Filed by Office Properties Income Trust

Commission File No. 001-34364

pursuant to Rule 425 under the Securities Act of

1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Diversified Healthcare Trust

Commission File No. 001-15319

Date: April 27, 2023

The following is the script for an earnings conference call of

Office Properties Income Trust (“OPI”) hosted by Christopher J. Bilotto, President and Chief Operating Officer of OPI, and

Matthew C. Brown, Chief Financial Officer and Treasurer of OPI, on April 27, 2023.

Office Properties Income Trust

Q1 2023 Earnings Call Script

Thursday, April 27, 2023 at 10:00 AM

Operator:

Good morning and welcome to Office Properties Income

Trust’s first quarter 2023 financial results conference call. [Operator instructions.] At this time for opening remarks and introductions,

I would like to turn the call over to Kevin Barry, Director of Investor Relations.

Speaker: Kevin Barry

Thank you, and good morning everyone. Thanks for

joining us today.

With me on the call are OPI’s President and

Chief Operating Officer Chris Bilotto, and Chief Financial Officer and Treasurer Matt Brown. In just a moment, they will provide details

about our business and our performance for the first quarter of 2023, followed by a question-and-answer session with sell-side analysts.

First, I would like to note that the recording and retransmission of today’s conference call is prohibited without the prior written

consent of the company.

Also note that today’s conference call contains

forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws. These

forward-looking statements are based on OPI’s beliefs and expectations as of today, Thursday, April 27th, 2023, and actual

results may differ materially from those that we project. The company undertakes no obligation to revise or publicly release the results

of any revision to the forward-looking statements made in today’s conference call. Additional information concerning factors that

could cause those differences is contained in our filings with the Securities and Exchange Commission – or SEC – which can

be accessed from our website – opireit.com – or the SEC’s website. Investors are cautioned not to place undue reliance

upon any forward-looking statements.

On today’s call we will be discussing the

planned merger with Diversified Healthcare Trust in our prepared remarks. We have not yet filed a preliminary joint proxy and registration

statement with the SEC and therefore will not be taking questions about the merger.

In addition, we will be discussing non-GAAP numbers

during this call, including Normalized Funds From Operations, or Normalized FFO, Cash Available for Distribution, or CAD, and cash basis

Net Operating Income, or Cash Basis NOI. A reconciliation of these non-GAAP figures to net income are available in our enhanced earnings

release presentation that we issued last night, which can be found on our website. We believe this combined presentation of information

will be helpful for analysts and investors to efficiently digest information about our company and our results.

And finally, we will be providing guidance on this

call, including Normalized FFO and Cash Basis NOI. We are not providing a reconciliation of these non-GAAP measures as part of our guidance

because certain information required for such reconciliation is not available without unreasonable efforts or at all, such as gains and

losses or impairment charges related to the disposition of real estate.

I will now turn the call over to Chris…

Speaker: Chris Bilotto

Thank you, Kevin. Good morning everyone and thank

you for joining the call today. Before I review OPI’s performance for the first quarter of 2023, I want to start by briefly discussing

current office fundamentals, our decision to reduce our quarterly dividend and our recently announced merger with Diversified Healthcare

Trust.

OPI has demonstrated solid operating performance

over the past few years while navigating through a global pandemic and amid an uncertain and evolving office environment. Our favorable

performance results through 2022 are attributed to several factors, including: our diversified real estate holdings; our geographic footprint

with properties in many premier growing markets and reflective of our leasing performance; our strong tenant roster with investment grade

tenants representing 63 percent of our portfolio; continuation of our capital recycling initiatives; and our strong balance sheet.

As we stand here today, we are looking at post

pandemic return to office trends which continue at a gradual pace across major U.S. markets providing a bright spot for improving office

fundamentals, however, headwinds in the office sector remain with added pressure as a result of corporate cost cutting, elevated sublease

space, a challenging financing environment and continued macroeconomic uncertainty. National office leasing volume declined for the third

consecutive quarter through Q1 and much of the sector’s occupancy gains achieved over the past several years has been given back

through negative absorption. Financing continues to be an obstacle for the investment sales market and widening credit spreads are putting

additional pressure on office valuations. These challenges will likely lead to declining cash flows and asset values, which may take years

to stabilize.

