Castor Maritime Inc. (NASDAQ: CTRM), (“Castor” or the “Company”), a

diversified global shipping company, today announced its results

for the three and six months ended June 30, 2021.

Highlights of the Second Quarter Ended

June 30, 2021:

- Revenues, net: $21.8 million for the three months ended

June 30, 2021, as compared to $2.6 million for the three months

ended June 30, 2020;

- Net income/loss: Net income of $6.5 million for the

three months ended June 30, 2021, as compared to net loss of $0.1

million for the three months ended June 30, 2020;

- Earnings/Loss per common

share(1): $0.07 earnings per

share for the three months ended June 30, 2021, as compared to loss

per share of $0.12 for the three months ended June 30,

2020;

- EBITDA(2): $10.0

million for the three months ended June 30, 2021, as compared to

$1.0 million for the three months ended June 30,

2020;

- Cash and restricted cash of $42.7 million as of June

30, 2021, as compared to $9.4 million as of December 31,

2020;

- During the second quarter of 2021 and as of the date of

this press release, we have taken successful delivery of 12 vessels

consisting of 4 Kamsarmax and 2 Panamax dry bulk carriers as well

as 1 Aframax, 3 Aframax / LR2 and 2 MR1 tankers. We expect three

remaining acquisitions to conclude in the third quarter of this

year, subject to customary closing conditions. On a fully delivered

basis, Castor will own a diversified fleet of 26 vessels with an

aggregate capacity of 2.2 million dwt, having more than quadrupled

its fleet size since December 31, 2020;

- On June 14, 2021, we received written notice from the

Nasdaq Stock Market (“Nasdaq”) that the Company has regained

compliance with the Nasdaq's minimum bid price requirement for

continued listing on the Nasdaq Capital Market; and

- In June 2021, we entered into an at-the-market (“ATM”)

sales agreement for the offer and sale from time to time of our

common shares, having an aggregate offering amount of up to $300.0

million.

Earnings Highlights of the Six Months

Ended June 30, 2021:

- Revenues, net: $28.8 million for the six months ended

June 30, 2021, as compared to $5.3 million for the six months ended

June 30, 2020;

- Net income/loss: Net income of $7.6 million for the six

months ended June 30, 2021, as compared to net loss of $0.4 million

for the six months ended June 30, 2020;

- Earnings/Loss per common

share(1): $0.10 earnings per

share for the six months ended June 30, 2021, as compared to loss

per share of $0.50 for the six months ended June 30, 2020;

and

- EBITDA(2): $12.6

million for the six months ended June 30, 2021, as compared to $1.9

million for the six months ended June 30, 2020.

(1) All share and per share amounts

disclosed throughout this press release and in the financial

information presented in Appendix B have been retroactively updated

to reflect the one-for-ten (1-for-10) reverse stock split effected

on May 28, 2021, unless otherwise indicated.

(2) EBITDA is not a recognized measure

under United States generally accepted accounting principles (“U.S.

GAAP”). Please refer to Appendix B for the definition and

reconciliation of this measure to the most directly comparable

financial measure calculated and presented in accordance with U.S.

GAAP.

Management Commentary:

Mr. Petros Panagiotidis, Chief Executive Officer

of Castor commented:

“The first six months of 2021 was a

transformational period for our Company, as we were able to raise

$262.5 million of equity and $33.3 million of debt and grow our

fleet from 6 vessels at the end of 2020 to 26 vessels on a fully

delivered basis.

Strong demand for dry bulk transportation

services has resulted in robust freight rates, with the upward

momentum expected to be sustained by the tight vessel supply and

historically low newbuilding orderbook. Following our timely

acquisitions, Castor is well positioned to take advantage of this

strong market with a dry bulk fleet consisting of 18 vessels, on a

fully delivered basis. At the same time, most of our newly acquired

tanker vessels are in either term or pool employment ensuring a

high utilization for that part of our fleet.”

Earnings Commentary:

Second Quarter ended June 30, 2021 and

2020 Results

Vessel revenues, net of charterers’ commissions,

for the three months ended June 30, 2021, increased to $21.8

million from $2.6 million in the same period of 2020. This increase

was largely driven by the increase in our Ownership days (defined

below) from 273 in the three months ended June 30, 2020 to 1,477 in

the three months ended June 30, 2021, following the acquisition and

delivery to our fleet of 20 vessels since June 30, 2020. The

increase in vessel revenues during the three months ended June 30,

2021 as compared with the same period of 2020 was further

underpinned by a stronger dry bulk shipping market resulting in

higher daily TCE earned on average for our fleet

The increase in operating expenses by $6.8

million, from $1.2 million in the second quarter of 2020 to $8.0

million in the second quarter of 2021, as well as the increase in

vessels’ depreciation costs by $2.5 million, from $0.3 million in

the second quarter of 2020 to $2.8 million in the second quarter of

2021, mainly reflect the increase in our Ownership days following

the expansion of our fleet.

