Current Report Filing (8-k)

September 29 2022 - 4:11PM

Edgar (US Regulatory)

0001158172false00011581722022-09-292022-09-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): September 29, 2022

COMSCORE, INC.

(Exact name of registrant as specified in charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 001-33520 | | 54-1955550 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

11950 Democracy Drive

Suite 600

Reston, Virginia 20190

(Address of principal executive offices, including zip code)

(703) 438–2000

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.001 per share | | SCOR | | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.05 Costs Associated with Exit or Disposal Activities.

On September 29, 2022, comScore, Inc. (the "Company") communicated a workforce reduction as part of its broader efforts to improve cost efficiency and better align its operating structure and resources with strategic priorities (collectively, the "Restructuring Plan"). In addition to employee terminations, the Restructuring Plan is expected to include the reallocation of commercial and product development resources; reinvestment in and modernization of key technology platforms; consolidation of data storage and processing activities to reduce the Company's data center footprint; and reduction of other operating expenses, including software and facility costs. The Company may also determine to exit certain activities in certain geographic regions in order to more effectively align resources with business priorities.

In connection with the Restructuring Plan, which was authorized by the Company's Board of Directors on September 19, 2022, the Company will incur certain exit-related costs. These costs are currently estimated to range between $13 million and $18 million, including (1) cash charges of approximately $6 million to $8 million for severance, termination benefits and related costs for impacted employees; (2) cash charges of approximately $6 million to $8 million for data center reduction; and (3) cash charges of approximately $1 million to $2 million for other associated costs, including legal, consulting and other professional fees. The Company expects implementation of the Restructuring Plan, including cash payments, to be substantially complete in the fourth quarter of 2023. The Company intends to exclude certain charges associated with the Restructuring Plan from its non-GAAP financial measures, including adjusted EBITDA and adjusted EBITDA margin.

Cautionary Note Regarding Forward-Looking Statements

Item 2.05 of this Current Report on Form 8-K contains forward-looking statements within the meaning of federal and state securities laws, including, without limitation, the Company's expectations and plans regarding the timing, scope and impact of the Restructuring Plan (including the termination of employees, reallocation of resources, modernization of platforms, consolidation of data storage and processing activities, and potential exit of geographic regions) and the type, amount and timing of related costs. These statements involve risks and uncertainties that could cause actual events to differ materially from expectations, including, but not limited to, impediments to the Company's ability to execute the Restructuring Plan as currently contemplated, higher-than-expected costs to implement the Restructuring Plan, changes to the assumptions upon which the estimated charges are based, and unintended consequences from the Restructuring Plan that could negatively impact the Company's business or strategy. For additional discussion of risk factors, please refer to the Company's Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and other filings that the Company makes from time to time with the U.S. Securities and Exchange Commission (the "SEC"), which are available on the SEC's website (www.sec.gov).

Investors are cautioned not to place undue reliance on the Company's forward-looking statements, which speak only as of the date such statements are made. Except as required by law, the Company does not intend or undertake, and expressly disclaims any duty or obligation, to publicly update any forward-looking statements to reflect events, circumstances or new information after the date of this Current Report on Form 8-K or to reflect the occurrence of unanticipated events.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| comScore, Inc. |

| |

| By: | | /s/ Mary Margaret Curry |

| | Mary Margaret Curry |

| | Chief Financial Officer and Treasurer |

Date: September 29, 2022

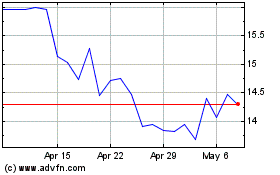

comScore (NASDAQ:SCOR)

Historical Stock Chart

From Mar 2024 to Apr 2024

comScore (NASDAQ:SCOR)

Historical Stock Chart

From Apr 2023 to Apr 2024