Recognizing these challenges, earlier this month

we announced a reduction in OPI’s quarterly dividend. We recognize the value of the dividend to our investors and the decision was

not made lightly. It was the result of careful consideration on the part of the company and its Board of Trustees based on several factors,

including the challenging outlook confronting the office sector, tenant retention risk, a rising CAD payout ratio approaching 100 percent

and in excess of our target coverage ratio, and our focus on capital preservation to support leasing activity and complete our two redevelopment

projects. With these factors in mind, we made the decision to lower the dividend to a sustainable level of $1 per share annually. While

this decision was communicated at the same time as the merger announcement, it was independent of our merger plans and reflective of our

outlook for OPI on a standalone basis. It provides increased liquidity to navigate office headwinds and to fuel capital projects that

we expect will improve OPI’s competitive positioning as a path to increased returns in the future.

Earlier this month we also announced plans to merge

with Diversified Healthcare Trust, providing us with a tremendous opportunity to create a larger, scalable and more diversified REIT.

This transaction combines two institutional quality portfolios, and better positions us to navigate office sector headwinds, while providing

embedded near and long-term growth and value creation. Immediate benefits to OPI include increased scale and diversity, and cash flow

stability with the addition of attractive MOB and life science properties as a complement to our established office portfolio; access

to additional capital sources with a more favorable interest rate outlook, including low-cost GSE and agency debt; and access to an institutional

quality portfolio of senior living communities benefiting from growth through favorable health care sector tailwinds and a turnaround

strategy currently underway. As a result of this combination, we expect the transaction to be accretive to OPI's normalized FFO, CAD,

and leverage during the second half of 2024, and ultimately maximizing long-term value for our shareholders.

Turning now to our first quarter leasing results…

We began the year with uneven operating fundamentals

and a deceleration in leasing volume, consistent with broad market trends and in-line with our expectation that new leasing activity will

increase over the next several quarters as tenant reengage on their office plan needs along with increased renewal activity given our

expirations mostly occur during the back half of the year. This is reflected in our leasing pipeline where we have close to 725,000 thousand

square feet of activity in advanced stages of negotiation.

Portfolio occupancy increased 170 basis points

year over year to 90.5 percent and we completed 203,000 square feet of leasing with a balanced mix of new and renewal leasing. This activity

resulted in a weighted average lease term of 6.8 years and leasing concessions and capital commitments of $6.37 per square foot per lease

year. Weighted average rent spreads for the quarter declined 18.5 percent, which was influenced by elevated concessions associated with

several leases at a property in greater Washington D.C. where we signed two strategic leases totaling 128,000 square feet, one with a

key tenant downsizing and another to backfill the available space. We expect our leasing spreads will normalize as activity progresses

throughout the year.

Looking ahead to OPI’s upcoming lease expirations…

We continue to actively manage through proactive

re-leasing efforts to address elevated lease expirations during the second half of 2023 and into 2024. In 2023, lease expirations represent

approximately 10 percent of our annualized rental income, a decrease of 90 basis points compared to the end of 2022. Annualized revenue

for 2023 expirations is comprised of the following:

| · | Net known vacates for the balance of the year are trending close to 6 percent

of annualized rental income. |

| · | Approximately 80 basis points represents planned dispositions. |

| · | The balance of 3.5 percent is expected to renew. |

Our leasing pipeline includes approximately 2.7

million square feet of potential leasing activity, with more than 1.1 million square feet attributable to new leasing and 782,000 thousand

square feet of potential absorption. The outlook for projected activity includes a rent roll up of 6 to 8 percent and an average lease

term of 8 to 10 years.

