UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

|

|

☒

|

Preliminary Proxy Statement

|

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

☐

|

Definitive Proxy Statement

|

|

|

☐

|

Definitive Additional Materials

|

|

|

☐

|

Soliciting Material Under Rule 14a-12

|

|

Cymabay Therapeutics, Inc.

|

|

(Name of Registrant as Specified in Its Charter)

|

|

|

|

ENGINE CAPITAL, L.P.

ENGINE JET CAPITAL, L.P.

ENGINE CAPITAL MANAGEMENT, LP

ENGINE CAPITAL MANAGEMENT GP, LLC

ENGINE INVESTMENTS, LLC

ARNAUD AJDLER

ROBERT FRANKFURT

NADAV KIDRON

|

|

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on

which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

☐

|

Fee paid previously with preliminary materials:

|

☐ Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of

its filing.

|

|

(1)

|

Amount previously paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED APRIL 24, 2020

Engine

Capital, L.P.

___________, 2020

Dear Fellow CymaBay Therapeutics Stockholder,

Engine Capital, L.P. (together

with its affiliates, “Engine Capital” or “we”) is the largest stockholder of CymaBay Therapeutics, Inc.,

a Delaware corporation (“CymaBay” or the “Company”), which, together with the other participants in this

solicitation, beneficially own in the aggregate approximately 9.4% of the outstanding shares of the common stock, $0.0001 par value

per share (the “Common Stock”) of the Company. For the reasons set forth in the attached Proxy Statement, we believe

that stockholders would benefit from significant changes to the composition of the Company’s Board of Directors (the “Board”).

We are seeking your support for the election of our three (3) nominees at the Company’s 2020 annual meeting of stockholders

scheduled to be held on [__] [__], 2020 at [__:__] a.m., local time, at the Pacific Research Center, 7677 Gateway Blvd., Conference

Center 2nd Floor, [__] Room, Newark, California 94560 (including any adjournments or postponements thereof and any meeting

which may be called in lieu thereof, the “Annual Meeting”), for the following purposes:

|

|

1.

|

To elect Engine Capital’s three (3) director nominees, Arnaud Ajdler, Robert Frankfurt and

Nadav Kidron (each a “Nominee” and collectively, the “Nominees”), to the Board to serve until the 2021

annual meeting of stockholders and until their respective successors are duly elected and qualified;

|

|

|

2.

|

To ratify the selection, by the Audit Committee of the Board, of Ernst & Young LLP as the independent

registered public accounting firm of the Company for its fiscal year ending December 31, 2020;

|

|

|

3.

|

To approve, on an advisory basis, the compensation for the Company’s named executive officers,

as disclosed in the Company’s proxy statement;

|

|

|

4.

|

To vote on an amendment to the Company’s Amended and Restated Certificate of Incorporation

to increase the number of authorized shares of the Company’s Common Stock from 100,000,000 shares to 200,000,000 shares;

and

|

|

|

5.

|

To conduct any other business properly brought before the Annual Meeting.

|

There are five (5)

directorships up for election at the Annual Meeting. The enclosed Proxy Statement is soliciting proxies to elect only our three

(3) Nominees. Accordingly, the enclosed BLUE proxy card may only be voted for our Nominees and does not confer voting power

with respect to any of the Company’s director nominees. Stockholders who return the BLUE proxy card will only be able to

vote for our three (3) Nominees. You can only vote for the Company’s director nominees by signing and returning a proxy

card provided by the Company, voting in person at the Annual Meeting or otherwise providing valid voting instructions to the Company

(including by telephone or Internet). Stockholders should refer to the Company’s proxy statement for the names, backgrounds,

qualifications and other information concerning the Company’s nominees. Your vote to elect our Nominees will have the legal

effect of replacing three (3) incumbent directors with our Nominees. If all three (3) of our Nominees are elected, they would represent

a majority of the directors on the Board.

The attached Proxy

Statement and the enclosed BLUE proxy card are first being mailed to stockholders on or about _____, 2020. We urge you to

carefully consider the information contained in the attached Proxy Statement and then support our efforts by signing, dating and

returning the enclosed BLUE proxy card today.

If you have already

voted for the Company’s slate of directors, you have every right to change your vote by signing, dating and returning a later

dated BLUE proxy card or by voting in person at the Annual Meeting.

If you have any

questions or require any assistance with your vote, please contact Saratoga Proxy Consulting LLC, which is assisting us, at its

address and toll-free numbers listed below.

|

|

Thank you for your support,

|

|

|

|

|

|

/s/ Arnaud Ajdler

|

|

|

|

|

|

Engine Capital, L.P.

|

If you have any questions or require assistance

in voting your BLUE proxy card,

please contact Saratoga at the phone numbers

listed below.

Saratoga Proxy Consulting, LLC

520 8th Avenue, 14th Floor

New York, NY 10018

(212) 257-1311

Stockholders may call toll-free: (888) 368-0379

info@Saratogaproxy.com

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED APRIL 24, 2020

2020 ANNUAL MEETING OF STOCKHOLDERS

OF

CymaBay Therapeutics, Inc.

_________________________

PROXY STATEMENT

OF

Engine Capital, L.P.

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED BLUE PROXY CARD TODAY

Engine Capital,

L.P. (“Engine”), Engine Jet Capital, L.P. (“Engine Jet”), Engine Capital Management, LP (“Engine

Management”), Engine Capital Management GP, LLC (“Engine GP”), Engine Investments, LLC (“Engine Investments”)

and Arnaud Ajdler (collectively, “Engine Capital” or “we”) is the largest stockholder of CymaBay Therapeutics,

Inc., a Delaware corporation (“CymaBay” or the “Company”), who, together with the other participants in

this solicitation, beneficially own in the aggregate approximately 9.4% of the outstanding shares of common stock, $0.0001 par

value per share (the “Common Stock”) of the Company. We believe that the Board of Directors of the Company (the “Board”)

must be meaningfully reconstituted to ensure that the Board takes the necessary steps for the Company’s stockholders to realize

the maximum value of their investments. We have nominated a slate of three highly qualified and capable candidates who are fully

committed to representing the best interests of stockholders in the boardroom. We are therefore seeking your support at the Company’s

upcoming 2020 annual meeting of stockholders scheduled to be held on [__] [__], 2020 at [__:__] a.m., local time, at the Pacific

Research Center, 7677 Gateway Blvd., Conference Center 2nd Floor, [__] Room, Newark, California 94560 (including any adjournments

or postponements thereof and any meeting which may be called in lieu thereof, the “Annual Meeting”), for the following

purposes:

|

|

1.

|

To elect Engine Capital’s three (3) director nominees, Arnaud Ajdler, Robert Frankfurt and

Nadav Kidron (each a “Nominee” and collectively, the “Nominees”) to the Board to serve until the 2021 annual

meeting of stockholders and until their respective successors are duly elected and qualified;

|

|

|

2.

|

To ratify the selection, by the Audit Committee of the Board, of Ernst & Young LLP as the independent

registered public accounting firm of the Company for its fiscal year ending December 31, 2020;

|

|

|

3.

|

To approve, on an advisory basis, the compensation for the Company’s named executive officers,

as disclosed in the Company’s proxy statement;

|

|

|

4.

|

To vote on an amendment to the Company’s Amended and Restated Certificate of Incorporation

to increase the number of authorized shares of the Company’s Common Stock from 100,000,000 shares to 200,000,000 shares;

and

|

|

|

5.

|

To conduct any other business properly brought before the Annual Meeting.

|

This Proxy Statement

and the enclosed BLUE proxy card are first being mailed to stockholders on or about [__________], 2020.

