Filed by Office Properties Income Trust

Commission File No. 001-34364

pursuant to Rule 425 under the Securities

Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Diversified Healthcare Trust

Commission File No. 001-15319

Date: May 5, 2023

The following are excerpts from the transcript of the investor

conference call of The RMR Group Inc. (“RMR”) hosted by Adam D. Portnoy, President and Chief Executive Officer of RMR,

and Matthew P. Jordan, Chief Financial Officer and Treasurer of RMR, on May 4, 2023, with respect to the proposed merger by and

between Office Properties Income Trust (“OPI”) and Diversified Healthcare Trust (“DHC”).

The RMR Group

Second Quarter of Fiscal 2023 Results

Investor Conference Call Script Excerpts

May 4, 2023 at 10:00 a.m.

[Omitted]

Adam Portnoy

Lastly, in April, two of our Perpetual Capital

clients, DHC and OPI, announced an agreement to merge and change the combined companies’ name to Diversified Properties Trust. The

merger will create a diversified REIT with a broad portfolio, defensive tenant base and strong growth potential. Financially, the merger

is expected to be accretive to both entities’ leverage and cash flow. The combined entity is expected to provide a sustainable annual

dividend of $1.00 per share, with the potential for dividend growth in the future.

As it relates to DHC, it is facing a number of

serious near-term challenges driven largely by debt covenant restrictions that prevent it from issuing or refinancing debt. This problem

is exacerbated by DHC having $700 million of debt coming due in early 2024, and DHC does not expect to be in debt covenant compliance

before this debt comes due. As a result, one of the biggest benefits of this merger for DHC is that upon its completion, the combined

company will be in debt covenant compliance and can access regular-way refinancing of its debt maturities. In addition, while the SHOP

recovery is underway and trending favorably, it is not happening fast enough and further capital is needed, in addition to debt refinancing,

to fund investments in DHC’s portfolio to help drive the on-going turn-around in its senior living properties. Finally, DHC also

benefits from the merger with OPI by immediately providing a significant increase in dividend for shareholders. Absent the merger, DHC

does not anticipate reinstating its regular dividend until 2025.

As it relates to OPI, it is facing a number of

current and longer-term challenges, as office sector headwinds are likely to negatively affect office owners for the foreseeable future.

More specifically, the financing environment for office properties is, and is expected to remain, very difficult for the foreseeable future.

One of the biggest benefits of the merger for OPI is that it provides it with greater access to capital sources, including, low-cost government

and agency debt. OPI’s office portfolio will also require increased capital investments in the coming years, and OPI was facing

an unsustainable dividend rate prior to the merger announcement. By merging with DHC, OPI gains access to an attractive, unencumbered

portfolio of medical office buildings and life science properties, and we expect OPI will benefit long term from the expected eventual

recovery in DHC’s SHOP portfolio.

[Omitted]

Bryan

Maher - B. Riley Securities, Inc., Research Division - MD

Got it. Just last for me, I don’t think I’ve seen

anywhere, and maybe you’re yet to disclose it but when OPI and DHC do merge, have you identified what the new benchmark index would

be for that combined entity?

Adam Portnoy

We have not. It’s an interesting, nuanced question, and we have

discussed it preliminarily at the board level. I will tell you that on a combined basis, the majority of the assets would be office, office

including medical office and life science. That all being said, I think that’s something that the board of the combined company

will likely take up after the completion of the merger, we’ll consider that more seriously.

Bryan Maher

Got it, thank you.

[Omitted]

Tamim

Sarwary - Morgan Stanley, Research Division - Research Associate

Great, that makes sense. And then obviously without getting into detail

on the OPI-DHC transaction, in terms of access to GSE financing, I understand that was one of the impetus for the transaction in

general, in terms of some of the underwriting standards and whatnot that will be looked at just because from my understanding the SHOP

portfolio isn’t fully stabilized, will that be looked at on a pro-forma basis, or just on trailing results, how are you thinking

about that?

Adam Portnoy

So, just to make sure I understand the question, how does in the SHOP

portfolio, let’s say the agencies look at financing those assets?

Tamim Sarwary

Yes, exactly.

