Costco's Sales Get Another Boost From Pandemic Buying -- Update

September 24 2020 - 6:45PM

Dow Jones News

By Sarah Nassauer

After stockpiling early in the coronavirus pandemic, Americans

continue to turn to Costco Wholesale Corp. to buy bulk quantities

of groceries and cleaning supplies. They have also been loading

carts with home furnishing.

"As people are spending less on travel and dining out they seem

to have redirected some of that spending," said Costco financial

chief Richard Galanti on a conference call Thursday.

The warehouse retailer reported a 14.1% jump in comparable sales

for the quarter ended Aug. 30, excluding gas and currency effects.

On that basis, Costco's growth was nearly twice as high as the

spring quarter when it was struggling with out-of-stock items and

placed limits on shoppers.

"We expected fresh food," paper goods and other items already

selling well early in the pandemic to continue selling, Mr. Galanti

said, "but we were a little surprised in the strength in some of

these non-food, discretionary categories," such as homegoods and

furniture.

Food is selling so fast that profit got a boost from the lack of

loss due to spoilage, he said.

In-stock levels have stabilized, but some items are still hard

to come by in some areas, including disposable gloves and

sanitizing wipes, said Mr. Galanti. Halloween-related sales are

weaker, with a "small reduction in the amount of costumes," he

said. Some people are booking travel through the company again, but

mostly for far in the future, Mr. Galanti said.

Like those at rival Walmart Inc., Costco's stores have largely

remained open throughout the pandemic, as the company was deemed an

essential retailer by government municipalities. Costco has mostly

returned to normal operations with shoppers and workers required to

wear masks since May.

Ecommerce sales nearly doubled in the latest quarter, rising 93%

from a year ago, a big jump for a company that has been slow to

embrace online sales and has built its business around bulk

packages. Same-day fresh food delivery has more than tripled, said

Mr. Galanti. "There are some people who are not going into the

supermarket."

Both Walmart and Costco have ramped up their grocery delivery

options. While Walmart has built its own delivery and pickup

services, Costco has mostly turned to Instacart Inc., which pays

people to shop and deliver items.

Company executives believe Costco is picking up business from

retailers that are closed or that don't sell items that people are

buying more of amid the pandemic, such as food and homegoods, said

Mr. Galanti. "We are retaining more of their dollars."

Costco, which operates 795 stores in the U.S, Canada and a few

other countries, has also resumed services that were temporarily

halted, such as its optical counters and food courts.

Costco is benefiting from stronger consumer spending among its

generally wealthier core shoppers, analysts say. Costco shoppers

pay a $60 or $120 annual membership for access to bulk products

often sold at lower prices than at competitors, which tends to draw

wealthier shoppers.

Costco's total revenue for the most recent quarter was $53.38

billion, 12% higher than a year ago, beating analysts' expectations

of $52.11 billion.

Profit was $1.39 billion, or $3.13 a share. In the comparable

quarter a year ago, Costco had a profit of $1.1 billion, or $2.47 a

share. Covid-19 premium wages and sanitation expenses hit earnings

by 47 cents a share, or $281 million, before tax.

--Allison Prang contributed to this article.

Write to Sarah Nassauer at sarah.nassauer@wsj.com

(END) Dow Jones Newswires

September 24, 2020 18:30 ET (22:30 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

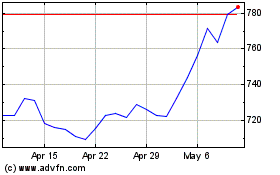

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Mar 2024 to Apr 2024

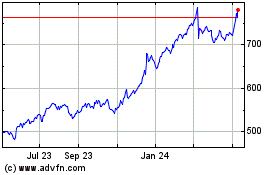

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Apr 2023 to Apr 2024