Digital Ally, Inc. (Nasdaq: DGLY), which develops, manufactures and

markets advanced video surveillance products for law enforcement,

homeland security and commercial applications, today announced its

operating results for the first quarter of 2019. An investor

conference call is scheduled for 11:15 a.m. EDT on Wednesday, May

15, 2019 (see details below).

Highlights for Quarter Ended March 31,

2019

- Revenues increased in first quarter

2019 to $2,550,796 from $2,378,287 in fourth quarter 2018 and

$2,471,513 in first quarter 2018. The primary reason for the

revenue increases in the first quarter 2019 is that our service

revenues continued to improve. We plan to introduce a new product

platform, the EVO-HD, specifically for in-car systems, in third

quarter 2019 to address our competitors’ new product

features. This new product platform will utilize advanced

chipsets that will generate new and highly advanced products for

our law enforcement and commercial customers. Our law enforcement

revenues remain challenging due to price-cutting, willful

infringement of our patents and other actions by our competitors

and adverse marketplace effects related to the patent

litigation.

- We are concentrating on expanding

our recurring service revenue to help stabilize our revenues on a

quarterly basis. Our revenues from cloud storages have grown in

recent quarters and reached approximately $179,500 in first quarter

2019, an increase of $34,100 (23%) over first quarter 2018.

Additionally, our revenues from extended warranties have grown and

were approximately $327,500 in first quarter 2019, compared to

approximately $253,000 for the prior year period, an increase of

approximately $75,000 (30%). We are pursuing several new

market channels that do not involve our traditional law enforcement

and private security customers, such as our NASCAR affiliation,

which we believe will help expand the appeal of our products and

service capabilities to new commercial markets. If

successful, we believe that these new market channels could yield

additional recurring service revenues for us in the future.

- We have asserted two significant

patent infringement lawsuits involving Axon and WatchGuard that

have had significant impacts on our quarterly results primarily due

to the timing and amount of legal fees expended on such lawsuits.

The WatchGuard lawsuit has been settled, as noted below, while the

Axon lawsuit remains active. Future quarterly results during

2019 and possibly beyond will continue to be impacted as the Axon

case moves to trial. If the jury in the Axon lawsuit

determines that Axon is infringing our patents, it would determine

the amount of compensatory damages owed to us by the defendant and

whether such damage awards should be trebled due to willful

infringement by the defendant. In addition, there may be

attempts by Axon to settle such lawsuit prior to the trial.

Such jury awards and/or potential settlement prior to trial would

likely have a significant impact on our quarterly operating results

if and when it occurs. Axon has been and remains our primary target

for its willful patent infringement of our “auto-activation”

related patents. WatchGuard was an important first step, but Axon

remains the market leader and the party most at risk from our

patent litigation and now that we have settled the lawsuit with

WatchGuard we can focus on holding Axon, its insurers and other

responsible parties accountable for its conduct.

- On May 14, 2019 we and WatchGuard

announced that we had settled the pending patent infringement

litigation. On May 26, 2016, we initiated a patent lawsuit in the

U.S. District Court for the District of Kansas against WatchGuard

for alleged infringement of the ’292 Patent, the ’452 Patent and

the ’950 Patent. On May 14, 2019, the parties resolved the dispute

and executed a settlement agreement in the form of a Release and

License Agreement. The litigation has been dismissed as a result of

this settlement.

The resolution of the dispute includes the

following key terms:

- WatchGuard will pay us a one-time, lump sum settlement payment

of six (6) million dollars.

- We have granted WatchGuard a perpetual covenant not to sue if

WatchGuard’s products incorporate agreed-upon modified recording

functionality.

- We have granted WatchGuard a license to the ’292 Patent and

“452 Patent (and related patents, now existing and yet-to-issue)

through December 31, 2023. The parties have agreed to negotiate in

good faith to attempt to resolve any alleged infringement that

occurs after the license period expires.

- The parties have further agreed to release each other from all

claims or liabilities pre-existing the settlement.

- As part of the settlement, the parties agreed that WatchGuard

is making no admission that it has infringed any of Digital Ally’s

patents.

Management Comments

“We are encouraged that our service- based

revenues increased 31% from the prior year and continued our trend

of growth in this area.,” stated Stanton E. Ross, Chief Executive

Officer of Digital Ally, Inc. “We are also very pleased that we

have settled our lawsuit with WatchGuard. The settlement should

serve notice to the industry that we are the rightful owner of

“auto-activation” patents and that we intend to defend our patents

and to hold infringing parties responsible for their actions. We

believe that this settlement begins our process of monetizing our

robust patent portfolio and specifically the “auto-activation”

technology that we invented and patented. We have long been the

leading company in developing new and advanced technologies used by

our law enforcement and commercial customers, and competitors like

Axon have felt it necessary to infringe on our patents rather than

develop their own new technology.” concluded Ross.