Turning to our developments…

Our mixed-use redevelopment at 20 Mass Ave. in

Washington D.C. is scheduled to deliver in the coming months. With the project near completion, we are encouraged by growing interest

in tour activity and the proposals we are discussing with multiple prospective tenants. The property is 54 percent leased to an anchor

tenant, the Royal Sonesta Hotel, which intends to begin welcoming guests to this flagship location this summer. Additionally, our Life

Science redevelopment in Seattle remains on track to deliver later this year. In addition to the 84,000 square feet signed at this property

late last year, we will deliver one full lab building with move-in ready spec suites, providing a needed outlet for small to medium companies

with near term space needs and therefore reducing the timeline for lease up and acceleration of NOI performance. Across both projects,

our development leasing pipeline includes more than 170,000 square feet of active proposals. Beginning as early as June 2023, we will

see gradual NOI improvement related to both projects as tenants begin to reimburse operating and tax expenses during their free rent periods.

Before I turn it over to Matt, I want to acknowledge

the recent publication of The RMR Group’s Annual Sustainability Report, which provides a comprehensive overview of our manager’s

commitment to long-term ESG goals. We are deeply committed to enhancing OPI’s corporate sustainability practices and continue to

advance initiatives that will position the company to thrive over the long-term. For example, we recently garnered recognition as an ENERGY

STAR Partner of the Year for the sixth consecutive year and a Sustained Excellence honoree for the fourth year in a row. This recognition

underscores our dedication to operating properties that benefit our tenants and communities. You can find links to the report and a tear

sheet specific to OPI’s highlights on our website at opireit.com.

I will now turn the call over to Matt to review

our financial results…

Speaker: Matt Brown

Thanks Chris, and good morning everyone.

Normalized FFO for the first quarter was $52.7

million, or $1.09 per share, a penny below our guidance range. This compares to Normalized FFO of $54.5 million, or $1.13 per share, for

the fourth quarter of 2022. The decrease on a sequential quarter basis was primarily driven by higher utility expenses and interest expense.

G&A expense for the first quarter was $5.9 million as compared to $5.8 million in the previous quarter.

Same property cash basis NOI decreased 4 percent

compared to the first quarter of 2022, in line with the low end of our guidance range. The decrease was mainly driven by elevated free

rent levels related to 2022 leasing activity and operating expense increases, most notably utility costs, due to inflationary pressures

and expenses previously paid by tenants now being paid by OPI as a result of tenant downsizes.

On a rolling four quarter basis, CAD decreased

sequentially by approximately 16 percent to $2.21 per share, resulting in a payout ratio of 99.5%. While our historical payout ratio had

been well covered since the beginning of 2019, we began seeing pressure in the fourth quarter of 2022 and with lower tenant retention

levels in 2023, another year of elevated capex requirements and worsening office fundamentals, the dividend rate was becoming unsustainable.

As a result and as Chris previously discussed, earlier this month we reduced our quarterly dividend to $0.25 per share, or $1 per share

annually. The new level equates to approximately $60 million of retained capital annually, enhancing OPI’s liquidity and financial

flexibility.

Turning to our outlook for Normalized FFO and same

property cash basis NOI expectations in the second quarter of 2023…

We expect Normalized FFO to be between $1.07 and

$1.09 per share. This guidance includes a range of $6.1 to $6.2 million of G&A expense, which includes expected annual Trustee compensation.

We expect same property cash basis NOI to be down

5 to 7 percent as compared to the second quarter of 2022, mainly driven by two full building vacates since the beginning of the prior

year period and increased inflationary pressure on operating expenses.

Turning to the balance sheet…

At quarter end, our outstanding debt had a weighted

average interest rate of 4 percent and a weighted average maturity of 4.7 years. Over 90 percent of our debt is fixed rate.

We ended the quarter with $528 million of total

liquidity, including $505 million of availability under our credit facility. In connection with our proposed merger with DHC, we plan

to recast our existing $750 million revolving credit facility and have commenced initial discussions to move this process forward. We

believe the improved scale and diversification of the combined company will result in the successful recast of OPI’s revolver.