This Proxy Statement

is soliciting proxies to elect only our Nominees. Accordingly, the enclosed BLUE proxy card may only be voted for our Nominees

and does not confer voting power with respect to any of the Company’s director nominees. Stockholders who return the BLUE

proxy card will only be able to vote for Engine Capital’s three (3) Nominees. See “Voting and Proxy Procedures”

below for additional information. You can only vote for the Company’s director nominees by signing and returning a proxy

card provided by the Company. Stockholders should refer to the Company’s proxy statement for the names, backgrounds, qualifications

and other information concerning the Company’s nominees.

The participants

in this solicitation intend to vote their shares (the “Engine Capital Group Shares”) FOR the election of the

Nominees, FOR the ratification of the selection of Ernst & Young LLP as the Company’s independent registered public

accounting firm for the fiscal year ending December 31, 2020, [FOR/AGAINST] the non-binding advisory vote on executive compensation,

and AGAINST the vote on an amendment to the Company’s Amended and Restate Certificate of Incorporation to increase

the number of authorized shares of the Company’s Common Stock, as described herein. While we currently intend to vote all

of the Engine Capital Group Shares in favor of the election of the Nominees, we reserve the right to vote some or all of the Engine

Capital Group Shares for some or all of the Company’s director nominees, as we see fit, in order to achieve a Board composition

that we believe is in the best interest of all stockholders. We would only intend to vote some or all of the Engine Capital Group

Shares for some or all of the Company’s director nominees in the event it were to become apparent to us, based on the projected

voting results at such time, that by voting the Engine Capital Group Shares we could help elect the Company nominee(s) that we

believe are the most qualified to serve as directors and thus help achieve a Board composition that we believe is in the best interest

of all stockholders. Stockholders should understand, however, that all shares of Common Stock represented by the enclosed BLUE

proxy card will be voted at the Annual Meeting as marked.

The Company has

set the close of business on [__], 2020 as the record date for determining stockholders entitled to notice of and to vote at the

Annual Meeting (the “Record Date”). The mailing address of the principal executive offices of the Company is 7575 Gateway

Boulevard, Suite 110, Newark, California 94560. According to the Company, as of the Record Date, there were [__] shares of Common

Stock outstanding.

THIS SOLICITATION

IS BEING MADE BY ENGINE CAPITAL AND NOT ON BEHALF OF THE BOARD OR MANAGEMENT OF THE COMPANY. ENGINE CAPITAL IS NOT AWARE OF ANY

OTHER MATTERS TO BE BROUGHT BEFORE THE ANNUAL MEETING OTHER THAN AS DESCRIBED HEREIN. SHOULD OTHER MATTERS, WHICH ENGINE CAPITAL

IS NOT AWARE OF A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES

IN THE ENCLOSED BLUE PROXY CARD WILL VOTE ON SUCH MATTERS IN THEIR DISCRETION.

ENGINE CAPITAL URGES

YOU TO SIGN, DATE AND RETURN THE BLUE PROXY CARD IN FAVOR OF THE ELECTION OF THE NOMINEES.

IF YOU HAVE ALREADY

SENT A PROXY CARD FURNISHED BY MANAGEMENT TO THE COMPANY, YOU MAY REVOKE THAT PROXY AND VOTE FOR THE ELECTION OF THE NOMINEES BY

SIGNING, DATING AND RETURNING THE ENCLOSED BLUE PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT COUNTS. ANY PROXY

MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR

THE ANNUAL MEETING OR BY VOTING IN PERSON AT THE ANNUAL MEETING.

Important Notice Regarding the Availability

of Proxy Materials for the Annual Meeting

This Proxy Statement and our BLUE

proxy card are available at [_____]

IMPORTANT

Your vote is

important, no matter how many shares of Common Stock you own. We urge you to sign, date, and return the enclosed BLUE proxy card

today to vote FOR the election of our Nominees and in accordance with Engine Capital’s recommendations on the other proposals

on the agenda for the Annual Meeting.

|

|

·

|

If your shares of Common Stock are registered in your own name, please sign and date the enclosed

BLUE proxy card and return it to Engine Capital c/o Saratoga Proxy Consulting LLC (“Saratoga”) in the enclosed

envelope today.

|

|

|

·

|

If your shares of Common Stock are held in a brokerage account, you are considered the beneficial

owner of the shares of Common Stock, and these proxy materials, together with a BLUE voting form, are being forwarded to

you by your broker. As a beneficial owner, if you wish to vote, you must instruct your broker how to vote. Your broker cannot vote

your shares of Common Stock on your behalf without your instructions.

|

|

|

·

|

Depending upon your broker, you may be able to vote either by toll-free telephone or by the Internet.

Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating and

returning the enclosed voting form.

|

Since only your

latest dated proxy card will count, we urge you not to return any proxy card you receive from the Company. Even if you return the

management proxy card marked “withhold” as a protest against the incumbent directors, it will revoke any proxy card

you may have previously sent to us. Remember, you can vote for our Nominees only on our BLUE proxy card. So please make

certain that the latest dated proxy card you return is the BLUE proxy card.

If you have any questions or require assistance

in voting your BLUE proxy card,

please contact Saratoga at the phone numbers

listed below.

Saratoga Proxy Consulting, LLC

520 8th Avenue, 14th Floor

New York, NY 10018

(212) 257-1311

Stockholders may call toll-free: (888) 368-0379

info@Saratogaproxy.com

BACKGROUND TO SOLICITATION

The following is a chronology of material events leading

up to this proxy solicitation:

|

|

·

|

On November 25, 2019, the Company issued a press release regarding Seladelpar. The Company

announced its termination of its Phase 2b study of Seladelpar in subjects with non-alcoholic steatohepatitis (NASH) and its recently

initiated Phase 2 study of Seladelpar in subjects with primary sclerosing cholangitis (PSC), and that the Company was putting on

hold all studies of Seladelpar in subjects with primary biliary cholangitis (the “November 25th Disclosures”).

|

|

|

·

|

On November 26, 2019, following the November 25th Disclosures, Arnaud

Ajdler, Managing Partner of Engine Capital, sent the Company an email indicating that Engine Capital owned just under 5% of the

Company’s Common Stock and requesting a phone conversation with a representative of the Company.

|

|

|

·

|

On November 29, 2019, Mr. Ajdler emailed Sujal Shah, the Company’s President and

Chief Executive Officer, requesting a meeting. Later that day, Mr. Ajdler had a phone conversation with Mr. Shah. During the

course of this conversation, Messrs. Ajdler and Shah discussed the November 25th Disclosures.

|

|

|

·

|

On December 12, 2019, Engine Capital filed a Schedule 13D with the Securities and Exchange Commission

(the “SEC”) disclosing beneficial ownership of 4,983,934 shares, representing approximately 7.3% of the Company’s

then outstanding Common Stock, making Engine Capital one of the Company’s largest stockholders. In its Schedule 13D, Engine

Capital disclosed that it may, among other matters, engage in discussions with the Company, the Board and the Company’s stockholders,

concerning “strategic alternatives, changes to the capitalization, ownership structure, board structure (including board

composition) or operations.”

|

|

|

·

|

On December 13, 2019, Messrs. Ajdler and Shah had another phone conversation regarding the

November 25th Disclosures.

|

|

|

·

|

On December 16, 2019, Mr. Ajdler sent Mr. Shah an email (the “Request”) requesting

to speak with the Chairman of the Board or the Chair of the Nominating and Corporate Governance Committee of the Board (the “NCG

Committee”).

|

|

|

·

|

On December 17, 2019, Mr. Ajdler sent Mr. Shah an email to follow up on the Request.

|

|

|

·

|

On December 22, 2019, Mr. Ajdler sent another email to Mr. Shah to follow up on the Request.

|

|

|

·

|

On December 28, 2019, Mr. Ajdler sent another email to Mr. Shah to follow up on the Request. That

email stated: “Sujal - do I need to write a public letter to get the board’s attention? 12 days ago, I sent an email

asking for a call with the chairman and or head of the governance committee. I have sent 2 follow-ups to that email. This is my

third follow-up. This lack of urgency does not reflect well on the board. Hopefully we can schedule a call early this week.”

|

|

|

·

|

On December 29, 2019, Mr. Shah offered to meet Mr. Ajdler in-person at the JP Morgan Healthcare

Conference scheduled for mid-January. Mr. Ajdler indicated that he would not be attending the conference and would prefer to have

a call before the end of the year.

|

|

|

·

|

On December 31, 2019, the Chair of the NCG Committee, Kurt von Emster, had a phone conversation

with Mr. Ajdler. During the course of the conversation, Mr. Ajdler requested that the Company appoint two individuals to the Board.