Management fees in the second quarter of 2021

amounted to $1.8 million, whereas, in the same period of 2020

management fees totalled $0.1 million. This increase in management

fees is primarily due to the sizeable increase of our fleet,

resulting in a substantial increase in our Ownership days for which

our managers charge us with a daily management fee, following the

acquisitions discussed above. Effective September 1, 2020, the

daily management fee for the technical management of our fleet by

Pavimar S.A. was increased from $500 to $600 per vessel, and the

daily management fee for the commercial and administrative

management of our fleet by Castor Ships S.A. was set to $250 per

vessel.

General and administrative expenses in the

second quarter of 2021 amounted to $0.7 million, whereas, in the

same period of 2020 general and administrative expenses totalled

$0.1 million. This increase stemmed from incurred legal and other

corporate fees primarily related to the growth of our company and

the $0.3 million quarterly flat fee we pay Castor Ships S.A. with

effect from September 1, 2020.

During the second quarter of 2021, we incurred

net interest costs and finance costs amounting to $0.5 million

compared to $0.8 million during the same period in 2020.

Recent Business and

Financial Developments

Commentary:

Nasdaq Listing Standards Compliance

Update

On June 14, 2021, Nasdaq notified us that as a

result of the closing bid price of the Company’s common stock

having been at $1.00 per share or greater for at least ten

consecutive business days, from May 28, 2021 to June 11, 2021, the

Company has regained compliance with Nasdaq’s minimum bid price

requirement for continued listing on the Nasdaq Capital Market, and

the matter is now closed.

ATM common stock offering

program

On June 14, 2021, we entered into an equity

distribution agreement with Maxim Group LLC acting as a sales

agent, under which we may, from time to time, offer and sell shares

of our common stock through the ATM program having an aggregate

offering price of up to $300.0 million (the “ATM Program”). As of

June 30, 2021, we had raised net proceeds of $9.7 million by

issuing and selling 3,563,407 common shares under the ATM Program.

Between June 30, 2021 and August 4, 2021, no sales of common shares

have taken place. We intend to use the net proceeds from the sale

of our common stock under the ATM Program, for capital

expenditures, working capital, funding for vessel and other asset

or share acquisitions or for other general corporate purposes or a

combination thereof.

Financing Transactions

Update

On July 23, 2021, we, through four of our

ship-owning subsidiaries, entered into a $40.75 million senior

secured term loan facility with a European bank which is secured by

the M/V Magic Thunder, M/V Magic Nebula, M/V Magic

Eclipse and the M/V Magic Twilight. The $40.75 million

term loan facility has a tenor of five years and bears interest at

a margin plus LIBOR. The loan was drawn down in full on July

27, 2021.

Vessel Acquisitions Update

During the second quarter of 2021 and as of the

date of this earnings press release, we have taken delivery of 12

vessels, aggregating to 17 completed vessel acquisitions of the

total 20 vessel acquisitions we made since the beginning of this

year.

Details and delivery information of our

completed as well as in progress vessel acquisitions within the

second quarter of 2021 and as of the date of this press release are

as follows:

|

Completed acquisitions: |

|

Vessel Name |

Vessel Type |

DWT |

Year Built |

Country of Construction |

Purchase Price (in million) |

Delivery Date in 2021 |

|

Dry Bulk Carriers |

|

|

|

|

|

|

|

Magic Twilight |

Kamsarmax |

80,283 |

2010 |

Korea |

$14.80 |

9 April |

|

Magic Thunder |

Kamsarmax |

83,375 |

2011 |

Japan |

$16.85 |

13 April |

|

Magic Vela |

Panamax |

75,003 |

2011 |

China |

$14.50 |

12 May |

|

Magic Nebula |

Kamsarmax |

80,281 |

2010 |

Korea |

$15.45 |

20 May |

|

Magic Starlight |

Kamsarmax |

81,048 |

2015 |

China |

$23.50 |

23 May |

|

Magic Eclipse |

Panamax |

74,940 |

2011 |

Japan |

$18.48 |

7 June |

|

Tankers |

|

|

|

|

|

|

|

Wonder Vega |

Aframax |

106,062 |

2005 |

Korea |

$14.80 |

21 May |

|

Wonder Avior |

Aframax/LR2 |

106,162 |

2004 |

Korea |

$12.00 |

27 May |

|

Wonder Mimosa |

MR1 |

37,620 |

2006 |

Korea |

$7.25 |

31 May |

|

Wonder Arcturus |

Aframax/LR2 |

106,149 |

2002 |

Korea |

$10.00 |

31 May |

|

Wonder Musica |

Aframax/LR2 |

106,209 |

2004 |

Korea |

$12.00 |

15 June |

|

Wonder Formosa |

MR1 |

37,562 |

2006 |

Korea |

$8.00 |

22 June |

Vessels we have agreed to

acquire:

|

Vessel Type |

DWT |

Year Built |

Country of Construction |

Purchase Price (in million) |

|

Dry Bulk Carriers |

|

|

|

|

|

Kamsarmax |

82,158 |

2013 |

Japan |

$21.00 |

|

Panamax |

74,940 |

2013 |

Japan |

$19.06 |

|

Panamax |

76,822 |

2014 |

Korea |

$21.00 |

Update on common shares issued and

outstanding

As of August 4, 2021, we had issued and

outstanding 93,519,255 common shares.