Adam Portnoy

Ok. So they’ve revised their financing criteria over the last

few years, and the good news is we have a large portfolio of senior living assets, and although they are struggling but improving, obviously

with over roughly 230 senior living assets, we obviously have many assets that are performing fine, unfortunately we have more assets

not performing fine. So you don’t have to take the entire portfolio, you can take a group of assets based on historical and the

agencies have become a little bit more forgiving in the way that they do the underwriting, where they may just look at maybe the most

recent quarter and then annualize that, keeping in mind your projections, they won’t take the last 12 months. So there is an opportunity

and the agencies have been doing this largely because this is something that came out of the pandemic, because they recognize that in

the recovery for a lot of senior living assets, if you look back 12-months you are going to have a pretty low ability to underwrite. Now

they are more willing to look at just one quarter back, which might obviously if things have been improving over many quarters, the most

recent quarter hopefully is the best quarter and then they annualize that, and that’s what you use for the underwriting. We’re

optimistic that there is a portfolio of assets within the DHC portfolio that will provide for significant capital or financing to be able

to be put on those assets, that we are not able to access today at DHC. And again, I said in my prepared remarks, I’m

just repeating it is, one of the benefits of the transaction is on a combined basis you’re in debt covenant compliance, that’s

a huge thing that I think a lot of investors decide about the covenants. It’s very onerous, we’re not allowed to finance new

debt, we’re not allowed to refinance expiring debt, you just can’t issue any debt. Then by being in compliance, we can then

access that, what I think very liquid, open and cost competitive financing. Then especially if you’re in the office sector, if you

have access to that funding window, I think you’re in a competitive advantage in the marketplace.

Tamim Sarwary

Right, and maybe just to follow up, the underwriting is based on quarterly

results, I guess the logical thing to do would be to wait until maybe the second half of 2024 before you actually access the GSE

financing just to show stabilized results, is that kind of the right way to think about it?

Adam Portnoy

I think we have to wait. This is getting a little ahead of ourselves.

It’s planning a little too far out. I think we could be in a position to put financing in place if we chose to in early 2024 we

could be in a position to do so. The question you’re asking is would you do so? And the answer is I don’t know, but I do know

that we could by early 2024 in my belief do so and do so in a sizable way if we had to. So, it’s there for us, whether we choose

to do it is a different question that you’re asking, but we can.

Tamim Sarwary

Thanks for all the help guys.

Operator: The next question is a follow up from Bryan Maher

of B. Riley Securities. Please go ahead.

Bryan Maher

Great thanks. So, Adam you opened up that door

for me on the SHOP financing question, which I think we understand here pretty well. When we look at roughly $4 billion in unencumbered

SHOP assets within DHC, we were thinking something along the lines of you cherry pick out $1.4-1.5 billion of the better performing NOI

accelerated from renovations last year properties to do a tranche in early 2024 to take out the 2024 debts for OPI and DHC and then maybe

you do another one a year later after other SHOP NOI assets have moved northward in support of that debt. Is that unrealistic to be thinking

in that way?

Adam Portnoy

You’re directionally in the right thinking about things correctly Bryan, those are all things we can

do. I will just put some markers out there for you to be thinking about. Obviously, we want to be very careful if we access that market,

picking the most mature properties, that we aren’t financing them too early in their recovery. We want properties that are largely

recovered and we’re not leaving some financing on the table. $1.4-1.5 billion in 2024 sounds a little heavy to me, to be honest.

If we did something that large, I think we would be taking some assets that were not fully recovered and leaving financing on the table.

The other benchmark to keep in mind is there are limits to how much secured debt we can put on the portfolio because remember every time

we put secured debt on, we’re removing those assets from the unencumbered asset pool. We still have unsecured bonds that have unsecured

debt covenants. So yes, we have significant room to add secured financing well past a billion dollars, but there’s a limit to how

much we can put on, think about that, I’m not sure you could say something like $1.5 billion and then there’s another $1.5

billion, I think you start really stressing covenants for the unencumbered bonds that will still be in place. Those are some reactions

and markers for you to think about.

Bryan Maher

Right, but I got to believe that if you just did in the first half of 2024 a pledge of

– and when I say $1.4-1.5 billion, I mean pledge $1.4-1.5 billion to take out, a billion cash. Your other debt will trade more

favorably, and one would have to believe that the bank groups associated with OPI and DHC combined company would have a sigh of relief

and be much more agreeable to simply just refinance debt that comes to you on a go-forward basis after you maybe tapped the first half a billion or billion of agency debt, is that correct thinking?

Adam Portnoy

Bryan that is correct thinking, yes. I think in

the near term we have a bias towards thinking about putting agency debt on some time in 2024. The timing is a little open, it’s

a little ways away so we’re not quite sure exactly when, but some time in 2024, and that’s right. Our hope is that we would

then have a more regular way of access to the unsecured market going forward after that. That would be sort of the base business plan,

but that has a lot of assumptions in that base business plan that we need to see come true.

Bryan Maher

Perfect. Thank you, that’s

helpful.

