North American Rail Traffic Fell 3.3% in Week Ended Aug. 31

September 04 2019 - 2:00PM

Dow Jones News

By Colin Kellaher

North American rail traffic fell 3.3% last week, as weakness in

the U.S. manufacturing sector continues to weigh on volumes, data

from the Association of American Railroads showed.

Carload volume and intermodal traffic for the week ended Aug. 31

on 12 reporting U.S., Canadian and Mexican railroads each fell

3.3%, the trade group said Wednesday.

North American rail traffic was 4.8% lower in the week ended

Aug. 24. For the first 35 weeks of the year, North American volume

is down 2.5%.

The AAR said U.S. rail traffic fell 4.5% last week after sliding

5.9% a week earlier. U.S. carloads fell 4.2% amid declines in eight

of the 10 commodity groups tracked, while the volume of U.S.

intermodal containers and trailers fell 4.9% for the week.

For the month of August, U.S. rail traffic fell 5%, marking the

seventh straight month of declines for both carloads and intermodal

units. U.S. rail traffic is now down 3.6% for the year to date, the

AAR said.

"While the strength of the overall economy remains unclear, in

the last quarter it has become much more evident that the portion

of the economy which generates freight--manufacturing and goods

trading--has weakened significantly," John Gray, AAR senior vice

president, said of the U.S. data.

"We had a similar pattern in 2016, when rail traffic was weak

and the overall economy wobbled but didn't fall down," Mr. Gray

added. "Railroads are hopeful that the uncertainty plaguing

economies here and abroad will dissipate soon and solid economic

and industrial growth will return."

Union Pacific Corp. (UNP) earlier Wednesday said it now expects

its freight volumes in the second half of the year will fall in the

mid-single digits, compared with a July forecast for a decline of

about 2%.

Adding to the pain, Moody's Investors Service on Wednesday said

it expects coal demand from utilities will drop by more than 50% by

2030, weighing on U.S. railroads. Coal is the largest freight

commodity, excluding intermodal units.

"Our forecast of a more than 50% drop in coal demand from

utilities by 2030 implies that coal demand would decline by about

7% per annum on average over the next 10 years, which would

translate into roughly $5 billion in lost revenues for the

railroads, or 5.5% of 2018 industry revenues," Moody's said.

Elsewhere in North America, the AAR said rail traffic edged up

0.3% in Canada last week, as a 2.2% rise in intermodal units more

than offset a 1.3% drop in carloads.

Rail traffic slipped 0.4% in Mexico last week, the AAR said,

with intermodal units and carloads both down 0.4%.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

September 04, 2019 13:45 ET (17:45 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

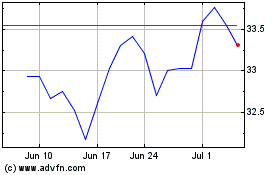

CSX (NASDAQ:CSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

CSX (NASDAQ:CSX)

Historical Stock Chart

From Apr 2023 to Apr 2024