Mr. von Emster indicated that the Board would consider Mr. Ajdler’s request, and that he would discuss the proposal with

the NCG Committee.

|

|

|

·

|

On January 7, 2020 and on January 9, 2020, Messrs. Ajdler and von Emster exchanged emails regarding

Mr. Ajdler’s request that the Company appoint two individuals to the Board.

|

|

|

·

|

On January 10, 2020, Mr. Ajdler sent an email to Mr. von Emster stating that Mr. Ajdler and Nadav

Kidron were the two individuals that Engine Capital would suggest to appoint to the Board.

|

|

|

·

|

On January 17, 2020, Messrs. Ajdler and Kidron had a telephone interview with Mr. von Emster regarding

their respective qualifications to serve on the Board. At the conclusion of Mr. Ajdler’s interview, Mr. von Emster indicated

that the Company was considering changes to its Board composition and asked whether Engine Capital would consider the appointment

of only one Board member. Mr. Ajdler stated that one Board member would be insufficient given the size of the existing Board. Mr.

von Emster responded that he would report back to the NCG Committee regarding the interviews.

|

|

|

·

|

On January 23, 2020, each of Drs. Carl Goldfischer and Evan Stein resigned from the Board.

|

|

|

·

|

On January 24, 2020, each of Dr. Robert Booth and Robert Weiland resigned from the Board.

|

|

|

·

|

On January 29, 2020, the Company published a letter to its stockholders disclosing (1) a reduction

in the size of the Board from nine to five members, and a reduction of the Company’s workforce by approximately 60%; (2)

the Company’s plan to have an independent, expert review of the NASH biopsies and an analysis of additional biomarkers to

better understand the unexpected histologic findings in the Seladelpar Phase 2b NASH study; and (3) that the Company would undertake

a review of strategic alternatives to consider ways to maximize stockholder value and that such review would consider, among other

options, a liquidation, sale, merger, asset acquisition and/or continuation of the development of the Company’s internal

programs.

|

|

|

·

|

Also, on January 29, 2020, following the release of the Company’s stockholder letter, Messrs.

Ajdler and von Emster had a phone conversation during which Mr. von Emster conveyed to Mr. Ajdler that the Board was not willing

to appoint Messrs. Ajdler and Kidron to the Board. Mr. Ajdler asked whether the Board would consider adding one member. Mr. von

Emster replied that the Board had not considered that option since Mr. Ajdler stated in an earlier call that one Board member would

be insufficient. Mr. Ajdler explained that, given the reduced size of the Board, Mr. Ajdler would be willing to consider one Board

seat to avoid an unnecessary fight. Mr. von Emster told Mr. Ajdler that the Board would consider his request.

|

|

|

·

|

On February 5, 2020, Messrs. Ajdler and Shah had a phone conversation discussing the Company’s

cash burn rate, as disclosed in the Company’s January 29, 2020 letter to stockholders.

|

|

|

·

|

On February 7, 2020, Messrs. Ajdler and von Emster had a phone conversation in which Mr. von Emster

communicated the Board’s decision not to appoint Mr. Ajdler or Mr. Kidron to the Board. Mr. Ajdler expressed his disappointment

that the Board was unwilling to offer Board representation to its largest stockholder and that it would waste stockholders’

money on a potential proxy contest instead.

|

|

|

·

|

On February 14, 2020, Engine Capital sent a letter to the Board in response to the Company’s

elevated cash burn. Engine Capital requested that the Company find a path forward for the suspended development of Seladelpar and,

if it did not, the Company should liquidate to return cash to stockholders. Additionally, given the Company’s minimal insider

ownership, Engine Capital requested that if the Company were to pursue an acquisition, any material transaction should be subject

to shareholder approval, whether legally required or not, and that if the Board were to pursue a transaction, instead of liquidation,

it should be because the Board is excited about the future prospects following the transaction.

|

|

|

·

|

Also on February 14, 2020, Engine Capital filed Amendment No. 1 to its Schedule 13D with the SEC,

disclosing beneficial ownership of 6,687,253 shares, representing approximately 9.7% of the Company’s then outstanding Common

Stock, making Engine Capital the Company’s largest stockholder, and disclosing the delivery of its February 14, 2020 letter

to the Board.

|

|

|

·

|

On February 21, 2020, Messrs. Ajdler and von Emster had a phone conversation regarding the Company’s

ongoing operations.

|

|

|

·

|

On March 12, 2020, Messrs. Ajdler and von Emster had another phone conversation regarding the Company’s

ongoing operations.

|

|

|

·

|

On March 13, 2020, Engine Capital delivered a letter (the “Nomination Letter”) to the

Company, in accordance with its organizational documents, nominating Messrs. Ajdler and Kidron and Robert Frankfurt for election

to the Board at Annual Meeting.

|

|

|

·

|

Also, on March 13, 2020, Engine Capital filed Amendment No. 2 to its Schedule 13D with the SEC

disclosing its delivery of the Nomination Letter to the Company and beneficial ownership of 6,443,977 shares, representing approximately

9.4% of the Company’s then outstanding Common Stock. Later that day, the Company issued a press release acknowledging receipt

of Engine Capital’s Nomination Letter.

|

|

|

·

|

On March 18, 2020, Engine Capital received an email from Mr. von Emster in which he requested each

of the Nominees complete the Company’s standard D&O questionnaire and schedule an interview with the NCG Committee.

|

|

|

·

|

On March 21, 2020, Mr. Ajdler received an email from Mr. Shah asking Mr. Ajdler if he would like

to speak following the Company’s 2019 year-end financial results and business update that occurred on March 12, 2020.

|

|

|

·

|

On March 23, 2020, Mr. Ajdler replied to Mr. Shah’s email to ask if they could speak the

following day. Mr. Shah replied to this email offering times to speak.

|

|

|

·

|

On March 25, 2020, Mr. von Emster emailed Mr. Ajdler asking for a response to his email of March

18, 2020.

|

|

|

·

|

Also, on March 25, 2020, Mr. Shah followed up on his March 21, 2020 email to ask Mr. Ajdler if

he still wanted to speak. Messrs. Ajdler and Shah subsequently scheduled a call for March 27, 2020.

|

|

|

·

|

On March 27, 2020, Mr. Ajdler informed Mr. Shah that he was unable to speak that day and asked

to reschedule their call. Mr. Shah proposed several alternative times.

|

|

|

·

|

On April 9, 2020, Mr. von Emster sent an email to Mr. Ajdler regarding the NCG Committee’s

request to interview Mr. Frankfurt, whose candidacy was not previously reviewed by the Board. Messrs. Ajdler and von Emster scheduled

a phone conversation for April 13, 2020.

|

|

|

·

|

On April 13, 2020, Messrs. Ajdler and von Emster had a phone conversation regarding the Company’s

ongoing operations. Mr. von Emster also followed up about the requested interviews with the Nominees. Mr. Ajdler replied that he

and Mr. Kidron had already been interviewed and that the Board was unwilling to appoint either of them. Mr. Ajdler stated that

it did not make sense to repeat such interviews or for Mr. Frankfurt to be interviewed since it was clear the Board was not interested

in providing Engine Capital with Board representation. Nevertheless, Mr. Ajdler explained that if the Board and Engine Capital

could agree on a framework for Board representation, then Engine Capital would have no problem submitting the Nominees for interviews.