Turning to our investing activities…

Since the beginning of the year, we sold three

vacant properties containing 89,000 square feet for $5.4 million and are currently under agreement to sell one vacant property containing

107,000 square feet for $4.9 million. Our capital recycling to date has been impacted by the current transaction environment and we expect

our activity to be somewhat muted until market conditions improve.

We spent $17.6 million on recurring capital and

$49.5 million on redevelopment capital during the first quarter. 2023 capex guidance is currently $100 million to $110 million of recurring

capital and approximately $140 million to $150 million of redevelopment capital.

Before we turn the

call over to Q&A, as a reminder, we will be taking questions related to OPI on a standalone basis. We have not yet filed a

preliminary joint proxy and registration statement and therefore will not be taking questions about the merger.

That concludes our prepared remarks. Operator,

we are ready to open the call up for questions.

Operator

Today’s first question comes from Bryan

Maher with B. Riley Securities.

Bryan Maher - B. Riley Securities, Inc., Research

Division - MD

I guess I can throw out maybe half

my questions ahead. So I’ll tighten it up. Can you walk us through slowly the occupancy outlook for this year? So we are starting

off at 90.5% total occupancy, 93.5% same-store. We have a series of known vacates that you discussed. Obviously, you’ll try and

backfill some of those with leasing activity. And then we also have 20 Mass Ave and Seattle coming online. How do you think that the year

progresses from an occupancy standpoint?

Chris Bilotto

Thanks, Bryan. I think historically,

we provided the range of 88% to 90%, and some of that is predicated on our ability to sell assets that we currently have in the market,

or those that we were projecting to bring to the market. And so I think as we sit here today, based on what we are seeing, we are looking

at kind of the low end of that guidance being kind of the target today.

What I’ll add is that most of

the expirations for 2023, where we have known vacates, are scheduled to occur in November or at year-end. And so the impact on performance

is heavily weighted towards the back half of the year, with occupancy then following. So that’s where we’re at today.

And I think, again, an important piece

of that is our ability to sell certain assets. The ones that we have talked about are mostly vacant. And so that has a direct impact to

occupancy.

Bryan Maher

Okay. And then when we think about the credit facility,

can you give us any update as to kind of the timing and what the size might be of that new facility? And is that needed to be completed

before a potential merger?

Matt Brown

So Bryan, it’s a good question.

Let me just first address the maturity of the revolver absent the merger. So right now, the revolver matures at the end of July. However,

we do have a 6-month extension option to push out that maturity to January of ‘24.

A recast or amended revolver is a

condition to closing the merger. So we have started our discussions with Wells Fargo on that. They are preliminary. We are expecting a

proposed term sheet from the bank group in the coming days. So it’s in process. And I think as we progress into 2023, there will

be more to provide as it relates to the revolver.

Bryan Maher

Okay. And kind of circling back to fundamentals, did I hear

you correctly say that you expected 6% to 8% rent roll-ups for this year 2023?

Chris Bilotto

The 6% to 8% roll-up is attributable

to our leasing pipeline. And so I think historically, for 2023, we’ve talked about 4% to 5% roll-up. And I think some of that --

I think we’ll stick to that for now, but I think a lot is going to be predicated on how this pipeline matures as we talked about

with the Q1 results and the roll-down, I mean that was heavily concentrated for a couple of specific deals.

And so we expect that will normalize,

and then we’ll see improvement on overall rent spreads as we execute on some of this pipeline. But it’s a lumpy process. So

it’s not exactly something quarter-to-quarter that we have definitive projections on just given the timing it takes to negotiate

some of these leases.

Bryan Maher

Okay. And just on the periphery of

the DHC transaction, I don’t know if you can answer this or not, but we know Vanguard and BlackRock own an awful lot of shares of

both DHC and OPI. Is it safe to expect that they will be able to vote on the transaction and that they would probably follow the guidance

of ISS and Glass Lewis, etc.?

