Pot Stocks Surge After Biden Floats Rescheduling

October 06 2022 - 7:47PM

Dow Jones News

By Will Feuer

Shares of companies with ties to the marijuana market, from

cannabis retailers to purveyors of hydroponic equipment and the

owners of real estate used by growers, surged on Thursday after

President Joe Biden called on federal regulators to review how the

drug is classified.

The president said Thursday he is asking the Department of

Health and Human Services and the attorney general to review the

status of marijuana as a schedule 1 controlled substance, a

category that also includes heroin and LSD. Mr. Biden's remarks

could be a major step toward decriminalizing marijuana, which

remains illegal under federal law even though 19 U.S. states and

Washington, D.C., have legalized adult use for recreation.

The rescheduling of marijuana in the U.S. could have an

immediate impact on how investors value companies such as Canopy

Growth Corp., Curaleaf Holdings Inc. and Tilray Brands Inc., MKM

analyst Bill Kirk said in a research note. Shares of such companies

have been hammered over the past year as an oversupply of marijuana

in North America weighs on the average selling price.

But Mr. Kirk said Mr. Biden's remarks could breathe some life

into the sector.

"It will be hard for people to be short the sector," he said,

adding that cannabis companies with operations confined to Canada

could look to push rapidly into the U.S. in the wake of a

rescheduling of the drug at the federal level.

Shares of Canopy, which sells cannabis in Canada and 13 other

countries but not in the U.S., where it only sells hemp and CBD

products, powered more than 20% higher in intraday trading Thursday

and were up another 5% in after-hours. Aurora Cannabis Inc. stock

finished the day more than 7% higher and traded 10% higher in

after-hours.

Nasdaq-listed shares of Tilray, another cannabis company that

mostly operates in Canada, jumped 31%, and were up another 11%

after the market closed. Shares of High Tide Inc. rose 7% and were

up another 3% in after-hours trading.

High Tide Chief Executive Raj Grover called Mr. Biden's remarks

"a game changer.

"De-scheduling would allow a Nasdaq-listed company like High

Tide to begin selling cannabis in legal states," he said.

Shares of Flora Growth Corp., which grows marijuana and operates

an e-commerce business that sells CBD and other federally legal

products in the U.S., jumped 16% in intraday trading and rose

another 15% to 90 cents a share in after-hours.

Chief Executive Luis Merchan said the rescheduling of marijuana

in the U.S. could pave the way for the free flow of cannabis

globally. Regulatory issues in the U.S. and other countries are the

single biggest factor confronting the industry, he said.

Many companies in the space over-invested as they prepared for

federal legalization in the U.S., which has yet to come, according

to Mr. Merchan. More free flow of supply around the world will

bring it into balance with demand, he said.

Other companies that don't directly grow or sell marijuana

themselves got a boost, too.

Shares of Innovative Industrial Properties Inc., a real-estate

investment trust that owns and manages properties for

state-licensed cannabis companies, closed the day more than 4%

higher at $96.28. The stock, down 63% so far this year amid a glut

of marijuana in the U.S., rose another 1% in after-hours

trading.

Shares of gardening company Scotts Miracle-Gro Co., which has a

business unit devoted to supplying the marijuana cultivation

industry, finished the day almost 4% higher after falling more than

70% so far this year.

On the other hand, the news appeared to weigh on shares of SHF

Holdings Inc., which recently went public through a merger with a

special-purpose acquisition company. Shares of the company, which

provides financial services to the cannabis industry, a space that

large banks have been hesitant to enter, finished the day almost 3%

lower.

"This will essentially have no effect on the business of

cannabis at this point," Chief Executive Sundie Seefried said. "Of

course, I'm encouraged by President Biden's actions today, and

would further request that Congress remove all barriers to banking

and financing in the legal cannabis industry so that cannabis

businesses can be integrated into our transparent, accountable and

taxable financial system."

Write to Will Feuer at Will.Feuer@wsj.com

(END) Dow Jones Newswires

October 06, 2022 19:32 ET (23:32 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

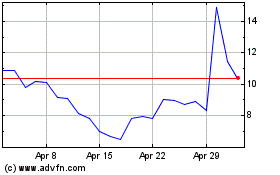

Canopy Growth (NASDAQ:CGC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Canopy Growth (NASDAQ:CGC)

Historical Stock Chart

From Apr 2023 to Apr 2024