Liquidity / Financing / Cash Flow

Commentary:

Our consolidated cash position as of June 30,

2021 increased by $33.3 million, to $42.7 million, in relation to

our cash position on December 31, 2020. That was mainly the result

of: (i) $7.2 million of positive operating cash flows during the

six months ended June 30, 2021, (ii) $157.0 million of net cash

proceeds pursuant to the three registered direct offerings of an

aggregate 42,405,770 common shares and the concurrent private

placement of an equivalent aggregate number of warrants on January

5, January 12 and April 7, 2021, (iii) proceeds of approximately

$83.4 million resulting from subsequent exercises of approximately

34.4 million warrants pursuant to the June 2020, July 2020 and the

January 2021 equity offerings, that resulted in the issuance of an

equal number of common shares, (iv) net cash inflows of

approximately $32.5 million following our entry into two secured

loan facilities with two reputable European banks in January and

April of 2021, (v) $9.8 million of net cash proceeds pursuant to

common stock sales under the ATM Program, as offset by (vi) $1.6 of

scheduled principal repayments on our existing debt agreements.

During the six months ended June 30 2021, we

used $255.1 million of the net proceeds from our first half of 2021

equity and debt financings to fund our growth and other capital

expenditures.

Between July 1, 2021 and August 4, 2021, there

have been no subsequent warrant exercises under our currently

effective warrant schemes.

As of June 30, 2021, our total debt (including

$5.0 million of related party debt maturing in September 2021),

gross of unamortized deferred loan fees, was $50.2 million of which

$12.5 million was repayable within one year, as compared to $18.5

million of debt as of December 31, 2020.

Fleet Employment

Update (as of

August 4,

2021)

During the second quarter of 2021, we operated

on average 16.2 vessels earning a daily average TCE rate of $14,381

as compared to an average 3 vessels earning a daily average TCE

rate of $9,090 during the same period in 2020. Our current

employment profile is presented below.

