare

services and solutions to federal agencies, today announced

financial results for its fiscal second quarter ended

March 31, 2022.

Highlights

- Second quarter revenue increased to

$108.7 million in fiscal 2022 from $61.5 million in fiscal 2021,

reflecting the previously-announced award of two FEMA contracts to

support Alaska, which accounted for approximately $39.8 million of

revenue

- Excluding these short-term

contracts, second quarter revenue rose to $68.9 million in fiscal

2022, an increase of 12% over the prior-year period

- Earnings were $7.2 million, or

$0.50 per diluted share, for the fiscal 2022 second quarter versus

$2.6 million, or $0.19 per diluted share, for the second quarter of

fiscal 2021

- Excluding contributions from the

aforementioned short-term FEMA contracts, earnings on a non-GAAP

basis for the fiscal 2022 second quarter were $3.1 million, or

$0.22 per diluted share

- The Company's term loan was reduced

to $37.5 million from $42.9 million during the second quarter;

- Contract backlog was $554.7 million as of March 31, 2022

versus $633.6 million at the end of the first quarter, with

approximately $30.0 million of the latter related to Alaska-based

task orders

Management Discussion“Our

second quarter continued the positive trends of the first, with

strong organic revenue growth and contributions from our Alaska

contracts resulting in solid financial performance,” said DLH

President and Chief Executive Officer Zach Parker. “The overall

business, net of short-term FEMA work, expanded 12% year-over-year,

reflecting increased demand for services even during a

slower-than-anticipated award environment. In addition, we achieved

an operating margin of 9.4% and continued our early repayment of

acquisition debt.

“With passage of the fiscal 2022 omnibus

appropriations bill in March, contract decision-making should

accelerate – at the same time DLH is expected to benefit from

obtaining FedRamp authorization for its Infinibyte® data analytics

solutions. We are pleased with the progress we are making to

strengthen and diversify our capabilities across the key federal

markets we serve. While focused on paying down debt and improving

the balance sheet, we continue to actively look at potential

acquisitions that may enhance and broaden our portfolio of

technology-enabled applications. It’s an exciting time at DLH, with

many opportunities ahead of us – leveraging our leadership position

in innovative, healthcare-related services and solutions to build a

unique, customer-centric enterprise that, at the same time, creates

value for our shareholders.”

Results for the Three Months Ended

March 31, 2022Revenue for the second quarter of

fiscal 2022 was $108.7 million versus $61.5 million in the

prior-year period. The increase was primarily due to the Company’s

work for FEMA in Alaska – which added approximately $39.8 million

in revenue – along with other new business wins and generally

higher volume across a number of legacy programs.

Income from operations was $10.3 million for the

quarter versus $4.6 million in the prior-year period and, as a

percent of revenue, the Company reported an operating margin of

9.4% in fiscal 2022 versus 7.5% in fiscal 2021. Income from

operations increased primarily due to performance on the FEMA task

orders. Income from operations on the remaining contract portfolio

was essentially flat, notwithstanding the increase in revenue,

reflecting planned investment in human capital management and

business development as we continue to build and strengthen our

sustaining business.

Interest expense was $0.6 million in the fiscal

second quarter of 2022 versus $1.0 million in the prior-year

period, reflecting lower debt outstanding. Income before taxes was

$9.7 million this year versus $3.6 million in fiscal 2021,

representing 8.9% and 5.9% of revenue, respectively, for each

period.

For the three months ended March 31, 2022

and 2021, respectively, DLH recorded a $2.5 million and $1.0

million provision for tax expense. The Company reported net income

of approximately $7.2 million, or $0.50 per diluted share, for the

second quarter of fiscal 2022 versus $2.6 million, or $0.19 per

diluted share, for the second quarter of fiscal 2021. As a percent

of revenue, net income was 6.6% for the second quarter of fiscal

2022 versus 4.2% for the prior-year period.

On a non-GAAP basis, EBITDA for the three months

ended March 31, 2022 was approximately $12.1 million versus

$6.6 million in the prior-year period, or 11.2% and 10.8% of

revenue, respectively. A reconciliation of the Company's

performance for the quarter less the contribution of the FEMA task

orders compared to the prior-year period is included at the back of

this document.