Mr. Ajdler presented a potential framework whereby the Board would increase its size by two and appoint two of the Nominees. Mr.

von Emster stated he would report the conversation back to members of the Board.

|

|

|

·

|

On April 17, 2020, Mr. Ajdler sent an email to Mr. von Emster requesting a response to his April

13, 2020 framework.

|

|

|

·

|

On April 20, 2020, Mr. Ajdler followed up on his April 17, 2020 email to Mr. von Emster.

|

|

|

·

|

On April 21, 2020, Mr. von Emster replied to Mr. Ajdler’s email, stating that the Board had

discussed his potential framework and that it was not interested in moving forward with it. Mr. Ajdler responded by expressing

his disappointment that the Company would rather move forward with a proxy contest than come to a resolution with its largest stockholder.

|

|

|

·

|

Also on April 21, 2020, the Company filed its preliminary proxy statement with the SEC.

|

|

|

·

|

On April 24, 2020, Engine Capital filed its preliminary proxy statement with the SEC.

|

REASONS FOR THE

SOLICITATION

WE BELIEVE THAT

SIGNIFICANT IMPROVEMENT TO CYMABAY’S BOARD IS NEEDED NOW

Engine Capital is

the largest stockholder of CymaBay. We believe CymaBay is significantly undervalued and that a reconstituted Board is required

in order to unlock value for the benefit of all stockholders. Over the last three years, the Company’s Board and management

team have raised $356 million at prices between $6.50 and $12.50 per share to pursue the development of Seladelpar, resulting in

significant destruction of value when the development of Seladelpar was suspended. These same shares are not even worth $60 million

as of CymaBay’s closing price of $1.60 per share on April 23, 2020. Considering the immense value destruction that has occurred

under their watch, we do not have confidence in the incumbent directors to continue to lead the Company forward or to properly

oversee a strategic review process. We attempted to address our concerns amicably with the Board and sought for months to have

a direct stockholder representative in the boardroom, which we believe would be in the best interests of stockholders, only to

have our overtures rebuffed without the Board ever making a counterproposal. We question the Board’s motivation, if other

than entrenchment, for refusing to ever make a counteroffer of what would be an acceptable resolution in the Board’s view

to avoid a costly and time consuming proxy contest.

Among our primary

areas of concern which led us to nominate a competing slate of director candidates include the Company’s prolonged stock

price underperformance, the discount at which the stock trades compared to the Company’s cash per share, the elevated cash

burn of the Company and a perceived lack of alignment between insiders and stockholders, particularly as it relates to the strategic

review process. Specifically, we are concerned that the Board and management team, whose ownership is mostly represented by underwater

options, may be incentivized to pursue a risky merger or acquisition in the hope of hitting a home run instead of pursuing a better

risk-adjusted path, such as liquidating the Company and returning the cash to stockholders.

We have little confidence

that the current Board is committed to, or capable of, taking the steps necessary to maximize stockholder value at CymaBay. Therefore,

we are soliciting your support to elect our Nominees at the Annual Meeting, who we believe would bring significant and relevant

industry and financial experience, new insight and fresh perspectives to the Board.

We Are Concerned

with the Company’s Prolonged Stock Price Underperformance

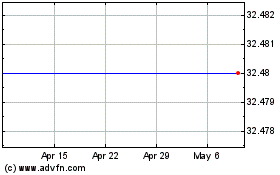

We believe that

the incumbent directors should be held accountable for the Company’s dismal stock price performance over nearly every relevant

measurable time period. The Company’s Total Stockholder Returns have been negative over each of the last 1-,

3- and 5-year periods, and have drastically underperformed relative to the Nasdaq Biotechnology and Russell 2000 Indices, as displayed

in the table below.

Source:

CapitalIQ, calculated as of closing price on April 23, 2020.

We are Concerned

by the Perceived Lack of Alignment between Insiders and Stockholders, Which we Believe may Jeopardize the Incumbents’ Ability

to Objectively Assess Strategic Alternatives

We are concerned

that the overwhelming majority of shares beneficially owned by the Board and management team consist of deep out-of-the-money options

rather than shares of Common Stock. For example, CEO Sujal Shah owns 120,000 shares of Common Stock, but more than 1.5 million

stock options that he has been awarded (many of which have an exercise price well above $2 per share, which is approximately the

liquidation value of the Company on a per share basis). Similarly, Chairman of the Board Robert J. Wills owns 30,000 shares of

Common Stock, but more than 145,000 stock options that he has been awarded.

We are concerned

that, given the vast majority of the incumbents’ ownership is represented by underwater options, they may have difficulty

objectively evaluating strategic alternatives in the best interests of stockholders. For instance, while a liquidation may be the

best risk adjusted path forward for stockholders, it would not be beneficial for those without a meaningful vested financial interest

in the Company’s shares of Common Stock (i.e. underwater options would be worthless). We question whether this could cause

the incumbents to pursue a more risky and speculative merger or acquisition since they have little to lose but potential to gain

in such a scenario.

This dynamic is

one of the primary reasons why we believe it is necessary to have a direct stockholder representative in the boardroom. Collectively,

our Nominees own 6,498,629 shares of Common Stock, representing approximately 9.4% of the outstanding shares of Common Stock (although

Messrs. Frankfurt and Kidron do not currently own shares of Common Stock, if elected, they intend to directly invest in the stock

of the Company by purchasing shares in the open market as long as market conditions permit). We believe the stockholders, as the

true owners of the Company, need to have a strong voice at the Board level. Such a voice promotes greater accountability

and creates an environment that forces other directors to consider new ways to positively impact stockholder value.

We Are Concerned

with the Company’s Elevated Cash Burn

While we commend

the Board and management for moving aggressively to reduce CymaBay’s workforce by 60% following the decision to suspend the

development of Seladelpar, we believe that more has to be done to further reduce costs and conserve the Company’s primary

asset - its cash. We are concerned by the elevated cash burn of the Company. In its update letter from January 29, 2020, CymaBay

implied $10 to $15 million of cash burn for general corporate purposes for the first 6 months of the year. This is simply too high.

Based on similar exercises done at other pharma companies (in similar situations), we believe the appropriate semi-annual cash

burn for a company with just over 20 employees should be between $5 and $7.5 million. Stockholders have suffered immensely with

CymaBay’s stock down over 87% over the past year. At this point, everything should be on the table to reduce the cash burn,

including senior management and Board members taking deep compensation cuts. We note that Board members each continue to receive

around $200,000 annually in director compensation despite overseeing significant value destruction. We are also troubled by the

fact that Mr. Shah received over $2.5 million in compensation for fiscal 2019 (up from more than $1.9 million in compensation for

fiscal 2018) given the Company’s poor performance. In light of the significant destruction of value, we are surprised and

disappointed that neither management nor the Board have reduced their compensation.

OUR THREE NOMINEES

HAVE THE EXPERIENCE, QUALIFICATIONS AND COMMITMENT NECESSARY TO FULLY EXPLORE AVAILABLE OPPORTUNITIES TO UNLOCK VALUE FOR STOCKHOLDERS

We have identified

three highly-qualified, independent directors with relevant business and financial experience who we believe will bring fresh perspective

into the boardroom and would be valuable in assessing and executing on initiatives to unlock value at the Company. We believe CymaBay’s

continued underperformance at this critical time for the future of the Company warrants the addition of directors whose interests

are closely aligned with those of all stockholders, and who will work constructively with the other members of the Board to protect

the best interests of CymaBay’s stockholders.

