Current Report Filing (8-k)

February 16 2023 - 6:05AM

Edgar (US Regulatory)

0001075415

false

0001075415

2023-02-14

2023-02-14

0001075415

us-gaap:CommonStockMember

2023-02-14

2023-02-14

0001075415

DHC:SeniorNotesDue2042Member

2023-02-14

2023-02-14

0001075415

DHC:SeniorNotesDue2046Member

2023-02-14

2023-02-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

February 14, 2023

DIVERSIFIED HEALTHCARE TRUST

(Exact Name of Registrant as Specified in

Its Charter)

Maryland

(State or Other Jurisdiction of Incorporation)

| 001-15319 |

|

04-3445278 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts

02458-1634

(Address of Principal Executive Offices) (Zip Code)

617-796-8350

(Registrant’s Telephone Number, Including

Area Code)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title Of Each Class |

|

Trading Symbol(s) |

|

Name Of Each Exchange

On Which Registered |

| Common

Shares of Beneficial Interest |

|

DHC |

|

The

Nasdaq Stock Market LLC |

| 5.625%

Senior Notes due 2042 |

|

DHCNI |

|

The

Nasdaq Stock Market LLC |

| 6.25%

Senior Notes due 2046 |

|

DHCNL |

|

The

Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

In this Current Report on Form 8-K, the

terms “we”, “us”, and “our” refer to Diversified Healthcare Trust.

Item 1.01. Entry into a Material Definitive

Agreement.

On

February 14, 2023, we amended the agreement governing our credit facility, or our credit agreement, with Wells Fargo Bank, National Association,

as administrative agent and a lender, and a syndicate of other lenders. Pursuant to the amendment, among other things, the waiver of the

fixed charge coverage ratio covenant was extended through the maturity date of our credit facility in January 2024, the minimum liquidity

requirement was decreased from $200.0 million to $100.0 million, and the facility commitments were reduced from $586.4 million

to $450.0 million.

In

addition, the amendment provides for certain additional financial covenants and restrictions on us, including that we are required

to repay outstanding amounts under the credit facility with excess cash flow from properties that secure the credit facility and

that, subject to certain exceptions, we are generally restricted from acquiring real property or incurring additional debt and our

ability to pay cash distributions to our shareholders remains limited to amounts required to maintain our qualification for taxation

as a REIT, to avoid the payment of income or excise taxes and to pay a dividend of $0.01 per share per quarter. The amendment

also establishes the secured overnight financing rate as the replacement benchmark rate in place of LIBOR to calculate interest

payable on amounts outstanding under our credit facility, increases the interest rate premium payable on borrowings under our credit

facility from 250 basis points per annum to 290 basis points per annum and eliminates the

feature of our credit facility permitting us to reborrow funds.

Wells Fargo Bank, National

Association and the other lenders party to our credit agreement, as amended, as well as their affiliates, have engaged in, and may in

the future engage in, investment banking, commercial banking, advisory and other commercial dealings in the ordinary course of business

with us. They have received, and may in the future receive, customary fees and commissions for these engagements.

The foregoing description

of the amendment to our credit agreement is not complete and is subject to and qualified in its entirety by reference to the copy of the

fifth amendment to our amended and restated credit agreement attached as Exhibit 10.1 to this Current Report on Form 8-K, and incorporated

herein by reference.

Warning Concerning Forward-Looking

Statements

This Current Report on

Form 8-K contains statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform

Act of 1995 and other securities laws. Also, whenever we use words such as “believe”, “expect”, “anticipate”,

“intend”, “plan”, “estimate”, “will”, “may” and negatives or derivatives of

these or similar expressions, we are making forward-looking statements. These forward-looking statements are based upon our present intent,

beliefs or expectations, but forward-looking statements are not guaranteed to occur and may not occur. Actual results may differ materially

from those contained in or implied by our forward-looking statements as a result of various factors. For example:

| · | Implications of the amendment could be that we will have sufficient liquidity under our credit agreement to fund our operations and repayment

of debt. We are currently fully drawn under our credit facility and could also be required to repay our

outstanding debt in the event of non-compliance with certain other requirements of our credit agreement or our senior unsecured

notes indentures or their supplements. In addition, we have no additional options to extend the maturity date of our credit

facility. We may therefore experience future liquidity constraints, as we are currently unable to incur additional debt under our

credit agreement or the agreements governing our public debt, and will be limited to cash on hand to fund our operations and

repayment of debt or we may be required to raise additional capital from other sources or take other measures to maintain adequate

liquidity; and |

| · | Actual costs under our credit facility will be higher than the stated rate plus a premium because of fees and expenses associated

with the facility. |

The information contained

in our filings with the SEC, including under the caption “Risk Factors” in our Annual Report on Form 10-K for the year ended

December 31, 2021 identifies other important factors that could cause our actual results to differ materially from those stated in or

implied by our forward-looking statements. Our filings with the SEC are available on the SEC’s website at www.sec.gov.

You should not place undue

reliance upon forward-looking statements.

Except as required by

law, we do not intend to update or change any forward-looking statements as a result of new information, future events or otherwise.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

DIVERSIFIED HEALTHCARE TRUST |

| |

|

| |

By: |

/s/ Richard W. Siedel, Jr. |

| |

Name: |

Richard W. Siedel, Jr. |

| |

Title: |

Chief Financial Officer and Treasurer |

Date: February 15, 2023

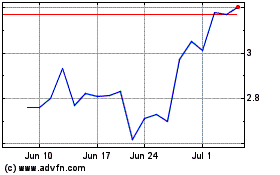

Diversified Healthcare (NASDAQ:DHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

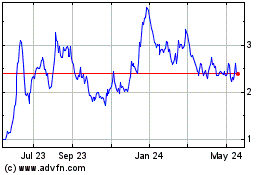

Diversified Healthcare (NASDAQ:DHC)

Historical Stock Chart

From Apr 2023 to Apr 2024