|

Vessel Name |

Type/ Country of

Construction |

DWT |

Year Built |

Type of Employment |

Daily Gross Charter Rate |

Estimated Redelivery Date (Earliest/ Latest) |

|

Magic P |

Panamax dry bulk carrier / Japan |

76,453 |

2004 |

Time charter period |

$12,750 |

August 2021 |

November 2021 |

|

Magic Sun |

Panamax dry bulk carrier / Korea |

75,311 |

2001 |

Time charter period |

$10,200 |

August 2021 |

October 2021 |

|

Magic Moon |

Panamax dry bulk carrier / Japan |

76,602 |

2005 |

Time charter period |

$10,500 |

July 2021 |

September 2021 |

|

Magic Rainbow |

Panamax dry bulk carrier / China |

73,593 |

2007 |

Time charter period |

$25,000 |

January 2022 |

March 2022 |

|

Magic Horizon |

Panamax dry bulk carrier / Japan |

76,619 |

2010 |

Time charter period |

$11,000 |

August 2021 |

December 2021 |

|

Magic Nova |

Panamax dry bulk carrier / Japan |

78,833 |

2010 |

Time charter period |

$10,400 |

April 2021 |

August 2021 |

|

Magic Venus |

Kamsarmax dry bulk carrier / Japan |

83,416 |

2010 |

Time charter period |

$18,500 |

August 2021 |

October 2021 |

|

Magic Orion |

Capesize dry bulk carrier / Japan |

180,200 |

2006 |

Time charter trip |

$39,500 |

September 2021 |

September 2021 |

|

Magic Argo |

Kamsarmax dry bulk carrier / Japan |

82,338 |

2009 |

Time charter trip |

$33,000 |

September 2021 |

September 2021 |

|

Magic Twilight |

Kamsarmax dry bulk carrier / Korea |

80,283 |

2010 |

Time charter period |

$21,000 |

November 2021 |

January 2022 |

|

Magic Thunder |

Kamsarmax dry bulk carrier / Japan |

83,375 |

2011 |

Unfixed |

N/A |

N/A |

N/A |

|

Magic Vela |

Panamax dry bulk carrier / China |

75,003 |

2011 |

Time charter trip |

$25,500 |

August 2021 |

August 2021 |

|

Magic Nebula |

Kamsarmax dry bulk carrier / Korea |

80,281 |

2010 |

Time charter trip |

$25,500 + $550,000 Ballast Bonus |

August 2021 |

August 2021 |

|

Magic Starlight |

Kamsarmax dry bulk carrier / China |

81,048 |

2015 |

Time charter period |

114% of BPI Index |

September 2022 |

March 2023 |

|

Magic Eclipse |

Panamax dry bulk carrier / Japan |

74,940 |

2011 |

Time charter trip |

$26,500 |

September 2021 |

September 2021 |

|

Wonder Polaris |

Aframax/LR2 tanker / Korea |

115,341 |

2005 |

Time charter period |

$15,000 + profit sharing |

February 2022 |

February 2023 |

|

Wonder Sirius |

Aframax/LR2 tanker / Korea |

115,341 |

2005 |

Time charter period |

$15,000 + profit sharing |

February 2022 |

February 2023 |

|

Wonder Vega |

Aframax tanker / Korea |

106,062 |

2005 |

Tanker Pool (1) |

N/A |

N/A |

N/A |

|

Wonder Avior |

Aframax/LR2 tanker / Korea |

106,162 |

2004 |

Voyage |

$11,280 (2) |

28 August 2021 (3) |

N/A |

|

Wonder Mimosa |

MR1 tanker / Korea |

37,620 |

2006 |

Tanker Pool (4) |

N/A |

N/A |

N/A |

|

Wonder Arcturus |

Aframax/LR2 tanker / Korea |

106,149 |

2002 |

Voyage |

$5,500 (2) |

7 August 2021 (3) |

N/A |

|

Wonder Musica |

Aframax/LR2 tanker / Korea |

106,209 |

2004 |

Voyage |

$5,000 (2) |

9 August 2021 (3) |

N/A |

|

Wonder Formosa |

MR1 tanker /Korea |

37,562 |

2006 |

Tanker Pool (4) |

N/A |

N/A |

N/A |

(1) The vessel is currently participating in an unaffiliated

tanker pool specializing in the employment of Aframax tanker

vessels

(2) For vessels that are employed on the voyage/spot market, the

daily gross charter rate is considered as the TCE on the basis of

the expected completion date.

(3) Estimated completion date of the voyage.

(4) The vessel is currently participating in an unaffiliated

tanker pool specializing in the employment of Handysize tanker

vessels.

Financial Results Overview:

| |

Three Months Ended |

|

Six Months Ended |

|

(expressed in U.S. dollars) |

|

June 30, 2021 (unaudited) |

|

|

June 30, 2020 (unaudited) |

|

|

June 30, 2021 (unaudited) |

|

|

June 30, 2020 (unaudited) |

|

Vessel revenues, net |

$ |

21,789,783 |

|

$ |

2,585,659 |

|

|

$ |

28,762,636 |

|

$ |

5,310,936 |

|

| Operating

income |

$ |

7,038,253 |

|

$ |

659,851 |

|

|

$ |

8,529,692 |

|

|

1,241,992 |

|

| Net income/

(loss) |

$ |

6,475,508 |

|

$ |

(144,600 |

) |

|

$ |

7,602,568 |

|

$ |

(404,468 |

) |

|

EBITDA(1) |

$ |

9,987,330 |

|

$ |

1,018,366 |

|

|

$ |

12,558,054 |

|

$ |

1,923,640 |

|

|

Earnings/(Loss) per common share |

$ |

0.07 |

|

$ |

(0.12 |

) |

|

$ |

0.10 |

|

$ |

(0.50 |

) |

(1) EBITDA is not a recognized measure

under U.S. GAAP. Please refer to Appendix B of this press release

for the definition and reconciliation of this measure to the most

directly comparable financial measure calculated and presented in

accordance with U.S. GAAP.

Fleet selected financial and operational

data:

Set forth below are selected financial and

operational data of our fleet for each of the three and six months

ended June 30, 2021 and 2020, respectively, that we believe are

useful in better analysing trends in our results of operations:

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

(expressed in U.S. dollars except for operational

data) |

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

Ownership days (1) (7) |

|

1,477 |

|

|

|

273 |

|

|

|

2,105 |

|

|

|

546 |

|

| Available

days (2)(7) |

|

1,420 |

|

|

|

273 |

|

|

|

2,030 |

|

|

|

488 |

|

| Operating

days (3) (7) |

|

1,380 |

|

|

|

273 |

|

|

|

1,978 |

|

|

|

488 |

|

| Daily TCE

rate(4) |

$ |

14,381 |

|

|

$ |

9,090 |

|

|

$ |

13,705 |

|

|

$ |

10,351 |

|

| Fleet

Utilization (5) |

|

97 |

% |

|

|

100 |

% |

|

|

97 |

% |

|

|

100 |

% |

| Daily vessel

operating expenses (6) |

$ |

5,390 |

|

|

$ |

4,452 |

|

|

$ |

5,352 |

|

|

$ |

4,770 |

|

(1) Ownership days are the total number of calendar days in a

period during which we owned our vessels.

