Central Garden & Pet Company (NASDAQ: CENT)(NASDAQ:CENTA)

today announced results for its second quarter ended March 27,

2010.

“We have continued to improve our profitability and cash flow

for the second quarter,” noted William Brown, Chairman and Chief

Executive Officer. “Higher gross margins and lower operating

expenses more than offset sales declines. Operating margins

improved to 13.7 percent for the second quarter 2010 from 12.0

percent for the second quarter last year. Our strong balance sheet,

together with the recent completion of our $400 million senior

subordinated note offering, give us the financial resources to

invest in brand building activities and new product innovations to

support future organic sales growth. We also continue to explore

potential acquisitions.”

The Company reported net sales of $442 million in the quarter, a

decline of 7 percent compared to $476 million in the comparable

fiscal 2009 period. Branded product sales decreased 10 percent to

$368 million. Sales of other manufacturers’ products increased 10

percent to $74 million. The Company reported operating income of

$60.5 million compared to $57.2 million in the year ago period. Net

interest expense was $9.8 million compared to $5.5 million a year

ago. Included in interest expense is a $3.2 million charge related

to the Company’s recent refinancing. Net income for the quarter was

$31.6 million for the second quarter of 2010 compared to $33.0

million for the second quarter of 2009. Fully diluted earnings per

share rose to $0.49 from $0.47 for the year ago period.

Net sales for the Garden Products segment were $220 million, a

decrease of 11 percent from $248 million in the comparable fiscal

2009 period. Branded product sales declined $34 million to $185

million. Sales of other manufacturers’ products increased $6

million to $35 million. The decrease in Garden Products segment

sales was due primarily to lower unit sales and price reductions

due to lower commodity costs. Operating income for the Garden

Products segment was $36.8 million, or 16.8 percent of sales,

compared to $36.7 million, or 14.8 percent of sales in the year ago

period.

Net sales for the Pet Products segment were $222 million, a

decrease of 3 percent compared to the year ago period. Branded

product sales were $183 million, a decrease of $7 million compared

to last year. Sales of other manufacturers’ products were $39

million compared to $38 million last year. Pet sales were lower

than the year ago period due primarily to decreased sales of animal

health products. The decrease in sales of animal health products

was due primarily to a supply issue for one product line, which is

expected to continue at a reduced level through our third fiscal

quarter. Operating income for the Pet Products segment was $34.8

million, or 15.6 percent of sales, compared to $31.9 million, or

13.9 percent of sales, in the year ago period.

For the six months ending March 27, 2010 of fiscal 2010, the

Company reported net sales of $711 million compared to $769 million

in the comparable 2009 period, a decline of 8 percent. Branded

products sales decreased 10 percent to $588 million. Sales of other

manufacturers’ products increased 5 percent to $123 million.

Operating income for the period was $61.0 million compared to $54.5

million in the year ago period. Operating margins increased to 8.6

percent for the six months ended March 27, 2010 from 7.1 percent in

the year ago period. Net income for the six months ending March 27,

2010 was $28.7 million compared to $26.8 million in the comparable

2009 period. Earnings per diluted share were $0.43 compared to

$0.38 per share per fully diluted share in the year ago period.

The Company will discuss its second quarter results on a

conference call today at 4:30 p.m. EDT / 1:30 p.m. PDT. Individuals

may access the call by dialing 1-888-713-4213 and passcode 9413

3044 (domestic) or 1-617-213-4865 and passcode 9413 3044

(international). The conference call will be simultaneously

broadcast over the Internet through Central’s website,

http://www.central.com/ or you may link directly to the webcast on

our website at

http://ir.central.com/phoenix.zhtml?c=93879&p=irol-calendar.

To listen to the webcast, please log on to the website prior to the

scheduled call time to register and download any necessary audio

software.

In order to simplify your registration process, you may

pre-register at the following link:

https://www.theconferencingservice.com/prereg/key.process?key=P4G7PLEAQ.

By pre-registering, you may bypass the operator and go directly to

the teleconference with a unique PIN number as soon as the call

begins. At the time of the call, after dialing the number and

passcode mentioned above, enter your PIN for immediate access to

the teleconference.

Re-play dial-in numbers for the call will be available for three

weeks: 1-888-286-8010 and passcode 4416 4680 (domestic) and

1-617-801-6888 and passcode 4416 4680 (international).