If elected, our

Nominees – Arnaud Ajdler, Robert Frankfurt and Nadav Kidron – will work hard to establish a culture of accountability

and will fully and fairly evaluate all opportunities to maximize stockholder value, including, but not limited to:

|

|

·

|

Conducting a full review of the Company’s operations to determine viability and the best

risk adjusted path forward;

|

|

|

·

|

Working with a financial advisor to explore strategic alternatives available to the Company, including

a potential liquidation; and

|

|

|

·

|

Reducing corporate expenses.

|

If elected, our

Nominees will bring direct stockholder representation and an owner’s mindset to the Board. Our interests are closely aligned

with those of all stockholders and we will relentlessly seek to restore the value of our Company for its stockholders.

PROPOSAL ONE

ELECTION OF DIRECTORS

The Board is currently

composed of five (5) directors, each with terms expiring at the Annual Meeting. We are seeking your support at the Annual Meeting

to elect our three (3) Nominees in opposition to the Company’s director nominees. If all three (3) of the Nominees are elected,

such Nominees will represent a majority of the members of the Board. In the event that our director Nominees comprise less than

a majority of the Board following the Annual Meeting, there can be no assurance that any actions or changes proposed by our Nominees

will be adopted or supported by the full Board.

THE NOMINEES

The following information

sets forth the name, age, business address, present principal occupation, and employment and material occupations, positions, offices,

or employments for the past five (5) years of each of the Nominees. The nomination was made in a timely manner and in compliance

with the applicable provisions of the Company’s governing instruments. The specific experience, qualifications, attributes

and skills that led us to conclude that the Nominees should serve as directors of the Company is set forth above in the section

entitled “Reasons For The Solicitation” and below. This information has been furnished to us by the Nominees. Mr. Ajdler

is a citizen of Belgium. Mr. Frankfurt is a citizen of the United States of America. Mr. Kidron is a citizen of Israel.

Arnaud Ajdler, age

44, has served as the Managing Partner of Engine Capital Management, LP, a value-oriented investment firm, since 2013. Previously,

Mr. Ajdler served as a Managing Director of Crescendo Partners L.P., a principal investment firm, from 2005 to 2013. From 2004

until 2006, Mr. Ajdler also served as the Chief Financial Officer, a director and the Secretary of Arpeggio Acquisition Corporation,

a specified purpose acquisition company, which completed a business combination with Hill International, Inc. (NYSE: HIL) (“Hill”),

a worldwide construction consulting firm, in 2006, and until 2009, Mr. Ajdler served as a director of Hill. Mr. Ajdler re-joined

the board of directors of Hill in October 2018 and also has served as a director of Recro Pharma, Inc. (NASDAQ: REPH), a leading

contract development and manufacturing organization, since March 2019. Mr. Ajdler is also an Adjunct Professor at Columbia University

Business School where he teaches a course in Value Investing. Previously, Mr. Ajdler served as a director of each of Stewart Information

Services Corporation (NYSE: STC), a provider of title insurance and real estate services worldwide, from May 2014 to December 2019,

StarTek, Inc. (Nasdaq: SRT), a provider of business process outsourcing services, from May 2015 to March 2018, Destination Maternity

Corporation (NASDAQ: DEST), the world's largest designer and retailer of maternity apparel, from March 2008 to October 2017 (including

as Non-Executive Chairman from February 2011 to October 2017), Imvescor Restaurant Group, Inc. (TSE: IRG), a Canadian franchisor

of restaurant concepts, from July 2013 to March 2016, Charming Shoppes, Inc., a specialty and plus size clothing retail company,

from 2008 until the company was acquired in 2012, O’Charley’s Inc., a multi-concept restaurant company, from March

2012 until the company was acquired in April 2012, and The Topps Company, Inc., a company that provides baseball, football, hockey,

entertainment and pop culture products, from 2006 until the company was acquired in 2007. Mr. Ajdler received a B.S. from Free

University of Brussels, a S.M. from Massachusetts Institute of Technology and an M.B.A from Harvard Business School.

We believe that Mr. Ajdler’s

investment experience across a broad range of industries, together with his significant public company board experience, will make

him a valuable asset to the Board.

Robert Frankfurt,

age 54, is the founder of Myca Partners, Inc., an investment advisory services firm, and has served as its President since November

2006, where, among other things, he has invested and helped build early stage lifestyle health and wellness businesses that prevent

and reverse chronic illness. From February 2005 through December 2005, he served as the Vice President of Sandell Asset Management

Corp., a privately owned hedge fund. From October 2002 through January 2005, Mr. Frankfurt was a private investor. Mr. Frankfurt

has served as a director of PFSweb, Inc. (NASDAQ:PFSW), a global eCommerce solutions provider, since March 2019. Mr. Frankfurt

previously served as a director of each of JetPay Corporation (formerly NASDAQ:JTPY), a vertically integrated solution provider,

from October 2017 until its sale in December 2018; Handy & Harman Ltd. (formerly NASDAQ: HNH), a diversified industrial manufacturer,

from November 2008 until its sale in October 2017; Jive Software, Inc. (formerly NASDAQ:JIVE), a leading provider of modern communication

and collaboration solutions for business, from March 2017 until its sale in June 2017; Peerless Systems Corp. (formerly NASDAQ:PRLS),

an imaging and networking technologies and components company, from November 2010 to June 2012; and Mercury Payment Systems, Inc.,

a private company that provides integrated transaction processing, from October 2010 until its sale in June 2014. Mr. Frankfurt

holds a B.S. in Economics from the Wharton School of Business at the University of Pennsylvania and an M.B.A. from the Anderson

Graduate School of Management at the University of California at Los Angeles. Mr. Frankfurt qualifies as an “audit committee

financial expert” satisfying the rules of the U.S. Securities and Exchange Commission.

We believe that

Mr. Frankfurt’s financial experience, expansive network and public company board experience will make him a valuable addition

to the Board.

Nadav Kidron, age

45, has served as the Chief Executive Officer, President and a director of Oramed Pharmaceuticals Inc. (“Oramed”) (NASDAQ:

ORMP), a pharmaceutical company, since he co-founded the company in 2006. From 2003 to 2006, Mr. Kidron served as the managing

director of the Institute of Advanced Jewish Studies at Bar-Ilan University. From 2001 to 2003, he was a legal intern at Wine,

Mishaiker & Ernstoff Law Offices in Jerusalem. Previously, Mr. Kidron served as a director of Entera Bio Ltd. (NASDAQ: ENTX),

a product-focused biotechnology company that he co-founded as a joint venture by Oramed and D.N.A Biomedical Solutions Ltd., from

2010 to March 2016. In 2009, Mr. Kidron was a fellow at the Merage Foundation for U.S.-Israel Trade Programs for executives in

the life sciences field. Since August 2015, Mr. Kidron has served as a Board Member of IATI (Israeli Advanced Technology Industries),

Israel’s umbrella organization of the high-tech, life science and other advanced technology industries. Mr. Kidron holds

an LL.B. and an International MBA from Bar-Ilan University in Israel. He is a member of the Israeli Bar Association.

We believe that Mr. Kidron’s

significant leadership experience in the pharmaceutical industry, together with his international business experience, will make

him a valuable addition to the Board.

The principal business

address of Mr. Ajdler is 1345 Avenue of the Americas, 33rd Floor, New York, New York 10105. The principal business address

of Mr. Frankfurt is 450 East 20th Street, Apt 8A, New York, New York 10009. The principal business address of Mr. Kidron is 1185

Avenue of the Americas, 3rd Floor, New York, New York 10036.

As of the date hereof,

Mr. Ajdler does not directly own any of the securities of the Company and has not directly entered into any transactions in securities

of the Company during the past two years. Mr. Ajdler, as the managing partner of Engine Management, and the managing member of

each of Engine GP and Engine Investments, may be deemed to beneficially own the 6,498,629 shares owned in the aggregate by Engine

and Engine Jet.

As of the date hereof,

Messrs. Frankfurt and Kidron do not own beneficially any securities of the Company and have not entered into any transactions in

securities of the Company during the past two years.