First Quarter Operating

Results

For the three months ended March 31, 2019, our

total revenue increased by 3% to approximately $2.6 million,

compared with revenue of approximately $2.5 million for the three

months ended March 31, 2018. The primary reasons for the

revenue increase in 2019 compared to 2018 was that our

service-based revenues were up 31%. However, our law enforcement

revenues declined over the prior period due to the willful

infringement of our patents and other actions by our competitors

and adverse marketplace effects related to the patent litigation.

We will introduce our EVO-HD in 2019 with the goal of enhancing our

product line features to meet these competitive challenges. Our

gross margin increased 7% to $1,181,740 for the three months ended

March 31, 2019 versus $1,109,394 in 2018. The gross margin increase

is commensurate with the 3% increase in total revenues and a

decline in our cost of sales as a percentage of revenues to 54%

during the three months ended March 31, 2019 from 55% for the three

months ended March 31, 2018.

Selling, General and Administrative (“SG&A”)

expenses increased approximately 38% to $4,267,898 in the three

months ended March 31, 2019 versus $3,082,710 a year earlier. The

primary cause for the increase in SG&A expenses for the three

months ended March 31, 2019 compared to the prior year was

professional fees and expenses attributable to legal fees and

expenses related to the Axon, WatchGuard and PGA lawsuits. The

WatchGuard lawsuit was resolved and settled in May 2019; however,

the Axon lawsuit remains active. The PGA lawsuit was resolved on

April 17, 2019 and the cost to resolve this suit was accrued as of

March 31, 2019. We expect that the legal fees related to the Axon

litigation will remain high in 2019 as we proceed to trial. We

intend to pursue recovery from Axon, its insurers and other

responsible parties as appropriate.

We reported a net loss of ($3,205,174), or

($0.29) per share, in the first quarter of 2019, compared with a

prior-year net loss of ($2,588,232), or ($0.37) per

share.

Investor Conference Call

The Company will host an investor

conference call at 11:15 a.m. EDT on Wednesday May 15, 2019, to

discuss its operating results for the first quarter 2019, along

with other topics of interest.

Shareholders and other interested parties may participate

in the conference call by dialing

844-761-0863 and entering conference

ID# 9081469 a few minutes before

11:15 a.m. EDT on Wednesday May 15, 2019.

A replay of the conference call will be

available two hours after its completion, from May 15, 2019 until

11:59 p.m. on July 15, 2019 by dialing 855-859-2056 and entering

the conference ID #

9081469.

For additional news and information please visit or follow

us on Twitter @digitalallyinc and

Facebook www.facebook.com/DigitalAllyInc

Follow additional Digital Ally Inc. social media channels

here:

Linkedin I Instagram I Google+ I Pinterest

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Act of 1934. These

forward-looking statements are based largely on the expectations or

forecasts of future events, can be affected by inaccurate

assumptions, and are subject to various business risks and known

and unknown uncertainties, a number of which are beyond the control

of management. Therefore, actual results could differ

materially from the forward-looking statements contained in this

press release. A wide variety of factors that may cause

actual results to differ from the forward-looking statements

include, but are not limited to, the following: whether the Company

will be able to improve its revenue and operating results; whether

it will be able to resolve its liquidity and operational

issues; whether it will be able to achieve improved

production and other efficiencies to restore its gross and

operating margins in the future; whether the Company will be

able to continue to expand into non-law enforcement markets and

increase its service based revenue; whether the Company has

resolved its product quality and supply chain issues; whether there

will be commercial markets, domestically and internationally, for

one or more of the Company’s new products; whether the Company will

achieve positive outcomes in its litigation with Axon; whether and

the extent to which the US Patent and Trademark Office (USPTO)

rulings will curtail, eliminate or otherwise have an effect on the

actions of Axon and others in the marketplace respecting the

Company, its products and customers; its ability to deliver its

newer product offerings as scheduled, and in particular the

new EVO-HD product platform, obtain the required components and

products on a timely basis, and have them perform as planned;

whether the new partnership with NASCAR will help expand the appeal

for the Company’s products and services; its ability to maintain or

expand its share of the markets in which it competes, including

those outside the law enforcement industry; whether it will be able

to adapt its technology to new and different uses, including being

able to introduce new products; competition from larger, more

established companies with far greater economic and human

resources; its ability to attract and retain customers and quality

employees; the effect of changing economic conditions; and changes

in government regulations, tax rates and similar matters.