[Omitted]

Warning

Concerning Forward-Looking Statements

This

transcript contains statements that constitute forward-looking statements within the meaning of the Private Securities Litigation

Reform Act of 1995 and other securities laws. Also, whenever Office Properties Income Trust (Nasdaq: OPI), or OPI, and Diversified

Healthcare Trust (Nasdaq: DHC), or DHC, use words such as “believe”, “expect”, “anticipate”, “intend”,

“plan”, “estimate”, “will”, “may” and negatives or derivatives of these or similar expressions,

they are making forward-looking statements. These forward-looking statements are based upon OPI’s and DHC’s present intent,

beliefs or expectations, but forward-looking statements are not guaranteed to occur and may not occur. Actual results may differ materially

from those contained in or implied by OPI’s and DHC’s forward-looking statements as a result of various factors, which include

those that are detailed in each of OPI’s and DHC’s periodic reports and subsequent filings with the Securities and Exchange

Commission, or the SEC.

You

should not place undue reliance upon any forward-looking statements. Except as required by law, OPI and DHC do not intend to update

or change any forward-looking statements as a result of new information, future events or otherwise.

Important Additional Information About the Transaction

In connection with the proposed merger, OPI intends

to file a registration statement on Form S-4 with the SEC, which will include a preliminary prospectus and related materials to register

OPI’s common shares of beneficial interest, $.01 par value per share, to be issued in the merger. OPI and DHC intend to file a joint

proxy statement/prospectus and other documents concerning the merger with the SEC. The proposed transaction involving OPI and DHC will

be submitted to OPI’s and DHC’s shareholders for their consideration. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS

ARE URGED TO CAREFULLY READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS THAT ARE FILED OR

WILL BE FILED WITH THE SEC IN CONNECTION WITH THE MERGER OR INCORPORATED BY REFERENCE IN THE REGISTRATION STATEMENT AND JOINT PROXY STATEMENT/PROSPECTUS

BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT OPI, DHC AND THE MERGER. When available, the relevant portions of the

joint proxy statement/prospectus will be mailed to OPI’s and DHC’s shareholders. Investors will also be able to obtain copies

of the registration statement and the joint proxy statement/prospectus and other relevant documents (when they become available) free

of charge at the SEC’s website (www.sec.gov). Additional copies of documents filed by OPI with the SEC may be obtained for free

on OPI’s Investor Relations website at www.opireit.com/investors or by contacting the OPI Investor Relations department at 1-617-219-1410.

In addition to the registration statement and joint

proxy statement/prospectus expected to be filed, OPI files annual, quarterly and current reports and other information with the SEC. OPI’s

filings with the SEC are also available to the public from commercial document-retrieval services and at the website maintained by the

SEC at www.sec.gov.

No Offer or Solicitation

This transcript shall not constitute an offer to

sell or the solicitation of an offer to subscribe for or buy any securities or a solicitation of any vote or approval in any jurisdiction

with respect to the merger or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful, prior to registration or qualification under the securities laws of any such jurisdiction.

No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities

Act of 1933, as amended.

Participants in the Solicitation

OPI and certain of its trustees and executive officers,

DHC and certain of its trustees and executive officers, and The RMR Group LLC, the manager of OPI and DHC, and its parent and certain

of their respective directors, officers and employees may be deemed to be participants in the solicitation of proxies from OPI’s

and DHC’s shareholders in connection with the merger. Certain information regarding the persons who may, under the rules of

the SEC, be deemed participants in the solicitation of OPI’s and DHC’s shareholders in connection with the merger and a description

of their direct and indirect interests will be set forth in the registration statement and the joint proxy statement/prospectus when filed

with the SEC. Information about OPI’s trustees and executive officers is included in the proxy statement for OPI’s 2023 annual

meeting of shareholders, which was filed with the SEC on April 6, 2023. Information about DHC’s trustees and executive officers

is included in the proxy statement for DHC’s 2023 annual meeting of shareholders, which was filed with the SEC on April 20,

2023. Copies of the foregoing documents may be obtained as provided above. Additional information regarding the interests of such participants

and other persons who may be deemed participants in the transaction will be included in the joint proxy statement/prospectus and the other

relevant documents filed with the SEC when they become available.

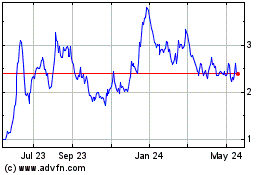

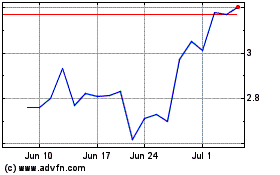

Diversified Healthcare (NASDAQ:DHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Diversified Healthcare (NASDAQ:DHC)

Historical Stock Chart

From Apr 2023 to Apr 2024