Current Report Filing (8-k)

June 04 2019 - 4:53PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): May 30, 2019

DEXCOM, INC.

(Exact Name of the Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

|

|

|

|

|

|

|

000-51222

|

|

33-0857544

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

6340 Sequence Drive, San Diego, CA

|

|

92121

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(858) 200-0200

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, If Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

Title of Each Class

|

|

Trading Symbol(s)

|

|

Name of Each Exchange on Which Registered

|

|

Common Stock, $0.001 Par Value Per Share

|

|

DXCM

|

|

Nasdaq Global Select Market

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2)

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

________________________________________________________________________________________________________________________

|

|

|

|

ITEM 5.02.

|

DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS.

|

(e)

Amendment to Amended and Restated 2015 Equity Incentive Plan

On April 18, 2019, the Board of Directors (the “

Board

”) of DexCom, Inc. (“

DexCom

”) approved, subject to stockholder approval, an amendment (the “

Plan Amendment

”) to DexCom’s Amended and Restated 2015 Equity Incentive Plan (the “

A&R

2015 Plan

”), which was approved by DexCom’s stockholders at its 2019 annual meeting of stockholders held on May 30, 2019 (the “

Annual Meeting

”). The Plan Amendment reserved for issuance an additional 2,200,000 shares of DexCom’s common stock, subject to certain additions and adjustments, and to provide administrator flexibility with respect to vesting during certain leaves of absences, as well as making changes for favorable income tax withholding and to conform with current tax law.

A more complete description of the A&R 2015 Plan, as amended by the Plan Amendment, and its terms is set forth in DexCom’s definitive proxy statement filed with the Securities and Exchange Commission on April 19, 2019 (the “

Proxy Statement

”). The foregoing description of the A&R 2015 Plan, as amended by the Plan Amendment, and the description of the A&R 2015 Plan, as amended by the Plan Amendment, in the Proxy Statement do not purport to be complete and are qualified in their respective entireties by reference to the A&R 2015 Plan, as amended by the Plan Amendment, a copy of which is included as

Appendix A

of the Proxy Statement and is incorporated herein by reference as Exhibit 10.01 to this Current Report on Form 8-K.

Adoption of Deferred Compensation Plan

On May 31, 2019, the Board adopted the DexCom, Inc. Executive Deferred Compensation Plan (the “

Plan

”), with an effective date of April 1, 2019.

The Plan is a non-qualified deferred compensation plan that allows eligible executives to defer receipt of taxable income and thereby defer income taxes and assist in saving for retirement. Under the Plan, each eligible executive, which includes DexCom’s named executive officers, is permitted to elect to defer receipt of a portion (up to 75%) of such executive’s base salary and up to 100% of such executive’s annual cash bonus from DexCom. Dollar amounts that are deferred are credited to an executive’s Plan account and are notionally invested in investments selected by such executive from among those the Plan administrator offers, and the account is credited with the gains or losses from such investment. Additionally, DexCom reserves the right to make discretionary or matching credits to such accounts, in DexCom’s sole discretion, and if made, such credits would be subject to vesting conditions determined by the Plan administrator. The Plan is “unfunded,” which means there are no specific assets set aside by DexCom in connection with the Plan. Upon the executive’s separation from DexCom, the amount in such executive’s account is paid either in a single lump sum or in equal annual installments over a period of up to 10 years, based on the payment election made by the executive at the time the payment was initially deferred.

The above summary of the Plan is qualified in its entirety by reference to the full text of the Plan, which is attached hereto as Exhibit 10.02 and incorporated herein by reference.

|

|

|

|

ITEM 5.07.

|

Submission of Matters to a Vote of Security Holders.

|

(a) DexCom held its Annual Meeting of Stockholders (the “

Annual Meeting

”) on May 30, 2019. Proxies for the Annual Meeting were solicited pursuant to Regulation 14A of the Securities Exchange Act of 1934, as amended. At the close of business on the record date, there were 91,037,358 shares outstanding and entitled to vote and 81,912,373 shares were voted in person or by proxy on the matters described below.

(b) The matters described below were voted on at the Annual Meeting and the number of votes cast with respect to each matter was as indicated:

(1) Holders of DexCom’s common stock voted to elect three Class II directors, each to serve until their successor has been elected and qualified or until their earlier resignation or removal as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

For (#)

|

|

Against (#)

|

|

Abstentions (#)

|

|

Broker Non-Votes

|

|

Steven R. Altman

|

|

68,677,612

|

|

6,378,279

|

|

10,705

|

|

6,845,777

|

|

Barbara E. Kahn

|

|

74,841,324

|

|

214,675

|

|

10,598

|

|

6,845,776

|

|

Jay S. Skyler

|

|

65,676,981

|

|

9,304,791

|

|

84,824

|

|

6,845,777

|

(2) Holders of DexCom’s common stock voted to ratify the appointment of Ernst & Young LLP as its independent registered public accounting firm for the fiscal year ending December 31, 2019:

|

|

|

|

|

|

|

|

|

Number of Shares

|

|

Shares Voted in Favor:

|

|

80,824,007

|

|

Shares Voted Against:

|

|

1,054,011

|

|

Shares Abstaining:

|

|

34,355

|

(3) Holders of DexCom’s common stock voted to approve the non-binding advisory resolution on compensation paid to DexCom’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including compensation discussion and analysis, compensation tables and narrative discussion:

|

|

|

|

|

|

|

|

|

Number of Shares

|

|

Shares Voted in Favor:

|

|

71,011,374

|

|

Shares Voted Against:

|

|

4,026,314

|

|

Shares Abstaining:

|

|

28,908

|

(4) Holders of DexCom’s common stock voted to approve the amendment to the Amended and Restated 2015 Equity Incentive Plan to increase the number of shares reserved thereunder by 2,200,00 and to approve such other amendments thereto:

|

|

|

|

|

|

|

|

|

Number of Shares

|

|

Shares Voted in Favor:

|

|

72,297,698

|

|

Shares Voted Against:

|

|

2,752,631

|

|

Shares Abstaining:

|

|

16,267

|

ITEM 9.01.

FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

DEXCOM, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Patrick M. Murphy

|

|

|

|

Patrick M. Murphy

|

|

|

|

Senior Vice President, General Counsel and Chief Compliance Officer

|

Date: June 4, 2019

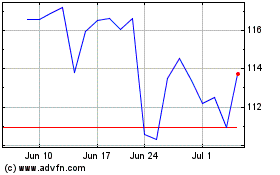

DexCom (NASDAQ:DXCM)

Historical Stock Chart

From Mar 2024 to Apr 2024

DexCom (NASDAQ:DXCM)

Historical Stock Chart

From Apr 2023 to Apr 2024