(2) Available days are the Ownership days in a period less the

aggregate number of days our vessels are off-hire due to scheduled

repairs, dry-dockings or special or intermediate surveys.

(3) Operating days are the Available days in a period after

subtracting off-hire and idle days.

(4) Daily TCE rate is not a recognized measure under U.S. GAAP.

Please refer to Appendix B of this press release for the definition

and reconciliation of this measure to the most directly comparable

financial measure calculated and presented in accordance with U.S.

GAAP.

(5) Fleet utilization is calculated by dividing the Operating

days during a period by the number of Available days during that

period.

(6) Daily vessel operating expenses are calculated by dividing

vessel operating expenses for the relevant period by the Ownership

days for such period.

(7) Our definitions of days (i.e. Ownership days, Available

days, Operating days) may not be comparable to that reported by

other companies.

APPENDIX A

CASTOR MARITIME INC.

Unaudited Condensed Consolidated Statements of

Comprehensive Income/ (Loss)

|

(In U.S. dollars except for number of share data) |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

REVENUES |

|

|

|

|

|

|

|

|

|

|

|

|

Vessel revenues, net |

$ |

21,789,783 |

|

|

$ |

2,585,659 |

|

|

$ |

28,762,636 |

|

|

$ |

5,310,936 |

|

|

EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

Voyage expenses -including commissions to related party |

|

(1,368,565 |

) |

|

|

(104,093 |

) |

|

|

(941,593 |

) |

|

|

(259,600 |

) |

|

Vessel operating expenses |

|

(7,960,638 |

) |

|

|

(1,215,266 |

) |

|

|

(11,266,895 |

) |

|

|

(2,604,336 |

) |

|

General and administrative expenses (including related party

fees) |

|

(720,124 |

) |

|

|

(109,253 |

) |

|

|

(1,459,355 |

) |

|

|

(237,636 |

) |

|

Management fees -related parties |

|

(1,750,150 |

) |

|

|

(136,500 |

) |

|

|

(2,524,500 |

) |

|

|

(273,000 |

) |

|

Depreciation and amortization |

|

(2,952,053 |

) |

|

|

(360,696 |

) |

|

|

(4,040,601 |

) |

|

|

(694,372 |

) |

|

Operating income |

$ |

7,038,253 |

|

|

$ |

659,851 |

|

|

$ |

8,529,692 |

|

|

$ |

1,241,992 |

|

|

Interest and finance costs, net (including related party interest

costs) |

|

(485,646 |

) |

|

|

(802,270 |

) |

|

|

(840,762 |

) |

|

|

(1,633,736 |

) |

|

Other expenses, net |

|

(2,976 |

) |

|

|

(2,181 |

) |

|

|

(12,239 |

) |

|

|

(12,724 |

) |

|

US source income taxes |

|

(74,123 |

) |

|

|

— |

|

|

|

(74,123 |

) |

|

|

— |

|

|

Net income/(loss) |

$ |

6,475,508 |

|

|

$ |

(144,600 |

) |

|

$ |

7,602,568 |

|

|

$ |

(404,468 |

) |

|

Earnings/(loss) per common share (basic and

diluted) |

$ |

0.07 |

|

|

$ |

(0.12 |

) |

|

$ |

0.10 |

|

|

$ |

(0.50 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding, basic |

|

88,933,581 |

|

|

|

1,222,427 |

|

|

|

73,384,422 |

|

|

|

802,765 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASTOR MARITIME INC.

Unaudited Condensed Consolidated Balance

Sheets (Expressed in U.S. Dollars—except for

number of share data)