Central Garden & Pet Company is a leading innovator,

marketer and producer of quality branded products for the lawn

& garden and pet supplies markets. Committed to new product

innovation, our products are sold to specialty independent and mass

retailers. Participating categories in Lawn & Garden include:

Grass seed including the brands PENNINGTON®, SMART SEED® and THE

REBELS™; wild bird feed and the brands PENNINGTON® and KAYTEE®;

weed and insect control and the brands AMDRO®, SEVIN®, and Over 'N

Out®; and decorative outdoor patio products and the brands NORCAL®,

NEW ENGLAND POTTERY®, CEDAR WORKS® and MATTHEWS FOUR SEASONS™. We

also provide a host of other regional and application-specific

garden brands and supplies. Participating categories in Pet

include: Animal health and the brands ADAMS™ and ZODIAC®; aquatics

and reptile and the brands OCEANIC®, AQUEON® and ZILLA®; bird &

small animal and the brands KAYTEE®, SUPER PET® and CRITTER TRAIL®;

dog & cat and the brands TFH™ , NYLABONE®, FOUR PAWS®,

PINNACLE® and AVODERM®; and equine and the brands FARNAM®, BRONCO®

and SUPER MASK®. We also provide a host of other

application-specific Pet brands and supplies. Central Garden &

Pet Company is based in Walnut Creek, California, and has

approximately 4,000 employees, primarily in North America and

Europe. For additional information on Central Garden & Pet

Company, including access to Central's SEC filings, please visit

Central's website at www.central.com.

“Safe Harbor” Statement under the Private Securities Litigation

Reform Act of 1995: The statements contained in this release which

are not historical facts are forward-looking statements that are

subject to risks and uncertainties that could cause actual results

to differ materially from those set forth in or implied by

forward-looking statements. These risks are described in the

Company’s Annual Report on Form 10-K, filed November 20, 2009 and

Central’s Quarterly Report on Form 10-Q, filed February 4, 2010,

and other Securities and Exchange Commission filings. Central

undertakes no obligation to publicly update these forward-looking

statements to reflect new information, subsequent events or

otherwise.

Central Garden & Pet

Company

Condensed Consolidated Statements

of Income

(Unaudited)

(In thousands, except per share

amounts)

Three Months Ended Six Months Ended March 27, March

28, March 27, March 28, 2010 2009 2010 2009 Net Sales

$ 441,936 $ 476,425 $ 711,172 $ 768,967 Cost of Goods Sold and

Occupancy 280,747 315,872

462,214 522,933 Gross Profit 161,189

160,553 248,958 246,034 Selling, General and Administrative

Expenses 100,667 103,397 187,915

191,544 Income From Operations 60,522

57,156 61,043 54,490 Interest Expense (9,814 ) (5,751 )

(14,758 ) (12,635 ) Interest Income 1 270 11 602 Other Income

(Expense) (206 ) (131 ) 386

(1,081 ) Income Before Income Taxes and Noncontrolling

Interest 50,503 51,544 46,682 41,376 Income Taxes

18,568 17,980 17,166

14,127 Income Including Noncontrolling Interest 31,935

33,564 29,516 27,249 Net Income Attributable to Noncontrolling

Interest 315 544 790

413 Net Income $ 31,620 $ 33,020

$ 28,726 $ 26,836 Net Income Per Share: Basic:

$ 0.49 $ 0.48 $ 0.44 $ 0.38 Diluted $ 0.49 $ 0.47 $ 0.43 $

0.38 Weighted Average Shares Outstanding Basic 63,988 69,122

65,408 70,122 Diluted 64,950 69,872 26 66,435 70,588

Central Garden & Pet

Company

Condensed Consolidated Balance

Sheets

(Unaudited)

(In thousands)

March 27,

2010

March 28,

2009

September 26,

2009

Assets Current Assets: Cash and Cash Equivalents $ 27,037 $ 8,545 $

85,668 Accounts Receivable 277,354 317,713 206,565 Inventories

330,570 380,156 284,834 Prepaid Expenses and Other Total Current

Assets 30,167 40,030 44,425 Total

Current Assets 665,128 746,444 621,492 Property and

Equipment - Net 162, 296 168,536 164,734 Goodwill 208,630

207,173 207,749 Other Intangible Assets – Net 101,007 105,520

103,366 Deferred Income Taxes and Other Assets 58,644

84,505 53,584 Total $ 1,195,705 $ 1,312,178 $

1,150,925 Liabilities and Shareholders’ Equity

Current Liabilities: Accounts Payable $ 147,698 $ 137,558 $ 108,836

Accrued Expenses 88,573 94,571 82,143 Current Portion of Long-Term

Debt 14,957 3,322 3,270 Total Current

Liabilities 251,228 235,451 194,249 Long-Term Debt 400,171

543,629 404,815 Other Long-Term Obligations 4,274 6,379 4,526

Shareholders’ Equity 540,032 526,719 547,335

Total $ 1,195,705 $ 1,312,178 $ 1,150,925

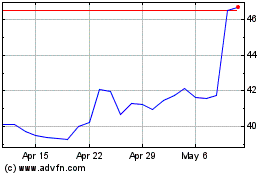

Central Garden and Pet (NASDAQ:CENT)

Historical Stock Chart

From Aug 2024 to Sep 2024

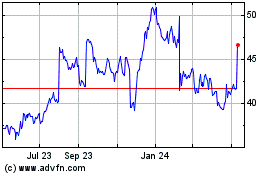

Central Garden and Pet (NASDAQ:CENT)

Historical Stock Chart

From Sep 2023 to Sep 2024