Justice Department Approves Merger of T-Mobile US and Sprint

July 26 2019 - 12:00PM

Dow Jones News

By Drew FitzGerald and Sarah Krouse

The Justice Department approved T-Mobile US Inc.'s merger with

Sprint Corp. after the companies agreed to create a new wireless

carrier by selling assets to satellite-TV provider Dish Network

Corp.

The landmark antitrust agreement seeks to address concerns that

the combination of T-Mobile, the nation's No. 3 carrier by

subscribers, and No. 4 Sprint will drive up prices for consumers.

It would leave more than 95% of American cellphone customers with

the top three U.S. operators.

A deal brokered by the Justice Department will require Dish,

which has been sitting on valuable airwaves, to build a 5G network

for cellphone customers. To help it get started, T-Mobile will sell

Sprint's prepaid brands to Dish and give access to the combined

carrier's network for seven years.

"With this merger and accompanying divestiture, we are expanding

output significantly by ensuring large amounts of currently unused

or underused spectrum are made available to American consumers in

the form of high quality 5G networks," said Makan Delrahim, the

Justice Department's antitrust chief.

Critics of the arrangement include a group of state attorneys

general that broke with the Justice Department and have filed an

antitrust lawsuit seeking to block the more than $26 billion

merger. Five states that weren't part of the lawsuit joined the

federal government in the settlement announced Friday.

"Why scramble so much to create a fourth competitor when you

already have one?" said Samuel Weinstein, an assistant law

professor at the Cardozo School of Law at Yeshiva University who

worked previously in the Justice Department's antitrust unit.

The deal gives Dish, a satellite-TV provider, about 9 million

Sprint prepaid cellphone customers and additional wireless

spectrum. Those subscribers represent about a fifth of Sprint's

customer base.

T-Mobile and Sprint must also give Dish access to at least

20,000 cell sites and hundreds of retail locations. The new

T-Mobile must provide "robust access" to its network, the Justice

Department said.

The union of T-Mobile and Sprint, years in the making, would

create a wireless company with more than 80 million U.S. customers,

closing the gap with Verizon Communications Inc. and AT&T Inc.,

which each have roughly 100 million wireless customers. It also

would fulfill a long-held goal of Japan's SoftBank Group Corp.,

which owns most of Sprint, and Deutsche Telekom AG, which controls

T-Mobile.

Write to Drew FitzGerald at andrew.fitzgerald@wsj.com and Sarah

Krouse at sarah.krouse@wsj.com

(END) Dow Jones Newswires

July 26, 2019 11:45 ET (15:45 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

DISH Network (NASDAQ:DISH)

Historical Stock Chart

From Mar 2024 to Apr 2024

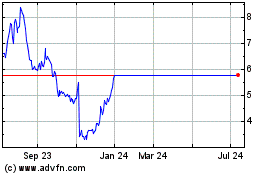

DISH Network (NASDAQ:DISH)

Historical Stock Chart

From Apr 2023 to Apr 2024