Current Report Filing (8-k)

June 01 2022 - 4:49PM

Edgar (US Regulatory)

false000031778800003177882022-05-272022-05-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): May 27, 2022

Digital Turbine, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-35958 | | 22-2267658 |

| (State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | |

110 San Antonio Street,Suite 160, Austin, TX | | 78701 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(512) 387-7717

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions. (see General Instruction A.2. below)

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common Stock | APPS | NASDAQ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(e) On May 27, 2022, the Company’s Board of Directors (the “Board”) and Compensation and Human Capital Management Committee of the Board (the “Compensation Committee”) approved compensation for William Stone, the Company’s Chief Executive Officer, and Barrett Garrison, the Company’s Chief Financial Officer. In connection with such approvals, the Board and the Compensation Committee increased Mr. Garrison’s threshold, target, and stretch target payout percentages of base salary for fiscal year 2023 annual incentive compensation to 50%, 100%, and 200%, respectively.

The Board and Compensation Committee granted Mr. Stone and Mr. Garrison performance-based restricted stock units (“PSUs”) for a target number of 70,330 shares and 26,257 shares, respectively, of the Company’s common stock on the following terms. The PSUs will vest based 50% upon achievement of a three-year revenue target and 50% upon achievement of a three-year adjusted EBITDA target determined by the Board, with threshold, target and stretch target payout percentages of 50%, 100%, and 167% of the target number of shares based on the extent of achievement of such revenue and adjusted EBITDA targets. In addition, the number of PSUs that will vest is subject to a total shareholder return (“TSR”) modifier that may increase the target number of shares vested based on a comparison of the Company’s TSR for the three-year period from the grant date until the third anniversary of the grant date (the “Performance Period”) to the TSR of the S&P Software and Services Select Industry Index (the “Peer Index”) over the Performance Period, as set forth in the following table:

| | | | | | | | | | | | | | | | | | | | |

Performance Measure | Performance Goals Relative TSR (Company compared to the S&P Software and Services Select Industry Index) | Relative TSR Multiplier |

| Threshold | Target | Stretch | Threshold | Target | Stretch |

| Relative TSR | 2+ CAGR percentage points above | 7+ CAGR percentage points above | 12+ CAGR percentage points above | 100% | 110% | 120% |

Thus, Mr. Stone and Mr. Garrison each has the opportunity to vest from 50% to a maximum of 200% of the PSUs granted to him depending on the extent to which the revenue and adjusted EBITDA performance goals are achieved or exceeded and where the Company’s TSR for the Performance Period ranks by comparison to the TSR of the Peer Index for the Performance Period. If the absolute Company TSR for the Performance Period is negative, then the Relative TSR Multiplier will equal 100%.

If the Company’s achievement of Performance Goals or if the Relative TSR falls in between the threshold and stretch percentages, such amounts will be interpolated on a linear basis in calculating the number of target shares vested.

The Board and the Compensation Committee also granted time-vesting restricted stock units and stock options to Mr. Stone and Mr. Garrison as part of the annual long-term incentive grants. The stock options were granted with an exercise price at a 10% premium to the closing price of the Company’s common stock on the grant date (i.e., 110% of such closing price).

In addition, the Company and each of Mr. Stone and Mr. Garrison agreed that the threshold, target and stretch percentages for both the annual incentive compensation and long-term incentive performance-based restricted stock units, along with the percentage allocation of the performance goals’ impact on annual incentive compensation, may be set in the discretion of the Compensation Committee and the Board from time to time notwithstanding the terms in their respective employment agreements.

Item 9.01 Financial Statements and Exhibits

Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | Form of Restricted Stock Unit Agreement (Performance-Vesting). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| June 1, 2022 | Digital Turbine, Inc. |

| | By: | /s/ Barrett Garrison |

| | | Barrett Garrison |

| | | Executive Vice President & Chief Financial Officer |

EXHIBITS INDEX

| | | | | | | | |

| Exhibit No. | | Description |

| | Form of Restricted Stock Unit Agreement (Performance-Vesting). |

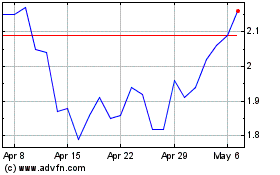

Digital Turbine (NASDAQ:APPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Digital Turbine (NASDAQ:APPS)

Historical Stock Chart

From Apr 2023 to Apr 2024