CleanSpark, Inc. (Nasdaq: CLSK) (the “Company”), a sustainable

bitcoin mining and energy technology company, today reported

financial results for the three months ended December 31,

2021.

“December 16th marked our one-year anniversary of

sustainable bitcoin mining and since then we have brought the

Company to record revenues and profit,” said Zach Bradford,

CleanSpark’s Chief Executive Officer. “As of the date of this

release, we have 20,900 machines in operation with a total hashrate

exceeding 2.1 EH/s and producing approximately 10 bitcoin per

day.

“Given our success with bitcoin mining,” Bradford continued,

“CleanSpark is considering strategic alternatives for our legacy

energy business. Focusing our efforts on our bitcoin

mining segment allows the Company to capitalize on the tremendous

opportunity bitcoin presents. We look forward to sharing

our corporate vision on our first quarter earnings call and

discussing the strategic pillars we believe are crucial to our

long-term success.”

“Our strong financial results are evidence of the operating

leverage of our business model,” said Gary A. Vecchiarelli, Chief

Financial Officer. “Gross margins remain high at almost 80%, and

much of that profitability translates to the bottom line as we saw

$14.5m of net income and $24.1m of Adjusted EBITDA[1], which

represents net margins of approximately 35% and 58%,

respectively. CleanSpark also has zero long-term debt,

and we will be looking to use our strong balance sheet and

operating cash flows as a springboard for future growth

expansion.”

Q1 Financial Highlights

Financial Results for the Three Months Ended December 31,

2021

- The Company increased its quarterly revenues to $41.2 million,

an increase of $38.9 million or 17x from $2.3 million for the same

prior year period.

- Net income for the three months ended December 31, 2021 was

$14.5m or $0.35 basic income per share compared to a loss of $(7.2)

million or $(0.32) loss per share for the same prior year

period.

- Adjusted EBITDA1 improved significantly to $24.1 million,

compared to Adjusted EBITDA1 of $(2.7) million from the same

prior year period.

- The Company also saw substantial sequential revenues growth in

the first quarter compared to the previous

quarter. Revenues increased $14.1 million or 52% from

the fourth quarter. Net income for the first quarter was

$14.5 million reversing a net loss of $(5.4) million in the fourth

quarter. Adjusted EBITDA1 was $24.1 million,

increasing almost 700% from $3.6 million in the fourth

quarter.

Balance Sheet Highlights as of December 31, 2021

Assets

- Cash: $5.2 million

- Digital Currency: $30.2 million

- Total Current assets: $58.7 million

- Total Mining assets (including prepaid deposits & deployed

miners): $286.9m

- Total Assets: $418.1 million

Liabilities and Stockholders’ equity

- Current Liabilities: $22.5 million

- Total Liabilities: $24.1 million

- Total Stockholders’ Equity: $394.1 million

The Company had working capital of $36.2 million and no

long-term debt as of December 31, 2021.

Investor Conference Call and Webcast

The Company will hold its first quarter 2022 earnings

presentation and business update for investors and analysts

today,February 9, 2022, at 2:00 p.m. PST/5:00 p.m.

EST. Webcast

URL: https://www.cleanspark.com/investor-relations/clsk-earnings

The webcast will be accessible for at least 30 days on the

Company's website.

Participant Dial-in (Toll free): 1-877-270-2148.

A transcript of the call will be available on the Company’s

website following the call.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. We intend such forward-looking statements to be covered by

the safe harbor provisions for forward-looking statements contained

in Section 27A of the Securities Act of 1933, as amended (the

“Securities Act”), and Section 21E of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”). All statements other than

statements of historical facts contained in this press release may

be forward-looking statements. In some cases, you can identify

forward-looking statements by terms such as “may,” “will,”

“should,” “expects,” “plans,” “anticipates,” “could,” “intends,”

“targets,” “projects,” “contemplates,” “believes,” “estimates,”

“forecasts,” “predicts,” “potential” or “continue” or the negative

of these terms or other similar expressions. Forward-looking

statements contained in this press release, but are not limited to

statements regarding our future results of operations and financial

position, industry and business trends, equity compensation,

business strategy, plans, market growth and our objectives for

future operations.