Each of the Nominees

may be deemed to be a member of a “group” for the purposes of Section 13(d)(3) of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”). Each of the Nominees specifically disclaims beneficial ownership of shares of Common

Stock that he does not directly own. For information regarding purchases and sales during the past two (2) years by the members

of the group of securities of the Company, see Schedule I.

On March 13, 2020,

Engine Capital and the Nominees (collectively, the “Group”) entered into a Joint Filing and Solicitation Agreement,

pursuant to which, among other things, the parties agreed to (a) the joint filing on behalf of each of them of statements on Schedule

13D, and any amendments thereto, with respect to the securities of the Company and (b) solicit proxies for the election of the

Nominees at the Annual Meeting.

Other than as stated

herein, there are no arrangements or understandings between the members of the Group or any other person or persons pursuant to

which the nomination of the Nominees described herein is to be made, other than the consent by the Nominees to be named in this

Proxy Statement and to serve as a director of the Company if elected as such at the Annual Meeting. Other than as stated herein,

none of the Nominees is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company

or any of its subsidiaries in any material pending legal proceeding.

We believe that

each Nominee presently is, and if elected as a director of the Company, each of the Nominees would qualify as, an “independent

director” within the meaning of (i) applicable NASDAQ listing standards applicable to board composition, including Rule 5605(a)(2),

and (ii) Section 301 of the Sarbanes-Oxley Act of 2002. Notwithstanding the foregoing, no director of a NASDAQ listed company qualifies

as “independent” under NASDAQ listing standards unless the board of directors affirmatively determines that such director

is independent under such standards. Accordingly, if the Nominees are elected, the determination of the Nominees’ independence

under the NASDAQ listing standards ultimately rests with the judgment and discretion of the Board. No Nominee is a member of the

Company’s compensation, nominating or audit committee that is not independent under any such committee’s applicable

independence standards.

If Engine Capital

is successful in electing all three of the Nominees at the Annual Meeting, then a change in control of the Board may be deemed

to have occurred under certain of the Company’s material contracts and agreements. Based on a review of the Company’s

material contracts and agreements, such a change in control may trigger certain change in control provisions or payments under

certain of the Company’s plans and agreements, including its 2003 Equity Incentive Plan (the “2003 Plan”), Amended

2013 Equity Incentive Plan (the “2013 Plan”), Form of Indemnity Agreement (the “Indemnity Agreement”),

and offer letters containing employment agreements with named executive officers (the “Employment Agreements”). However,

even if it should be determined that electing our three Nominees would result in a change in control under certain documents, we

do not believe any potential effects from such a change in control would outweigh the benefits of an improved Board. For example,

under the 2003 Plan and the 2013 Plan, a change in control would provide the Company with flexibility to accelerate the vesting

and exercisability of certain awards granted thereunder. Under the Indemnity Agreement, the Company indemnifies its directors and

executive officers, and in the event of a change in control, to determine the right to an indemnification payment, such request

is determined by independent counsel selected by the indemnitee and approved by the Company. Under the Employment Agreements, a

change in control accelerates the vesting of stock options such that 50% of outstanding and unvested options will become fully

vested. Further, if a named executive officer is terminated without cause, or such officer resigns within 12 months following a

change in control for good reason, such officer is entitled to receive: (i) cash severance up or 12 months of such officer’s

base salary, (ii) eligibility to receive 125% of the officer’s annual discretionary bonus amount at the officer’s target

incentive, (iii) accelerated vesting of then outstanding and then-unvested equity awards at the date of termination and (iv) continued

health insurance up to 15 months following such separation. Notably, as the Company has disclosed, the Employment Agreements have

double-trigger provisions, meaning that a change in control in and of itself does not trigger such severance benefits, but rather

there would also need to be a termination of the affected employee before any severance benefits are triggered.

We do not expect

that the Nominees will be unable to stand for election, but, in the event any Nominee is unable to serve or for good cause will

not serve, the shares of Common Stock represented by the enclosed BLUE proxy card will be voted for substitute nominee(s),

to the extent this is not prohibited under the Bylaws and applicable law. In addition, we reserve the right to nominate substitute

person(s) if the Company makes or announces any changes to the Bylaws or takes or announces any other action that has, or if consummated

would have, the effect of disqualifying any Nominee, to the extent this is not prohibited under the Bylaws and applicable law.

In any such case, we would identify and properly nominate such substitute nominee(s) in accordance with the Bylaws and shares of

Common Stock represented by the enclosed BLUE proxy card will be voted for such substitute nominee(s). We reserve the right

to nominate additional person(s), to the extent this is not prohibited under the Bylaws and applicable law, if the Company increases

the size of the Board above its existing size or increases the number of directors whose terms expire at the Annual Meeting.

WE URGE YOU TO VOTE “FOR”

THE ELECTION OF THE NOMINEES ON THE ENCLOSED BLUE PROXY CARD.

PROPOSAL TWO

RATIFICATION

OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

As discussed in

further detail in the Company’s proxy statement, the Audit Committee of the Board has selected Ernst & Young LLP as the

Company’s independent registered public accounting firm for the fiscal year ending December 31, 2020, and the Audit Committee

and the Board are requesting that stockholders ratify such selection.

As disclosed in

the Company’s proxy statement, stockholder approval of the selection of Ernst & Young LLP is not required by law or SEC

rules and the Audit Committee is not required to take any action as a result of the outcome of the vote on this proposal. However,

the Company has disclosed that if stockholders do not ratify the appointment, the Audit Committee may investigate the reasons for

stockholder rejection and may consider whether to retain Ernst & Young LLP or to appoint another independent registered public

accounting firm. The Company further disclosed that even if the appointment is ratified, the Audit Committee in its discretion

may direct the appointment of a different independent registered public accounting firm at any time during the year if it determines

that such a change would be in the best interests of stockholders or the Company.

WE MAKE NO RECOMMENDATION

WITH RESPECT TO THIS PROPOSAL AND INTEND TO VOTE OUR SHARES “FOR” THIS PROPOSAL.

PROPOSAL THREE

ADVISORY VOTE ON THE COMPENSATION

OF THE COMPANY’S NAMED EXECUTIVE OFFICERS

As discussed in further

detail in the Company’s proxy statement, the Company is providing stockholders with the opportunity to vote to approve, on

an advisory, non-binding basis, the compensation of the Company’s named executive officers as disclosed in the Company’s

proxy statement in accordance with the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 and Section 14A of the

Exchange Act. This proposal, which is commonly referred to as “say-on-pay,” is not intended to address any specific

item of compensation, but rather the overall compensation of the Company’s named executive officers and the philosophy, policies

and practices described in the Company’s proxy statement. Accordingly, the Company is asking stockholders to vote for the

following resolution:

“RESOLVED,

that the stockholders of CymaBay Therapeutics, Inc. approve, on an advisory basis, the compensation of the company’s named

executive officers disclosed in the Summary Compensation Table and the related compensation tables, notes and narratives in the

proxy statement for the company’s 2020 Annual Meeting of Stockholders.”

According to the

Company’s proxy statement, as an advisory vote, this proposal is not binding on the Board and will not directly affect or

otherwise limit any existing compensation or award arrangement of any of the Company’s named executive officers. However,

the Company has further disclosed that the Board will take into account the outcome of the vote on the say-on-pay proposal when

considering future compensation arrangements.

WE MAKE NO RECOMMENDATION WITH RESPECT TO

THIS PROPOSAL AND INTEND TO VOTE OUR SHARES “[FOR/AGAINST]” THIS PROPOSAL.