|

|

|

June 30,

2021 |

|

|

December 31,

2020 |

|

ASSETS |

|

|

|

|

|

|

CURRENT ASSETS: |

|

|

|

|

|

| Cash and

cash equivalents |

$ |

40,032,095 |

|

$ |

8,926,903 |

| Due from

related party |

|

1,831,311 |

|

|

1,559,132 |

| Other

current assets |

|

8,614,300 |

|

|

3,078,119 |

|

Total current assets |

|

50,477,706 |

|

|

13,564,154 |

| |

|

|

|

|

|

|

NON-CURRENT ASSETS: |

|

|

|

|

|

| Vessels,

net |

|

300,516,947 |

|

|

58,045,628 |

| Advances for

vessel acquisitions |

|

9,243,007 |

|

|

— |

| Due from

related party |

|

1,104,394 |

|

|

— |

| Other

non-currents assets |

|

5,650,447 |

|

|

2,761,573 |

|

Total non-current assets, net |

|

316,514,795 |

|

|

60,807,201 |

|

Total assets |

|

366,992,501 |

|

|

74,371,355 |

| |

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

|

| Current

portion of long-term debt, net – including related party |

|

12,153,410 |

|

|

7,102,037 |

| Due to

related parties |

|

198,845 |

|

|

1,941 |

| Trade

payables |

|

2,419,986 |

|

|

2,078,695 |

| Accrued

liabilities |

|

3,616,175 |

|

|

1,613,109 |

| Deferred

Revenue, net |

|

1,516,027 |

|

|

108,125 |

|

Total current liabilities |

|

19,904,443 |

|

|

10,903,907 |

|

NON-CURRENT LIABILITIES: |

|

|

|

|

|

| Long-term

debt, net |

|

37,120,639 |

|

|

11,083,829 |

|

Total non-current liabilities |

|

37,120,639 |

|

|

11,083,829 |

|

Total Liabilities |

|

57,025,082 |

|

|

21,987,736 |

| |

|

|

|

|

|

|

SHAREHOLDERS’ EQUITY |

|

|

|

|

|

| Common

shares, $0.001 par value; 1,950,000,000 shares authorized;

93,519,255 and 13,121,238 shares, issued and outstanding as at June

30, 2021 and December 31, 2020, respectively (1) |

|

93,519 |

|

|

13,121 |

| Series A

Preferred Shares- 480,000 shares issued and outstanding as at June

30, 2021 and December 31, 2020 |

|

480 |

|

|

480 |

| Series B

Preferred Shares- 12,000 shares issued and outstanding as at June

30, 2021 and December 31, 2020 |

|

12 |

|

|

12 |

| Additional

paid-in capital |

|

303,587,575 |

|

|

53,686,741 |

| Retained

Earnings/(Accumulated Deficit) |

|

6,285,833 |

|

|

(1,316,735) |

|

Total shareholders’ equity |

|

309,967,419 |

|

|

52,383,619 |

|

Total liabilities and shareholders’ equity |

$ |

366,992,501 |

|

$ |

74,371,355 |

CASTOR MARITIME INC.

Unaudited Consolidated Statements of Cash

Flows

|

(Expressed in U.S. Dollars—except for number of share

data) |

Six Months Ended June 30, |

|

|

|

2021 |

|

|

|

2020 |

|

Cash flows (used in)/provided by Operating

Activities: |

|

|

|

|

|

|

|

|

Net income/(loss) |

$ |

7,602,568 |

|

|

$ |

(404,468 |

) |

|

Adjustments to reconcile net income/(loss) to net cash

provided by/(used in) Operating activities: |

|

|

|

|

| Vessels’