Key Financial IndicatorsFiscal

year to date, DLH used $14.8 million in operating cash, reflecting

performance of the $22.2 million deferred revenue on the

aforementioned FEMA contracts, for which there were advance

payments in the fourth quarter of fiscal 2021. Excluding the impact

of the FEMA contracts, DLH would have generated positive operating

cash flow fiscal year to date.

Fiscal year to date, accounts receivable

increased by $28.7 million, including $13.6 million related to the

FEMA contracts, for which the cash flow impact was largely offset

by corresponding subcontractor accruals. Both the receivables and

corresponding payables on the FEMA contracts were largely settled

subsequent to quarter end. The remaining increase in accounts

receivable is related to normal fluctuations in the timing of

customer payments and to growth in the overall business volume.

As of March 31, 2022, the Company had cash

of $0.4 million and debt outstanding under its credit facility of

$37.5 million, versus cash of $24.1 million and debt outstanding of

$46.8 million as of September 30, 2021. The Company has satisfied

mandatory principal amortization on the loan facility until

December 31, 2024. Subsequent to the end of the quarter, the

Company made additional debt payments, reducing the outstanding

balance on the term loan to $33 million. As a result of these

payments, DLH retired the $70 million debt associated with the

Social & Scientific Systems, Inc. acquisition more than two

years early. The Company intends to continue using cash to make

debt prepayments when possible.

At March 31, 2022, total backlog was

approximately $554.7 million, including funded backlog of

approximately $82.4 million and unfunded backlog of $472.3

million.

Conference Call and Webcast

DetailsDLH management will discuss second quarter results

and provide a general business update, including current

competitive conditions and strategies, during a conference call

beginning at 11:00 AM Eastern Time tomorrow, May 5, 2022.

Interested parties may listen to the conference call by dialing

888-347-5290 or 412-317-5256. Presentation materials

will also be posted on the Investor Relations section of the DLH

website prior to the commencement of the conference

call.

A digital recording of the conference call will be available for

replay two hours after the completion of the call and can be

accessed on the DLH Investor Relations website or by dialing

877-344-7529 and entering the conference ID 7532524.

About DLHDLH (NASDAQ:DLHC)

delivers improved health and readiness solutions for federal

programs through research, development, and innovative care

processes. The Company’s experts in public health, performance

evaluation, and health operations solve the complex problems faced

by civilian and military customers alike, leveraging digital

transformation, artificial intelligence, advanced analytics,

cloud-based applications, telehealth systems, and more. With over

2,300 employees dedicated to the idea that “Your Mission is Our

Passion,” DLH brings a unique combination of government sector

experience, proven methodology, and unwavering commitment to public

health to improve the lives of millions. For more information,

visit www.DLHcorp.com.

Safe Harbor Statement under the Private

Securities Litigation Reform Act of 1995:This press

release may contain forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995. These

statements relate to future events or DLH`s future financial

performance. Any statements that refer to expectations, projections

or other characterizations of future events or circumstances or

that are not statements of historical fact (including without

limitation statements to the effect that the Company or its

management “believes”, “expects”, “anticipates”, “plans”, “intends”

and similar expressions) should be considered forward looking

statements that involve risks and uncertainties which could cause

actual events or DLH’s actual results to differ materially from

those indicated by the forward-looking statements. Forward-looking

statements in this release include, among others, statements

regarding estimates of future revenues, operating income, earnings

and cash flow. These statements reflect our belief and assumptions

as to future events that may not prove to be accurate. Our actual

results may differ materially from such forward-looking statements

made in this release due to a variety of factors, including: the

outbreak of the novel coronavirus (“COVID-19”), including the

measures to reduce its spread, and its impact on the economy and

demand for our services, are uncertain, cannot be predicted, and

may precipitate or exacerbate other risks and uncertainties; the

risk that we will not realize the anticipated benefits

of acquisitions; the challenges of managing larger and

more widespread operations; contract awards in connection with

re-competes for present business and/or competition for new

business; compliance with new bank financial and other covenants;

changes in client budgetary priorities; government contract

procurement (such as bid and award protests, small business set

asides, loss of work due to organizational conflicts of interest,

etc.) and termination risks; the ability to successfully integrate

the operations of acquisitions; the impact of inflation and higher

interest rates; and other risks described in our SEC filings. For a

discussion of such risks and uncertainties which could cause actual

results to differ from those contained in the forward-looking

statements, see “Risk Factors” in the Company’s periodic reports

filed with the SEC, including our Annual Report on Form 10-K for

the fiscal year ended September 30, 2021, as well as subsequent

reports filed thereafter. The forward-looking statements contained

herein are not historical facts, but rather are based on current

expectations, estimates, assumptions and projections about our

industry and business.

