By Chris Matthews and Mark DeCambre, MarketWatch

Bank of America beats earnings estimates on retail business

U.S. stocks slipped Wednesday afternoon as investors digested

mixed earnings results and economic data, while the lack of

progress on the trade dispute with China remained a concern

also.

How are the major benchmarks performing?

The Dow Jones Industrial Average was down 62 points, or 0.2% at

27,282, the S&P 500 index ) down 10 points, 0.4%, at 2,993 ,

while The Nasdaq Composite index slipped 9 points to 8,213, a loss

of 0.1%.

On Tuesday, the Dow closed 23.50 points lower to 27,335.6, a

loss of 0.1%, after briefly touching an intraday high at 27,398.68.

The S&P 500 dropped 0.3% to 3,004.04, shedding 10.3 points and

the Nasdaq Composite Index edged 0.4% lower, or a 35.4 point drop,

to 8,222.80.

What's driving the market?

More than 7% of S&P 500 index companies have reported

second-quarter earnings thus far, according to FactSet data. Of

those companies, about 85% have posted profits that beat analyst

expectations. The reported earnings growth of those companies is

about 3.1%.

Investors came into the earnings season with a bearish outlook

on corporate profits. Analysts expected S&P 500 earnings to

have fallen by 3% in the second quarter, FactSet data shows.

"There are good reasons to believe that despite the downbeat

expectations, earnings season could come in better than

expected--which would be good for markets," Brad McMillan, chief

investment officer at Commonwealth Financial Network said in a

note. "With markets priced for slower growth, faster growth should

be a tailwind. With markets priced for a meaningful earnings

decline, a smaller decline--or even growth--would be another

tailwind."

At the macro-economic level, businesses were generally positive

through early July about the economic outlook for the coming months

despite "widespread concerns about the possible negative impact of

trade-related uncertainty," according to the "Beige Book" survey

released by the Federal Reserve on Wednesday

(http://www.marketwatch.com/story/feds-beige-book-says-outlook-for-economy-remains-positive-despite-widespread-worries-over-trade-2019-07-17).

The survey found that the economy expanded at modest pace from

mid-May through early July, little changed from the spring. In line

with recent, data, retail sales were up slightly while

manufacturing was flat. Price pressures were muted, with the rate

of price inflation described as "stable to down." Firms remain

unable to pass along higher input prices to their customers because

of "brisk competition." Reports from labor markets spoke again of

tight conditions and modestly higher wages, except for entry level

positions where compensation grew at a significant pace.

The Fed is widely expected to cut interest rates at the

conclusion of its two-day July 30-31 policy meeting and the Beige

Book didn't alter that outlook. Fed officials have said a rate cut

would guard against potential downside risks to the economy from

the long-running Sino-American trade dispute and might also boost

inflation, which has been soft since the beginning of the year.

Stocks were also weighing data on new building permits which

came in weaker than expected, falling 6.1% in June to an annual

pace of 1.22 million homes, versus the 1.3 million expected by

economists, per a MarketWatch poll. Home builders broke ground on

new homes at a rate of 1.25 million last month, down 0.9% from May,

though above the forecasted 1.24 million homes.

Which stocks are in focus?

Bank of America Corp. (BAC), the second-largest bank in the U.S.

by assets, produced better-than-expected earnings

(http://www.marketwatch.com/story/bank-of-americas-stock-falls-after-profit-beats-but-revenue-comes-up-a-bit-short-2019-07-17)

of 74 cents a share, or $7.35 billion, compared with expectations

for 71 cents a share based on analysts polled by FactSet. Revenue

for the quarter came in slightly below expectations, but the bank

raised its dividend by 20%

(http://www.marketwatch.com/story/bank-of-america-plans-to-boost-dividend-20-increase-pace-of-stock-buybacks-2019-07-17),while

announcing an authorization for $30 billion in stock buybacks,

helping boost the stock by 0.3%. However, the company's CFO warned

that lower rates would hit its net interest income growth.

CSX (CSX) posted weaker-than-forecast quarterly results, after

the close Tuesday, sending its stock down more than 10%. The

company also said it expects full-year revenue to fall between 1%

and 2%. CSX's decline pushed the Dow Transports down 3%.

Shares of Abbot Laboratories(ABT) rose after the health-care

product manufacturer reported second-quarter earnings

(http://www.marketwatch.com/story/abbott-stock-rises-after-earnings-beat-full-year-guidance-boost-2019-07-17)

that beat analyst forecasts, while raising its guidance for the

full year.

United Airlines (UAL) meanwhile, reported earnings and revenue

that topped analyst expectations and increased its share buyback

program by $3 billion.

Qualcomm Inc. (QCOM) shares are in focus Wednesday after the

Justice Department filed documents Tuesday

(http://www.marketwatch.com/story/justice-department-backs-qualcomms-bid-to-halt-enforcement-of-antitrust-ruling-2019-07-16)

that support the chip maker in its appeal against a federal ruling

in May that it had violated antitrust laws through licensing

practices that thwart competition. The antitrust action was

initiated by the Federal Trade Commission.

After the bell, results from Netflix Inc. (NFLX) and eBay Inc.

(EBAY) are due.

How are other markets trading?

The yield on the 10-year Treasury note was at 2.08%, after

touching a four-week high of to 2.12% on Tuesday

(http://www.marketwatch.com/story/treasury-yields-edge-higher-ahead-of-retail-sales-2019-07-16).

In Asia overnight Tuesday, the China CSI 300 ended with a slight

loss of less than 0.1%, Japan's Nikkei 225 declined 0.3% and Hong

Kong's Hang Seng Index gave up 0.1%. Meanwhile, European shares

were trading lower

(http://www.marketwatch.com/story/european-markets-subdued-on-trade-war-concerns-but-inflation-data-buoys-stimulus-hopes-2019-07-17),

with the Stoxx Europe 600 down about 0.3%.

In commodities markets, August West Texas Intermediate crude

shed 39 cents, or 0.7%, to $57.23 a barrel on the New York

Mercantile Exchange, after a 3.3% tumble on Tuesday. International

benchmark September Brent added 20 cents, or 0.3%, at $64.55 a

barrel on ICE Futures Europe, after its 3.2% skid in the prior

session.

August gold trading on Comex rose $12.10, or 0.9%, to settle at

$1,423.30 an ounce, after closing 0.2% lower Tuesday. Prices for

the most-active contract posted their highest finish since May 14,

2013, FactSet data show.

The U.S. dollar was off 0.1% at 97.25, as measured by the ICE

U.S. Dollar Index.

(END) Dow Jones Newswires

July 17, 2019 14:45 ET (18:45 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

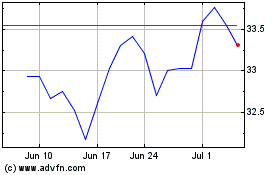

CSX (NASDAQ:CSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

CSX (NASDAQ:CSX)

Historical Stock Chart

From Apr 2023 to Apr 2024