Data I/O Corporation (NASDAQ: DAIO), the leading global provider

of advanced data and security deployment solutions for flash,

flash-memory based intelligent devices and microcontrollers, today

announced financial results for the second quarter ended June 30,

2020.

Second Quarter 2020 Highlights

- Net sales of $4.7 million; bookings of $5.0 million

- Gross margin as a percentage of sales of 52.4 %

- Net loss of ($1,057,000) or ($0.13) per share

- Adjusted earnings before interest, taxes, depreciation and

amortization (EBITDA)*, excluding equity compensation, of

($231,000)

- Cash & Equivalents of $13.3 million; no debt

- Automotive electronics, advanced programming and secure

provisioning leadership

- Automotive Electronics represented approximately 50% of second

quarter 2020 bookings

- Wins in UFS infotainment, vehicle electrification, and

competitive replacement within the automotive sector

- Win at Asia-based IoT manufacturer for multiple PSV family

systems

- 300th PSV family system deployed

- Shipments began for the SentriX® supported PSoC 64 Standard

Secure Amazon Web Services (AWS) microcontroller (MCU)

*EBITDA and Adjusted EBITDA are non-GAAP

financial measures. A reconciliation is provided in the tables of

this press release.

Management Comments

Commenting on the second quarter ended June 30, 2020, Anthony

Ambrose, President and CEO of Data I/O Corporation, said, “In a

COVID-19 pandemic-stricken world, we are grateful for the health of

our staff, customers, partners, stakeholders and families, and

appreciate the sacrifices made by healthcare responders around the

world. Under the circumstances during the better part of the past

six months, global commerce has been anything but predictable.

Expectations in general have been reduced, and our performance in

the second quarter reflected these business conditions.

“For Data I/O, our second quarter revenues of $4.7 million were

modestly under the $4.8 million recorded in the first quarter.

Second quarter bookings improved to $5.0 million from $4.3M in the

first quarter. Backlog strengthened at June 30 to $2.8 million from

$2.3 million at March 31.

“During the second quarter, global COVID-19 negatively affected

many of our customers and our business. We saw many automotive

manufacturing facilities temporarily closing. In turn, this delayed

equipment and consumable purchases. Within automotive, the market

for electric vehicles has been emerging to complement our strength

in ADAS and infotainment segments. In the second quarter, we

shipped a PSV7000 unit for use in a major European OEM’s

electrification program, and we are actively pursuing more

opportunities in this area. We also had other competitive

automotive wins in Asia and Latin America. While the traditional

automotive capital equipment market has been challenging, we

experienced pockets of strength within the broader industrial/IoT

electronics market as well as from other sectors. We gained a

significant new IoT customer in Asia in the second quarter. We are

pleased to have reached the milestone of deploying our 300th PSV

unit during the second quarter.

“SentriX saw continued progress with our channel partners in the

second quarter. Through a programming center partner, we won a

significant opportunity in utilities/smart metering. Cypress, an

Infineon Technologies company, announced in July the production

availability of its PSoC 64 Standard Secure Amazon Web Services

(AWS) microcontroller (MCU). The MCU provides secure IoT device

management that enables OEMs to safely deploy applications and

handle data at scale. These are important highlights of our SentriX

ecosystems’ growing presence.

“The basic tenets of our success have been and will continue to

be rooted in our technology and prudent financial planning with

realistic expectations. Data I/O has built a sustainable and

resilient business to withstand down periods such as the one we are

in and then to flourish from our proven operational leverage as

conditions improve. The last market cycle upswing for Data I/O was

based on our capital equipment and consumable business lines,

whereas the next cycle upswing should benefit from our SentriX

platform. At the end of the second quarter, we had $13.3 million in

cash and no debt. This provides us with ample liquidity so that we

may be flexible in these challenging times and remain committed to

our long-term growth objectives.”

Financial Results

Net sales in the second quarter of 2020 were $4.7 million, as

compared with $5.8 million in the second quarter of 2019. The

year-over-year decline in sales reflects the cyclical downtrend in

the industry and the broadening impact of the COVID-19 pandemic,

with particular emphasis on the automotive market.

For the 2020 second quarter, gross margin as a percentage of

sales was 52.4%, as compared to 61.4% in the second quarter of

2019. The 2020 second quarter gross margin was primarily impacted

by fixed costs being spread over lower revenue and a less favorable

revenue mix due to reduced levels of consumable sales resulting

from limited activities among automotive customers with many

temporary closures and reductions due to COVID-19.