PROPOSAL FOUR

AMENDMENT TO THE COMPANY’S AMENDED

AND RESTATED CERTIFICATE OF INCORPORATION TO INCREASE AUTHORIZED SHARES OF THE COMPANY’S COMMON STOCK

As discussed in

further detail in the Company’s proxy statement, the Board has adopted an amendment to the Company’s Amended and Restated

Certificate of Incorporation to increase the number of shares of capital stock the Company is authorized to issue from 110,000,000

shares (100,000,000 shares of Common Stock and 10,000,000 shares of preferred stock), par value $0.0001, to 210,000,000 shares

(200,000,000 shares of Common Stock and 10,000,000 shares of preferred stock), par value $0.0001. On February 29, 2020, 68,882,459

shares of the Company’s Common Stock were outstanding, zero shares of the Company’s preferred stock were outstanding

and 9,143,863 shares were reserved for issuance upon conversion of the Company’s employee equity plans and outstanding equity

awards. Accordingly, as of February 29, 2020, there were approximately 21,973,678 shares of Common Stock available for general

corporate purposes. Upon the approval of this Proposal 4, there would be approximately 121,973,678 authorized and unreserved shares

of the Company’s Common Stock available for issuance.

As stated in the

Company’s proxy statement, the Board has reserved the right, notwithstanding stockholder approval and without further action

by stockholders, to elect not to proceed with the increase in the authorized shares of Common Stock if the Board determines that

such increase is no longer in the best interests of the Company and its stockholders.

If approved, the

amendment would amend and restate paragraph A of Article IV of the Amended and Restated Certificate of Incorporation as follows:

“A. This

Corporation is authorized to issue two classes of stock to be designated, respectively, “Common Stock”

and “Preferred Stock.” The total number of shares that the Corporation is authorized to issue is 210,000,000

shares. 200,000,000 shares shall be Common Stock, each having a par value of $0.0001. 10,000,000 shares shall be Preferred Stock,

each having a par value of $0.0001.”

For the reasons

set forth in the “Reasons For The Solicitation” section and explained below, we oppose the proposed increase in the

number of shares of Common Stock from 100,000,000 shares to 200,000,000 shares. In our view, authorizing an increase in the number

of shares would provide the Board with more flexibility to issue shares in connection with equity financings or to pursue business

combinations or acquisitions that we do not believe would be in the best interests of stockholders. We do not believe that the

Board, as currently constructed, has proven itself to be an effective steward of capital, and we are concerned that providing the

Board with additional capital flexibility could result in further value destruction.

WE RECOMMEND A VOTE “AGAINST”

THE PROPOSAL TO INCREASE THE AUTHORIZED NUMBER OF SHARES OF THE COMPANY’S COMMON STOCK AND INTEND TO VOTE OUR SHARES “AGAINST”

THIS PROPOSAL.

VOTING AND PROXY PROCEDURES

Only stockholders

of record on the Record Date will be entitled to notice of and to vote at the Annual Meeting. Stockholders who sell shares of Common

Stock before the Record Date (or acquire them without voting rights after the Record Date) may not vote such shares of Common Stock.

Stockholders of record on the Record Date will retain their voting rights in connection with the Annual Meeting even if they sell

such shares of Common Stock after the Record Date. Based on publicly available information, we believe that the only outstanding

class of securities of the Company entitled to vote at the Annual Meeting is the shares of Common Stock.

Shares of Common

Stock represented by properly executed BLUE proxy cards will be voted at the Annual Meeting as marked and, in the absence

of specific instructions, will be voted FOR the election of the Nominees to the Board, “FOR” the ratification

of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year

ending December 31, 2020, “[FOR/AGAINST]” the non-binding advisory vote on executive compensation and “AGAINST”

the Company’s amendment of its Amended and Restated Certificate of Incorporation to increase the number of authorized shares

of Common Stock.

According to the

Company’s proxy statement for the Annual Meeting, the current Board intends to nominate five (5) candidates for election

as directors at the Annual Meeting. This Proxy Statement is soliciting proxies to elect only our Nominees. Accordingly, the enclosed

BLUE proxy card may only be voted for the Nominees and does not confer voting power with respect to the Company’s

nominees. Stockholders should refer to the Company’s proxy statement for the names, backgrounds, qualifications and other

information concerning the Company’s nominees. In the event that some of the Nominees are elected, there can be no assurance

that the Company nominee(s) who get the most votes and are elected to the Board will choose to serve on the Board with the Nominees

who are elected.

While we currently

intend to vote all of our shares of Common Stock in favor of the election of the Nominees, we reserve the right to vote some or

all of our shares of Common Stock for some or all of the Company’s director nominees, as we see fit, in order to achieve

a Board composition that we believe is in the best interest of all stockholders. We would only intend to vote some or all of our

shares of Common Stock for some or all of the Company’s director nominees in the event it were to become apparent to us,

based on the projected voting results at such time, that by voting our shares we could help elect the Company nominees that we

believe are the most qualified to serve as directors and thus help achieve a Board composition that we believe is in the best interest

of all stockholders. Stockholders should understand, however, that all shares of Common Stock represented by the enclosed BLUE

proxy card will be voted at the Annual Meeting as marked.

Quorum; Broker Non-Votes; Discretionary Voting

A quorum is the

minimum number of shares of Common Stock that must be represented at a duly called meeting in person or by proxy in order to legally

conduct business at the meeting. The holders of a majority of the shares of the Company’s Common Stock issued and outstanding

and entitled to vote at the Annual Meeting will constitute a quorum for the transaction of business at the Annual Meeting.

Abstentions are

counted as present and entitled to vote for purposes of determining a quorum. Shares represented by “broker non-votes”

also are counted as present and entitled to vote for purposes of determining a quorum. However, if you hold your shares in street

name and do not provide voting instructions to your broker, your shares will not be voted on any proposal on which your broker

does not have discretionary authority to vote (a “broker non-vote”). Under applicable rules, your broker will not have

discretionary authority to vote your shares at the Annual Meeting on any of the proposals.

If you are a stockholder

of record, you must deliver your vote pursuant to valid voting instructions or attend the Annual Meeting in person and vote in

order to be counted in the determination of a quorum.

If you are a beneficial

owner, your broker will vote your shares pursuant to your instructions, and those shares will count in the determination of a quorum.

Brokers do not have discretionary authority to vote on any of the proposals at the Annual Meeting. Accordingly, unless you vote

via proxy card or provide instructions to your broker, your shares of Common Stock will count for purposes of attaining a quorum,

but will not be voted on those proposals.

Votes Required for Approval

Proposal 1: Election

of Directors ─ The Company has adopted a plurality vote standard for non-contested and contested director elections.

As a result of our nomination of the Nominees, the director election at the Annual Meeting will be contested, so the five (5) nominees

for director receiving the highest vote totals will be elected as directors of the Company. With respect to the election of directors,

only votes cast “FOR” a nominee will be counted. Proxy cards specifying that votes should be withheld with respect

to one or more nominees will result in those nominees receiving fewer votes but will not count as a vote against the nominees.

Neither an abstention nor a broker non-vote will count as a vote cast “FOR” or “AGAINST” a director nominee.

Therefore, abstentions and broker non-votes will have no direct effect on the outcome of the election of directors.

Proposal 2: Ratification

of Independent Registered Public Accounting Firm ─ According to the Company’s proxy statement, the affirmative

vote of the holders of a majority of shares present in person or represented by proxy at the Annual Meeting and entitled to vote

on the matter is required for the ratification of the selection of Ernst & Young LLP as the Company’s independent registered

public accounting firm for the fiscal year ending December 31, 2020. Abstentions will be counted towards the vote and will have

the same effect as “AGAINST” votes. Broker non-votes will have no effect and will not be counted towards the vote total.

Proposal 3: Advisory

Vote on Executive Compensation ─ According to the Company’s proxy statement, the affirmative vote of the holders

of a majority of shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the matter is required

to approve the advisory “say-on-pay” vote on the compensation of the Company’s named executive officers. The

Company has indicated that abstentions will be counted towards the vote and will have the same effect as “AGAINST”

votes. Broker non-votes will have no effect and will not be counted towards the vote total.