The forward-looking statements in this press release are only

predictions. We have based these forward-looking statements largely

on our current expectations and projections about future events and

financial trends that we believe may affect our business, financial

condition and results of operations. Forward-looking statements

involve known and unknown risks, uncertainties and other important

factors that may cause our actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements, including, but not limited to: the

success of its digital currency mining activities; the volatile and

unpredictable cycles in the emerging and evolving industries in

which we operate, increasing difficulty rates for bitcoin mining;

bitcoin halving; new or additional governmental regulation; the

anticipated delivery dates of new miners; the ability to

successfully deploy new miners; the dependency on utility rate

structures and government incentive programs; the successful

deployment of energy solutions for residential and commercial

applications; the expectations of future revenue growth may not be

realized; ongoing demand for the Company's software products and

related services; the impact of global pandemics (including

COVID-19) on logistics and shipping and the demand for our products

and services; and other risks described in the Company's prior

press releases and in its filings with the Securities and Exchange

Commission (SEC), including under the heading "Risk Factors" in the

Company's Annual Report on Form 10-K and any subsequent filings

with the SEC. The forward-looking statements in this press release

are based upon information available to us as of the date of this

press release, and while we believe such information forms a

reasonable basis for such statements, such information may be

limited or incomplete, and our statements should not be read to

indicate that we have conducted an exhaustive inquiry into, or

review of, all potentially available relevant information. These

statements are inherently uncertain and investors are cautioned not

to unduly rely upon these statements.

You should read this press release with the understanding that

our actual future results, performance and achievements may be

materially different from what we expect. We qualify all of our

forward-looking statements by these cautionary statements. These

forward-looking statements speak only as of the date of this press

release. Except as required by applicable law, we do not plan to

publicly update or revise any forward-looking statements contained

in this press release, whether as a result of any new information,

future events or otherwise.

Non-GAAP Measures

Adjusted EBITDA is not a measurement of financial performance

under generally accepted accounting principles in the United States

(“GAAP”). Because of varying available valuation methodologies,

subjective assumptions and the variety of equity instruments that

can impact a company's non-cash operating expenses, CleanSpark

management believes that providing a non-GAAP financial measure

that excludes non-cash and non-recurring expenses allows for

meaningful comparisons between the Company's core business

operating results and those of other companies, as well as

providing the Company with an important tool for financial and

operational decision making and for evaluating its own core

business operating results over different periods of time.

The Company's Adjusted EBITDA measure may not provide

information that is directly comparable to that provided by other

companies in its industry, as other companies in its industry may

calculate non-GAAP financial results differently, particularly

related to non-recurring, unusual items. The Company's Adjusted

EBITDA is not a measurement of financial performance under GAAP and

should not be considered as an alternative to operating income or

as an indication of operating performance or any other measure of

performance derived in accordance with GAAP. Our management does

not consider Adjusted EBITDA to be a substitute for, or superior

to, the information provided by GAAP financial results.

We are providing supplemental financial measures for (i)

non-GAAP adjusted earnings before interest, taxes, depreciation and

amortization (“Adjusted EBITDA”) that excludes the impact of

interest, taxes, depreciation, amortization, our share-based

compensation expense, and impairment of assets, unrealized

gains/losses on securities, certain financing costs, other non-cash

items, certain non-recurring expenses, and impacts related to

discontinued operations; and (ii) non-GAAP Adjusted EBITDA that

excludes the impact of interest, taxes, depreciation, amortization,

our share-based compensation expense, and impairment of assets,

unrealized gains/losses on securities, certain financing costs,

other non-cash items, and impacts related to discontinued

operations. These supplemental financial measures are not

measurements of financial performance under GAAP and, as a result,

these supplemental financial measures may not be comparable to

similarly titled measures of other companies. Management uses these

non-GAAP financial measures internally to help understand, manage,

and evaluate our business performance and to help make operating

decisions.

We believe that these non-GAAP financial measures are also

useful to investors and analysts in comparing our performance

across reporting periods on a consistent basis. Adjusted EBITDA

excludes (i) impacts of interest, taxes, and depreciation; (ii)

significant non-cash expenses such as our share-based compensation

expense, unrealized gains/losses on securities, certain financing

costs, other non-cash items that we believe are not reflective of

our general business performance, and for which the accounting

requires management judgment, and the resulting expenses could vary

significantly in comparison to other companies; (iii) significant

impairment losses related to long-lived and digital assets, which

include our bitcoin for which the accounting requires significant

estimates and judgment, and the resulting expenses could vary

significantly in comparison to other companies; and (iv) and

impacts related to discontinued operations that would not be

applicable to our future business activities.

Non-GAAP financial measures are subject to material limitations

as they are not in accordance with, or a substitute for,

measurements prepared in accordance with GAAP. For example, we

expect that share-based compensation expense, which is excluded

from Adjusted EBITDA, will continue to be a significant recurring

expense over the coming years and is an important part of the

compensation provided to certain employees, officers, and

directors.

