CFOs Fear a Recession Is Coming. Preparation Will Help Them Stand Out

May 16 2019 - 5:59AM

Dow Jones News

By Tatyana Shumsky

In the early stages of the last major economic downturn, Costco

Wholesale Corp. did for its shelves what it preaches to its

customers: It bought in bulk and saved.

The company, sensing a worsening economic slump, slimmed its

product variety and bought more from fewer suppliers, said Richard

Galanti, Costco's chief financial officer. Doing so helped the

retailer boost buying power with its suppliers and take advantage

of the pricing benefits that come with buying more by the

truckload.

"Clearly, it's easier to manage 3,800 active items in a location

than it is 60,000," Mr. Galanti said, adding that operations became

more efficient.

More companies need to think like that as the prospect of

another downturn looms, according to research released Thursday by

Bain & Co. In particular, companies should be assessing

financial strengths and weaknesses to streamline operations and

reduce costs through technology, according to the consulting

firm.

CFOs also must outline strategies for a variety of sour economic

scenarios that include opportunistic investments, mergers and

acquisitions, according to Bain, which examined financial results

for nearly 3,900 companies world-wide across a variety of

industries to determine which characteristics allowed some

companies to thrive during rough economic headwinds.

"The plain vanilla response to recession is often wait for bad

news, and then start cutting costs," said Tom Holland, a partner at

Bain and an author of the report. "But the more successful

companies cut costs early, before things slowed, and did so through

smart steps such as automation, rather than sweeping emergency

cost-cut programs."

That kind of strategy, including introspective downside scenario

planning, helped about 10% of companies, including Costco, increase

earnings before interest and taxes at a compound annual growth rate

of 17% on average during the 2007-09 recession, compared with zero

growth for those that weren't as proactive, Bain said.

Fears of a downturn have resurfaced after more than a decade of

steady economic expansion.

Two-thirds of CFOs said they expect the U.S. economy to enter a

recession by the third quarter of 2020, according to the Duke

University/CFO Global Business Outlook survey of more than 1,500

CFOs around the world. And nearly half of U.S. CFOs say a recession

is likely to by the end of 2019, the December survey found.

But while most finance chiefs expect the U.S. economy to take a

turn for the worse, less than half are preparing for it. Only 49%

said their company had a detailed plan for a downturn, according to

a February survey of 158 CFOs in the U.S. and Canada by Deloitte.

Deloitte sponsors WSJ's CFO Journal.

The absence of a backup plan is risky. A downturn can narrow the

CFO's field of vision to the bottom line, whereas stringent focus

on working capital can help wring cash from inventory or

late-paying customers, Bain said.

Those funds can ensure the company continues to invest in growth

-- another area that can suffer during a recession. Successful

companies continued funding efforts such as research and

development, new business lines and focused marketing campaigns

throughout the recession, helping them win market share and expand

reach, Bain said.

At Twinkie and Ding Dong maker Hostess Brands, finance chief

Thomas Peterson said the executive team regularly reviews its

pipeline of potential measures, such as those aimed at costs or

pricing, that could be implemented in response to shifts in the

market or the broader economy.

"You want to make sure that you have ideas that are somewhat

thought out so that you can do the next measure, if needed," Mr.

Peterson said.

"And you want to have a pipeline of opportunities," he added,

saying that the company continues to be on the search for potential

acquisitions that would dovetail with its core competencies.

Write to Tatyana Shumsky at tatyana.shumsky@wsj.com

(END) Dow Jones Newswires

May 16, 2019 05:44 ET (09:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

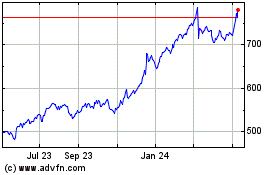

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Mar 2024 to Apr 2024

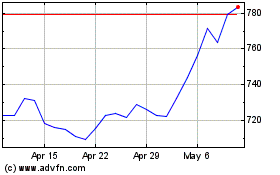

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Apr 2023 to Apr 2024