Total operating expenses in the second quarter of 2020 were $3.3

million, down from $3.5 million in the 2019 period. Data I/O

continues to invest in research and development and SentriX, while

emphasizing ongoing expense management practices. The second

quarter of 2020 marks two consecutive quarters in which operating

expenses have been reduced.

An operating loss of ($878,000) for the second quarter of 2020

compares to operating income of $75,000 for the second quarter of

2019. Net loss in the second quarter of 2020 was ($1,057,000), or

($0.13) per share, compared with net income of $127,000, or $0.02

per diluted share, for the second quarter of 2019. Included in net

income are foreign currency transaction gains/(loss) of ($83,000)

for the 2020 period and $69,000 for the second quarter of 2019.

Earnings before interest, taxes, depreciation and amortization

(“EBITDA”) was ($712,000) in the second quarter of 2020, compared

to EBITDA of $364,000 in the second quarter of 2019. Adjusted

EBITDA, excluding equity compensation, was ($231,000) in the second

quarter of 2020, compared to adjusted EBITDA of $728,000 in the

second quarter of 2019.

Bookings in the second quarter of 2020 were $5.0 million,

compared to $4.3 million in the first quarter of 2020 and $5.1

million in the second quarter of 2019. Backlog at June 30, 2020 was

$2.8 million, as compared with $2.3 million at March 31, 2020.

Data I/O’s financial condition remains strong with cash of $13.3

million at June 30, 2020, as compared with $13.8 million at March

31, 2020 and $13.9 million at December 31, 2019. The Company had

net working capital of $18.0 million at June 30, 2020, a slight

reduction from $18.4 million at March 31, 2020. The Company

continues to have no debt.

Conference Call Information

A conference call discussing financial results for the second

quarter ended June 30, 2020 will follow this release today at 2

p.m. Pacific Time/5 p.m. Eastern Time. To listen to the conference

call, please dial 412-902-6510. A replay will be made available

approximately one hour after the conclusion of the call. To access

the replay, please dial 412-317-0088, access code 10146518. The

conference call will also be simultaneously webcast over the

Internet; visit the News and Events section of the Data I/O

Corporation website at www.dataio.com to access the call from the

site. This webcast will be recorded and available for replay on the

Data I/O Corporation website approximately one hour after the

conclusion of the conference call.

About Data I/O Corporation

Since 1972 Data I/O has developed innovative solutions to enable

the design and manufacture of electronic products for automotive,

Internet-of-Things, medical, wireless, consumer electronics,

industrial controls and other electronic devices. Today, our

customers use Data I/O security deployment and programming

solutions to reliably, securely, and cost-effectively bring

innovative new products to life. These solutions are backed by a

global network of Data I/O support and service professionals,

ensuring success for our customers.

________________

Learn more at dataio.com

Forward Looking Statement and Non-GAAP financial

measures

Statements in this news release concerning economic outlook,

expected revenue, expected margins, expected savings, expected

results, orders, deliveries, backlog and financial positions, as

well as any other statement that may be construed as a prediction

of future performance or events are forward-looking statements

which involve known and unknown risks, uncertainties and other

factors which may cause actual results to differ materially from

those expressed or implied by such statements. Forward-looking

statement disclaimers also apply to the global COVID-19 pandemic,

including the expected effects on the Company’s business from

COVID-19, the duration and scope, impact on the demand for the

Company’s products, and the pace of recovery for the COVID-19

pandemic to subside. These factors include uncertainties as to the

ability to record revenues based upon the timing of product

deliveries, installations and acceptance, accrual of expenses,

coronavirus related business interruptions, changes in economic

conditions and other risks including those described in the

Company's filings on Forms 10K and 10Q with the Securities and

Exchange Commission (SEC), press releases and other

communications.

Non-GAAP financial measures, such as EBITDA and Adjusted EBITDA

excluding equity compensation, should not be considered a

substitute for, or superior to, measures of financial performance

prepared in accordance with GAAP. We believe that these non-GAAP

financial measures provide meaningful supplemental information

regarding the Company’s results and facilitate the comparison of

results.

