Current Report Filing (8-k)

January 06 2021 - 4:11PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 6, 2021

DERMTECH, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-38118

|

|

84-2870849

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

11099 N. Torrey Pines Road, Suite 100

La Jolla, CA 92037

(Address of Principal Executive Offices and Zip Code)

Registrant’s telephone number, including area code (858) 450-4222

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock,

par value $0.0001 per share

|

DMTK

|

The Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Cautionary Note Regarding Forward Looking Statements

All statements, other than those of historical fact, contained in this Current Report on Form 8-K, are forward-looking statements, including preliminary financial information and results of operations for the quarter ended December 31, 2020. Our actual results, performance or achievements could differ materially from those expressed or implied by forward-looking statements we make as a result of a variety of risks and uncertainties, including those related to the preliminary nature of our financial and results of operations estimates for the quarter ended December 31, 2020, which are subject to completion of our financial closing procedures and year-end audit; and the factors discussed in the “Risk Factors” section of our most recent Quarterly Report on Form 10-Q as well as any updates to these risk factors filed from time to time in our other filings with the Securities and Exchange Commission, or the SEC. You are urged to carefully consider all such factors. The forward-looking statements contained herein and the exhibits hereto represent our views only as of the date of this Current Report on Form 8-K and we do not undertake or plan to update or revise any such forward-looking statements to reflect actual results or changes in plans, prospects, assumptions, estimates or other circumstances occurring after the date of this Current Report on Form 8-K except as required by law.

|

Item 2.02.

|

Results of Operations and Financial Conditions.

|

In connection with our proposed underwritten public offering, we are providing certain preliminary financial information and results of operations for the quarter ended December 31, 2020, based on currently available information. Our financial closing procedures with respect to the estimated financial data provided below are not yet complete. These procedures often result in changes to accounts. As a result, our final results may vary from the preliminary results presented below. We undertake no obligation to update or supplement the information provided below until we release our financial statements for the quarter and year ended December 31, 2020.

The preliminary financial data included in this Current Report on Form 8-K has been prepared by, and is the responsibility of, our management. KPMG LLP has not audited, reviewed, compiled, or applied agreed-upon procedures with respect to the preliminary financial information and results of operations. Accordingly, KPMG LLP does not express an opinion or any other form of assurance with respect thereto.

Based on currently available information, we estimate our revenue for the quarter ended December 31, 2020 to be at least $2.0 million, of which at least $1.5 million is assay revenue. We estimate billable sample volume for the same period to be approximately 8,300, which would represent a 24% increase when compared to billable sample volume for the quarter ended September 30, 2020 and a 69% increase when compared to billable sample volume for the quarter ended December 31, 2019. We estimate billable sample volume for December 2020 to be approximately 2,900, which would represent a twelve-month run rate of 34,000 to 35,000 assuming no growth in monthly billable samples. Additionally, we estimate that as of December 31, 2020, we had approximately $64 million in cash, cash equivalents and marketable securities.

As previously disclosed in the Current Report on Form 8‑K filed by us with the SEC on November 10, 2020, we are party to that certain Sales Agreement, dated November 10, 2020, with Cowen and Company, LLC, or Cowen, as sales agent, pursuant to which we may offer and sell, from time to time through Cowen, shares of our common stock having an aggregate offering price of up to $50.0 million. We have sold an aggregate of 951,792 shares of our common stock pursuant to the Sales Agreement at an average selling price of $20.97 per share, which resulted in approximately $20.0 million of gross proceeds and $19.4 million of net proceeds to us.

The information provided in this Item 2.02 of this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

On January 6, 2021, we issued a press release, or the Offering Release, announcing the commencement of a proposed underwritten public offering of our common stock pursuant to a shelf registration statement on Form S-3 (File No. 333-248642) declared effective by the SEC on September 17, 2020, or the Registration Statement. In connection with the proposed offering, we also announced our intention to grant the underwriters a 30-day option to purchase up to an additional 15% of the shares of common stock sold in the offering. The Offering Release is attached hereto as Exhibit 99.1 and incorporated by reference into this Item 8.01.

The proposed offering will be made only by means of a written prospectus and related prospectus supplement forming a part of the Registration Statement. This Current Report on Form 8-K, including the exhibit hereto, shall not constitute an offer to sell or the solicitation of an offer to buy any of our securities, nor shall there be any offer, solicitation or sale of our securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

DERMTECH, INC.

|

|

|

|

|

|

|

Date: January 6, 2021

|

|

By:

|

|

/s/ Kevin Sun

|

|

|

|

Name:

|

|

Kevin Sun

|

|

|

|

Title:

|

|

Chief Financial Officer

|

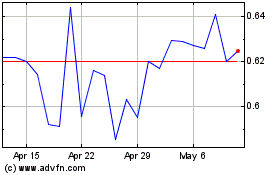

DermTech (NASDAQ:DMTK)

Historical Stock Chart

From Mar 2024 to Apr 2024

DermTech (NASDAQ:DMTK)

Historical Stock Chart

From Apr 2023 to Apr 2024