Costco Wholesale Corporation Announces Reauthorization of Stock Repurchase Program and Quarterly Cash Dividend Increase

April 26 2019 - 4:36PM

Costco Wholesale Corporation ("Costco" or the

"Company") (NASDAQ: COST) today announced that its Board of

Directors has reauthorized a common stock repurchase program of up

to $4 billion. This program will expire in April 2023 and replaces

the current $4 billion program (which expired earlier this month),

which had unused authorization of approximately $2.2 billion. The

Board of Directors also declared a quarterly cash dividend on

Costco common stock, including a quarterly increase from 57 to 65

cents per share, or $2.60 per share on an annualized basis. The

dividend is payable May 24, 2019, to shareholders of record at the

close of business on May 10, 2019.

Costco currently operates 770 warehouses,

including 535 in the United States and Puerto Rico, 100 in Canada,

39 in Mexico, 28 in the United Kingdom, 26 in Japan, 15 in Korea,

13 in Taiwan, 10 in Australia, two in Spain, and one each in

Iceland and France. Costco also operates e-commerce sites in the

U.S., Canada, the United Kingdom, Mexico, Korea, and Taiwan.

Certain statements contained in this document

constitute forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. For these

purposes, forward-looking statements are statements that address

activities, events, conditions or developments that the Company

expects or anticipates may occur in the future. In some cases

forward-looking statements can be identified because they contain

words such as “anticipate,” “believe,” “continue,” “could,”

“estimate,” “expect,” “intend,” “may,” “might,” “likely,” “plan,”

“potential,” “predict,” “project,” “seek,” “should,” “target,”

“will,” “would,” or similar expressions and the negatives of those

terms. Such forward-looking statements involve risks and

uncertainties that may cause actual events, results or performance

to differ materially from those indicated by such statements. These

risks and uncertainties include, but are not limited to, domestic

and international economic conditions, including exchange rates,

the effects of competition and regulation, uncertainties in the

financial markets, consumer and small business spending patterns

and debt levels, breaches of security or privacy

of member or business information, conditions affecting

the acquisition, development, ownership or use of real estate,

capital spending, actions of vendors, rising costs associated with

employees (generally including health care costs), energy and

certain commodities, geopolitical conditions (including

tariffs), the ability to remediate material

weaknesses in internal control, and other risks identified

from time to time in the Company’s public statements and reports

filed with the Securities and Exchange Commission. Forward-looking

statements speak only as of the date they are made, and the Company

does not undertake to update these statements, except as required

by law.

CONTACTS:

Costco Wholesale CorporationRichard Galanti,

425/313-8203Bob Nelson, 425/313-8255David Sherwood,

425/313-8239Josh Dahmen, 425/313-8254

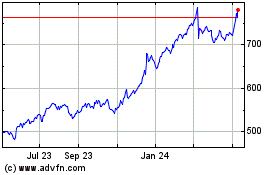

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Mar 2024 to Apr 2024

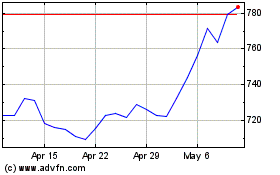

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Apr 2023 to Apr 2024