Companies struggle to keep up supply of fish as wholesale prices

shoot up sharply

By Lucy Craymer

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 16, 2020).

HONG KONG -- Tuna fish has surged in popularity thanks to pantry

loading during the coronavirus pandemic, but producers of the

canned fish are dealing with higher prices and other challenges

that are making it difficult to keep up with the increased

demand.

Americans have been buying more canned tuna during the economic

downturn, in part because it is one of the cheapest proteins on the

market, costing as little as $1 for a 5-ounce can. Bumble Bee Foods

said sales of canned and pouched tuna jumped as much as 100% from

mid-March to early April, while Costco Wholesale Corp. put limits

earlier this year on how many tuna containers a customer could

purchase.

Even after the initial feeding frenzy, canned tuna producers say

sales for these products have remained significantly higher than a

year earlier.

Companies have been able to keep retail prices steady for tuna

so far, even though average wholesale prices for tuna were up 41%

from a year earlier in the year through May after reaching decade

lows late last year, according to data from the Food and

Agriculture Organization of the United Nations.

Prices vary depending on where the fish is bought. Skipjack tuna

purchased in Bangkok cost $1,200 a metric ton in June, up 14% from

December 2019 but down from a peak of $1,500 in March, according to

data from Thai Union Group, a global seafood-based food producer

that owns the Chicken of the Sea canned tuna brand.

Tuna has gone the opposite way of wholesale prices for other

seafood, which have broadly declined due to sharp drops in

restaurant demand.

The tuna industry has a very long supply chain. Analysts say

wholesale prices could remain elevated or trend higher in the

coming months due to challenges of getting enough fish to meet the

surge in demand.

More than 40% of the world's commercially caught tuna comes from

the western and central Pacific Ocean, in the waters around tiny

nations such as Tuvalu and Kiribati. The fish are then shipped to

processing plants on islands in the Pacific, in Asia or South

America. Tuna is often canned in a third country before landing on

supermarket shelves.

Tuna stocks have been ample this year, say food-industry

analysts, but border controls and other supply-chain issues are

hampering production.

Pittsburgh-based StarKist Co., which is owned by a South Korean

conglomerate, processes and cans most of its tuna in American

Samoa, a tiny territory that is closer to New Zealand than it is to

the continental U.S.

The company has wanted to increase production, said Andrew Choe,

StarKist's president and chief executive, but it has been unable to

buy tuna from some of its regular suppliers during the pandemic.

Border restrictions and fishing-port closures at some neighboring

Pacific islands -- where StarKist often buys tuna -- have prevented

fishing vessels from coming in and delivering their catch.

Compounding matters, StarKist's plant on American Samoa recently

encountered mechanical issues that took a while to fix, in part

because the company had to charter a plane to fly in people to

bring parts and do the repairs. Then shipments of canned tuna to

the continental U.S. were held up because the ship that services

the archipelago broke down twice and had to be replaced.

"There have been a lot of complaints -- rightly so -- because

they're not getting their products," said Mr. Choe, referring to

retailers. He added that problems at the plant probably could have

been easily and quickly been fixed were it not for the

pandemic.

For decades, the world's largest producers of canned tuna

struggled to reverse falling sales and shed negative perceptions

that their products were old-fashioned, pungent, high in mercury

and environmentally unfriendly. Then the pandemic occurred, and the

20th-century pantry staple became popular again.

Thai Union, the owner of El Segundo, Calif.-based Chicken of the

Sea, said in May that sharply higher sales of canned tuna during

the first quarter helped the group achieve its best operating

performance in years. In March alone, sales of so-called ambient

seafood -- which includes canned products -- jumped 50%.

"People are asking, is this pantry-loading? Is this consumption?

I would say, every pantry-loading leads to higher consumption.

People are not just leaving that in their pantry. They are

consuming it," Joerg Ayrle, Thai Union's chief financial officer,

said on a conference call. He also said the company has released

videos with recipes for various types of tuna fish cakes and tuna

pancakes.

Darian McBain, Thai Union's global director of corporate affairs

and sustainability, said the company expects demand for canned tuna

to remain elevated, though not at the level it experienced earlier

this year.

Chicken of the Sea had to close a canning facility in Lyons,

Ga., for one day last month after a coronavirus outbreak at the

plant. "It's our new normal," Dr. McBain said.

At a Bumble Bee Foods facility in Santa Fe Springs, Calif., the

company has added Saturday shifts for workers to meet increased

demand.

Todd Putman, Bumble Bee Foods' executive vice president and

chief growth officer, said the company's tuna stocks are running

low.

"The product is available; it's just a matter of getting it into

the U.S.," Mr. Putman said. "Our supply chain is strained."

Write to Lucy Craymer at Lucy.Craymer@wsj.com

(END) Dow Jones Newswires

July 16, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

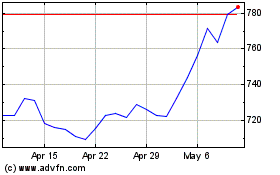

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Mar 2024 to Apr 2024

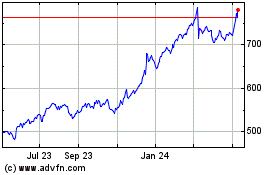

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Apr 2023 to Apr 2024