depreciation and amortization of deferred dry-docking costs |

|

4,040,601 |

|

|

|

694,372 |

|

| Amortization

and write-off of deferred finance charges |

|

125,234 |

|

|

|

541,441 |

|

| Amortization

of other deferred charges |

|

53,449 |

|

|

|

112,508 |

|

| Deferred

revenue amortization |

|

(157,076 |

) |

|

|

(430,994 |

) |

| Interest

settled in common stock |

|

— |

|

|

|

57,773 |

|

| Amortization

and write-off of convertible notes beneficial conversion

feature |

|

— |

|

|

|

532,437 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

| Accounts

receivable trade |

|

(1,496,824 |

) |

|

|

(705,003 |

) |

|

Inventories |

|

(2,836,214 |

) |

|

|

(47,380 |

) |

| Due from/to

related parties |

|

(1,179,669 |

) |

|

|

288,538 |

|

| Prepaid

expenses and other assets |

|

(901,228 |

) |

|

|

(260,596 |

) |

| Dry-dock

costs paid |

|

(1,288,364 |

) |

|

|

(509,976 |

) |

| Other

deferred charges |

|

(196,347 |

) |

|

|

— |

|

| Accounts

payable |

|

515,337 |

|

|

|

(179,960 |

) |

| Accrued

liabilities |

|

1,365,569 |

|

|

|

(17,290 |

) |

| Deferred

revenue |

|

1,564,978 |

|

|

|

(62,021 |

) |

| Net

Cash provided by/(used in) Operating Activities |

|

7,212,014 |

|

|

|

(390,619 |

) |

| |

|

|

|

|

| Cash

flows used in Investing Activities: |

|

|

|

|

| Vessel

acquisitions and other vessel improvements |

|

(245,945,567 |

) |

|

|

(388,635 |

) |

| Advances for

vessel acquisitions |

|

(9,178,452 |

) |

|

|

— |

|

| Net

cash used in Investing Activities |

|

(255,124,019 |

) |

|

|

(388,635 |

) |

| |

|

|

|

|

| Cash

flows provided by Financing Activities: |

|

|

|

|

| Gross

proceeds from issuance of common stock and warrants |

|

262,516,826 |

|

|

|

20,671,500 |

|

| Common stock

issuance expenses |

|

(12,311,638 |

) |

|

|

(1,637,559 |

) |

| Proceeds

from long-term debt |

|

33,290,000 |

|

|

|

9,500,000 |

|

| Repayment of

long-term debt |

|

(1,571,000 |

) |

|

|

(950,000 |

) |

| Payment of

deferred financing costs |

|

(756,051 |

) |

|

|

(608,985 |

) |

| Net

cash provided by Financing Activities |

|

281,168,137 |

|

|

|

26,974,956 |

|

| |

|

|

|

|

| Net

increase in cash, cash equivalents, and restricted

cash |

|

33,256,132 |

|

|

|

26,195,702 |

|

|

Cash, cash equivalents and restricted cash at the beginning

of the period |

|

9,426,903 |

|

|

|

5,058,939 |

|

|

Cash, cash equivalents and restricted cash at the end of

the period |

$ |

42,683,035 |

|

|

$ |

31,254,641 |

|

| |

|

|

|

|

All numbers of share and earnings per share

amounts in these unaudited interim condensed financial statements

have been retroactively adjusted to reflect the reverse stock split

effected on May 28, 2021.

APPENDIX B

Non-GAAP Financial

Information

Daily TCE Rate. TCE rate, is a

measure of the average daily revenue performance of a vessel. The

TCE rate is calculated by dividing total revenues (time charter

and/or voyage charter revenues, net of charterers’ commissions),

less voyage expenses, by the number of Available days during that

period. Under a time charter, the charterer pays substantially all

the vessel voyage related expenses. However, we may incur voyage

related expenses when positioning or repositioning vessels before

or after the period of a time charter, during periods of commercial

waiting time or while off-hire during dry docking or due to other

unforeseen circumstances. The TCE rate is not a measure of

financial performance under U.S. GAAP (non-GAAP measure), and

should not be considered as an alternative to Time charter

revenues, net, the most directly comparable GAAP measure, or any

other measure of financial performance presented in accordance with

U.S. GAAP. However, TCE rate is a standard shipping industry

performance measure used primarily to compare period-to-period

changes in a company's performance and, management believes that

the TCE rate provides meaningful information to our investors since

it compares daily net earnings generated by our vessels

irrespective of the mix of charter types (i.e., time charter trips,

time charter periods and voyage charters) under which our vessels

are employed between the periods while it further assists our

management in making decisions regarding the deployment and use of

our vessels and in evaluating our financial performance. Our

calculation of TCE rates may not be comparable to that reported by

other companies. The following table reflects the calculation of

our TCE rates for the periods presented (amounts in U.S. dollars,

except for Available days):

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

(In U.S. dollars, except for Available Days) |

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

|

2020 |

|

|

Vessel revenues, net |

$ |

21,789,783 |

|

|

$ |

2,585,659 |

|

|

$ |

28,762,636 |

|

|

$ |

5,310,936 |

|

|

Voyage expenses -including commissions from related party |

|

(1,368,565 |

) |

|

|

(104,093 |

) |

|

|

(941,593 |

) |

|

|

(259,600 |

) |

|

TCE revenues |

$ |

20,421,218 |

|

|

$ |

2,481,566 |

|

|

$ |

27,821,043 |

|

|

$ |

5,051,336 |

|

|

Available Days |

|

1,420 |

|

|

|

273 |

|

|

|

2,030 |

|

|

|

488 |

|

|

TCE rate |

$ |

14,381 |

|

|

$ |

9,090 |

|

|

$ |

13,705 |

|

|

$ |

10,351 |

|

EBITDA. We define EBITDA as

earnings before interest and finance costs (if any), net of

interest income, taxes (when incurred), depreciation and

amortization of deferred dry-docking costs. EBITDA is used as a

supplemental financial measure by management and external users of

financial statements to assess our operating performance. We

believe that EBITDA assists our management by providing useful

information that increases the comparability of our performance

operating from period to period and against the operating

performance of other companies in our industry that provide EBITDA

information. This increased comparability is achieved by excluding

the potentially disparate effects between periods or companies of

interest, other financial items, depreciation and amortization and

taxes, which items are affected by various and possibly changing

financing methods, capital structure and historical cost basis and

which items may significantly affect net income between periods. We

believe that including EBITDA as a measure of operating performance

benefits investors in (a) selecting between investing in us and

other investment alternatives and (b) monitoring our ongoing

financial and operational strength. EBITDA is not a measure of

financial performance under U.S. GAAP, does not represent and

should not be considered as an alternative to net income, operating

income, cash flow from operating activities or any other measure of

financial performance presented in accordance with U.S. GAAP.