Proposal 4: Vote

on An Amendment to the Company’s Amended and Restated Certification of Incorporation to Increase Authorized Shares of Common

Stock ─ According to the Company’s proxy statement, the affirmative vote of the holders of a majority of the outstanding

shares of Common Stock entitled to vote at the Annual Meeting is required to approve the proposed amendment to the Company’s

Amended and Restated Certification of Incorporation. Abstentions and broker non votes and other shares not voted will be counted

as votes “AGAINST” the proposal.

If you sign and

submit your BLUE proxy card without specifying how you would like your shares voted, your shares will be voted in accordance

with Engine Capital’s recommendations specified herein and in accordance with the discretion of the persons named on the BLUE proxy

card with respect to any other matters that may be voted upon at the Annual Meeting.

Appraisal Rights

Under applicable

Delaware law, none of the holders of Common Stock are entitled to appraisal rights in connection with any matter to be acted on

at the Annual Meeting.

Revocation of Proxies

Stockholders of

the Company may revoke their proxies at any time prior to exercise by attending the Annual Meeting and voting in person (although

attendance at the Annual Meeting will not in and of itself constitute revocation of a proxy) or by delivering a written notice

of revocation. The delivery of a subsequently dated proxy which is properly completed will constitute a revocation of any earlier

proxy. The revocation may be delivered either to Engine Capital in care of Saratoga at the address set forth on the back cover

of this Proxy Statement or to the Company at 7575 Gateway Boulevard, Suite 110, Newark, California 94560, or any other address

provided by the Company. Although a revocation is effective if delivered to the Company, Engine Capital requests that either the

original or photostatic copies of all revocations be mailed to Engine Capital in care of Saratoga at the address set forth on the

back cover of this Proxy Statement so that we will be aware of all revocations and can more accurately determine if and when proxies

have been received from the holders of record on the Record Date of a majority of the outstanding shares of Common Stock. Additionally,

Saratoga may use this information to contact stockholders who have revoked their proxies in order to solicit later dated proxies

for the election of the Nominees.

IF YOU WISH TO VOTE FOR THE ELECTION

OF THE NOMINEES TO THE BOARD, PLEASE SIGN, DATE AND RETURN PROMPTLY THE ENCLOSED BLUE PROXY CARD IN THE POSTAGE-PAID ENVELOPE PROVIDED.

SOLICITATION OF PROXIES

The solicitation

of proxies pursuant to this Proxy Statement is being made by Engine Capital. Proxies may be solicited by mail, facsimile, telephone,

telegraph, Internet, in person and by advertisements.

Engine Capital has

entered into an agreement with Saratoga for solicitation and advisory services in connection with this solicitation, for which

Saratoga will receive a fee not to exceed $[____], together with reimbursement for its reasonable out-of-pocket expenses, and will

be indemnified against certain liabilities and expenses, including certain liabilities under the federal securities laws. Saratoga

will solicit proxies from individuals, brokers, banks, bank nominees and other institutional holders. Engine Capital has requested

banks, brokerage houses and other custodians, nominees and fiduciaries to forward all solicitation materials to the beneficial

owners of the shares of Common Stock they hold of record. Engine Capital will reimburse these record holders for their reasonable

out-of-pocket expenses in so doing. It is anticipated that Saratoga will employ approximately [__] persons to solicit the Company’s

stockholders for the Annual Meeting.

The entire expense

of soliciting proxies is being borne by Engine Capital. Costs of this solicitation of proxies are currently estimated to be approximately

$[___]. Engine Capital estimates that through the date hereof, its expenses in connection with this solicitation are approximately

$[___]. Engine Capital intends to seek reimbursement from the Company of all expenses it incurs in connection with the solicitation

of proxies for the election of the Nominees to the Board at the Annual Meeting. If such reimbursement is approved by the Board,

Engine Capital does not intend to submit the question of such reimbursement to a vote of security holders of the Company.

ADDITIONAL PARTICIPANT INFORMATION

The participants

in this solicitation are the members of Engine Capital and the Nominees.

The principal business

of each of Engine and Engine Jet is investing in securities. Engine Management is the investment manager of each of Engine and

Engine Jet. Engine GP serves as the general partner of Engine Management. Engine Investments serves as the general partner of each

of Engine and Engine Jet. Mr. Ajdler serves as the Managing Partner of Engine Management and the Managing Member of each of Engine

GP and Engine Investments.

The address of the

principal office of each of Engine, Engine Jet, Engine Management, Engine GP, Engine Investments and Mr. Ajdler is 1345 Avenue

of the Americas, 33rd Floor, New York, New York 10105.

As

of the date hereof, Engine directly owned 5,354,366 shares. As of the date hereof, Engine Jet directly owned 1,144,263 shares.

As of the date hereof, Engine Management, as the investment manager of each of Engine and Engine Jet, may be deemed the beneficial

owner of the 6,498,629 shares of Common Stock owned directly by Engine and Engine Jet. Engine GP, as the general partner of Engine

Management, may be deemed the beneficial owner of the 6,498,629 shares of Common Stock owned directly by Engine and Engine Jet.

Engine Investments, as the general partner of each of Engine and Engine Jet, may be deemed the beneficial owner of the 6,498,629

shares of Common Stock owned directly by Engine and Engine Jet. Mr. Ajdler, as the Managing Partner of Engine Management, and the

Managing Member of each of Engine GP and Engine Investments, may be deemed the beneficial owner of the 6,498,629 shares of Common

Stock owned directly by Engine and Engine Jet.

Each participant

in this solicitation is a member of a “group” with the other participants for the purposes of Section 13(d)(3) of the

Exchange Act. The Group may be deemed to beneficially own the 6,498,629 shares of Common Stock owned in the aggregate by all of

the participants in this solicitation. Each participant in this solicitation disclaims beneficial ownership of the shares of Common

Stock he or it does not directly own. For information regarding purchases and sales of securities of the Company during the past

two (2) years by the participants in this solicitation, see Schedule I.

The shares of Common

Stock directly owned by Engine and Engine Jet were purchased with working capital.

Except as set forth

in this Proxy Statement (including the Schedules hereto), (i) during the past ten (10) years, no participant in this solicitation

has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors); (ii) no participant in this

solicitation directly or indirectly beneficially owns any securities of the Company; (iii) no participant in this solicitation

owns any securities of the Company which are owned of record but not beneficially; (iv) no participant in this solicitation has

purchased or sold any securities of the Company during the past two (2) years; (v) no part of the purchase price or market value

of the securities of the Company owned by any participant in this solicitation is represented by funds borrowed or otherwise obtained

for the purpose of acquiring or holding such securities; (vi) no participant in this solicitation is, or within the past year was,

a party to any contract, arrangements or understandings with any person with respect to any securities of the Company, including,

but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit,

division of losses or profits, or the giving or withholding of proxies; (vii) no associate of any participant in this solicitation

owns beneficially, directly or indirectly, any securities of the Company; (viii) no participant in this solicitation owns beneficially,

directly or indirectly, any securities of any parent or subsidiary of the Company; (ix) no participant in this solicitation or

any of his or its associates was a party to any transaction, or series of similar transactions, since the beginning of the Company’s

last fiscal year, or is a party to any currently proposed transaction, or series of similar transactions, to which the Company

or any of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000; (x) no participant in this solicitation

or any of his or its associates has any arrangement or understanding with any person with respect to any future employment by the

Company or its affiliates, or with respect to any future transactions to which the Company or any of its affiliates will or may

be a party; and (xi) no participant in this solicitation has a substantial interest, direct or indirect, by securities holdings

or otherwise in any matter to be acted on at the Annual Meeting.

There are no material

proceedings to which any participant in this solicitation or any of his or its associates is a party adverse to the Company or

any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries. With respect to each of the

Nominees, none of the events enumerated in Item 401(f)(1)-(8) of Regulation S-K of the Exchange Act occurred during the past ten

(10) years.

OTHER MATTERS

Engine Capital is