Such forward-looking statements are made as of

the date hereof and may become outdated over time. The Company does

not assume any responsibility for updating forward-looking

statements, except as may be required by law.

CONTACTS:

|

INVESTOR RELATIONS |

|

Contact: Chris Witty |

|

Phone: 646-438-9385 |

|

Email: cwitty@darrowir.com |

TABLES TO FOLLOW

DLH HOLDINGS

CORP.CONSOLIDATED STATEMENTS OF

INCOME(Amounts in thousands except per share amounts)

| |

|

(unaudited) |

|

(unaudited) |

| |

|

Three Months Ended |

|

Six Months Ended |

| |

|

March 31, |

|

March 31, |

|

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

Revenue |

|

$ |

108,699 |

|

$ |

61,506 |

|

$ |

261,500 |

|

$ |

119,358 |

| Cost

of Operations: |

|

|

|

|

|

|

|

|

|

Contract costs |

|

|

88,831 |

|

|

48,722 |

|

|

221,517 |

|

|

94,727 |

|

General and administrative costs |

|

|

7,733 |

|

|

6,135 |

|

|

14,644 |

|

|

12,285 |

|

Depreciation and amortization |

|

|

1,881 |

|

|

2,029 |

|

|

3,866 |

|

|

4,091 |

|

Total operating costs |

|

|

98,445 |

|

|

56,886 |

|

|

240,027 |

|

|

111,103 |

|

Income from operations |

|

|

10,254 |

|

|

4,620 |

|

|

21,473 |

|

|

8,255 |

|

Interest expense, net |

|

|

554 |

|

|

1,004 |

|

|

1,226 |

|

|

2,084 |

|

Income before income taxes |

|

|

9,700 |

|

|

3,616 |

|

|

20,247 |

|

|

6,171 |

|

Income tax expense |

|

|

2,522 |

|

|

1,049 |

|

|

5,265 |

|

|

1,790 |

|

Net income |

|

$ |

7,178 |

|

$ |

2,567 |

|

$ |

14,982 |

|

$ |

4,381 |

| |

|

|

|

|

|

|

|

|

| Net

income per share - basic |

|

$ |

0.56 |

|

$ |

0.20 |

|

$ |

1.17 |

|

$ |

0.35 |

| Net

income per share - diluted |

|

$ |

0.50 |

|

$ |

0.19 |

|

$ |

1.04 |

|

$ |

0.32 |

|

Weighted average common shares outstanding |

|

|

|

|

|

|

|

|

|

Basic |

|

|

12,778 |

|

|

12,544 |

|

|

12,763 |

|

|

12,521 |

|

Diluted |

|

|

14,442 |

|

|

13,570 |

|

|

14,368 |

|

|

13,568 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DLH HOLDINGS

CORP.CONSOLIDATED BALANCE SHEETS(Amounts

in thousands except par value of shares)