These cautionary statements should not be construed as exhaustive

or as any admission as to the adequacy of the Company’s

disclosures. The Company cannot predict or determine after

the fact what factors would cause actual results to differ

materially from those indicated by the forward-looking statements

or other statements. The reader should consider statements

that include the words “believes,” “expects,” “anticipates,”

“intends,” “estimates,” “plans,” “projects,” “should,” or other

expressions that are predictions of or indicate future events or

trends, to be uncertain and forward-looking. It does not

undertake to publicly update or revise forward-looking statements,

whether because of new information, future events or

otherwise. Additional information respecting factors that

could materially affect the Company and its operations are

contained in its annual report on Form 10-K for the year ended

December 31, 2018 and quarterly report on Form 10-Q for the three

months ended March 31, 2019, filed with the Securities and Exchange

Commission.

For Additional Information, Please

Contact:Stanton E. Ross, CEO, at (913) 814-7774

orThomas J. Heckman, CFO, at (913)

814-7774

(Financial Highlights Follow)

DIGITAL ALLY,

INC.CONDENSED CONSOLIDATED BALANCE

SHEETSMARCH 31, 2019 AND DECEMBER 31,

2018

| |

|

March 31, 2019 |

|

|

December 31, 2018 |

|

| |

|

(Unaudited) |

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

2,379,521 |

|

|

$ |

3,598,807 |

|

|

Accounts receivable-trade, less allowance for doubtful accounts of

$70,000 – 2019 and 2018 |

|

|

1,702,249 |

|

|

|

1,847,886 |

|

|

Accounts receivable-other |

|

|

434,951 |

|

|

|

382,412 |

|

|

Inventories, net |

|

|

6,995,333 |

|

|

|

6,999,060 |

|

|

Income tax refund receivable, current |

|

|

44,603 |

|

|

|

44,603 |

|

|

Prepaid expenses |

|

|

237,631 |

|

|

|

429,403 |

|

| |

|

|

|

|

|

|

|

|

|

Total current assets |

|

|

11,794,288 |

|

|

|

13,302,171 |

|

| |

|

|

|

|

|

|

|

|

| Furniture, fixtures and

equipment, net |

|

|

232,052 |

|

|

|

247,541 |

|

| Intangible assets, net |

|

|

477,936 |

|

|

|

486,797 |

|

| Operating lease right of use

assets |

|

|

387,426 |

|

|

|

— |

|

| Income tax refund

receivable |

|

|

45,397 |

|

|

|

45,397 |

|

| Other assets |

|

|

298,552 |

|

|

|

256,749 |

|

| |

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

13,235,651 |

|

|

$ |

14,338,655 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity

(Deficit) |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

1,623,707 |

|

|

$ |

784,599 |

|

|

Accrued expenses |

|

|

1,660,972 |

|

|

|

2,080,667 |

|

|

Current portion of operating lease obligations |

|

|

433,007 |

|

|

|

— |

|

|

Contract liabilities-current |

|

|

1,663,009 |

|

|

|

1,748,789 |

|

|

Proceeds investment agreement, at fair value-current |

|

|

6,000,000 |

|

|

|

— |

|

|

Income taxes payable |

|

|

3,933 |

|

|

|

3,689 |

|

| |

|

|

|

|

|

|

|

|

|

Total current liabilities |

|

|

11,384,628 |

|

|

|

4,617,744 |

|

| |

|

|

|

|

|

|

|

|

| Long-term liabilities: |

|

|

|

|

|

|

|

|

|

Proceeds investment agreement, at fair value- less current

portion |

|

|

3,279,000 |

|

|

|

9,142,000 |

|

|

Operating lease obligations- less current portion |

|

|

35,580 |

|

|

|

— |

|

|

Contract liabilities-long term |

|

|

1,912,599 |

|

|

|

1,991,091 |

|

| |

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

16,611,807 |

|

|

|

15,750,835 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Stockholder’s Equity

(Deficit): |

|

|

|

|

|

|

|

|

|

Common stock, $0.001 par value; 50,000,000 shares authorized;

shares issued: 11,126,055 – 2019 and 10,445,445 – 2018 |

|

|

11,126 |

|

|

|

10,445 |

|

|

Additional paid in capital |

|

|

79,358,024 |

|

|

|

78,117,507 |

|

|

Treasury stock, at cost (63,518 shares) |

|

|

(2,157,226 |

) |

|

|

(2,157,226 |

) |

|

Accumulated deficit |

|

|

(80,588,080 |

) |

|

|

(77,382,906 |

) |

| |

|

|

|

|

|

|

|

|

|

Total stockholders’ equity (deficit) |

|

|

(3,376,156 |

) |

|

|

(1,412,180 |

) |

| |

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity (deficit) |

|

$ |

13,235,651 |

|

|

$ |

14,338,655 |

|

(FOR ADDITIONAL INFORMATION, PLEASE REFER TO THE

COMPANY’S QUARTERLY REPORT ON FORM 10-Q FOR THE PERIOD ENDED MARCH

31, 2019 FILED WITH THE SEC)