We have also excluded impairment losses on assets, including

impairments of our digital currency our non-GAAP financial

measures, which may continue to occur in future periods as a result

of our continued holdings of significant amounts of bitcoin. Our

non-GAAP financial measures are not meant to be considered in

isolation and should be read only in conjunction with our

Consolidated Financial Statements, which have been prepared in

accordance with GAAP. We rely primarily on such Consolidated

Financial Statements to understand, manage, and evaluate our

business performance and use the non-GAAP financial measures only

supplementally.

About CleanSpark

CleanSpark, Inc., a Nevada corporation, is a sustainable bitcoin

mining and energy technology company that is solving modern energy

challenges. For more information about the Company, please visit

the Company's website

at https://www.cleanspark.com/investor-relations.

Investor Relations Contact Matt Schultz,

Executive Chairmanir@cleanspark.com

Media Contacts Isaac

Holyoak pr@cleanspark.com

BlocksBridge Consulting Nishant

Sharma cleanspark@blocksbridge.com

CLEANSPARK, INC.

CONSOLIDATED BALANCE SHEETS

| |

|

December 31, 2021

(Unaudited) |

|

|

September 30,

2021 |

|

| ASSETS |

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

| Cash and cash equivalents, including restricted cash |

|

$ |

5,212,414 |

|

|

$ |

18,040,327 |

|

| Accounts receivable, net |

|

|

4,622,002 |

|

|

|

2,619,957 |

|

| Inventory |

|

|

1,432,110 |

|

|

|

2,672,744 |

|

| Prepaid expense and other current assets |

|

|

11,245,426 |

|

|

|

5,129,047 |

|

| Digital currency |

|

|

30,203,387 |

|

|

|

23,603,210 |

|

| Derivative investment asset |

|

|

5,204,505 |

|

|

|

4,905,656 |

|

| Investment in equity security |

|

|

250,000 |

|

|

|

260,772 |

|

| Investment in debt security, AFS, at fair value |

|

|

512,721 |

|

|

|

494,608 |

|

| Total current assets |

|

$ |

58,682,565 |

|

|

$ |

57,726,321 |

|

| |

|

|

|

|

|

|

| Property and equipment, net |

|

$ |

198,490,355 |

|

|

$ |

137,674,739 |

|

| Operating lease right of use asset |

|

|

1,421,252 |

|

|

|

1,488,240 |

|

| Capitalized software, net |

|

|

477,191 |

|

|

|

503,685 |

|

| Intangible assets, net |

|

|

10,996,442 |

|

|

|

12,195,492 |

|

| Deposits on mining equipment |

|

|

125,700,523 |

|

|

|

87,959,910 |

|

| Other long-term asset |

|

|

3,327,245 |

|

|

|

875,536 |

|

| Goodwill |

|

|

19,049,198 |

|

|

|

19,049,198 |

|

| Total assets |

|

$ |

418,144,771 |

|

|

$ |

317,473,121 |

|

| |

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

| Accounts payable and accrued liabilities |

|

$ |

20,237,550 |

|

|

$ |

7,975,263 |

|

| Contract liabilities |

|

|

386,740 |

|

|

|

296,964 |

|

| Operating lease liability |

|

|

261,101 |

|

|

|

256,195 |

|

| Finance lease liability |

|

|

366,728 |

|

|

|

413,798 |

|

| Acquisition liability |

|

|

300,000 |

|

|

|

300,000 |

|

| Contingent consideration |

|

|

615,249 |

|

|

|

820,802 |

|

| Dividends payable |

|

|

314,611 |

|

|

|

— |

|

| Total current liabilities |

|

|

22,481,979 |

|

|

|

10,063,022 |

|

| Long-term liabilities |

|

|

|

|

|

|

| Operating lease liability, net of current portion |

|

|

1,167,779 |

|

|

|

1,235,325 |

|

| Finance lease liability, net of current portion |

|

|

419,563 |

|

|

|

458,308 |

|

| Total liabilities |

|

$ |

24,069,321 |

|

|

$ |

11,756,655 |

|

| |

|

|

|

|

|

|

| Stockholders' equity |

|

|

|

|

|

|

| Common stock; $0.001 par value; 100,000,000 shares authorized;

41,474,062 and 37,395,945 shares issued and

outstanding as of December 31, 2021

and September 30, 2021,

respectively |

|

|

41,475 |

|

|

|

37,394 |

|

| Preferred stock; $0.001 par value; 10,000,000 shares

authorized; Series A shares; 2,000,000 authorized;

