Current Report Filing (8-k)

March 06 2020 - 4:20PM

Edgar (US Regulatory)

false000031754000003175402020-03-032020-03-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 3, 2020

COCA-COLA CONSOLIDATED, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

0-9286

|

|

56-0950585

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

4100 Coca-Cola Plaza

Charlotte, NC

|

|

|

|

28211

|

|

(Address of principal executive offices)

|

|

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (704) 557-4400

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $1.00 Par Value

|

COKE

|

The NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On March 3, 2020, Umesh M. Kasbekar informed the Board of Directors (the “Board”) of Coca-Cola Consolidated, Inc. (the “Company”) that he will retire from his position as executive Vice Chairman of the Company, effective as of the close of business on July 5, 2020. Following his retirement, Mr. Kasbekar will remain a member of the Board and serve as non-executive Vice Chairman.

In connection with his retirement, Mr. Kasbekar and the Company entered into a Consulting Agreement (the “Agreement”) on March 3, 2020 to provide continued access to Mr. Kasbekar’s skills and experience with respect to the operation of the Company’s business. Pursuant to the Agreement, Mr. Kasbekar has agreed to provide such advisory and consulting services as the Chairman and Chief Executive Officer of the Company may from time to time request in connection with significant Company matters, including key financial and strategic human resource matters (such as succession planning), and to assist with the collaboration and development of relationships with the Company’s key strategic partners. Mr. Kasbekar will also continue to serve as a member of the board of directors of certain of the Company’s subsidiaries. The initial term of the Agreement is a two-year period commencing July 6, 2020 and is subject to annual renewal thereafter unless either party provides the other notice of nonrenewal at least 120 days prior to the end of the then current term. The term of the Agreement may be terminated by either party upon seven days’ advance written notice or immediately upon Mr. Kasbekar’s death or if the Company determines Mr. Kasbekar has engaged in misconduct or is unable to perform his duties under the Agreement due to medical infirmity.

Mr. Kasbekar will be entitled to receive a consulting fee of $20,000 per month during the term of the Agreement and reimbursement of any expenses he incurs in connection with his performance of services under the Agreement. In addition, following his retirement, Mr. Kasbekar will be entitled to receive compensation in accordance with the Company’s standard compensation arrangements for non-employee directors, which are described under the caption “Director Compensation” in the Company’s definitive proxy statement on Schedule 14A filed with the Securities and Exchange Commission on March 25, 2019, as adjusted by the Board from time to time.

The foregoing description of the terms and conditions of the Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Agreement, a copy of which is filed as Exhibit 10.1 hereto and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

Incorporated by Reference or

Filed/Furnished Herewith

|

|

10.1

|

|

|

|

Filed herewith.

|

|

104

|

|

|

Cover Page Interactive Data File – the cover page interactive data file does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document.

|

|

Filed herewith.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COCA-COLA CONSOLIDATED, INC.

|

|

|

|

|

|

|

|

|

|

Date: March 6, 2020

|

|

By:

|

/s/ E. Beauregarde Fisher III

|

|

|

|

|

|

E. Beauregarde Fisher III

Executive Vice President, General Counsel and Secretary

|

|

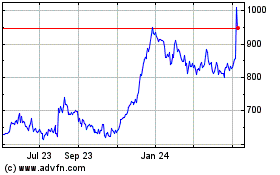

Coca Cola Consolidated (NASDAQ:COKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

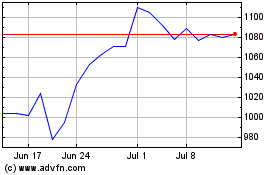

Coca Cola Consolidated (NASDAQ:COKE)

Historical Stock Chart

From Apr 2023 to Apr 2024