The Zacks Analyst Blog Highlights: Canadian Pacific Railway, CSX, Union Pacific, Canadian National Railway & Norfolk Southern..

March 12 2012 - 4:30AM

Zacks

For Immediate Release

Chicago, IL – March 12, 2012 – Zacks.com announces the list of

stocks featured in the Analyst Blog. Every day the Zacks Equity

Research analysts discuss the latest news and events impacting

stocks and the financial markets. Stocks recently featured in the

blog include Canadian

Pacific Railway Ltd. (

CP), CSX Corporation ( CSX), Union

Pacific Corporation ( UNP), Canadian National

Railway ( CNI) and Norfolk Southern

Corporation ( NSC).

Get the most recent insight from Zacks Equity Research with the

free Profit from the Pros newsletter:

http://at.zacks.com/?id=5513

Here are highlights from Friday’s Analyst

Blog:

Railroads See Drop in Carloads

According to the weekly data for March 3, North American Rail

Freight Carloads continued to see results slide. Total carloads

declined 3.48% year over year to 373,530 units, mainly due to a

9.5% drop in trailers. However, Intermodal and Container

traffic remain healthy with 6.4% and 8.9% year-over-year growth,

respectively.

Commodity wise, rail freight for the week ended March 3

registered maximum declines in its coal volumes (15.2% year over

year) due to continued substitution with lower-priced natural gas

impacting utility coal volume.

On the other hand, Petroleum products remain strong, driven by a

22.5% year-over-year increase in carloads. The surging crude prices

remain attractive for railroads, especially in regions like North

Dakota that lack pipeline facility and rely more on rail freight

services.

Rail freight carriers like Canadian

Pacific Railway Ltd. ( CP) have

already begun to capitalize on these market opportunities by

expanding rail freight services. The company will be the only rail

freight to carry crude from the soon-to-begin oil terminal in North

Dakota's Bakken shale oil fields, carrying 35,000 barrels of oil

per day. The terminal construction is underway near Van Hook in

North Dakota by the U.S. Development Group, a Texas-based developer

of rail logistics and terminal facilities.

Going forward, the recovery in the growth in the North American

auto industry continues to bode well for Metal products, driving

growth of 18.5% year over year.

The current scenario of North American Rail Freight suggests a

strong momentum in freight prices rather than any significant

additions in freight volumes. Class I carriers

like CSX Corporation (

CSX), Union Pacific Corporation (

UNP), Canadian National Railway ( CNI)

and Norfolk Southern Corporation ( NSC)

continue to enjoy pricing discretion with an average pricing growth

of nearly 4%-5% per annum while maintaining double-digit profit

margin.

However, the on-going economic volatilities in the U.S. and

abroad may keep these railroads’ top-line growth under pressure in

the near future. Moreover, the near-term growth for these companies

will continue to be tempered by lower coal production, as

forecasted by the U.S. Energy Information Administration.

Lower natural gas prices, coupled with a weak utility coal

market have raised significant concerns. This is because utility

coal makes up roughly a third of total coal shipments. Strong

exports to Asian countries continue to remain a silver lining.

Currently we maintain a long-term Neutral recommendation on CSX

Corp., Union Pacific, Canadian National, Canadian Pacific and

Norfolk Southern. All these stocks carry a short-term (1-3 months)

Hold rating (Zacks #3 Rank).

Want more from Zacks Equity Research? Subscribe to the free

Profit from the Pros newsletter: http://at.zacks.com/?id=5515.

About Zacks Equity Research

Zacks Equity Research provides the best of quantitative and

qualitative analysis to help investors know what stocks to buy and

which to sell for the long-term.

Continuous coverage is provided for a universe of 1,150 publicly

traded stocks. Our analysts are organized by industry which gives

them keen insights to developments that affect company profits and

stock performance. Recommendations and target prices are six-month

time horizons.

Zacks "Profit from the Pros" e-mail newsletter provides

highlights of the latest analysis from Zacks Equity Research.

Subscribe to this free newsletter today:

http://at.zacks.com/?id=5517

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc.,

which was formed in 1978 by Leon Zacks. As a PhD from MIT Len knew

he could find patterns in stock market data that would lead to

superior investment results. Amongst his many accomplishments was

the formation of his proprietary stock picking system; the Zacks

Rank, which continues to outperform the market by nearly a 3 to 1

margin. The best way to unlock the profitable stock recommendations

and market insights of Zacks Investment Research is through our

free daily email newsletter; Profit from the Pros. In short, it's

your steady flow of Profitable ideas GUARANTEED to be worth your

time! Register for your free subscription to Profit from the Pros

at http://at.zacks.com/?id=5518.

Visit http://www.zacks.com/performance for information about the

performance numbers displayed in this press release.

Follow us on Twitter: http://twitter.com/zacksresearch

Join us on Facebook:

http://www.facebook.com/home.php#/pages/Zacks-Investment-Research/57553657748?ref=ts

Disclaimer: Past performance does not guarantee future results.

Investors should always research companies and securities before

making any investments. Nothing herein should be construed as an

offer or solicitation to buy or sell any security.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

support@zacks.com

http://www.zacks.com

CDN NATL RY CO (CNI): Free Stock Analysis Report

CDN PAC RLWY (CP): Free Stock Analysis Report

CSX CORP (CSX): Free Stock Analysis Report

NORFOLK SOUTHRN (NSC): Free Stock Analysis Report

UNION PAC CORP (UNP): Free Stock Analysis Report

To read this article on Zacks.com click here.

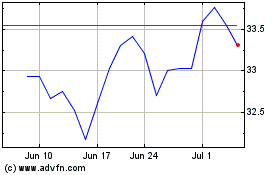

CSX (NASDAQ:CSX)

Historical Stock Chart

From Aug 2024 to Sep 2024

CSX (NASDAQ:CSX)

Historical Stock Chart

From Sep 2023 to Sep 2024