Cord-Cutting Clips Dish Network's Profit

May 03 2019 - 3:54PM

Dow Jones News

By Drew FitzGerald

Dish Network Corp.'s first-quarter profit fell 7.6% as its

satellite-TV customer base continued to shrink, adding pressure on

the telecom company to find new income sources.

The company lost 266,000 satellite customers during the three

months that ended March 31, while internet-based Sling TV added

7,000 customers, its smallest-ever quarterly gain. Dish ended the

period with 12.1 million pay-TV subscribers.

"It's still a declining business," Executive Chairman Charlie

Ergen said during a conference call. "I don't want to sugarcoat it,

but we think we can build value there."

Some Wall Street analysts said the customer losses were less

severe than expected. An increase in average revenue per user to

$85.03 from $84.50 a year earlier also cushioned the blow from

viewer defections.

Shares rose 3.8% to $34.86 Friday. They are up about 6% over the

past 12 months.

Dish's first-quarter profit totaled $339.8 million, or 65 cents

a share, down from $367.6 million, or 70 cents a share, a year

earlier. Revenue fell 7.8% to $3.19 billion.

The U.S. pay-TV sector has been shrinking in recent years as

price-conscious cord-cutters drop expensive cable and satellite-TV

connections in search of other forms of entertainment. Dish offset

some of those losses by launching online-only Sling TV in 2015,

though growth in this market has also slowed in recent months.

A dispute that left customers without Spanish-language channels

from Univision will no longer weigh on the business after the

companies agreed in late March to sign a new contract. But Dish

executives offered no signs of an end to their continued dispute

with premium channel HBO, owned by telecom competitor AT&T

Inc.

"With regard to HBO and AT&T, there's nothing new to

report," Dish Chief Executive Erik Carlson said. "We recently met

again with AT&T, but unfortunately they only offer different

words with really the same meaning."

Dish's shrinking TV base adds pressure on the company to convert

the wireless spectrum licenses it has amassed into a profitable

business. The company is equipping a basic network of cell towers

to serve business customers by the end of this year to meet certain

regulatory requirements. The company intends to build a full

wireless network with fifth generation, or 5G, technology in the

coming years.

"The best opportunity for us is building a new state-of-the-art

stand-alone 5G network," Mr. Ergen said.

Write to Drew FitzGerald at andrew.fitzgerald@wsj.com

(END) Dow Jones Newswires

May 03, 2019 15:39 ET (19:39 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

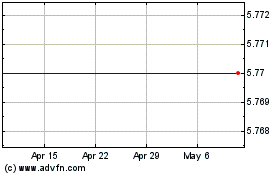

DISH Network (NASDAQ:DISH)

Historical Stock Chart

From Mar 2024 to Apr 2024

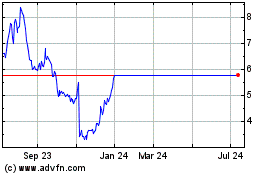

DISH Network (NASDAQ:DISH)

Historical Stock Chart

From Apr 2023 to Apr 2024