| |

|

March 31,2022 |

|

September 30,2021 |

| |

|

(unaudited) |

|

|

| ASSETS |

|

|

|

|

| Current assets: |

|

|

|

|

|

Cash |

|

$ |

359 |

|

|

$ |

24,051 |

|

|

Accounts receivable |

|

|

62,152 |

|

|

|

33,447 |

|

|

Other current assets |

|

|

3,599 |

|

|

|

4,265 |

|

| Total current assets |

|

|

66,110 |

|

|

|

61,763 |

|

| Equipment and improvements,

net |

|

|

1,427 |

|

|

|

1,912 |

|

| Operating lease right-of-use

assets |

|

|

17,999 |

|

|

|

19,919 |

|

| Goodwill |

|

|

65,643 |

|

|

|

65,643 |

|

| Intangible assets, net |

|

|

44,177 |

|

|

|

47,469 |

|

| Other long-term assets |

|

|

398 |

|

|

|

464 |

|

| Total

assets |

|

$ |

195,754 |

|

|

$ |

197,170 |

|

| LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

|

|

| Current liabilities: |

|

|

|

|

|

Operating lease liabilities - current |

|

$ |

2,216 |

|

|

$ |

2,261 |

|

|

Accrued payroll |

|

|

12,464 |

|

|

|

9,125 |

|

|

Deferred revenue |

|

|

— |

|

|

|

22,273 |

|

|

Accounts payable, accrued expenses, and other current

liabilities |

|

|

44,317 |

|

|

|

32,717 |

|

| Total current liabilities |

|

|

58,997 |

|

|

|

66,376 |

|

| Long-term liabilities: |

|

|

|

|

|

Deferred taxes, net |

|

|

1,176 |

|

|

|

1,176 |

|

|

Operating lease liabilities - long-term |

|

|

17,582 |

|

|

|

19,374 |

|

|

Debt obligations - long-term, net of deferred financing costs |

|

|

35,638 |

|

|

|

44,636 |

|

| Total long-term

liabilities |

|

|

54,396 |

|

|

|

65,186 |

|

| Total liabilities |

|

|

113,393 |

|

|

|

131,562 |

|

| Shareholders' equity: |

|

|

|

|

| Common stock, $0.001 par

value; authorized 40,000 shares; issued and outstanding 12,794 and

12,714 at March 31, 2022 and September 30, 2021,

respectively |

|

|

13 |

|

|

|

13 |

|

|

Additional paid-in capital |

|

|

89,664 |

|

|

|

87,893 |

|

|

Accumulated deficit |

|

|

(7,316 |

) |

|

|

(22,298 |

) |

| Total shareholders’

equity |

|

|

82,361 |

|

|

|

65,608 |

|

| Total liabilities and

shareholders' equity |

|

$ |

195,754 |

|

|

$ |

197,170 |

|

| |

|

|

|

|

|

|

|

|

DLH HOLDINGS CORP.

CONSOLIDATED STATEMENTS OF CASH FLOWS(Amounts in

thousands)