EBITDA as presented below may not be comparable to similarly titled

measures of other companies. The following table reconciles EBITDA

to net (loss)/income, the most directly comparable U.S. GAAP

financial measure, for the periods presented:

Reconciliation of Net Income/(Loss) to

EBITDA

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

(In U.S. dollars) |

|

2021 |

|

|

2020 |

|

|

|

2021 |

|

|

2020 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Net

Income/(Loss) |

$ |

6,475,508 |

|

$ |

(144,600 |

) |

|

$ |

7,602,568 |

|

$ |

(404,468 |

) |

| Depreciation

and amortization |

|

2,952,053 |

|

|

360,696 |

|

|

|

4,040,601 |

|

|

694,372 |

|

| Interest and

finance costs, net (including amortization of deferred financing

costs and beneficial conversion feature, as applicable) |

|

485,646 |

|

|

802,270 |

|

|

|

840,762 |

|

|

1,633,736 |

|

| US source

income taxes |

|

74,123 |

|

|

— |

|

|

|

74,123 |

|

|

— |

|

|

EBITDA |

$ |

9,987,330 |

|

$ |

1,018,366 |

|

|

$ |

12,558,054 |

|

$ |

1,923,640 |

|

Cautionary Statement Regarding

Forward-Looking Statements

Matters discussed in this press release may

constitute forward-looking statements. The Private Securities

Litigation Reform Act of 1995 provides safe harbor protections for

forward-looking statements in order to encourage companies to

provide prospective information about their business.

Forward-looking statements include statements concerning plans,

objectives, goals, strategies, future events or performance, and

underlying assumptions and other statements, which are other than

statements of historical facts. We desire to take advantage of the

safe harbor provisions of the Private Securities Litigation Reform

Act of 1995 and are including this cautionary statement in

connection with this safe harbor legislation. The words “believe”,

“anticipate”, “intend”, “estimate”, “forecast”, “project”, “plan”,

“potential”, “will”, “may”, “should”, “expect”, “pending” and

similar expressions identify forward-looking statements. The

forward-looking statements in this press release are based upon

various assumptions, many of which are based, in turn, upon further

assumptions, including without limitation, our management’s

examination of historical operating trends, data contained in our

records and other data available from third parties. Although we

believe that these assumptions were reasonable when made, because

these assumptions are inherently subject to significant

uncertainties and contingencies which are difficult or impossible

to predict and are beyond our control, we cannot assure you that we

will achieve or accomplish these expectations, beliefs or

projections. We undertake no obligation to update any

forward-looking statement, whether as a result of new information,

future events or otherwise. In addition to these important factors,

other important factors that, in our view, could cause actual

results to differ materially from those discussed in the

forward‐looking statements include general dry bulk and tanker

shipping market conditions, including fluctuations in charterhire

rates and vessel values, the strength of world economies the

stability of Europe and the Euro, fluctuations in interest rates

and foreign exchange rates, changes in demand in the dry bulk and

tanker shipping industries, including the market for our vessels,

changes in our operating expenses, including bunker prices, dry

docking and insurance costs, changes in governmental rules and

regulations or actions taken by regulatory authorities, potential

liability from pending or future litigation, general domestic and

international political conditions, potential disruption of

shipping routes due to accidents or political events, the length

and severity of the COVID-19 outbreak, the impact of public health

threats and outbreaks of other highly communicable diseases, the

impact of the expected discontinuance of LIBOR after 2021 on

interest rates of our debt that reference LIBOR, the availability

of financing and refinancing and grow our business, vessel

breakdowns and instances of off‐hire, potential exposure or loss

from investment in derivative instruments, potential conflicts of

interest involving our Chief Executive Officer, his family and

other members of our senior management, and our ability to complete

acquisition transactions as planned. Please see our filings with

the Securities and Exchange Commission for a more complete

discussion of these and other risks and uncertainties. The

information set forth herein speaks only as of the date hereof, and

we disclaim any intention or obligation to update any

forward‐looking statements as a result of developments occurring

after the date of this communication.

CONTACT DETAILS For further

information please contact:

Petros Panagiotidis Chief Executive Officer

& Chief Financial Officer Castor Maritime Inc. Email:

ir@castormaritime.com

Media Contact: Kevin Karlis Capital Link Email:

castormaritime@capitallink.com

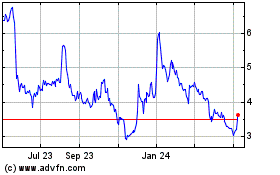

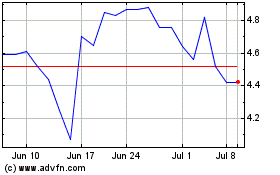

Castor Maritime (NASDAQ:CTRM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Castor Maritime (NASDAQ:CTRM)

Historical Stock Chart

From Apr 2023 to Apr 2024