Chris Bilotto

We’re not going to speculate today. As we mentioned,

we’re in the process now of the filing of the S-4 and the proxy. And I think as we get through that, there will be more color on

of next steps and expectations.

Bryan Maher

Okay. And just last on Seattle. I think you said something

about having one lab building completed in 4Q for prospective tenants. Is that above and beyond the leasing activity you’ve already

communicated with Sonoma Biotherapeutics?

Chris Bilotto

That’s correct. Yes. I mean,

Sonoma, that is expected to transact in the form of them finishing and moving in, in Q4. And then we’re assuming some speculative

leasing to occur with the spec suites that we are delivering. And so it’s a lighter touch, and we think more of that will transact

as we get into 2024.

Operator

And our next question today comes from Ronald Kamdem with Morgan

Stanley.

Tamim Mahmud Sarwary - Morgan Stanley,

Research Division - Research Associate

This is Tamim on for Ronald. Yes,

just maybe just a question on development again. You talked about the Seattle development and expected movement in the fourth quarter

of this year. Maybe just on 20 Mass Ave, any update on timing of when you expect the move-ins actually occur? I understand that’s

completed in the second quarter, but just from a revenue recognition point of view, how should we think about that for the rest of the

year?

Chris Bilotto

Good question. For 20 Mass Ave, we have the hotel representing

54% of the leasing. We expect to deliver at the end of Q2 and at which point, the lease on that side would commence, so let’s just

call it early Q3. And with that, the tenant is going to have 18 months of free rent. And so the benefit to the property during that time

frame is the reimbursement of operating expense. So we will start to see some of the recovery of the cost outlay that’s occurring

today.

And then from a lease-up perspective,

what we’ve talked about is a trajectory of roughly 18 months for kind of lease-up of the balance of the property. And so we’re

in advanced stages. We have several tours that have taken place across the property and also have several proposals out to tenants.

And so I think at this stage, we don’t

have anything definitive. But hopefully in the next few quarters, we will have feedback on the status of those proposals.

Tamim Mahmud Sarwary

Great. And then just on leasing.

I think you guys mentioned in the prepared remarks expectations for a sequential increase throughout the year. So is that based off of

the current pipeline and most of that’s locked in? Or how much of that is just expectations for things to improve versus kind of

what you guys already have locked in?

Chris Bilotto

Yes, the number I provided on advanced

stages, just north of 700,000 square feet. Advanced stages for us represents signed LOI or those where we are negotiating a lease document.

And so look, there’s risk, but I think we feel like the risk is somewhat mitigated at that stage. So I would imagine that we’d

start to see a good portion of that mature for Q2.

Operator

Ladies and gentlemen, this concludes our question-and-answer

session. I’d like to turn the conference back over to Chris Bilotto for any closing remarks.

Chris Bilotto

Thank you for joining the call today. We look forward to seeing

many of you at NAREIT and other industry conferences in the upcoming months.

Operator

This concludes today’s conference call. We thank

you all for attending today’s presentation. You may now disconnect your lines, and have a wonderful day.

[End]

Warning Concerning Forward-Looking

Statements

This transcript

contains statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act

of 1995 and other securities laws. Also, whenever Office Properties Income Trust (Nasdaq: OPI), or OPI, and Diversified Healthcare

Trust (Nasdaq: DHC), or DHC, use words such as “believe”, “expect”, “anticipate”, “intend”,

“plan”, “estimate”, “will”, “may” and negatives or derivatives of these or similar expressions,

they are making forward-looking statements. These forward-looking statements are based upon OPI’s and DHC’s present intent,

beliefs or expectations, but forward-looking statements are not guaranteed to occur and may not occur. Actual results may differ materially

from those contained in or implied by OPI’s and DHC’s forward-looking statements as a result of various factors, which include

those that are detailed in each of OPI’s and DHC’s periodic reports and subsequent filings with the Securities and Exchange

Commission, or the SEC.