| |

|

(unaudited) |

| |

|

Six Months Ended |

| |

|

March 31, |

|

|

|

|

2022 |

|

|

|

2021 |

|

| Operating

activities |

|

|

|

|

|

Net income |

|

$ |

14,982 |

|

|

$ |

4,381 |

|

|

Adjustments to reconcile net income to net cash provided by (used

in) operating activities: |

|

|

|

|

|

Depreciation and amortization |

|

|

3,866 |

|

|

|

4,091 |

|

|

Amortization of deferred financing costs charged to interest

expense |

|

|

319 |

|

|

|

413 |

|

|

Stock based compensation expense |

|

|

1,309 |

|

|

|

844 |

|

|

Deferred taxes, net |

|

|

— |

|

|

|

1,512 |

|

|

Changes in operating assets and liabilities |

|

|

|

|

|

Accounts receivable |

|

|

(28,705 |

) |

|

|

(9,134 |

) |

|

Other current assets |

|

|

666 |

|

|

|

30 |

|

|

Accrued payroll |

|

|

3,339 |

|

|

|

1,401 |

|

|

Deferred revenue |

|

|

(22,273 |

) |

|

|

— |

|

|

Accounts payable, accrued expenses, and other current

liabilities |

|

|

11,600 |

|

|

|

2,245 |

|

|

Other long-term assets and liabilities |

|

|

82 |

|

|

|

336 |

|

|

Net cash provided by (used in) operating

activities |

|

|

(14,815 |

) |

|

|

6,119 |

|

| Investing

activities |

|

|

|

|

|

Business acquisition adjustment, net of cash acquired |

|

|

— |

|

|

|

59 |

|

|

Purchase of equipment and improvements |

|

|

(89 |

) |

|

|

(53 |

) |

|

Net cash provided by (used in) investing

activities |

|

|

(89 |

) |

|

|

6 |

|

| Financing

activities |

|

|

|

|

|

Proceeds from debt obligations |

|

|

13,500 |

|

|

|

18,950 |

|

|

Repayment of debt obligations |

|

|

(22,750 |

) |

|

|

(26,200 |

) |

|

Payment of deferred financing costs |

|

|

— |

|

|

|

(43 |

) |

|

Proceeds from issuance of common stock upon exercise of options and

warrants |

|

|

462 |

|

|

|

231 |

|

|

Net cash used in financing activities |

|

|

(8,788 |

) |

|

|

(7,062 |

) |

| |

|

|

|

|

| Net change in cash |

|

|

(23,692 |

) |

|

|

(937 |

) |

| Cash at beginning of

period |

|

|

24,051 |

|

|

|

1,357 |

|

| Cash at end of

period |

|

$ |

359 |

|

|

$ |

420 |

|

| |

|

|

|

|

| Supplemental

disclosure of cash flow information |

|

|

|

|

|

Cash paid during the period for interest |

|

$ |

896 |

|

|

$ |

1,639 |

|

|

Cash paid during the period for income taxes |

|

$ |

3,482 |

|

|

$ |

184 |

|

|

|

|

|

|

|

|

|

|

|

Revenue Metrics

| |

|

Six Months Ended |

| |

|

March 31, |

|

March 31, |

|

|

|

2022 |

|

|

2021 |

|

| Market

Mix: |

|

|

|

|

| Defense/VA |

|

29 |

% |

|

59 |

% |

| Human Services and

Solutions |

|

57 |

% |

|

14 |

% |

| Public Health/Life

Sciences |

|

14 |

% |

|

27 |

% |

| |

|

|

|

|

| Contract

Mix: |

|

|

|

|

| Time and Materials |

|

84 |

% |

|

76 |

% |

| Cost Reimbursable |

|

9 |

% |

|

20 |

% |

| Firm Fixed Price |

|

7 |

% |

|

4 |

% |

| |

|

|

|

|

| Prime vs

Sub: |

|

|

|

|

| Prime |

|

94 |

% |

|

89 |

% |

| Subcontractor |

|

6 |

% |

|

11 |

% |

| |

|

|

|

|

|

|

Non-GAAP Financial MeasuresThe

Company uses EBITDA and EBITDA as a percent of revenue as

supplemental non-GAAP measures of performance. We define EBITDA as

net income excluding (i) interest expense, (ii) provision for or

benefit from income taxes and (iii) depreciation and amortization.

EBITDA as a percent of revenue is EBITDA for the measurement period

divided by revenue for the same period.

The Company is presenting additional non-GAAP

measures to describe the impact from two short-term FEMA task

orders' on its financial performance for the three and six months

periods ended March 31, 2022. The measures presented are

revenue, operating income, net income, diluted earnings per share,

and EBITDA for our enterprise contract portfolio less the

respective performance on the FEMA task orders. These resulting

measures present the remaining contract portfolio's quarterly

financial performance compared to results delivered in the prior

year period. Definitions of these additional non-GAAP measures are

set forth in the footnotes to the reconciliation table below.

These non-GAAP measures of performance are used

by management to conduct and evaluate its business during its

review of operating results for the periods presented. Management

and the Company's Board utilize these non-GAAP measures to make

decisions about the use of the Company's resources, analyze

performance between periods, develop internal projections and

measure management performance. We believe that these non-GAAP

measures are useful to investors in evaluating the Company's

ongoing operating and financial results and understanding how such

results compare with the Company's historical performance.

Reconciliation of GAAP net income to EBITDA, a non-GAAP

measure:

| |

|

Three Months Ended |

|

Six Months Ended |

| |

|

March 31, |

|

March 31, |

|

(in thousands) |

|

|

2022 |

|

|

|

2021 |

|

|

Change |

|

|

2022 |

|

|

|

2021 |

|

|

Change |

|

Net income |

|

$ |

7,178 |

|

|

$ |

2,567 |

|

|

$ |

4,611 |

|

|

$ |

14,982 |

|

|

$ |

4,381 |

|

|

$ |

10,601 |

|

| (i) Interest expense, net |

|

|

554 |

|

|

|

1,004 |

|

|

|

(450 |

) |

|

|

1,226 |

|

|

|

2,084 |

|

|

|

(858 |

) |

| (ii) Provision for taxes |

|

|

2,522 |

|

|

|

1,049 |

|

|

|

1,473 |

|

|

|

5,265 |

|

|

|

1,790 |

|

|

|

3,475 |

|

| (iii) Depreciation and

amortization |

|

|

1,881 |

|

|

|

2,029 |

|

|

|

(148 |

) |

|

|

3,866 |

|

|

|

4,091 |

|

|

|

(225 |

) |

| EBITDA |

|

$ |

12,135 |

|

|

$ |

6,649 |

|

|

$ |

5,486 |

|

|

$ |

25,339 |

|

|

$ |

12,346 |

|

|

$ |

12,993 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income as a % of

revenue |

|

|

6.6 |

% |

|

|

4.2 |

% |

|

|

2.4 |

% |

|

|

5.7 |

% |

|

|

3.7 |

% |

|

|

2.0 |

% |

| EBITDA as a % of revenue |

|

|

11.2 |

% |

|

|

10.8 |

% |

|

|

0.4 |

% |

|

|

9.7 |

% |

|

|

10.3 |

% |

|

(0.6)% |

| Revenue |

|

$ |

108,699 |

|

|

$ |

61,506 |

|

|

$ |

47,193 |

|

|

$ |

261,500 |

|

|

$ |

119,358 |

|

|

$ |

142,142 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of GAAP revenue, operating income, net

income, diluted earnings per share, and non-GAAP EBITDA reported

for the three and six months ended to the same metrics for our

contract portfolio less the FEMA task orders:

| |

|

|

Three Months Ended |

|

Six Months Ended |

|

|

|

|

March 31, |

|

March 31, |

|

( in thousands) |

Ref |

|

|

2022 |

|

|

2021 |

|

Change |

|

|

2022 |

|

|

2021 |

|

Change |

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total enterprise |

|

|

$ |

108,699 |

|

$ |

61,506 |

|

$ |

47,193 |

|

|

$ |

261,500 |

|

$ |

119,358 |

|

$ |

142,142 |

| Less: FEMA task orders to

support Alaska |

(a) |

|

|

39,764 |

|

|

— |

|

|

39,764 |

|

|

|

130,889 |

|

|

— |

|

|

130,889 |

| Remaining contract

portfolio |

(a) |

|

$ |

68,935 |

|

|

61,506 |

|

|

7,429 |

|

|

$ |

130,611 |

|

$ |

119,358 |

|

$ |

11,253 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

income |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total enterprise |

|

|

$ |

10,254 |

|

$ |

4,620 |

|

$ |

5,634 |

|

|

$ |

21,473 |

|

$ |

8,255 |

|

$ |

13,218 |

| Less: FEMA task orders to

support Alaska |

(b) |

|

|

5,525 |

|

$ |

— |

|

$ |

5,525 |

|

|

|

11,871 |

|

|

— |

|

|

11,871 |

| Remaining contract

portfolio |

(b) |

|

$ |

4,729 |

|

$ |

4,620 |

|

$ |

109 |

|

|

$ |

9,602 |

|

$ |

8,255 |

|

$ |

1,347 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

income |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total enterprise |

|

|

$ |

7,178 |

|

$ |

2,567 |

|

$ |

4,611 |

|

|

$ |

14,982 |

|

$ |

4,381 |

|

$ |

10,601 |

| Less: FEMA task orders to

support Alaska |

(c) |

|

|

4,089 |

|

|

— |

|

|

4,089 |

|

|

|

8,785 |

|

|

— |

|

|

8,785 |

| Remaining contract

portfolio |

(c) |

|

$ |

3,089 |

|

$ |

2,567 |

|

$ |

522 |

|

|

$ |

6,197 |

|

$ |

4,381 |

|

$ |

1,816 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings per

share |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total enterprise |

|

|

$ |

0.50 |

|

$ |

0.19 |

|

$ |

0.31 |

|

|

$ |

1.04 |

|

$ |

0.32 |

|

$ |

0.72 |

| Less: FEMA task orders to

support Alaska |

(d) |

|

|

0.28 |

|

|

— |

|

|

0.28 |

|

|

|

0.61 |

|

|

— |

|

|

0.61 |

| Remaining contract

portfolio |

(d) |

|

$ |

0.22 |

|

$ |

0.19 |

|

$ |

0.03 |

|

|

$ |

0.43 |

|

$ |

0.32 |

|

$ |

0.11 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total enterprise |

|

|

$ |

12,135 |

|

$ |

6,649 |

|

$ |

5,486 |

|

|

$ |

25,339 |

|

$ |

12,346 |

|

$ |

12,993 |

| Less: FEMA task orders to

support Alaska |

(e) |

|

|

5,525 |

|

|

— |

|

|

5,525 |

|

|

|

11,871 |

|

|

— |

|

|

11,871 |

| Remaining contract

portfolio |

(e) |

|

$ |

6,610 |

|

$ |

6,649 |

|

$ |

(39 |

) |

|

$ |

13,468 |

|

$ |

12,346 |

|

$ |

1,122 |

Ref (a): Revenue for

the Company’s remaining contract portfolio less the FEMA task

orders represents our consolidated revenues less the revenues

generated from the FEMA task orders.

Ref (b): Operating

income attributable to the remaining contract portfolio less the

FEMA task orders represents the Company’s consolidated operating

income, determined in accordance with GAAP, less the operating

income derived from the FEMA task orders. Operating income for the

FEMA task orders is derived by subtracting from the revenue

attributable to such task orders during the three months ended

March 31, 2022 of $39.8 million the following amounts attributable

to the task orders: contract costs of $33.7 million and general

& administrative costs of $0.6 million. Similarly, for the six

months ended March 31, 2022 operating income for the FEMA task

orders is derived by subtracting from the revenue attributable to

the tasks orders of $130.9 million the following amounts

attributable to the task orders: contract costs $117.9 million and

general & administrative costs of $1.1 million. Operating

income for the remaining contract portfolio for the three and six

months ended March 31, 2022 represents the Company’s consolidated

operating income for such period less the operating income

attributable to the FEMA task orders for such period.

Ref (c): Net income

attributable to the remaining contract portfolio less the FEMA task

orders represents the Company’s consolidated net income, determined

in accordance with GAAP, less the net income derived from the FEMA

task orders. Net income for the FEMA task orders is derived by

subtracting from the revenue attributable to such task orders

during the three months ended March 31, 2022 of $39.8 million the

following amounts attributable to the task orders: contract costs

of $33.7 million, general & administrative costs of $0.6

million, and income tax expense of $1.4 million. Similarly, for the

six months ended March 31, 2022 net income for the FEMA task orders

is derived by subtracting from the revenue attributable to the

tasks orders of $130.9 million the following amounts attributable

to the task orders: contract costs $117.9 million, general &

administrative costs of $1.1 million, and tax expense of $3.1

million. Net income for the remaining contract portfolio for the

three and six months ended March 31, 2022 represents the Company’s

consolidated net income for such period less the net income

attributable to the FEMA task orders for such period.

Ref (d): Diluted

earnings per share (diluted EPS) for the FEMA task orders is

calculated using the net income attributable to such task orders as

opposed to GAAP net income. Diluted EPS for the remaining contract

portfolio (total contract portfolio excluding the FEMA task orders)

is calculated by subtracting the diluted EPS for the FEMA task

orders from the Company's total diluted EPS.

Ref (e): EBITDA

attributable to the FEMA tasks orders of $5.5 million and $11.9

million for the three and six months ended March 31, 2022,

respectively, is arrived at through the same calculation as

operating income as there are not any depreciation and amortization

costs attributable to the FEMA tasks orders. EBITDA for the

remaining contract portfolio is calculated by subtracting the

EBITDA attributable to the FEMA task orders from the Company’s

total EBITDA.

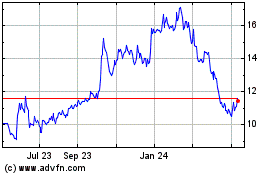

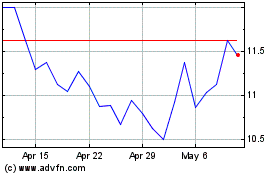

DLH (NASDAQ:DLHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

DLH (NASDAQ:DLHC)

Historical Stock Chart

From Apr 2023 to Apr 2024