DATA I/O CORPORATION

CONSOLIDATED STATEMENTS OF

OPERATIONS

(in thousands, except per

share amounts)

(UNAUDITED)

Three Months Ended June

30,

Six Months Ended June

30,

2020

2019

2020

2019

Net Sales

$4,655

$5,834

$9,440

$11,892

Cost of goods sold

2,216

2,250

4,217

4,623

Gross margin

2,439

3,584

5,223

7,269

Operating expenses:

Research and development

1,614

1,680

3,196

3,361

Selling, general and administrative

1,703

1,829

3,514

3,803

Total operating expenses

3,317

3,509

6,710

7,164

Operating income (loss)

(878)

75

(1,487)

105

Non-operating income:

Interest income

1

10

9

22

Gain on sale of assets

-

-

-

60

Foreign currency transaction gain

(loss)

(83)

69

(31)

(36)

Total non-operating income (loss)

(82)

79

(22)

46

Income (loss) before income taxes

(960)

154

(1,509)

151

Income tax (expense) benefit

(97)

(27)

(102)

2

Net income (loss)

($1,057)

$127

($1,611)

$153

Basic earnings (loss) per share

($0.13)

$0.02

($0.19)

$0.02

Diluted earnings (loss) per share

($0.13)

$0.02

($0.19)

$0.02

Weighted-average basic shares

8,302

8,257

8,261

8,280

Weighted-average diluted shares

8,302

8,332

8,261

8,375

DATA I/O CORPORATION

CONSOLIDATED BALANCE

SHEETS

(in thousands, except share

data)

(UNAUDITED)

June 30, 2020

December 31, 2019

ASSETS

CURRENT ASSETS:

Cash and cash equivalents

$13,273

$13,936

Trade accounts receivable, net of

allowance for

doubtful accounts of $73 and $80,

respectively

2,840

4,099

Inventories

4,731

5,020

Other current assets

2,000

924

TOTAL CURRENT ASSETS

22,844

23,979

Property, plant and equipment – net

1,602

1,668

Income tax receivable

-

640

Other assets

1,717

1,994

TOTAL ASSETS

$26,163

$28,281

LIABILITIES AND STOCKHOLDERS’

EQUITY

CURRENT LIABILITIES:

Accounts payable

$908

$1,151

Accrued compensation

1,304

1,541

Deferred revenue

1,334

1,387

Other accrued liabilities

1,259

1,372

Income taxes payable

64

31

TOTAL CURRENT LIABILITIES

4,869

5,482

Operating lease liabilities

834

1,178

Long-term other payables

150

91

COMMITMENTS

-

-

STOCKHOLDERS’ EQUITY

Preferred stock -

Authorized, 5,000,000 shares,

including

200,000 shares of Series A Junior

Participating

Issued and outstanding, none

-

-

Common stock, at stated value -

Authorized, 30,000,000 shares

Issued and outstanding, 8,390,943 shares

as of June 30,

2020 and 8,212,748 shares as of December

31, 2019

19,319

18,748

Accumulated earnings

897

2,508

Accumulated other comprehensive income

94

274

TOTAL STOCKHOLDERS’ EQUITY

20,310

21,530

TOTAL LIABILITIES AND STOCKHOLDERS’

EQUITY

$26,163

$28,281

DATA I/O CORPORATION

NON-GAAP FINANCIAL MEASURE

RECONCILIATION

Three Months Ended June

30,

Six Months Ended June

30,

2020

2019

2020

2019

(in thousands)

Net Income (loss)

($1,057)

$127

($1,611)

$153

Interest (income)

(1)

(10)

(9)

(22)

Taxes

97

27

102

(2)

Depreciation and amortization

249

220

447

424

EBITDA earnings (loss)

($712)

$364

($1,071)

$553

Equity compensation

481

364

730

651

Adjusted EBITDA earnings (loss),

excluding equity compensation

($231)

$728

($341)

$1,204

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200804005919/en/

Joel Hatlen Chief Operating and Financial Officer Data I/O

Corporation (425) 881-6444

Darrow Associates, Inc. Jordan Darrow (512) 551-9296

jdarrow@darrowir.com

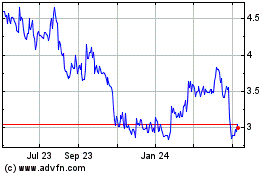

Data I O (NASDAQ:DAIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

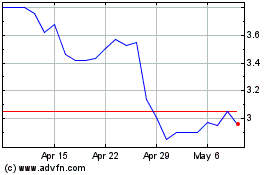

Data I O (NASDAQ:DAIO)

Historical Stock Chart

From Apr 2023 to Apr 2024