You should not place

undue reliance upon any forward-looking statements. Except as required by law, OPI and DHC do not intend to update or change any

forward-looking statements as a result of new information, future events or otherwise.

Important Additional Information About the Transaction

In connection with the proposed merger, OPI intends

to file a registration statement on Form S-4 with the SEC, which will include a preliminary prospectus and related materials to register

OPI’s common shares of beneficial interest, $.01 par value per share, to be issued in the merger. OPI and DHC intend to file a joint

proxy statement/prospectus and other documents concerning the merger with the SEC. The proposed transaction involving OPI and DHC will

be submitted to OPI’s and DHC’s shareholders for their consideration. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS

ARE URGED TO CAREFULLY READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS THAT ARE FILED OR

WILL BE FILED WITH THE SEC IN CONNECTION WITH THE MERGER OR INCORPORATED BY REFERENCE IN THE REGISTRATION STATEMENT AND JOINT PROXY STATEMENT/PROSPECTUS

BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT OPI, DHC AND THE MERGER. When available, the relevant portions of the

joint proxy statement/prospectus will be mailed to OPI’s and DHC’s shareholders. Investors will also be able to obtain copies

of the registration statement and the joint proxy statement/prospectus and other relevant documents (when they become available) free

of charge at the SEC’s website (www.sec.gov). Additional copies of documents filed by OPI with the SEC may be obtained for free

on OPI’s Investor Relations’ website at www.opireit.com/investors or by contacting OPI’s Investor Relations department

at 1-617-219-1410.

In addition to the registration statement and joint

proxy statement/prospectus expected to be filed, OPI files annual, quarterly and current reports and other information with the SEC. OPI’s

filings with the SEC are also available to the public from commercial document-retrieval services and at the website maintained by the

SEC at www.sec.gov.

No Offer or Solicitation

This transcript shall not constitute an offer to

sell or the solicitation of an offer to subscribe for or buy any securities or a solicitation of any vote or approval in any jurisdiction

with respect to the merger or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful, prior to registration or qualification under the securities laws of any such jurisdiction.

No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities

Act of 1933, as amended.

Participants in the Solicitation

OPI and certain of its trustees and executive officers,

DHC and certain of its trustees and executive officers, and The RMR Group LLC, the manager of OPI and DHC, and its parent and certain

of their respective directors, officers and employees may be deemed to be participants in the solicitation of proxies from OPI’s

and DHC’s shareholders in connection with the merger. Certain information regarding the persons who may, under the rules of the

SEC, be deemed participants in the solicitation of OPI’s and DHC’s shareholders in connection with the merger and a description

of their direct and indirect interests will be set forth in the registration statement and the joint proxy statement/prospectus when filed

with the SEC. Information about OPI’s trustees and executive officers is included in the proxy statement for OPI’s 2023 annual

meeting of shareholders, which was filed with the SEC on April 6, 2023. Information about DHC’s trustees and executive officers

is included in the proxy statement for DHC’s 2023 annual meeting of shareholders, which was filed with the SEC on April 20, 2023.

Copies of the foregoing documents may be obtained as provided above. Additional information regarding the interests of such participants

and other persons who may be deemed participants in the transaction will be included in the joint proxy statement/prospectus and the other

relevant documents filed with the SEC when they become available.

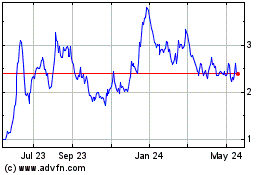

Diversified Healthcare (NASDAQ:DHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

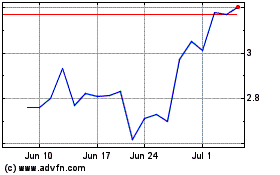

Diversified Healthcare (NASDAQ:DHC)

Historical Stock Chart

From Apr 2023 to Apr 2024