1,750,000 and 1,750,000 issued and outstanding as

of December 31, 2021 and September 30, 2021, respectively |

|

|

1,750 |

|

|

|

1,750 |

|

| Additional paid-in capital |

|

|

518,240,478 |

|

|

|

444,074,832 |

|

| Accumulated other comprehensive income (loss) |

|

|

12,721 |

|

|

|

(5,392) |

|

| Accumulated deficit |

|

|

(124,220,974) |

|

|

|

(138,392,118) |

|

| Total stockholders' equity |

|

|

394,075,450 |

|

|

|

305,716,466 |

|

| |

|

|

|

|

|

|

| Total liabilities and stockholders' equity |

|

$ |

418,144,771 |

|

|

$ |

317,473,121 |

|

CLEANSPARK, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE INCOME (LOSS)

(UNAUDITED)

| |

|

Three months

ended |

|

|

|

|

December

31,2021 |

|

|

December

31,2020 |

|

| Revenues, net |

|

|

|

|

|

|

| Digital currency mining revenue, net |

|

$ |

36,974,578 |

|

|

$ |

733,410 |

|

| Energy hardware, software and services revenue |

|

|

3,970,210 |

|

|

|

1,213,870 |

|

| Other services revenue |

|

|

297,181 |

|

|

|

310,290 |

|

| Total revenues, net |

|

|

41,241,969 |

|

|

|

2,257,570 |

|

| |

|

|

|

|

|

|

| Costs and expenses |

|

|

|

|

|

|

| Cost of revenues (exclusive of depreciation and amortization

shown below) |

|

|

8,797,926 |

|

|

|

1,332,890 |

|

| Professional fees |

|

|

3,317,819 |

|

|

|

1,712,723 |

|

| Payroll expenses |

|

|

8,883,047 |

|

|

|

3,314,201 |

|

| General and administrative expenses |

|

|

1,888,100 |

|

|

|

950,139 |

|

| Other impairment expense (related to Digital Currency) |

|

|

6,222,346 |

|

|

|

— |

|

| Depreciation and amortization |

|

|

7,697,568 |

|

|

|

1,117,715 |

|

| Total costs and expenses |

|

|

36,806,806 |

|

|

|

8,427,668 |

|

| |

|

|

|

|

|

|

| Income (loss) from operations |

|

|

4,435,163 |

|

|

|

(6,170,098) |

|

| |

|

|

|

|

|

|

| Other income/(expense) |

|

|

|

|

|

|

| Change in fair value of contingent consideration |

|

|

55,542 |

|

|

|

— |

|

| Realized gain on sale of digital currency |

|

|

9,994,791 |

|

|

|

49,918 |

|

| Realized gain on sale of equity security |

|

|

665 |

|

|

|

— |

|

| Unrealized loss on equity security |

|

|

(1,847) |

|

|

|

(73,500) |

|

| Unrealized gain (loss) on derivative security |

|

|

298,849 |

|

|

|

(1,020,494) |

|

| Interest income |

|

|

33,471 |

|

|

|

47,984 |

|

| Interest expense |

|

|

(52,709) |

|

|

|

(1,340) |

|

| Loss on write off and disposal of assets |

|

|

(278,170) |

|

|

|

— |

|

| Total other income (expense) |

|

|

10,050,592 |

|

|

|

(997,432) |

|

| |

|

|

|

|

|

|

| Income (loss) before income tax (expense) or benefit |

|

|

14,485,755 |

|

|

|

(7,167,530) |

|

| Income tax (expense) or benefit |

|

|

— |

|

|

|

— |

|

| Net income (loss) |

|

$ |

14,485,755 |

|

|

$ |

(7,167,530) |

|

| |

|

|

|

|

|

|

| Preferred stock dividends |

|

|

314,611 |

|

|

|

— |

|

| |

|

|

|

|

|

|

| Net income (loss) attributable to common shareholders |

|

$ |

14,171,144 |

|

|

$ |

(7,167,530) |

|

| |

|

|

|

|

|

|

| Other comprehensive income |

|

|

18,113 |

|

|

|

— |

|

| |

|

|

|

|

|

|

| Total comprehensive income (loss) attributable to common

shareholders |

|

$ |

14,189,257 |

|

|

$ |

(7,167,530) |

|

| |

|

|

|

|

|

|

| Income (loss) per common share - basic |

|

$ |

0.35 |

|

|

$ |

(0.32) |

|

| |

|

|

|

|

|

|

| Weighted average common shares outstanding - basic |

|

|

40,279,938 |

|

|

|

22,146,992 |

|

| |

|

|

|

|

|

|

| Income (loss) per common share - diluted |

|

$ |

0.35 |

|

|

$ |

(0.32) |

|

| |

|

|

|

|

|

|

| Weighted average common shares outstanding - diluted |

|

|

40,485,761 |

|

|

|

22,146,992 |

|

| |

|

|

|

|

|

|

CLEANSPARK, INC.