DIGITAL ALLY,

INC.CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONSFOR THE THREE MONTHS

ENDED MARCH 31, 2019 AND 2018

(Unaudited)

| |

|

Three Months ended March 31, |

|

| |

|

2019 |

|

|

2018 |

|

| |

|

|

|

|

|

|

| Revenue: |

|

|

|

|

|

|

|

|

|

Product |

|

$ |

1,920,464 |

|

|

$ |

1,991,113 |

|

|

Service and other |

|

|

630,332 |

|

|

|

480,400 |

|

| |

|

|

|

|

|

|

|

|

|

Total revenue |

|

|

2,550,796 |

|

|

|

2,471,513 |

|

| |

|

|

|

|

|

|

|

|

| Cost of revenue: |

|

|

|

|

|

|

|

|

|

Product |

|

|

1,263,071 |

|

|

|

1,253,019 |

|

|

Service and other |

|

|

105,985 |

|

|

|

109,100 |

|

| |

|

|

|

|

|

|

|

|

|

Total cost of revenue |

|

|

1,369,056 |

|

|

|

1,362,119 |

|

| |

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

1,181,740 |

|

|

|

1,109,394 |

|

| Selling, general and

administrative expenses: |

|

|

|

|

|

|

|

|

|

Research and development |

|

|

462,171 |

|

|

|

440,120 |

|

|

Selling, advertising and promotional |

|

|

755,989 |

|

|

|

674,405 |

|

|

Stock-based compensation |

|

|

725,198 |

|

|

|

493,519 |

|

|

General and administrative |

|

|

2,324,540 |

|

|

|

1,474,666 |

|

| |

|

|

|

|

|

|

|

|

| Total selling, general and

administrative expenses |

|

|

4,267,898 |

|

|

|

3,082,710 |

|

| |

|

|

|

|

|

|

|

|

|

Operating loss |

|

|

(3,086,158 |

) |

|

|

(1,973,316 |

) |

| |

|

|

|

|

|

|

|

|

| Interest and other income |

|

|

17,984 |

|

|

|

1,616 |

|

| Change in warrant derivative

liabilities |

|

|

— |

|

|

|

889 |

|

| Change in fair value of

secured convertible debentures |

|

|

— |

|

|

|

12,807 |

|

| Change in fair value of

proceeds investment agreement |

|

|

(137,000 |

) |

|

|

— |

|

| Loss on the extinguishment of

secured convertible debentures |

|

|

— |

|

|

|

(500,000 |

) |

| Interest expense |

|

|

— |

|

|

|

(130,228 |

) |

| |

|

|

|

|

|

|

|

|

| Loss before income tax

(benefit) |

|

|

(3,205,174 |

) |

|

|

(2,588,232 |

) |

| Income tax (benefit) |

|

|

— |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(3,205,174 |

) |

|

$ |

(2,588,232 |

) |

| |

|

|

|

|

|

|

|

|

| Net loss per share

information: |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.29 |

) |

|

$ |

(0.37 |

) |

|

Diluted |

|

$ |

(0.29 |

) |

|

$ |

(0.37 |

) |

| |

|

|

|

|

|

|

|

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

|

Basic |

|

|

10,941,856 |

|

|

|

7,030,809 |

|

|

Diluted |

|

|

10,941,856 |

|

|

|

7,030,809 |

|

(FOR ADDITIONAL INFORMATION, PLEASE REFER TO THE

COMPANY’S QUARTERLY REPORT ON FORM 10-Q FOR THE PERIOD ENDED MARCH

31, 2019 FILED WITH THE SEC)

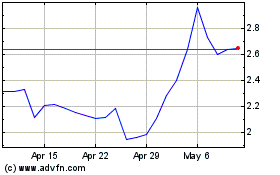

Digital Ally (NASDAQ:DGLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

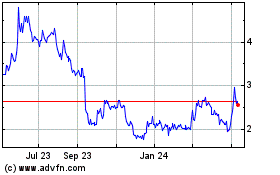

Digital Ally (NASDAQ:DGLY)

Historical Stock Chart

From Apr 2023 to Apr 2024