RECONCILIATION OF ADJUSTED EBITDA

(UNAUDITED)

| |

|

Three months ended

December 31, |

|

|

|

|

2021 |

|

|

2020 |

|

| Revenues, net |

|

|

|

|

|

|

| Digital currency mining revenue, net |

|

$ |

36,974,578 |

|

|

$ |

733,410 |

|

| Energy hardware, software and services revenue |

|

|

3,970,210 |

|

|

|

1,213,870 |

|

| Other services revenue |

|

|

297,181 |

|

|

|

310,290 |

|

| Total revenues, net |

|

$ |

41,241,969 |

|

|

$ |

2,257,570 |

|

| |

|

|

|

|

|

|

| Net income (loss) |

|

$ |

14,485,755 |

|

|

$ |

(7,167,530) |

|

| Adjustments: |

|

|

|

|

|

|

|

|

| Other impairment expense (related to Digital Currency) |

|

$ |

6,222,346 |

|

|

$ |

— |

|

| Depreciation and amortization |

|

|

7,697,568 |

|

|

|

1,117,715 |

|

| Stock based compensation |

|

|

5,749,107 |

|

|

|

4,350,643 |

|

| Change in fair value of contingent consideration |

|

|

55,542 |

|

|

|

— |

|

| Realized gain on sale of digital currency |

|

|

(9,994,791) |

|

|

|

(49,918) |

|

| Realized gain on sale of equity security |

|

|

(665) |

|

|

|

— |

|

| Unrealized loss on equity security |

|

|

1,847 |

|

|

|

73,500 |

|

| Unrealized gain (loss) on derivative security |

|

|

(298,849) |

|

|

|

(1,020,494) |

|

| Interest income |

|

(33,471) |

|

|

(47,984) |

|

| Interest expense |

|

52,709 |

|

|

1,340 |

|

| Loss on write off and disposal of assets |

|

278,170 |

|

|

— |

|

| Total Adjusted EBITDA |

|

$ |

24,104,184 |

|

|

$ |

(2,742,728) |

|

| |

|

|

|

|

|

|

|

|

|

Three months

ended September 30, 2021 |

|

|

| Revenues, net |

|

|

|

|

| Digital currency mining revenue, net |

|

$ |

22,747,990 |

|

|

| Energy hardware, software and services revenue |

|

|

4,017,574 |

|

|

| Other services revenue |

|

|

379,230 |

|

|

| Total revenues, net |

|

$ |

27,144,794 |

|

|

| |

|

|

|

|

| Net loss |

|

$ |

(5,367,391) |

|

|

| Adjustments: |

|

|

|

|

|

| Other impairment expense (related to Digital Currency) |

|

$ |

3,441,917 |

|

|

| Depreciation and amortization |

|

|

5,361,348 |

|

|

| Stock based compensation |

|

|

52,317 |

|

|

| Change in fair value of contingent consideration |

|

|

(84,198) |

|

|

| Realized gain on sale of digital currency |

|

|

(2,432,313) |

|

|

| Realized gain on sale of equity security |

|

|

(73,138) |

|

|

| Unrealized loss on equity security |

|

|

104,067 |

|

|

| Unrealized loss on derivative security |

|

|

2,528,974 |

|

|

| Interest expense, net |

|

33,958 |

|

|

| Other income |

|

(1,761) |

|

|

| Total Adjusted EBITDA |

|

$ |

3,563,780 |

|

|

| |

|

|

|

|

[1] Non-GAAP financial metric; see “Non-GAAP Measures” and

“Reconciliation of Adjusted EBITDA” in this press release.

Isaac Holyoak

CleanSpark, Inc.

702-989-7694

pr@cleanspark.com

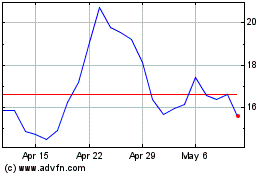

CleanSpark (NASDAQ:CLSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

CleanSpark (NASDAQ:CLSK)

Historical Stock Chart

From Apr 2023 to Apr 2024